UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant

to Section 14(A) of the

Securities Exchange

Act of 1934

x Filed by the Registrant ¨ Filed

by a party other than the Registrant

Check the appropriate box:

| ¨ |

|

Preliminary Proxy Statement |

| |

|

| ¨ |

|

CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14A-6(e)(2)) |

| |

|

| ¨ |

|

Definitive Proxy Statement |

| |

|

| ¨ |

|

Definitive Additional Materials |

| |

|

| x |

|

Soliciting Material under §240.14a-12 |

VERITIV CORPORATION

(Name of Registrant

as Specified in its Charter)

(Name of Person(s)

Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate

box):

| |

|

|

|

|

| x |

|

No fee required. |

| |

|

|

| ☐ |

|

Fee paid previously with preliminary materials. |

| |

|

| ☐ |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange

Act Rules 14a-6(i)(1) and 0-11 |

| |

|

|

Important Information

The following communications

relate to the proposed acquisition of Veritiv Corporation, a Delaware corporation (the “Company”), by Company, Verde Purchaser,

LLC, a Delaware limited liability company (“Parent”) that is affiliated with Clayton, Dubilier & Rice, LLC (“CD&R”),

and Verde Merger Sub, Inc., a Delaware corporation and a wholly-owned subsidiary of Parent (“Merger Subsidiary”), pursuant

to the Agreement and Plan of Merger, dated as of August 6, 2023, by and among the Company, Parent and Merger Subsidiary.

On August 7, 2023, the

Company distributed (i) a communication by the Company to its suppliers, (ii) a communication by the Company to its customers, (iii) a

set of frequently asked questions for employees (iv) a set of key messages being made available to the Company’s employees, and

(v) an email message to all employees of the Company.

Forward-Looking Statements

This communication contains

forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to the proposed acquisition

of the Company by CD&R and financial condition, results of operations and businesses of the Company. Some of these statements can

be identified by terms and phrases such as “believe,” “expect,” “anticipate,” “continue,”

“intend,” “will,” “may,” “should,” “could,” “would,” “plan,”

“estimate,” “predict,” “potential,” “goal,” “outlook,” or the negative of

such terms, or other comparable expressions. The Company cautions readers of this communication that such “forward looking statements,”

including without limitation, those relating to the timing of the proposed acquisition, the satisfaction of the closing conditions to

the proposed acquisition, including required regulatory and stockholder approvals, and the Company’s future business prospects,

revenue, working capital, liquidity, capital needs, interest costs and income, wherever they occur in this communication or in other statements

attributable to the Company, are necessarily estimates reflecting the judgment of the Company’s senior management and involve a

number of risks and uncertainties that could cause actual results to differ materially from those suggested by the “forward looking

statements.”

Factors that could cause

actual results to differ materially from those expressed or implied in such forward-looking statements include, but are not limited to,

the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; the inability

to complete the proposed acquisition due to the failure to obtain stockholder approval for the proposed acquisition or the failure to

satisfy other conditions to completion of the proposed acquisition, including that a governmental entity may prohibit, delay or refuse

to grant approval for the consummation of the proposed acquisition; risks related to disruption of management’s attention from the

Company’s ongoing business operations due to the proposed acquisition and the significant costs that the Company will and has incurred

in connection with the proposed acquisition; the effect of the announcement of the proposed acquisition on the Company’s relationships

with its customers, suppliers and joint venture partners, and on its operating results and business generally; the risk that the proposed

acquisition will not be consummated in a timely manner; the industry-wide decline in demand for paper and related products; increased

competition from existing and non-traditional sources; procurement and other risks in obtaining packaging, facility products and paper

from the Company’s suppliers for resale to the Company’s customers; changes in prices for raw materials; changes in trade

policies and regulations; increases in the cost of fuel and third-party freight and the availability of third-party freight providers;

the loss of multiple significant customers; adverse developments in general business and economic conditions that could impair the Company’s

ability to use net operating loss carryforwards and other deferred tax assets; the Company’s ability to adequately protect the Company’s

material intellectual property and other proprietary rights, or to defend successfully against intellectual property infringement claims

by third parties; the Company’s ability to attract, train and retain appropriately qualified employees; the Company’s pension

and health care costs and participation in multi-employer pension, health and welfare plans; the effects of work stoppages, union negotiations

and labor disputes; the Company’s ability to generate sufficient cash to service the Company’s debt; the Company’s ability

to comply with the covenants contained in our debt agreements; costs to comply with laws, rules and regulations, including environmental,

health and safety laws, and to satisfy any liability or obligation imposed under such laws; the Company’s ability to adequately

address environmental, social and governance matters; changes in tax laws; adverse results from litigation, governmental investigations

or audits, or tax-related proceedings or audits; regulatory changes and judicial rulings impacting the Company’s business; the impact

of adverse developments in general business and economic conditions as well as conditions in the global capital and credit markets on

demand for the Company’s products and services, the Company’s business including the Company’s international operations,

and the Company’s customers; foreign currency fluctuations; inclement weather, widespread outbreak of a pandemic or other health

emergency, anti-terrorism measures and other disruptions to the Company’s supply chain, distribution system and operations; the

Company’s dependence on a variety of information technology and telecommunications systems and the Internet; the Company’s

reliance on third-party vendors for various services; cybersecurity risks; and other events of which the Company is presently unaware

or that the Company currently deems immaterial that may result in unexpected adverse operating results. For a more detailed discussion

of these factors, see the information under the captions “Risk Factors” and “Management’s Discussion and Analysis

of Financial Condition and Results of Operations” in the Company’s most recent Annual Report on Form 10-K filed

with the Securities and Exchange Commission (the “SEC”) on February 28, 2023 and Quarterly Report on Form 10-Q filed with

the SEC on May 9, 2023.

The Company’s forward-looking

statements speak only as of the date of this communication or as of the date they are made. The Company disclaims any intent or obligation

to update any “forward looking statement” made in this communication to reflect changed assumptions, the occurrence of unanticipated

events or changes to future operating results over time.

Additional Information and Where to Find

It

This communication may

be deemed solicitation material in respect of the proposed acquisition of the Company by CD&R. In connection with the proposed acquisition,

the Company will file with the SEC and furnish to the Company’s stockholders a proxy statement and other relevant documents. This

filing does not constitute a solicitation of any vote or approval. Stockholders are urged to read the proxy statement when it becomes

available and any other documents to be filed with the SEC in connection with the proposed acquisition or incorporated by reference in

the proxy statement because they will contain important information about the proposed acquisition.

Investors will be able

to obtain free of charge the proxy statement and other documents filed with the SEC at the SEC’s website at https://www.sec.gov.

In addition, the proxy statement and the Company’s annual reports on Form 10-K, quarterly reports on Form 10-Q, current

reports on Form 8-K and amendments to those reports filed or furnished pursuant to section 13(a) or 15(d) of the Securities

Exchange Act of 1934 are available free of charge through the Company’s website at https://ir.veritiv.com as soon as reasonably

practicable after they are electronically filed with, or furnished to, the SEC.

The directors, executive officers and certain other members of management

and employees of the Company may be deemed “participants” in the solicitation of proxies from stockholders of the Company

in favor of the proposed acquisition. Information regarding the persons who may, under the rules of the SEC, be considered participants

in the solicitation of the stockholders of the Company in connection with the proposed acquisition will be set forth in the proxy statement

and the other relevant documents to be filed with the SEC. You can find information about the Company’s executive officers and directors

in its Annual Report on Form 10-K for the fiscal year ended December 31, 2022 and in its definitive proxy statement filed

with the SEC on Schedule 14A on March 17, 2023.

Communication by the Company to its Suppliers

SUPPLIER NOTIFICATION –

VERITIV SIGNS AGREEMENT

TO BE ACQUIRED BY CD&R

Dear Valued Supplier,

I am pleased to announce that on August 6, Veritiv entered into an

agreement to be acquired by Clayton, Dubilier, & Rice, LLC (CD&R). CD&R’s interest in Veritiv is based on the strong

company our team has built, and as one of our suppliers, you have been an important partner in our growth.

CD&R is a private investment

firm that builds strong and healthy businesses across a broad range of industries, including industrials, healthcare, business services,

consumer, technology, and financial services. Approximately half of CD&R’s industrials investments have been in distribution

businesses, mostly market leaders with significant growth potential, where CD&R believes it can work with management teams

to invest in building greater scale and sustainable growth. CD&R will offer us greater financial

and operational flexibility to help us fuel our long-term growth and better serve our customers.

We are proud to be a recognized leader in packaging distribution and

design services, facility solutions, print, publishing, and logistics solutions. Our world-class supplier network has contributed significantly

to that success. We look forward to building on these partnerships so together we can further shape the success of your business and ours.

The transaction is subject to customary shareholder and regulatory

approvals and is expected to close in the fourth quarter of 2023. At this time, no action is required related to Purchase Orders or any

ongoing business with Veritiv. We remain operating business as usual and will continue working to forge strong supplier relationships

across our network.

Thank you, as always, for your support and your partnership. We value

our relationship with you and look forward to future opportunities. We are committed to keeping you updated as new information becomes

available. Please contact your Veritiv Buyer or Category Management if you have any questions.

Sincerely,

Salvatore A. Abbate

Chief Executive Officer

Additional Information and Where to Find It

This filing may be deemed solicitation material in respect of the proposed

merger of an affiliate of Clayton, Dubilier & Rice, LLC with and into Veritiv. In connection with the proposed merger transaction,

Veritiv will file with the SEC and furnish to Veritiv’s stockholders a proxy statement and other relevant documents. This filing

does not constitute a solicitation of any vote or approval. Stockholders are urged to read the proxy statement when it becomes available

and any other documents to be filed with the SEC in connection with the proposed merger or incorporated by reference in the proxy statement

because they will contain important information about the proposed merger.

Investors will be able to obtain free of charge the proxy statement

and other documents filed with the SEC at the SEC’s website at https://www.sec.gov. In addition, the proxy statement and Veritiv’s

annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished

pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 are available free of charge through Veritiv’s website

at https://ir.veritiv.com/ as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC.

The directors, executive officers and certain other members of management

and employees of Veritiv may be deemed “participants” in the solicitation of proxies from stockholders of Veritiv in favor

of the proposed merger. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation

of the stockholders of Veritiv in connection with the proposed merger will be set forth in the proxy statement and the other relevant

documents to be filed with the SEC. You can find information about the Company’s executive officers and directors in its Annual

Report on Form 10-K for the fiscal year ended December 31, 2022 and in its definitive proxy statement for the 2023 annual meeting of stockholders

as filed with the SEC on Schedule 14A on March 17, 2023.

Communication by the Company to its Customers

CUSTOMER NOTIFICATION –

VERITIV SIGNS AGREEMENT

TO BE ACQUIRED BY CD&R

Dear Valued Customer,

I am pleased to announce that on August 6, Veritiv entered into an

agreement to be acquired by Clayton, Dubilier, & Rice, LLC (CD&R). CD&R’s interest in our company demonstrates the success

of our customer-first strategy, and our focus on you and your business will not change. We will continue to provide you with the same

high-quality products and services you’ve come to expect from Veritiv, and we are excited at the opportunity this will create for

us to further enhance our offerings.

CD&R is a private investment

firm that builds strong businesses focused on their customers across a broad range of industries, including industrials, healthcare, business

services, consumer, technology, and financial services. Approximately half of CD&R’s industrials investments have been

in distribution businesses, mostly market leaders with significant growth potential, where CD&R believes it can work with management

teams to invest in customer offerings and sustainable growth. CD&R will offer us greater financial

and operational flexibility to help us fuel our long-term growth and better serve you.

We are proud to be a recognized leader in packaging distribution and

design services, facility solutions, print and publishing, and logistics solutions. CD&R’s decision to invest in Veritiv was

driven by our company’s strong competitive positioning as a leading business-to-business distribution solutions company, coupled

with our substantial potential for additional growth.

The transaction is subject to customary shareholder and regulatory

approvals and is expected to close in the fourth quarter of 2023. No action is required on your part, as this should be seamless to our

customers. Please continue to place orders and remit payments as you do today. Your existing Sales and Customer Experience representatives

remain available to help ensure your business operates successfully.

Thank you, as always, for your support and your business. We value

our relationship with you and look forward to continuing our partnership. We are committed to keeping you updated as new information becomes

available. Please contact your Veritiv Sales Representative or Customer Experience Professional if you have any questions.

Sincerely,

Salvatore A. Abbate

Chief Executive Officer

Additional Information and Where to Find It

This filing may be deemed solicitation material in respect of the

proposed merger of an affiliate of Clayton, Dubilier & Rice, LLC with and into Veritiv. In connection with the proposed merger transaction,

Veritiv will file with the SEC and furnish to Veritiv’s stockholders a proxy statement and other relevant documents. This filing

does not constitute a solicitation of any vote or approval. Stockholders are urged to read the proxy statement when it becomes available

and any other documents to be filed with the SEC in connection with the proposed merger or incorporated by reference in the proxy statement

because they will contain important information about the proposed merger.

Investors will be able to obtain free of charge the proxy statement

and other documents filed with the SEC at the SEC’s website at https://www.sec.gov. In addition,

the proxy statement and Veritiv’s annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments

to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 are available free of charge

through Veritiv’s website at https://ir.veritiv.com/ as soon as reasonably practicable after

they are electronically filed with, or furnished to, the SEC.

The directors, executive officers and certain other members of management

and employees of Veritiv may be deemed “participants” in the solicitation of proxies from stockholders of Veritiv in favor

of the proposed merger. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation

of the stockholders of Veritiv in connection with the proposed merger will be set forth in the proxy statement and the other relevant

documents to be filed with the SEC. You can find information about the Company’s executive officers and directors in its Annual

Report on Form 10-K for the fiscal year ended December 31, 2022 and in its definitive proxy statement for the 2023 annual meeting of stockholders

as filed with the SEC on Schedule 14A on March 17, 2023.

Frequently Asked Questions for Employees

August 7, 2023

Frequently Asked Questions (FAQs) for Employees with Outstanding

Equity Awards Under Veritiv’s Long-Term Incentive Plan (LTIP)

Q. What happens to the vested equity awards I currently own?

Upon closing of the sale, you will receive $170 for each share of your

Veritiv stock. This includes equity awards that have already vested and are held in your E*TRADE or Morgan Stanley accounts.

Q. I have an outstanding, unvested LTIP award. What happens to those

awards?

Upon closing of the sale, you will receive $170 for each share of your

stock-based LTIP awards. This includes:

| · | All time-based Restricted Stock Units (RSUs), including those from annual

grants, promotional grants, and special retention awards |

| · | All outstanding Performance Share Units (PSUs), which will have accelerated

vesting based on the target number of shares you were awarded |

| · | All cash-settled RSU and PSU awards issued to employees outside the U.S. |

Additionally, for employees who received a cash-based Performance-Based

Unit (PBU) award in 2021, the target number of PBUs will be immediately vested and paid out upon closing of the sale. Each PBU unit is

worth $1.00.

Q. Does actual company performance affect payout of PSUs and PBUs?

No. PSUs and PBUs have a 3-year performance period based on Company

ROIC and Packaging Gross Profit $, with a Relative TSR modifier. According to the LTIP, because the 3-year performance period hasn’t

completed for outstanding performance-based awards, those awards will vest at the target number of units. However, you will get the benefit

of accelerated vesting now, without any proration. This includes, for example, full vesting at target of all 2023 LTIP awards.

Q. Do I need to take any action?

No. As long as you remain a Veritiv employee through the closing date,

all outstanding awards will be immediately vested and paid out as described above. If your employment ends prior to the closing date,

you will forfeit your unvested awards or have them prorated if you are eligible for retirement under the LTIP terms.

Q. How will I receive payment for my outstanding LTIP awards?

Payout of all LTIP awards will occur upon closing and through normal

payroll channels.

Q. Will there be taxes withheld from the payout of my LTIP awards?

Yes, all LTIP awards will be processed through normal payroll channels

and will be subject to typical withholdings for this type of payment. For U.S. employees, payments like LTIP payouts are subject to federal

supplemental withholding rates. While individual circumstances will vary, the required supplemental federal withholding may not be enough

withholding to cover your full tax liability relating to the awards. Therefore:

WE STRONGLY ADVISE EVERY EMPLOYEE

WITH AN LTIP AWARD TO IMMEDIATELY WORK WITH YOUR TAX ADVISOR TO ENSURE YOUR TAX WITHHOLDINGS MATCH YOUR TAX FILING OBJECTIVES.

This may require you to review and change your W-4 form in Workday

for your remaining 2023 salary, as well as even making additional 2023 withholding payments directly to the IRS. Your tax advisor can

review your latest pay stub and E*TRADE equity plan account details to advise you. You may also use the IRS’s tax withholding estimator

for a self-assessment.

Q. Will I continue to participate in the LTIP program after closing?

Once the closing occurs, all outstanding LTIP awards will be cancelled

and paid out in full. Details around 2024 incentive compensation programs will be provided in the coming months.

Additional Information and Where to Find It

This filing may be deemed solicitation material in respect of the proposed

merger of an affiliate of Clayton, Dubilier & Rice, LLC with and into Veritiv. In connection with the proposed merger transaction,

Veritiv will file with the SEC and furnish to Veritiv’s stockholders a proxy statement and other relevant documents. This filing

does not constitute a solicitation of any vote or approval. Stockholders are urged to read the proxy statement when it becomes available

and any other documents to be filed with the SEC in connection with the proposed merger or incorporated by reference in the proxy statement

because they will contain important information about the proposed merger.

Investors will be able to obtain free of charge the proxy statement

and other documents filed with the SEC at the SEC’s website at https://www.sec.gov. In addition, the proxy statement and Veritiv’s

annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished

pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 are available free of charge through Veritiv’s website

at https://ir.veritiv.com/ as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC.

The directors, executive officers and certain other members of management

and employees of Veritiv may be deemed “participants” in the solicitation of proxies from stockholders of Veritiv in favor

of the proposed merger. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation

of the stockholders of Veritiv in connection with the proposed merger will be set forth in the proxy statement and the other relevant

documents to be filed with the SEC. You can find information about the Company’s executive officers and directors in its Annual

Report on Form 10-K for the fiscal year ended December 31, 2022 and in its definitive proxy statement for the 2023 annual meeting of stockholders

as filed with the SEC on Schedule 14A on March 17, 2023.

###

Messages Being Made Available to Certain Employees

August 7, 2023

Veritiv Signs Agreement with Clayton, Dubilier, & Rice (CD&R)

to Become a Private Company

Talking Points and Frequently Asked Questions (FAQs)

The Talking Points and FAQs below can be used by managers when addressing

questions from employees, customers, and suppliers. Please refer all media calls to Kristie Madara in Corporate Communications at (770)

391-8471.

Talking Points

| § | Veritiv has entered into a definitive agreement with Clayton, Dubilier &

Rice, LLC (CD&R) that would change our ownership from a public company to a private company. |

| § | Clayton, Dubilier & Rice is a private investment firm with a strategy

to build strong, profitable businesses across a broad range of industries, including industrials, healthcare, business services, consumer,

technology and financial services. |

| § | This is an exciting development and a pivotal moment in the history of our

company that was made possible by our team of dedicated employees. |

| § | CD&R’s interest in our company is a testament to our team’s

hard work, innovation, and dedication, as well as the financially strong company we have built and our potential for future growth. |

| § | Our current strategy, priorities, and 50/90/1 commitment will not change

as a result of this ownership change. In fact, operating as a private company will offer greater financial and operational flexibility

to continue delighting our customers, executing our strategy, and powering our long-term growth. |

| § | Our focus remains on expanding our position as a leading provider of value-added

packaging and specialty distribution services from concept to delivery. |

| § | Under the terms of the agreement, each holder of Veritiv common stock will

be entitled to receive $170 per share in cash, which represents a 40.4% premium over our 60-day volume-weighted average price of $121.05. |

| § | The deal is subject to shareholder and regulatory approval and is expected

to close in the fourth quarter of 2023. |

| § | Once the deal is finalized, Veritiv will become a privately held company

and shares of Veritiv common stock will no longer be listed on any public markets. |

FAQs

GENERAL

Q. Why is leadership selling Veritiv?

As a privately held company, Veritiv will have greater financial and

operational flexibility to continue delighting our customers and pursuing our long-term growth. This deal is a testament to the commitment

and performance of our One Team and we remain focused on our current strategy and priorities.

Q. What benefit does this sale offer Veritiv?

This transaction will give Veritiv greater financial and operational

flexibility to continue delighting our customers and pursuing our long-term growth.

Q. Who is CD&R?

Founded in 1978, CD&R is one of the oldest and most experienced

private equity firms. Over this 40-year period, CD&R has honed its focus in working with management teams to build fundamental and

sustainable value in its businesses and has invested more than $40 billion in over 100 companies across the Industrials, Healthcare, Business

Services, Consumer, Technology and Financial Services sectors. All of CD&R’s investments are supported by dedicated investment

professionals and operating talent (former industry executives), which provide companies with additional support and resources as they

seek to achieve their long-term strategic objectives.

Q: What experience does CD&R have in Veritiv’s business

markets?

CD&R has a strong track record of driving operational excellence

in distribution businesses and the industrials sector, and they believe their partnership will help drive additional operational improvements

and sustainable growth for Veritiv well into the future.

Roughly half of CD&R’s industrial investments have been in

distribution businesses, mostly market leaders with significant growth potential where we can work closely with management teams to help

drive operational scale and achieve sustained growth:

| · | CD&R is currently invested in several industrial distribution businesses,

including Core & Main (NYSE: CNM), Beacon Roofing Supply (NASDAQ: BECN), White Cap and SunSource, among others. |

| · | In 2017, CD&R invested in Core & Main, the nation’s largest

distributor of water, sewer, storm, fusible piping, and fire protection infrastructure products. In 2021, after a successful partnership

with CD&R, Core & Main re-listed on the New York Stock Exchange and gained a valuation of $7 billion as its shares rose over 8%

in their market debut. |

| · | In 2017, CD&R invested in Beacon Roofing Supply, a leading distributor

of residential and non-residential roofing materials and building products in the U.S. Under CD&R’s ownership, the Beacon management

team executed on strategic priorities and impressive financial targets. The company returned in 2017 to the public markets in a strong

position to create value for its customers, stockholders, employees and stakeholders. |

| · | In 2020, CD&R merged HD Supply’s Construction & Industrial

business (also known as White Cap) with Construction Supply Group (CSG) to create a market leading North American distributor of concrete

accessories and specialty construction and safety products with more than $4 billion in annual revenue. |

Q. Why does CD&R want to purchase Veritiv?

CD&R seeks to acquire companies that are stable, global industry

leaders that enjoy competitive advantages in their respective markets and show potential to further improve their growth. Their decision

to invest in Veritiv was driven by our strong competitive positioning as a leading business-to-business distribution solutions company.

The key differentiators of Veritiv’s business model include our industry-leading packaging, facility solutions, and print businesses,

our team of design-to-delivery experts able to solve customers’ most complex supply chain challenges, as well as our diversified

portfolio of products, customers, and industry verticals.

Q. What are CD&R’s plans for the company?

CD&R has a strong track record of helping the companies they acquire

grow and prosper. They create value through strong collaborations with management to help companies solve problems, cultivate talent,

and accelerate development. Our current strategy, priorities, and 50/90/1 commitment will not change as a result of this ownership change.

In fact, operating as a private company will offer greater financial and operational flexibility to continue delighting our customers,

executing our strategy, and powering our long-term growth.

Q. How actively involved will CD&R be in our business? Why is

CD&R, a private investment firm, the right partner for the company?

CD&R will support our leadership team as they look to enhance strategic

planning processes, drive operational improvements, and execute strategic growth initiatives.

Q. Will the company retain its Veritiv name?

Yes, our name will not change as a result of this transaction.

Q. What is the timeline to finalize the sale?

The sale is pending final shareholder and regulatory approval, and

we anticipate that it will be completed by the fourth quarter of 2023.

Q. Were other companies provided an opportunity to bid on Veritiv?

We cannot comment on any other details related to the process at this

time. We will provide details of the process in the proxy statement that we will be filing with the U.S. Securities and Exchange Commission

(SEC) in due course in connection with the transaction.

Q. Will Veritiv remain a public company?

No. Once the deal is finalized, Veritiv will become a privately held

company and shares of Veritiv common stock will no longer be listed on any public markets.

Q. Will the new owners retain Veritiv’s current leadership?

It is our understanding that Veritiv will continue to operate under

the leadership of the existing Veritiv Senior Leadership Team.

Q. Where will the new company be headquartered?

Veritiv will continue to be based in Atlanta, Georgia.

Q. What approvals are required for the deal to go through?

The deal has already been approved by Veritiv’s board of directors

and is pending additional shareholder and regulatory approvals.

EMPLOYEES

Q. Will my job be impacted as a result of the sale?

At this time, we will continue to operate business as usual and there

will be no immediate impact from this news. Please continue to remain focused on serving our customers and suppliers, while keeping safety

in mind for every task, every day. As always, our success is built on the skill, dedication, and talent of our employees.

Q. Will our culture change?

CD&R is committed to our strategic plan and to the strong culture

we have built. We will continue to operate as One Team, with the Veritiv CODE continuing to shape our day-to-day actions and how

we do business. We remain committed to providing an environment where every individual is valued, every voice is heard, and to fostering

a workforce that reflects the diversity of our stakeholders in the communities where we live and work.

Q. Will my hourly rate or salary and benefits change?

At this time, we will continue to operate business as usual and there

will be no immediate impact on hourly rates, salaries, or benefits (including medical, dental, vision, and retirement plans that you participate

in today). Your years of service and vacation eligibility will remain in place. We remain committed to providing competitive salaries

and benefits to ensure we attract and retain top talent.

Q. Will we still receive the Annual Incentive Plan (AIP) and Profit-Sharing

payouts for this year?

Both AIP and Profit-Sharing will continue as is for 2023. Payouts are

subject to achievement of the current metrics for AIP Earnings and the Performance Scorecard. Plans and metrics for the new year will

be announced in early 2024.

Q. If I participate in a commission plan, does this transaction

affect my plan?

No. We will continue to operate business as usual at this time, and

commission plans are not changing as a result of this transaction.

Q. How will employees under labor contracts be impacted?

Existing labor contracts are not impacted by a change in ownership

of Veritiv Corporation.

Q. What happens to the Veritiv stock I currently own?

Upon closing of the sale, you will receive $170 for each share of your

Veritiv stock.

Q. For participants in Veritiv’s Long-Term Incentive Plan

(LTIP), what happens to unvested equity awards?

Details on the impact to the LTIP will be communicated separately to

employees with outstanding equity awards.

Q. What changes can we expect as a result of this sale?

At this time, we will continue to operate business as usual. Our current

strategy, priorities, and 50/90/1 commitment will not change as a result of this ownership change. In fact, operating as a private company

will offer greater financial and operational flexibility to continue delighting our customers, executing our strategy, and powering our

long-term growth.

Q. How will this transaction affect my professional development

and objectives?

Veritiv remains committed to developing our employees and setting them

up for growth.

Q. What do I do if I am contacted by a member of the media about

the transaction?

We ask that you forward any media calls to Veritiv’s Corporate

Communications Department: Kristie Madara at (770) 391-8471.

Q. Who should I contact with questions? Where can I go for more

information?

Let your Manager or Human Resources Business partner know you have

additional questions or concerns. We are committed to keeping employees informed as we approach closing of the transaction in the fourth

quarter. You can also submit any questions your Manager or HR Business Partner cannot answer to corporatecommunications@veritivcorp.com.

CUSTOMERS AND SUPPLIERS

Customers

Q. How will this change impact my current relationship with Veritiv?

We value our customers and we look forward to providing the same, consistent

level of quality products and services that you have come to rely on from Veritiv. We are excited at the opportunity this will create

for us to further enhance our offerings in the future.

Q. Will this change impact pricing or product/service offerings?

At this time, we will continue to operate business as usual with no

impact to pricing or product offerings. We are excited at the opportunity this will create for us to further enhance our offerings in

the future. As with all pricing, product, and service changes, if any are made in the future, we will communicate to you in a timely manner.

Q. Will there be any changes to my contract or quote proposals?

No, all existing contracts and proposals will be honored.

Q. What are the benefits to me as a Veritiv customer as a result

of these changes?

We value our customers and we look forward to providing the same, consistent

level of quality products and services that you have come to rely on. We are excited at the opportunity this will create for us to further

enhance our offerings in the future. Operating as a private company will provide Veritiv greater financial and operational flexibility

to continue delighting our customers, executing our strategy, and powering our long-term growth.

Q. Will there be any staffing changes that will impact me?

At this time, we will continue to operate business as usual with no

impact to positions or organizational structure.

Q. Do you anticipate making any other changes at Veritiv in the

short-term?

There are no meaningful changes planned at this time. Any future steps

we take will be guided by what we believe is in the best interests of our customers, suppliers, employees, and company.

Suppliers

Q. How will this change impact my current relationship with Veritiv?

This deal is based on the strong company our team has built, and our

suppliers have been important partners in our growth. At this time, we will continue to operate business as usual. We value our world-class

supplier network and look forward to building on these partnerships.

Q. Will my current contract/purchase order with Veritiv remain in

place?

At this time, we will continue to operate business as usual. We value

our world-class supplier network and do not anticipate any changes related to this transaction.

Q. Will policies regarding how you select vendors/suppliers change?

At this time, we will continue to operate business as usual. As with

all policy changes, if any are made in the future, we will communicate to our suppliers in a timely manner.

Q. What are the benefits to me as a Veritiv supplier as a result

of these changes?

This deal is based on the strong company our team has built, and our

suppliers have been important partners in our growth. We value our world-class supplier network and look forward to providing the same,

consistent level of quality products and services our customers rely on. We are excited at the opportunity this will create for us to

further enhance our offerings in the future. Operating as a private company will provide Veritiv greater financial and operational flexibility

to continue delighting our customers, executing our strategy, and powering our long-term growth.

Q. Will we still be working with the same purchasing contacts?

At this time, we will continue to operate business as usual. We value

our world-class supplier network and do not anticipate any changes related to this transaction.

Q. Will there be any changes to my contract or service agreements?

At this time, we will continue to operate business as usual. As with

all business decisions, if any changes are made in the future, we will communicate to our suppliers in a timely manner.

Additional Information and Where to Find It

This filing may be deemed solicitation material in respect of the proposed

merger of an affiliate of Clayton, Dubilier & Rice, LLC with and into Veritiv. In connection with the proposed merger transaction,

Veritiv will file with the SEC and furnish to Veritiv’s stockholders a proxy statement and other relevant documents. This filing

does not constitute a solicitation of any vote or approval. Stockholders are urged to read the proxy statement when it becomes available

and any other documents to be filed with the SEC in connection with the proposed merger or incorporated by reference in the proxy statement

because they will contain important information about the proposed merger.

Investors will be able to obtain free of charge the proxy statement

and other documents filed with the SEC at the SEC’s website at https://www.sec.gov. In addition, the proxy statement and Veritiv’s

annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished

pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 are available free of charge through Veritiv’s website

at https://ir.veritiv.com/ as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC.

The directors, executive officers and certain other members of management

and employees of Veritiv may be deemed “participants” in the solicitation of proxies from stockholders of Veritiv in favor

of the proposed merger. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation

of the stockholders of Veritiv in connection with the proposed merger will be set forth in the proxy statement and the other relevant

documents to be filed with the SEC. You can find information about the Company’s executive officers and directors in its Annual

Report on Form 10-K for the fiscal year ended December 31, 2022 and in its definitive proxy statement for the 2023 annual meeting of stockholders

as filed with the SEC on Schedule 14A on March 17, 2023.

###

Message to All Employees of the Company

This communication is being sent to all employees. Translations

will be available on Vibe.

Veritiv Signs Definitive Agreement with CD&R; Company to Transition

from Public to Private

Veritiv Team:

This morning we announced some exciting news about the future of our

company. Veritiv has entered into a definitive agreement with Clayton, Dubilier & Rice, LLC (CD&R) that would change our ownership

structure from a public company to a private company.

Our Board of Directors and our Senior Leadership Team, believe this

is the right decision for our company and all our shareholders. Our largest shareholder, Baupost, which owns approximately 25% of our

shares, also supports the deal and believes it will accelerate our leading position in the market. We are excited about the opportunities

this agreement presents to us going forward.

As a private company, Veritiv will have greater financial and operational

flexibility with future options, including acquisitions. It will also eliminate the previous technical challenges we experienced with

our shares including undervaluation due to low trading volume, a lack of competitive peers, and limited analyst coverage.

CD&R is one of the world’s largest private investment firms

with a 45-year track record of building strong, profitable businesses across a broad range of industries, including industrials, healthcare,

business services, consumer, technology, and financial services. They seek to acquire companies that are stable, global industry leaders

that enjoy competitive advantages in their respective markets and show further growth potential. CD&R already has a number of distribution

companies in their portfolio, and they appreciate the strong cash flow position businesses like ours have.

CD&R’s interest in our company is a testament to your hard

work, innovation, and dedication, as well as the financially strong company we have built together. Operating as a private company as

part of CD&R will provide us with greater financial and operational flexibility to continue delighting our customers, executing our

strategy, and powering our long-term growth.

The key point to remember is that Veritiv will continue operating business

as usual. The primary change that happens when this transaction closes is our ownership structure. According to Rob Volpe, Partner at

CD&R, they “look forward to supporting the talented Veritiv leadership team in this next phase of the company’s growth,

as they continue to pursue their long-term strategic objectives while maintaining an unwavering commitment to employees, suppliers, and

customers.” The Veritiv CODE will continue to serve as our guidepost in all that we do.

The transaction is subject to customary shareholder and regulatory

approvals and is expected to close in the fourth quarter of 2023. Under the terms of the agreement, once the deal closes, each holder

of Veritiv common stock will be entitled to receive $170 per share in cash, representing a premium of 40.4% over Veritiv’s 60-day

volume-weighted average price of $121.05.

For additional information on the agreement with CD&R you can access

the news release on our website at ir.veritiv.com/newsroom. Please also join me for our All-Employee Webcast at 2:00 p.m. Eastern tomorrow

where I will discuss highlights of our second quarter performance, as well as provide additional information on what the agreement with

CD&R means for us. You can access logon details on the webcast here.

Because this transaction still has to go through standard approval

processes, we are not able to provide a lot of details at this time. The important thing is for us to continue business as usual. Please

remain focused on delighting our customers and suppliers, while keeping safety in mind for every task, every day.

A Word About Safety

Because it is so important, I did also want to provide an update on

safety. While we didn’t have a great start to the year as it relates to safety, I am pleased to report that we are at a TIR

of .98 through August 4, which is on track with our target of 1.0 or less. Thank you for the great work and enhanced focus on improving

safety. As always, our goal is always zero injuries. We all need to continue to “Own It” and ensure we are providing

a safe work environment for each other every day.

CD&R’s interest in our company reflects the hard work each

of you have contributed over the past few years to execute on our multi-year commercial strategy. These efforts not only improved our

profitability but also enhanced the resiliency of our business and helped us continue to deliver value to our shareholders and customers.

Even if our ownership changes, we will remain focused on our key strategic

initiatives including Projects EVOLVE, IGNITE and ASPIRE and our 50/90/1 Commitment. I am confident we can finish the year strong. Thank

you for your hard work and dedication to delivering products and solutions that delight our customers. I look forward to continuing with

you on the next phase of Veritiv’s journey.

Stay safe,

Sal

Additional Information and Where to Find It

This filing may be deemed solicitation material in respect of the proposed

merger of an affiliate of Clayton, Dubilier & Rice, LLC with and into Veritiv. In connection with the proposed merger transaction,

Veritiv will file with the SEC and furnish to Veritiv’s stockholders a proxy statement and other relevant documents. This filing

does not constitute a solicitation of any vote or approval. Stockholders are urged to read the proxy statement when it becomes available

and any other documents to be filed with the SEC in connection with the proposed merger or incorporated by reference in the proxy statement

because they will contain important information about the proposed merger.

Investors will be able to obtain free of charge the proxy statement

and other documents filed with the SEC at the SEC’s website at https://www.sec.gov. In addition, the proxy statement and Veritiv’s

annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished

pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 are available free of charge through Veritiv’s website

at https://ir.veritiv.com/ as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC.

The directors, executive officers and certain other members of management

and employees of Veritiv may be deemed “participants” in the solicitation of proxies from stockholders of Veritiv in favor

of the proposed merger. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation

of the stockholders of Veritiv in connection with the proposed merger will be set forth in the proxy statement and the other relevant

documents to be filed with the SEC. You can find information about the Company’s executive officers and directors in its Annual

Report on Form 10-K for the fiscal year ended December 31, 2022 and in its definitive proxy statement for the 2023 annual meeting of stockholders

as filed with the SEC on Schedule 14A on March 17, 2023.

DATE: August 7, 2023

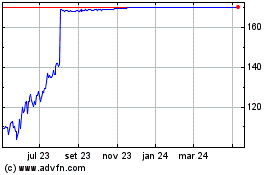

Veritiv (NYSE:VRTV)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

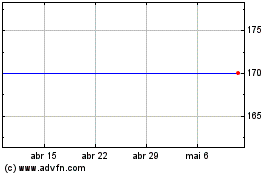

Veritiv (NYSE:VRTV)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025