0001513525

false

--12-31

0001513525

2023-08-03

2023-08-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (date of earliest event reported):

August 3, 2023

Adial Pharmaceuticals, Inc.

(Exact name of registrant as specified in charter)

| Delaware |

|

001-38323 |

|

82-3074668 |

(State or other jurisdiction

of incorporation) |

|

(Commission File

Number) |

|

(IRS Employer

Identification No.) |

1180 Seminole Trail, Ste 495

Charlottesville, VA 22901

(Address of principal executive offices and zip

code)

(434) 422-9800

(Registrant’s telephone number including

area code)

N/A

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Securities |

registered pursuant to Section 12(b) of the Act: |

| Title of each class |

|

Trading Symbols |

|

Name of each exchange on which registered |

| Common Stock |

|

ADIL |

|

The Nasdaq Stock Market LLC

(Nasdaq Capital Market) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by checkmark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

Item 3.03. Material Modification to Rights

of Security Holders.

To the extent required by Item 3.03 of Form 8-K,

the information regarding the Reverse Stock Split (as defined below) contained in Item 5.03 of this Current Report on Form 8-K is incorporated

by reference herein.

Item 5.03. Amendments to Articles of Incorporation

or Bylaws; Change in Fiscal Year.

On April 12, 2023, the stockholders of Adial Pharmaceuticals,

Inc., a Delaware corporation (the “Company”), approved a proposal at the Company’s special meeting of stockholders (the

“Special Meeting”) to amend the Company’s Certificate of Incorporation (the “Certificate of Incorporation”)

to effect a reverse stock split of the Company’s common stock, par value $0.001 per share (the “Common Stock”), at a

ratio between 1-for-2 (1:2) to 1-for-50 (1:50), with the ratio within such range to be determined at the discretion of the Company’s

Board of Directors (the “Board”), without reducing the authorized number of shares of Common Stock. Following the Special

Meeting, the Board approved a final split ratio of one-for-twenty-five (1:25). Following such approval, on August 3, 2023, the Company

filed an amendment to the Certificate of Incorporation (the “Amendment”) with the Secretary of State of the State of Delaware

to effect the reverse stock split, with an effective time of 11:59 p.m. Eastern Time on August 4, 2023 (the “Reverse Stock Split”).

No fractional shares will be issued in connection

with the Reverse Stock Split. In lieu of fractional shares, any person who would otherwise be entitled to a fractional share of Common

Stock as a result of the reclassification and combination following the effective time of the Reverse Stock Split (after taking into account

all fractional shares of Common Stock otherwise issuable to such holder) shall be entitled to receive from the Company’s paying

agent, VStock Transfer, LLC, a cash payment equal to the number of shares of the Common Stock held by such stockholder before the Reverse

Stock Split that would otherwise have been exchanged for such fractional share interest multiplied by the average closing sales price

of the Common Stock as reported on the Nasdaq for the ten days preceding August 7, 2023.

The 1-for-25 Reverse Stock Split will reduce the number

of outstanding shares of Common Stock from approximately 30.5 million shares to approximately 1.2 million shares. Proportional adjustments

will be made to the number of Common Stock issuable upon exercise or conversion of the Company’s outstanding equity awards and warrants,

as well as the applicable exercise price.

After the Reverse Stock Split, the trading symbol

for the Common Stock will continue to be “ADIL.” The new CUSIP number for the Common Stock following the Reverse Stock Split

is 00688A 205.

The description of the Amendment set forth above

does not purport to be complete and is qualified in its entirety by the full text of the Amendment, a copy of which is attached hereto

as Exhibit 3.1 and is incorporated herein by reference.

Item 8.01. Other Events.

The primary purpose of the 1-for-25 Reverse Stock

Split is to raise the per-share trading price of the Common Stock to allow for its continuous listing on the Nasdaq Capital Market, among

other benefits. The Nasdaq Capital Market requires, among other things, that for listing a company’s common stock maintain a minimum

bid price of at least $1.00 per share. However, there can be no assurance that the Reverse Stock Split will have the desired effect of

sufficiently raising the bid price of the Common Stock for the required period.

In addition, on August 4, 2023, the Company issued

a press release relating to the Reverse Stock Split described in this Current Report on Form 8-K. A copy of the press release is attached

as Exhibit 99.1 to this report and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

* * *

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: August 4, 2023 |

ADIAL PHARMACEUTICALS, INC. |

| |

|

| |

By: |

/s/ Cary J. Claiborne |

| |

Name: |

Cary J. Claiborne |

| |

Title: |

President and Chief Executive Officer |

2

Exhibit 3.1

| State

of Delaware

Secretary

of State

Division

of Corporations

Delivered

08:03 AM 08/03/2023

FILED

08:03 AM 08/03/2023

SR

20233153666 - File Number 6439279

|

CERTIFICATE

OF AMENDMENT

OF |

|

CERTIFICATE

OF INCORPORATION

OF

ADIAL PHARMACEUTICALS, INC.

Adial

Pharmaceuticals, Inc. (the “Corporation”), a corporation organized and existing under and by virtue of the General

Corporation Law of the State of Delaware, does hereby certify that:

| 1. | The

name of the Corporation is Adial Pharmaceuticals, Inc. |

| 2. | The

Board of Directors of the Corporation has duly adopted a resolution pursuant to Section 242

of the General Corporation Law of the State of Delaware setting forth a proposed amendment

to the Certificate of Incorporation of the Corporation and declaring said amendment to be

advisable. The requisite stockholders of the Corporation have duly approved said proposed

amendment in accordance with Section 242 of the General Corporation Law of the State of Delaware.

The amendment amends the Certificate of Incorporation of the Corporation as follows: |

| 3. | The

Certificate of Incorporation is hereby amended by adding the following new paragraph C to

ARTICLE IV: |

“C. Reverse Stock Split.

Effective

at 11:59 p.m. Eastern Time on the day immediately following the filing of this Certificate of Amendment to the Certificate of

Incorporation (the “Effective Time”) each share of the Corporation’s common stock, $0.001 par value per

share (the “Old Common Stock”), either issued or outstanding or held by the Corporation as treasury stock,

immediately prior to the Effective Time, will be automatically reclassified and combined (without any further act) into a smaller

number of shares such that each twenty (25) shares of Old Common Stock issued and outstanding or held by the Company as treasury

stock immediately prior to the Effective Time is reclassified and combined into one share of Common Stock, $0.001 par value per

share, of the Corporation (the “New Common Stock”) (the “Reverse Stock Split”).

Notwithstanding the immediately preceding sentence, no fractional shares shall be issued and, in lieu thereof, any person who would

otherwise be entitled to a fractional share of Common Stock as a result of the reclassification and combination following the

Effective Time (after taking into account all fractional shares of Common Stock otherwise issuable to such holder) shall be entitled

to receive a cash payment equal to the number of shares of the common stock held by such stockholder before the Reverse Stock Split

that would otherwise have been exchanged for such fractional share interest multiplied by the average closing sales price of the

Common Stock as reported on the Nasdaq for the ten days preceding the Effective Time.

Each

stock certificate that, immediately prior to the Effective Time, represented shares of Common Stock that were issued and outstanding

immediately prior to the Effective Time shall, from and after the Effective Time, automatically and without the necessity of presenting

the same for exchange, represent that number of whole shares of Common Stock after the Effective Time into which the shares of Common

Stock formerly represented by such certificate shall have been reclassified and combined (as well as the right to receive cash in lieu

of fractional shares of Common Stock after the Effective Time), provided however, that each person of record holding a certificate that

represented shares of Common Stock that were issued and outstanding immediately prior to the Effective Time shall receive, upon surrender

of such certificate, a new certificate evidencing and representing the number of whole shares of Common stock after the Effective Time

into which the shares of Common Stock formerly represented by such certificate shall have been combined.”

| 4. | The

foregoing amendment was duly adopted in accordance with the provisions of Section 242 of

the General Corporation Law of the State of Delaware. |

| 5. | This

Certificate of Amendment shall be effective as of August 4, 2023 at 11:59 p.m. Eastern Time. |

[SIGNATURE

PAGE TO CERTIFICATE OF AMENDMENT]

IN

WITNESS WHEREOF, Adial Pharmaceuticals, Inc. has caused this Certificate to be duly executed by the undersigned duly authorized officer

as of this 3rd day of August, 2023.

| |

ADIAL

PHARMACEUTICALS, INC. |

| |

|

| |

By: |

/s/

Cary J. Claiborne |

| |

Name:

|

Cary J.

Claiborne |

| |

Title: |

President and Chief Executive

Officer |

3

Exhibit 99.1

Adial Pharmaceuticals Announces Reverse Stock

Split to Regain Compliance with Nasdaq’s Minimum Bid Price Requirement and Reduce the Public Float

Common Stock Will Begin Trading on Split-Adjusted

Basis on August 7, 2023

Charlottesville, VA – August 4, 2023

– Adial Pharmaceuticals, Inc. (NASDAQ: ADIL; ADILW) (“Adial” or the “Company”), a clinical-stage biopharmaceutical

company focused on developing therapies for the treatment and prevention of addiction and related disorders, today announced that it will

effect a 1-for-25 reverse stock split (“reverse split”) of its common stock, par value $0.001 per share (“Common Stock”),

that will become effective on August 4, 2023 at 11:59 p.m. Eastern Time. Adial’s Common Stock will continue to trade on the Nasdaq

Capital Market (“Nasdaq”) under the symbol “ADIL” and will begin trading on a split-adjusted basis when the Nasdaq

opens on August 7, 2023 (“Effective Time”). The new CUSIP number for the Common Stock following the reverse split will be

00688A 205.

On April 12, 2023, Adial held a Special Meeting

of Stockholders in which the Company’s stockholders approved the reverse split. The 1-for-25 reverse

stock split will proportionally reduce the number of outstanding shares of Company Common Stock from approximately 30.5 million shares

to approximately 1.2 million shares and the ownership percentage of each shareholder will remain unchanged other than as a

result of fractional shares. Proportional adjustments will be made to the number of shares of Adial’s

Common Stock issuable upon exercise or conversion of the Company’s outstanding equity awards and warrants, as well as the applicable

exercise price. There will be no change to the total number of authorized shares of Company Common Stock as set forth in the Certificate

of Incorporation of the Company, as amended.

Among other considerations, the reverse split

is intended to bring the Company into compliance with the minimum bid price requirement for maintaining the listing of its Common Stock

on the Nasdaq Capital Market, and to make the bid price more attractive to a broader group of institutional and retail investors. The

Nasdaq Capital Market requires, among other things, that a listing company’s common stock maintain a minimum bid price of at least

$1.00 per share.

“We have made continued progress on our

partnering and regulatory strategies, as illustrated by the recent positive feedback we have received from relevant global regulatory

bodies,” stated Cary Claiborne, CEO of Adial Pharmaceuticals. “Nevertheless, similar to other micro-cap and biotech companies,

we have faced a challenging capital markets environment. We believe this reverse split will not only allow us to regain compliance with

Nasdaq’s minimum bid price requirement, but also tighten the public float in our stock, enabling us to attract a broader universe

of investors. We remain highly encouraged by the outlook for the business and look forward to providing updates on our progress as we

advance a number of key strategic initiatives around AD04, our genetically targeted, serotonin-3 receptor antagonist for the treatment

of Alcohol Use Disorder.”

The Company’s transfer agent, VStock Transfer,

LLC, which is also acting as the paying agent for the reverse split, will provide instructions to stockholders regarding the process for

exchanging stock certificates. Any person who would otherwise be entitled to a fractional share of Common Stock as a result of the reclassification

and combination following the Effective Time (after taking into account all fractional shares of Common Stock otherwise issuable to such

holder) shall be entitled to receive a cash payment equal to the number of shares of the Common Stock held by such stockholder before

the Reverse Stock Split that would otherwise have been exchanged for such fractional share interest multiplied by the average closing

sales price of the Common Stock as reported on the Nasdaq for the ten days preceding the Effective Time.

About Adial Pharmaceuticals, Inc.

Adial Pharmaceuticals is a clinical-stage

biopharmaceutical company focused on the development of therapies for the treatment and prevention of addiction and related disorders.

The Company’s lead investigational new drug product, AD04, is a genetically targeted, serotonin-3 receptor antagonist, therapeutic

agent for the treatment of Alcohol Use Disorder (AUD) in heavy drinking patients and was recently investigated in the Company’s

ONWARD™ pivotal Phase 3 clinical trial for the potential treatment of AUD in subjects with certain target genotypes (estimated to

be approximately one-third of the AUD population) identified using the Company’s proprietary companion diagnostic genetic test.

ONWARD showed promising results in reducing heavy drinking in heavy drinking patients, and no overt safety or tolerability concerns. AD04

is also believed to have the potential to treat other addictive disorders such as Opioid Use Disorder, gambling, and obesity. Additional

information is available at www.adial.com.

Forward Looking Statements

This communication contains certain “forward-looking

statements” within the meaning of the U.S. federal securities laws. Such statements are based upon various facts and derived utilizing

numerous important assumptions and are subject to known and unknown risks, uncertainties and other factors that may cause actual results,

performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such

forward-looking statements. Statements preceded by, followed by or that otherwise include the words “believes,” “expects,”

“anticipates,” “intends,” “projects,” “estimates,” “plans” and similar expressions or

future or conditional verbs such as “will,” “should,” “would,” “may” and “could” are

generally forward-looking in nature and not historical facts, although not all forward-looking statements include the foregoing. The forward-looking

statements include statements regarding the reverse stock split allowing us to regain compliance with Nasdaq’s minimum bid price

requirement, and also tighten the public float in our stock, enabling us to attract a broader universe of investors and providing updates

on our progress as we advance a number of key strategic initiatives around AD04. Any forward-looking statements included herein

reflect our current views, and they involve certain risks and uncertainties, including, among others, our ability to regain and maintain

compliance with the Nasdaq’s minimum bid price and tighten our float, the ability to pursue our regulatory strategy, our ability

to advance ongoing partnering discussions, our ability to execute on our business strategy and bring AD04 to large markets in the most

cost-effective and timely manner, our ability to exclusively focus on advancing AD04 through potential regulatory approval and prioritize

our resources accordingly, our ability to obtain regulatory approvals for commercialization of product candidates or to comply with ongoing

regulatory requirements, our ability to develop strategic partnership opportunities

and maintain collaborations, our ability to obtain or maintain the capital or grants necessary to fund our research and development activities,

our ability to retain our key employees, our ability to complete clinical trials on time and achieve desired results and benefits

as expected, regulatory limitations relating to our ability to promote or commercialize our product candidates for specific indications,

acceptance of our product candidates in the marketplace and the successful development, marketing or sale of our products, our ability

to maintain our license agreements, the continued maintenance and growth of our patent estate and our ability to retain our key employees

or maintain our Nasdaq listing,. These risks should not be construed as exhaustive and should be read together with the other cautionary

statement included in our Annual Report on Form 10-K for the year ended December 31, 2022, subsequent Quarterly Reports on Form 10-Q and

current reports on Form 8-K filed with the Securities and Exchange Commission. Any forward-looking statement speaks only as of the date

on which it was initially made. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result

of new information, future events, changed circumstances or otherwise, unless required by law.

Contact:

Crescendo Communications, LLC

David Waldman / Alexandra Schilt

Tel: 212-671-1020

Email: ADIL@crescendo-ir.com

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

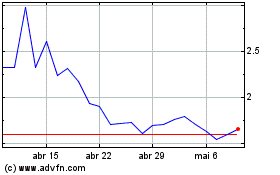

Adial Pharmaceuticals (NASDAQ:ADIL)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Adial Pharmaceuticals (NASDAQ:ADIL)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025