0001572334false00015723342023-06-292023-06-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): June 29, 2023 |

VIRGINIA NATIONAL BANKSHARES CORPORATION

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Virginia |

001-40305 |

46-2331578 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

404 People Place |

|

Charlottesville, Virginia |

|

22911 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (434) 817-8621 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock |

|

VABK |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On Thursday, June 29, 2023, certain executive officers of Virginia National Bankshares Corporation (the "Company') or its affiliates are scheduled to make a presentation at the Company's Annual Meeting of Shareholders, which will be held at the Hilton Garden Inn, 1793 Richmond Road, Charlottesville, VA 22911, at 10:00 a.m. Eastern Time. The slides that will be presented at the meeting are attached as Exhibit 99.1 to this Current Report on Form 10-K.

The information disclosed in or incorporated by reference into this Item 7.01, including Exhibit 99.1, is furnished and shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The following exhibit(s) are furnished herewith:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

VIRGINIA NATIONAL BANKSHARES CORPORATION |

|

|

|

|

Date: |

June 29, 2023 |

By: |

/s/ Tara Y. Harrison |

|

|

|

Tara Y. Harrison

Executive Vice President and Chief Financial Officer |

ANNUAL SHAREHOLDERS’ MEETING June 29, 2023 Exhibit 99.1

Disclosures Forward-Looking Statements Certain statements in this release may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, without limitation, statements with respect to the Company’s operations, performance, future strategy and goals, and are often characterized by use of qualified words such as “expect,” “believe,” “estimate,” “project,” “anticipate,” “intend,” “will,” “should,” or words of similar meaning or other statements concerning the opinions or judgement of the Company and its management about future events. While Company management believes such statements to be reasonable, future events and predictions are subject to circumstances that are not within the control of the Company and its management. Actual results may differ materially from those included in the forward-looking statements due to a number of factors, including, without limitation, the effects of and changes in: general economic and market conditions, including the effects of declines in real estate values, an increase in unemployment levels and general economic contraction as a result of COVID-19 or other pandemics; fluctuations in interest rates, deposits, loan demand, and asset quality; assumptions that underlie the Company’s allowance for loan losses; the potential adverse effects of unusual and infrequently occurring events, such as weather-related disasters, terrorist acts or public health events (e.g., COVID-19 or other pandemics), and of governmental and societal responses thereto; the performance of vendors or other parties with which the Company does business; competition; technology; changes in laws, regulations and guidance; changes in accounting principles or guidelines; performance of assets under management; expected revenue synergies and cost savings from the recently completed merger with Fauquier may not be fully realized or realized within the expected timeframe; the businesses of the Company and Fauquier may not be integrated successfully or such integration may be more difficult, time-consuming or costly than expected; revenues following the merger may be lower than expected; customer and employee relationships and business operations may be disrupted by the merger; and other factors impacting financial services businesses. Many of these factors and additional risks and uncertainties are described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 and other reports filed from time to time by the Company with the Securities and Exchange Commission. These statements speak only as of the date made, and the Company does not undertake to update any forward-looking statements to reflect changes or events that may occur after this release. Non-GAAP Financial Measures The accounting and reporting policies of the Company conform to U.S. generally accepted accounting principles (“GAAP”) and prevailing practices in the banking industry. However, management uses certain non-GAAP measures to supplement the evaluation of the Company’s performance, including (i) net interest income (FTE), (ii) efficiency ratio (FTE), (iii) net interest margin (FTE), (iv) ALLL to total loans, excluding acquired loans and fair value mark, (v) ALLL to total loans, excluding PPP loans and (vi) tangible book value per share. Management believes presentations of these non-GAAP financial measures provide useful supplemental information that is essential to a proper understanding of the operating results of the Company’s core businesses. These non-GAAP disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Reconciliations of GAAP to non-GAAP measures are included at the end of this release.

Corporate Overview

Baltimore Virginia Beach Norfolk Arlington Newport News WASHINGTON, DC Annapolis Richmond Lynchburg Lancaster Frederick Charlottesville 64 64 250 95 70 83 76 Source: S&P Global Market Intelligence; Company documents Data as of or for the three months ended 3/31/23 Overview of Virginia National Bankshares Corporation $1.6 billion in assets bank holding company headquartered in Charlottesville, VA Seasoned management team with over 220 years of collective banking experience Dominant deposit market share in core markets Recent expansion into high growth markets Well positioned for current interest rate environment with a cumulative deposit beta of 15.8% and 111 bps of NIM expansion YoY Conservative credit culture: 0.66% of cumulative losses in Global Financial Crisis (“GFC“) vs. banking industry over 8% Strong tangible book value growth Virginia’s Premier Community Bank $1.6B Assets $1.4B Deposits $0.9B Loans VABK Branches (14) Our Story Soundness Growth Profitability 0.26% NPAs / Loans + OREO 0.02% NCOs / Avg. Loans 1.46% ROAA 20.4% ROATCE 17% Asset CAGR since 2016 17% Deposit CAGR since 2016 81 29

Virginia R. Bayes Chief Credit Officer & Executive Vice President Age: 62 Banking Experience: 36 Years Virginia National Experience: 25 Years Donna G. Shewmake General Counsel, Corporate Secretary & Executive Vice President Age: 62 Legal Experience: 38 Years Virginia National Experience: 15 Years Tara Y. Harrison Chief Financial Officer & Executive Vice President Age: 54 Banking Experience: 23 Years Virginia National Experience: 7 Years Glenn W. Rust President, CEO & Director Age: 67 Banking Experience: 49 Years Virginia National Experience: 17 Years Source: S&P Global Market Intelligence; Company Documents Per Company’s 2023 Proxy Statement, as of April 27, 2023 Experienced Management Seasoned Executive Leadership Mark Meulenberg Chief Investment Officer of Masonry Capital Management Age: 51 Investment Management Experience: 30 Years Virginia National Experience: 15 Years Wendy Stone Senior Fiduciary & Trust Officer of VNB Trust & Estate Services Age: 54 Fiduciary & Trust Experience: 27 Years Virginia National Experience: 9 Years Company insiders own approximately 13% of common shares and equivalents (1) Diane Corscadden-Weaver President & Director of Virginia National Bank Age: 60 Banking Experience: 36 Years Virginia National Experience: 2 Years

Source: S&P Global Market Intelligence; Company Documents Per Company’s 2023 Proxy Statement, as of April 27, 2023 * Include prior board experience at Fauquier Bankshares, Inc. Experienced Board of Directors Board Member (Age) Experience Board Tenure William D. Ditmar, Jr. (70) Chairman of the Board 25 Years Corporate executive and investor at Enterprise Properties, LLC John B. Adams, Jr. (78) Vice Chairman of the Board 21 Years * Chairman of Fauquier Bank; CEO of Bowman Companies, Inc. Steven W. Blaine (65) Director 25 Years Of Counsel with Woods Rogers PLC Kevin T. Carter (57) Director 7 Years * Managing Director for Lansdowne Resort Hunter E. Craig (62) Director 25 Years Principal real estate broker with Georgetown Real Estate Randolph D. Frostick (66) Director 14 Years * Co-Founder, Of Counsel Vanderpool, Frostick & Nishanian, P.C. Linda M. Houston (65) Director 5 Years Former Managing director & executive with Merrill Lynch Jay B. Keyser (66) Director 14 Years * Chief Executive of the William A. Hazel Family Office Glenn W. Rust (67) Director 17 Years President & CEO of Virginia National Bankshares Corporation Sterling T. Strange III (62) Director 16 Years * President, Founder & CEO of The Solution Design Group, Inc. Gregory L. Wells (66) Director 11 Years Former CEO of ACAC Fitness and Wellness Centers Company insiders own approximately 13% of common shares and equivalents (1) Experienced and Balanced Board

Source: S&P Global Market Intelligence Deposit data as of 6/30 each respective year * Prior to Truist merger, Virginia National was ranked third in Charlottesville MSA by deposit market share Dominant Market Share in Core Markets Charlottesville, VA MSA * Historical Growth in Charlottesville Deposits ($B) 11.0% Rank: 5 9.8% Rank: 5 4.1% Rank: 7 VABK Deposit Market Share & Rank VABK CAGR: 10.7% Charlottesville MSA CAGR: 5.8% Fauquier County, VA

Source: Company documents, Standalone data as of the quarter prior to announcement (Q3 ’20) Overview of our Merger with Fauquier Bankshares Inc. At Announcement >25% ’21 EPS Accretion $7M Merger Charges 3.9 years TBV Earnback $7M Estimated Cost Savings Actual Through June 2023 >30% ’21 EPS Accretion $7M Merger Charges 1.8 years TBV Earnback $13M Estimated Cost Savings Attractive Financial Impact

Virginia National has been profitable since the first year post-inception Cumulative losses in Global Financial Crisis of 0.66% vs. aggregate banking industry losses of 8.56% (1) Consistent Credit Quality and Profitability ROAA: Source: S&P Global Market Intelligence, FDIC Data as of or for the twelve months ended each year end stated; VABK Q1 ’23 data as of or for the three months ended 3/31/23 Calculated as the quotient of the sum of net charge-offs between ‘08-’12 over average loan balance in 2008 FDIC banking industry YTD data as of 3/31/23 Net Charge-Offs / Average Loans (2) (2)

Shareholder Update

Returning Value to Shareholders Source: S&P Global Market Intelligence Data as of or for the twelve months ended each year end stated; YTD data as of or for the three months ended 3/31/23 Board recently approved a share repurchase plan of up to 5% of outstanding common stock, subject to consultation with the Federal Reserve VABK declared 15%, 5% and 5% stock dividends in 2011, 2018 and 2019, respectively $1.32 Implied ’23 ann. dividend

2006 – Q1 ’23: TBVPS CAGR of 4.55% vs. KRX Median of 3.82% vs. Peer Median of 4.06% Top-Tier Shareholder Value Growth Source: S&P Global Market Intelligence Data as of or for the twelve months ended each year end stated; YTD data as of or for the three months ended 3/31/23 Peers include major exchange-traded banks headquartered in FL, GA, MD, NC, SC, TN, VA and WV with total assets between $1.5 - $6.0 billion that reported TBVPS in 2006 Note: Tangible book value per share inclusive of stock dividends over time (1) Tangible book value per share adjusted to exclude impact of AOCI in each respective period (1) Figures above bars represent tangible book value per share adjusted to exclude AOCI plus cumulative dividends per share

Financial Highlights

Balance Sheet Trends Source: S&P Global Market Intelligence Data as of or for the twelve months ended each year end stated; Q1 ’23 data as of or for the three months ended 3/31/23 Total Assets ($M) Total Gross Loans ($M) Total Deposits ($M) ’16 – Q1 ’23 CAGR: 16.5% ’16 – ’20 CAGR: 8.8% ’16 – Q3 ’22 CAGR: 11.3% ’16 – ’20 CAGR: 6.0% ’16 – Q3 ’22 CAGR: 17.0% ’16 – ’20 CAGR: 8.6%

Core Funded Deposit Portfolio Cost of Deposits Over Time Historical Deposit Composition ($M) Source: S&P Global Market Intelligence Data as of or for the twelve months ended each year end stated; quarterly data as of or for the three months ended quarter stated Deposit beta for the last cycle of rising Fed Funds rate from Q4 ’16 to Q4 ’18 Deposit beta for the current cycle of rising Fed Funds rate from Q4 ’21 to Q1 ’23 Non-core deposits defined as jumbo time deposits > 250k Deposit Composition (%) Last Cycle VABK Deposit Beta(1): 23.6% Current Cycle VABK Deposit Beta(2): 15.8% (3)

Loan Composition Highlights Loan Composition (%) Source: S&P Global Market Intelligence Data as of or for the twelve months ended each year end stated; Q1 ’23 data as of or for the three months ended 3/31/23 Loans / Deposits (%) Historical Loan Composition ($M) No Shared National Credit Exposure and limited exposure to purchased and participated loans Funded $207.5 million Paycheck Protection Program loans over the program, with origination fees of 3.9% 11 commercial bankers throughout our footprint 4.24% 4.53% 4.62% 4.15% 4.32% 4.52% 4.13% Yield on Loans (%) 5.55%

Asset Quality Cumulative losses from the Global Financial Crisis of 0.66%(1) Post-Global Financial Crisis Peak NPAs of $8.7mm, 1.98% of total assets, in 2009 Source: S&P Global Market Intelligence Data as of or for the twelve months ended each year end stated; Q1 ’23 data as of or for the three months ended 3/31/23 (1) Calculated as the sum of NCOs for the years ended 2008 – 2012 divided by total loans as of 12/31/08 NPAs / Loans + OREO (%) NCOs / Average Loans (%) Loan Loss Reserve / Gross Loans (%) $2.6 = Nonperforming Assets ($M) = Net Charge-Offs (Recoveries) ($000) = Loan Loss Reserve ($M) $2.8 $2.5 $1.3 $2.1 $1.5 $48 $1,025 $2,056 $376 $485 $538 $4.0 $4.9 $4.2 $5.5 $6.0 $5.6 20-Year Average: 0.10% Loan Mark / Gross Loans Loan Loss Reserve / Gross Loans $2.4 $36 $7.8

Operating Expense Noninterest Expense / Average Assets (%) Noninterest Expense ($M) Source: S&P Global Market Intelligence Annual data as of or for the twelve months ended each year end stated; Quarterly data as of or for the three months ended each quarter stated Peers include major-exchange traded banks headquartered in FL, GA, KY, MD, NC, SC, TN, VA, and WV with total assets between $1.5 - $10 billion The KRX (KBW Nasdaq Regional Banking Index) is a modified market capitalization weighted index designed to track the performance of publicly traded leading regional banks and thrifts Assets / Full Time Employee ($000) Noninterest Expense / Average Assets versus Peers = Deposits / Branch $90 $115 $89 $104 $100 $92 $100

Profitability Trends Source: S&P Global Market Intelligence Annual data as of or for the twelve months ended each year end stated; Quarterly data as of or for the three months ended each quarter stated Refer to the Non-GAAP reconciliation in the appendix for a calculation of core metrics Core Return on Average Assets (%) Core Return on Average Tangible Common Equity (%) Net Interest Margin (%) Core Efficiency Ratio (%)

Interest Rate Sensitivity Source: Company documents Data as of or for the three months ended 3/31/23 Net Interest Income % Change GAP Summary ($M) Static Shock / Rate Ramp Analysis (2-Year Immediate)

Capital Ratios Source: S&P Global Market Intelligence Data as of or for the twelve months ended each year end stated; Q1 ’23 data as of or for the three months ended 3/31/23 Tangible Common Equity / Tangible Assets (%) CET1 Ratio (%) Total Capital Ratio (%) Bank CRE / C&D Concentration Ratios

Questions

Thank You

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

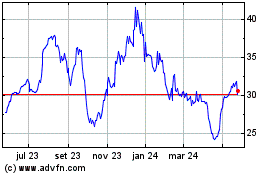

Virginia National Banksh... (NASDAQ:VABK)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

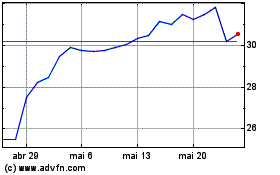

Virginia National Banksh... (NASDAQ:VABK)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025