false000182668100018266812023-07-102023-07-100001826681strc:RedeemableWarrantMember2023-07-102023-07-100001826681us-gaap:CommonStockMember2023-07-102023-07-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): July 10, 2023 |

Sarcos Technology and Robotics Corporation

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-39897 |

85-2838301 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

650 South 500 West, Suite 150 |

|

Salt Lake City, Utah |

|

84101 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (888) 927-7296 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.0001 per share |

|

STRC |

|

The Nasdaq Stock Market LLC |

Redeemable warrants, exercisable for shares of Common Stock at an exercise price of $69.00 per share |

|

STRCW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.05. Costs Associated with Exit or Disposal Activities

On July 10, 2023, the board of directors of Sarcos Technology and Robotics Corporation (the “Company”) approved a reduction in force affecting approximately 71 employees, representing approximately 24% of the Company’s workforce. The Company took this step to decrease its costs and create a more streamlined organization to support its business. In connection with the reduction in force, the Company currently estimates it will incur approximately $1.5 million of costs, consisting primarily of personnel expenses such as salaries and wages, one-time severance payments, and other benefits. The majority of the cash payments related to these expenses will be paid out during the third quarter of 2023. The reduction in force is expected to be completed by the end of 2023.

A copy of the press release regarding the reduction in force is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

In connection with the reduction in force described above, Jorgen Pedersen ceased to be Chief Operating Officer of the Company and its subsidiaries (the “Company Group”) on July 12, 2023. It is anticipated that Mr. Pedersen will remain available to the Company Group as an advisor. In addition, in connection with the reduction in force described above, Kristi Martindale, ceased to be the Chief Marketing Officer of the Company Group on July 12, 2023. It is currently anticipated that Ms. Martindale will continue as an employee until August 31, 2023 to help transition her responsibilities and to support the Company Group’s marketing efforts related to its newly announced Advanced Technologies Division related to developing and commercializing the Company Group’s AI/ML software. With the reduced size of the Company Group and narrower business focus, the decision was made to eliminate the roles of Chief Operating Officer and Chief Marketing Officer. The Company thanks Mr. Pedersen and Ms. Martindale for their many valuable contributions to the Company Group.

Forward-Looking Statements

This Current Report on Form 8-K, including the accompanying exhibits, contains “forward-looking statements” within the meaning of the federal securities laws. These forward-looking statements include, but are not limited to, those related to the expected costs and benefits associated with the reduction in force as well as the Company’s timeline for completing the reduction in force and recognition of associated costs. These forward-looking statements are based on the Company’s current expectations and inherently involve significant risks and uncertainties, including those described in the Company’s most recent Quarterly report on Form 10-Q and Annual Report on Form 10-K. Therefore, the Company’s actual results could differ materially from those expressed, implied or forecast in any such forward-looking statements. For example, the expected costs associated with the reduction in force may be greater than anticipated, completion of the reduction in force may take longer than anticipated, the Company may be unable to realize the contemplated benefits in connection with the reduction in force, and the reduction in force may have an adverse impact on the Company’s performance. Except as required by law, the Company undertakes no duty or obligation to update any forward-looking statements contained in this Current Report on Form 8-K, whether as a result of new information, future events or otherwise.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

Sarcos Technology and Robotics Corporation |

|

|

|

|

Date: |

July 12, 2023 |

By: |

/s/ Andrew Hamer |

|

|

Name: Title: |

Andrew Hamer

Chief Financial Officer |

Sarcos Takes Steps to Improve Efficiency, Reduce Cash Spend

Provides Second Quarter 2023 Preliminary Revenue

•Aligning workforce with targeted robotics solutions and end markets; eliminating non-essential positions

•Optimizing ongoing operations

•SaaS/AI emerging as important future revenue opportunity; building on years of AI software development

•Second quarter preliminary revenue of approximately $1.3 million

•Average monthly cash usage expected to decline to approximately $3.0 million in the first quarter 2024

SALT LAKE CITY – July 12, 2023 – Sarcos Technology and Robotics Corporation (“Sarcos” or “Company”) (NASDAQ: STRC and STRCW), a leader in the design, development, and manufacture of advanced robotic systems, solutions, and software that redefine human possibilities, today announced that it has further refined its sales strategy to focus on products that have the most potential for near-term revenue growth and strategic opportunities that show the greatest market traction and meet an acute customer need.

“We have initiated a more focused business plan, concentrating on solutions that we believe have the greatest alignment with customer demand and speed to market. These solutions consist of our Guardian® Sea Class, aviation and solar solutions, as well as advancing our AI software,” said Laura Peterson, Interim President and Chief Executive Officer of Sarcos. “We are realigning our operations to capitalize on the most promising revenue opportunities and end markets. We are also reducing expenses and headcount and consolidating our manufacturing footprint.

“These decisions are always difficult because they involve our colleagues, but we must be pragmatic about where we are as a company, the level of revenue we are producing and our cash usage. These business optimization efforts are expected to result in a marked decrease in cash spend and more streamlined operations.”

Optimization efforts include the following:

•Focusing on targeted robotics solutions for the subsea, aviation and solar end markets

•Forming new Advanced Technologies software business division to drive emerging SaaS/AI revenue opportunities; unit to be led by the Company’s Chief Technology Officer, Dr. Denis Garagić. This division will continue to advance Sarcos’ AI platform to support a broad range of industrial robots, Unmanned Aircraft Systems (UASs) and Unmanned Aerial Vehicles (UAVs).

•Realigning cost structure and reducing cash use by reorganizing the workforce and rationalizing spend across the business

•Optimizing manufacturing facilities: Pittsburgh manufacturing to be consolidated into Salt Lake City location

In conjunction with these initiatives, Sarcos conducted a thorough review of its organization and made the difficult but strategic decision to significantly reduce its headcount. The leaner structure matches the company’s refined focus and positions the Company for future growth, while reducing monthly average cash usage from approximately $6.5 million in the second quarter of 2023 to $3.0 million in the first quarter of 2024. As a result, approximately one-fourth of the Company’s approximately 300 employees will be let go across the company. The reduction in force is largely happening immediately and is expected to save approximately $14.1 million annually. A one-time charge of approximately $1.5 million will occur in the third quarter.

Sarcos New AI-Focused Business Division Advanced Technologies Ramping to Meet Increased Demand

The focus of the Advanced Technologies division will be the company’s AI and machine learning (ML) software platform for generalizable autonomy. The AI and ML platform will be designed to be usable across a variety of autonomous systems, including factory robots and drones. Advanced Technologies will have a market-led approach through collaboration with industry partners to accelerate the adoption of its innovative AI platform and related technologies.

Financial Discussion

“Our agreement with VideoRay, to provide underwater robotic systems combining VideoRay’s remotely operated vehicles and our Guardian® Sea Class system, continues and we anticipate sales of such systems in the second half of this year,”

continued Peterson. “We also continue to make progress developing our industry-specific solutions for solar panel installation and baggage handling, building upon the foundational technology and know-how in our Guardian family of robotic systems. However, the timeline to get commercial-ready industry-specific solutions to our customers is longer than we originally expected. This, coupled with the impact of the current macro climate, has extended the sales cycle, and we are not realizing revenue at the rate we anticipated this year. As such, we are announcing preliminary revenue of approximately $1.3 million for the second quarter of 2023. We are also withdrawing our prior full year revenue guidance.”

“With today’s announced actions, we are significantly reducing our cash usage to provide us the runway to continue developing our products and capitalize on anticipated demand. We intend to manage our average monthly cash usage to approximately $3.0 million in 2024.”

###

About Sarcos Technology and Robotics Corporation

Sarcos Technology and Robotics Corporation (NASDAQ: STRC and STRCW) designs, develops, and manufactures a broad range of advanced mobile robotic systems, solutions, and software that redefine human possibilities and are designed to enable the safest most productive workforce in the world. Sarcos robotic systems operate in challenging, unstructured, industrial environments and include teleoperated robotic systems, a powered robotic exoskeleton, and software solutions that enable task autonomy. For more information, please visit www.sarcos.com and connect with us on LinkedIn at www.linkedin.com/company/sarcos.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding the Company’s products, revenue opportunities, customer demand and end markets, cash savings and future cash usage. Forward-looking statements are inherently subject to risks, uncertainties, and assumptions. Generally, statements that are not historical facts, including statements concerning possible or assumed future actions, business strategies, events, or results of operations, are forward-looking statements. These statements may be preceded by, followed by, or include the words “believes,” “estimates,” “expects,” “projects,” “forecasts,” “may,” “will,” “aim,” “should,” “seeks,” “plans,” “scheduled,” “anticipates,” “intends” or “continue” or similar expressions. Such forward-looking statements involve risks and uncertainties that may cause actual events, results, or performance to differ materially from those indicated by such statements. These forward-looking statements are based on Sarcos’ management’s current expectations and beliefs, as well as a number of assumptions concerning future events. However, there can be no assurance that the events, results, or trends identified in these forward-looking statements will occur or be achieved. Forward-looking statements speak only as of the date they are made, and Sarcos is not under any obligation and expressly disclaims any obligation, to update, alter or otherwise revise any forward-looking statement, whether as a result of new information, future events, or otherwise, except as required by law.

Readers should carefully review the statements set forth in the reports which Sarcos has filed or will file from time to time with the Securities and Exchange Commission (the “SEC”), in particular the risks and uncertainties set forth in the sections of those reports entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements,” for a description of risks facing Sarcos and that could cause actual events, results or performance to differ from those indicated in the forward-looking statements contained herein. The documents filed by Sarcos with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov.

Sarcos Media and Investor Contacts:

Media: mediarelations@sarcos.com

Investors: STRC@finprofiles.com

v3.23.2

Document And Entity Information

|

Jul. 10, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 10, 2023

|

| Entity Registrant Name |

Sarcos Technology and Robotics Corporation

|

| Entity Central Index Key |

0001826681

|

| Entity Emerging Growth Company |

true

|

| Securities Act File Number |

001-39897

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

85-2838301

|

| Entity Address, Address Line One |

650 South 500 West, Suite 150

|

| Entity Address, City or Town |

Salt Lake City

|

| Entity Address, State or Province |

UT

|

| Entity Address, Postal Zip Code |

84101

|

| City Area Code |

(888)

|

| Local Phone Number |

927-7296

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

false

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

STRC

|

| Security Exchange Name |

NASDAQ

|

| Redeemable Warrant Member |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Redeemable warrants, exercisable for shares of Common Stock at an exercise price of $69.00 per share

|

| Trading Symbol |

STRCW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=strc_RedeemableWarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

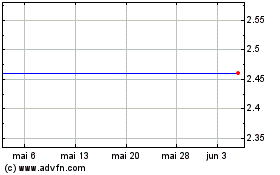

Palladyne AI (NASDAQ:STRC)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Palladyne AI (NASDAQ:STRC)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025