0001138978

false

0001138978

2023-06-28

2023-06-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest reported): June 28, 2023

Novo

Integrated Sciences, Inc.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-40089 |

|

59-3691650 |

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

Incorporation) |

|

File

Number) |

|

Identification

Number) |

11120

NE 2nd Street, Suite 100, Bellevue, WA 98004

(Address

of principal executive offices)

(206)

617-9797

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2.)

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CF$ 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on which Registered |

| Common

Stock, $0.001 par value |

|

NVOS |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

On

June 28, 2023 (the “Effective Date”), Novo Integrated Sciences, Inc., a Nevada corporation (the “Company”) entered

into a separation and general release agreement (the “Agreement”) with Jim Zsebok (“Zsebok”) and RTZ Consulting

Group, Inc. (“RTZ”, and collectively with Zsebok, the “Zsebok Parties”), an entity owned by Zsebok. Pursuant

to the terms of the Agreement, all independent contract relationships between the Company and the Zsebok Parties were terminated, and

Zsebok resigned from the position of principal financial officer with respect to the Company. The Company issued to RTZ (i) 1,000,000

shares of the Company’s common stock pursuant to the Company’s 2021 Equity Incentive Plan and (ii) 335,000 unregistered shares

of the Company’s common stock for the full satisfaction of the Company’s obligations to the Zsebok Parties in connection

with such termination and resignation. The Agreement contains customary representations, warranties, and covenants, including, among

other things and subject to certain exceptions, confidentiality and non-disparagement provisions.

The

foregoing description of the Agreement does not purport to be complete and is qualified in its entirety by reference to the full text

of the Agreement, a copy of which is filed herewith as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by

reference.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Novo

Integrated Sciences, Inc. |

| |

|

|

| Dated:

July 3, 2023 |

By:

|

/s/

Christopher David |

| |

|

Christopher

David |

| |

|

President |

Exhibit

10.1

Separation

and General Release Agreement

Dated

as of June 28, 2023

This

Separation and General Release Agreement (this “Agreement”), dated as of the date first set forth above (the “Effective

Date”), is entered into by and between Novo Integrated Sciences, Inc., a Nevada corporation (the “Company”), Jim Zsebok

(“Zsebok”) and RTZ Consulting Group, Inc., an entity owned by Zsebok (“RTZ”). Zsebok and RTZ may be referred

to herein individually as a “Zsebok Party” and collectively as the “Zsebok Parties”). Each of the Company the

Zsebok Parties may be referred to herein individually as a “Party” and collectively as the “Parties”.

NOW,

THEREFORE, in consideration of the covenants, promises and representations set forth herein, and for other good and valuable consideration,

the receipt and sufficiency of which is hereby acknowledged, and intending to be legally bound hereby, the Parties agree as follows:

Section

1. Cessation of Engagement; Issuances. As of the Effective Date, each of the Zsebok Parties’ engagement by the Company

as an independent contract is hereby terminated by the mutual agreement of the Parties and each Zsebok Party here resigns from all positions

either of them may hold as an officer, employee, director, manager, contractor or other position with the Company or any of its subsidiaries.

As full and complete consideration and satisfaction of, and in connection with, each of the Zsebok Parties’ engagement by the Company,

the cessation of each of the Zsebok Parties’ engagement by the Company and the agreements of the Zsebok Parties as set forth herein,

on the Effective Date and immediately following the execution of this Agreement by all of the Parties, the Company shall issue to RTZ

(i) 1,000,000 shares of common stock, par value $0.001 per share, of the Company (the “Common Stock”), which shall be issued

to RTZ pursuant to the Novo Integrated Sciences, Inc. 2021 Equity Incentive Plan (the “Plan”) and therefore registered for

resale pursuant to the Form S-8 filed by the Company with the Securities and Exchange Commission on February 19, 2021 (the “Registered

Shares”); and (iii) 335,000 shares of Common Stock, which shall be unregistered shares of Common Stock not issued pursuant to the

Plan (the “Restricted Shares” and, together with the Registered Shares, the “Shares”). The Shares shall be issued

in book-entry format and shall not be certificated. The Zsebok Parties shall be responsible for the payment of any and all taxes imposed

on the Zsebok Parties as a result of the issuance of the Shares. The Zsebok Parties acknowledge that the issuance of the Shares as set

forth in this Section 1 constitute full satisfaction by the Company of its obligations for any payments to each of the Zsebok Parties

in connection with the Zsebok Parties’ engagement by the Company and the cessation of the Zsebok Parties’ engagement and

the Zsebok Parties hereby irrevocably waive any other requirements for payments or benefits to either of the Zsebok Parties in connection

with such engagement or termination.

Section

2. Release of Claims.

| 2.1. | Subject

to the terms and conditions herein, effective as of the Effective Date, each Party, for itself

and its Affiliates (as defined below), whether an Affiliate as of the Effective Date or hereafter

becoming an Affiliate, and for each of their respective predecessors, successors, assigns,

heirs, representatives, and agents and for all related parties, and all persons acting by,

through, under or in concert with any of them in both their official and personal capacities

(collectively, the “Releasing Parties”) hereby irrevocably, unconditionally and

forever release, discharge and remise the other Party and its Affiliates (whether an Affiliate

as of the Effective Date or later), and their respective predecessors, successors, assigns,

heirs, representatives, and agents and for all related parties and all persons acting by,

through, under or in concert with any of them in both their official and personal capacities

(collectively, the “Released Parties”), from all claims of any type and all manner

of action and actions, cause and causes of action, suits, debts, dues, sums of money, accounts,

reckonings, bonds, bills, specialties, covenants, contracts, controversies, agreements, promises,

variances, trespasses, damages, judgments, executions, claims and demands whatsoever, in

law or in equity, known or unknown, that any Releasing Party may have now or may have in

the future, against any of Released Parties to the extent that those claims arose, may have

arisen, or are based on events which occurred at any point in the past up to and including

the Effective Date, including, without limitation, any such matters related to the service

of Zsebok as an officer of the Company, but excluding any claims arising out of or pertaining

to this Agreement (collectively, the “Released Claims”). Each Party as the Releasing

Party represents and warrants that no Released Claim released by such Releasing Party has

been assigned, expressly, impliedly, or by operation of law, and that all such Released Claims

released herein are owned by the Releasing Party, which has the respective sole authority

to release them. Each Party as the Releasing Party agrees that it shall forever refrain and

forebear from commencing, instituting or prosecuting any lawsuit action or proceeding, judicial,

administrative or otherwise collect or enforce any Released Claim which is released and discharged

herein by the Releasing Party. For purposes herein, “Affiliate” shall mean, as

to any person or entity (each, a “Person”), any other Person that, directly or

indirectly, through one of more intermediaries, controls, is controlled by or is under common

control with such Person. |

| 2.2. | Each

Party as the Releasing Party, on its own behalf and on behalf of its related Releasing Parties,

agrees not to file for itself or on behalf of any other Releasing Party, any claim, charge,

complaint, action, or cause of action against any Released Party related to the Released

Claims, and agrees to indemnify and save harmless such Released Parties from and against

any and all losses, including, without limitation, the cost of defense and legal fees, occurring

as a result of any claims, charges, complaints, actions, or causes of action made or brought

by any such Releasing Party against any Released Party in violation of the terms and conditions

of this Agreement. |

Section

3. Non-Disparagement. Following the date hereof, neither Party shall make any statements or representations, or otherwise communicate,

directly or indirectly, in writing, orally, or otherwise, or take any action, which may, directly or indirectly, disparage the other

Party or any of such other Party’s Affiliates or their respective officers, directors, employees, advisors, businesses or reputations.

Notwithstanding the foregoing, nothing in this Agreement shall preclude a Party from making truthful statements that are required by

applicable law, regulation or legal process.

Section

4. Confidentiality.

| 4.1. | Definition.

For purposes of this Agreement, “Confidential Information” shall mean all

Company Work Product (as hereinafter defined) and all non-public written, electronic, and

oral information or materials of Company communicated to or otherwise obtained by either

of the Zsebok Parties in connection with the Zsebok Parties’ engagement by the Company,

which is related to the products, business and activities of Company, its Affiliates and

subsidiaries, and their respective customers, clients, suppliers, and other entities with

which such party does business, including: (i) all costing, pricing, technology, software,

documentation, research, techniques, procedures, processes, discoveries, inventions, methodologies,

data, tools, templates, know how, intellectual property and all other proprietary information

of Company; (ii) the terms of this Agreement; and (iii) any other information identified

as confidential in writing by Company. Confidential Information shall not include information

that: (a) was lawfully known by either of the Zsebok Parties without an obligation of confidentiality

before its receipt from Company; (b) is independently developed by either of the Zsebok Parties

without reliance on or use of Confidential Information; (c) is or becomes publicly available

without a breach by either of the Zsebok Parties of this Agreement; or (d) is disclosed to

either of the Zsebok Parties by a third party which is not required to maintain its confidentiality. |

| 4.2. | Company

Ownership; Confidentiality Obligations. Company shall retain all right, title, and interest

to the Confidential Information, including all copies thereof and all rights to patents,

copyrights, trademarks, trade secrets and other intellectual property rights inherent therein

and appurtenant thereto. No licenses or rights under any patent, copyright, trademark, or

trade secret are granted by Company to either of the Zsebok Parties hereunder, or as a result

of the Company’s disclosure of any Confidential Information to either of the Zsebok

Parties. Each of the Zsebok Parties agrees to hold the Confidential Information in confidence

and not to copy, reproduce, sell, assign, license, market, transfer, give or otherwise disclose

such Confidential Information to any person or entity or to use the Confidential Information

for any purposes whatsoever, without the express written permission of Company. Each of the

Zsebok Parties shall be responsible to Company for any violation of this Section 4 by either

of the Zsebok Parties’ employees, subcontractors, and agents. Each of the Zsebok Parties

shall maintain the Confidential Information with the same degree of care, but no less than

a reasonable degree of care, as either of the Zsebok Parties employs concerning its respective

own information of like kind and character. |

Section

5. Intellectual Property Rights.

| 5.1. | Definitions.

As used in this Agreement, the term “Work Product” means any invention, whether

or not patentable, know-how, designs, mask works, trademarks, formulae, processes, manufacturing

techniques, trade secrets, ideas, artwork, software or any copyrightable or patentable works.

“Company Work Product” means any Work Product that has been or was created by

either of the Zsebok Parties during the time of their respective engagement by the Company

or any of its Affiliates and specifically for the Company and/or any of its Affiliates. Each

of the Zsebok Parties agrees (a) to use such Zsebok Party’s best efforts to maintain

such Company Work Product in trust and strict confidence; and (b) not to disclose any such

Company Work Product to any third party without first obtaining Company’s express written

consent on a case-by-case basis. |

| 5.2. | Ownership

of Company Work Product. Each of the Zsebok Parties agrees that any and all Company Work

Product was, is and shall be deemed “work for hire” under applicable law and

shall be the sole and exclusive property of Company. Each of the Zsebok Parties irrevocably

assigns to the Company all right, title and interest worldwide in and to the Company Work

Product and all applicable intellectual property rights related to the Company Work Product,

including without limitation, copyrights, trademarks, trade secrets, patents, moral rights,

contract and licensing rights (the “Proprietary Rights”). Neither Zsebok Party

retains any rights to use the Company Work Product and each Zsebok Party agrees not to challenge

the validity of Company’s ownership in the Company Work Product. Each Zsebok Party

hereby grants to the Company a perpetual, non-exclusive, fully paid-up, royalty-free, irrevocable

and world-wide right, with rights to sublicense through multiple tiers of sublicensees, to

reproduce, make derivative works of, publicly perform, and display in any form or medium

whether now known or later developed, distribute, make, use and sell any and all Zsebok-Party-owned

or controlled Work Product or technology that either Zsebok Party used to complete the services

and which is necessary for Company to use or exploit the Company Work Product. |

Section

6. Representations and Warranties of the Parties. Each Party (the “Representing Party”) represents and warrants

to the other Party as set forth in this Section 6. Representing Party has all requisite rights and authority or the capacity to execute,

deliver and perform its obligations under this Agreement. The execution and delivery of this Agreement and the consummation of the transactions

contemplated hereby have been duly and validly authorized by such Representing Party, and no other proceedings are necessary to authorize

the execution, delivery and performance of this Agreement or the transactions contemplated hereby or thereby on the part of such Representing

Party. The execution, delivery and performance of this Agreement will not (a) violate, conflict with, or result in the breach, acceleration,

default or termination of, or otherwise give any other contracting party the right to terminate, accelerate, modify or cancel any of

the terms, provisions, or conditions of any material agreement or instrument to which such Representing Party is a party or by which

such Representing Party’s assets may be bound or (b) constitute a violation of any material applicable law, rule or regulation,

or of any judgment, order, injunctive award or decree of any governmental authority applicable to such Representing Party or (c) conflict

with, result in the breach or termination of any provision of, or constitute a default under (in each case whether with or without the

giving of notice or the lapse of time, or both) any order, judgment, arbitration award, or decree to which such Representing Party is

a party or by which it or any of its assets or properties are bound. No approval, authority, or consent of or filing by such Representing

Party with, or notification to, any governmental authority, is necessary to authorize the execution and delivery of this Agreement or

the consummation of the transactions contemplated herein. This Agreement has been duly executed and delivered by such Representing Party

and, assuming that this Agreement constitutes the legal, valid and binding obligation of the other Party, constitutes the legal, valid,

and binding obligation of such Representing Party, enforceable against such Representing Party in accordance with its terms, except to

the extent that the enforceability thereof may be limited by applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent

conveyance and other similar laws of general application affecting enforcement of creditors’ rights generally.

Section

7. Zsebok Parties’ Representations and Warranties Relating to the Shares. Each Zsebok Party represents and warrants to

the Company as set forth in this Section 7 with respect to the Shares and the Zsebok Parties’ receipt thereof.

| 7.1. | Such

Zsebok Party is an “accredited investor” as that term is defined in Rule 501(a)

of Regulation D promulgated pursuant to the Securities Act of 1933, as amended (the “Securities

Act”). Such Zsebok Party hereby represent that the Shares awarded pursuant to this

Agreement are being acquired for such Zsebok Party’s own account and not for sale or

with a view to distribution thereof. Such Zsebok Party acknowledges and agrees that any sale

or distribution of Shares may be made only pursuant to either (a) a registration statement

on an appropriate form under the Securities Act, which registration statement has become

effective and is current with regard to the shares being sold, or (b) a specific exemption

from the registration requirements of the Securities Act that is confirmed in a favorable

written opinion of counsel, in form and substance satisfactory to counsel for the Company,

prior to any such sale or distribution. |

| 7.2. | Such

Zsebok Party has been furnished with all documents and materials relating to the business,

finances and operations of the Company and information that such Zsebok Party requested and

deemed material to making an informed decision regarding such Zsebok Party’s acquisition

of the Shares. Such Zsebok Party has been afforded the opportunity to review such documents

and materials and the information contained therein. Such Zsebok Party has been afforded

the opportunity to ask questions of the Company and its management. Such Zsebok Party understands

that such discussions, as well as any written information provided by the Company, were intended

to describe the aspects of the Company’s business and prospects which the Company believes

to be material, but were not necessarily a thorough or exhaustive description and the Company

makes no representation or warranty with respect to the completeness of such information

and makes no representation or warranty of any kind with respect to any information provided

by any entity other than the Company. Such Zsebok Party, either personally, or together with

such Zsebok Party’s advisors has such knowledge and experience in financial and business

matters as to be capable of evaluating the merits and risks of obtaining the Shares, is able

to bear the risks of obtaining the Shares and understands the risks of, and other considerations

relating to, the receipt of the Shares. Such Zsebok Party’s financial condition is

such that such Zsebok Party is able to bear the risk of holding the Shares that such Zsebok

Party may acquire pursuant to this Agreement for an indefinite period of time, and the risk

of loss of the entire value thereof. Such Zsebok Party has investigated the acquisition of

the Shares to the extent such Zsebok Party deemed necessary or desirable. No representations

or warranties have been made to such Zsebok Party by the Company, or any representative of

the Company, or any securities broker/dealer, other than as set forth in this Agreement.

Such Zsebok Party also acknowledges and agrees that the Shares are highly speculative and

involve a high degree of risk of loss of the value of the Shares. Such Zsebok Party has full

power and authority to make the representations referred to herein, to acquire the Shares

and to execute and deliver this Agreement. Such Zsebok Party understands that no United States

federal or state agency or any other government or governmental agency has passed upon or

made any recommendation or endorsement of the Shares. |

| 7.3. | Such

Zsebok Party understands that until such time as the Shares have been registered under the

Securities Act or may be sold pursuant to Rule 144, Rule 144A under the Securities Act or

Regulation S without any restriction as to the number of securities as of a particular date

that can then be immediately sold, the Shares may bear a restrictive legend in form and substance

as determined by the Company. |

Section

8. Miscellaneous.

| 8.1. | Expenses;

Damages. Other than as specifically set forth herein, each of the Parties shall pay its

own costs that it incurs incident to the preparation, execution, and delivery of this Agreement

and the performance of any related obligations, whether or not the transactions contemplated

by this Agreement shall be consummated. EACH PARTY HERETO WAIVES ANY AND ALL CLAIMS AGAINST

THE OTHER FOR ANY LOSS, COST, DAMAGE, EXPENSE, INJURY OR OTHER LIABILITY WHICH IS IN THE

NATURE OF INDIRECT, SPECIAL, INCIDENTAL, PUNITIVE OR CONSEQUENTIAL DAMAGES WHICH ARE SUFFERED

OR INCURRED AS THE RESULT OF, ARISE OUT OF, OR ARE IN ANY WAY CONNECTED TO THE PERFORMANCE

OF THE OBLIGATIONS UNDER THIS AGREEMENT. |

| 8.2. | Assignment.

This Agreement shall be binding upon and shall inure to the benefit of the Parties and their

respective successors and permitted assigns. No Party shall have any power or any right to

assign or transfer, in whole or in part, this Agreement, or any of its rights or any of its

obligations hereunder, including, without limitation, any right to pursue any claim for damages

pursuant to this Agreement or the transactions contemplated herein, or to pursue any claim

for any breach or default of this Agreement, or any right arising from the purported assignor’s

due performance of its obligations hereunder, without the prior written consent of the other

Party and any such purported assignment in contravention of the provisions herein shall be

null and void and of no force or effect. |

| 8.3. | Entire

Agreement; Amendment; Severability; Waiver; No Third-Party Rights. This Agreement sets

forth the entire agreement of the Parties hereto and supersede any and all prior agreements

and understandings concerning the Zsebok Parties’ engagement by the Company. This Agreement

may be changed only by a written document signed by all of the Parties. If any one or more

of the provisions, or portions of any provision, of the Agreement shall be held to be invalid,

illegal or unenforceable, the validity, legality or enforceability of the remaining provisions

or parts hereof shall not in any way be affected or impaired thereby. The waiver by either

Party of a breach of any provision of this Agreement shall not operate or be construed as

a waiver of any subsequent breach hereof. No waiver shall be valid unless in writing. Except

as expressly provided in this Agreement, this Agreement is intended solely for the benefit

of the Parties hereto and is not intended to confer any benefits upon, or create any rights

in favor of, any person or entity other than the Parties hereto. The section headings contained

in this Agreement are inserted for convenience only and shall not affect in any way the meaning

or interpretation of this Agreement. |

| 8.4. | Governing

Law and Waiver of Jury Trial. This Agreement, and any and all claims, proceedings or

causes of action relating to this Agreement or arising from this Agreement or the transactions

contemplated herein, including, without limitation, tort claims, statutory claims and contract

claims, shall be interpreted, construed, governed and enforced under and solely in accordance

with the substantive and procedural laws of the Province of Ontario, in each case as in effect

from time to time and as the same may be amended from time to time, and as applied to agreements

performed wholly within the Province of Ontario. TO THE EXTENT PERMITTED BY APPLICABLE LAW,

EACH OF THE PARTIES HEREBY IRREVOCABLY WAIVES ALL RIGHT TO TRIAL BY JURY IN ANY ACTION, PROCEEDING

OR COUNTERCLAIM ARISING OUT OF OR RELATING TO THIS AGREEMENT OR THE TRANSACTIONS CONTEMPLATED

HEREBY. EACH PARTY HERETO (A) CERTIFIES THAT NO REPRESENTATIVE, AGENT OR ATTORNEY OF ANY

OTHER PARTY HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT SUCH OTHER PARTY WOULD NOT, IN

THE EVENT OF LITIGATION, SEEK TO ENFORCE THE FOREGOING WAIVER AND (B) ACKNOWLEDGES THAT IT

AND THE OTHER PARTIES HERETO HAVE BEEN INDUCED TO ENTER INTO THIS AGREEMENT BY, AMONG OTHER

THINGS, THE MUTUAL WAIVERS AND CERTIFICATIONS IN THIS SECTION 8.4. |

| 8.5. | Specific

Performance. The Parties agree that irreparable damage would occur in the event that

any of the provisions of this Agreement were not performed by them in accordance with the

terms hereof or were otherwise breached and that each Party hereto shall be entitled to an

injunction or injunctions, specific performance and other equitable relief to prevent breaches

of the provisions hereof and to enforce specifically the terms and provisions hereof, without

the proof of actual damages, in addition to any other remedy to which they are entitled at

law or in equity. |

| 8.6. | Notices.

All notices and other communications hereunder shall be in writing and shall be given by

hand delivery to the other Party, or by registered or certified mail, return receipt requested,

postage prepaid, or by email with return receipt requested and received or nationally recognized

overnight courier service. Notices shall be sent to the Company at its business address or

by email to the Chief Executive Officer of the Company or to the Zsebok Parties to the address

and email address for Zsebok as set forth in the books and records of the Company. |

| 8.7. | Counsel.

The Parties acknowledge and agree that Anthony L.G., PLLC (“Counsel”) has acted

as legal counsel to the Company, and that Counsel has prepared this Agreement at the request

of the Company, and that Counsel is not legal counsel to either of the Zsebok Parties individually.

Each of the Parties acknowledges and agrees that they are aware of, and have consented to,

the Counsel acting as legal counsel to the Company and preparing this Agreement, and that

Counsel has advised each of the Parties to retain separate counsel to review the terms and

conditions of this Agreement and the other documents to be delivered in connection herewith,

and each Party has either waived such right freely or has otherwise sought such additional

counsel as it has deemed necessary. Each of the Parties acknowledges and agrees that Counsel

does not owe any duties to either of the Zsebok Parties in such Zsebok Party’s individual

capacity in connection with this Agreement and the transactions contemplated herein. Each

of the Parties hereby waives any conflict of interest which may apply with respect to Counsel’s

actions as set forth herein, and the Parties confirm that the Parties have previously negotiated

the material terms of the agreements as set forth herein. |

| 8.8. | Rule

of Construction. The general rule of construction for interpreting a contract, which

provides that the provisions of a contract should be construed against the Party preparing

the contract, is waived by the Parties hereto. Each Party acknowledges that such Party was

represented by separate legal counsel in this matter who participated in the preparation

of this Agreement or such Party had the opportunity to retain counsel to participate in the

preparation of this Agreement but elected not to do so. |

| 8.9. | Execution

in Counterparts, Electronic Transmission. This Agreement may be executed in any number

of counterparts, each of which shall be deemed an original. The signature of any Party which

is transmitted by any reliable electronic means such as, but not limited to, a photocopy,

electronically scanned or facsimile machine, for purposes hereof, is to be considered as

an original signature, and the document transmitted is to be considered to have the same

binding effect as an original signature or an original document. |

[Signatures

appear on following page]

IN

WITNESS WHEREOF, the Parties have duly executed this Agreement as of the Effective Date.

| |

Novo

Integrated Sciences, Inc. |

| |

|

|

| |

By:

|

/s/

Robert Mattacchione |

| |

Name:

|

Robert

Mattacchione |

| |

Title:

|

Chief

Executive Officer |

| |

|

|

| |

Zsebok:

Jim Zsebok |

| |

|

|

| |

By:

|

/s/

Jim Zsebok |

| |

Name: |

Jim

Zsebok |

| |

|

|

| |

RTZ

Consulting Group, Inc. |

| |

|

|

| |

By:

|

/s/

Jim Zsebok |

| |

Name: |

Jim

Zsebok |

| |

Title: |

President |

v3.23.2

Cover

|

Jun. 28, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jun. 28, 2023

|

| Entity File Number |

001-40089

|

| Entity Registrant Name |

Novo

Integrated Sciences, Inc.

|

| Entity Central Index Key |

0001138978

|

| Entity Tax Identification Number |

59-3691650

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

11120

NE 2nd Street

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Bellevue

|

| Entity Address, State or Province |

WA

|

| Entity Address, Postal Zip Code |

98004

|

| City Area Code |

(206)

|

| Local Phone Number |

617-9797

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.001 par value

|

| Trading Symbol |

NVOS

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

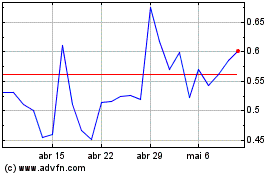

Novo Integrated Sciences (NASDAQ:NVOS)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Novo Integrated Sciences (NASDAQ:NVOS)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025