false000164038400016403842023-06-022023-06-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): June 02, 2023 |

LM FUNDING AMERICA, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-37605 |

47-3844457 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

1200 West Platt Street Suite 100 |

|

Tampa, Florida |

|

33606 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 813 222-8996 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock par value $0.001 per share |

|

LMFA |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

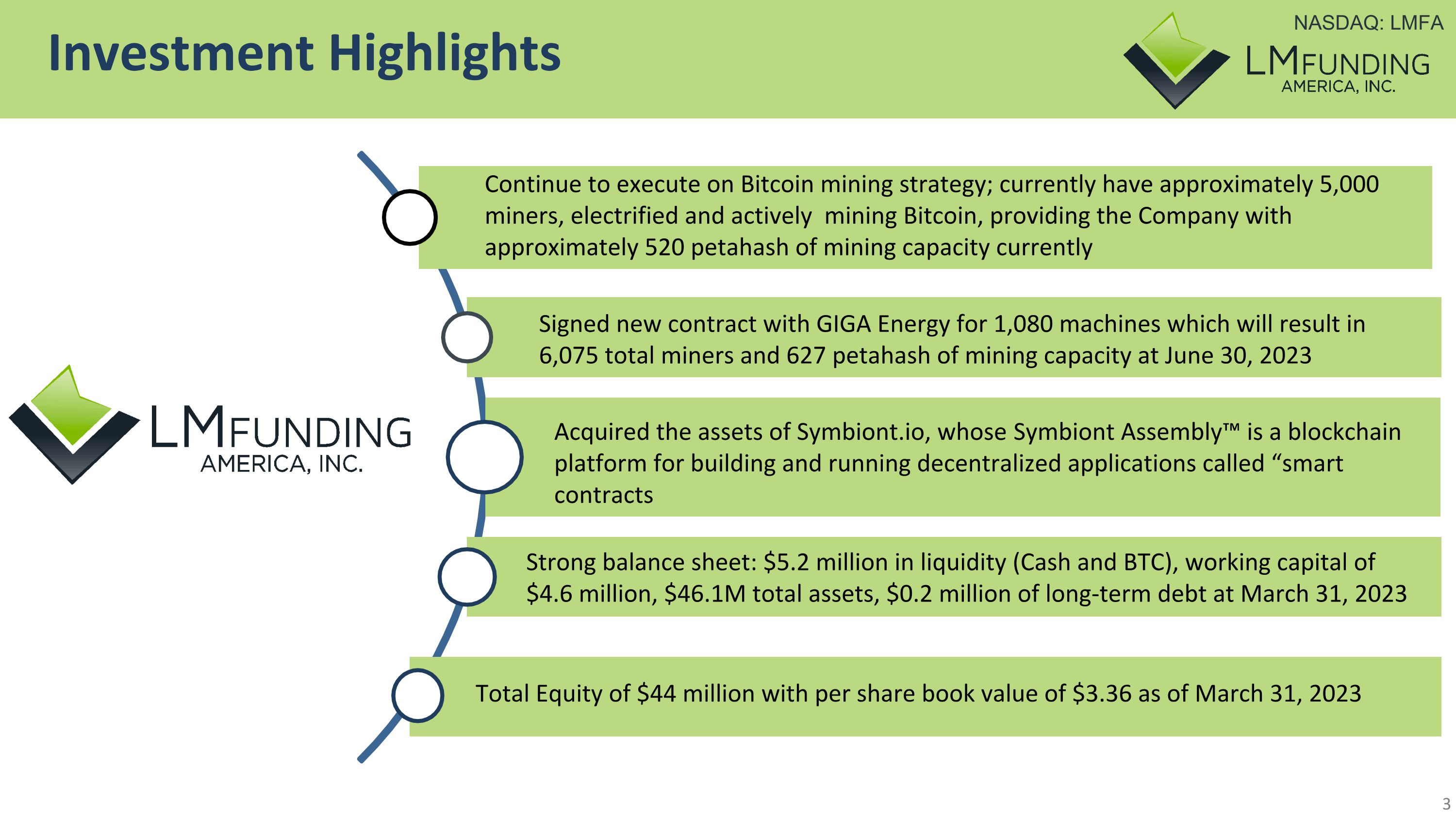

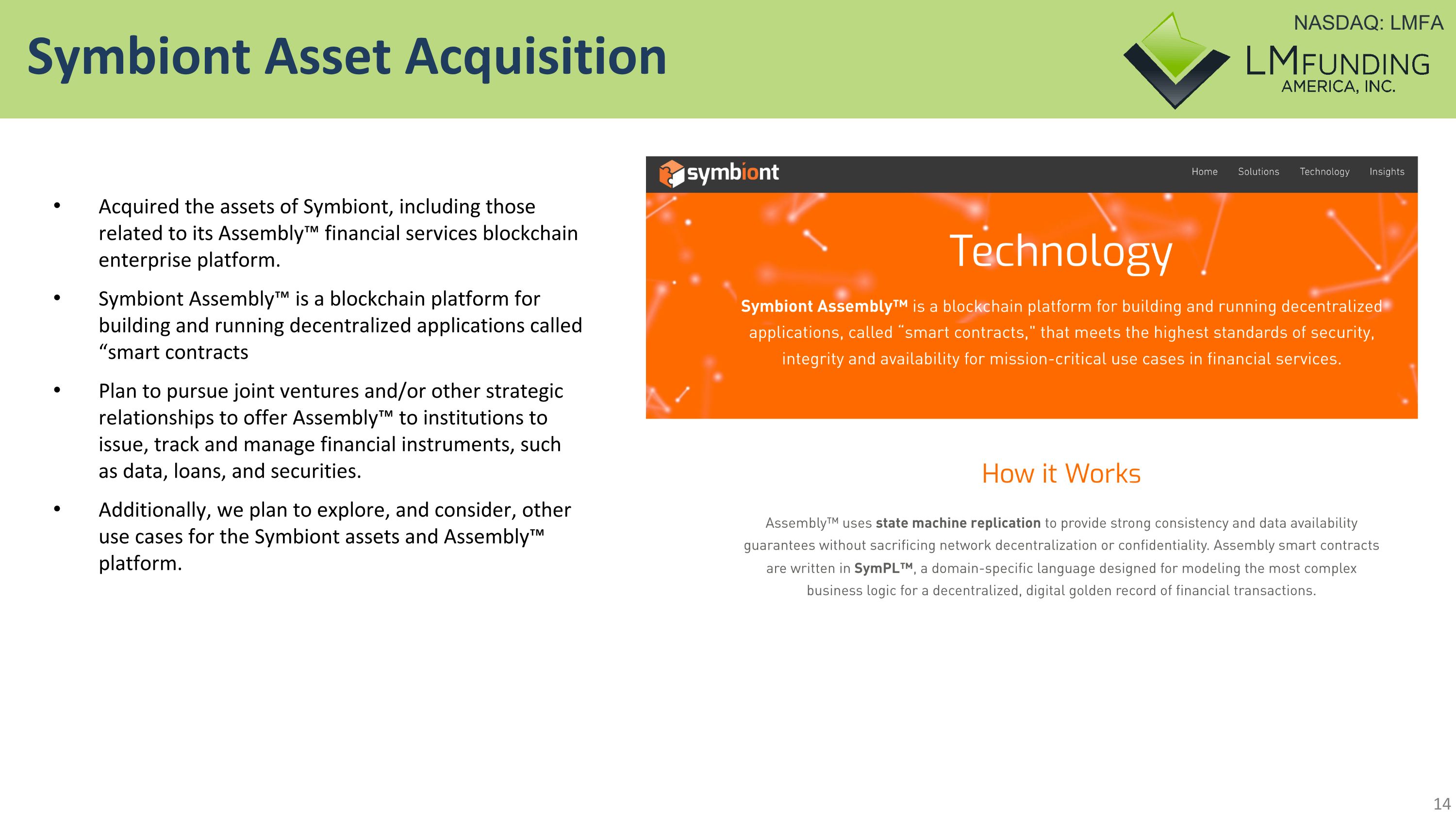

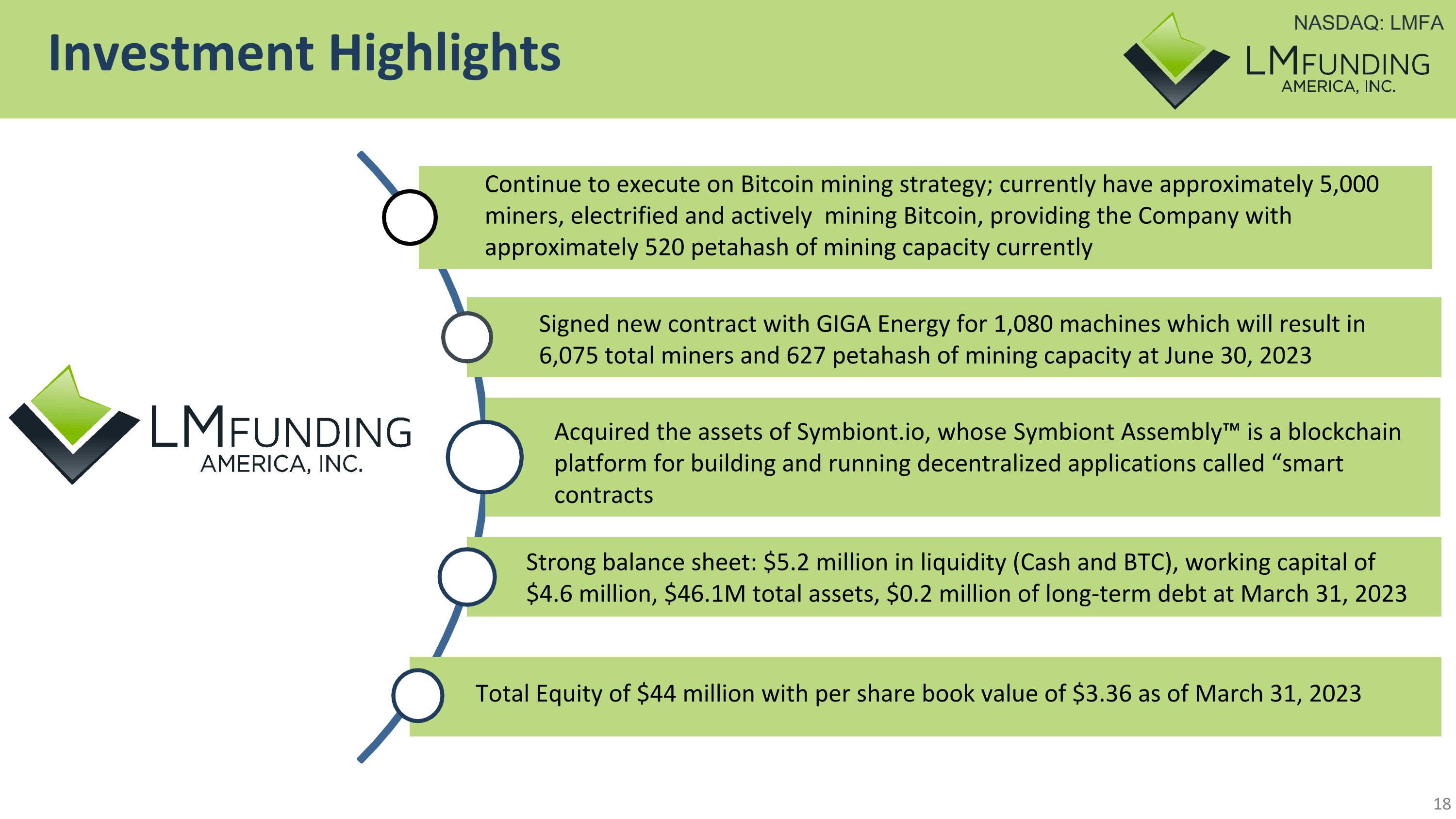

On June 2, 2023, the United States Bankruptcy Court for the Southern District of New York entered an order (the “Symbiont Bankruptcy Order”) approving the sale of substantially all of the assets of Symbiont.io, LLC, as debtor in possession (“Symbiont”), to LM Funding America, Inc. (the “Company”) pursuant to a form of Asset Purchase Agreement attached to the Symbiont Bankruptcy Sale Order (the “Asset Purchase Agreement”) free and clear of all liens, claims and encumbrances. The Company and Symbiont signed the Asset Purchase Agreement on June 5, 2023, and the purchase and sale of the Symbiont assets pursuant to the Asset Purchase Agreement closed on June 5, 2023.

Pursuant to the Asset Purchase Agreement, the Company purchased substantially all of the assets of Symbiont (the “Purchased Assets”) for a purchase price of $2,589,416, which was paid by means of a credit bid of the full amount of the note payable owed by Symbiont to the Company. The Purchased Assets are comprised principally of intellectual property and software code relating to Symbiont’s financial services blockchain enterprise platform. The Company intends to pursue strategic relationships and explore various use cases to commercialize the Purchased Assets. The Company did not assume any liabilities of Symbiont in the transaction. The amount paid by the Company for the Purchased Assets is less than ten percent of the total assets of the Company and its subsidiaries on a consolidated basis, and accordingly the acquisition does not involve a “significant amount of assets” for purposes of Item 2.01 of Form 8-K.

The foregoing description is qualified in its entirety by reference to the terms of the Asset Purchase Agreement and the Symbiont Bankruptcy Order, copies of which are filed as Exhibit 2.1 and Exhibit 2.2, respectively, to this Current Report on Form 8-K.

Item 7.01 Regulation FD.

On June 6, 2023, the Company issued a press release announcing the acquisition of the Purchase Assets from Symbiont. The press release is furnished as Exhibit 99.1 and incorporated herein by reference.

Also on June 6, 2023, representatives of the Company began making presentations to investors, analysts, and others using the investor presentation attached to this Current Report on Form 8-K as Exhibit 99.2 (the “Investor Presentation”). The Company expects to use the Investor Presentation, in whole or in part, and possibly with modifications, in connection with presentations to investors, analysts and others from time to time.

By filing this Current Report on Form 8-K and furnishing the information contained herein, the Company makes no admission as to the materiality of any information in this report, which is required to be disclosed solely by reason of Regulation FD. The information contained in the Investor Presentation is summary information that is intended to be considered in the context of the Company's Securities and Exchange Commission (“SEC”) filings and other public announcements that the Company may make, by press release or otherwise, from time to time. The Company undertakes no duty or obligation to publicly update or revise the information contained in this report, although it may do so from time to time as its management believes is warranted. Any such updating may be made through the filing of other reports or documents with the SEC, through press releases or through other public disclosure.

The information in this Item 7.01, including Exhibit 99.1 and Exhibit 99.2 attached hereto, is being furnished, shall not be deemed “filed” for any purpose, and shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

Exhibit Number |

|

Description |

|

|

|

|

|

2.1* |

|

Asset Purchase Agreement, dated June 5, 2023, between LM Funding America, Inc. and Symbiont.io, LLC, as Chapter 11 Debtor in Possession and Seller |

|

2.2* |

|

Court Order, dated June 2, 2023, relating to acquisition of Symbiont assets |

|

99.1 |

|

Press Release, dated June 6, 2023 |

|

99.2 |

|

Investor Presentation |

|

EX-104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

|

* Certain schedules and attachments to these exhibits have been omitted pursuant to Regulation S-K, Item 601(a)(5). The registrant hereby undertakes to furnish copies of any of the omitted schedules and exhibits upon request by the U.S. Securities and Exchange Commission.

***

Forward-Looking Statements

This Current Report on Form 8-K may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements involve risks and uncertainty. Words such as “anticipate,” “estimate,” “expect,” “intend,” “plan,” and “project” and other similar words and expressions are intended to signify forward-looking statements. Forward-looking statements are not guarantees of future results and conditions but rather are subject to various risks and uncertainties. Such statements are based on the Company’s current expectations and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. Investors are cautioned that there can be no assurance actual results or business conditions will not differ materially from those projected or suggested in such forward-looking statements as a result of various risks and uncertainties. These risks and uncertainties include, without limitation, uncertainty created by the COVID-19 pandemic, the risk of not successfully commercializing or realizing value from the Symbiont assets, the risks of operating in the cryptocurrency mining business, the capacity of the Company’s bitcoin mining machines and the Company’s related ability to purchase power at reasonable prices, and the ability to finance the Company’s cryptocurrency mining operations. Investors should refer to the risks detailed from time to time in the reports the Company files with the SEC, including the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, as well as other filings on Form 10-Q and periodic filings on Form 8-K, for additional factors that could cause actual results to differ materially from those stated or implied by such forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, unless required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

LM Funding America, Inc. |

|

|

|

|

Date: |

June 6, 2023 |

By: |

/s/ Richard Russell |

|

|

|

Richard Russell, Chief Financial Officer |

Exhibit 2.1

EXECUTION COPY

ASSET PURCHASE AGREEMENT

BY AND BETWEEN

SYMBIONT.IO, LLC,

as the Chapter 11 Debtor-in-Possession and Seller

AND

LM Funding America, Inc., or its designee,

as the Buyer

June 5, 2023

ARTICLE I DEFINITIONS 6

1.1. Definitions 6

ARTICLE II TRANSACTIONS AT THE CLOSING 11

2.1. Purchased Assets 11

2.2. Excluded Assets 13

2.3. Assumed Liabilities 14

2.4. Excluded Liabilities 14

2.5. Deposit; Purchase Price 16

2.6. Closing 16

2.7. Actions of Seller at Closing 16

2.8. Actions of Buyer at Closing 17

2.9. Risk of Loss 17

ARTICLE III REPRESENTATIONS AND WARRANTIES OF SELLER 17

3.1. Capacity, Authority and Governmental Consents 17

3.2. Binding Agreement 18

3.3. Condition and Sufficiency of Assets 18

3.4. Brokers 19

3.5. International Compliance 19

3.6. Full Disclosure 19

ARTICLE IV REPRESENTATIONS AND WARRANTIES OF BUYER 19

4.1. Capacity, Authority and Consents 19

4.2. Binding Agreement 20

4.3. Brokers 20

ARTICLE V COVENANTS OF THE PARTIES PRIOR TO CLOSING 20

5.1. Cooperation 20

5.2. Access 20

5.3. Consents and Approvals 20

5.4. Operating Covenants 21

5.5. Negative Covenants 21

5.6. Seller Release 21

5.7. Buyer Release 22

5.8. Bankruptcy Court Approval; Executory Contracts; Sale Procedures. 23

5.9. Confidentiality 24

5.10. Permits 24

ARTICLE VI CONDITIONS PRECEDENT TO BUYER CLOSING 24

6.1. Representations and Warranties; Covenants 25

6.2. Actions and Proceedings 25

6.3. Material Adverse Effect 25

6.4. Buyer’s Due Diligence 25

6.5. Bankruptcy Court Approval; No Inconsistency 25

6.6. Closing Deliveries 26

ARTICLE VII CONDITIONS PRECEDENT TO SELLER CLOSING 26

7.1. Representations and Warranties; Covenants 26

7.2. Actions and Proceedings 26

7.3. Closing Deliveries 26

ARTICLE VIII ADDITIONAL AGREEMENTS 26

8.1. Termination Prior to Closing 26

8.2. Post-Closing Filings and Access to Information 28

8.3. Refunds and Remittances 28

8.4. Availability of Business Records 28

8.5. Assurances 28

8.6. Public Announcement 29

8.7. Taxes; Final Sales Tax Return 29

8.8. Waiver of Bulk Sales Law Compliance 30

|

|

|

ARTICLE IX GENERAL PROVISIONS |

30 |

9.1. |

Survival |

30 |

9.2. |

Additional Assurances |

30 |

9.3. |

Choice of Law; Venue |

30 |

9.4. |

Benefit, Assignment and Third-Party Beneficiaries |

31 |

9.5. |

Cost of Transaction |

31 |

9.6. |

Waiver of Breach |

31 |

9.7. |

Notice |

31 |

9.8. |

Severability |

32 |

9.9. |

Interpretation |

33 |

9.10. |

Entire Agreement, Amendments and Counterparts |

33 |

9.11. |

Time of Essence |

34 |

EXHIBITS AND SCHEDULES

Schedules:

Schedule 1: Intellectual Property

Schedule 2: Assigned Contracts

ASSET PURCHASE AGREEMENT

This ASSET PURCHASE AGREEMENT (this “Agreement”) is entered into effective as of June 5, 2023 (the “Effective Date”), by and among LM Funding America, Inc., a Delaware corporation, or its designee, (“Buyer” or “Secured Lender”), and Symbiont.io, LLC, a Delaware limited liability company (“Seller” or “Debtor”), a debtor and debtor in possession under Case No. 22-11620-(PB) (the “Bankruptcy Case”) in the United States Bankruptcy Court for the Southern District of New York (the “Bankruptcy Court”). Seller and Buyer are together referred to as the “Parties” and each individually as a “Party.” Certain terms used in this Agreement are defined in Section 1.1.

BACKGROUND

WHEREAS, Seller, among other things, is engaged in the business of developing blockchain platform products, called “smart contracts,” to build and run decentralized applications involving the blockchain that permit financial institutions to use the blockchain to create a more robust and secure record of their financial transactions (the “Business”);

WHEREAS, on or about December 1, 2022 (the “Petition Date”), Seller filed a voluntary petition for chapter 11 relief under title 11 of the United States Code (the “Bankruptcy Code”), in the Bankruptcy Court;

WHEREAS, pursuant to the Order Approving Joint Application for an Order Authorizing the Debtor to Retain Huron Consulting Services LLC to Designate a Chief Restructuring Officer for the Debtor Effective as of March 31, 2023 entered in the Chapter 11 Case on April 19, 2023 Dkt. No. 47 (the “CRO Order”), the Bankruptcy Court authorized the retention of Laura Marcero of Huron Consulting Services LLC as the Chief Restructuring Officer of the Debtor (the “CRO”);

WHEREAS, pursuant to the CRO Order, the CRO has the power and authority to, among other things, market and sell the assets of the Debtor for the benefit of the estate and its creditors;

WHEREAS, on May 1, 2023, the Debtor filed the Sale Motion, seeking permission to sell the Debtor’s assets on the terms and conditions set forth therein;

WHEREAS, on or about May 26, 2023, the Debtor filed a notice [Dkt. No. 73] that it received no bids by the Bidding Deadline and canceled the auction scheduled for May 30, 2023;

WHEREAS, Buyer desires to purchase from Seller, all of the Purchased Assets on the terms and conditions set forth herein, free and clear of all liens, claims, rights, encumbrances, and interests pursuant to and in accordance with sections 105, 363 and 365 of the Bankruptcy Code and Rules 4001, 6004, and 6006 of the Federal Rules of Bankruptcy Procedure (the “Bankruptcy Rules”), all as more fully set forth in this Agreement;

WHEREAS, Buyer holds a pre-petition secured promissory note and other related documents issued by the Seller with principal, plus accrued interest, fees and expenses in the aggregate amount of not less than $2,589,416, plus $127,000 in fees and costs, plus any additional amounts that accrue between May 1, 2023 and the Closing Date (the “Note Holder Obligations”);

5

WHEREAS, after the Petition Date, on March 31, 2023, the Buyer entered into a stipulation with the Seller authorizing the Seller to use the Buyer’s cash collateral to pay the reasonable fees and costs of the CRO for services rendered in consummating a sale of substantially all of the Seller’s assets, which was so-ordered by the Bankruptcy Court on April 19, 2023 [Dkt. No. 48], and on May 13, 2023, the Buyer and Seller entered into an amended stipulation for the use of cash collateral [Dkt No. 57] (the “Cash Collateral Stipulation”);

WHEREAS, in the Debtor’s business judgment, consummation of the transaction described in this Agreement, is a necessary condition to the Debtor’s ability to maximize the value of its assets and recoveries for all holders of rights and claims against the Seller and its property;

WHEREAS, the Parties acknowledge and agree that this Agreement was negotiated at arm’s length and in good faith; and

WHEREAS, the Parties acknowledge and agree that this Agreement is subject to the approval of the Bankruptcy Court and will be consummated only under the Final Sale Order to be entered in the Bankruptcy Case.

NOW, THEREFORE, in consideration of the foregoing recitals, which are incorporated into the agreements of the Parties herein, and for good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Parties agree as follows:

ARTICLE I

DEFINITIONS

1.1. Definitions. As used in this Agreement, the following terms have the following meanings (unless otherwise expressly provided herein):

“Accounts Receivable” means (i) all accounts, accounts receivable, contractual rights to payment, notes, notes receivable, negotiable instruments, chattel paper and vendor and supplier rebates of the Seller in connection with the Business; and (ii) any security interest, claim, remedy or other right related to any of the foregoing.

“Action” means any claim, demand, cause of action, litigation, action, suit, arbitration, proceeding, hearing, audit or right in action, as further defined in Section 2.1(xii).

“Affiliate” means, with respect to a Person, any other Person that directly or indirectly controls, is controlled by, or is under common control with, such Person. The term “control” used in the preceding sentence means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a Person whether through ownership of voting securities, by contract or otherwise.

“Agreement” is defined in the Preamble.

“Alternative Transaction” means in the event that the Bankruptcy Court fails to approve the sale of the Purchased Assets to the Buyer as provided hereunder and instead approves a sale of the Purchased Assets to an entity that has submitted a counteroffer, and such sale closes.

6

“Assessment” is defined in Section 5.2.

“Assigned Contract” is defined in Section 2.1(iv).

“Ancillary Agreements” means, with respect to any Party, all agreements to which such Party is or will become a party pursuant to this Agreement, if any.

“Assignment and Assumption” is defined in Section 2.7(b).

“Assumed Liabilities” is defined in Section 2.3(a).

“Bankruptcy Case” is defined in the Preamble.

“Bankruptcy Code” is defined in the Recitals.

“Bankruptcy Court” is defined in the Preamble.

“Bankruptcy Estate” means the Debtor’s bankruptcy estate in the Bankruptcy Case created pursuant to 11 U.S.C. § 541(a).

“Bankruptcy Rules” is defined in the Recitals.

“Break-Up Fee” is defined in Section 8.1(b)(i).

“Bill of Sale” is defined in Section 2.7(a).

“Business” is defined in the Recitals.

“Business Day” means any day other than a Saturday, Sunday or day on which banks are authorized or required to be closed in New York, New York.

“Buyer” is defined in the Preamble.

“Buyer Released Parties” is defined in Section 5.6.

“Closing” is defined in Section 2.6.

“Closing Date” is defined in Section 2.6.

“Contract” means any agreement, purchase order, license, lease, contract, arrangement, understanding or commitment, whether oral or written, express or implied, to which a Person or its assets is legally bound.

“Cure Amounts” means the amounts, if any, determined by the Bankruptcy Court to be necessary to cure all defaults and to pay all actual losses that have resulted from defaults by Seller pursuant to the Assigned Contracts. Seller believes the Cure Amounts are $0. Pursuant to the Bid Procedures Order and Sale Notice entered May 20, 2023 [Dkt. No. 62], the Buyer shall have until five (5) business days after the Sale Hearing to provide the Seller with list of proposed Assigned Contracts. Within one (1) business day thereafter, the Debtor shall notify the contract

7

counterparties of the proposed Assigned Contracts and that the associated Cure Amounts are $0. A Cure Objection (as defined in the Bid Procedures Order) is due within fourteen (14) days of receiving the Sale Notice. If no Cure Objection is received, any objection to the assumption and assignment or Cure Amounts is deemed waived.

“Deposit” is defined in Section 2.5(a).

“Disputes” is defined in Section 5.6.

“Effective Date” is defined in the Preamble.

“Encumbrances” means any and all liens, claims, rights, encumbrances and interests, including without limitation, mortgages, deeds of trust, liens, warehouse liens, Tax Liabilities (defined in Section 2.4(l)), pledges, security interests, leases, subleases, licenses, rights of way, easements, rights of first refusal or first offer, options, options to purchase, agreements to sell, rights of redemption, pledges, restrictions, covenants, violations of law, reservations, set-off rights or similar matters, whether or not of record, or encroachments of any nature whatsoever, or any conditional sale contracts, title retention contracts or other agreements or arrangements to give or to refrain from giving any of the foregoing, whether secured or unsecured, choate or inchoate, filed or unfiled, scheduled or unscheduled, noticed or unnoticed, contingent or non-contingent, material or non-material, known or unknown.

“Excluded Assets” is defined in Section 2.2(a).

“Excluded Liabilities” is defined in Section 2.4.

“Expense Reimbursement” is defined in Section 8.1(b)(i).

“Final Order” means an Order of the Bankruptcy Court (or any other court of competent jurisdiction) which has not been modified, amended, reversed, vacated or stayed and as to which (i) the time to appeal, petition for certiorari, or move for a new trial, stay, reargument or rehearing has expired and as to which no appeal, petition for certiorari or motion for new trial, stay, reargument or rehearing shall then be pending or (ii) if an appeal, writ of certiorari, new trial, stay, reargument or rehearing thereof has been sought, such Order of the Bankruptcy Court (or other court of competent jurisdiction) shall have been affirmed by the highest court to which such order was appealed, or certiorari shall have been denied, or a new trial, stay, reargument or rehearing shall have expired, as a result of which such action or Order shall have become final in accordance with Bankruptcy Rule 8002; provided that the possibility that a motion under Rule 60 of the Federal Rules of Civil Procedure, or any analogous rule under the Bankruptcy Rules, may be filed relating to such Order, shall not cause an Order not to be a Final Order.

“Final Sale Order” means the Bankruptcy Court entering a final, non-appealable order approving the Agreement.

“Fundamental Representations” means Section 3.1(a), Section 3.2, Section 3.3(a), and Section 3.5.

8

“Governing Documents” means, for the Person in question, that Person’s Articles of Incorporation, Certificate of Formation, Certificate of Limited Partnership, Bylaws, Partnership Agreement, Limited Liability Company Agreement or other similar documents relating to the formation and/or governance of the business and affairs of such Person.

“Governmental Authority” means any foreign, domestic, federal, state, local or municipal government, including any subdivision, court, commission or regulatory agency; any governmental or quasi-governmental authority; and any Person exercising or entitled to exercise any administrative, executive, judicial, legislative, regulatory or taxing authority.

“Indebtedness” as applied to any Person means without duplication: (i) all obligations of such Person for borrowed money or in respect of loans or advances; (ii) all obligations of such Person evidenced by bonds, debentures, notes or other similar instruments; (iii) all obligations in respect of letters of credit, whether or not drawn, and bankers’ acceptances issued for the account of such Person; (iv) all capitalized lease liabilities of such Person; (v) all obligations for the costs or purchase prices of any of the Purchased Assets; (vi) any debt-like obligation or financing-type arrangement in respect of the deferred purchase price of the Purchased Assets; and (vii) any accrued interest, prepayment premiums or penalties or other costs or expenses related to any of the foregoing.

“Intellectual Property” means all intellectual property, including: (i) inventions (whether patentable or unpatentable and whether or not reduced to practice), all improvements thereto, and all patents, patent applications and patent disclosures, together with all reissuances, continuations, continuations-in-part, revisions, extensions and reexaminations thereof; (ii) trademarks, service marks, trade dress, logos, trade names, brand names, corporate names, domain names and other electronic communication identifications, together with all translations, adaptations, derivations and combinations thereof and including all goodwill associated therewith, and all applications, registrations and renewals in connection therewith; (iii) copyrightable works, copyrights and applications, registrations and renewals in connection therewith; (iv) trade secrets and confidential business information (including ideas, research and development, know-how, formulas, compositions, manufacturing and production processes and techniques, technical data, designs, drawings, specifications, customer and supplier lists, pricing and cost information, and business and marketing plans and proposals); (v) all computer software (including data and related documentation); (vi) all other intellectual proprietary rights; and (vii) all copies and tangible embodiments of any of the foregoing (in whatever form or medium).

“Interim Period” is defined in Section 5.2.

“Liens” is defined in Section 2.4(l).

“Material Adverse Effect” means a change, event, development or occurrence that, individually or in the aggregate, (a) would or would reasonably be expected to prevent or materially delay consummation of the transactions contemplated by this Agreement or (b) has or would reasonably be expected to have a material adverse effect on the Purchased Assets, taken as a whole. Notwithstanding the foregoing, none of the following changes, events, developments or occurrences shall be deemed to constitute or be taken into account in determining whether there has been or may be a Material Adverse Effect under clause (b): (i) any actual or proposed change

9

in law or accounting standards or the interpretation or implementation thereof; (ii) the entry into this Agreement or the announcement, commencement, pendency or consummation of the transactions contemplated hereby; (iii) any action taken by Seller that is expressly required to be taken by this Agreement; (iv) any change in general business, economic, geopolitical or financial market conditions; (v) acts of war or terrorism; and (vi) any natural disaster or calamity.

“Order” means any award, writ, injunction, judgment, order, ruling, decision, decree, directive, or similar determination entered, issued, made or rendered by any Governmental Authority (whether judicial, administrative or arbitral).

“Party” and “Parties” are defined in the Preamble.

“Permits” means all licenses, permits, franchises, privileges, certificates, rights, registrations, approvals, authorizations, consents, waivers, exemptions, releases, variances,

certificates of authority, accreditations, or Orders issued by any Governmental Authority.

“Person” means an individual, corporation, partnership, limited liability company, limited liability partnership, trust, association, joint venture, or any other entity or organization, including any Governmental Authority.

“Plan” means any plan of reorganization or liquidation pursuant to Title 11 of the United States Code.

“Purchase Price” is defined in Section 2.5.

“Purchased Assets” is defined in Section 2.1.

“Records” means books of account, ledgers, forms, records, documents, files, invoices, vendor or supplier lists, plans and other data which are necessary to or desirable for the ownership, use, maintenance or operation of the Business, the Purchased Assets or the Assumed Liabilities and which are owned or used by the Seller, including all blueprints and specifications, all design drawings and related documents, all manuals, all personnel, payroll, payroll tax and labor relations records, all environmental control records, environmental impact reports, statements, studies and related documents, handbooks, technical manuals and data, engineering specifications and work papers, all pricing and cost information, all sales records, all accounting and financial records, all sales and use tax returns, reports, files and records, asset history records and files, all data entry and accounting systems used to conduct the day-to-day operations of the Business, all maintenance and repair records, all correspondence, notices, citations and all other documents received from, sent to or in the Seller’s possession in connection with any Governmental Entity (including federal, state, county or regional environmental protection, air or water quality control, occupational health and safety, land use, planning or zoning and any alcohol, beverage or fire prevention authorities).

“Representatives” means, with respect to any Person, the officers, directors, principals, employees, agents, auditors, advisors and bankers of such Person.

“Sale Hearing” means the hearing to be held by the Bankruptcy Court on or about June 1, 2023, to approve the transactions contemplated by this Agreement.

10

“Sale Motion” means Seller’s Motion for an Order (A) Authorizing and Approving Sale and Bidding Procedures in Connection with Proposed Sale of Substantially All of Debtor’s Assets; (B) Scheduling a Hearing on Shortened Notice to Approve Bidding Procedures (C) Scheduling a Hearing to Consider Approval of the Sale; (D) Prescribing the Manner of Notice for Such Hearings; (E) Authorizing and Approving the Asset Purchase Agreement with LM Funding America, Inc.; and (F) Authorizing Such Sale Free and Clear of all Liens, Claims and Encumbrances and any related supplemental pleadings, filed May 1, 2023.

“Sale Order” means a Final Order of the Bankruptcy Court approving, inter alia, (i) the sale of the Purchased Assets to Buyer free and clear of any Encumbrances, and (ii) the assumption and assignment of the Assigned Contracts to Buyer, in the form of the Sale Order attached as Exhibit C to the Sale Motion or otherwise in form and substance satisfactory to Buyer and Seller.

“Seller” is defined in the Preamble.

“Seller Releasing Parties” is defined in Section 5.6.

“Taxes” means all federal, state, local and foreign taxes or similar charges, including all income, franchise, margin, real property, withholding, employment, sales, excise and transfer taxes and any interest and penalties thereon.

“Tax Liabilities” is defined in Section 2.4(l).

“Termination Date” is as defined in Section 8.1 and can be extended upon the mutual agreement of Seller and Buyer.

“Title Liens” is defined in Section 2.4(c).

“UCC Liens” is defined in Section 2.4(b)4.

ARTICLE II

TRANSACTIONS AT THE CLOSING

2.1. Purchased Assets.

Subject to and in reliance upon the terms and conditions of this Agreement and the Final Sale Order, at the Closing, Seller shall grant, sell, convey, assign, transfer and deliver to Buyer, and Buyer shall acquire, all of Seller’s right, title and interest in and under all of Seller’s assets, properties and rights of every kind and nature, whether real, personal or mixed, tangible or intangible, wherever located and whether now existing or hereafter acquired, which are owned, maintained, used or held for use by the Seller in connection with the Business, other than the Excluded Assets (all such assets other than the Excluded Assets, the “Purchased Assets”), free and clear of all claims, Encumbrances, Excluded Liabilities, and other interests, without limitation, pursuant to Sections 105, 363 and 365 of the Bankruptcy Code, including the following:

(i) all equipment, furniture, appliances, industrial artwork, computers,

computer terminals and printers, telephone systems, information technology systems, telecopiers and photocopiers, office supplies and office equipment, factory machinery and

11

equipment, tools, all materials handling and plant vehicles, fixtures, leasehold improvements and all other tangible personal property of every kind and description;

(ii)all Intellectual Property, including any work product thereto, source code, domain names, and all goodwill associated with the Business, as more specifically described on Schedule 1, along with any and all (i) associated licenses and sublicenses obtained by the Seller (i.e. where the Seller is the licensee or sublicensee) with respect thereto and rights thereunder, (ii) rights to receive license fees and royalties (including under any executory contract that is not an Assigned Contract to the extent the counterparty continues to perform thereunder), (iii) remedies against infringements thereof and rights to protection of interests therein under the laws of all jurisdictions, (iv) claims and causes of action with respect to any of the foregoing, whether accruing before, on, or after the date hereof, including all rights to and claims for damages, restitution, and injunctive and other legal and equitable relief for past, present, and future infringement, dilution, misappropriation, violation, misuse, breach, or default, with the right but no obligation to sue for such legal and equitable relief and to collect, or otherwise recover, any such damages, and (v) all rights under any confidentiality agreements executed by any third party for the benefit of the Seller; provided, however, that nothing in this Section 2.1(iii) shall be deemed an assumption of any executory contract by the Buyer that is not expressly an Assigned Contract;

(iii)all inventories of raw materials, work-in-progress, finished goods, component parts and materials, supplies and accessories (the “Inventory”);

(iv)all contracts, leases, subleases, arrangements, commitments and other agreements of the Seller, including customer agreements, vendor agreements, purchase orders, sales orders, installation and maintenance agreements, hardware lease or rental agreements, and other arrangements and understandings that are listed on Schedule 2 assuming, as Seller has indicated, the cure cost for these contracts is $0 (the “Assigned Contracts”);

(v)all Permits, to the extent legally transferrable;

(viii)all sales, marketing and development and expansion plans, strategic plans, projections, studies, reports and other documents and data (including creative materials, advertising and promotional matters, websites, and current and past lists of customers, suppliers, vendors and sources), and all training materials and marketing brochures;

(ix)all Accounts Receivable;

(x)without duplication of the above, all deposits (including supplier or vendor deposits and security deposits for rent, electricity, telephone, utilities or otherwise) and other prepaid charges and expenses;

12

(xi)rights to indemnification, contribution, advancement of expenses or reimbursement, or similar rights of the Seller;

(xii)All causes of action, choses in action, lawsuits, judgments, claims, refunds, rights of recovery, rights of set-off, counterclaims, defenses, demands, warranty claims, or similar rights of the Seller (at any time or in any manner arising or existing, whether choate or inchoate, known or unknown, now existing or hereafter acquired, contingent or noncontingent) (collectively, “Actions”) and rights of recovery with respect to any of the foregoing, including all Actions and rights of recovery of the Debtor against the Buyer or any of its respective Affiliates, but excluding in the case of Actions and rights of recovery against any other Person, any Actions under Section 544, 545, 547, 548, 549, 550 or 553 of the Code.

(xiii)all rights of the Seller under any Intellectual Property assignment, work-for-hire, assignment of inventions, non-disclosure or confidentiality, non-compete, or non-solicitation agreements with current or former employees, directors, consultants, independent contractors and agents of the Seller; and

(xiv)the amount of, and all rights to any, insurance proceeds received by the Seller after the date hereof in respect of (x) the loss, destruction or condemnation of any of the other Purchased Assets, occurring prior to, on or after the Closing or (y) any of the Assumed Liabilities.

(xv)All guarantees, warranties, indemnities, and similar rights in favor of Seller with respect to any of the Purchased Assets.

2.2. Excluded Assets.

(a) Notwithstanding the foregoing, all other assets of Seller that are not Purchased Assets shall not be conveyed to Buyer and shall be excluded from the definition of Purchased Assets, including, but not limited to, the following (collectively, including the items listed below, the “Excluded Assets”):

(i)Employee Benefit Plans. All employee benefit plans, including, without limitation, employee pension plans, profit sharing 401(k) plans, medical benefit or health plans and trusts, and related trust accounts, funds, insurance policies, investments, or other assets, and any sale bonus or retention agreements.

(ii)Corporate and other Records Regarding Excluded Assets. All minute books, seals, stock records, tax returns and tax records, and all other books and records related to the Excluded Assets listed in this Section 2.2.

(iii)Claims. Rights of recovery against any Person, other than Buyer, of any actions under sections 544, 545, 547, 548, 549, 550 or 553 of the Code.

13

2.3. Assumed Liabilities.

(a)At Closing, Buyer shall not assume or be responsible for any of Seller’s or any of Seller’s shareholders’, directors’, officers’, affiliates’, creditors’ or parent or subsidiary companies’ liabilities, obligations or duties whatsoever, except with respect to any assumed liabilities of the Assigned Contracts, but only to the extent that such liabilities thereunder are required to be performed after the Closing Date, were incurred in the ordinary course of business, and do not relate to any Cure Amounts, either asserted or unasserted, known or unknown, filed or unfiled, liquidated or to be liquidated, and determined or to be determined by the Bankruptcy Court, or to any failure to perform, improper performance, warranty or other breach, default or violation by Seller on or prior to the Closing (the “Assumed Liabilities”).

(b)Nothing in this Agreement shall be construed as an attempt to assign, and Buyer shall not assume any liabilities or obligations with respect to, any Contract, lease, or agreement intended to be included in the Purchased Assets that by applicable law is non-assignable, or that by its terms is non-assignable without the consent of the other party or parties thereto to the extent such party or parties assert in writing that such assignment is a breach of such Contract, lease or agreement as to which all the remedies for the enforcement thereof enjoyed by Seller would not, as a matter of law, pass to Buyer as an incident of the assignments provided for by this Agreement unless the Bankruptcy Court shall have determined that such Contract, lease, or agreement may be assigned notwithstanding the claim or objection of the counterparty that the Contract may not be assigned without its consent or approval. Seller shall, at the request and under the direction of Buyer, take all reasonable actions (including, without limitation, the appointment of Buyer or Buyer as attorney-in-fact for Seller) and do or cause to be done all such things as shall in the reasonable judgment of Buyer be necessary or proper (i) to assure that the rights and benefits of Seller under such Contracts shall be preserved for the benefit of Buyer, and (ii) to facilitate receipt of the consideration to be received by Seller in and under every such Contract, which consideration shall be held for the benefit of, and shall be delivered to, Buyer. Nothing in this Section 2.3 shall be deemed a waiver by Buyer of its right to receive an effective assignment of the Purchased Assets on the Closing Date, nor shall this Section 2.3 be deemed to constitute an agreement to exclude from the Purchased Assets any assets described in this Section 2.3.

2.4. Excluded Liabilities. Notwithstanding the terms of Section 2.3 or any other provision in this Agreement to the contrary, Buyer shall not assume, and under no circumstances shall Buyer be obligated to pay, discharge, perform or assume any debt, obligation, expense or liability of Seller or any of its Affiliates that is not an Assumed Liability (whether express or implied, fixed or contingent, known or unknown, or whether the liabilities could be asserted against or imposed upon Buyer as successors or transferees of a Seller as an acquirer of the Purchased Assets under any legal principle) (collectively, the “Excluded Liabilities”). For the avoidance of doubt, any Cure Amounts, regardless of when the obligation to pay such Cure Amounts arise, and any liabilities related to the operation of the Business including, but not limited to, employee obligations, pension obligations, Small Business Administration obligations, environmental liabilities attributable to Seller or Seller’s use, possession or ownership of the Purchased Assets (regardless of when such liabilities arise), or any other liabilities of the Business are Excluded Liabilities. Seller shall, and shall cause its Affiliates to, as applicable, pay and satisfy in due course

14

all Excluded Liabilities which they are obligated to pay and satisfy. Without limiting the generality

of the foregoing, the Excluded Liabilities shall include, but not be limited to, the following:

(a)any liabilities owed by Seller to an Affiliate of the Seller;

(b)any and all Liens arising under the U.S. Uniform Commercial Code not otherwise described herein (“UCC Liens”);

(c)any and all Liens listed on any title documents of the Purchased Assets (“Title Liens”);

(d)all trade payables, accounts payable and other current liabilities of Seller;

(e)any liability of Seller arising out of or resulting from its compliance or noncompliance with any law, order, or regulation;

(f)all liabilities and obligations relating to or arising from any Excluded Asset;

(g)all liabilities and obligations relating to or arising from any storage or warehouse agreement to store Inventory or any asserted warehouse lien;

(h)any other liabilities arising out of or relating to the Business;

(i)liabilities relating to any complaint, action, arbitration or regulatory, administrative, or government proceeding or investigation involving Seller or arising from actions of Seller or on or prior to the Closing Date;

(j)any liability to indemnify, defend, or hold harmless any of Seller’s officers, directors, employees, or agents;

(k)all Indebtedness of Seller;

(l)liabilities relating to all Taxes arising as a result of Seller’s operation of the Business or ownership of the Purchased Assets prior to the Closing, and Taxes based on net income or attributable to sales or use that are assessed, accrued, or attributable for periods on or prior to the Closing Date and related penalties and interest, if any (“Tax Liabilities” and together with the UCC Liens, Title Liens, and any other liens, the “Liens”), including Taxes that have resulted in a tax lien;

(m)liabilities to, under or with respect to any benefit plan and the administration of any benefit plan, or relating to payroll, vacation, sick leave, workers’ compensation, unemployment benefits with respect to employees or former employees of Seller or any of its predecessors, under any employment, severance, retention, or termination agreement with any employee of Seller, or arising out of or relating to any employee claim or allegation whether or not the affected employees are hired by Buyer, including any amounts payable under and sale bonus or retention agreements and/or any disputes related thereto or relating to injuries suffered by employees prior to the Closing Date;

15

(n)any liability of Seller under any contract that is not an Assigned Contract; and

(o)any and all fees, costs and expenses (including legal fees, accounting fees, brokerage commissions, finders’ fees or similar compensation to any Person) that have been incurred or that are incurred by Seller or any of its Affiliates in connection with the transactions contemplated by this Agreement or any prior attempted sale transaction or the Bankruptcy Case, including all fees, costs and expenses incurred in connection with or by virtue of the negotiation, preparation and review of this Agreement and all Ancillary Agreements and the consummation of the transactions contemplated by this Agreement and the Ancillary Agreements; provided, however this provision shall not prohibit any fees, costs or expenses from being paid from the proceeds received by or on behalf of Seller at Closing.

2.5. Deposit; Purchase Price. The aggregate consideration to be paid for the Purchased Assets shall be a credit bid of the full amount of the Note Holder Obligation, $2,589,416, plus $127,000 in fees and costs, plus any additional amounts that accrue between May 1, 2023 and the Closing Date, and the Buyer Release (the “Purchase Price”). At the Closing, the Buyer shall pay the Purchase Price as follows:

(a) the Buyer shall effect the Buyer Release by acknowledging in writing the full release and discharge of the Note Holder Obligations covered by the Buyer Release, through signature of this Agreement;

2.6. Closing. The consummation of the transactions provided for in this Agreement (the “Closing”), which shall be deemed to occur at 12:01 a.m. Eastern Time within five (5) Business Days of the date that all of the conditions precedent to Closing set forth in Section 2.7 and Section 2.8 have been satisfied and the Bankruptcy Court has entered the Final Sale Order or on such other date as the Parties may agree (“Closing Date”), shall take place via telephonic conferencing and electronic exchange of signature pages, or at such other time or place as the Parties may agree. The rights and obligations of the Parties if there is no Closing are set forth in Section 8.1. Title to all Purchased Assets shall pass from Seller to Buyer at Closing, subject to the terms and conditions of this Agreement.

2.7. Actions of Seller at Closing. At the Closing or within such other timeframes as specified below and unless otherwise waived in writing by Buyer, Seller shall deliver or cause to be delivered to Buyer the following, or take or cause to be taken the following actions:

(a)a bill of sale and assignment in a form mutually agreeable to Buyer and Seller (the “Bill of Sale”) duly executed by Seller in favor of Buyer;

(b)an assignment and assumption agreement in a form mutually agreeable to Buyer and Seller (the “Assignment and Assumption”) duly executed by Seller in favor of Buyer to be held in escrow until the Cure Amounts are determined to be $0 in accordance with the Bid Procedures Order;

(c)a copy of the Final Sale Order, which shall include language specifically authorizing the sale of the Purchased Assets free and clear of all Encumbrances;

16

(d)current contact information, passwords, logins and other information for and relating to: (i) any Purchased Asset being held, stored, maintained or otherwise by a third party; and (ii) whether such party may assert a claim or lien against any Purchased Asset;

(e)a duly completed and executed IRS Form W-9 of Seller;

(f)such other documents or instruments as Buyer reasonably requests and are reasonably necessary to consummate the transactions contemplated by this Agreement;

(g)Seller must have provided notice of the filing of the sale motion to all Lien holders of record that the sale to Buyer of the Purchased Assets is free and clear of all Liens; and

(h)Seller authorizes Buyer to file UCC terminations and other terminations of the Liens on behalf of the Lien holders with respect to the Purchased Assets, to the extent permitted by law.

2.8. Actions of Buyer at Closing. At the Closing and unless otherwise waived in writing by Seller, Buyer shall deliver or cause to be delivered to Seller the following:

(a)the Buyer Release in accordance with Section 2.5(a);

(b)the Bill of Sale duly executed by Buyer; and

(c)the Assignment and Assumption duly executed by Buyer, if applicable. 2.9. Risk of Loss.

(a)The risk of loss or damage to any of the Purchased Assets shall remain with Seller until the Closing Date, and Seller shall maintain its insurance policies covering such Purchased Assets through the Closing Date.

(b)To the extent applicable, Seller, upon request and proof of loss by Buyer, must assign, transfer and set over to Buyer all of Seller’s right, title and interest to any insurance proceeds on account of damage or destruction to a Purchased Asset.

ARTICLE III

REPRESENTATIONS AND WARRANTIES OF SELLER

Seller represents and warrants to Buyer that the statements contained in this ARTICLE III are true and correct as of the Effective Date and as of the Closing:

3.1. Capacity, Authority and Governmental Consents.

(a) Seller is duly organized, validly existing and in good standing under the laws of the state of its incorporation with the requisite power and authority to enter into this Agreement, to perform its obligations hereunder and to conduct its business as now being conducted. Subject to the entry of the Sale Order, the execution, delivery and performance of this Agreement and all

17

Ancillary Agreements to which Seller is or will become a party and the actions to be taken by Seller in connection with the consummation of the transactions contemplated herein:

(i)are within the powers of Seller, are not in contravention of applicable law or the terms of the Governing Documents of Seller and have been duly authorized by all appropriate action;

(ii)have been duly authorized by all actions and proceedings on behalf of Seller, and no other actions or proceedings on the part of Seller, its board of directors or equity holders are necessary;

(iii)except as otherwise expressly herein provided, to Seller’s reasonable knowledge, do not require any approval or consent of, or filing with, any third party or any Governmental Authority; and

(iv)to Seller’s reasonable knowledge, will not violate any law to which Seller is subject.

(b) Subject to the entry of the Sale Order, the execution, delivery and performance by Seller of this Agreement and all Ancillary Agreements to which Seller is or will become a party, consummation of the transactions contemplated by this Agreement or such Ancillary Agreements and compliance with the terms of this Agreement or such Ancillary Agreements will not give rise to a right of termination, modification, cancellation or acceleration of any Assigned Contracts.

3.2. Binding Agreement. Subject to the entry of the Sale Order, this Agreement and all Ancillary Agreements to which Seller is or will become a party are and will constitute the valid and legally binding obligations of Seller, and are and will be enforceable against Seller in accordance with the respective terms hereof or thereof, except as enforceability may be restricted, limited or delayed by applicable bankruptcy or other laws affecting creditors’ rights generally and except as enforceability may be subject to general principles of equity.

3.3. Condition and Sufficiency of Assets.

(a)Seller has good and valid title, sole ownership, custody and control of all of the Purchased Assets with the full right to sell or dispose of the Purchased Assets subject to approval of the Bankruptcy Court.

(b)To Seller’s reasonable knowledge, Seller has no undischarged obligations affecting the Purchased Assets being sold under this Agreement and no Encumbrances, liens or security interests exist against the Purchased Assets being sold under this Agreement, other than those to be discharged in the Sale Order.

(c)Subject to the entry of the Sale Order, Seller has the power and the right to sell, assign and transfer the Purchased Assets, free and clear of all Encumbrances.

Notwithstanding the foregoing, the sale of the Purchased Assets will be “as is” and “where is” to Buyer.

18

3.4. Brokers. Neither Seller nor any of its Affiliates has employed or retained any broker, finder or agent to act on their behalf in connection with this Agreement or the transactions contemplated hereby, or incurred any liability to any broker, finder or agent for any brokerage fees, finder’s fees, commissions or other amounts with respect to this Agreement or the transactions contemplated hereby.

3.5. International Compliance. Seller has conducted the Business in all material respects in accordance with all U.S. and other applicable customs, export control, economic sanctions, anticorruption and anti-bribery laws and regulations (the “Compliance Requirements”). Seller has maintained all applicable authorizations, licenses, permits, and other records regarding the Business required to be maintained in Seller’s possession under all applicable Compliance Requirements. Any Permits used or required pursuant to Compliance Requirements in connection with the Business are listed on Schedule 3.5.

3.6. Full Disclosure. No representation or warranty by Seller in this Agreement or any certificate or other document furnished or to be furnished to Buyer pursuant to this Agreement, or filed with the Bankruptcy Court in the Bankruptcy Case, contains any untrue statement of a material fact, or omits to state a material fact necessary to make the statements contained therein, in light of the circumstances in which they are made, not misleading.

ARTICLE IV

REPRESENTATIONS AND WARRANTIES OF BUYER

Buyer represents and warrants to Seller that the following statements are true and correct as of the Effective Date and as of the Closing:

4.1. Capacity, Authority and Consents. Buyer is duly organized and validly existing in good standing under the laws of the state of its formation with the requisite power and authority to enter into this Agreement, to perform its obligations hereunder and to conduct its business as now being conducted. The execution, delivery and performance of this Agreement and all Ancillary Agreements to which Buyer is or will become a party and the actions to be taken by Buyer in connection with the consummation of the transactions contemplated herein:

(a)are within the corporate powers of Buyer, are not in contravention of applicable law or the terms of the Governing Documents of Buyer and have been duly authorized by all appropriate action;

(b)have been duly authorized by all actions and proceedings on behalf of Buyer, and no other actions or proceedings on the part of Buyer or its governing body or equity holders are necessary;

(c)other than the approval of the Bankruptcy Court and the board of directors of the Buyer, do not require any approval or consent of, or filing with, any third party or any Governmental Authority; and

(d)will not violate any law to which Buyer is subject.

19

4.2. Binding Agreement. This Agreement and all Ancillary Agreements to which Buyer is or will become a party are and will constitute the valid and legally binding obligations of Buyer, and are and will be enforceable against Buyer in accordance with the respective terms hereof or thereof, except as enforceability may be restricted, limited or delayed by applicable bankruptcy or other laws affecting creditors’ rights generally and except as enforceability may be subject to general principles of equity.

4.3. Brokers. Neither Buyer nor any of its Affiliates has employed or retained any broker, finder or agent to act on its behalf in connection with this Agreement or the transactions contemplated hereby, or incurred any liability to any broker, finder or agent for any brokerage fees, finder’s fees, commissions or other amounts with respect to this Agreement or the transactions contemplated hereby.

ARTICLE V

COVENANTS OF THE PARTIES PRIOR TO CLOSING

5.1. Cooperation. Each of the Parties shall cooperate with each other, and shall use their commercially reasonable efforts to cause their respective Representatives to cooperate with each other, to provide an orderly transition of the Purchased Assets and Assumed Liabilities from Sellers to Buyer and to minimize the disruption to the Business resulting from the contemplated transactions.

5.2. Access. From and after the Effective Date until the Closing or the earlier termination of this Agreement (the “Interim Period”), at the reasonable request of Buyer and upon reasonable advance notice, Seller shall, during normal business hours, give or cause to be given to Buyer and the Representatives of Buyer: (i) full access to the management personnel, property, accounts, books, deeds, title papers, insurance policies, licenses, agreements, contracts, commitments, logs, records and files of every character, related to the Purchased Assets, and (ii) all such other information as Buyer may reasonably request, all as it relates to the Purchased Assets. Buyer shall have the right to have the Purchased Assets inspected by Buyer or Buyer’s Representatives for purposes of determining the physical condition and legal characteristics of the tangible personal property. For the avoidance of doubt, other than with respect to any notice required to be given to Seller and as a precondition to any inspection, review, assessment, interview, test or audit (each an “Assessment”), which may be conducted by Buyer or its Representatives pursuant to this Agreement, Buyer and its Representatives shall coordinate and communicate directly with the Representatives of Seller and in connection with the scheduling and undertaking, and the disclosure of the outcome or results, of any such Assessment.

5.3. Consents and Approvals. Seller shall use commercially reasonable efforts, at its sole cost and expense, to obtain any and all consents and approvals necessary to consummate the transactions contemplated hereby (Seller believes that except for Bankruptcy Court approval, no

20

other consent is required to be obtained in connection with the execution and delivery of this Agreement and the consummation of the transactions contemplated hereby).

5.4. Operating Covenants. During the Interim Period, except with the prior written consent of Buyer or as required by this Agreement or a Bankruptcy Court Order, Seller shall use its commercially reasonable efforts to:

(a)maintain the Purchased Assets in the ordinary course of business consistent with past practice, provided, however, that Buyer understands and agrees that Seller’s business operations are severely restricted as of and prior to the Effective Date due to a lack of liquidity; and

(b)maintain the goodwill and preserve its relationships with suppliers, customers and others having business relations with the Business.

5.5. Negative Covenants. During the Interim Period, except as required by law or as ordered by the Bankruptcy Court, and without limiting the generality of Section 5.4, Seller shall not, with respect to the Purchased Assets, without the prior written consent of Buyer:

(a)amend, modify, reject or terminate (other than at its stated expiration date) any of the Contracts;

(b)sell, assign, lease, convey, mortgage, license, encumber or otherwise transfer or dispose of any Purchased Assets;

(c)transfer or otherwise relocate any of the Purchased Assets to locations owned by third parties other than in the ordinary course of business;

(d)permit any insurance policy naming Seller as a beneficiary or a loss payable payee to be canceled or terminated; or

(e)authorize, agree, resolve or consent to any of the foregoing.

5.6. Seller Release. Effective upon the Closing, the Seller, on behalf of itself, its Bankruptcy Estate, and its past, present and future subsidiaries, parents, divisions, Affiliates, agents, representatives, insurers, attorneys, successors and assigns, all solely in such capacity, (collectively, the “Seller Releasing Parties”), hereby release, remise, acquit and forever discharge (i) the Buyer and its past, present and future subsidiaries, parents, divisions, Affiliates, agents, representatives, insurers, attorneys, successors and assigns, and each of its and their respective directors, managers, officers, employees, shareholders, members, agents, representatives, attorneys, contractors, subcontractors, independent contractors, owners, insurance companies and partners (collectively, the “Buyer Released Parties”), from any and all claims, Contracts, demands, causes of action, disputes, controversies, suits, cross-claims, torts, losses, attorneys’ fees and expenses, obligations, agreements, covenants, damages, Liabilities, costs and expenses (collectively, “Disputes”) arising on or prior to the Closing Date, whether known or unknown, whether anticipated or unanticipated, whether claimed or suspected, whether fixed or contingent, whether yet accrued or not, whether damage has resulted or not, whether at law or in equity, whether arising out of agreement or imposed by statute, common law of any kind, nature, or

21

description, including, without limitation as to any of the foregoing, any claim by way of indemnity or contribution, which any Seller Releasing Party has, may have had or may hereafter assert against any Buyer Released Party and (ii) any claim, right or interest of Sellers (whether known or unknown, whether anticipated or unanticipated, whether claimed or suspected, whether fixed or contingent, whether yet accrued or not, whether at law or in equity, whether arising out of agreement or imposed by statute, common law of any kind, nature, or description) in the Purchased Assets; provided, that notwithstanding the foregoing, Seller Releasing Parties do not in any event release Buyer from its obligations under this Agreement or the Ancillary Agreements, including the Assumed Liabilities. In addition, if Seller files a Plan, such Plan shall be consistent with this Agreement in all respects and will include releases and exculpation provisions in favor of Buyer Released Parties to the maximum extent permitted by law. The Seller agrees, on behalf of each Seller Releasing Party, that the release in this Section 5.6 applies not only to Disputes that are presently known, suspected, or disclosed to such Seller, but also to Disputes that are presently unknown, unsuspected, or undisclosed to such Seller. The Seller acknowledges that each Seller Releasing Party is assuming the risk that the facts may turn out to be different from what such Seller Releasing Party believes them to be and agrees that the release in this Section 5.6 shall be in all respects effective and not subject to termination or rescission because of such mistaken belief.

5.7. Buyer Release. Effective upon the Closing, the Buyer, on behalf of itself, and its past, present and future subsidiaries, parents, divisions, Affiliates, agents, representatives, insurers, attorneys, successors and assigns, all solely in such capacity, (collectively, the “Buyer Releasing Parties”), hereby release, remise, acquit and forever discharge (i) the Seller and its Bankruptcy Estate, its past, present and future subsidiaries, parents, divisions, Affiliates, agents, representatives, insurers, attorneys, successors and assigns, and each of its and their respective directors, managers, officers, employees, shareholders, members, agents, representatives, attorneys, contractors, subcontractors, independent contractors, owners, insurance companies and partners (collectively, the “Seller Released Parties”), from any and all claims, Contracts, demands, causes of action, disputes, controversies, suits, cross-claims, torts, losses, attorneys’ fees and expenses, obligations, agreements, covenants, damages, Liabilities, costs and expenses (collectively, “Disputes”) arising on or prior to the Closing Date, whether known or unknown, whether anticipated or unanticipated, whether claimed or suspected, whether fixed or contingent, whether yet accrued or not, whether damage has resulted or not, whether at law or in equity, whether arising out of agreement or imposed by statute, common law of any kind, nature, or description, including, without limitation as to any of the foregoing, any claim by way of indemnity or contribution, which any Buyer Releasing Party has, may have had or may hereafter assert against any Seller Released Party and (ii) any claim, right or interest of Buyer (whether known or unknown, whether anticipated or unanticipated, whether claimed or suspected, whether fixed or contingent, whether yet accrued or not, whether at law or in equity, whether arising out of agreement or imposed by statute, common law of any kind, nature, or description) in the Excluded Assets; provided, that notwithstanding the foregoing, Buyer Releasing Parties do not in any event release Seller from its obligations under this Agreement or the Ancillary Agreements, including the Assumed Liabilities, if any. The Buyer agrees, on behalf of each Buyer Releasing Party, that the release in this Section 5.6 applies not only to Disputes that are presently known, suspected, or disclosed to such Buyer, but also to Disputes that are presently unknown, unsuspected, or undisclosed to such Buyer. The Buyer acknowledges that each Buyer Releasing Party is assuming the risk that the facts may turn out to be different from what such Buyer Releasing Party believes

22

them to be and agrees that the release in this Section 5.6 shall be in all respects effective and not subject to termination or rescission because of such mistaken belief.

5.8. Bankruptcy Court Approval; Executory Contracts; Sale Procedures.

(a)Seller filed the Sale Motion on May 1, 2023, seeking approval of the transactions contemplated by this Agreement, under the applicable bidding procedures and to the extent required by Sections 363 and 365 and all other applicable provisions of the Bankruptcy Code. Seller shall use reasonable efforts to obtain the entry of the Sale Order. Seller shall promptly provide Buyer with copies or any responses or objections (either formal or informal) to the Sale Motion. Buyer shall take such actions as are reasonably requested by Seller to assist Seller in obtaining a finding by the Bankruptcy Court that Buyer is deemed to have purchased the Purchased Assets in good faith pursuant to Section 363(m) of the Bankruptcy Code.

(b)Pursuant to the Bid Procedures Order and Sale Notice entered May 20, 2023 [Dkt. No. 62], the Buyer shall have until five (5) business days after the Sale Hearing to provide the Seller with list of proposed Assigned Contracts. Within one (1) business day thereafter, the Seller shall serve on all non-Seller contract counterparties to all of the proposed Assigned Contracts a notice specifically stating that the Seller is seeking the assumption of assignment of such Assigned Contracts, and that the associated Cure Amounts are $0. A Cure Objection (as defined in the Bid Procedures Order) is due within fourteen (14) days of receiving the Sale Notice. If no Cure Objection is received, any objection to the assumption and assignment or Cure Amounts is deemed waived.

(c)The Sale Order shall approve the transactions contemplated by this Agreement, including, but not limited to, the sale of all of the Purchased Assets free and clear of all Encumbrances, including, but not limited to, the Tax Liabilities, UCC Liens and Title Liens, and shall, without limitation, contain findings of fact and conclusions of law that: (I) Buyer is a good faith purchaser entitled to the protections of Section 363(m) of the Bankruptcy Code and the sale contemplated by this Agreement does not violate and is not subject to avoidance under Section 363(n) of the Bankruptcy Code; (II) all of the requirements of Sections 363 and 365 of the Bankruptcy Code have been satisfied; (III) any Encumbrances on the Purchased Assets shall attach to the proceeds received by Seller pursuant to this Agreement and to the extent, and with the same validity, priority, perfection and enforceability, as such Encumbrances had with respect to the Purchased Assets; (IV) notice of the hearing on the transactions contemplated by this Agreement was (A) given to all holders of claims (as defined in Section 101 of the Bankruptcy Code) or interests entitled to receive such notice under, and in accordance with the applicable provisions of the Bankruptcy Code and the Bankruptcy Rules, and (B) constitutes such notice as is appropriate under the particular circumstances and in accordance with the Bankruptcy Code and applicable law; (V) neither Buyer nor its designees shall be considered successors of Seller or any of Seller’s Affiliates, except as expressly assumed in writing by Buyer pursuant to this Agreement; and (VI) include provisions for the Bankruptcy Court’s retention of jurisdiction over matters arising out of or related to this Agreement and the transactions contemplated hereby.

(d)Seller has requested that the Bankruptcy Court hold a hearing approving the sale of the Purchased Assets on June 1, 2023 (the “Sale Hearing”), with the Sale Order to be entered

23

within five (5) day after the Sale Hearing, which shall be in form and substance satisfactory to the Buyer.

(e)The Closing shall take place in accordance with Section 2.6. The Closing may be extended upon mutual written agreement of the Parties.

(f)In the event an appeal is taken, or a stay pending appeal is requested or reconsideration is sought, from the Sale Order, and Buyer has not also been served with papers related to such appeal, stay or reconsideration, Seller shall promptly notify Buyer of such appeal or stay request and shall provide to Buyer within one (1) Business Day a copy of the related notice of appeal or order of stay or application for reconsideration. Seller shall also provide Buyer with written notice (and copies) of, any other or further notice of appeal, motion or application filed in connection with any appeal from or application for reconsideration of, either of such orders and any related briefs if Buyer is not also included on such additional documents and communications.

(g)Any terms or conditions of any Plan that relate to or affect any Purchased Assets or the transactions contemplated by this Agreement shall be in form and substance satisfactory to Buyer.

(h)Counsel for Seller shall promptly notify (i) counsel for Buyer; (ii) all entities that claim any interest in or lien upon the Purchased Assets; (iii) all parties entitled to notice pursuant to the Bankruptcy Code, the Bankruptcy Rules and orders of the Bankruptcy Court; (iv) all creditors (whether liquidated, contingent or unmatured) of Seller; (v) the Office of the United States Trustee; and (vi) any party that has filed a notice of appearance in the Bankruptcy case of all motions, notices and orders required to consummate the transactions contemplated by this Agreement, including the Sale Motion and the Sale Order. At least three (3) Business Days prior to filing any papers or pleadings in the Bankruptcy Cases that relate primarily to this Agreement or Buyer, Seller shall provide Buyer’s counsel with a copy of such papers or pleadings for review and comments. Seller shall consider such changes thereto as reasonably requested by Buyer’s counsel.

5.9. Confidentiality. Following the Closing, Seller shall, and shall cause its Affiliates to, keep confidential and not disclose to any other Person or use for its own benefit or the benefit of any other Person any confidential information regarding the Purchased Assets or other intellectual property regarding Buyer; provided that the Parties understand this Agreement and other related documents will be attached to the sale pleading to be filed with the Bankruptcy Court.

5.10. Permits. Prior to Closing, Seller shall use reasonable best efforts to seek entry of the Sale Order, which provides, in part, that the Bankruptcy Court authorizes and directs the transfer to Buyer of any Permit of Seller with respect to the Purchased Assets at the Closing.

ARTICLE VI

CONDITIONS PRECEDENT TO BUYER CLOSING

Notwithstanding anything herein to the contrary, the obligation of Buyer to consummate the transactions described herein is subject to the fulfillment, as of the Closing, of the following conditions precedent unless (but only to the extent) waived in writing by Buyer on or prior to the Closing:

24

6.1. Representations and Warranties; Covenants.

(a)The Fundamental Representations shall be true and correct in all respects as of the Effective Date and the Closing Date, as though made as of the Closing Date (except for representations and warranties which address matters only as of a specific date, which representations and warranties shall continue as of the Closing Date to be true and correct as of such specific date).

(b)The representations of Seller contained in ARTICLE III hereof (other than the Fundamental Representations), shall be true and correct in all material respects (without giving effect to any “materiality,” “in all material respects,” “Material Adverse Effect” or similar qualifiers) as of the Effective Date and the Closing Date as though made on the Closing Date (except for representations and warranties which address matters only as of a specific date, which representations and warranties shall continue as of the Closing Date to be true and correct as of such specific dates).

(c)All of the covenants, agreements and other obligations in this Agreement to be complied with or performed by Seller on or before the Closing Date pursuant to the terms hereof shall have been duly complied with and performed in all material respects (without giving effect to any “materiality,” “in all material respects,” “Material Adverse Effect” or similar qualifiers).

(d)All Closing conditions as set forth in this ARTICLE VI and listed in Section 2.7 must be met before Buyer releases the Seller.

6.2. Actions and Proceedings. No Governmental Authority shall have issued any Order or enacted any law that is then in effect and that enjoins, restrains, makes illegal or otherwise prohibits the consummation of the transactions contemplated by this Agreement, and no Action, claim or investigation seeking to enjoin, restrain or prohibit the consummation of the transactions contemplated by this Agreement shall be pending.

6.3. Material Adverse Effect. From the Effective Date, there shall not have occurred any Material Adverse Effect, nor shall any event or events have occurred that, individually or in the aggregate, with or without the lapse of time, could reasonably be expected to result in a Material Adverse Effect.

6.4. Buyer’s Due Diligence. Buyer has completed its due diligence investigation of the Purchased Assets, and Closing is not subject to further due diligence investigation.

6.5. Bankruptcy Court Approval; No Inconsistency. The Sale Order shall have been entered by the Bankruptcy Court and shall not have been (a) vacated, stayed or reversed or (b) (except with the express written consent of Buyer, or as would not be adverse to Buyer in any material respect) amended, supplemented or otherwise modified. There shall be no Order (including, but not limited to, the Sale Procedures Order) entered in the Bankruptcy Cases that is inconsistent with

25

the terms of this Agreement, the Ancillary Agreements or the transactions contemplated hereby or thereby.

6.6. Closing Deliveries. Seller shall have executed and delivered, or caused to have been executed and delivered, to Buyer the documents and items described in Section 2.7.

ARTICLE VII

CONDITIONS PRECEDENT TO SELLER CLOSING

Notwithstanding anything herein to the contrary, the obligations of Seller to consummate the transactions described herein are subject to the fulfillment, as of the Closing, of the following conditions precedent unless (but only to the extent) waived in writing by Seller on or prior to the Closing:

7.1. Representations and Warranties; Covenants.

(a)The representations and warranties of Buyer contained in this Agreement shall be true and correct in all material respects (without giving effect to any “materiality,” “in all material respects,” “material adverse effect” or similar qualifiers) as of the Effective Date and as of the Closing Date (except for representations and warranties which address matters only as of a specific date, which representations and warranties shall continue as of the Closing Date to be true and correct as of such specific date).

(b)All of the covenants, agreements and other obligations in this Agreement to be complied with or performed by Buyer on or before the Closing pursuant to the terms hereof shall have been duly complied with and performed in all material respects (without giving effect to any “materiality,” “in all material respects,” “material adverse effect” or similar qualifiers).

7.2. Actions and Proceedings. No Governmental Authority shall have issued any Order or enacted any law that is then in effect and that enjoins, restrains, makes illegal or otherwise prohibits the consummation of the transactions contemplated by this Agreement, and no Action, claim or investigation seeking to enjoin, restrain or prohibit the consummation of the transactions contemplated by this Agreement shall be pending.