UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

| Filed by the

Registrant |

|

x |

| |

|

|

| Filed by a Party other than the Registrant |

|

¨ |

Check the appropriate box:

| ¨ |

|

Preliminary

Proxy Statement |

| ¨ |

|

Confidential, for Use

of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ |

|

Definitive Proxy Statement |

| x |

|

Definitive Additional Materials |

| ¨ |

|

Soliciting Material Pursuant

to §240.14a-12 |

PERMIANVILLE

ROYALTY TRUST

(Name of Registrant as Specified in Its Charter)

_________________________________________________________________

(Name of Person(s) Filing Proxy Statement

if other than the Registrant)

Payment of Filing Fee (Check the appropriate

box):

| x |

|

No fee required. |

| ¨ |

|

Fee paid

previously with preliminary materials. |

| ¨ |

|

Fee computed

on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Permianville

Royalty Trust Announces Monthly Cash Distribution

HOUSTON, Texas—(BUSINESS

WIRE)— July 17, 2023

Permianville Royalty

Trust (NYSE: PVL, the “Trust”) today announced a cash distribution to the holders of its units of beneficial interest of

$0.053500 per unit, payable on August 14, 2023 to unitholders of record on July 31, 2023. The net profits interest calculation represents

reported oil production for the month of April 2023 and reported natural gas production during March 2023. The calculation includes accrued

costs incurred in May 2023.

The following table

displays reported underlying oil and natural gas sales volumes and average received wellhead prices attributable to the current and prior

month recorded net profits interest calculations.

| | |

Underlying Sales Volumes | | |

Average Price | |

| | |

Oil | | |

Natural Gas | | |

Oil | | |

Natural Gas | |

| | |

Bbls | | |

Bbls/D | | |

Mcf | | |

Mcf/D | | |

(per Bbl) | | |

(per Mcf) | |

| Current Month | |

| 64,721 | | |

| 2,088 | | |

| 604,148 | | |

| 21,577 | | |

$ | 86.52 | | |

$ | 2.75 | |

| Prior Month | |

| 38,120 | | |

| 1,230 | | |

| 195,616 | | |

| 6,986 | | |

$ | 71.94 | | |

$ | 2.85 | |

Recorded oil cash

receipts from the oil and gas properties underlying the Trust (the “Underlying Properties”) totaled $5.6 million for the

current month on realized wellhead prices of $86.52/Bbl, up $2.9 million from the prior month’s oil cash receipts.

Recorded natural

gas cash receipts from the Underlying Properties totaled $1.7 million for the current month on realized wellhead prices of $2.75/Mcf,

up $1.1 million from the prior month.

Total accrued operating

expenses for the period were $2.9 million, up $0.4 million from the prior period. Capital expenditures increased $2.1 million from the

prior period to $2.2 million.

Operational Update and Acreage Sale

As previously disclosed, COERT Holdings 1 LLC

(the “Sponsor”) informed the Trustee in May that three wells from one of the larger, previously detailed drilling projects

were finally converted to first revenues after a delay associated with the operator. These wells began generating revenues in 2022, but

the amounts were only finalized for non-operating partners in 2023. The cash revenue catch-up totaled approximately $3.7 million,

or approximately $2.9 million net to the Trust’s interest, which is included in the reported production and revenues for the current

month’s net profits interest calculation.

Consistent with the Trust’s recent quarterly

reports on Form 10-Q, the Sponsor intends to provide a more detailed update regarding the progress to date under the Sponsor’s capital

expenditure program and the second half 2023 capital activity outlook for the Underlying Properties. The Sponsor has indicated that the

Underlying Properties are seeing continued success in converting capital expenditures into operating revenues, as shown in the increased

production and cash flows reflected in the current month’s net profits interest calculation.

As previously disclosed, in May, the Sponsor sold

approximately $0.3 million in non-producing, non-cash flowing acreage to a private oil company, free and clear of the net profits interest

burdening the properties, as permitted under the Amended and Restated Trust Agreement. The cash proceeds of this sale are included in

the current month’s net profits interest calculation.

As previously disclosed, on May 3, 2023, the Sponsor

entered into a sale contract for certain oil and natural gas properties (the “Divestiture Properties”) that constitute part

of the Underlying Properties, subject to approval by the unitholders. The estimated net profits from the Divestiture Properties for the

current month’s calculation were again negative, consistent with last month, given elevated operating expenses that do not exceed

current commodity prices and increased capital expenditures by the operator of the Divestiture Properties.

Special Unitholder Meeting

As previously announced, the Trust will hold a

special meeting for its unitholders to approve the sale of the Divestiture Properties and the release of the net profits interest with

respect to the Divestiture Properties, as well as two proposals to raise certain threshold requirements for similar, future transactions.

The special meeting will be held virtually on

July 19, 2023 at 10:00 a.m., Central Daylight Time, by live webcast at https://web.lumiagm.com/295009374, password “permianville2023”

(case-sensitive).

Time is of the essence and Trust unitholders are

urged to vote online by following the instructions on their proxy card to ensure votes are received in a timely manner.

The proxy statement filed with the Securities

and Exchange Commission provides Trust unitholders with detailed information about the proposals and related matters. Trust unitholders

are encouraged to carefully read the entire proxy statement and other relevant documents filed or to be filed by the Trust with the Securities

and Exchange Commission in their entirety.

About Permianville Royalty Trust

Permianville Royalty Trust is a Delaware statutory

trust formed to own a net profits interest representing the right to receive 80% of the net profits from the sale of oil and natural gas

production from certain, predominantly non-operated, oil and gas properties in the states of Texas, Louisiana and New Mexico. As described

in the Trust’s filings with the Securities and Exchange Commission (the “SEC”), the amount of the periodic distributions

is expected to fluctuate, depending on the proceeds received by the Trust as a result of actual production volumes, oil and gas prices,

the amount and timing of capital expenditures, and the Trust’s administrative expenses, among other factors. Future distributions

are expected to be made on a monthly basis. For additional information on the Trust, please visit www.permianvilleroyaltytrust.com.

Forward-Looking Statements and Cautionary Statements

This press release contains statements that are

“forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. All statements

contained in this press release, other than statements of historical facts, are “forward-looking statements” for purposes

of these provisions. These forward-looking statements include expectations regarding future operations and production from recently drilled

wells, estimates of future amounts to be distributed to unitholders reflecting net proceeds from the sale of certain of the Underlying

Properties, the timing of such distributions, and the amount and date of any anticipated distribution to unitholders. The anticipated

distribution is based, in large part, on the amount of cash received or expected to be received by the Trust from the Sponsor with respect

to the relevant period. The amount of such cash received or expected to be received by the Trust (and its ability to pay distributions)

has been and will continue to be directly affected by the volatility in commodity prices, which have experienced significant fluctuation

since the beginning of 2020 as a result of a variety of factors that are beyond the control of the Trust and the Sponsor. Low oil and

natural gas prices will reduce profits to which the Trust is entitled, which will reduce the amount of cash available for distribution

to unitholders and in certain periods could result in no distributions to unitholders. Other important factors that could cause actual

results to differ materially include expenses of the Trust, reserves for anticipated future expenses and public health concerns, including

the COVID-19 pandemic. In addition, future monthly capital expenditures may exceed the average levels experienced in 2022 and prior periods.

Statements made in this press release are qualified by the cautionary statements made in this press release. Neither the Sponsor nor the

Trustee intends, and neither assumes any obligation, to update any of the statements included in this press release. An investment in

units issued by the Trust is subject to the risks described in the Trust’s filings with the SEC, including the risks described in

the Trust’s Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC on March 23, 2023. The Trust’s

quarterly and other filed reports are or will be available over the Internet at the SEC’s website at http://www.sec.gov.

Contact

Permianville Royalty Trust

The Bank of New York Mellon Trust Company,

N.A., as Trustee

601 Travis Street, 16th Floor

Houston, Texas 77002

Sarah Newell 1 (512) 236-6555

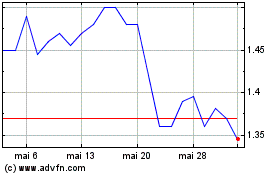

Permianville Royalty (NYSE:PVL)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Permianville Royalty (NYSE:PVL)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025