0001138978

false

0001138978

2023-07-17

2023-07-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest reported): July 17, 2023

Novo

Integrated Sciences, Inc.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-40089 |

|

59-3691650 |

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

Incorporation) |

|

File

Number) |

|

Identification

Number) |

11120

NE 2nd Street, Suite 200, Bellevue, WA 98004

(Address

of principal executive offices)

(206)

617-9797

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2.)

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CF$ 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on which Registered |

| Common

Stock |

|

NVOS |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02. Results of Operations and Financial Condition.

On

July 17, 2023, Novo Integrated Sciences, Inc. (“Novo”) issued a press release announcing its financial results for the fiscal

quarter ended May 31, 2023. A copy of this press release is attached hereto as Exhibit 99.1 and incorporated herein by reference. The

information contained in the website is not a part of this Current Report on Form 8-K.

The

information furnished pursuant to this Item 2.02, including the information contained in Exhibit 99.1, is “furnished” and

not “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise

subject to the liabilities of that section. Such information shall not be incorporated by reference in another filing under the Exchange

Act or the Securities Act of 1933, as amended, except to the extent such other filing specifically incorporates such information by reference.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Novo

Integrated Sciences, Inc. |

| |

|

|

| Dated:

July 17, 2023 |

By: |

/s/

Robert Mattacchione |

| |

|

Robert

Mattacchione |

| |

|

Chief

Executive Officer |

Exhibit 99.1

Novo

Integrated Sciences Reports Fiscal Year 2023 Third Quarter Financial Results

BELLEVUE,

Wash., July 17, 2023 - Novo Integrated Sciences, Inc. (NASDAQ:NVOS) (the “Company” or “Novo”), pioneering

a holistic approach to patient-first health and wellness through a multidisciplinary healthcare ecosystem of multiple patient and consumer

touchpoints for services and product innovation, today reported its financial results for the third fiscal quarter ended May 31, 2023.

Robert

Mattacchione, Novo’s CEO and Board Chairman, stated, “The Company remains committed to the commercialization of its proprietary

product offerings and the expansion and delivery of its essential services and solutions of how non-catastrophic healthcare is delivered

both now and in the future. During the fiscal year 2023 third quarter period, the Company announced the signing of agreements for an

unsecured, non-dilutive 15-year debt instrument, with a principal sum of $70,000,000, which provides for the Company to receive net proceeds

of approximately $55,000,000 after fees. In today’s environment of tight capital markets and expensive capital raises, this cash

infusion is consequential and will provide the Company with the foundational capital and repayment terms required to support and accelerate

the further implementation and growth of Novo’s three-pillar business model.”

Financial

Highlights for the three month period ended May 31, 2023:

| |

● |

Cash

and cash equivalents were $464,011, total assets were $35.7 million, total liabilities were $9.5 million, and stockholders’

equity was $26.5 million. |

| |

|

|

| |

● |

Revenues

were $3,292,933, representing a decrease of $10,558,950, or 76%, from $13,851,883 for the same period in 2022. The decrease in revenue

is principally due to the decrease in outsourced product sales and IoNovo Iodine. Acenzia’s and Terragenx’s revenue for

the three months ended May 31, 2023 was $896,405 and $5,866, respectively. Revenue from our healthcare services decreased by 8% when

comparing the revenue for the three months ended for the same period in 2022. |

| |

|

|

| |

● |

Operating

costs were $2,744,512, representing a decrease of $867,116, or 24%, from $3,611,628 for the same period in 2022. The decrease in

operating costs was principally due to the decrease in overhead expenses and depreciation and amortization. |

| |

|

|

| |

● |

Net

loss attributed to the Company was $1,497,330, representing a decrease of $2,312,724, or 61%, from $3,810,054 for the same period

in 2022. The decrease in net loss was principally due to the decrease in operating expenses. |

| |

|

|

| |

● |

On

March 21, 2023, the Company issued a $573,000 promissory note (12% per annum interest rate) and completed the related Securities

Purchase Agreement with FirstFire Global Opportunities Fund, LLC (“FirstFire”) for gross proceeds of $515,700. The Company

granted 5-year warrants with an exercise price of $0.25 per share and issued 955,000 restricted shares to FirstFire. |

| |

|

|

| |

● |

On

April 26, 2023, the Company entered into a securities purchase agreement with RC Consulting Group LLC in favor of SCP Tourbillion

Monaco or registered assigns pursuant to which the Company issued an unsecured 15-year promissory note to the RC Noteholder (the

“RC Note”) with a maturity date of April 26, 2038, in the principal sum of $70,000,000, which amount represents the $57,000,000

purchase price plus a yield (non-compounding) of 1.52% (zero coupon) per annum from April 26, 2023 until the same becomes due and

payable as provided in the RC Note. |

| |

|

|

| |

● |

Subsequent

to the period ended May 31, 2023, on June 20, 2023, the Company issued a $445,000 promissory note (12% per annum interest rate) and

completed the related Securities Purchase Agreement with Mast Hill Fund, L.P. for gross proceeds of $400,500. The Company granted

5-year warrants with an exercise price of $0.25 per share and issued 776,614 restricted shares to Mast Hill Fund, L.P. |

About

Novo Integrated Sciences, Inc.

Novo

Integrated Sciences, Inc. is pioneering a holistic approach to patient-first health and wellness through a multidisciplinary healthcare

ecosystem of services and product innovation. Novo offers an essential and differentiated solution to deliver, or intend to deliver,

these services and products through the integration of medical technology, advanced therapeutics, and rehabilitative science.

We

believe that “decentralizing” healthcare, through the integration of medical technology and interconnectivity, is an essential

solution to the rapidly evolving fundamental transformation of how non-catastrophic healthcare is delivered both now and in the future.

Specific to non-critical care, ongoing advancements in both medical technology and inter-connectivity are allowing for a shift of the

patient/practitioner relationship to the patient’s home and away from on-site visits to primary medical centers with mass-services.

This acceleration of “ease-of-access” in the patient/practitioner interaction for non-critical care diagnosis and subsequent

treatment minimizes the degradation of non-critical health conditions to critical conditions as well as allowing for more cost-effective

healthcare distribution.

The

Company’s decentralized healthcare business model is centered on three primary pillars to best support the transformation of non-catastrophic

healthcare delivery to patients and consumers:

| |

● |

First

Pillar: Service Networks. Deliver multidisciplinary primary care services through (i) an affiliate network of clinic facilities,

(ii) small and micro footprint sized clinic facilities primarily located within the footprint of box-store commercial enterprises,

(iii) clinic facilities operated through a franchise relationship with the Company, and (iv) corporate operated clinic facilities. |

| |

|

|

| |

● |

Second

Pillar: Technology. Develop, deploy, and integrate sophisticated interconnected technology, interfacing the patient to the healthcare

practitioner thus expanding the reach and availability of the Company’s services, beyond the traditional clinic location, to

geographic areas not readily providing advanced, peripheral based healthcare services, including the patient’s home. |

| |

|

|

| |

● |

Third

Pillar: Products. Develop and distribute effective, personalized health and wellness product solutions allowing for the customization

of patient preventative care remedies and ultimately a healthier population. The Company’s science-first approach to product

innovation further emphasizes our mandate to create and provide over-the-counter preventative and maintenance care solutions. |

Innovation

through science combined with the integration of sophisticated, secure technology assures Novo Integrated Sciences of continued cutting-edge

advancement in patient-first platforms.

For

more information concerning Novo Integrated Sciences, please visit www.novointegrated.com.

Twitter,

LinkedIn, Facebook, Instagram, YouTube

Forward-Looking

Statements

This

press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical facts included in this press

release are forward-looking statements. In some cases, forward-looking statements can be identified by words such as “believe,”

“intend,” “expect,” “anticipate,” “plan,” “potential,” “continue”

or similar expressions. Such forward-looking statements include risks and uncertainties, and there are important factors that could cause

actual results to differ materially from those expressed or implied by such forward-looking statements. These factors, risks and uncertainties

are discussed in Novo’s filings with the Securities and Exchange Commission. Investors should not place any undue reliance on forward-looking

statements since they involve known and unknown, uncertainties and other factors which are, in some cases, beyond Novo’s control

which could, and likely will, materially affect actual results, levels of activity, performance or achievements. Any forward-looking

statement reflects Novo’s current views with respect to future events and is subject to these and other risks, uncertainties and

assumptions relating to operations, results of operations, growth strategy and liquidity. Novo assumes no obligation to publicly update

or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those

anticipated in these forward-looking statements, even if new information becomes available in the future. The contents of any website

referenced in this press release are not incorporated by reference herein.

Contact

Chris

David, COO-President

Novo

Integrated Sciences, Inc.

chris.david@novointegrated.com

(888)

512-1195

NOVO

INTEGRATED SCIENCES, INC.

CONDENSED

CONSOLIDATED BALANCE SHEETS

As

of May 31, 2023 (unaudited) and August 31, 2022

| | |

May 31, | | |

August 31, | |

| | |

2023 | | |

2022 | |

| | |

(unaudited) | | |

| |

| ASSETS | |

| | | |

| | |

| Current Assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 464,011 | | |

$ | 2,178,687 | |

| Accounts receivable, net | |

| 1,327,613 | | |

| 1,017,405 | |

| Inventory, net | |

| 938,940 | | |

| 879,033 | |

| Other receivables | |

| 1,046,080 | | |

| 1,085,335 | |

| Prepaid expenses and other current assets | |

| 221,414 | | |

| 571,335 | |

| Total current assets | |

| 3,998,058 | | |

| 5,731,795 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 5,411,438 | | |

| 5,800,648 | |

| Intangible assets, net | |

| 16,696,363 | | |

| 18,840,619 | |

| Right-of-use assets, net | |

| 2,096,376 | | |

| 2,673,934 | |

| Goodwill | |

| 7,542,795 | | |

| 7,825,844 | |

| TOTAL ASSETS | |

$ | 35,745,030 | | |

$ | 40,872,840 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| Current Liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 1,896,040 | | |

$ | 1,800,268 | |

| Accrued expenses | |

| 1,178,245 | | |

| 1,116,125 | |

| Accrued interest (including amounts to related parties) | |

| 350,831 | | |

| 454,189 | |

| Government loans and notes payable, current portion | |

| 312,672 | | |

| - | |

| Convertible notes payable, net of discount of $494,523 | |

| 651,477 | | |

| 9,099,654 | |

| Contingent liability | |

| 57,933 | | |

| 534,595 | |

| Due to related parties | |

| 406,683 | | |

| 478,897 | |

| Debentures, related parties, current portion | |

| 912,025 | | |

| - | |

| Finance lease liability, current portion | |

| 13,814 | | |

| 8,890 | |

| Operating lease liability, current portion | |

| 428,951 | | |

| 582,088 | |

| Total current liabilities | |

| 6,208,671 | | |

| 14,074,706 | |

| | |

| | | |

| | |

| Debentures, related parties, net of current portion | |

| - | | |

| 946,250 | |

| Government loans and notes payable, net of current portion | |

| 64,946 | | |

| 161,460 | |

| Finance lease liability, net of current portion | |

| - | | |

| 12,076 | |

| Operating lease liability, net of current portion | |

| 1,786,961 | | |

| 2,185,329 | |

| Deferred tax liability | |

| 1,393,168 | | |

| 1,445,448 | |

| TOTAL LIABILITIES | |

| 9,453,746 | | |

| 18,825,269 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| - | | |

| - | |

| | |

| | | |

| | |

| STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Novo Integrated Sciences, Inc. | |

| | | |

| | |

| Convertible preferred stock; $0.001 par value; 1,000,000 shares authorized; 0 and 0 shares issued and outstanding at May 31, 2023 and August 31, 2022, respectively | |

| - | | |

| - | |

| Common stock; $0.001 par value; 499,000,000 shares authorized; 144,857,518 and 31,180,603 shares issued and outstanding at May 31, 2023 and August 31, 2022, respectively | |

| 144,857 | | |

| 31,181 | |

| Additional paid-in capital | |

| 89,249,590 | | |

| 66,056,824 | |

| Common stock to be issued (911,392 and 4,149,633 shares at May 31, 2023 and August 31, 2022, respectively) | |

| 1,217,293 | | |

| 9,474,807 | |

| Other comprehensive (loss) income | |

| (172,526 | ) | |

| 560,836 | |

| Accumulated deficit | |

| (63,872,587 | ) | |

| (53,818,489 | ) |

| Total Novo Integrated Sciences, Inc. stockholders’ equity | |

| 26,566,627 | | |

| 22,305,159 | |

| Noncontrolling interest | |

| (275,343 | ) | |

| (257,588 | ) |

| Total stockholders’ equity | |

| 26,291,284 | | |

| 22,047,571 | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | |

$ | 35,745,030 | | |

$ | 40,872,840 | |

NOVO

INTEGRATED SCIENCES, INC.

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

For

the Three and Nine Months Ended May 31, 2023 and 2022 (unaudited)

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

May 31, | | |

May 31, | | |

May 31, | | |

May 31, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Revenues | |

$ | 3,292,933 | | |

$ | 13,851,883 | | |

$ | 9,268,722 | | |

$ | 19,883,033 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of revenues | |

| 1,978,839 | | |

| 11,443,001 | | |

| 5,244,192 | | |

| 14,991,331 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| 1,314,094 | | |

| 2,408,882 | | |

| 4,024,530 | | |

| 4,891,702 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Selling expenses | |

| 1,877 | | |

| 9,802 | | |

| 9,916 | | |

| 36,340 | |

| General and administrative expenses | |

| 2,742,635 | | |

| 3,601,826 | | |

| 9,473,802 | | |

| 9,542,443 | |

| Total operating expenses | |

| 2,744,512 | | |

| 3,611,628 | | |

| 9,483,718 | | |

| 9,578,783 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (1,430,418 | ) | |

| (1,202,746 | ) | |

| (5,459,188 | ) | |

| (4,687,081 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Non-operating income (expense) | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 62,397 | | |

| 8,355 | | |

| 6,762 | | |

| 25,233 | |

| Interest expense | |

| (9,570 | ) | |

| (513,398 | ) | |

| (240,520 | ) | |

| (1,808,310 | ) |

| Amortization of debt discount | |

| (156,037 | ) | |

| (2,133,890 | ) | |

| (4,386,899 | ) | |

| (3,654,752 | ) |

| Foreign currency transaction gain (loss) | |

| 48,333 | | |

| 97,654 | | |

| 12,652 | | |

| (303,714 | ) |

| Total other expense | |

| (54,877 | ) | |

| (2,541,279 | ) | |

| (4,608,005 | ) | |

| (5,741,543 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss before income taxes | |

| (1,485,295 | ) | |

| (3,744,025 | ) | |

| (10,067,193 | ) | |

| (10,428,624 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Income tax expense | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (1,485,295 | ) | |

$ | (3,744,025 | ) | |

$ | (10,067,193 | ) | |

$ | (10,428,624 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss attributed to noncontrolling interest | |

| 12,035 | | |

| 66,029 | | |

| (13,095 | ) | |

| (6,816 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss attributed to Novo Integrated Sciences, Inc. | |

| (1,497,330 | ) | |

| (3,810,054 | ) | |

| (10,054,098 | ) | |

| (10,421,808 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Comprehensive loss: | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| (1,485,295 | ) | |

| (3,744,025 | ) | |

| (10,067,193 | ) | |

| (10,428,624 | ) |

| Foreign currency translation (loss) gain | |

| (120,357 | ) | |

| 13,711 | | |

| (738,022 | ) | |

| 24,916 | |

| Comprehensive loss: | |

$ | (1,605,652 | ) | |

$ | (3,730,314 | ) | |

$ | (10,805,215 | ) | |

$ | (10,403,708 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average common shares outstanding – basic and diluted | |

| 143,600,541 | | |

| 29,817,999 | | |

| 85,832,252 | | |

| 28,498,414 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per common share – basic and diluted | |

$ | (0.01 | ) | |

$ | (0.13 | ) | |

$ | (0.12 | ) | |

$ | (0.37 | ) |

NOVO

INTEGRATED SCIENCES, INC.

CONDENSED

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

For

the Three and Nine Months Ended May 31, 2023 and 2022 (unaudited)

| | |

Common

Stock | | |

Additional

Paid-in | | |

Common

Stock To | | |

Other

Comprehensive | | |

Accumulated | | |

Novo

Stockholders’ | | |

Noncontrolling | | |

Total | |

| | |

Shares | | |

Amount | | |

Capital | | |

Be

Issued | | |

Income | | |

Deficit | | |

Equity | | |

Interest | | |

Equity | |

| Balance,

August 31, 2022 | |

| 31,180,603 | | |

$ | 31,181 | | |

$ | 66,056,824 | | |

$ | 9,474,807 | | |

$ | 560,836 | | |

$ | (53,818,489 | ) | |

$ | 22,305,159 | | |

$ | (257,588 | ) | |

$ | 22,047,571 | |

| Units

issued for cash, net of offering costs | |

| 4,000,000 | | |

| 4,000 | | |

| 1,791,000 | | |

| - | | |

| - | | |

| - | | |

| 1,795,000 | | |

| - | | |

| 1,795,000 | |

| Issuance

of common stock to be issued | |

| 36,222 | | |

| 36 | | |

| 92,330 | | |

| (92,366 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Cashless

exercise of warrants | |

| 4,673,986 | | |

| 4,674 | | |

| 1,134,376 | | |

| - | | |

| - | | |

| - | | |

| 1,139,050 | | |

| - | | |

| 1,139,050 | |

| Fair

value of stock options | |

| - | | |

| - | | |

| 60,887 | | |

| - | | |

| - | | |

| - | | |

| 60,887 | | |

| - | | |

| 60,887 | |

| Foreign

currency translation loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (417,008 | ) | |

| - | | |

| (417,008 | ) | |

| (3,974 | ) | |

| (420,982 | ) |

| Net

loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (3,935,413 | ) | |

| (3,935,413 | ) | |

| (1,323 | ) | |

| (3,936,736 | ) |

| Balance,

November 30, 2022 | |

| 39,890,811 | | |

$ | 39,891 | | |

$ | 69,135,417 | | |

$ | 9,382,441 | | |

$ | 143,828 | | |

$ | (57,753,902 | ) | |

$ | 20,947,675 | | |

$ | (262,885 | ) | |

$ | 20,684,790 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Share

issuance for convertible debt settlement | |

| 93,109,398 | | |

| 93,110 | | |

| 8,992,941 | | |

| - | | |

| - | | |

| - | | |

| 9,086,051 | | |

| - | | |

| 9,086,051 | |

| Cashless

exercise of warrants | |

| 1,159,348 | | |

| 1,159 | | |

| 281,374 | | |

| - | | |

| - | | |

| - | | |

| 282,533 | | |

| - | | |

| 282,533 | |

| Exercise

of warrants for cash | |

| 1,310,000 | | |

| 1,310 | | |

| 129,690 | | |

| - | | |

| - | | |

| - | | |

| 131,000 | | |

| - | | |

| 131,000 | |

| Issuance

of common stock to be issued | |

| 3,202,019 | | |

| 3,201 | | |

| 8,161,947 | | |

| (8,165,148 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Shares

issued with convertible notes | |

| 955,000 | | |

| 955 | | |

| 82,008 | | |

| - | | |

| - | | |

| - | | |

| 82,963 | | |

| - | | |

| 82,963 | |

| Value

of warrants issued with convertible notes | |

| - | | |

| - | | |

| 86,327 | | |

| - | | |

| - | | |

| - | | |

| 86,327 | | |

| - | | |

| 86,327 | |

| Fair

value of stock options | |

| - | | |

| - | | |

| 60,887 | | |

| - | | |

| - | | |

| - | | |

| 60,887 | | |

| - | | |

| 60,887 | |

| Extinguishment

of derivative liability due to conversion | |

| - | | |

| - | | |

| 1,390,380 | | |

| - | | |

| - | | |

| - | | |

| 1,390,380 | | |

| - | | |

| 1,390,380 | |

| Foreign

currency translation loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (195,821 | ) | |

| - | | |

| (195,821 | ) | |

| (862 | ) | |

| (196,683 | ) |

| Net

loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (4,621,355 | ) | |

| (4,621,355 | ) | |

| (23,807 | ) | |

| (4,645,162 | ) |

| Balance,

February 28, 2023 | |

| 139,626,576 | | |

$ | 139,626 | | |

$ | 88,320,971 | | |

$ | 1,217,293 | | |

$ | (51,993 | ) | |

$ | (62,375,257 | ) | |

$ | 27,250,640 | | |

$ | (287,554 | ) | |

$ | 26,963,086 | |

| Share

issuance for convertible debt settlement | |

| 1,075,942 | | |

| 1,076 | | |

| 99,202 | | |

| - | | |

| - | | |

| - | | |

| 100,278 | | |

| - | | |

| 100,278 | |

| Exercise

of warrants for cash | |

| 3,200,000 | | |

| 3,200 | | |

| 316,800 | | |

| - | | |

| - | | |

| - | | |

| 320,000 | | |

| - | | |

| 320,000 | |

| Shares

issued with convertible notes | |

| 955,000 | | |

| 955 | | |

| 89,177 | | |

| - | | |

| - | | |

| - | | |

| 90,132 | | |

| - | | |

| 90,132 | |

| Value

of warrants issued with convertible notes | |

| - | | |

| - | | |

| 93,811 | | |

| - | | |

| - | | |

| - | | |

| 93,811 | | |

| - | | |

| 93,811 | |

| Beneficial

conversion feature upon issuance on convertible debt | |

| - | | |

| - | | |

| 66,068 | | |

| - | | |

| - | | |

| - | | |

| 66,068 | | |

| - | | |

| 66,068 | |

| Stock

option expense | |

| - | | |

| - | | |

| 263,561 | | |

| - | | |

| - | | |

| - | | |

| 263,561 | | |

| - | | |

| 263,561 | |

| Foreign

currency translation loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (120,533 | ) | |

| - | | |

| (120,533 | ) | |

| 176 | | |

| (120,357 | ) |

| Net

loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (1,497,330 | ) | |

| (1,497,330 | ) | |

| 12,035 | | |

| (1,485,295 | ) |

| Balance,

May 31, 2023 | |

| 144,857,518 | | |

$ | 144,857 | | |

$ | 89,249,590 | | |

$ | 1,217,293 | | |

$ | (172,526 | ) | |

$ | (63,872,587 | ) | |

$ | 26,566,627 | | |

$ | (275,343 | ) | |

$ | 26,291,284 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance,

August 31, 2021 | |

| 26,610,144 | | |

$ | 26,610 | | |

$ | 54,579,396 | | |

$ | 9,236,607 | | |

$ | 991,077 | | |

$ | (20,969,274 | ) | |

$ | 43,864,416 | | |

$ | (60,261 | ) | |

$ | 43,804,155 | |

| Common

stock for services | |

| 35,000 | | |

| 35 | | |

| 64,715 | | |

| - | | |

| - | | |

| - | | |

| 64,750 | | |

| - | | |

| 64,750 | |

| Common

stock issued as collateral and held in escrow | |

| 2,000,000 | | |

| 2,000 | | |

| (2,000 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Common

stock to be issued for purchase of Terragenx | |

| - | | |

| - | | |

| - | | |

| 983,925 | | |

| - | | |

| - | | |

| 983,925 | | |

| 97,311 | | |

| 1,081,236 | |

| Common

stock to be issued for purchase of Mullin assets | |

| - | | |

| - | | |

| - | | |

| 188,925 | | |

| - | | |

| - | | |

| 188,925 | | |

| - | | |

| 188,925 | |

| Value

of warrants issued with convertible notes | |

| - | | |

| - | | |

| 295,824 | | |

| - | | |

| - | | |

| - | | |

| 295,824 | | |

| - | | |

| 295,824 | |

| Fair

value of stock options | |

| - | | |

| - | | |

| 154,135 | | |

| - | | |

| - | | |

| - | | |

| 154,135 | | |

| - | | |

| 154,135 | |

| Foreign

currency translation loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (103,533 | ) | |

| - | | |

| (103,533 | ) | |

| (855 | ) | |

| (104,388 | ) |

| Net

loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (1,806,587 | ) | |

| (1,806,587 | ) | |

| (9,808 | ) | |

| (1,816,395 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance,

November 30, 2021 | |

| 28,645,144 | | |

$ | 28,645 | | |

$ | 55,092,070 | | |

$ | 10,409,457 | | |

$ | 887,544 | | |

$ | (22,775,861 | ) | |

$ | 43,641,855 | | |

$ | 26,387 | | |

$ | 43,668,242 | |

| Common

stock for services | |

| 240,000 | | |

| 240 | | |

| 297,760 | | |

| - | | |

| - | | |

| - | | |

| 298,000 | | |

| - | | |

| 298,000 | |

| Value

of warrants issued with convertible notes | |

| - | | |

| - | | |

| 5,257,466 | | |

| - | | |

| - | | |

| - | | |

| 5,257,466 | | |

| - | | |

| 5,257,466 | |

| Fair

value of stock options | |

| - | | |

| - | | |

| 44,427 | | |

| - | | |

| - | | |

| - | | |

| 44,427 | | |

| - | | |

| 44,427 | |

| Foreign

currency translation gain | |

| - | | |

| - | | |

| - | | |

| - | | |

| 114,738 | | |

| - | | |

| 114,738 | | |

| 355 | | |

| 115,093 | |

| Net

loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (4,805,167 | ) | |

| (4,805,167 | ) | |

| (63,037 | ) | |

| (4,868,204 | ) |

| Balance,

February 28, 2022 | |

| 28,885,144 | | |

$ | 28,885 | | |

$ | 60,691,723 | | |

$ | 10,409,457 | | |

$ | 1,002,282 | | |

$ | (27,581,028 | ) | |

$ | 44,551,319 | | |

$ | (36,295 | ) | |

$ | 44,515,024 | |

| Common

stock issued for services | |

| 125,000 | | |

| 125 | | |

| 313,875 | | |

| - | | |

| - | | |

| - | | |

| 314,000 | | |

| - | | |

| 314,000 | |

| Share

issuance for convertible debt settlement | |

| 623,929 | | |

| 624 | | |

| 1,247,225 | | |

| - | | |

| - | | |

| - | | |

| 1,247,849 | | |

| - | | |

| 1,247,849 | |

| Common

stock issued for acquisition | |

| 800,000 | | |

| 800 | | |

| 1,703,200 | | |

| - | | |

| - | | |

| - | | |

| 1,704,000 | | |

| - | | |

| 1,704,000 | |

| Common

stock to be issued for acquisitions | |

| - | | |

| - | | |

| - | | |

| 260,625 | | |

| - | | |

| - | | |

| 260,625 | | |

| 25,402 | | |

| 286,027 | |

| Issuance

of common stock to be issued | |

| 225,000 | | |

| 225 | | |

| 573,525 | | |

| (573,750 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Fair

value of stock options | |

| - | | |

| - | | |

| 91,330 | | |

| - | | |

| - | | |

| - | | |

| 91,330 | | |

| - | | |

| 91,330 | |

| Foreign

currency translation gain | |

| - | | |

| - | | |

| - | | |

| - | | |

| 13,711 | | |

| - | | |

| 13,711 | | |

| 51 | | |

| 13,762 | |

| Net

Loss | |

| | | |

| | | |

| | | |

| | | |

| | | |

| (3,810,054 | ) | |

| (3,810,054 | ) | |

| 66,029 | | |

| (3,744,025 | ) |

| Balance,

May 31, 2022 | |

| 30,659,073 | | |

$ | 30,659 | | |

$ | 64,620,878 | | |

$ | 10,096,332 | | |

$ | 1,015,993 | | |

$ | (31,391,082 | ) | |

$ | 44,372,780 | | |

$ | 55,187 | | |

$ | 44,427,967 | |

NOVO

INTEGRATED SCIENCES, INC.

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

For

the Nine Months Ended May 31, 2023 and 2022 (unaudited)

| | |

Nine Months Ended | |

| | |

May 31, | | |

May 31, | |

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | | |

| | |

| Net loss | |

$ | (10,067,193 | ) | |

$ | (10,428,624 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 1,718,388 | | |

| 2,349,434 | |

| Fair value of vested stock options | |

| 385,335 | | |

| 289,892 | |

| Common stock issued for services | |

| - | | |

| 676,750 | |

| Financing costs for debt extension | |

| 1,421,583 | | |

| - | |

| Operating lease expense | |

| 624,246 | | |

| 418,188 | |

| Amortization of debt discount | |

| 4,386,899 | | |

| 3,654,752 | |

| Foreign currency transaction (gain) loss | |

| (12,652 | ) | |

| 303,714 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| (308,907 | ) | |

| (3,650,069 | ) |

| Inventory | |

| (92,260 | ) | |

| (263,539 | ) |

| Prepaid expenses and other current assets | |

| 333,724 | | |

| (150,632 | ) |

| Accounts payable | |

| 154,542 | | |

| 117,056 | |

| Accrued expenses | |

| 104,004 | | |

| (68,871 | ) |

| Accrued interest | |

| (67,634 | ) | |

| 598,904 | |

| Operating lease liability | |

| (594,618 | ) | |

| (406,862 | ) |

| Net cash used in operating activities | |

| (2,014,543 | ) | |

| (6,559,907 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | |

| | | |

| | |

| Purchase of property and equipment | |

| (18,870 | ) | |

| (190,973 | ) |

| Cash acquired with acquisition | |

| - | | |

| 57,489 | |

| Payments received from other receivables | |

| - | | |

| 296,138 | |

| Net cash (used in) provided by investing activities | |

| (18,870 | ) | |

| 162,654 | |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | |

| Repayments to related parties | |

| (56,649 | ) | |

| (21,932 | ) |

| Repayments of finance leases | |

| (6,435 | ) | |

| (14,797 | ) |

| Proceeds from (repayments of) notes payable | |

| 222,000 | | |

| (4,430,794 | ) |

| Proceeds from the sale of common stock, net of offering costs | |

| 1,795,000 | | |

| - | |

| Proceeds from exercise of warrants | |

| 451,000 | | |

| - | |

| Repayment of convertible notes | |

| (3,033,888 | ) | |

| - | |

| Proceeds from issuance of convertible notes, net | |

| 925,306 | | |

| 15,270,000 | |

| Net cash provided by financing activities | |

| 296,334 | | |

| 10,802,477 | |

| | |

| | | |

| | |

| Effect of exchange rate changes on cash and cash equivalents | |

| 22,403 | | |

| (20,940 | ) |

| | |

| | | |

| | |

| NET (DECREASE) INCREASE IN CASH AND CASH EQUIVALENTS | |

| (1,714,676 | ) | |

| 4,384,284 | |

| | |

| | | |

| | |

| CASH AND CASH EQUIVALENTS, BEGINNING OF PERIOD | |

| 2,178,687 | | |

| 8,293,162 | |

| | |

| | | |

| | |

| CASH AND CASH EQUIVALENTS, END OF PERIOD | |

$ | 464,011 | | |

$ | 12,677,446 | |

| | |

| | | |

| | |

| CASH PAID FOR: | |

| | | |

| | |

| Interest | |

$ | 343,878 | | |

$ | 1,294,912 | |

| Income taxes | |

$ | - | | |

$ | - | |

| | |

| | | |

| | |

| SUPPLEMENTAL NON-CASH INVESTING AND FINANCING ACTIVITIES: | |

| | | |

| | |

| Common stock issued for convertible debt settlement | |

$ | 9,186,329 | | |

$ | 1,247,849 | |

| Common stock to be issued for intangible assets | |

$ | - | | |

$ | 188,925 | |

| Common stock to be issued for acquisition | |

$ | - | | |

$ | 1,244,550 | |

| Common stock issued for acquisition | |

$ | - | | |

$ | 1,704,000 | |

| Beneficial conversion feature upon issuance of convertible notes | |

$ | 66,068 | | |

$ | - | |

| Debt discount recognized on derivative liability | |

$ | 1,390,380 | | |

$ | - | |

| Debt discount recognized on convertible note | |

$ | 639,993 | | |

$ | - | |

| Extinguishment of derivative liability due to conversion | |

$ | 1,390,380 | | |

$ | - | |

| Common stock issued with convertible notes | |

$ | 173,095 | | |

$ | - | |

| Warrants issued with convertible notes | |

$ | 180,138 | | |

$ | - | |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

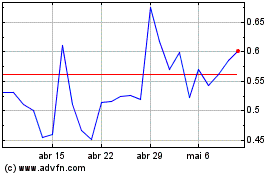

Novo Integrated Sciences (NASDAQ:NVOS)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Novo Integrated Sciences (NASDAQ:NVOS)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025