0001692376false00016923762023-08-032023-08-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 03, 2023 |

Velocity Financial, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-39183 |

46-0659719 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

30699 Russell Ranch Road, Suite 295 |

|

Westlake Village, California |

|

91362 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (818) 532-3700 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common stock, par value $0.01 per share |

|

VEL |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

We posted to our Investor Relations website, www.velfinance.com, management's second quarter 2023 earnings presentation. A copy of the presentation is furnished as Exhibit 99 and is incorporated herein by reference.

The information provided in this Form 8-K, including Exhibit 99, is intended to be furnished and shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Securities Act or the Securities Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

Velocity Financial, Inc. |

|

|

|

|

Date: |

August 4, 2023 |

By: |

/s/ Roland T. Kelly |

|

|

|

Chief Legal Officer and General Counsel |

2Q23 Results Presentation August 3, 2023 Exhibit 99

Forward-looking statements Some of the statements contained in this presentation may constitute forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, projections, plans and strategies, positioning, anticipated events or trends, and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as "may," "will," "should," "expects," "intends," "plans," "anticipates," "believes," "estimates," "predicts," or "potential" or the negative of these words and phrases. You can also identify forward-looking statements by discussions of strategy, plans, or intentions. The forward-looking statements contained in this presentation reflect our current views about future events and are subject to numerous known and unknown risks, uncertainties, assumptions and changes in circumstances that may cause actual results to differ significantly from those expressed or contemplated in any forward-looking statement. While forward-looking statements reflect our good faith projections, assumptions and expectations, they are not guarantees of future results. Furthermore, we disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, new information, data or methods, future events or other changes, except as required by applicable law. Factors that could cause our results to differ materially include but are not limited to: (1) the continued course and severity of COVID-19 variants and subvariants and their direct and indirect impacts (2) general economic conditions and real estate market conditions, such as a possible recession, (3) regulatory and/or legislative changes, (4) our customers' continued interest in loans and doing business with us, (5) market conditions and investor interest in our contemplated securitizations and (6) changes in federal government fiscal and monetary policies and (7) the continued conflict in Ukraine. For a further discussion of these and other factors that could cause future results to differ materially from those expressed or contemplated in any forward-looking statements, see the section titled ''Risk Factors" previously disclosed in our Form 10-Q filed with the SEC on May 14, 2020, as well as other cautionary statements we make in our current and periodic filings with the SEC. Such filings are available publicly on our Investor Relations web page at www.velfinance.com.

2Q23 Highlights Production& �Loan Portfolio Earnings Financing & �Capital Net income of $12.2 million and diluted earnings per share (EPS) of $0.36, compared to $10.6 million and $0.31 per share, respectively, for 2Q22 Core net income(1) of $12.9 million and core diluted EPS(1) of $0.38, compared to �$10.6 million and $0.31 per share, respectively, for 2Q22 Net revenue growth of 6.8% Q/Q; Operating expense growth Q/Q growth essentially flat W.A. portfolio yield reached 8.24% for 2Q23, a 24 bps increase from 7.97% for 2Q22 Loan production in 2Q23 totaled $258.6 million in UPB, a decrease of 41.9% from �$445.4 million in UPB for 2Q22 Total loan portfolio of $3.7 billion in UPB as of June 30, 2023, an increase of 20.4% from June 30, 2022 NPLs were 10.0% of Held for Investment (HFI) as of June 30, 2023, up from 8.2% as of June 30, 2022. Realized 3.0% gains on NPL UPB resolved in 2Q23 Completed the VCC 2023-1R (Re-REMIC) securitization totaling $64.8 million of non – mark to market securities issued, collateralized by retained tranches from previous VCC securitizations, resulting in $48.0 million in additional liquidity Completed the VCC 2023-2 securitization totaling $202.2 million of securities issued, comprised of long-term business-purpose loans Liquidity(2) of $72.0 million as of June 30, 2023 Total available warehouse line capacity was $573.0 million as of June 30, 2023 (1) “Core net income” is a non-GAAP measure which excludes non-recurring and/or unusual activities from GAAP net income. (2) Liquidity includes unrestricted cash and cash equivalents of $34.0 million and available liquidity in unfinanced loans of $38.0 million.

Core Income and Book Value Per Share Core Income(1) Book Value Per Share(2) Core net income totaled $12.9 million in 2Q23, an increase of 21.4% from 2Q22 Core adjustment includes equity incentive compensation expenses and costs related to the Company’s employee stock purchase plan (ESPP) Book value per share as of June 30, 2023, was $12.57(4), compared to $12.18(3) as of �March 31, 2023 Equity award & ESPP costs $745 (1) “Core net income” is a non-GAAP measure which excludes non-recurring and/or unusual activities from GAAP net income. (2) Book value per share is the ratio of total equity divided by total shares outstanding. Total equity included non-controlling interest of $3.54 million as of �June 30, 2023, and $3.62 million as of March 31, 2023. (3) Based on 32,111,906 common shares outstanding as of March 31, 2023 and excludes unvested shares of common stock authorized for incentive compensation totaling 490,526. (4) Based on 32,238,715 common shares outstanding as of June 30, 2023 and excludes unvested shares of common stock authorized for incentive compensation totaling 502,913. GAAP Net Income $12,183 (3) (4) Core Net Income $12,928 (0.02)

Platform Value Embedded Gain in Securitized Portfolio(1) Fully Diluted Value of Equity(2) $845,936 - $870,936 $2.93 - $3.66 $100,000 - $125,000 Economic Value of Equity (Non-GAAP) Economic Value of Equity $24.78 - $25.51 EVPS(3) $9.66 $12.19 (1) Embedded gain in securitized portfolio assumes a 10% discount rate of projected securitization earnings and is net of $57,468,581 of deferred loan origination costs and securitization deal costs (2) Fully Diluted Value of Equity assumes 6/30/2023 GAAP Book Value of Stockholders' Equity of $405.2MM + $10.9MM from pro forma exercise of all warrants. (3) Economic Value of Equity per Share ("EVPS") calculated using 34,140,104 weighted average shares outstanding assuming dilution impact based on Velocity's average stock price for 2Q 2023. (4) Recent M&A precedents for business purpose lenders demonstrate significant platform/franchise values that investors are ascribing to businesses like Velocity Financial. These transactions have demonstrated platform values of ~10%+ of annual origination run rate. The graph reflects our estimate of economic value of equity by adding the net present value of expected future gains embedded in the amortized cost portfolio and the value of our unique origination platform (4) Fair Value Election to Capture Embedded Economic Value of Equity Over Time Prior to October 1, 2023, we elected to carry our retained interests in securitizations at amortized cost Recent M&A precedents for business purpose lenders demonstrate significant platform/franchise values that investors are ascribing to businesses like Velocity Financial These transactions have demonstrated platform values of ~10%+ of annual originations run rate

Loan Production 2Q23 production volumes reflects an improved market environment and heightened investor interest as the pace of interest rate increases slowed Loan production in 2Q23 totaled $258.6 million in UPB, a 19.2% increase from $217.0 million in UPB for 1Q23 and a 41.9% decrease from $445.4 million in UPB for 2Q22 The WAC(1) on 2Q23 HFI loan production was 11.0%, essentially flat compared to 1Q23 and an increase of 325 bps from 2Q22 Loan Production Volume ($ of UPB in millions) Production Volumes Rebound in 2Q23; Improved Demand as Rate Increases Slow Units Average loan balance (1) Weighted Average Coupon WAC(1)

Loan Portfolio by Property Type The total loan portfolio was $3.7 billion in UPB as of June 30, 2023, a 3.4% increase from $3.6 billion in UPB as of March 31, 2023, and 20.4% from $3.1 billion as of June 30, 2022 Approximately 75% of the loans in Velocity’s HFI portfolio are collateralized by properties that have a housing component (Investor 1-4 Rental, Multifamily and Mixed Use) Loan prepayments totaled $105.8 million, a 21.6% Q/Q increase, and a 26.1% Y/Y decrease The WAC(1) of the portfolio was 8.40% as of �June 30, 2023, an increase from 8.15% as of �March 31, 2023, and 7.53% as of June 30, 2022 The UPB of FVO loans was $688.1 million, or 18.5% of total HFI loans as of June 30, 2023, an increase from $436.6 million in UPB, or 12.2% as of �March 31, 2023 Loan Portfolio (UPB in millions) (1) Weighted Average Coupon (2) $ in thousands. Strong Portfolio Growth Driven by Improved Production Volumes

Portfolio Net Interest Income & NIM(1) Portfolio Yield and Cost of Funds Portfolio Related Portfolio NIM(1) in 2Q23 was 3.24%, an increase of 1 bps from 3.23% in 1Q23, and a decrease of 86 bps from 4.10% in 2Q22 Portfolio Yield: Increased 24 bps from 1Q23 driven primarily by: Weighted average coupon of 11% on YTD 2023 production Growth in NPL resolutions and realized gains resulting from the collection of default interest and prepayment fees Cost of Funds: Increased 25 bps from 1Q23 primarily driven by higher warehouse line utilization and cost Net Interest Margin (1) Net Interest Income and Net Interest Margin related to the loan portfolio only; excludes corporate debt. Portfolio Related ($ in millions) Portfolio NIM Growth Driven By Higher Loan Yields, Partially Offset by Higher Cost of Funds

Nonperforming Loans(1) Nonperforming loans (NPL) as a percentage of total HFI loans was 10.0% as of June 30, 2023, an increase from 8.7% as of March 31, 2023, and 8.2% as of June 30, 2022 NPL growth driven by portfolio seasoning and strong collection efforts Gains on NPL resolutions at 3.0%, consistent with 1Q23 and remained in line with historical averages $ UPB in millions Loan Investment Portfolio Performance (1) For additional detail, please see page 17 in the Appendix of this presentation. Nonperforming Loan Rate Rise Mitigated by Strong NPL Resolution Activity

2Q23 Asset Resolution Activity Resolution Activity 2Q23 NPL resolutions represented 13.5% of nonperforming loan UPB as of March 31, 2023 UPB of loans resolved in 2Q23 were in-line with the recent five-quarter resolution average of $42.0 million NPL Loan Resolutions UPB and Gains Increase Q/Q

The reserve balance was $4.6 million as of June 30, 2023, an 8.3% decrease from $5.0 million as of �March 31, 2023, and a 5.7% decrease from $4.9 million as of June 30, 2022 The Q/Q decrease resulted from run-off of the amortized cost HFI loan portfolio and a modestly improved �macroeconomic outlook. Loans carried at fair value are not subject to a CECL reserve. Velocity’s 0.15% CECL reserve rate on eligible (non-”FVO”) HFI portfolio remained consistent with the previous 4 quarters. Charge-offs in 2Q23 totaled $716.6 thousand, compared to $484.2 thousand in 1Q23, and $37.8 thousand in 2Q22 CECL Reserve and Charge-Offs Loan Loss Reserve Reserve Decrease As Amortized Cost HFI Loan Portfolio Pays Down Charge-offs (1) Amortized cost (2) Reflects the annualized quarterly charge-offs to average nonperforming loans for the period. $ in thousands (2) Quarterly Periods At Period End (1)

Durable Funding and Liquidity Strategy Two Securitizations Issued in 2Q23(1); VCC2023-1R Further Diversifies Financing Options Outstanding Debt Balances(2) ($ in Millions) (1) Through June 30, 2023. (2) Debt balances are net of issuance costs and discounts as reported in the consolidated balance sheet. (3) Represents the remaining balance of securitization outstanding net of issuance costs, discounts and fair value marks as of period end. (4) As of 6/30/23, five of six warehouse lines have non-mark-to-market features and staggered maturities. Non-Recourse Debt Recourse Debt (3) Cash reserves and unfinanced collateral of �$72.0 million as of June 30, 2023 Issuance of VCC 2023-1R, collateralized by retained tranches from previous VCC securitizations, expands cost-effective non MTM financing options for Velocity Available warehouse line capacity of $573.0 million as of June 30, 2023 Recourse debt to equity was 1.1X as of �June 30, 2023, compared to 1.2X as of �June 30, 2022 Outstanding debt was $3.5 billion as of �June 30, 2023, a net increase of �$558.0 million driven by growth in non-recourse securitization debt No maturities of long-term corporate debt until 2027 (4) (5)

U.S. economic resilience continues, but inflation and recession concerns remain Credit box to remain tight as we monitor economic activity and loan performance End to Federal Reserve tightening cycle expected in 2H23 Underlying property value of small commercial and residential properties through 1H23 Gains on resolution activities to continue Outlook for Velocity’s Key Business Drivers MARKET CREDIT CAPITAL Next long-term loan securitization on target for 3Q23 Modest improvement in securitization market tone Continuing to pursue opportunities to further diversity of our capital structure Improving Outlook for Capital Markets and Growth Increased loan coupons in 1H23 and higher origination volumes are expected to drive further improvement in loan yields Continuing to assess strategic opportunities EARNINGS

Appendix

Velocity Financial, Inc. Balance Sheet

Velocity Financial, Inc. Income Statement (Quarter)

HFI Portfolio Delinquency Trends

Loan Portfolio Rollforward Total Loan Portfolio UPB Rollforward (UPB in millions) $(119.5) $(6.2) $(17.4) $266.7 (1) (1) Includes $8.1 million in UPB of repurchased loans.

HFI Loan Portfolio Portfolio by Property Type (100% = $3.72 billion UPB)(1) (1) As of June 30, 2023 Portfolio by State

Adjusted Financial Metric Reconciliation: Adjusted Financial Metric Reconciliation to GAAP Net Income Quarter:

v3.23.2

Document And Entity Information

|

Aug. 03, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 03, 2023

|

| Entity Registrant Name |

Velocity Financial, Inc.

|

| Entity Central Index Key |

0001692376

|

| Entity Emerging Growth Company |

false

|

| Securities Act File Number |

001-39183

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

46-0659719

|

| Entity Address, Address Line One |

30699 Russell Ranch Road, Suite 295

|

| Entity Address, City or Town |

Westlake Village

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

91362

|

| City Area Code |

(818)

|

| Local Phone Number |

532-3700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.01 per share

|

| Trading Symbol |

VEL

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

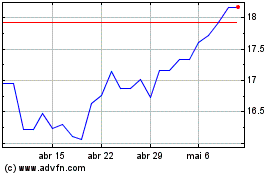

Velocity Financial (NYSE:VEL)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Velocity Financial (NYSE:VEL)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024