UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION

REQUIRED IN PROXY STATEMENT

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| ☐ |

Preliminary

Proxy Statement |

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ |

Definitive

Proxy Statement |

| ☐ |

Definitive

Additional Materials |

| ☐ |

Soliciting

Material Pursuant to Rule 14a-12 |

INNSUITES

HOSPITALITY TRUST

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

| ☒ |

No

fee required. |

| |

|

| ☐ |

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

(1) |

Title

of each class of securities to which transaction applies: |

| |

|

|

| |

|

|

| |

(2) |

Aggregate

number of securities to which transaction applies: |

| |

|

|

| |

|

|

| |

(3) |

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the

filing fee is calculated and state how it was determined): |

| |

|

|

| |

|

|

| |

(4) |

Proposed

maximum aggregate value of transaction: |

| |

|

|

| |

|

|

| |

(5) |

Total

fee paid: |

| |

|

|

| ☐ |

Fee

paid previously with preliminary materials. |

| |

|

| ☐ |

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its

filing. |

| |

(1) |

Amount

Previously Paid: |

| |

|

|

| |

|

|

| |

(2) |

Form,

Schedule or Registration Statement No.: |

| |

|

|

| |

|

|

| |

(3) |

Filing

Party: |

| |

|

|

| |

|

|

| |

(4) |

Date

Filed: |

| |

|

|

NOTICE

OF ANNUAL MEETING OF SHAREHOLDERS

Notice

is hereby given that the Fiscal 2023 Annual Meeting of Shareholders of InnSuites Hospitality Trust (the “Trust”) will be

held at the InnSuites Hospitality Trust corporate offices located at 1730 E. Northern Avenue, Suite 122, Phoenix, Arizona 85020 (phone:

602-944-1500) on Wednesday August 16, 2023, at 1:00 P.M., local time, for the purpose of considering and acting upon the following matters:

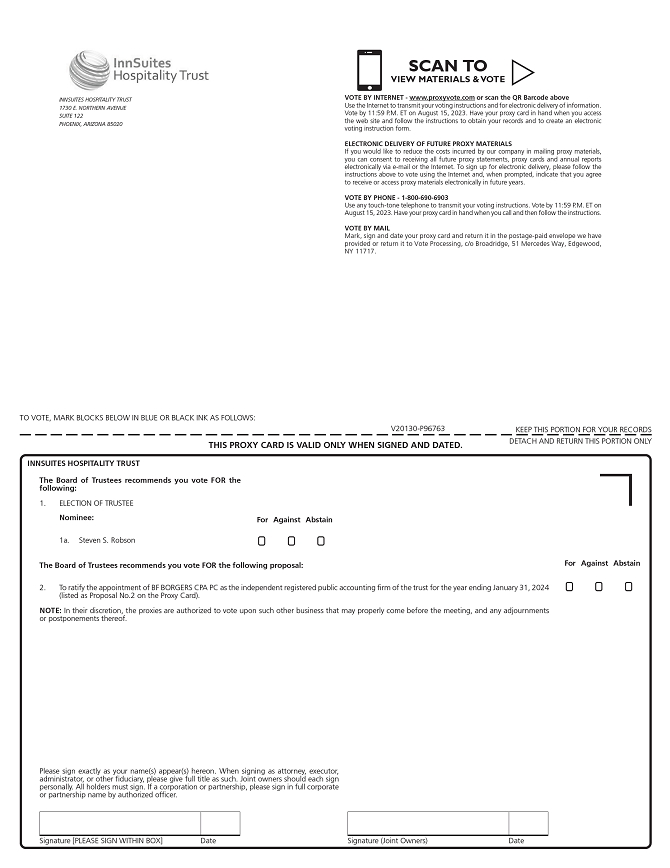

| |

1. |

The

election of the Trustee named in this proxy statement and recommended by the Board of Trustees to hold office until the Fiscal 2026

Annual Meeting of Shareholders and until their respective successors shall be duly elected and qualified (listed as Proposal No.

1 on the Proxy Card); |

| |

|

|

| |

2. |

To

ratify the appointment of BF Borgers CPA, PC, Certified Public Accountants & Consultants, Inc. (“BF Borgers”) as

the independent registered public accounting firm of the trust for the year ending January 31, 2024. (listed as Proposal No. 2 on

the Proxy Card);

|

|

3. |

The

transaction of any other business that may properly come before the meeting and any adjournments or postponements thereof. |

Shareholders

of the Trust of record at the close of business on July 7, 2023 are entitled to vote at the 2023 Annual Meeting of Shareholders and any

adjournments or postponements thereof.

| |

By

order of the Board of Trustees |

| |

|

| |

/s/

MARC E. BERG |

| Phoenix,

Arizona |

Secretary |

| July

9, 2023 |

|

| Shareholders

are requested to complete, date, sign and return the enclosed Proxy Card in the envelope provided, which requires no postage if mailed

in the United States. |

Important

Notice Regarding the Availability of Proxy Materials

for

the Annual Meeting of Shareholders to be held on August 16, 2023

The

Proxy Statement, Proxy Card and Annual Report on Form 10-K for the Fiscal Year

ended

January 31, 2023 are available at our Internet website at www.innsuitestrust.com.

Table

of Contents

InnSuites

Hotels Centre

1730

E. Northern Avenue, Suite 122

Phoenix,

Arizona 85020

PROXY

STATEMENT

Proxy

Solicitation

The

accompanying proxy is solicited by the Board of Trustees of InnSuites Hospitality Trust (“IHT” or “the Trust”)

for use at the Fiscal 2023 Annual Meeting of Shareholders (the “Annual Meeting”) to be held on Wednesday August 16, 2023,

and any adjournments or postponements thereof. In addition to the solicitation of proxies by mail, our Trustees, officers and regular

employees may also solicit the return of proxies by regular or electronic mail, telephone or personal contact, for which they will not

receive additional compensation. We will pay all costs of soliciting proxies and will reimburse brokers or other persons holding our

Shares of Beneficial Interest (“Shares”) in their names or in the names of their nominees for their reasonable expenses in

forwarding proxy materials to the beneficial owners of such Shares.

General

Information

Shareholders

of record at the close of business on July 7, 2023 (the record date) will be entitled to vote at the Annual Meeting and at any adjournments

or postponements thereof. As of that date, there were 9,006,206 Shares issued and outstanding. Each outstanding Share is entitled

to one vote on all matters that properly come before the Annual Meeting. A majority of the issued and outstanding Shares must be represented

at the Annual Meeting in person or by proxy in order to constitute a quorum for the transaction of business.

Shares

represented by properly executed proxy cards will be voted in accordance with the specifications made thereon. If no specification is

made, proxies will be voted “FOR”:

| |

1. |

The

election of the Trustee nominee named herein (Proposal No. 1); |

| |

2. |

Approval

of the ratification of the appointment of BF Borgers CPA, PC as the independent registered public accounting firm to audit the Trust

for the year ending January 31, 2024 (Proposal No. 2); |

Shares

will be voted in the discretion of the persons voting the Shares represented by proxies if any other business properly comes before the

meeting. The number of Shares printed on your proxy card(s) represents all your Shares under a particular registration. Receipt of more

than one proxy card means that your Shares are registered differently and are in more than one account. To ensure that all of your Shares

are voted at the Annual Meeting, sign and return all proxy cards you receive pursuant to the instructions thereon.

The

election of the Trustee requires the affirmative vote of the holders of at least a majority of the issued and outstanding Shares entitled

to vote present in person or by proxy at the Annual Meeting. Approval of the Proposal no. 2 requires the affirmative vote of the holders

of a majority of the Shares cast on the proposal.

Abstentions,

but not broker non-votes, will be tabulated in determining the votes present at the Annual Meeting for purposes of determining a quorum.

If your Shares are held in street name and you do not provide voting instructions to the brokerage firm that holds your shares, the brokerage

firm can, in its discretion, vote your uninstructed Shares only on matters on which it is permitted to exercise authority (“routine”

matters). A broker non-vote occurs when a broker, bank or other holder of record holding Shares for a beneficial owner does not vote

on a particular proposal because it does not have discretionary voting power for that particular item, or chooses not to vote, and has

not received instructions from the beneficial owner. Brokers may not exercise their discretion to vote uninstructed Shares for the election

of the Trustee’s because the election of Trustees are not considered routine. Therefore, if your Shares are to be represented by

a broker at the Annual Meeting, you must give specific instructions to your broker for your Shares to be voted on each of the proposals

to be voted on at the Annual Meeting.

Abstentions

will have the same effect as votes against the Trustee nominees, as each abstention will be one less vote for each Trustee nominee. Broker

non-votes will have no effect on the election of the Trustees.

This

proxy statement and the voting form of proxy will be mailed to our shareholders on or about July 9, 2023. We are also mailing

with this proxy statement our Annual Report to Shareholders for the Fiscal Year ended January 31, 2023 (“Fiscal Year 2023”).

A

proxy may be revoked at any time before a vote is taken or the authority granted is otherwise exercised. Revocation may be accomplished

by the execution of a later proxy with regard to the same Shares, by giving notice in writing to our Secretary, or by voting your Shares

in person at the Annual Meeting (but your attendance at the Annual Meeting, in and of itself, will not revoke the proxy).

Representatives

of Broadridge Financial Solutions (“Broadridge”) will tabulate the votes. Sylvin R. Lange, the Trust’s Chief Financial

Officer will serve as election inspector.

Election

of Trustees

(Proposal

No. 1 on the Proxy Card)

At

the Annual Meeting, one Trustee (Steven S. Robson) will stand for election as Trustee’s each to serve a three-year term expiring

at the Fiscal 2026 Annual Meeting of Shareholders and until his respective successor is duly elected and qualified. Mr. Robson has been

a Trustee since June 16, 1998. Mr. Robson is standing for re-election at the Annual Meeting as his current term as Trustee expires at

the Annual Meeting.

Unless

a shareholder requests that a proxy be voted against Mr. Robson, the sole nominee for Trustee, in accordance with the instructions set

forth on the proxy card, Shares represented by proxies solicited hereby will be voted “ FOR “ the election of Mr.

Robson as Trustee. Mr. Robson has consented to being named in this proxy statement and to serve if elected. Should Mr. Robson subsequently

decline or be unable to accept such nomination or to serve as a Trustee, an event that the Board of Trustees does not currently expect,

the persons voting the Shares represented by proxies solicited hereby may vote such Shares for a substitute nominee in their discretion.

Our

Board of Trustees currently has five members and is divided into three classes. Effective immediately following the Annual Meeting, the

Board of Trustees will consist of five members and will be divided into three classes as follows:

| |

● |

two

Trustees in the class whose term will expire at the Fiscal 2024 Annual Meeting of Shareholders; |

| |

|

|

| |

● |

two

Trustees in the class whose terms will expire at the Fiscal 2025 Annual Meeting of Shareholders; and |

| |

|

|

| |

● |

one

Trustee in the class whose terms will expire at the Fiscal 2026 Annual Meeting of Shareholders. |

Each

of the Trustees serves for three years and until his or her successor is duly elected and qualified. The Board of Trustees has determined

that Messrs. J.R. Chase, Les T. Kutasi, and Steven Robson, who constitute a majority of the Board of Trustees, are “independent”

as defined by the NYSE American listing standards and the rules of the SEC for the purposes of serving on the Board of Trustees and each

committee of which they are members. Messrs. Marc E. Berg and James F. Wirth are executive officers and are not independent. Except as

described under “Certain Transactions” below, there were no transactions, relationships or arrangements in Fiscal Year 2023

that required review by the Board for purposes of determining Trustee independence.

We

request that all of our Trustees attend our Annual Meetings of Shareholders. All Trustees were present at the last Annual Meeting of

Shareholders, and attended 100% of the meetings held by the Board of Trustees, either in person or telephonically. All Trustees attended

each meeting of the Committees on which the Trustee served during Fiscal Year 2023. In addition, the independent Trustees meet at least

annually in executive session without the presence of non-independent Trustees and management.

Vote

Required

The

election of the Trustee requires the affirmative vote of the holders of at least a majority of the issued and outstanding Shares entitled

to vote present in person or by proxy at the Annual Meeting.

Recommendation

the Board of Trustees

OUR

BOARD OF TRUSTEES RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF MR. ROBSON AS TRUSTEE.

Approval

of the Ratification of BF Borgers

(Proposal

No. 2 on the Proxy Card)

RATIFICATION

OF APPOINTMENT OF INDEPENDENT AUDITORS

The

Audit Committee has recommended the appointment of BF Borgers CPA PC (“BF Borgers”), as the Company’s independent registered

public accounting firm for the Fiscal Year ending January 31, 2024. BF Borgers has been the Trust’s independent registered public

accounting firm since 2022 and audited our financial statements for the years ending January 31, 2022, and 2023.

The

shareholders are being requested to ratify the appointment of BF Borgers at the Annual Meeting. The Company anticipates that a representative

of BF Borgers may be available by phone and/or may attend the Annual Meeting. The representative will have an opportunity to make a statement

and to respond to appropriate shareholder questions.

Neither

the Company’s Articles of Incorporation nor the Company’s Bylaws require that shareholders ratify the appointment of BF Borgers

as the Company’s independent registered public accounting firm. We are, however, requesting ratification because we believe it

is a matter of good corporate governance. If the Company’s shareholders do not ratify the appointment, the Audit Committee will

reconsider whether, or not, to retain BF Borgers, but may, nonetheless, retain BF Borgers as the Company’s independent registered

public accountants. Even if the appointment is ratified, the Audit Committee in its discretion may change the appointment at any time

if it determines that the change would be in the best interests of the Company and its shareholders.

Vote

Required

You

may vote in favor or against this proposal or you may abstain from voting. The affirmative vote of a majority of all votes present, or

represented by proxy, and entitled to vote at the Annual Meeting is required to ratify the appointment of BF Borgers CPA PC, as the Company’s

independent registered public accounting firm. If shareholders of record do not specify the manner in which their shares represented

by a validly executed proxy solicited by the Board of Directors are to be voted on this proposal, such shares will be voted in favor

of the ratification of the appointment of BF Borgers as the Company’s independent registered public accounting firm. Abstentions

will have the same effect as votes cast against the proposal. Generally, brokers and other nominees that do not receive instructions

are entitled to vote on the ratification of the appointment of our independent registered public accounting firm as this is a routine

matter.

THE

board of Trustees RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF BF BORGERS CPA PC.

Board

of Trustees and Executive Officers

Nominees,

Trustees and Executive Officers

The

biography of our nominee for Trustee, Mr. Robson, whose term if elected will continue after the Annual Meeting, and our current executive

officers, are set forth below. The information concerning our Trustee nominee, continuing Trustees and executive officers set forth below

is based in part on information received from the respective Trustee nominee, continuing Trustees and executive officers and in part

on our records. The information below sets forth the name, age, term of office, outside directorships and principal business experience

for the Trustee nominee, continuing Trustees and executive officers of the Trust and includes the specific experience, qualifications,

attributes and skills that led to the conclusion that the Trustee nominee and Trustees should serve on our Board of Trustees, in light

of the Trust’s business and structure.

If

elected, the terms of Mr. Robson as Trustee will expire at the Fiscal 2026 Annual Meeting of shareholders.

Nominee

Whose Term,

if

elected, Expire in 2026 |

|

Age

as of Record Date |

|

Principal

Occupations During Past Five Years

And

Directorships Held |

|

Trustee

Since |

Steven

S. Robson

(1)(2)(3)(5)

|

|

66 |

|

Owner

of Scott Homes, residential real estate developers.

Mr.

Robson has strategic leadership and residential real estate development experience as well as experience in negotiating complex transactions

and maintaining mission, vision and values. In addition, Mr. Robson has served on our Board for nearly 25 years. |

|

June

16, 1998 |

| |

|

|

|

|

|

|

Trustees Whose Term,

Will Expire in 2025

|

|

Age

as of Record Date |

|

Principal

Occupations During Past Five Years

And

Directorships Held |

|

Trustee

Since |

| James

F. Wirth |

|

77 |

|

Chairman

and Chief Executive Officer of the Trust since January 30, 1998, and since June 15, 2016, as President of the Trust. Manager and

primary owner (together with family members) of Rare Earth Financial, L.L.C. and affiliated entities, owners and operators of hotels,

since 1980.

Mr.

Wirth holds a B.S. in Economics and Mathematics from the University of Arizona, Eller School of Business. As a Mellon Fellow, he

holds an MBA from Carnegie Mellon University, Tepper School of Business.

Mr.

Wirth has significant real estate and hotel industry experience, including Division President of Ramada Inns, Inc., and has extensive

experience with the Trust for the past 25 years, since 1998. He also has a significant investment in our Shares, which we believe

provides him with a strong incentive to advance shareholder interests. Mr. Wirth has served on our Board for more than 25 years. |

|

January

30, 1998

|

| |

|

|

|

|

|

|

| Leslie

(Les) T. Kutasi(1)(2)(3)(4) |

|

72 |

|

Chairman

of the Audit Committee, as well Founder and President of Trend-Tex International, a multi-line textile sales and marketing Trust,

since 2000. In 1996, Mr. Kutasi founded Pacesetter Fabrics, LLC, a start-up textile importer and converter, and served as its Chief

Executive Officer until 2000. Prior to that, he served as President of California Textile Sales from 1990 to 1996.

Mr.

Kutasi currently brokers high end Arizona real estate with more than 35 years of residential real estate and investment experience. |

|

January

31, 2013 |

Trustees Whose Term,

Will Expire in 2024

|

|

Age

as of Record Date |

|

Principal

Occupations During Past Five Years

And

Directorships Held |

|

Trustee

Since |

| Marc

E. Berg |

|

71 |

|

Executive

Vice President, Secretary and Treasurer of the Trust since February 10, 1999, handling Acquisitions and Dispositions. Vice Chairman

of the Board of the Trust since January 2019.

Prior

to InnSuites, Mr. Berg was a wealth manager at Valley National Bank where his portfolio consisted of over half a billion dollars

in equities, bonds and fixed income securities. Mr. Berg also worked at Young, Smith and Peacock, an investment banking firm, in

public finance.

Mr.

Berg has been qualified as a US Trustee, a Registered Investment Advisor with the SEC and holds both an MBA (Finance) degree from

the WP Carey Business School at Arizona State University as well as a Masters in International Management from the Thunderbird Graduate

School of International Management. His undergraduate degree was a BSBA from American University in Washington, D.C.

Mr.

Berg has in-depth familiarity with the operations of the Trust and extensive experience in property acquisitions and dispositions.

In addition, Mr. Berg has served on our Board over 25 years. |

|

January

30, 1998 |

| |

|

|

|

|

|

|

| Jessie

Ronnie Chase (1)(2)(3)(6) |

|

73 |

|

President

and owner of Park Avenue Investments, a real estate investment firm, since 2000. From 1993 - 2003, Mr. Chase provided investor and

management expertise to a subsidiary of the Trust.

With

over 35 years of real estate investment and hospitality experience, including experience managing a variety of real estate assets,

Mr. Chase brings to our Board with wide-ranging and in-depth experience in hotel management companies, technology and operations. |

|

December

22, 2015 |

1

Member of the Audit Committee.

2

Member of the Compensation Committee.

3

Member of the Governance and Nominating Committee.

4

Chair of the Audit Committee.

5

Chair of the Compensation Committee.

6.

Chair of the Governance and Nominating Committee.

| Other

Executive Officer |

|

Age

as of Record Date |

|

Principal

Occupations During Past Five Years

And

Directorships Held |

| Sylvin

Lange |

|

50 |

|

Chief

Financial Officer, (CFO), of the Trust since September 7, 2020. Mr. Lange previously served as an Independent Consultant until becoming

CFO. |

| |

|

|

|

|

| |

|

|

|

Prior

to joining the Trust, Mr. Lange was an Independent Consultant providing Financial Analysis, Auditing, Tax Assistance and Advice,

Regulatory Supervision, Financial Reporting Guidance, and Overall Accounting Direction; providing overall financial and operational

consulting and support, to a variety of business enterprises. He has over 25 years of experience in finance, accounting, tax, auditing,

and management. |

| |

|

|

|

|

| |

|

|

|

Mr.

Lange holds a bachelor’s degree in Business Administration with a Concentration in Accounting from California State University.

He has served in steadily increasing roles of responsibility, including within the leadership and management teams at both US Airways,

and JDA Software previously. |

We

request that when convenient, all Trustees attend our Annual Meetings of Shareholders. Board attendance was high, with 100% attendance

for each of the meetings held by the Board of Trustees and the Committees during Fiscal Year 2023. In addition, the independent Trustees

are required to meet at least annually in executive session without the presence of non-independent Trustees and management.

Trustee

Nominations and Qualifications

The

Governance and Nominating Committee expects to identify nominees to serve as our Trustees primarily by accepting and considering the

suggestions and nominee recommendations made by members of the Board of Trustees and our management and shareholders. Nominees for Trustees

are evaluated based on their character, judgment, independence, financial or business acumen, diversity of experience, ability to represent

and act on behalf of all of our shareholders, and the needs of the Board of Trustees. In accordance with its charter, the Governance

and Nominating Committee discusses diversity of experience as one of many factors in identifying nominees for Trustee, but does not have

a policy of assessing diversity with respect to any particular qualities or attributes. All of the current Trustees are men, due to the

departure of one woman during fiscal 2019. The Governance and Nominating Committee has not identified any specific attributes that the

Committee would desire to diversify on the Board. In general, before evaluating any nominee, the Governance and Nominating Committee

first determines the need for additional Trustees to fill vacancies or expand the size of the Board of Trustees and the likelihood that

a nominee can satisfy the evaluation criteria. The Governance and Nominating Committee would expect to re-nominate incumbent Trustees

who have served well on the Board of Trustees and express an interest in continuing to serve. Our Board of Trustees is satisfied that

the backgrounds and qualifications of our Trustees, considered as a group, provide a mix of experience, knowledge and abilities that

allows our Board to fulfill its responsibilities.

The

Governance and Nominating Committee will consider shareholder recommendations for Trustee nominees. A shareholder who wishes to suggest

a Trustee nominee for consideration by the Governance and Nominating Committee should send a resume of the nominee’s business experience

and background to Mr. Ronnie Chase, Chairperson of the Governance and Nominating Committee, InnSuites Hospitality Trust, 1730 E. Northern

Avenue, Suite 122, Phoenix, Arizona 85020. The mailing envelope and letter must contain a clear notation indicating that the enclosed

letter is a “Shareholder-Board of Trustees Nominee.”

Leadership

Structure of the Board of Trustees

Mr.

Wirth, our Chief Executive Officer, currently serves as Chairman of the Board. Our Second Amended and Restated Declaration of Trust,

as amended, provides that the Trustees shall annually elect a Chairman who shall be the principal officer of the Trust. Mr. Wirth has

served as Chairman of our Board of Trustees and our Chief Executive Officer since January 30, 1998. Our Board of Trustees has determined

that the Trust has been well-served by this structure of combined Chairman and Chief Executive Officer positions and that this structure

facilitates strong and clear leadership, with a single person setting the tone of the organization and having the ultimate responsibility

for all of the Trust’s operating and strategic functions, thus providing unified leadership and direction for the Board of Trustees

and the Trust’s executive management. Our Chairman also has a significant investment in our Shares, which we believe provides him

with a strong incentive to advance shareholder interests.

The

Trust does not have a lead independent Trustee but receives strong leadership from all of its members. Our Board Committees consist of

only independent members, and our independent Trustees meet at least annually in executive session without the presence of non-independent

Trustees and management. In addition, our Trustees take active and substantial roles in the activities of our Board of Trustees at the

full Board meetings. Our Trustees are able to propose items for Board meeting agendas, and the Board’s meetings include time for

discussion of items not on the formal agenda. Our Board believes that this open structure, as compared to a system in which there is

a designated lead independent trustee, facilitates a greater sense of responsibility among our Trustees and facilitates active and effective

oversight by the independent Trustees of the Trust’s operations and strategic initiatives, including any risks.

The

Board’s Role in Risk Oversight

Our

management devotes significant attention to risk management, and our Board of Trustees is engaged in the oversight of this activity,

both at the full Board and at the Board Committee level. The Board’s role in risk oversight does not affect the Board’s leadership

structure. However, our Board’s leadership structure supports such risk oversight by combining the Chairman position with the Chief

Executive Officer position (the person with primary corporate responsibility for risk management).

Our

Board’s role in the Trust’s risk oversight process includes receiving reports from members of senior management on areas

of material risk to the Trust, including operational, financial, legal, and regulatory and strategic risks. The Board of Trustees requires

management to report to the full Board (or an appropriate Committee) on a variety of matters at regular meetings of the Board and on

an as-needed basis, including the performance and operations of the Trust and other matters relating to risk management. The Audit Committee

also receives regular reports from the Trust’s independent registered public accounting firm on internal control and financial

reporting matters. In addition, pursuant to its charter, the Audit Committee is tasked with reviewing with the Trust’s counsel

major litigation risks as well as compliance with applicable laws and regulations, discussing with management its procedures for monitoring

compliance with the Trust’s code of conduct, and discussing significant financial risk exposures and the steps management has taken

to monitor, control and report such exposures. These reviews are conducted in conjunction with the Board’s risk oversight function

and enable the Board to review and assess any material risks facing the Trust.

Our

Board also works to oversee risk through its consideration and authorization of significant matters, such as major strategic, operational,

and financial initiatives and its oversight of management’s implementation of those initiatives. The Board periodically reviews

with management its strategies, techniques, policies, and procedures designed to manage these risks. Under the overall supervision of

our Board, management has implemented a variety of processes, procedures, and controls to address these risks.

Communications

with the Board of Trustees

Shareholders

and other interested parties who wish to communicate with the Board of Trustees or any individual member thereof may do so by writing

to the Secretary, InnSuites Hospitality Trust, 1730 E. Northern Avenue, Suite 122, Phoenix, Arizona 85020. The mailing envelope and letter

must contain a clear notation indicating that the enclosed letter is an “Interested Party-Board of Trustees Communication.”

The Secretary will review all such correspondence and regularly forward to the Board of Trustees a log and summary of all such correspondence

and copies of all correspondence that, in the opinion of the Secretary, deals with the functions of the Board of Trustees or Committees

thereof or that he otherwise determines requires their attention. Trustees may at any time review a log of all correspondence received

by us that is addressed to members of the Board of Trustees and request copies of any such correspondence. Concerns relating to accounting,

internal controls or auditing matters are immediately brought to the attention of our accounting department and handled in accordance

with procedures established by the Audit Committee for such matters.

Code

of Ethics for Senior Financial Officers

We

have a Code of Ethics that applies to our Chief Executive Officer and Chief Financial Officer and persons performing similar functions.

We have posted our Code of Ethics on our website at www.innsuitestrust.com. We intend to satisfy all SEC and NYSE American disclosure

requirements regarding any amendment to, or waiver of, the Code of Ethics relating to our Chief Executive Officer and Chief Financial

Officer and persons performing similar functions, by posting such information on our website unless the NYSE American requires a Form

8-K. In addition, we have adopted a Code of Conduct and Ethics that applies to all of our employees, officers and Trustees. It is also

available on our website at www.innsuitestrust.com.

Section

16(a) Beneficial Ownership Reporting Compliance

Section

16(a) of the Exchange Act requires our Trustees, executive officers and beneficial holders of more than 10% of our Shares to file with

the SEC initial reports of ownership and reports of subsequent changes in ownership. The SEC has established specific due dates for these

reports, and we are required to disclose in this Proxy Statement any late filings or failures to file.

Based

solely on our review of the copies of such forms (and amendments thereto) furnished to us, we believe that all our Trustees, executive

officers and holders of more than 10% of the Shares complied with all Section 16(a) filing requirements during the Fiscal Year ended

January 31, 2023.

Board

Committees

All

five of the incumbent Trustees attended 100% of the aggregate number of meetings held by the Board of Trustees and the Committees, either

in person or telephonically, on which the Trustees served during Fiscal Year 2023. The Board of Trustees met four times during the Fiscal

Year ended January 31, 2023. The independent Trustees meet at least annually in executive session without the presence of non-independent

Trustees and management.

Audit

Committee

The

Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the work of our independent auditors,

including reviewing the scope and results of audit and non-audit services. The Audit Committee also reviews internal accounting controls

and assesses the independence of our auditors. In addition, the Audit Committee has established procedures for the receipt, retention

and treatment of any complaints received by us regarding accounting, internal controls or auditing matters and the confidential, anonymous

submission by our employees of any concerns regarding accounting or auditing matters. The Audit Committee has the authority to engage

independent counsel and other advisors as it deems necessary to carry out its duties. The Audit Committee met four (4) times during Fiscal

Year 2023.

All

members of the Audit Committee are “independent,” as such term is defined by the SEC’s rules and the NYSE American’s

listing standards. The Board of Trustees has determined that Mr. Kutasi, a member and the chairman of our Audit Committee, qualifies

as an “audit committee financial expert” under applicable SEC rules. We have posted our Amended and Restated Audit Committee

Charter on our Internet website at www.innsuitestrust.com. Information on our website is not part of this proxy statement.

Audit

Committee Report

The

Audit Committee of the Board of Trustees has reviewed and discussed the audited consolidated financial statements included in the Trust’s

Annual Report on Form 10-K for the Fiscal Years ended January 31, 2023, and 2022 with the management of the Trust. In addition, the Audit

Committee has discussed with BF Borgers CPA PC (“BF Borgers”), the independent registered public accounting firm of the Trust,

the matters required to be discussed under Public Company Accounting Oversight Board Auditing Standard No. 1301, Communications with

Audit Committees.

Communications

with Audit Committees: The Audit Committee has also received and reviewed the written disclosures and the letters from BF Borgers,

required by the applicable requirements of the Public Company Accounting Oversight Board regarding the independent auditor’s communications

with the Audit Committee concerning independence and has discussed with BF Borgers their respective independence from the Trust, including

the compatibility of any non-audit services with BF Borger’s independence. The Audit Committee has also pre-approved the fees to

be charged to the Trust by its independent auditors for audit services.

Based

on the foregoing, the Audit Committee recommended that such audited consolidated financial statements be included in the Trust’s

Annual Report for the Fiscal Year ended January 31, 2023.

By

the Audit Committee of the Board of Trustees:

Les

T. Kutasi, Chairman

Steven

S. Robson

Jessie

Ronnie Chase

Compensation

Committee

The

Compensation Committee has the responsibility of determining the compensation of the Chief Executive Officer and all of our other officers,

advising the Board of Trustees on the adoption and administration of employee benefit and compensation plans and administering our 1997

Stock Incentive and Option Plan. A description of the Compensation Committee’s processes and procedures for the consideration and

determination of executive officer compensation is included in this proxy statement under “Compensation of Trustees and Executive

Officers - Executive Compensation Overview.” The Compensation Committee met two times during the Fiscal Year ended January 31,

2023.

All

members of the Compensation Committee are “independent,” as such term is defined by the SEC’s rules and the NYSE American’s

listing standards. We have posted our Amended and Restated Compensation Committee Charter on our Internet website at www.innsuitestrust.com.

Information on our website is not part of this proxy statement.

By

the Compensation Committee of the Board of Trustees:

Steven

S. Robson, Chairman

Les

T. Kutasi

Jessie

Ronnie Chase

Governance

and Nominating Committee

The

Governance and Nominating Committee has the responsibility of screening and nominating candidates for election as Trustees and recommending

Committee members for appointment by the Board of Trustees. See “Board of Trustees and Executive Officers - Trustee Nominations

and Qualifications” above for more information on how shareholders can nominate Trustee candidates, as well as information regarding

how Trustee candidates are identified and evaluated. The Governance and Nominating Committee also advises the Board of Trustees with

respect to governance issues and trusteeship practices, including determining whether Trustee candidates and current Trustees meet the

criteria for independence required by the NYSE American and the SEC. The Governance and Nominating Committee met twice during the Fiscal

Year ended January 31, 2023.

All

members of the Governance and Nominating Committee are “independent,” as such term is defined by the SEC’s rules and

NYSE American listing standards. We have posted our Governance and Nominating Committee Charter on our Internet website at www.innsuitestrust.com.

Information on our website is not part of this proxy statement.

By

the Governance and Nominating Committee of the Board of Trustees:

Jessie

Ronnie Chase, Chairman

Les

T. Kutasi

Steven

S. Robson

Approval

of the Ratification of BF Borgers

(Proposal

No. 2 on the Proxy Card)

RATIFICATION

OF APPOINTMENT OF INDEPENDENT AUDITORS

The

Audit Committee has recommended the appointment of BF Borgers CPA PC, as the Company’s independent registered public accounting

firm for the Fiscal Year ending January 31, 2024. BF Borgers has been the Company’s independent registered public accounting firm

since 2022 and audited our financial statements for the year ending January 31, 2023.

The

shareholders are being requested to ratify the appointment of BF Borgers at the Annual Meeting. The Company anticipates that a representative

of BF Borgers may attend the Annual Meeting. The representative will have an opportunity to make a statement and to respond to appropriate

shareholder questions.

Neither

the Company’s Articles of Incorporation nor the Company’s Bylaws require that shareholders ratify the appointment of BF Borgers

as the Company’s independent registered public accounting firm. However, we are requesting ratification because we believe it is

a matter of good corporate governance. If the Company’s shareholders do not ratify the appointment, the Audit Committee will reconsider

whether or not to retain BF Borgers, but may, nonetheless, retain BF Borgers as the Company’s independent registered public accountants.

Even if the appointment is ratified, the Audit Committee in its discretion may change the appointment at any time if it determines that

the change would be in the best interests of the Company and its shareholders.

Vote

Required

You

may vote in favor or against this proposal or you may abstain from voting. The affirmative vote of a majority of all votes presents or

represented by proxy and entitled to vote at the Annual Meeting is required to ratify the appointment of BF Borgers CPA PC, as the Company’s

independent registered public accounting firm. If shareholders of record do not specify the manner in which their shares represented

by a validly executed proxy solicited by the Board of Directors are to be voted on this proposal, such shares will be voted in favor

of the ratification of the appointment of BF Borgers as the Company’s independent registered public accounting firm. Abstentions

will have the same effect as votes cast against the proposal. Generally, brokers and other nominees that do not receive instructions

are entitled to vote on the ratification of the appointment of our independent registered public accounting firm as this is a routine

matter.

THE

BOARD OF TRUSTEES RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF BF BORGERS CPA PC.

Compensation

of Trustees and Executive Officers

The

following overview relates to the compensation of our executive officers listed in the Summary Compensation Table set forth below during

Fiscal Year 2023. Our executive officers are James F. Wirth, Chairman of the Board, President and Chief Executive Officer, Marc E. Berg,

Vice Chairman, Executive Vice President, Secretary, and Treasurer, and Sylvin Lange, Chief Financial Officer, (referred to below as our

“executive officers”).

Overview

of the Compensation Committee

The

Compensation Committee of the Board of Trustees currently consists of three independent Trustees. The Committee sets the principles and

strategies that serve to guide the design of the compensation programs for our executive officers. The Committee annually evaluates the

performance of our executive officers. Taking into consideration the factors set forth below, the Committee then approves their compensation

levels, including any bonuses. The Committee does not use an independent compensation consultant to assist it with its responsibilities.

The Committee does consider input from the Chief Executive Officer when determining compensation for the other executive officers.

Compensation

Philosophy and Objectives

Under

the supervision of the Compensation Committee, we have developed and implemented compensation policies, plans and programs that seek

to enhance our ability to recruit and retain qualified management and other personnel. In developing and implementing compensation policies

and procedures, the Compensation Committee seeks to provide rewards for the long-term value of an individual’s contribution to

the Trust. The Compensation Committee seeks to develop policies and procedures that offer both recurring and non-recurring, and both

financial and non-financial, incentives.

Compensation

for our executive officers has two main monetary components, salary, and bonus, as well as a benefits component. A base salary is a fixed

compensation component subject to annual adjustment and review, if appropriate, that is designed to attract, retain, and motivate our

executive officers and to align their compensation with market practices. As discussed below, for Fiscal Year 2023, the bonus component

consisted of cash bonuses that were intended to incentivize performance, as described below.

Our

compensation program does not rely to any significant extent on broad-based benefits or prerequisites. The benefits offered to our executive

officers are those that are offered to all of our full-time employees. We do not offer our executive officers any prerequisites.

Our

management and the Compensation Committee work in a cooperative fashion. Management advises the Compensation Committee on compensation

developments, compensation packages and our overall compensation program. The Compensation Committee then reviews, modifies, if necessary,

and approves the compensation packages for our executive officers.

Elements

of Compensation

In

setting the compensation for each executive officer, the Compensation Committee considers (i) the responsibility and authority of each

position relative to other positions within the Trust, (ii) the individual performance of each executive officer, (iii) the experience

and skills of the executive officer, and (iv) the importance of the executive officer to the Trust.

Base

Salary and Discretionary Cash Bonuses

We

pay base salaries to our executive officers in order to provide a level of assured compensation reflecting an estimate of the value in

the employment market of the executive officer’s skills, the demands of his or her position and the relative size of the Trust.

In establishing base salaries for our executive officers, the Compensation Committee considers our overall performance and the performance

of each individual executive officer, as well as market forces and other general factors believed to be relevant, including time between

salary increases, promotion, expansion of responsibilities, advancement potential, and the execution of special or difficult projects.

Additionally, the Compensation Committee considers the relative salaries of the executive officers and determines what it believes are

appropriate compensation level distinctions between and among the executive officers, including between the Chief Executive Officer and

the Chief Financial Officer and among the other executive officers. Although the Compensation Committee considers our financial performance,

there is no specific relationship between achieving, or failing to achieve, budgeted estimates, the performance of our Shares or our

financial performance and the annual salaries determined by the Compensation Committee for any of our executive officers. No specific

weight is attributed to any of the factors considered by the Compensation Committee; the Compensation Committee considers all factors

and makes a subjective determination based upon the experience of its members and the recommendations of our management.

Fiscal

Year 2023

As

Mr. Wirth holds a significant ownership stake in the Trust, the Compensation Committee did not increase his salary or provide him with

additional incentives. Based upon a review of Mr. Wirth’s performance and upon the recommendation of the Compensation Committee,

for Fiscal Years 2023 and 2022, Mr. Wirth’s annual base salary remained set at $153,060. The Compensation Committee did not rely

on any particular set of financial or non-financial factors, measures or criteria when determining the compensation offered to Mr. Wirth.

The Compensation Committee did consider Mr. Wirth’s substantial Share ownership when setting his base salary.

Cash

and Equity Bonuses

Fiscal

2023 Bonuses

Fiscal

2023– Full Year Cash and Equity Bonus Program

On

January 29, 2019, the Compensation Committee adopted an incentive bonus program for the Executives for the full Fiscal Year ended January

31, 2023 (the “2019 Fiscal Year Bonus Program”). Under the 2019 Fiscal Year Bonus Program, an Executive will be entitled

to receive a bonus, upon the achievement by the Executive of performance-based on objectives which was based on exceeding budgeted revenues

and net income in hotel operations.

Performance-Based

Cash Bonuses

Fiscal

2023 - Performance-Based Cash Bonuses

Our

executive officers are eligible to receive cash bonuses under the General Manager Bonus Plan equal to 15% of the aggregate cash bonuses

received by the general managers of all of our hotels, regardless of region. The general managers receive a bonus based on the achievement

of budgeted gross operating profit (total revenues less operating expenses) (“GOP”) at their hotel on a quarterly and annual

basis. Under the plan, if the hotel’s actual quarterly and annual GOP exceeds the budgeted GOP, each general manager is eligible

for a potential maximum annual bonus of $20,000, consisting of a potential maximum quarterly bonus of $2,000 per quarter, ($8,000 per

year), and a potential maximum year-end bonus of $11,000, a risk management bonus of $1,000 and a discretionary excellent property inspection

bonus up to $1,000.

Quarterly

General Manager GOP Bonus Potential:

| Percentage of Budgeted Quarterly GOP Achieved | |

Cash Bonus | |

| Less than 95% | |

$ | 0 | |

| 95% | |

$ | 500 | |

| 98% | |

$ | 1,000 | |

| 102% | |

$ | 1,500 | |

| 106% or more | |

$ | 2,000 | |

Year-End

General Manager GOP Bonus Potential:

| Percentage of Budgeted Annual GOP Achieved | |

Cash Bonus | |

| Less than 95% | |

$ | 0 | |

| 95% | |

$ | 1,000 | |

| 98% | |

$ | 2,000 | |

| 102% | |

$ | 5,000 | |

| 106% | |

$ | 9,000 | |

| 108% or more | |

$ | 11,000 | |

In

Fiscal Years 2022 and 2023, each of our executive officers received an annual cash bonus equal to 15% of the aggregate cash bonuses received

by the general managers of all of our hotels, regardless of region. The general manager aggregate cash bonuses for Fiscal Year 2023 were

as follows:

| Period | |

GM

Aggregate

Cash Bonus | |

| | |

| |

| First Quarter – Fiscal Year 2023 | |

$ | 4,000 | |

| Second Quarter – Fiscal Year 2023 | |

$ | 4,000 | |

| Third Quarter – Fiscal Year 2023 | |

$ | 2,500 | |

| Fourth Quarter – Fiscal Year 2023 | |

$ | 3,500 | |

| Year End – Fiscal Year 2023 | |

$ | 12,000 | |

Benefits

and Other Compensation

We

maintain broad-based benefits that are provided to all employees, including health and dental insurance, life insurance and a 401(k)

plan. We also have a mandatory matching contribution for our 401(k) plan. We do not have a pension plan. Our executive officers are eligible

to participate in all of our employee benefit plans, in each case on the same basis as our other employees. See Note 23 – “Share

Based Payments and Stock Options” for additional information about our Stock Options.

Fiscal

Year 2023 Summary Compensation Table

The

table below shows individual compensation information paid to our executive officers for our Fiscal Years ended January 31, 2023 and

2022:

| Name and Principal | |

Fiscal | | |

Salary | | |

Discretionary Bonus | | |

Non-Equity Incentive Plan Compensation | | |

All Other Compensation | | |

Total | |

| Position (1) | |

Year | | |

($) | | |

($)(3) | | |

($)(4) | | |

($)(1)(2) | | |

($) | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| James F. Wirth, | |

| 2022 | | |

| 153,060 | | |

| | | |

| 2,245 | | |

| | | |

| 155,275 | |

| Chief Executive Officer | |

| 2023 | | |

| 153,060 | | |

| | | |

| 4,629 | | |

| | | |

| 157,689 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Sylvin R. Lange, | |

| 2022 | | |

| 79,735 | | |

| | | |

| 7,575 | | |

| 900 | | |

| 88,210 | |

| Chief Financial Officer | |

| 2023 | | |

| 97,375 | | |

| | | |

| 5,475 | | |

| 1,125 | | |

| 103,975 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Marc E. Berg, | |

| 2022 | | |

| 67,134 | | |

| 22,500 | | |

| 7,484 | | |

| 1,200 | | |

| 98,318 | |

| Executive Vice President | |

| 2023 | | |

| 67,134 | | |

| | | |

| 4,629 | | |

| 1,200 | | |

| 72,963 | |

(1)

Matching contributions made under our 401(k) plan to our executive officers with a maximum of $500 per calendar year are included in

all other compensation.

(2)

In addition to the employer 401(k) match provided to all eligible Trust employees, Mr. Berg through his Berg Investment Advisors company

was compensated $6,000 for additional consultative services rendered by Mr. Marc Berg, the Trust’s Executive Vice President. Mr.

Berg, and Mr. Lange receive a monthly travel expense reimbursement of $100. For the Fiscal Year ending January 31, 2023, Mr. Berg, and

Mr. Lange received $1,200, and $1,125 respectively in expense reimbursement. For the Fiscal Year ending January 31, 2022, Mr. Berg, and

Mr. Lange received $1,200, and $900, respectively.

(3)

For the Fiscal Year ending January 31, 2021 Mr. Berg received a discretionary bonus approved by the Compensation Committee team of $30,000,

related to his efforts resulting in the sale of the Tempe Hotel, an affiliate of the Trust, of which $7,500 was paid during the Fiscal

Year ended January 31, 2021. The balance of $22,500, was paid during the Fiscal Year ended January 31, 2022.

(4)

During Fiscal Year ending January 31, 2023 Mr. Wirth, Mr. Berg, and Mr. Lange received Non-Equity Incentive Plan Compensation consisting

of Fiscal 2023 – Performance Based Cash Bonuses of $4,629, $4,629, and $5,475, respectively. During Fiscal Year ending January

31, 2022 Mr. Wirth, Mr. Berg, and Mr. Lange received Non-Equity Incentive Plan Compensation consisting of Fiscal 2022 – Performance

Based Cash Bonuses of $2,245, $7,484, and $7,575, respectively.

During

Fiscal Year 2023 and 2022, we did grant other equity-based awards. None of our executive officers owned any stock options, or had any

outstanding unvested Shares, as of January 31, 2023 and 2022. Consistent with ASC 718-10-55-10, compensation cost associated with issuance

of these options has not been recognized as shareholder approval is not perfunctory. For stock option grants additional information about

our stock option plan, see Note 23 to our Consolidated Financial Statements - “Stock Options.”

Additionally,

refer Note 23 of our Consolidated Financial Statements - Share Based Payments, and the section on Fiscal Year 2023 Trustee Compensation,

contained in Item11, for information on shares issued to our independent trustees from shareholder equity.

Indemnification

Agreements

We

have entered into indemnification agreements with all of our executive officers and Trustees. The agreements provide for indemnification

against all liabilities and expenses reasonably incurred by an officer or Trustee in connection with the defense or disposition of any

suit or other proceeding, in which he or she may be involved or with which he or she may be threatened, while in office or thereafter,

because of his or her position at the Trust. There is no indemnification for any matter as to which an officer or Trustee is adjudicated

to have acted in bad faith, with willful misconduct or reckless disregard of his or her duties, with gross negligence, or not in good

faith in the reasonable belief that his or her action was in our best interests. We may advance payments in connection with indemnification

under the agreements. The level of indemnification is to the full extent of the net equity based on appraised and/or market value of

the Trust.

Potential

Payments Upon Change in Control

We

do not have employment agreements with our executive officers. However, our 2017 Equity Incentive Plan (the “2017 Plan”)

provides that the Compensation Committee of the Board of Trustees, in its sole discretion, may take such actions, if any, as it deems

necessary or desirable with respect to any award that is outstanding as of the date of the consummation of the change in control. Such

actions may include, without limitation: (a) the acceleration of the vesting, settlement and/or exercisability of an award; (b) the payment

of a cash amount in exchange for the cancellation of an award; (c) the cancellation of stock options and/or SARs without payment therefor

if the fair market value of a share on the date of the change in control does not exceed the exercise price per share of the applicable

award; and/or (d) the issuance of substitute awards that substantially preserve the value, rights and benefits of any affected awards.

For

purposes of the 2017 Plan, subject to exceptions set forth in the 2017 Plan, a “change in control” generally includes (a)

the acquisition of more than 50% of the Trust’s Shares; (b) the incumbent board of trustees ceasing to constitute a majority of

the board of trustees; (c) a reorganization, merger, consolidation or sale or other disposition of all or substantially all of the assets

of the Trust; and (d) approval by the shareholders of the Trust of a complete liquidation or dissolution of the Trust. The full definition

of “change in control” is set forth in the 2017 Plan.

When

an award is granted under the 2017 Plan, the Compensation Committee establishes the terms and conditions of that award, which are contained

in an award agreement. The form of stock option award agreement under the 2017 Plan provides for unvested stock options to immediately

vest in full and become exercisable if a change in control occurs while the participant is employed by the Trust or a subsidiary. In

addition, the form of restricted share agreement for non-employee Trustee awards provides that unvested restricted shares held by a Trustee

will immediately vest in full if, prior to a vesting date, a change in control of the Trust occurs while the participant is serving as

a Trustee.

A

participant’s award agreement under the 2017 Plan may also contain specific provisions governing the vesting or forfeiture of an

award upon a termination of the participant’s service to the Trust or a subsidiary. The form of stock option award agreement generally

provides that unvested stock options will become immediately vested in full if, prior to a vesting date, the participant ceases to be

employed by the Trust and its subsidiaries by reason of death or disability. Unvested stock options will be forfeited automatically if

the participant ceases to be employed by the Trust and its subsidiaries prior to an applicable vesting date. In addition, the form of

stock option award agreement provides for the termination of stock options, to the extent not previously exercised or forfeited, on the

earliest of the following dates: (i) one year after the termination of the participant’s employment by the Trust and its subsidiaries

due to death or disability; (ii) three months after the termination of the participant’s employment with the Trust and its subsidiaries

for any reason other than for death, disability or cause; (iii) immediately upon termination of employment, if the participant’s

employment is terminated by the Company and its subsidiaries for cause; or (iv) midnight on the tenth anniversary of the date of grant.

Unless otherwise provided in the applicable award agreement or in an another written agreement with the participant, “cause”,

as a reason for termination of a participant’s employment generally includes (a) the participant’s willful refusal to follow

lawful directives of the Trust which are consistent with the scope and nature of the participant’s duties and responsibilities;

(b) conviction of, or plea of guilty or nolo contendere to, a felony or any crime involving moral turpitude, fraud or embezzlement; (c)

gross negligence or willful misconduct resulting in a material loss to the Trust or any of its subsidiaries or material damage to the

reputation of the Trust or any of its subsidiaries; (d) material breach of any one or more of the covenants contained in any proprietary

interest protection, confidentiality, non-competition or non-solicitation agreement between the participant and the Trust or a subsidiary;

or (e) violation of any statutory or common law duty of loyalty to the Trust or any of its subsidiaries.

The

form of restricted share agreement for non-employee Trustees generally provides that unvested restricted shares will become vested in

full if, prior to a vesting date, the participant dies or a change in control occurs while the participant is serving as a Trustee. Any

unvested restricted shares will be forfeited automatically if the participant ceases to serve as a Trustee prior to an applicable vesting

date.

Fiscal

Year 2023 Trustee Compensation

We

compensate our non-employee Trustees for their services through grants of restricted Shares. The aggregate grant date fair value of these

Shares is shown in the table below. These restricted Shares vested in equal monthly amounts during our Fiscal Year 2023. As of January

31, 2023, Messrs. Kutasi, Chase and Robson did not hold any unvested Shares. As compensation for our Fiscal Year 2023, on February 01,

2022, we issued 6,000 additional restricted Shares (with the aggregate grant date fair value of $12,480 (per grant) to each of Messrs.

Kutasi, Chase, and Robson.

We

do not pay our Trustees an annual cash retainer, per meeting fees or additional compensation for serving on a Committee or as a Committee

Chair.

The

table below shows individual compensation information for our non-employee Trustees for our Fiscal Year ended January 31, 2023. Compensation

information for Messrs. Wirth and Berg and, who do not receive additional compensation for their service as Trustees, is included in

the Summary Compensation Table above:

| Name | |

Fees Earned

or Paid in

Cash

($) | | |

Stock Awards ($)(1) | | |

Total ($) | |

| | |

| | |

| | |

| |

| Leslie T. Kutasi | |

$ | 0 | | |

$ | 12,840 | | |

$ | 12,840 | |

| Steven S. Robson | |

$ | 0 | | |

$ | 12,840 | | |

$ | 12,840 | |

| JR Chase | |

$ | 0 | | |

$ | 12,840 | | |

$ | 12,840 | |

| |

(1) |

The

dollar amounts shown in the Stock Awards column reflect the aggregate grant date fair value of restricted Shares computed in accordance

with the Financial Accounting Standards Board Accounting Standards Codification Topic 718. For a discussion of assumptions, we made

in valuing restricted Shares, see Note 2, “Summary of Significant Accounting Policies – Stock-Based Compensation,”

in the notes to our consolidated financial statements contained in our Annual Reports on Form 10-K for the Fiscal Years ended January

31, 2023 and 2022. The Stock Awards were based on a stock price of $2.08 which was the closing price of the Trust’s Shares

of Beneficial Interest as of February 17, 2023. The Board of Trustees met on February 17, 2023 and approved the payment. |

Certain

Transactions

Management

and Licensing Agreements

The

Trust directly manages the Hotels through the Trust’s majority-owned subsidiary, RRF Limited Partnership. Under the management

agreements, RRF manages the daily operations of both Trust Hotels. All Trust managed Hotel expenses, revenues and reimbursements among

the Trust, and the Partnership have been eliminated in consolidation. The management fees for the Hotels are 5% of room revenue and a

monthly accounting fee of $2,000 per hotel. These agreements have no expiration dates but may be cancelled by either party with 30-days

written notice, or potentially sooner in the event the property changes ownership.

The

Trust also provides the use of the “InnSuites” trademark to the Hotels through the Trust’s wholly-owned subsidiary,

RRF Limited Partnership, at no additional charge.

Restructuring

Agreements

Albuquerque

Suite Hospitality Restructuring Agreement

Three

Class A units were sold back to the Trust during the Fiscal Year ended January 31, 2023 for $30,000. Two Class A units were sold during

the Fiscal Year ended January 31, 2022 for $20,000. As of January 31, 2023, the Trust held a 21.50% ownership interest, or 129 Class

B units, in the Albuquerque entity, Mr. Wirth and his affiliates held a 0.17% interest, or 1 Class C unit, and other parties held a 78.33%

interest, or 471 Class A units. Interests to qualified third parties. REF and other REF Affiliates may purchase Interests under the offering.

This restructuring is part of the Trust’s Equity Enhancement Plan to comply with Section 1003(a)(iii) of the NYSE American Company

Guide.

Tucson

Hospitality Properties Restructuring Agreement

During

the Fiscal Years ended January 31, 2023 and 2022, there were no units of the Tucson entity sold. As of January 31, 2023, the Partnership

held a 51.01% ownership interest, or 404 Class B units, in the Tucson entity, Mr. Wirth and his affiliates held a 0.38% interest, or

approximately 3 Class C units, and other parties held a 48.61% interest, or approximately 385 Class A units. For the Fiscal Year ended

January 31, 2023, the Tucson entity made quarterly Priority Return payments.

Financing

Arrangements and Guarantees

On

December 30, 2020, the Trust entered a $2,000,000 net maximum Demand/Revolving Line of Credit/Promissory Note with Rare Earth Financial.

The Demand/Revolving Line of Credit/Promissory Note bears interest at 7.0% per annum, is interest only quarterly and matures on June

30, 2022 and automatically renews annually unless either party gives a six-month written advance notice. No prepayment penalty exists

on the Demand/Revolving Line of Credit/Promissory Note. The balance fluctuates significantly through the period with the highest payable

balance being approximately $1,595,000 during the Fiscal Year ended January 31, 2023. The Demand/Revolving Line of Credit/Promissory

Note has a net maximum borrowing capacity of $2,000,000. Related party interest expense or income for the Demand/Revolving Line of Credit/Promissory

Note for the Fiscal Year ended January 31, 2023 was $17,000 of expense, and for the Fiscal Year ended January 31, 2022 was $71,000 of

expense.

The

above Demand/Revolving Line of Credit/Promissory Notes are presented together as one line item on the balance sheet and totaled a receivable

of $0 and $0, at January 31, 2023 and 2022, respectively, all of which is considered a current receivable.

As

of January 31, 2023, the Trust had a $200,000 unsecured note payable with an individual lender. The promissory note is payable on demand,

or on June 30, 2024, whichever occurs first. The loan accrues interest at 4.5% and interest only payments shall be made monthly. The

Trust may pay all of part of this note without any repayment penalties. The total principal amount of this loan is $200,000 as of January

31, 2023.

On

July 1, 2019, the Trust and the Partnership together entered into an unsecured loan totaling $270,000 with an individual investor at

4.5%, interest only, payable monthly. The loan has been subsequently extended to June 30, 2024. The Trust may pay all or part of this

note without any repayment penalties. The total principal amount of this loan is $270,000 as of January 31, 2023

On

July 1, 2019, the Trust and Partnership together entered into an unsecured loan, totaling $100,000 with an individual investor at 4.0%

interest only, payable monthly. The loan had been subsequently extended to December 31, 2022. The total principal amount of this loan

is $100,000 as of January 31, 2023. This loan was repaid in full during the first Fiscal Quarter of Fiscal Year 2024.

On

June 29, 2017, Tucson Oracle entered into a $5.0 million Business Loan Agreement (“Tucson Loan”) as a first mortgage credit

facility with KS State Bank to refinance the existing first mortgage credit facility with an approximate payoff balance of $3.045 million

which will allow Tucson Hospitality Properties, LLLP to be reimbursed for prior and future hotel improvements. The Tucson Loan has a

maturity date of June 19, 2042. The Tucson Loan has an initial interest rate of 4.99% for the first five years and thereafter a variable

rate equal to the US Treasury + 2.0% with a floor of 4.99% and no prepayment penalty. This credit facility is guaranteed by InnSuites

Hospitality Trust, RRF Limited Partnership, Rare Earth Financial, LLC, James F. Wirth and Gail J. Wirth and the Wirth Family Trust dated

July 14, 2016. As of January 31, 2022, the mortgage loan balance was approximately $4,461,000.

On

March 29, 2022 Tucson Hospitality Properties LLLP, 51% owned by RRF Limited partnership, a subsidiary of InnSuites Hospitality Trust,

funded a new loan for $8.4 million to refinance it’s relatively low $ 4.5 million first position debt along with approximately

$ 3.8 million in inter-company advances from IHT used to complete the Best Western Product Improvement Plan (“PIP”) refurbishment

of the Hotel at an interest rate of 4.99% financed on a 25 year amortization with no prepayment penalty and no balloon. This credit facility

is guaranteed by InnSuites Hospitality Trust, RRF Limited Partnership, Rare Earth Financial, LLC, James F. Wirth and Gail J. Wirth, and

the Wirth Family Trust dated July 14, 2016. As of January 31, 2023, the mortgage loan balance was approximately $8,223,000.

On

December 2, 2019, Albuquerque Suites Hospitality, LLC entered into a $1.4 million Business Loan Agreement (“Albuquerque Loan”)

as a first mortgage credit facility with Republic Bank of Arizona. The Albuquerque Loan has a maturity date of December 2, 2029. The

Albuquerque Loan has an initial interest rate of 4.90% for the first five years and thereafter a variable rate equal to the US Treasury

+ 3.5% with a floor of 4.69% and no prepayment penalty. This credit facility is guaranteed by InnSuites Hospitality Trust. As of January

31, 2023, the mortgage loan balance was approximately $1,251,000.

On

January 2, 2001, the Board of Trustees approved a share repurchase program under Rule 10b-18 of the Securities Exchange Act of 1934,

as amended, for the purchase of up to 250,000 Partnership units and/or Shares of Beneficial Interest in open market or privately negotiated

transactions. On September 10, 2002, August 18, 2005 and September 10, 2007, the Board of Trustees approved the purchase of up to 350,000

additional Partnership units and/or Shares of Beneficial Interest in open market or privately negotiated transactions. Additionally,

on January 5, 2009, September 15, 2009 and January 31, 2010, the Board of Trustees approved the purchase of up to 300,000, 250,000 and

350,000, respectively, of additional Partnership units and/or Shares of Beneficial Interest in open market or privately negotiated transactions.

Acquired Shares of Beneficial Interest will be held in treasury and will be available for future acquisitions and financings and/or for

awards granted under the Trust’s equity compensation plans/programs. Additionally, on June 19, 2017, the Board of Trustees approved

a share repurchase program under Rule 10b-18 of the Securities Exchange Act of 1934, as amended, for the purchase of up to 750,000 Partnership

units and/or Shares of Beneficial Interest in open market or privately negotiated transactions. Acquired Shares of Beneficial Interest

will be held in treasury and will be available for future acquisitions and financings and/or for awards granted under the InnSuites Hospitality

Trust 1997 Stock Incentive and Option Plan.

For

the years ended January 31, 2023 and 2022, the Trust repurchased 106,604 and 44,076 Shares of Beneficial Interest at an average price

of $2.69 and $2.96 per share, respectively. The average price paid includes brokerage commissions. The Trust intends to continue repurchasing

Shares of Beneficial Interest in compliance with applicable legal and NYSE AMERICAN requirements. The Trust remains authorized to repurchase

an additional 266,361 Partnership units and/or Shares of Beneficial Interest pursuant to the publicly announced share repurchase program,

which has no expiration date. Repurchased Shares of Beneficial Interest are accounted for as treasury stock in the Trust’s Consolidated

Statements of Shareholders’ Equity.

Compensation

Information

For

information regarding compensation of our executive officers, see “Compensation of Trustees and Executive Officers” in this

proxy statement.

Review,

Approval or Ratification of Transactions with Related Parties

On

December 10, 2013, the Board of Trustees adopted a Related Party Transactions Policy, which established procedures for reviewing transactions

between us and our Trustees and executive officers, their immediate family members, entities with which they have a position or relationship,

and persons known to us to be the beneficial owner of more than 5% of our Shares of Beneficial Interest. These procedures help us evaluate

whether any related person transaction could impair the independence of a Trustee or presents a conflict of interest on the part of a

Trustee or executive officer. First, the related party transaction is presented to our executive management, including our Chief Financial

Officer. Our Chief Financial Officer then discusses the transaction with our outside counsel, as needed. Lastly, the Audit Committee

and the members of the Board of Trustees who do not have an interest in the transaction review the transaction and, if they approve,

pass a resolution authorizing the transaction. In determining whether to approve a Related Party Transaction, the Audit Committee and

the members of the Board of Trustees consider whether the terms of the related party transaction are fair to the Trust on the same basis

as would apply if the transaction did not involve a related party; whether there are business reasons for the Trust to enter into the

related party transaction; whether the related party transaction would impair the independence of the outside Trustee and whether the

related party transaction would present an improper conflict of interest for any Trustee or executive officer of the Trust, taking into

account the size of the transaction, the overall financial position of the trustee, executive officer or related party, the direct or

indirect nature of the Trustee’s, executive officer’s or other related party interest in the transaction and the ongoing

nature of any proposed relationship, and any other factors the Audit Committee and members of the Board of Trustees deem relevant. Our

Related Party Transactions Policy is available in the Corporate Governance portion of our website at www.innsuitestrust.com.

Certain

Information Concerning the Trust

The

following table shows the persons who were known to us to be beneficial owners of more than five percent of our outstanding Shares of

Beneficial Interest, together with the number of Shares of Beneficial Interest owned beneficially by each Trustee and executive officer,