Current Report Filing (8-k)

05 Abril 2023 - 5:32PM

Edgar (US Regulatory)

false000021608500002160852023-04-052023-04-050000216085us-gaap:CommonStockMember2023-04-052023-04-050000216085us-gaap:CommonClassAMember2023-04-052023-04-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): April 5, 2023 (March 31, 2023)

Haverty Furniture Companies, Inc.

(Exact Name of Registrant as Specified in Its Charter)

1-14445

(Commission File Number)

|

Maryland

|

58-0281900

|

|

(State or Other Jurisdiction of Incorporation)

|

(I.R.S. Employer Identification No.)

|

780 Johnson Ferry Road, NE, Suite 800

Atlanta, Georgia 30342

(Address of principal executive offices, including zip code)

(404) 443-2900

(Registrant’s telephone number, including area code)

NOT APPLICABLE

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

Class A Common Stock

|

|

HVTA

|

|

NYSE

|

Common Stock

|

|

HVT

|

|

NYSE

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act

of 1934 (§240.12b-2 of this chapter):

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into

a Material Definitive Agreement.

On March 31, 2023, Haverty Furniture Companies, Inc. (“Havertys” or the “Company”) entered into an agreement to purchase (the “Purchase”) a distribution facility

located at 7100 Havertys Way, Lakeland, Florida (the “Facility”), pursuant to that certain Purchase and Sale Agreement (the “Purchase Agreement”), by and between HF Lakeland FL Landlord, LLC (the “Landlord”) and the Company. The Company

previously owned the Facility prior to selling it to the Landlord in May 2020 in a sale leaseback transaction.

The purchase price of the Facility, excluding costs and taxes, is $28.2 million. The Company expects the closing of the Purchase to occur on or before May 15, 2023,

subject to the satisfaction of customary closing conditions. In connection with the closing of the Purchase, the Company and the Landlord will terminate that certain Lease Agreement, dated as of May 19, 2020, by and between the Company and the

Landlord (incorporated by reference to Exhibit 10.4 to the Company’s Current Report on Form 8-K dated as of May 20, 2020).

The foregoing description of the Purchase Agreement does not comport to be complete and is qualified in its entirety by reference to the Purchase Agreement, filed as

Exhibit 10.1 to this Current Report on Form 8-K, which is incorporated herein by reference.

Item 1.02 Termination

of a Material Definitive Agreement.

The information set forth above under Item 1.01 is incorporated herein by reference into this Item 1.02.

Item 7.01 Regulation FD Disclosure.

The Company reported in its Annual Report on Form 10-K for the year ended December 31, 2022 that its expected capital expenditures for the 2023 year were

approximately $27.6 million. Given the anticipated closing of the Purchase discussed in Item 1.01, the Company expects its current planned capital expenditures for 2023 to increase to approximately $56.0 million, inclusive of the Purchase.

Item 9.01 Financial Statements and

Exhibits

(d) Exhibits. The following exhibits are furnished as part of this Report:

10.1 Purchase

Agreement, dated as of March 31, 2023, by and between HF Lakeland FL Landlord, LLC and Haverty Furniture Companies, Inc.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

|

HAVERTY FURNITURE COMPANIES, INC.

|

|

April 5, 2023

|

By:

|

|

| |

|

Jenny Hill Parker

Senior Vice President, Finance and

Corporate Secretary

|

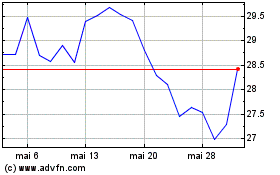

Haverty Furniture Compan... (NYSE:HVT)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Haverty Furniture Compan... (NYSE:HVT)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024