UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: May 2, 2023

BioPlus

Acquisition Corp.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Cayman Islands |

|

001-41116 |

|

98-1583272 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

| 260 Madison Avenue |

| Suite 800 |

| New York, New York 10016 |

| (Address of principal executive offices, including zip code) |

Registrant’s telephone number, including area code: (212)

287-4092

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions:

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

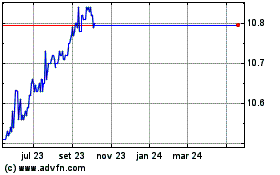

| Units, each consisting of one Class A Ordinary Share and one-half of one Redeemable Warrant |

|

BIOSU |

|

The Nasdaq Stock Market LLC |

| Class A Ordinary Share, par value $0.0001 per share |

|

BIOS |

|

The Nasdaq Stock Market LLC |

| Warrants, each whole warrant exercisable for one Class A Ordinary Share for $11.50 per share |

|

BIOSW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of

1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

| Item 1.01 |

Entry into a Material Definitive Agreement. |

This section describes the material provisions of the Business Combination Agreement (as defined below) but does not purport to describe all

of the terms thereof. The following summary is qualified in its entirety by reference to the complete text of the Business Combination Agreement, a copy of which is attached hereto as Exhibit 2.1. Unless otherwise defined herein, the capitalized

terms used below are defined in the Business Combination Agreement.

Business Combination Agreement

On May 2, 2023, BioPlus Acquisition Corp., a Cayman Islands exempted company (“BIOS”), Guardian Merger Subsidiary Corp., a

Delaware corporation and a direct wholly owned subsidiary of BIOS (“Merger Sub”), and Avertix Medical, Inc. (f/k/a Angel Medical Systems, Inc.), a Delaware corporation (“Avertix”), and, solely with respect to Section 3.03(b)

and Section 7.21 of the Business Combination Agreement (as defined below), BioPlus Sponsor LLC, a Cayman Islands limited liability company (the “Sponsor”), entered into a business combination agreement and plan of reorganization (the

“Business Combination Agreement”), pursuant to which Merger Sub will merge with and into Avertix (the “Merger,” and together with the other transactions related thereto, the “Transactions”), with Avertix surviving the

Merger as a direct wholly owned subsidiary of BIOS.

The Domestication

Pursuant to the Business Combination Agreement, prior to (but no later than the day preceding) the closing of the Merger (the

“Closing”) and following the exercise of their redemption right by the shareholders of BIOS (the “BIOS Shareholders”), BIOS will domesticate as a Delaware corporation in accordance with the Delaware General Corporation Law and

the Companies Act (as revised) of the Cayman Islands (the “Domestication”). Upon the effectiveness of the Domestication, BIOS will change its name to “Avertix Medical, Inc.” (“New Avertix”).

Upon the effectiveness of the Domestication, (i) each then issued and outstanding Class A ordinary share, par value $0.0001 per

share, of BIOS will convert automatically into one (1) share of common stock, par value $0.0001 per share, of New Avertix (the “New Avertix Common Stock”), (ii) each then issued and outstanding Class B ordinary share, par

value $0.0001 per share, of BIOS will convert automatically into one (1) share of New Avertix Common Stock, (iii) each then issued and outstanding BIOS warrant exercisable to purchase one Class A ordinary share of BIOS will convert

automatically into one New Avertix warrant exercisable to purchase one share of New Avertix Common Stock and (iv) each unit consisting of one Class A ordinary share of BIOS and one-half of one BIOS

warrant will convert automatically into a unit consisting of one share of New Avertix Common Stock and one-half of one New Avertix warrant.

Transaction Consideration

Upon the

consummation of the Merger, (i) each share of Avertix common stock, par value $0.001 per share (“Avertix Common Stock”), issued and outstanding immediately prior to the effective time of the Merger (the “Effective Time”)

will be canceled and converted into the right to receive (A) a number of shares of BIOS Common Stock equal to the Exchange Ratio (as defined in the Business Combination Agreement) and (B) the holder of such Avertix Common Stock’s

contingent right to receive such holder’s pro rata share of the Avertix Earnout Shares (as defined below) in accordance with the terms of the Business Combination Agreement, in each case, without interest, and (ii) each option to purchase

shares of Avertix Common Stock (“Avertix Option”) that is outstanding and unexercised as of immediately prior to the Effective Time, whether then vested or unvested, will be assumed by New Avertix and converted into (A) an option to

purchase a number of shares of New Avertix Common Stock (rounded down to the nearest whole share) (“Exchanged Option”) equal to (x) the number of shares of Avertix Common Stock subject to such Avertix Option immediately prior to the

Effective Time, multiplied by (y) the Exchange Ratio, at an exercise price per share (rounded up to the nearest whole cent) equal to (1) the exercise price per share of such Avertix Option immediately prior to the Effective Time, divided

by (2) the Exchange Ratio and (B) the holder of such Avertix Option’s contingent right to receive such holder’s pro rata share of the Avertix Earnout Shares in accordance with the terms of the Business Combination Agreement.

Following the Closing, as additional consideration for the Merger and the other

Transactions, eligible equityholders of Avertix will be entitled to receive their respective pro rata share of 2,970,000 shares of New Avertix Common Stock (the “Avertix Earnout Shares”) in two equal tranches, each contingent upon New

Avertix’s achievement of the applicable stock price milestones (the “Triggering Events”) during the Earnout Period; provided that, with respect to any holder of a unvested Exchanged Option, an award of restricted stock units

for a number of Avertix Earnout Shares otherwise issuable to such holder and subject to the same vesting terms as the unvested Exchanged Option will be issued to such holder in lieu of any Avertix Earnout Shares.

At the Effective Time, a portion of the Sponsor’s founder shares, consisting of 1,150,000 Class B ordinary shares of BIOS as of the

date hereof (the “Sponsor Earnout Shares”), will become unvested and subject to vesting and forfeiture, and will thereafter become vested only upon the occurrence of the applicable Triggering Event in the same proportion as the issuance of

Avertix Earnout Shares to eligible equityholders of Avertix upon the occurrence of such Triggering Event. The Sponsor Earnout Shares are subject to reduction in connection with certain additional financing permitted under the Business Combination

Agreement, and will be forfeited if the applicable Triggering Events do not occur during the Earnout Period.

Representations, Warranties and Covenants

The parties to the Business Combination Agreement (the “Parties”) have made customary representations, warranties and

covenants, including, among others, with respect to the conduct of the businesses of Avertix and BIOS during the period between execution of the Business Combination Agreement and the Closing (the “Interim Period”). Certain of the

representations are subject to specified exceptions and qualifications contained in the Business Combination Agreement or in information provided pursuant to certain disclosure schedules to the Business Combination Agreement.

The Parties have agreed to take all actions necessary or appropriate such that, as of immediately following the Closing, New Avertix’s

board of directors will be divided into three classes and be composed of a total of seven (7) directors, which directors shall include Ross Haghighat, two (2) individuals designated by the Sponsor and four (4) individuals designated

by Avertix.

The Parties have agreed that, during the Interim Period, BIOS may sell to any other person in a private placement additional

shares of BIOS’ equity that have the same rights, privileges and preferences as the shares of New Avertix Common Stock to be issued to the stockholders of Avertix pursuant to the terms of the Business Combination Agreement and at a price per

share not less than $10.00 per share. At the Closing, subject to the terms and conditions of the Business Combination Agreement, convertible note financing provided by the Sponsor prior to the Closing will be repaid at the Closing or converted into

New Avertix units pursuant to their terms.

Conditions to Closing

The obligations of Avertix and BIOS to consummate the Transactions are subject to the satisfaction or waiver (where permissible) at or prior to

the Closing of various conditions, including, among other things: (i) the accuracy of the representations and warranties of BIOS and Avertix, respectively; (ii) the performance by BIOS and Avertix, respectively, of its covenants and

agreements; (iii) the absence of any material adverse effect that is continuing with respect to Avertix during the Interim Period, (iv) the approval of Avertix’s stockholders and BIOS’ shareholders; (v) the effectiveness of

a registration statement on Form S-4 to be filed with the U.S. Securities and Exchange Commission (the “SEC”) in connection with the Transactions (the “Registration Statement”) and the

submission by BIOS of the supplemental listing application to the Nasdaq Stock Market; (vi) the receipt of requisite government approvals; (vii) BIOS having at least $5,000,001 of net tangible assets following the exercise of Redemption

Rights provided in accordance with the organizational documents of BIOS; and (viii) as a condition to Avertix’s obligations to consummate the Transactions, the total cash and cash equivalents of BIOS at the Closing, after giving effect to

redemptions by BIOS Shareholders, additional financing permitted under the Business Combination Agreement (including repayment of convertible notes issued to the Sponsor, if applicable) and payment of transaction expenses, being no less than

$40,000,000.

Termination

The Business Combination Agreement may be terminated under certain customary and limited circumstances at any time prior to the Closing,

including: (i) by mutual written consent of BIOS and Avertix; (ii) subject to certain cure periods, by either BIOS or Avertix, as applicable, if there has been a breach of any representation, warranty, covenant or other agreement made by

BIOS or Avertix, as applicable, that would result in the failure of related closing conditions; (iii) by either BIOS or Avertix if the Effective Time does not occur prior to December 31, 2023, subject to certain exceptions; (iv) by

either BIOS or Avertix if the transaction is prohibited by a final, non-appealable law or a government order; (v) by either BIOS or Avertix if requisite approval is not obtained from BIOS Shareholders at

the extraordinary general meeting of BIOS Shareholders contemplated by the Business Combination Agreement; and (vi) by BIOS if requisite approval is not obtained from Avertix’s stockholders within 2 business days after the Registration

Statement becomes effective.

The foregoing description of the Business Combination Agreement and the Transactions does not purport to be

complete and is qualified in its entirety by the terms and conditions of the Business Combination Agreement, a copy of which is attached hereto as Exhibit 2.1 and incorporated herein by reference. The Business Combination Agreement contains

representations, warranties and covenants that the respective parties made to each other as of the date of such agreement or other specific dates. The assertions embodied in those representations, warranties and covenants were made for purposes of

the contract among the respective parties and are subject to important qualifications and limitations agreed to by the parties in connection with negotiating such agreement. The Business Combination Agreement has been attached to provide investors

with information regarding its terms. It is not intended to provide any other factual information about BIOS, Avertix or any other party to the Business Combination Agreement. In particular, the representations, warranties, covenants and agreements

contained in the Business Combination Agreement, which were made only for purposes of such agreement and as of specific dates, were solely for the benefit of the parties to the Business Combination Agreement, may be subject to limitations agreed

upon by the contracting parties (including being qualified by confidential disclosures made for the purposes of allocating contractual risk between the parties to the Business Combination Agreement instead of establishing these matters as facts) and

may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors and reports and documents filed with the SEC. Investors should not rely on the representations, warranties, covenants and

agreements, or any descriptions thereof, as characterizations of the actual state of facts or condition of any party to the Business Combination Agreement. In addition, the representations, warranties, covenants and agreements and other terms of the

Business Combination Agreement may be subject to subsequent waiver or modification. Moreover, information concerning the subject matter of the representations and warranties and other terms may change after the date of the Business Combination

Agreement, which subsequent information may or may not be fully reflected in public disclosures by BIOS.

Proxy and Registration Statement

As promptly as practicable after the date of the Business Combination Agreement, BIOS will prepare and file with the SEC a proxy

and registration statement on Form S-4 (as amended or supplemented from time to time, the “Proxy”) to be sent to the BIOS Shareholders relating to the extraordinary meeting of the BIOS Shareholders

to be held to consider (i) approval and adoption of the Business Combination Agreement and the Transactions, (ii) approval of the issuance of BIOS Common Stock as contemplated by the Business Combination Agreement, (iii) approval of

the proposed certificate of incorporation and bylaws of BIOS to be adopted upon the Domestication, (iv) election of directors to New Avertix’s board of directors, (v) approval of the adoption of an equity incentive plan in

substantially the form attached to the Business Combination Agreement, (vi) approval of the adoption of an employee stock purchase plan in substantially the form attached to the Business Combination Agreement and (vii) any other proposals

the parties deem necessary to effectuate the Transactions.

Stock Exchange Listing

BIOS will use its reasonable best efforts to cause the shares of New Avertix Common Stock to be issued in connection with the Transactions to

be approved for listing on the Nasdaq Capital Market at the Closing. During the Interim Period, BIOS shall use its reasonable best efforts to keep its shares, units and warrants listed for trading on the Nasdaq Global Market.

Related Agreements

Registration Rights Agreement

At the

Closing, BIOS, the Sponsor, the executive officers and directors of BIOS, and certain equityholders of Avertix will enter into an Amended and Restated Registration Rights Agreement (the “Registration Rights Agreement”) pursuant to which,

among other things, the parties thereto will be granted customary registration rights with respect to shares of New Avertix Common Stock.

The foregoing description of the Registration Rights Agreement is qualified in its entirety by reference to the full text of the form of

Registration Rights Agreement, a copy of which is included as Exhibit 10.1 to this Current Report on Form 8-K, and incorporated herein by reference.

Lock-Up Arrangements

The Sponsor, holders of Placement Units, and Avertix equityholders will be subject to lock-up

restrictions (the “Lock-Up”) contained in the proposed bylaws of New Avertix pursuant to which, without the prior written consent of New Avertix’s board of directors, during the period commencing on the date of the Closing and ending

on the date that is the one-year anniversary of the Closing, such parties will not (i) offer, pledge, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to

sell, grant any option, right or warrant to purchase, lend, or otherwise transfer or dispose of, directly or indirectly, such shares or other equity securities (the “Lock-Up Securities”) or

(2) enter into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of the Lock-Up Securities, whether any such transaction described

in clause (1) or (2) above is to be settled by delivery of New Avertix Common Stock; provided, however, (a) if at any time 151 days after the Closing, the closing share price of New Avertix Common Stock is greater than or equal to

$12.50 over any 20 trading days within any consecutive 30 trading day period (“Initial Price Target”), then one-third (1/3) of the Lock-Up Securities shall

automatically be released from the Lock-Up, and (b) if at any time 151 days after the Closing, the closing share price of the New Avertix Common Stock is greater than or equal to $15.00 over any 20

trading days within any consecutive 30 trading day period (“Second Price Target”), then an additional one-third (1/3) of the Lock-Up Securities shall be

released from the Lock-Up. For clarity, in the event that the Initial Price Target and/or the Second Price Target are not met, then the Lock-up Period shall terminate

for all Lock-up Securities on the one-year anniversary of the Closing. The lock-up restrictions contain customary exceptions,

including for estate planning transfers, affiliates transfers, certain open market transfers and transfers upon death or by will.

Pursuant to an amendment to that certain letter agreement by and between BIOS, its officers and directors, and the Sponsor, dated

December 2, 2021, to be entered into at the Closing (the “Letter Agreement Amendment”) and Registration Rights Agreement, the lock-up restrictions for the Sponsor

At-Risk Capital Lockup Shares, the Placement Shares and Placement Warrants (each as defined in the Letter Agreement Amendment) will lapse upon the six-month anniversary

of the Closing, unless the Initial Price Target or Second Price Target are achieved before such date.

The foregoing description of the Lock-Up, and Letter Agreement Amendment and the Registration Rights Agreement is qualified in its entirety by reference to the full text of the form of the New Avertix’s bylaws, the form of the Letter Agreement

Amendment and the form of Registration Rights Agreement, copies of which are included as Exhibit B to the Business Combination Agreement included as Exhibit 2.1 to this Current Report on Form 8-K, Exhibit 10.1

and Exhibit 10.2, respectively, to this Current Report on Form 8-K, and incorporated herein by reference.

Stockholder Support Agreement

On

May 2, 2023, BIOS, Avertix, and certain affiliate stockholders of Avertix (“Key Avertix Holders”) entered into Stockholder Support Agreements (the “Stockholder Support Agreements”) pursuant to which the Key Avertix Holders

agreed to, among other things, (i) waive any appraisal rights in connection with the Merger and (ii) consent to and vote in favor of the Business Combination Agreement and the Transactions.

The foregoing description of the Stockholder Support Agreements is qualified in its entirety by reference to the full text of the form of

Stockholder Support Agreement, a copy of which is included as Exhibit 10.3 to this Current Report on Form 8-K, and incorporated herein by reference.

Sponsor Support Agreement

On May 2, 2023, BIOS, the Sponsor, and Avertix entered into the Sponsor Support Agreement (the “Sponsor Support Agreement”)

pursuant to which, among other things, the Sponsor has agreed to (i) vote all of its ordinary shares in favor of the proposals being presented at the extraordinary general meeting of BIOS Shareholders, (ii) waive the anti-dilution or

similar protections with respect to the Sponsor’s founder shares, consisting of 5,750,000 Class B ordinary shares of BIOS as of the date hereof, in connection with the consummation of the Transactions and (iii) not redeem any of its

shares in connection with the vote to approve the Transactions.

The foregoing description of the Sponsor Support Agreement is qualified

in its entirety by reference to the full text of the Sponsor Support Agreement, a copy of which is included as Exhibit 10.4 to this Current Report on Form 8-K, and incorporated herein by reference.

| Item 7.01. |

Regulation FD Disclosure. |

On May 3, 2023, BIOS issued a press release announcing the execution of the Business Combination Agreement. A copy of the press release is

furnished as Exhibit 99.1 hereto.

Furnished as Exhibit 99.2 is a copy of an investor presentation to be used by BIOS in connection with

the Transactions.

The information in this Item 7.01 and Exhibits 99.1 and 99.2 attached hereto shall not be deemed “filed” for

purposes of Section 18 of Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by

specific reference in such filing.

Important Information About the Transactions and Where to Find It

In connection with the proposed Business Combination, BIOS intends to file the Proxy with the SEC. BIOS will mail a definitive proxy statement

and other relevant documents to its shareholders. BIOS’ shareholders and other interested persons are advised to read, when available, the preliminary proxy statement and any amendments thereto and the definitive proxy statement and documents

incorporated by reference therein filed in connection with the Transactions, as these materials will contain important information about BIOS, Avertix and the Transactions. When available, the definitive proxy statement and other relevant materials

for the Transactions will be mailed to shareholders of BIOS as of a record date to be established for voting on the Transactions. INVESTORS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT AND OTHER RELEVANT MATERIALS CAREFULLY AND IN THEIR ENTIRETY

WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT BIOS AND THE TRANSACTIONS. Shareholders will also be able to obtain copies of the preliminary proxy statement, the definitive proxy statement and other documents filed

with the SEC that will be incorporated by reference therein, without charge, once available, at the SEC’s website at www.sec.gov, or by directing a request to: BioPlus Acquisition Corp., 260 Madison Avenue, Suite 800, New York, NY 10026 or by

emailing info@biosspac.com.

Participants in the Solicitation

BIOS and its directors and executive officers may be deemed participants in the solicitation of proxies from BIOS’ shareholders with

respect to the Transactions. A list of the names of those directors and executive officers and a description of their interests in BIOS is contained in BIOS’ annual report on Form 10-K for the fiscal year

ended December 31, 2022, which was filed with the SEC on March 31, 2022 and is available free of charge at the SEC’s website at www.sec.gov, or by directing a request to BioPlus Acquisition Corp., 260 Madison Avenue, Suite 800, New

York, NY 10026 or by emailing info@biosspac.com. Additional information regarding the interests of such participants will be contained in the Proxy.

Avertix and its directors and executive officers may also be deemed to be participants in the solicitation of proxies from the shareholders of

BIOS in connection with the Transactions. A list of the names of such directors and executive officers and information regarding their interests in the Transactions will be included in the Proxy.

Forward-Looking Statements

This

Current Report on Form 8-K contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 that

are not historical facts, and involve risks and uncertainties that could cause actual results of BIOS and Avertix to differ materially from those expected

and projected. These forward-looking statements can be identified by the use of forward-looking terminology, including the words “believes,” “estimates,”

“anticipates,” “expects,” “intends,” “plans,” “may,” “will,” “potential,” “projects,” “predicts,” “continue,” or “should,” or, in each

case, their negative or other variations or comparable terminology. These forward-looking statements include, without limitation, statements regarding BIOS’ ability to enter into definitive agreements or consummate a transaction with Avertix

and the expected timing of completion of the Transactions.

These forward-looking statements involve significant risks and uncertainties

that could cause the actual results to differ materially from the expected results. Most of these factors are outside BIOS’ and are difficult to predict. Factors that may cause such differences include, but are not limited to: the inability of

the Parties to successfully or timely consummate the Transactions; the risk that the Transactions may not be completed by BIOS’ business combination deadline and the potential failure to obtain an extension of the Transactions deadline by BIOS;

failure to realize the anticipated benefits of the Transactions; risks relating to the uncertainty of the projected financial information with respect to Avertix; the occurrence of any event, change or other circumstance that could give rise to the

termination of the definitive transaction agreement; Avertix’s history of operating losses; Avertix’s need for additional capital to support its present business plan and anticipated growth; Avertix’s ability to engage physicians to

utilize and prescribe its solution; changes in reimbursement practices; technological changes in Avertix’s market; Avertix’s ability to protect its intellectual property; Avertix’s material weaknesses in financial reporting; and

Avertix’s ability to navigate complex regulatory requirements; the ability to maintain the listing of BIOS’ securities on a national securities exchange; the ability to implement business plans, forecasts, and other expectations after the

completion of the Transactions; the effects of competition on Avertix’s business; the risks of operating and effectively managing growth in evolving and uncertain macroeconomic conditions, such as high inflation and recessionary environments;

continuing risks relating to the COVID 19 pandemic; and risks associated with Avertix’s ability to develop its products and achieve regulatory approvals or milestones on the timelines expected or at all. The foregoing list of factors is not

exhaustive.

BIOS cautions that the foregoing list of factors is not exclusive. BIOS cautions readers not to place undue reliance upon any

forward-looking statements, which speak only as of the date made. BIOS does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its

expectations or any change in events, conditions or circumstances on which any such statement is based. Further information about factors that could materially affect BIOS, including its results of operations and financial condition, is set forth

under “Risk Factors” in Part I, Item 1A of BIOS’ Annual Report on Form 10-K for the fiscal year ended December 31, 2022.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 2.1* |

|

Business Combination Agreement and Plan of Reorganization, dated May 2, 2023, by and among BioPlus Acquisition Corp., Avertix Medical, Inc. and other parties thereto. |

|

|

| 10.1 |

|

Form of Amended and Restated Registration Rights Agreement. |

|

|

| 10.2 |

|

Form of Amendment No. 1 to the Sponsor Letter Agreement. |

|

|

| 10.3 |

|

Form of Stockholder Support Agreement, dated May 2, 2023, by and among BioPlus Acquisition Corp., Avertix Medical, Inc. and other parties thereto. |

|

|

| 10.4 |

|

Sponsor Support Agreement, dated May 2, 2023, by and among BioPlus Acquisition Corp., Avertix Medical, Inc. and BioPlus Sponsor LLC. |

|

|

| 99.1 |

|

Press Release, dated May 3, 2023. |

|

|

| 99.2 |

|

Investor Presentation, dated May 2023. |

|

|

| 104.1 |

|

Cover page interactive data file (embedded within the Inline XBRL document). |

| * |

Certain exhibits and schedules to this Exhibit have been omitted in accordance with Regulation S-K Item 601(a)(5). BIOS agrees to supplementally furnish a copy of any omitted exhibit or schedule to the SEC upon its request. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

| BioPlus Acquisition Corp. |

|

|

| By: |

|

/s/ Ross Haghighat |

| Name: |

|

Ross Haghighat |

| Title: |

|

Chief Executive Officer and Chief Financial Officer |

Dated: May 3, 2023

Exhibit 2.1

Execution Version

BUSINESS COMBINATION AGREEMENT AND PLAN OF REORGANIZATION

by and among

BIOPLUS

ACQUISITION CORP.,

GUARDIAN MERGER SUBSIDIARY CORP.

AVERTIX MEDICAL, INC.

and, solely with respect to Section 3.03(b) and Section 7.21,

BIOPLUS SPONSOR LLC

Dated as of May 2, 2023

TABLE OF CONTENTS

|

|

|

|

|

|

|

| |

|

|

|

Page |

|

| ARTICLE I DEFINITIONS |

|

|

3 |

|

|

|

|

| 1.01 |

|

Certain Definitions |

|

|

3 |

|

|

|

|

| 1.02 |

|

Further Definitions |

|

|

15 |

|

|

|

|

| 1.03 |

|

Construction |

|

|

19 |

|

|

|

| ARTICLE II AGREEMENT AND PLAN OF MERGER |

|

|

20 |

|

|

|

|

| 2.01 |

|

Closing Transactions |

|

|

20 |

|

|

|

|

| 2.02 |

|

Effective Time; Closing |

|

|

21 |

|

|

|

|

| 2.03 |

|

Effect of the Merger |

|

|

21 |

|

|

|

|

| 2.04 |

|

Certificate of Incorporation; Bylaws |

|

|

21 |

|

|

|

|

| 2.05 |

|

Directors and Officers |

|

|

21 |

|

|

|

| ARTICLE III EFFECTS OF THE MERGER |

|

|

22 |

|

|

|

|

| 3.01 |

|

Conversion of Securities |

|

|

22 |

|

|

|

|

| 3.02 |

|

Exchange of Certificates |

|

|

23 |

|

|

|

|

| 3.03 |

|

Earnout |

|

|

25 |

|

|

|

|

| 3.04 |

|

Payment of Acquiror Transaction Costs; Closing Statement |

|

|

26 |

|

|

|

|

| 3.05 |

|

Stock Transfer Books |

|

|

27 |

|

|

|

|

| 3.06 |

|

Appraisal Rights |

|

|

28 |

|

|

|

| ARTICLE IV REPRESENTATIONS AND WARRANTIES OF THE COMPANY |

|

|

28 |

|

|

|

|

| 4.01 |

|

Organization and Qualification; Subsidiaries |

|

|

28 |

|

|

|

|

| 4.02 |

|

Certificate of Incorporation and Bylaws |

|

|

29 |

|

|

|

|

| 4.03 |

|

Capitalization |

|

|

29 |

|

|

|

|

| 4.04 |

|

Authority Relative to this Agreement |

|

|

31 |

|

|

|

|

| 4.05 |

|

No Conflict; Required Filings and Consents |

|

|

31 |

|

|

|

|

| 4.06 |

|

Permits; Compliance |

|

|

32 |

|

|

|

|

| 4.07 |

|

Financial Statements |

|

|

32 |

|

|

|

|

| 4.08 |

|

Absence of Certain Changes or Events |

|

|

34 |

|

|

|

|

| 4.09 |

|

Absence of Litigation |

|

|

34 |

|

|

|

|

| 4.10 |

|

Employee Benefit Plans |

|

|

34 |

|

|

|

|

| 4.11 |

|

Labor and Employment Matters |

|

|

36 |

|

|

|

|

| 4.12 |

|

Real Property; Title to Assets |

|

|

37 |

|

|

|

|

| 4.13 |

|

Company Assets |

|

|

38 |

|

|

|

|

| 4.14 |

|

Intellectual Property |

|

|

38 |

|

i

TABLE OF CONTENTS

(continued)

|

|

|

|

|

|

|

| |

|

|

|

Page |

|

| 4.15 |

|

Taxes |

|

|

41 |

|

|

|

|

| 4.16 |

|

Environmental Matters |

|

|

43 |

|

|

|

|

| 4.17 |

|

Material Contracts |

|

|

43 |

|

|

|

|

| 4.18 |

|

Customers, Vendors and Suppliers |

|

|

46 |

|

|

|

|

| 4.19 |

|

Insurance |

|

|

46 |

|

|

|

|

| 4.20 |

|

Board Approval; Vote Required |

|

|

46 |

|

|

|

|

| 4.21 |

|

Certain Business Practices |

|

|

47 |

|

|

|

|

| 4.22 |

|

Interested Party Transactions; Side Letter Agreements |

|

|

47 |

|

|

|

|

| 4.23 |

|

Exchange Act |

|

|

47 |

|

|

|

|

| 4.24 |

|

Brokers |

|

|

48 |

|

|

|

|

| 4.25 |

|

Healthcare Compliance |

|

|

48 |

|

|

|

| ARTICLE V REPRESENTATIONS AND WARRANTIES OF ACQUIROR AND MERGER SUB |

|

|

50 |

|

|

|

|

| 5.01 |

|

Corporate Organization |

|

|

51 |

|

|

|

|

| 5.02 |

|

Organizational Documents |

|

|

51 |

|

|

|

|

| 5.03 |

|

Capitalization |

|

|

51 |

|

|

|

|

| 5.04 |

|

Authority Relative to This Agreement |

|

|

52 |

|

|

|

|

| 5.05 |

|

No Conflict; Required Filings and Consents |

|

|

53 |

|

|

|

|

| 5.06 |

|

Compliance |

|

|

53 |

|

|

|

|

| 5.07 |

|

SEC Filings; Financial Statements; Sarbanes-Oxley |

|

|

53 |

|

|

|

|

| 5.08 |

|

Business Activities; Absence of Certain Changes or Events |

|

|

55 |

|

|

|

|

| 5.09 |

|

Absence of Litigation |

|

|

56 |

|

|

|

|

| 5.10 |

|

Board Approval; Vote Required |

|

|

57 |

|

|

|

|

| 5.11 |

|

No Prior Operations of Merger Sub |

|

|

57 |

|

|

|

|

| 5.12 |

|

Brokers |

|

|

57 |

|

|

|

|

| 5.13 |

|

Acquiror Trust Fund |

|

|

57 |

|

|

|

|

| 5.14 |

|

Employees and Employee Benefit Plans |

|

|

58 |

|

|

|

|

| 5.15 |

|

Taxes |

|

|

58 |

|

|

|

|

| 5.16 |

|

Registration and Listing |

|

|

60 |

|

|

|

|

| 5.17 |

|

Interested Party Transaction |

|

|

60 |

|

|

|

|

| 5.18 |

|

Acquiror’s and Merger Sub’s Reliance |

|

|

60 |

|

|

|

| ARTICLE VI CONDUCT OF BUSINESS PENDING THE MERGER |

|

|

61 |

|

|

|

|

| 6.01 |

|

Conduct of Business by the Company Pending the Merger |

|

|

61 |

|

ii

TABLE OF CONTENTS

(continued)

|

|

|

|

|

|

|

| |

|

|

|

Page |

|

| 6.02 |

|

Conduct of Business by Acquiror and Merger Sub Pending the Merger |

|

|

64 |

|

|

|

|

| 6.03 |

|

Waiver of Claims Against Trust Account |

|

|

66 |

|

|

|

| ARTICLE VII ADDITIONAL AGREEMENTS |

|

|

67 |

|

|

|

|

| 7.01 |

|

No Solicitation |

|

|

67 |

|

|

|

|

| 7.02 |

|

Registration Statement; Consent Solicitation Statement; Proxy Statement |

|

|

69 |

|

|

|

|

| 7.03 |

|

Consent Solicitation; Written Consent; Company Change in Recommendation |

|

|

71 |

|

|

|

|

| 7.04 |

|

Acquiror General Meeting; Merger Sub Stockholder’s Approval |

|

|

72 |

|

|

|

|

| 7.05 |

|

Access to Information; Confidentiality |

|

|

73 |

|

|

|

|

| 7.06 |

|

Directors’ and Officers’ Indemnification |

|

|

74 |

|

|

|

|

| 7.07 |

|

Notification of Certain Reserved Matters |

|

|

75 |

|

|

|

|

| 7.08 |

|

Further Action; Reasonable Best Efforts |

|

|

76 |

|

|

|

|

| 7.09 |

|

Public Announcements |

|

|

76 |

|

|

|

|

| 7.10 |

|

Listing |

|

|

76 |

|

|

|

|

| 7.11 |

|

Antitrust |

|

|

77 |

|

|

|

|

| 7.12 |

|

Trust Account |

|

|

77 |

|

|

|

|

| 7.13 |

|

Tax Matters |

|

|

78 |

|

|

|

|

| 7.14 |

|

Section 16 Matters |

|

|

79 |

|

|

|

|

| 7.15 |

|

Directors and Officers |

|

|

79 |

|

|

|

|

| 7.16 |

|

FIRPTA Tax Certificates |

|

|

79 |

|

|

|

|

| 7.17 |

|

Domestication |

|

|

79 |

|

|

|

|

| 7.18 |

|

Related Party Statements |

|

|

79 |

|

|

|

|

| 7.19 |

|

Transaction Litigation |

|

|

80 |

|

|

|

|

| 7.20 |

|

Required Company Permits |

|

|

80 |

|

|

|

|

| 7.21 |

|

Additional Financing; Sponsor Notes |

|

|

80 |

|

|

|

|

| 7.22 |

|

Financial Statements |

|

|

81 |

|

|

|

|

| 7.23 |

|

280G Matters |

|

|

81 |

|

|

|

| ARTICLE VIII CONDITIONS TO THE MERGER |

|

|

82 |

|

|

|

|

| 8.01 |

|

Conditions to the Obligations of Each Party |

|

|

82 |

|

|

|

|

| 8.02 |

|

Conditions to the Obligations of Acquiror and Merger Sub |

|

|

82 |

|

|

|

|

| 8.03 |

|

Conditions to the Obligations of the Company |

|

|

83 |

|

|

|

| ARTICLE IX TERMINATION, AMENDMENT AND WAIVER |

|

|

84 |

|

|

|

|

| 9.01 |

|

Termination |

|

|

84 |

|

iii

TABLE OF CONTENTS

(continued)

|

|

|

|

|

|

|

| |

|

|

|

Page |

|

| 9.02 |

|

Effect of Termination |

|

|

85 |

|

|

|

|

| 9.03 |

|

Expenses |

|

|

85 |

|

|

|

|

| 9.04 |

|

Amendment |

|

|

86 |

|

|

|

|

| 9.05 |

|

Waiver |

|

|

86 |

|

|

|

| ARTICLE X GENERAL PROVISIONS |

|

|

86 |

|

|

|

|

| 10.01 |

|

Notices |

|

|

86 |

|

|

|

|

| 10.02 |

|

Nonsurvival of Representations, Warranties and Covenants |

|

|

87 |

|

|

|

|

| 10.03 |

|

No Other Representations; No Reliance |

|

|

87 |

|

|

|

|

| 10.04 |

|

Severability |

|

|

89 |

|

|

|

|

| 10.05 |

|

Entire Agreement; Assignment |

|

|

89 |

|

|

|

|

| 10.06 |

|

Parties in Interest |

|

|

89 |

|

|

|

|

| 10.07 |

|

Governing Law |

|

|

89 |

|

|

|

|

| 10.08 |

|

Waiver of Jury Trial |

|

|

90 |

|

|

|

|

| 10.09 |

|

Headings |

|

|

90 |

|

|

|

|

| 10.10 |

|

Counterparts; Electronic Delivery |

|

|

90 |

|

|

|

|

| 10.11 |

|

Specific Performance |

|

|

90 |

|

|

|

|

| 10.12 |

|

No Recourse |

|

|

90 |

|

|

|

|

| EXHIBIT A |

|

Form of Acquiror Certificate of Incorporation |

| EXHIBIT B |

|

Form of Acquiror Bylaws |

| EXHIBIT C |

|

Form of Stockholder Support Agreement |

| EXHIBIT D |

|

Form of Registration Rights Agreement |

| EXHIBIT E |

|

Form of Letter Agreement Amendment |

| EXHIBIT F |

|

Form of Certificate of Domestication |

| EXHIBIT G |

|

Form of Certificate of Merger |

| EXHIBIT H |

|

Form of Omnibus Incentive Plan |

| EXHIBIT I |

|

Form of ESPP |

| EXHIBIT J |

|

Form of Written Consent |

| SCHEDULE A |

|

Company Knowledge Parties |

| SCHEDULE B |

|

Board of Directors of Surviving Corporation |

iv

BUSINESS COMBINATION AGREEMENT AND PLAN OF REORGANIZATION

This Business Combination Agreement and Plan of Reorganization, dated as of May 2, 2023 (this “Agreement”), is

entered into by and among BioPlus Acquisition Corp., a Cayman Islands exempted company (which shall migrate to and domesticate as a Delaware corporation prior to the Closing) (“Acquiror”), Guardian Merger Subsidiary Corp., a

Delaware corporation and a direct wholly owned Subsidiary of Acquiror (“Merger Sub”), Avertix Medical, Inc. (f/k/a Angel Medical Systems, Inc.), a Delaware corporation (the “Company”), and, solely with

respect to Section 3.03(b) and Section 7.21, BioPlus Sponsor LLC, a Cayman Islands limited liability company (the “Sponsor”). Capitalized terms used in this Agreement shall

have the meanings ascribed to such terms in Article I or as defined elsewhere in this Agreement.

WHEREAS, Acquiror is a

blank check company incorporated as a Cayman Islands exempted company and incorporated for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more

businesses;

WHEREAS, Merger Sub is a newly formed, wholly-owned, direct subsidiary of Acquiror, and was formed for the purpose of

the Merger (as defined below);

WHEREAS, prior to (but no later than the day preceding) the Closing Date and following Acquiror

shareholders’ exercise of their Redemption Rights, and subject to the conditions of this Agreement, Acquiror shall migrate to and domesticate as a Delaware corporation in accordance with Section 388 of the Delaware General Corporation Law,

as amended (the “DGCL”) and the Companies Act (the “Domestication”);

WHEREAS,

concurrently with the Domestication, Acquiror shall file a certificate of incorporation in substantially the form attached as Exhibit A hereto (the “Acquiror Certificate of Incorporation”) with the Secretary of State

of Delaware and adopt bylaws in substantially the form attached as Exhibit B hereto (the “Acquiror Bylaws”);

WHEREAS, upon the effectiveness of the Domestication, (i) each then issued and outstanding Acquiror Class A Ordinary Share

shall convert automatically, on a one-for-one basis, into one share of Domesticated Acquiror Common Stock; (ii) each then issued and outstanding Acquiror

Class B Ordinary Share shall convert automatically, on a one-for-one basis, into a share of Domesticated Acquiror Common Stock; (iii) each then issued and

outstanding Acquiror Warrant shall convert automatically into a warrant to acquire one share of Domesticated Acquiror Common Stock (“Domesticated Acquiror Warrant”) pursuant to the Acquiror Warrant Agreement; and

(iv) each then issued and outstanding Acquiror Unit shall convert automatically into a unit of Acquiror (“Domesticated Acquiror Unit”), with each Domesticated Acquiror Unit representing one share of Domesticated Acquiror

Common Stock and one-half of one Domesticated Acquiror Warrant;

WHEREAS, upon the terms

and subject to the conditions of this Agreement and in accordance with the DGCL, (i) Acquiror and the Company will enter into a business combination transaction pursuant to which Merger Sub will merge with and into the Company (the

“Merger”), with the Company surviving the Merger as a direct wholly owned Subsidiary of Acquiror and (ii) Acquiror will change its name to “Avertix Medical, Inc.”;

1

WHEREAS, the parties intend (i) that, for U.S. federal and applicable state

income Tax purposes (A) the Domestication shall constitute a transaction treated as a “reorganization” within the meaning of Section 368(a)(1)(F) of the Code and (B) the Merger will be treated as qualifying as a

“reorganization” within the meaning of Section 368(a) of the Code (this clause (i)(B) the “Tax-Free Reorganization”, and together with (i)(A), the “Intended

Tax Treatment”), (ii) for this Agreement to constitute a “plan of reorganization” within the meaning of Treasury Regulations Sections 1.368-2(g) and

1.368-3, and (iii) to file the statement required by Treasury Regulations Section 1.368-3(a);

WHEREAS, (i) prior to the Effective Time, each of the outstanding warrants to purchase shares of Company Common Stock issued by

the Company (the “Company Warrants”) shall be exercised in full on a cash or cashless basis or terminated without exercise, as applicable, in accordance with the terms of the applicable Company Warrant (the

“Company Warrant Settlement”), and (ii) following the Company Warrant Settlement but prior to giving effect to the transactions contemplated by Section 3.01, each share of Company Preferred

Stock shall be converted into shares of Company Common Stock in accordance with the Company Certificate of Incorporation (the “Conversion”);

WHEREAS, upon the Effective Time and following the Company Warrant Settlement and the Conversion, all issued and outstanding shares of

Company Stock shall be converted into the holder’s right to receive the holder’s applicable portion of the aggregate Per Share Merger Consideration and, if the applicable Triggering Event has occurred, the Company Earnout Shares, in each

case, pursuant to the terms and subject to the conditions of this Agreement;

WHEREAS, the Board of Directors of the Company (the

“Company Board”) has (i) determined that the Merger is fair to, and in the best interests of, the Company and its stockholders, (ii) approved and adopted this Agreement and declared its advisability and approved the

Merger and the other Transactions, and (iii) recommended that the stockholders of the Company approve and adopt this Agreement and approve the Merger and the other Transactions and directed that this Agreement and the Merger and the other

Transactions be submitted for consideration by the Company’s stockholders (the “Company Recommendation”);

WHEREAS, the Board of Directors of Acquiror (the “Acquiror Board”) has (i) determined that this Agreement,

the Domestication, the Merger and the other Transactions are in the best interests of Acquiror, (ii) approved this Agreement, the Domestication, the Merger and the other Transactions and declared their advisability, and (iii) recommended

that the shareholders of Acquiror approve and adopt this Agreement, the Domestication, the Merger and the other Transactions, and directed that this Agreement, the Domestication, the Merger and the other Transactions be submitted for consideration

by the shareholders of Acquiror at the Acquiror General Meeting;

WHEREAS, after giving effect to the Domestication, the Board of

Directors of Acquiror (the “Domesticated Acquiror Board”) shall (i) determine that this Agreement, the Merger and the other Transactions are in the best interests of Acquiror, and (ii) approve this Agreement, the

Merger and the other Transactions and declare their advisability;

WHEREAS, the Board of Directors of Merger Sub (the

“Merger Sub Board”) has unanimously (a) determined that this Agreement and the Merger are fair to and in the best interests of Merger Sub and its sole stockholder, (b) approved this Agreement and the Merger and

declared their advisability, and (c) recommended that the sole stockholder of Merger Sub approve and adopt this Agreement and approve the Merger and directed that this Agreement and the Merger be submitted for consideration by the sole

stockholder of Merger Sub;

WHEREAS, as a condition and inducement to Acquiror’s willingness to enter into this Agreement,

concurrently with the execution and delivery of this Agreement, certain Company Stockholders (the “Key Company Stockholders”) have entered into a Stockholder Support Agreement with the Company and Acquiror in substantially

the form attached as Exhibit C hereto (the “Stockholder Support Agreement”), providing that, among other things, upon the terms and subject to the conditions set forth therein, the Key Company Stockholders will vote

their shares of Company Stock in favor of this Agreement, the Merger and the other Transactions;

2

WHEREAS, in connection with the Closing, Acquiror, certain shareholders of Acquiror

and certain stockholders of the Company shall enter into an Amended and Restated Registration Rights Agreement in substantially the form attached as Exhibit D hereto (the “Registration Rights Agreement”);

WHEREAS, Acquiror, its officers and directors, and the Sponsor are parties to that certain Letter Agreement, dated December 2,

2021 (the “Letter Agreement”), and, in connection with the Closing, the parties thereto shall enter into an amendment to the Letter Agreement in the form attached as Exhibit E hereto (the “Letter

Agreement Amendment” and the Letter Agreement as amended by the Letter Agreement Amendment, the “Amended Letter Agreement”); and

WHEREAS, pursuant to the Acquiror Organizational Documents, Acquiror shall provide an opportunity to its shareholders to have their

Acquiror Common Stock redeemed for the amounts, and on the terms and subject to the conditions and limitations set forth in this Agreement, the Acquiror Organizational Documents, the Trust Agreement, and the Proxy Statement in conjunction with,

inter alia, obtaining approval from the shareholders of Acquiror for the Transactions.

NOW, THEREFORE, in consideration of

the foregoing and the mutual covenants and agreements herein contained, and intending to be legally bound hereby, the parties hereto hereby agree as follows:

ARTICLE I

DEFINITIONS

1.01 Certain Definitions. For purposes of this Agreement:

“Acquiror Adjusted Minimum Cash” means, as of the Closing, an amount equal to thirty (30) percent of Acquiror

Cash, excluding any amounts from the Sponsor Loan Note or the Additional Sponsor Loan Note.

“Acquiror Cash”

means, as of the date or time of determination and excluding any Restricted Cash: (a) all amounts in the Trust Account (for the avoidance of doubt, prior to exercise of Redemption Rights in connection with the Closing in accordance with the

Acquiror Organizational Documents, if any); plus (b) the aggregate amount of cash proceeds from the Additional Financing, if any; minus (c) the aggregate amount of cash proceeds that will be required to satisfy the exercise

of Redemption Rights in accordance with the Acquiror Organizational Documents, if any; minus (d) all Acquiror Transaction Costs and Company Transaction Costs that remain unpaid at the Closing or are to be paid simultaneously with the

Closing (including, if the Sponsor Loan Note and the Additional Sponsor Loan Note are to be repaid at the Closing pursuant to Section 3.04(c) and Section 7.21(b), all outstanding principal and

accrued interest amounts under the Sponsor Loan Note and the Additional Sponsor Loan Note).

“Acquiror Charter”

means (a) prior to the Domestication, the Amended and Restated Memorandum and Articles of Association of Acquiror, adopted on December 2, 2021 (the “Acquiror Articles of Association”) and (b) from and

immediately after the Domestication, the Acquiror Certificate of Incorporation.

“Acquiror

Class A Ordinary Shares” means, prior to the Domestication, the Acquiror’s Class A ordinary shares, par value $0.0001 per share.

3

“Acquiror Class B Ordinary Shares”

means, prior to the Domestication, Acquiror’s Class B ordinary shares, par value $0.0001 per share.

“Acquiror Common

Stock” means (a) prior to the Domestication, Acquiror Class A Ordinary Shares and Acquiror Class B Ordinary Shares, and (b) after the Domestication, Domesticated Acquiror Common Stock.

“Acquiror Founders Stock” means (a) prior to the Domestication, (i) 5,750,000 Acquiror Class B Ordinary

Shares held by the Sponsor, which comprise 6,325,000 Acquiror Class B Ordinary Shares purchased by the Sponsor on March 18, 2021, less 1,150,000 Acquiror Class B Ordinary Shares surrendered by the Sponsor to the Company for no

consideration on November 6, 2021, plus 575,000 Acquiror Class B Ordinary Shares purchased by the Sponsor on December 2, 2021 (“Acquiror Founders Cayman Stock”), and (ii) if any such share of Acquiror

Founders Cayman Stock is converted into Acquiror Class A Ordinary Shares prior to the Domestication, such equivalent number of Acquiror Class A Ordinary Shares, and (b) after the Domestication, 5,750,000 shares of Domesticated

Acquiror Common Stock held by the Sponsor.

“Acquiror Material Adverse Effect” means any event, circumstance,

change or effect (collectively “Effect”) that, individually or in the aggregate with all other Effects, has a material adverse effect on (a) the business, condition (financial or otherwise), assets, liabilities or

operations of Acquiror or (b) the ability of Acquiror or Merger Sub to consummate the Transactions; provided, however, that solely in the case of the foregoing clause (a), none of the following shall be deemed to constitute, alone

or in combination, or be taken into account in the determination of whether, there has been or will be an Acquiror Material Adverse Effect: (i) any change or proposed change in or change in the interpretation of any Law or GAAP;

(ii) events or conditions generally affecting the industries or markets in which Acquiror operates, or the economy as a whole; (iii) any downturn in general economic conditions, including changes in the credit, debt, securities, financial

or capital markets (including changes in interest or exchange rates, prices of any security or market index or commodity or any disruption of such markets); (iv) any geopolitical conditions, outbreak of hostilities, acts of war, sabotage,

cyberterrorism, terrorism or military actions (including any escalation or general worsening thereof), or any earthquakes, volcanic activity, hurricanes, tsunamis, tornadoes, floods, mudslides, wild fires or other natural disasters, weather

conditions, act of God or other force majeure events, including any escalation or worsening thereof; (v) any actions taken or not taken by Acquiror, or such other changes or events, in each case, which (A) the Company has requested in

writing or to which it has consented in writing or (B) are required by this Agreement; (vi) any Effect attributable to the announcement or execution, pendency, negotiation or consummation of the Merger or any of the other Transactions

(provided that this clause (vi) shall not apply to references to “Acquiror Material Adverse Effect” in the representations and warranties in Section 5.05(a) and, to the extent related thereto, the condition

in Section 8.03(a)); or (vii) any epidemic, pandemic or disease outbreak (including COVID-19) or any Law, directive, pronouncement or guideline issued by a Governmental

Authority, the Centers for Disease Control and Prevention, the World Health Organization or any relevant industry group providing for business closures, changes to business operations,

“sheltering-in-place” or other restrictions that relate to, or arise out of, an epidemic, pandemic or disease outbreak (including COVID-19) or any change in such Law, directive, pronouncement or guideline or interpretation thereof following the date of this Agreement, except, in the case of the foregoing clauses (i) through (iii), to the

extent that Acquiror is disproportionately affected thereby as compared with other participants in the industry in which Acquiror operates.

“Acquiror Minimum Cash” means an amount equal to $40,000,000.

“Acquiror Organizational Documents” means the Acquiror Charter, the Acquiror Bylaws, and Trust Agreement of Acquiror,

in each case as amended, modified or supplemented from time to time.

4

“Acquiror Transaction Costs” means, to the extent incurred prior to

or at the Closing and without duplication of any Company Transaction Costs: (a) the sum of all outstanding deferred, unpaid or contingent underwriting, transaction, deal, brokerage, financial, accounting or legal advisory, auditor or SEC filing

fees or any similar fees, commissions or expenses owed by Acquiror or Merger Sub (to the extent Acquiror or Merger Sub is responsible for or obligated to reimburse or repay any such amounts) to financial advisors, investment banks, data room

administrators, financial printers, attorneys, accountants and other similar advisors, service providers or the SEC in connection with the evaluation, negotiation, preparation, execution or consummation of Acquiror’s initial public offering or

any business combination transaction, including the Transactions; (b) any accounting, legal or other advisory or any similar fees, commissions or expenses incurred by Acquiror or Merger Sub in the ordinary course of business and not in

connection with the negotiation, preparation and execution of this Agreement, the other Transaction Documents or the consummation of the Transactions; (c) the cash portion of any loan payable to the Sponsor (or its Affiliates) by Acquiror

outstanding as of the date hereof or incurred by Acquiror from Sponsor (or its Affiliates) after the date hereof prior to the Closing (including, if required to be repaid at the Closing pursuant to Section 3.04(c) and

Section 7.21(b), all outstanding principal and accrued interest amounts under the Sponsor Loan Note and the Additional Sponsor Loan Note); and (d) the cost of the Acquiror Tail Policy.

“Acquiror Units” means a unit consisting of one Acquiror Class A Ordinary Share and one-half (1/2) of one Acquiror Warrant.

“Acquiror Warrant Agreement” means that

certain warrant agreement dated December 2, 2021, by and between Acquiror and Continental Stock Transfer & Trust Company.

“Acquiror Warrants” means warrants to purchase Acquiror Class A Ordinary Shares as contemplated under the

Acquiror Warrant Agreement, each exercisable to purchase one Acquiror Class A Ordinary Share at an exercise price of $11.50 per share.

“Affiliate” of a specified person means a person who, directly or indirectly through one or more intermediaries,

controls, is controlled by, or is under common control with, such specified person.

“Ancillary Agreements” means

the Registration Rights Agreement, the Stockholder Support Agreement, the Letter Agreement Amendment and all other agreements, certificates and instruments executed and delivered by Acquiror, Merger Sub or the Company in connection with the

Transactions and specifically contemplated by this Agreement.

“Anti-Corruption Laws” means (a) the U.S.

Foreign Corrupt Practices Act of 1977, (b) the UK Bribery Act 2010, (c) anti-bribery legislation promulgated by the European Union and implemented by its member states, (d) legislation adopted in furtherance of the OECD Convention on Combating

Bribery of Foreign Public Officials in International Business Transactions, (e) Anti-Money Laundering Laws and (f) similar legislation applicable to the Company or any Company Subsidiary from time to time.

“Anti-Money Laundering Laws” means applicable Laws related to

money laundering, including the U.S. federal Bank Secrecy Act, 31 USC § 5311 et seq., and its implementing regulations at 31 CFR Chapter X; the U.S. Money Laundering Control Act of 1986, as amended; and any

anti-racketeering Laws involving money laundering or bribery as a racketeering act.

“Business Combination” has the meaning ascribed to such term in the Acquiror Charter.

5

“Business Data” means all sensitive or confidential business

information and data, excluding Personal Information (whether of employees, contractors, consultants, customers, consumers, or other persons and whether in electronic or any other form or medium) that is accessed, collected, used, stored, shared,

distributed, transferred, disclosed, destroyed, disposed of or otherwise processed by any of the Business Systems in the conduct of the business of the Company or any Company Subsidiaries or otherwise in the course of the conduct of the business of

the Company or any Company Subsidiaries.

“Business Day” means any day on which the principal offices of the SEC

in Washington, D.C. are open to accept filings, or, in the case of determining a date when any payment is due, any day on which banks in New York, NY or Governmental Authorities in the Cayman Islands (for so long as Acquiror remains domiciled in the

Cayman Islands) are not required or authorized to close; provided, that banks shall not be deemed to be authorized or obligated to be closed due to a “shelter in place,” “non-essential

employee” or similar closure of physical branch locations at the direction of any Governmental Authority if such banks’ electronic funds transfer systems (including for wire transfers) are open for use by customers on such day.

“Business Systems” means all computer hardware (whether general or special purpose), integrated Software (whether

installed on premises or provided via the cloud or “as a service”) and databases, electronic data processors, telecommunication systems, networks, interfaces, platforms, servers, peripherals, computer systems, including any outsourced

systems and processes, any other technology system, in each case, that are owned by the Company or a Company Subsidiary, or used by the Company or a Company Subsidiary in the conduct of the business of the Company or any Company Subsidiaries as

currently conducted, in each case to the extent subject to the Company’s or a Company Subsidiary’s administrative and operational control.

“Cayman Registrar” means the Registrar of Companies of the Cayman Islands.

“Change in Control” means any transaction or series of related transactions, including any sale, merger, liquidation,

exchange offer or other similar transaction, that is consummated after the Effective Time that results (a) in any person or “group” (within the meaning of Section 13(d)(3) of the Exchange Act) acquiring beneficial ownership of

50% or more of the outstanding voting securities of Acquiror (or any successor to Acquiror), directly or indirectly, immediately following such transaction; provided that any transaction or series of related transactions which results in at

least 50% of the combined voting power of the then outstanding shares of Acquiror Common Stock (or at least 50% of the combined voting power of the then outstanding shares of any successor to Acquiror or any parent company of Acquiror issued in

exchange for Acquiror Common Stock) immediately following the closing of such transaction (or series of related transactions) being beneficially owned, directly or indirectly, by individuals and entities who were the beneficial owners of at least

50% of the shares of Acquiror Common Stock outstanding immediately prior to such transaction (or series of related transactions), shall not be deemed a “Change in Control”, or (b) a sale or disposition of all or substantially all of

the assets of Acquiror (or any successor to Acquiror) and its Subsidiaries on a consolidated basis.

“Code” means

the United States Internal Revenue Code of 1986, as amended.

“Companies Act” means the Companies Act (as amended)

of the Cayman Islands.

“Company Certificate of Incorporation” means the Eighth Amended and Restated Certificate

of Incorporation of the Company, dated February 14, 2023, as the same may be amended, supplemented or modified from time to time.

“Company Common Stock” means the shares of the Company’s Common Stock, par value $0.001 per share.

6

“Company Earnout Shares” means 2,970,000 shares of Acquiror Common

Stock reserved for issuance pursuant to Section 3.03(a) hereof, as adjusted pursuant to Section 3.03(d) hereof.

“Company IP” means, collectively, all Company-Owned IP and Company-Licensed IP.

“Company-Licensed IP” means all Intellectual Property owned by a third party and licensed to the Company or any

Company Subsidiary.

“Company-Licensed Exclusive IP” means all Company-Licensed IP licensed exclusively to the

Company or any Company Subsidiary.

“Company Material Adverse Effect” means any Effect that, individually or in

the aggregate with all other Effects, has a material adverse effect on (a) the business, condition (financial or otherwise), assets, liabilities or operations of the Company and the Company Subsidiaries taken as a whole or (b) the ability

of the Company to consummate the Transactions; provided, however, that solely in the case of the foregoing clause (a), none of the following shall be deemed to constitute, alone or in combination, or be taken into account in the

determination of whether, there has been or will be a Company Material Adverse Effect: (i) any change or proposed change in or change in the interpretation of any Law or GAAP; (ii) events or conditions generally affecting the industries or

markets in with the Company and the Company Subsidiaries operate or the economy as a whole; (iii) any downturn in general economic conditions, including changes in the credit, debt, securities, financial or capital markets (including changes in

interest or exchange rates, prices of any security or market index or commodity or any disruption of such markets); (iv) any geopolitical conditions, outbreak of hostilities, acts of war, sabotage, cyberterrorism, terrorism or military actions

(including any escalation or general worsening thereof), or any earthquakes, volcanic activity, hurricanes, tsunamis, tornadoes, floods, mudslides, wild fires or other natural disasters, weather conditions, act of God or other force majeure events,

including any escalation or worsening thereof; (v) any actions taken or not taken by the Company or the Company Subsidiaries, or such other changes or events, in each case, which (A) Acquiror has requested in writing or to which it has

consented in writing or (B) are required by this Agreement; (vi) any Effect attributable to the announcement or execution, pendency, negotiation or consummation of the Merger or any of the other Transactions (including the impact thereof

on relationships with customers, Suppliers, employees or Governmental Authorities) (provided that this clause (vi) shall not apply to references to “Company Material Adverse Effect” in the representations and warranties in

Section 4.05(a) and, to the extent related thereto, the condition in Section 8.02(a)); (vii) any failure to meet any projections, forecasts, guidance, estimates, milestones, budgets or financial or

operating predictions of revenue, earnings, cash flow or cash position, provided that this clause (vii) shall not prevent a determination that any Effect underlying such failure has resulted in a Company Material Adverse Effect (to the extent

such Effect is not otherwise excluded from this definition of Company Material Adverse Effect); or (viii) any epidemic, pandemic or disease outbreak (including COVID-19) or any Law, directive,

pronouncement or guideline issued by a Governmental Authority, the Centers for Disease Control and Prevention, the World Health Organization or any relevant industry group providing for business closures, changes to business operations, “sheltering-in-place” or other restrictions that relate to, or arise out of, an epidemic, pandemic or disease outbreak (including

COVID-19) or any change in such Law, directive, pronouncement or guideline or interpretation thereof following the date of this Agreement, except, in the case of the foregoing clauses (i) through (iii),

to the extent that the Company and the Company Subsidiaries, taken as a whole, are disproportionately affected thereby as compared with other participants in the industries in which the Company or the Company Subsidiaries operate.

“Company Merger Shares” means a number of shares equal to (i) the Company Valuation divided by

(ii) the Company Per Share Valuation.

7

“Company Options” means all outstanding incentive stock options or

nonstatutory stock options to purchase outstanding shares of Company Common Stock, whether or not exercisable and whether or not vested, granted under the Company Stock Plan or otherwise.

“Company Outstanding Shares” means, after giving effect to the Company Warrant Settlement and the Conversion and as of

the immediately prior to the Effective Time, the sum of: (a) all issued and outstanding shares of Company Common Stock and (b) shares of Company Common Stock subject to all issued and outstanding Company Options that are issuable upon the

net exercise of such Company Options, assuming that the fair market value of one Option Share equals (i) the Exchange Ratio multiplied by (ii) the Company Per Share Valuation.

“Company-Owned IP” means all Intellectual Property owned or purported to be owned by the Company or any of the Company

Subsidiaries.

“Company Per Share Valuation” means $10.00.

“Company Preferred Stock” means, collectively, the Company Series A Preferred Stock and the Company Series B Preferred

Stock.

“Company Series A Preferred Stock” means the shares of the Company’s Preferred Stock, par value

$0.001 per share, designated as Series A Preferred Stock in the Company Certificate of Incorporation.

“Company Series B

Preferred Stock” means the shares of the Company’s Preferred Stock, par value $0.001 per share, designated as Series B Preferred Stock in the Company Certificate of Incorporation.

“Company Stock” means the Company Common Stock and the Company Preferred Stock.

“Company Stock Plan” means the 2019 Equity Incentive Plan of the Company, as amended from time to time.

“Company Stockholder Approval” means the affirmative vote of (a) the holders of a majority of the outstanding

shares of Company Common Stock, voting together as a separate class, and (b) the holders of a majority of the outstanding shares of Company Preferred Stock on an as-converted to shares of Company Common

Stock basis.

“Company Stockholders” means holders of Company Stock.

“Company Subsidiary” means each subsidiary of the Company.

“Company Transaction Costs” means, to the extent incurred prior to or at the Closing in connection with the

negotiation, preparation and execution of this Agreement, the other Transaction Documents and the consummation of the Transactions, without duplication of any Acquiror Transaction Costs, the sum of (i) all outstanding deferred, unpaid or

contingent transaction, deal, brokerage, financial, accounting or legal advisory, auditor or any similar fees, commissions or expenses owed by the Company or any of its Subsidiaries (to the extent the Company or any of its Subsidiaries is

responsible for or obligated to reimburse or repay any such amounts) to financial advisors, investment banks, data room administrators, financial printers, attorneys, accountants and other similar advisors, service providers and the SEC and

(ii) the cost of the Company Tail Policy.