UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: May 30, 2023

BioPlus

Acquisition Corp.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Cayman Islands |

|

001-41116 |

|

98-1583272 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

| 260 Madison Avenue |

| Suite 800 |

| New York, New York 10016 |

| (Address of principal executive offices, including zip code) |

Registrant’s telephone number, including area code: (212) 287-4092

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Units, each consisting of one Class A Ordinary Share and one-half of one Redeemable Warrant |

|

BIOSU |

|

The Nasdaq Stock Market LLC |

| Class A Ordinary Share, par value $0.0001 per share |

|

BIOS |

|

The Nasdaq Stock Market LLC |

| Warrants, each whole warrant exercisable for one Class A Ordinary Share for $11.50 per share |

|

BIOSW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of

1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01. |

Regulation FD Disclosure. |

On May 30, 2023, BioPlus Acquisition Corp (“BIOS”) and Avertix Medical, Inc. (f/k/a Angel Medical Systems, Inc.), a Delaware corporation

(“Avertix”) will make available a joint investor presentation concerning their previously announced proposed business combination. A copy of the investor presentation is furnished herewith as Exhibit 99.1.

The information in this Item 7.01, including Exhibit 99.1, is furnished and shall not be deemed “filed” for purposes of Section 18 of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities under that section, and shall not be deemed to be incorporated by reference into the filings of BIOS under the Securities Act of 1933, as

amended, or the Exchange Act, regardless of any general incorporation language in such filings. This Current Report on Form 8-K will not be deemed an admission as to the materiality of any

information contained in this Item 7.01, including Exhibit 99.1.

Important Information About the Transactions and Where to Find It

This Current Report on Form 8-K may contain information relating to a proposed business

combination between BIOS and Avertix. In connection with the proposed transaction, BIOS has filed a registration statement on Form S-4 (as amended or supplemented, the “Registration Statement”) with

the Securities and Exchange Commission (the “SEC”), which includes a preliminary proxy statement/prospectus of BIOS, which will be both the proxy statement to be distributed to holders of BIOS’ ordinary shares in connection with the

solicitation of proxies for the vote by BIOS’ shareholders with respect to the proposed business combination and related matters as may be described in the Registration Statement, as well as the prospectus relating to the offer and sale of the

securities to be issued in the business combination. After the Registration Statement is declared effective, BIOS will mail a definitive proxy statement/prospectus and other relevant documents to its shareholders. BIOS shareholders and other

interested persons are advised to read, when available, the preliminary proxy statement/prospectus, and amendments thereto, and the definitive proxy statement/prospectus in connection with BIOS’ solicitation of proxies for its

shareholders’ meeting to be held to approve the proposed business combination and related matters because the proxy statement/prospectus will contain important information about BIOS and Avertix and the proposed business combination.

The definitive proxy statement/prospectus will be mailed to shareholders of BIOS as of a record date to be established for voting on the proposed business

combination and related matters. Shareholders may obtain copies of the proxy statement/prospectus, when available, without charge, at the SEC’s website at www.sec.gov or by directing a request to: BioPlus Acquisition Corp., 260 Madison Avenue,

Suite 800, New York, NY 10026 or by emailing info@Biosspac.com

Participants in the Solicitation

BIOS and Avertix and their respective directors, officers and other members of their management and employees may be deemed to be participants in the

solicitation of proxies from BIOS’ shareholders with respect to the proposed business combination and related matters. Investors and securityholders may obtain more detailed information regarding the names, affiliations and interests of the

directors and officers of BIOS and Avertix in the proxy statement/prospectus relating to the proposed business combination filed with the SEC. These documents may be obtained free of charge from the sources indicated above.

No Offer or Solicitation

This Current Report on Form 8-K is for informational purposes only and is not intended to and shall not constitute a proxy statement or the solicitation of a proxy, consent or authorization with respect to any securities

or in respect of the proposed transaction and is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy or subscribe for any securities or a solicitation of any vote

of approval, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

Forward-Looking Statements

This Current Report on Form 8-K contains “forward-looking statements” within the meaning of Section 27A

of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 that are not historical facts, and involve risks and uncertainties that could cause actual results of BIOS and Avertix to differ materially from those expected

and projected. These statements, other than statements of present or historical fact included in this document, regarding BIOS’ proposed business combination with Avertix, BIOS’ ability to consummate the proposed transactions, the benefits

of the proposed transactions and the combined company’s future financial performance, including financial projections, as well as the combined company’s strategy, demand for products and services, use cases for products and services,

anticipated business model and future operations, estimated financial position, estimated revenue growth, prospects expectations, estimated market growth, size and opportunity, plans and objectives of management, among others, are forward-looking

statements. These statements are based on various assumptions, whether or not identified in this document, and on the current expectations of Avertix’s management and are not predictions of actual performance, and, as a result, are subject to

risks and uncertainties. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement

of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many factors could cause actual future events to differ materially from the forward-looking statements in this document,

including but not limited to: the inability of the parties to successfully or timely consummate the proposed business combination; the risk that the proposed business combination may not be completed by BIOS’ business combination deadline and

the potential failure to obtain an extension of the business combination deadline by BIOS; failure to realize the anticipated benefits of the proposed business combination; the occurrence of any event, change or other circumstance that could give

rise to the termination of the definitive transaction agreement; Avertix’s history of operating losses; Avertix’s ability to engage physicians to utilize and prescribe its solution; changes in reimbursement practices; technological changes

in Avertix’s market; Avertix’s ability to protect its intellectual property; Avertix ‘s material weaknesses in financial reporting; and the Avertix’s ability to navigate complex regulatory requirements. The foregoing list of

factors is not exhaustive. Please carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of the final prospectus to BIOS’ registration statement on Form S-1, as amended (File No. 333-249676), the Registration Statement filed with the SEC by BIOS and other documents filed or that may be filed by BIOS

from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those obtained in the forward-looking statements.

There may be additional risks that neither BIOS nor Avertix presently know or that BIOS and Avertix currently believe are immaterial that could also cause

actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect BIOS’ and Avertix’s expectations, plans or forecasts of future events and views as of the date of this

document. BIOS and Avertix anticipate that subsequent events and developments will cause BIOS’ and Avertix’s assessments to change. However, while BIOS and Avertix may elect to update these forward-looking statements at some point in the

future, BIOS and Avertix specifically assume no obligation and do not intend to do so, nor do they intend to revise these forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required by

applicable law. These forward-looking statements should not be relied upon as representing BIOS’ and Avertix’s assessments as of any date subsequent to the date of this document. Neither BIOS nor Avertix gives any assurance that either

BIOS or Avertix, or the combined company, will achieve its expectations. Accordingly, undue reliance should not be placed upon the forward-looking statements as predictions of future events.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Investor Presentation, dated May 30, 2023. |

|

|

| 104.1 |

|

Cover page interactive data file (embedded within the Inline XBRL document). |

| * |

Certain exhibits and schedules to this Exhibit have been omitted in accordance with Regulation S-K Item 601(a)(5). BIOS agrees to supplementally furnish a copy of any omitted exhibit or schedule to the SEC upon its request. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

| BioPlus Acquisition Corp. |

|

|

| By: |

|

/s/ Ross Haghighat |

| Name: |

|

Ross Haghighat |

| Title: |

|

Chief Executive Officer and Chief Financial Officer |

Dated: May 30, 2023

Exhibit 99.1 Investor Presentation June 2023

Disclaimers (1 of 2) This presentation and any accompanying oral

presentation (this “Presentation”) is provided for informational purposes only and has been prepared to assist interested parties in making their own evaluation with respect to a potential business combination between Avertix Medical,

Inc. (f/k/a Angel Medical Systems, Inc. (“Target” or “Avertix”) and BioPlus Acquisition Corp. (“BIOS” or the “SPAC”) and related transactions (the “Potential Business Combination”) and for

no other purpose. By reviewing or reading this Presentation, you will be deemed to have agreed to the obligations and restrictions set out below. Without the express prior written consent of BIOS, this Presentation and any information contained

within it may not be (i) reproduced (in whole or in part), (ii) copied at any time, (iii) used for any purpose other than your evaluation of Target or (iv) provided to any other person, except your employees and advisors with a need to know who are

advised of the confidentiality of the information. This Presentation supersedes and replaces all previous oral or written communications between the parties hereto relating to the subject matter hereof. This Presentation and any oral statements made

in connection with this Presentation do not constitute an offer to sell, or a solicitation of an offer to buy, or a recommendation to purchase, any securities in any jurisdiction, or the solicitation of any vote, consent or approval in any

jurisdiction in connection with the Potential Business Combination or any related transactions, nor shall there be any sale, issuance or transfer of any securities in any jurisdiction where, or to any person to whom, such offer, solicitation or sale

may be unlawful under the laws of such jurisdiction. This Presentation does not constitute either advice or a recommendation regarding any securities. Any offer to sell securities will be made only pursuant to a definitive subscription agreement and

will be made in reliance on an exemption from registration under the Securities Act of 1933, as amended, for offers and sales of securities that do not involve a public offering. BIOS and the Target reserve the right to withdraw or amend for any

reason any offering and to reject any subscription agreement for any reason. The communication of this Presentation is restricted by law; it is not intended for distribution to, or use by any person in, any jurisdiction where such distribution or

use would be contrary to local law or regulation. No representations or warranties, express or implied are given in, or in respect of, this Presentation. Industry and market data used in this Presentation have been obtained from third-party industry

publications and sources as well as from research reports prepared for other purposes. Neither BIOS nor Target has independently verified the data obtained from these sources and cannot assure you of the data’s accuracy or completeness. This

data is subject to change. Recipients of this Presentation are not to construe its contents, or any prior or subsequent communications from or with BIOS, Target or their respective representatives as investment, legal or tax advice. In addition,

this Presentation does not purport to be all-inclusive or to contain all of the information that may be required to make a full analysis of Target or the Potential Business Combination. Recipients of this Presentation should each make their own

evaluation of Target and of the relevance and adequacy of the information and should make such other investigations as they deem necessary. Forward Looking Statements Certain statements included in this Presentation are not historical facts but are

forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “believe,”

“may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,”

“potential,” “seem,” “seek,” “future,” “outlook,” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters, but the absence

of these words does not mean that a statement is not forward-looking. All statements, other than statements of present or historical fact included in this Presentation, regarding BIOS’ proposed acquisition of Target, BIOS’ ability to

consummate the proposed transactions, the benefits of the proposed transactions and the combined company’s future financial performance, including financial projections, as well as the combined company’s strategy, demand for products and

services, use cases for products and services, anticipated business model and future operations, estimated financial position, estimated revenue growth, prospects expectations, estimated market growth, size and opportunity, plans and objectives of

management, and among others, are forward-looking statements. These statements are based on various assumptions, whether or not identified in this Presentation, and on the current expectations of Target’s management and are not predictions of

actual performance, and, as a result, are subject to risks and uncertainties. These forward- looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee,

an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many factors could cause actual future events to differ materially

from the forward-looking statements in this Presentation, including but not limited to: the inability of the parties to successfully or timely consummate the Potential Business Combination; the risk that the Potential Business Combination may not be

completed by BIOS’ business combination deadline and the potential failure to obtain an extension of the business combination deadline by BIOS; failure to realize the anticipated benefits of the Potential Business Combination; risks relating

to the uncertainty of the projected financial information with respect to Target; the inability to complete a PIPE financing; the occurrence of any event, change or other circumstance that could give rise to the termination of the definitive

transaction agreement; the Target’s history of operating losses; the Target’s need for additional capital to support its present business plan and anticipated growth; the Target’s ability to engage physicians to utilize and

prescribe its solution; changes in reimbursement practices; technological changes in the Target’s market; the Target’s ability to protect its intellectual property; the Target's material weaknesses in financial reporting; and the

Target’s ability to navigate complex regulatory requirements. The foregoing list of factors is not exhaustive. Please carefully consider the foregoing factors, the risk factors on pages 4 and 5 of this Presentation and the other risks and

uncertainties described in the “Risk Factors” section of the final prospectus to BIOS’ registration statement on Form S-1, as amended (File No. 333-249676), the registration statement on Form S-4 to be filed with the SEC by BIOS

and other documents filed or that may be filed by BIOS from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in

the forward-looking statements. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that neither

BIOS nor Target presently know or that BIOS and Target currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect

BIOS’ and Target’s expectations, plans or forecasts of future events and views as of the date of this Presentation. BIOS and Target anticipate that subsequent events and developments will cause BIOS’ and Target’s assessments

to change. However, while BIOS and Target may elect to update these forward-looking statements at some point in the future, BIOS and Target specifically assume no obligation and do not intend to do so, nor do they intend to revise these

forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required by applicable law. These forward-looking statements should not be relied upon as representing BIOS’ and Target’s

assessments as of any date subsequent to the date of this Presentation. Neither BIOS nor Target gives any assurance that either BIOS or Target, or the combined company, will achieve its expectations. Accordingly, undue reliance should not be placed

upon the forward-looking statements as predictions of future events. 2

Disclaimers (2 of 2) Use of Data The data contained herein is derived

from various internal and external sources. No representation is made as to the reasonableness of the assumptions made within or the accuracy or completeness of any projections or modeling or any other information contained herein. Any data on past

performance or modeling contained herein is not an indication as to future performance. BIOS and Target assume no obligation to update the information in this presentation. Further, the financials contained herein were prepared by Target in

accordance with private company AICPA standards. Target is currently in the process of uplifting its financials to comply with public company and SEC requirements. Trademarks BIOS and Target own or have rights to various trademarks, service marks

and trade names that they use in connection with the operation of their respective businesses. This presentation may also contain trademarks, service marks, trade names and copyrights of third parties, which are the property of their respective

owners. The use or display of third parties’ trademarks, service marks, trade names or products in this presentation is not intended to, and does not imply, a relationship with BIOS or Target, or an endorsement or sponsorship by or of BIOS or

Target. Solely for convenience, the trademarks, service marks, trade names and copyrights referred to in this presentation may appear without the TM, SM, ® or © symbols, but such references are not intended to indicate, in any way, that

BIOS or Target will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks, trade names and copyrights. Use of Projections The projections, estimates and

targets in this Presentation are forward-looking statements that are based on assumptions that are inherently subject to significant uncertainties and contingencies, many of which are beyond BIOS’ and Target’s control. While all

projections, estimates and targets are necessarily speculative, BIOS and Target believe that the preparation of prospective financial information involves increasingly higher levels of uncertainty the further out the projection, estimate or target

extends from the date of preparation. The assumptions and estimates underlying the projected, expected or target results are inherently uncertain and are subject to a wide variety of significant business, economic, regulatory and competitive risks

and uncertainties that could cause actual results to differ materially from those contained in such projections, estimates and targets. The inclusion of projections, estimates and targets in this presentation should not be regarded as an

indication that BIOS and Target, or their representatives, considered or consider the financial projections, estimates and targets to be a reliable prediction of future events. Financial Information The financial information and data contained in

this Presentation is unaudited and does not conform to Regulation S-X. Accordingly, such information and data may not be included in, may be adjusted in or may be presented differently in, any proxy statement or registration statement to be filed by

BIOS or Target with the SEC. Important Information for Investors and Stockholders BIOS and Target and their respective directors and executive officers, under SEC rules, may be deemed to be participants in the solicitation of proxies of BIOS’

shareholders in connection with the Potential Business Combination. Investors and security holders may obtain more detailed information regarding the names and interests in the Potential Business Combination of BIOS’ directors and officers in

BIOS’ filings with the SEC, including BIOS’ registration statement on Form S-1, which was originally filed with the SEC on July 20, 2021. To the extent that holdings of BIOS’ securities have changed from the amounts reported in

BIOS’ registration statement on Form S-1, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Information regarding the persons who may, under SEC rules, be deemed participants in the

solicitation of proxies to BIOS’ shareholders in connection with the Potential Business Combination is set forth in the registration statement filed by BIOS on Form S-4 (as amended or supplemented, the “Registration Statement”),

which includes a preliminary proxy statement/prospectus of BIOS, which will be both the proxy statement to be distributed to holders of BIOS’ ordinary shares in connection with the solicitation of proxies for the vote by BIOS‘

shareholders with respect to the proposed business combination and related matters as may be described in the Registration Statement, as well as the prospectus relating to the offer and sale of the securities to be issued in the Proposed Business

Combination. After the Registration Statement is declared effective, BIOS will mail a definitive proxy statement/prospectus and other relevant documents to its shareholders. BIOS shareholders and other interested persons are advised to read, when

available, the preliminary proxy statement/prospectus, and amendments thereto, and the definitive proxy statement/prospectus in connection with BIOS’ solicitation of proxies for its shareholders’ meeting to be held to approve the

Proposed Business Combination and related matters because the proxy statement/prospectus will contain important information about BIOS and Avertix and the Proposed Business Combination. This Presentation is not a substitute for the registration

statement or for any other document that BIOS may file with the SEC in connection with the Potential Business Combination. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY

BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders may obtain free copies of other documents filed with the SEC by BIOS through the website maintained by the SEC at http://www.sec.gov. INVESTMENT IN ANY

SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN.

ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. 3

Summary of Risk Factors (1 of 2) Risks Related to Avertix’s

Business • Avertix has a history of operating losses and may not achieve or sustain profitability in the future. We expect to incur losses for the foreseeable future, and our ability to achieve and maintain profitability depends on the

commercial success of the Guardian System. • Avertix requires additional capital to support its present business plan and anticipated business growth, and such capital may not be available on acceptable terms, or at all, which would adversely

affect its ability to operate. • Avertix’s business is dependent upon physicians utilizing and prescribing its solution; if Avertix fails to engage physicians to utilize its solution, its revenues may never materialize or may not meet

its projections. Moreover, if we are unable to educate clinicians on the safe, effective and appropriate use of our product and designed surgery, we may experience increased claims of product liability and may be unable to achieve our expected

growth. • Avertix’s forecasts and projections are based upon assumptions, analyses and estimates developed by its management. If these assumptions, analyses or estimates prove to be incorrect or inaccurate, Avertix’s actual results

may differ materially from those forecasted or projected. • Avertix’s revenue relies on the Guardian System, which is currently its only offering. If the Guardian System or future offerings fail to gain, or lose, market acceptance,

Avertix’s business will suffer. • Avertix’s success depends on its ability to effectively market its Guardian System against those of existing or new technologies in the market. • If Avertix is unable to keep up with demand

for the Guardian System, its revenue could be impaired, market acceptance for the Guardian System could be harmed, and physicians may instead order alternative treatments. • If Avertix is not able to maintain adequate levels of third-party

reimbursement for its Guardian System, it would have a material adverse effect on its business. • Changes in reimbursement practices of third-party payors could affect the demand for the Guardian System and Avertix’s revenue levels.

• Reimbursement by Medicare is highly regulated and subject to change; any failure to comply with applicable regulations could decrease Avertix’s expected revenue and may subject it to penalties or have an adverse impact on its business.

• If reimbursement or other payment for the Guardian System is reduced or modified in the United States, including through cost containment measures or changes to policies with respect to pricing, Avertix’s business could suffer. •

Avertix is increasingly dependent on sophisticated information technology and if it fails to effectively maintain or protect its information systems or data, including from data breaches, its business could be adversely affected. • Avertix

could be exposed to significant liability claims if it is unable to obtain insurance at acceptable costs and adequate levels or otherwise protect against potential product liability claims. • If Avertix fails to retain certain of its key

personnel and attract and retain additional qualified personnel, it might not be able to pursue its growth strategy. • International expansion of Avertix’s business is expected to lead to increased exposure to market, regulatory,

political, operational, financial and economic risks associated with doing business outside of the United States. • The industry in which Avertix operates is highly competitive and subject to rapid technological change. If competitors are

better able to develop and market products that are safer, more effective, less costly, easier to use, or are otherwise more attractive, which would gain greater acceptance in the marketplace, Avertix may be unable to compete effectively with other

companies. • The COVID-19 pandemic or other future global health emergencies may materially and adversely impact our business, operating results, financial condition and liquidity. If the impacts from the COVID-19 pandemic extend beyond our

assumed timelines or new global health emergencies emerge, our actual results may vary significantly from our expectations. • Unfavorable global economic conditions, including slower growth or recession, inflation or decreases in consumer

spending power or confidence, could adversely affect our business, financial condition or results of operations. Risks Related to Intellectual Property • Intellectual property litigation and infringement claims could cause Avertix to incur

significant expenses or prevent it from selling the Guardian System and future iterations. • If Avertix is unable to protect its proprietary rights, or if it infringes on the proprietary rights of others, its competitiveness and business

prospects may be materially damaged. • Dependence on proprietary rights and failing to protect such rights or to be successful in litigation related to such rights may result in payment of significant monetary damages or impact Avertix’s

ability to sell its products. Risks Related to Manufacturing and Supply Chain Management • Interruption of manufacturing operations could adversely affect Avertix’s business, financial condition and results of operations. •

Disruptions in the supply of the materials and components used in manufacturing Avertix’s products or the sterilization of its products by third-party suppliers could adversely affect its business, financial condition and results of

operations. • Avertix depends on third-party vendors for the supply and manufacture of certain components of the Guardian System, as well as for other aspects of its operations. • Avertix’s dependence on a limited number of

suppliers to perform tasks unique to its business, such as cleaning and packaging of implant devices for sterilization, may prevent Avertix from delivering its devices on a timely basis. Regulatory, Legal and Quality Risks • Avertix is subject

to extensive compliance requirements for the quality of the Guardian System it manufactures and for vigilance on complaint-handling, escalation, assessment, and reporting of adverse events and malfunctions. A wide range of quality, regulatory, or

safety matters could trigger the need for a recall or correction to marketed products. • If Avertix fails to comply with medical device, healthcare and other governmental regulations, it could face substantial penalties and its business,

results of operations, and financial condition could be adversely affected. • Avertix’s communications with healthcare stakeholders – physicians and other healthcare professionals, payors and similar entities, as well as patients

– are subject to a high degree of scrutiny for compliance with a wide range of laws and regulations. Continuing or increasing its sales and marketing and other external communication efforts may expose Avertix to additional risk of being

alleged or deemed to be non-compliant by regulatory, enforcement authorities, or competitors. 4

Summary of Risk Factors (2 of 2) • Enforcement of federal and

state laws regarding privacy and security of patient information may adversely affect Avertix’s business, financial condition or operations. • Avertix is subject to data privacy laws that govern the collection, use, disclosure and

protection of health-related and other personal information that it collects, and its failure to comply with them could subject it to substantial liabilities, including private litigation and/or adverse publicity and could negatively affect its

operating results and business. • Avertix may be subject to federal and state false claims laws which impose substantial penalties. • Defects or quality issues associated with Avertix’s products could adversely affect the results

of its operations. • Negative publicity concerning our product or our competitors’ products, including due to product defects and any resulting litigation, could harm our reputation and reduce demand for heart attack warning systems,

either of which could adversely impact our brand and financial results. • If Avertix or its suppliers fail to comply with the Food and Drug Administration’s (the “FDA”) good manufacturing practice regulations and similar

international regulations, this could impair its ability to market its products in a cost-effective and timely manner. • If the FDA or similar regulatory authority does not approve our future products or requires additional clinical trials

before any approval or if any approval of our products includes additional restrictions on the label, or requires a characterization of our products that differs from ours and/or other regulatory authorities, our business, financial condition,

results of operations and growth prospects could be materially adversely affected. Risks Related to Owning the Combined Company’s Stock • Avertix has identified material weaknesses in our internal control over financial reporting which,

if not corrected, could affect the reliability of the combined company's financial statements, and have other adverse consequences. • Following the closing of the potential business combination, an active trading market for the combined

company’s common stock may not be available on a consistent basis to provide shareholders with adequate liquidity. The share price may be extremely volatile and shareholders could lose a significant part of their investment. • Sales of a

substantial number of shares of the combined company’s common stock in the public market by existing shareholders could cause the combined company’s share price to decline. • The combined company’s common stock may fail to

meet the initial or continued listing standards of the Nasdaq Stock Market LLC (“Nasdaq”), and additional stock may not be approved for listing on Nasdaq, following the closing of the potential business combination exchange, which could

limit investors’ ability to make transactions in the Company’s securities and subject the Company to additional trading restrictions. • Because Avertix has no current plans to pay cash dividends for the foreseeable future, you may

not receive any return on investment unless you sell your shares for a price greater than which you paid for them. • If, following the potential business combination, securities or industry analysts do not publish or cease publishing reports

about the combined company, its business, or its market, or if they change their recommendations regarding the combined company’s securities adversely, the price and trading volume of the combined company’s securities could decline.

Risks Related to the Proposed Business Combination • The benefits of the potential business combination may not be realized to the extent currently anticipated by BIOS and Avertix, or at all. The ability to recognize any such benefits may be

affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees. • The costs related to the

potential business combination could be significantly higher than currently anticipated and may exceed the amount of capital raised in connection with the potential business combination. • If BIOS does not consummate an initial business

combination by June 7, 2023 (unless extended up to December 7, 2023 as a result of the adoption of the extension amendment proposal at the upcoming extension meeting), its public shareholders may be forced to wait until thereafter before redemption

from the Trust Account. • The consummation of the potential business combination is expected to be subject to a number of conditions and, if those conditions are not satisfied or waived, any definitive agreement relating to the potential

business combination may be terminated in accordance with its terms and the potential business combination may not be completed. • BIOS directors and officers may have interests in the potential business combination different from the

interests of BIOS, Avertix or their respective securityholders. • The potential business combination will result in changes to the board of directors of Avertix that may affect the strategy of the combined company. • Because the combined

company will become a publicly traded company by virtue of mergers in connection with the potential business combination as opposed to an underwritten initial public offering, there are no underwriters involved in the process, which could result in

less diligence being conducted on the Target than in an underwritten initial public offering. • The ability of BIOS’ shareholders to exercise redemption rights with respect to up to all of the outstanding BIOS Class A ordinary shares

could increase the probability that the potential business combination would not occur or, if it does occur, limit the potential benefits of the potential business combination, harm the business and financial condition of the combined company

following the potential business combination and heighten other risks facing the combined company. . • The SEC has recently issued proposed rules on March 30, 2022 (the “SPAC Rule Proposals”) relating to certain activities of

special purpose acquisition companies. Certain of the procedures that BIOS, a potential business combination target or others may determine to undertake in connection with such proposals may increase BIOS’ costs and the time needed to complete

its initial business combination and may constrain the circumstances under which BIOS could complete an initial business combination. The need for compliance with the SPAC Rule Proposals may cause BIOS to liquidate the funds in the Trust Account or

liquidate BIOS at an earlier time than BIOS might otherwise choose. • If BIOS is deemed to be an investment company under the Investment Company Act, BIOS may be required to institute burdensome compliance requirements and its activities may

be restricted, which may make it difficult for BIOS to complete its initial business combination. To mitigate the risk of being deemed to be an investment company for purposes of the Investment Company Act, BIOS may instruct trustee of the Trust

Account to liquidate the securities held in the Trust Account and instead hold all funds in the Trust Account in a bank deposit account. 5

Avertix Executive Leadership Tim Moran Philip Tom Peter Elia President,

EVP and Chief Chief Revenue Chief Executive Officer Financial Officer Officer • Former CEO, Motus GI Holdings (Nasdaq: MOTS)• Former Principal, Explorer (Serial SPAC Sponsor)• Former Chief Strategy and Business • Former

President, ConvaTec (LSE: CTEC)• Former CFO, Hudson MX Development Officer, Acutus Medical • Former Global VP & GM, Covidien / Medtronic • Former Investment Team, Insight Partners• Former VP, Biotronik (NYSE: MDT) David

Keenan Holly Windler Sasha John PhD Chief Technology SVP Global Chief Scientific Officer Marketing Officer • 20+ years with Avertix in the development and • Former VP, Communications, Lucira Health• 30+ years of experience in

statistical/algorithmic deployment of The Guardian System• Former VP, Marketing & Communications, assessment of biological signals • Former Director, Corente Acutus Medical• Clinical translation focus • Former Engineer,

AT&T/Bell Labs• Former Brand & Product Marketing, Biotronik, Chrysler 6

BIOS Board: World Class Biotech Executives with Synergistic &

Complementary Skillsets Ross Jonathan Ronald 1 Haghighat Rigby Eastman Chairman, CBO Vice Chairman CEO, CFO • Chairman & CEO, Triton Systems• CEO, Revolo Biotherapeutics• Senior Advisor, EW Healthcare Partners •

Co-Founder, CoreTek Inc.• Former President, United Therapeutics• Former CEO, Geron Corporation • Director, Chinook Therapeutics• Former CEO, SteadyMed Therapeutics• Former CEO, Rinat Neuroscience • Director,

Fluence Corporation• Co-Founder & Former SVP of BD, Zogenix• Director, Suneva Medical Stephen Lou Lange, Glen Shawn Sherwin, M.D. M.D., Ph.D. Giovannetti Cross Director Director Director Director • Former Chairman & CEO,

Cell Genesys• Founder & Former Director, CardioGen• Former Global Biotech, Life Science • President & COO, App. Molecular • Former Chairman & Co-Founder, Sciences Leader, EY Transport Ceregene• Former EVP

& Sr. Advisor, Gilead• Director, Revolo Biotherapeutics• Former Chairman / CEO, GT Biopharma • Former Chairman & Co-Founder, Abgenix• Former Chairman & CEO, CV Therapeutics• Director, Teon

Therapeutics• Former MD, Co-Head Healthcare IB, JMP 1) Ross Haghighat (BIOS CEO and CFO, and Avertix’s Executive Chair) has recused himself from decision-making on the transaction on BIOS side given his role as Executive Chairman of the

Board of Avertix. For additional information regarding the interests of BIOS and Avertix's directors and officers in the proposed business combination, please refer to the Important Information for Investors and Stockholders section of the

Disclaimer on slide 3. 7

Transaction Summary 1 Overview Post-Transaction Ownership BIOS Founder

& Private ▪ Fully diluted distributed pro forma enterprise value of up Placement Shares 1 to $195mm , representing 2.6x CY25E revenue Existing Avertix 11.1% Shareholders ▪ Targeting to raise $50mm in PIPE proceeds 28.5% PIPE

Investors ▪ Expected to close in the second half of 2023 10.8% ▪ Existing Avertix Shareholders are rolling 100% of their existing equity BIOS Public 6 Shareholders 49.6% Enterprise Value ($mm) Sources and Uses ($mm) Enterprise Value

Calculation Sources 1 1 Shares Outstanding (mm) BIOS Cash in Trust 46.4 $239 2 PIPE Proceeds (x) Share Price $10.00 50 3 Existing Cash on Balance Sheet Equity Value $464 1 4 Equity Rollover (-) Net Cash (269) 132 Enterprise Value $195 Total Sources

$422 Transaction Multiples Uses Enterprise Value / 2024E Revenue 6.0x Cash to Balance Sheet $269 5 Enterprise Value / 2025E Revenue 2.6x Transaction Costs 21 4 Equity Rollover 132 Total Uses $422 1) Reflects estimated ownership at close as of May 1,

2023; assumes no Class A shareholder redemptions in connection with any extension of BIOS business combination deadline or the business combination. Percentages may not add up to 100% due to rounding. 2) Assumes $50 million of targeted PIPE proceeds

are raised, none of which have been committed as of the public announcement of the transaction. 3) Reflects estimate of Avertix’s existing cash on balance sheet at transaction close as of May 1, 2023. 4) Does not include 2.97mm earnout shares

to existing Avertix equityholders that are subject to vesting milestones being achieved (50% at 20-day VWAP of $12.50 and 50% at 20-day VWAP of $15.00, any time in 7 years following business combination closing. 5) Assumes no Class A share

redemptions in connection with the potential business combination, ~$50 million of PIPE proceeds are raised, ~$21 million of transaction- 8 related expenses, and that existing Avertix stockholders roll 100% of their equity into the pro forma entity.

6) Reflects preliminary estimates.

Before The Guardian: Fear and Anxiety of Another Heart Attack

There’s reason for them to be fearful: ~8.8m What’s worse, 1 heart attack survivors in US ~25% ~1 in 5 of heart attack heart attacks survivors Every 2.6 minutes 2 will experience another are silent a heart attack survivor 2 heart attack

1 experiences a second event #1 12.7 They are seeking 4 avg. hours reason for ER admission , to arrive for medical although ~80% of visits are Peace of Mind 3 5 intervention at a hospital erroneous 1)

https://www.survivorshaveheart.com/statistics-and-risk.html 2) https://www.cdc.gov/heartdisease/facts.htm 3) https://www.sciencedirect.com/science/article/pii/S0735109719373747?via%3Dihub 4)

https://hcup-us.ahrq.gov/reports/statbriefs/sb286-ED-Frequent-Conditions-2018.pdf 9 5) https://www.sciencedirect.com/science/article/pii/S0735109719302372?via%3Dihub

Today: The Guardian Provides Peace of Mind & Better Decisions,

Faster The first and only FDA-approved implantable cardiac monitoring and 1,2 alerting platform designed for the early detection of heart attacks. • Patented and proprietary algorithm using machine learning, tailored to the individual patient

• 24/7/365 continuous cardiac monitoring & alerts • Identical procedure to single chamber pacemaker • FDA approved & CMS reimbursed • Better Decisions, Faster. 1)

https://clinicaltrials.gov/ct2/results?term=Acute+Coronary+Syndrome+device&age_v=&gndr=&type=Intr&rslt=&Search=Apply 10 2) Image of device shown is a computer-generated image that does not represent the actual size of the

device.

Sizeable Global TAM with Significant Whitespace Market Size US and

Outside US (“OUS”) 1 • 8.8M existing heart attack survivors in US • Each year >800,000 heart attacks, of which >600,000 are 2 3 new , and ~90% of these patients are eligible for Guardian OUS US • The US represents

a ~$7 billion addressable market OUS up to ~7.5x the 4 size of US Opportunity 1) https://www.survivorshaveheart.com 2) https://www.cdc.gov/heartdisease/facts.htm 3) Based on management calculations that approximately 10% of individuals who suffer a

heart attack receive an implanted ICD 11 4) OUS market size data as of 2019; https://vizhub.healthdata.org/gbd-results

We Believe Avertix Presents a De-Risked Commercial Opportunity

De-Risked Foundation Compelling Commercial Opportunity • FDA Approved Class III Cardiac Device• Large Addressable Market 1 • Broad Label Indication• Robust Sales Strategy Projecting $75M Rev in ‘25 • Reimbursement

Coverage• Healthy Gross Margins • Favorable Physician Economics• Global Revenue Strategy • Broad IP Protection• Platform Expansion Roadmap • Stable Manufacturing & Supply• Proven Leadership Team •

Implementation Similar to Commonly Performed Procedure 1) Projections assume July 2023 close. 12

Potential for Rapid Revenue Growth 1 Management Projections • US

sales expected to ramp to $50M in 2025 Figures in USD millions $75 • Expected nationwide sales coverage, 200+ accounts (Ambulatory Surgery Centers and Hospitals), increasing adoption & $25 productivity • Projections assume implant

revenue of reimbursable $10,250 only • Projected OUS sales of approximately $25M by $33 2025 including only contracted distribution $9 agreements in MENA and AsiaPac (ex. China) $50 • Healthy Gross Margins, led by TPT $24 reimbursement

and thoughtful manufacturing plan $6 • Strong OpEx efficiencies and robust gross margin 2023E 2024E 2025E are expected to drive to EBITDA positive in 2025 US Revenue OUS Revenue • Anticipate ~$50M in capital raised required to reach cash

flow positive by 2025 1) Projections assume July 2023 close. 13

The Solution 14

The Solution HARDWARE SOFTWARE Implantable Histogram REAL-TIME •

Simple implantation and programming Generation ACS • Primary alerting via vibration DETECTION Intracardiac Lead Wireless Signal (1.80m) External Receiver Machine Learning • Secondary audio/visual alerting Subcutaneous IMD System uses

proprietary algorithms and machine learning to continuously provide Implantation in a Left • Enables patient to silence alarm intracardiac monitoring of ST-segments Pectoral Pocket Programmer Real-time Detection • Wirelessly communicates

with the implant Every 90 seconds, GUARDIAN measures ST-segments and compares to a patient’s for parameter setting and data retrieval baseline — notifying the patient in real-time to seek emergency medical attention •

Displays/analyzes stored data 15

Guardian’s Alerting System - Proven Benefits Alert System

“Call 911 / Emergency Alarm” Physician assesses patient’s “See Doctor” Alert non-urgent condition Guardian Proven Impact Guardian Added Benefits 4 • Speed of diagnosis 1 • Faster time to ED 4 • Speed

of revascularization 2 • Asymptomatic alerts 4 • Reduced infarct size 2 • Positive predictive value 4 • Better longitudinal outcomes 3 • Quality of life / peace of mind 4 • Arrhythmia detection 1)

https://www.sciencedirect.com/science/article/pii/S0735109719373747?via%3Dihub 2) https://www.sciencedirect.com/science/article/pii/S0735109719302372?via%3Dihub 3) ALERTS Quality-Of-Life (AQOL) Sub-study (Company Study);

https://www.accessdata.fda.gov/cdrh_docs/pdf15/P150009C.pdf 16 4) Quattro Guardian Growth Opportunity Market Study (Company Study)

ALERTS Clinical Study Key Findings: 100 Centers n=907 Impact on

Time-to-Door for Heart Attacks Other Clinical Findings Symptom + alarm was 40+ 91% 26% Silent MI’s detected more predictive than Reduction in 2 2 (~20% of total) symptoms alone for unnecessary ER visits 2 real ACS event REDUCES 3 Quality of

Life Impact STEMI & NSTEMIs Silent MIs from symptom onset from alarm Time w/out Guardian Time w/ Guardian 1) https://www.sciencedirect.com/science/article/pii/S0735109719373747?via%3Dihub 2)

https://www.sciencedirect.com/science/article/pii/S0735109719302372?via%3Dihub 17 3) ALERTS Quality-Of-Life (AQOL) Sub-study (Company Study); https://www.accessdata.fda.gov/cdrh_docs/pdf15/P150009C.pdf 1 12.7 hours 1 1.6 hours 1 1.4 hours

Commercial Strategy 18

Proven Commercial Leadership Extending Reach and Talent Sales Team

Operational Leadership Sales Team Footprint End of 2022 Mike Gillem • Former CCO, McGinley Orthopedics, • Previously leadership roles at Foxhollow Technologies, Cayenne Medical Arin Barooah =District Sales Manager (5) • Former CRO,

Varsity Healthcare =Clinical (3) • Previously leadership roles at Guidant/Boston Scientific, St. Jude/Abbott, Biotronik, and Foxhollow Caesar Fonte Sales Team Footprint Expected By End of • Former VP, US Sales, Acutus Medical •

Former VP, Biotronik Q3 2023 Tim Glynn • Former VP Business and Market Development, Acutus Medical and Volcano Corporation =District Sales Manager (18) =Clinical (18) =Independents (10) 19

Commercial Playbook: Network Referral & Scalable Execution Model

Hospital and ASC Referrals Physician to Physician Referral One designated “Implanter” likely an Electrophysiologist who has expertise in Pacemakers, Implantable Cardiac Defibrillators (ICDs), etc. in the practice. Commercial Strategy

• Demonstrate repeatable and scalable growth with predictable results • Implement “hub and partial spoke model” (controlled launch) with Referrers: 2-3 high vol PCI>ICs who believe and refer to Implanter

Precision>control approach that yields “natural referring expansions” 20

Our Positioning Focuses on the Unprotected Patient: EF>35

“Ejection Fraction (EF) is a measurement that your physician may use to gauge how healthy your heart is. Your ejection fraction is the amount of blood that your heart pumps each time it beats.” – University of Pennsylvania Medicine

EF: 35% or Lower EF: 35% to 60% EF: 60% or Higher Eligible for The majority of patients who experience an ACS Patient is more an ICD but are sent home with no or limited treatment stabilized but TM can now be offered a Guardian still at risk ~90% of

annual cases 21

Ambulatory Surgery Centers (ASCs): A Key Focus 1 2 ASC Reimbursement

Dynamics % of Cardiology Procedures Performed in ASCs ASC Specific APC Payment (0525T) Total $6,266 33% Device Offset Amount -$2,903 Net APC Payment $3,659 10% Transitional Pass-Through Payment to Avertix (C1833) $10,250 4% Estimated Implanter

Reimbursement $800-$1,200 2015 2018F mid-2020s Growth 2018F through mid-2020s 23% 6% Growth 2015-2018F 1) Medicare 2023 National Average Reimbursement. Reimbursement support provided by 3rd party advisory firm and funded by Avertix. 2)

https://www.bain.com/insights/ambulatory-surgery-center-growth-accelerates-is-medtech-ready/# 22

Building Significant Hospital Presence & Value Analysis Approvals 1

Hospital Reimbursement Dynamics Sample Partner Hospitals Where Guardian is Approved Hospital Specific APC Payment (0525T) Total $10,329 Device Offset Amount -$8,246 Net APC Payment $2,083 Transitional Pass-Through Payment to Avertix (C1833) $10,250

Estimated Implanter Reimbursement $800-$1,200 1) Medicare 2023 National Average Reimbursement. Reimbursement support provided by 3rd party advisory firm and funded by Avertix. 2)

https://www.bain.com/insights/ambulatory-surgery-center-growth-accelerates-is-medtech-ready/# 23

1 Case Studies from the Field Early Ischemic Heart Detection with Early

Arrythmia Detection Guardian ST Trending See Dr.Alert July 8th 9 December ST Deviation Trending Asymptomatic Asymptomatic patients Threshold patients diagnosed with (Max-Min >20) diagnosed Guardian Arrythmia with ST event storage. Last 191 Days

Starting From 12/9/2010 trending. Patients then received Patient Change in ST Heart Cath ablation treatment EGMs Deviation confirmed (5 months) -4 Figure A - ST -25 with 90% Deviation Trending lesion and Histogram and Corresponding patient was EGM

stented A0 Moving Avg. A0 Max A0 Min Last 191 Days Starting From 3/14/2023 24 1) Conducted case studies are company funded. Max Median ST Deviation ST Min Median ST Deviation Deviation ST Deviation

Building a Global Business International Strategy Partnership Activity

Approval Status OUS • Avertix entered a Distribution and Supply Agreement with Hydrix in 2020 Singapore Applications Malaysia • Avertix entered a Product Distribution Agreement in MENA Approved Thailand in 2023 New Zealand • Early

discussions with partners in EU and China are Japan ongoing Applications Hong Kong Under Development Australia Saudi Arabia Application UAE Planned in 2023 EU 25

Technology Roadmap 26

The Avertix Platform Hardware Software Revenue Streams Implant (TPT)

Physician Visits Aurora Remote Patient Monitoring Algorithm Data Capture and Monetization Expanded Adoptability MI Detection Custom Treatment Plans and Use Cases Diagnostics (Symptomatic and Silent) Compliance 27

The Avertix Platform Expansion Hardware Software Revenue Streams

Implant (TPT) Physician Visits Aurora Remote Patient Monitoring Algorithm Data Capture and Monetization Expanded Adoption MI Detection Custom Treatment Plans and Use Cases Diagnostics (Symptomatic and Silent) Compliance 28

Completed and Expected Upcoming Key Milestones FY ‘23 FY

‘24 $85M MENA Agreement Aurora FDA Submission Q1 H1 Sales Force Expansion & EU MDR Submission Q1+ H1 Revenue Ramp Next GEN Aurora Design Freeze EU MDR Approval Q2 H2 Q4 MENA Regulatory Approval Next GEN Aurora FDA Approval H2 29

Financial Profile 30

Potential for Rapid Revenue Growth 1 Management Projections • US

sales expected to ramp to $50M in 2025 Figures in USD millions $75 • Expected nationwide sales coverage, 200+ accounts (ASCs and Hospitals), increasing adoption & productivity $25 • Projections assume implant revenue of reimbursable

$10,250 only • Projected OUS sales of approximately $25M by 2025 $33 including only contracted distribution agreements in MENA and AsiaPac (ex. China) $9 $50 • Healthy Gross Margins, led by TPT reimbursement and thoughtful manufacturing

plan $24 • Strong OpEx efficiencies and robust gross margin are $6 expected to drive to EBITDA positive in 2025 2023E 2024E 2025E • Anticipate ~$50M in capital raised required to reach US Revenue OUS Revenue cash flow positive by 2025 1)

Projections assume July 2023 close. 31

Avertix Revenue Streams: Significant Opportunities for Growth Implant

Physician Patient Other Visits Subscription TPT code Remote patient Remote patient Data, reporting, monitoring: monitoring with analytics Wound check, 14 day customizable and 3, 6, 12-month notifications check-ups; alert-driven Subscription 1

appointments Example : $99/Mo X 6 Years $10,250 per Physician / Avertix ~$7K per patient of Build or partner Implant revenue share recurring revenue model over life of implant 1) Represents management estimate. 32

We Believe Avertix Presents a De-Risked Commercial Opportunity

De-Risked Foundation Compelling Commercial Opportunity • FDA Approved Class III Cardiac Device• Large Addressable Market 1 • Broad Label Indication• Robust Sales Strategy Projecting $75M Rev in ‘25 • Reimbursement

Coverage• Healthy Gross Margins • Favorable Physician Economics• Global Revenue Strategy • Broad IP Protection• Platform Expansion Roadmap • Stable Manufacturing & Supply• Proven Leadership Team •

Implementation Similar to Commonly Performed Procedure 1) Projections assume July 2023 close. 33

APPENDIX

How We Got Here AngelMed Proprietary Aurora DEVELOPMENT 2001 - 2021

Founded Algorithm Creation Patents Guardian FDA Approval Guardian FDA Approval ALERTS Trial 6yr Implant Life 3yr Implant Life (10 Years) FDA APPROVALS Q3 2021 Q2 2018 Jan 2022 Q1 2022 Q4 2022 Q1 2023 COMMERCIALIZATION Awarded CMS 1st US 100th

Experienced leadership Reimbursement Commercial Commercial team and commercial 1 1 TPT Code Implant Implant sales organization ramp 1) Based on Avertix management estimates. 35

Summary Transaction Overview ◼ Avertix Medical, Inc.

(“Avertix”) and BioPlus Acquisition Corp., (“BIOS”) (NASDAQ: BIOS) to combine to create a publicly listed (1) company with an up to ~$195mm enterprise value Transaction ◼ Post-closing entity expected to be listed on

NASDAQ under new ticker, AVRT, and maintain the Avertix name Description ◼ The transaction is expected to close in the second half of 2023 (2) ◼ Implied enterprise value of 2.6x 2025E revenue (3) ◼ Existing Avertix equityholders

will be issued approximately 13.2mm shares in new Avertix shares or Avertix options Transaction (4) ◼ Transaction to be funded by a combination of up to approximately $239mm BIOS cash in trust and $50mm of expected PIPE proceeds raised

post-announcement from institutional investors and strategics Structure (5) ◼ Assuming no redemptions, Avertix is expected to have $269mm in cash on its balance sheet pro forma for the transaction, of which ~$50mm is expected to fully fund the

company until projected profitability in 2025 ◼ BIOS CEO Ross Haghighat is expected to be Avertix’s Chairman following the closing of the proposed business combination Governance ◼ BioPlus Sponsor LLC to nominate two Directors to

Avertix Board of Directors ◼ Expected Board of Directors: 7 members, of which majority are independents 1) Based on a $10.00 share price. 2) Assuming expansion into markets outside of the United States. 3) Does not include 2.97mm earnout

shares to existing Avertix equityholders that are subject to vesting milestones being achieved (50% at 20-day VWAP of $12.50 and 50% at 20-day VWAP of $15.00, any time in 7 years following the closing of the business combination). 4) As of

31-Dec-2022, which does not reflect the adjustment, if any, as a result of the vote from shareholders regarding the proposal to extend the date by which BIOS has to consummate a potential business combination. Note: Refer to transaction summary page

for further detail. 5) Assumes no Class A share redemptions in connection with the potential business combination, 36 ~$50mm of PIPE proceeds are raised, ~$21mm of transaction-related expenses, and that existing Avertix stockholders roll 100% of

their equity into the pro forma entity

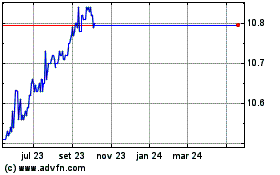

BioPlus Acquisition (NASDAQ:BIOS)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

BioPlus Acquisition (NASDAQ:BIOS)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024