UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 OF THE SECURITIES EXCHANGE ACT OF 1934

For

the month of August 2023

Commission

File Number: 001-38064

Aeterna

Zentaris Inc.

(Translation

of registrant’s name into English)

c/o

Norton Rose Fulbright Canada, LLP, 222 Bay Street, Suite 3000, PO Box 53, Toronto ON M5K 1E7

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F [X] Form 40-F [ ]

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Exhibits

99.1 and 99.2 included with this report on Form 6-K are hereby incorporated by reference into the Registrant’s Registration Statements

on Forms S-8 (No. 333-224737, No. 333-210561 and No. 333-200834), Forms F-3 (No. 333-254680) and Forms F-1 (No.333-239264, No. 333-248561

and No. 333-239019) and shall be deemed to be a part thereof from the date on which this report is furnished, to the extent not superseded

by documents or reports subsequently filed or furnished.

DOCUMENTS

INDEX

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

|

AETERNA

ZENTARIS INC. |

| |

|

|

|

| Date:

August 9, 2023 |

|

By: |

/s/

Klaus Paulini |

| |

|

|

Klaus

Paulini |

| |

|

|

President

and Chief Executive Officer |

0001113423

false

--12-31

2023

Q2

CA

2023-06-30

0001113423

2023-01-01

2023-06-30

0001113423

2023-06-30

0001113423

2022-12-31

0001113423

ifrs-full:IssuedCapitalMember

2022-12-31

0001113423

AEZS:WarrantsMember

2022-12-31

0001113423

ifrs-full:OtherEquityInterestMember

2022-12-31

0001113423

ifrs-full:RetainedEarningsMember

2022-12-31

0001113423

ifrs-full:AccumulatedOtherComprehensiveIncomeMember

2022-12-31

0001113423

ifrs-full:IssuedCapitalMember

2021-12-31

0001113423

AEZS:WarrantsMember

2021-12-31

0001113423

ifrs-full:OtherEquityInterestMember

2021-12-31

0001113423

ifrs-full:RetainedEarningsMember

2021-12-31

0001113423

ifrs-full:AccumulatedOtherComprehensiveIncomeMember

2021-12-31

0001113423

2021-12-31

0001113423

ifrs-full:IssuedCapitalMember

2023-01-01

2023-06-30

0001113423

AEZS:WarrantsMember

2023-01-01

2023-06-30

0001113423

ifrs-full:OtherEquityInterestMember

2023-01-01

2023-06-30

0001113423

ifrs-full:RetainedEarningsMember

2023-01-01

2023-06-30

0001113423

ifrs-full:AccumulatedOtherComprehensiveIncomeMember

2023-01-01

2023-06-30

0001113423

ifrs-full:IssuedCapitalMember

2022-01-01

2022-06-30

0001113423

AEZS:WarrantsMember

2022-01-01

2022-06-30

0001113423

ifrs-full:OtherEquityInterestMember

2022-01-01

2022-06-30

0001113423

ifrs-full:RetainedEarningsMember

2022-01-01

2022-06-30

0001113423

ifrs-full:AccumulatedOtherComprehensiveIncomeMember

2022-01-01

2022-06-30

0001113423

2022-01-01

2022-06-30

0001113423

ifrs-full:IssuedCapitalMember

2023-06-30

0001113423

AEZS:WarrantsMember

2023-06-30

0001113423

ifrs-full:OtherEquityInterestMember

2023-06-30

0001113423

ifrs-full:RetainedEarningsMember

2023-06-30

0001113423

ifrs-full:AccumulatedOtherComprehensiveIncomeMember

2023-06-30

0001113423

ifrs-full:IssuedCapitalMember

2022-06-30

0001113423

AEZS:WarrantsMember

2022-06-30

0001113423

ifrs-full:OtherEquityInterestMember

2022-06-30

0001113423

ifrs-full:RetainedEarningsMember

2022-06-30

0001113423

ifrs-full:AccumulatedOtherComprehensiveIncomeMember

2022-06-30

0001113423

2022-06-30

0001113423

2023-04-01

2023-06-30

0001113423

2022-04-01

2022-06-30

0001113423

2023-03-31

0001113423

2022-03-31

0001113423

AEZS:LicenseFeesMember

2023-04-01

2023-06-30

0001113423

AEZS:LicenseFeesMember

2022-04-01

2022-06-30

0001113423

AEZS:LicenseFeesMember

2023-01-01

2023-06-30

0001113423

AEZS:LicenseFeesMember

2022-01-01

2022-06-30

0001113423

AEZS:DevelopmentServicesMember

2023-04-01

2023-06-30

0001113423

AEZS:DevelopmentServicesMember

2022-04-01

2022-06-30

0001113423

AEZS:DevelopmentServicesMember

2023-01-01

2023-06-30

0001113423

AEZS:DevelopmentServicesMember

2022-01-01

2022-06-30

0001113423

AEZS:ProductSalesMember

2023-04-01

2023-06-30

0001113423

AEZS:ProductSalesMember

2022-04-01

2022-06-30

0001113423

AEZS:ProductSalesMember

2023-01-01

2023-06-30

0001113423

AEZS:ProductSalesMember

2022-01-01

2022-06-30

0001113423

AEZS:RoyaltiesMember

2023-04-01

2023-06-30

0001113423

AEZS:RoyaltiesMember

2022-04-01

2022-06-30

0001113423

AEZS:RoyaltiesMember

2023-01-01

2023-06-30

0001113423

AEZS:RoyaltiesMember

2022-01-01

2022-06-30

0001113423

AEZS:SupplyChainMember

2023-04-01

2023-06-30

0001113423

AEZS:SupplyChainMember

2022-04-01

2022-06-30

0001113423

AEZS:SupplyChainMember

2023-01-01

2023-06-30

0001113423

AEZS:SupplyChainMember

2022-01-01

2022-06-30

0001113423

ifrs-full:GoodsOrServicesTransferredOverTimeMember

2023-04-01

2023-06-30

0001113423

ifrs-full:GoodsOrServicesTransferredOverTimeMember

2022-04-01

2022-06-30

0001113423

ifrs-full:GoodsOrServicesTransferredOverTimeMember

2023-01-01

2023-06-30

0001113423

ifrs-full:GoodsOrServicesTransferredOverTimeMember

2022-01-01

2022-06-30

0001113423

ifrs-full:GoodsOrServicesTransferredAtPointInTimeMember

2023-04-01

2023-06-30

0001113423

ifrs-full:GoodsOrServicesTransferredAtPointInTimeMember

2022-04-01

2022-06-30

0001113423

ifrs-full:GoodsOrServicesTransferredAtPointInTimeMember

2023-01-01

2023-06-30

0001113423

ifrs-full:GoodsOrServicesTransferredAtPointInTimeMember

2022-01-01

2022-06-30

0001113423

AEZS:UnsatisfiedPerformanceObligationsMember

2023-03-15

0001113423

AEZS:IndicationPerformanceObligationMember

2023-03-15

0001113423

AEZS:PediatricIndicationPerformanceMember

2023-03-15

0001113423

AEZS:NovoNordiskHealthCareAGMember

2023-05-23

2023-05-23

0001113423

AEZS:NovoNordiskHealthCareMember

2023-06-30

0001113423

AEZS:PharmanoviaMember

2023-06-30

0001113423

AEZS:NKMeditechMember

2023-06-30

0001113423

AEZS:NovoNordiskHealthCareMember

2022-12-31

0001113423

AEZS:ConsilientHealthMember

2022-12-31

0001113423

AEZS:NKMeditechMember

2022-12-31

0001113423

ifrs-full:PensionDefinedBenefitPlansMember

2023-01-01

2023-06-30

0001113423

AEZS:OtherBenefitPlansMember

2023-01-01

2023-06-30

0001113423

2022-01-01

2022-12-31

0001113423

ifrs-full:PensionDefinedBenefitPlansMember

2022-12-31

0001113423

AEZS:OtherBenefitPlansMember

2022-12-31

0001113423

ifrs-full:PensionDefinedBenefitPlansMember

2023-06-30

0001113423

AEZS:OtherBenefitPlansMember

2023-06-30

0001113423

AEZS:ShareholdersAndBoardOfDirectorsMember

2022-07-15

2022-07-15

0001113423

AEZS:DeferredStockUnitsMember

2022-07-15

2022-07-15

0001113423

AEZS:TwoThousandEighteenLongTermIncentivePlanMember

2023-01-16

2023-01-17

0001113423

AEZS:TwoThousandEighteenLongTermIncentivePlanMember

2022-01-16

2022-01-17

0001113423

AEZS:DeferredShareUnitMember

2023-06-14

2023-06-14

0001113423

AEZS:DeferredShareUnitMember

2022-06-14

2022-06-14

0001113423

AEZS:DeferredShareUnitMember

2023-04-01

2023-06-30

0001113423

AEZS:DeferredShareUnitMember

2023-01-01

2023-06-30

0001113423

AEZS:DeferredShareUnitMember

2022-04-01

2022-06-30

0001113423

AEZS:DeferredShareUnitMember

2022-01-01

2022-06-30

0001113423

AEZS:DeferredShareUnitMember

2022-12-31

0001113423

AEZS:DeferredShareUnitMember

2021-12-31

0001113423

AEZS:DeferredShareUnitMember

2023-06-30

0001113423

AEZS:DeferredShareUnitMember

2022-06-30

0001113423

AEZS:EmployeeStockOption1DeferredStockUnitsMember

2023-04-01

2023-06-30

0001113423

AEZS:EmployeeStockOption1DeferredStockUnitsMember

2022-04-01

2022-06-30

0001113423

AEZS:EmployeeStockOption1DeferredStockUnitsMember

2023-01-01

2023-06-30

0001113423

AEZS:EmployeeStockOption1DeferredStockUnitsMember

2022-01-01

2022-06-30

0001113423

AEZS:WarrantsMember

2023-04-01

2023-06-30

0001113423

AEZS:WarrantsMember

2022-04-01

2022-06-30

0001113423

AEZS:WarrantsMember

2023-01-01

2023-06-30

0001113423

AEZS:WarrantsMember

2022-01-01

2022-06-30

0001113423

ifrs-full:NotLaterThanOneYearMember

2023-06-30

0001113423

AEZS:OneToThreeYearsMember

2023-06-30

0001113423

AEZS:FourToFiveYearsMember

2023-06-30

0001113423

ifrs-full:LaterThanFiveYearsMember

2023-06-30

0001113423

ifrs-full:TopOfRangeMember

2021-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

iso4217:EUR

AEZS:Integer

iso4217:CAD

xbrli:shares

Exhibit 99.1

Aeterna

Zentaris Inc.

Condensed Interim Consolidated Financial Statements

As of June 30, 2023, and for the three and six months ended

June 30, 2023, and 2022

(In thousands of US dollars)

(Unaudited)

Aeterna

Zentaris Inc.

Condensed

Interim Consolidated Statements of Financial Position

(In

thousands of US dollars)

(Unaudited)

| | |

As of

June 30,

2023 | | |

As of

December 31,

2022 | |

| | |

$ | | |

$ | |

| ASSETS | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

| 42,186 | | |

| 50,611 | |

| Trade and other receivables | |

| 185 | | |

| 732 | |

| Inventory | |

| 93 | | |

| 229 | |

| Income taxes receivable | |

| 792 | | |

| 1,428 | |

| Prepaid expenses and other current assets | |

| 2,637 | | |

| 2,488 | |

| Total current assets | |

| 45,893 | | |

| 55,488 | |

| | |

| | | |

| | |

| Non-current assets | |

| | | |

| | |

| Restricted cash equivalents | |

| 325 | | |

| 322 | |

| Property and equipment | |

| 265 | | |

| 216 | |

| Total non-current assets | |

| 591 | | |

| 538 | |

| Total assets | |

| 46,483 | | |

| 56,026 | |

| | |

| | | |

| | |

| LIABILITIES | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Payables and accrued liabilities | |

| 3,572 | | |

| 3,828 | |

| Provisions | |

| 49 | | |

| 45 | |

| Income taxes payable | |

| 109 | | |

| 108 | |

| Deferred revenues (note 3) | |

| 202 | | |

| 2,949 | |

| Lease liabilities | |

| 145 | | |

| 114 | |

| Total current liabilities | |

| 4,077 | | |

| 7,044 | |

| | |

| | | |

| | |

| Non-current liabilities | |

| | | |

| | |

| Deferred revenues (note 3) | |

| 1,580 | | |

| 1,684 | |

| Deferred gain | |

| 111 | | |

| 110 | |

| Lease liabilities | |

| 85 | | |

| 65 | |

| Employee future benefits (note 4) | |

| 11,381 | | |

| 11,159 | |

| Provisions | |

| 170 | | |

| 188 | |

| Total non-current liabilities | |

| 13,327 | | |

| 13,206 | |

| Total liabilities | |

| 17,404 | | |

| 20,250 | |

| | |

| | | |

| | |

| Shareholders’ equity | |

| | | |

| | |

| Share capital (note 5) | |

| 293,410 | | |

| 293,410 | |

| Warrants | |

| 5,085 | | |

| 5,085 | |

| Contributed surplus | |

| 90,654 | | |

| 90,332 | |

| Deficit | |

| (358,936 | ) | |

| (352,084 | ) |

| Accumulated other comprehensive loss | |

| (1,134 | ) | |

| (967 | ) |

| Total Shareholders’ equity | |

| 29,079 | | |

| 35,776 | |

| Total liabilities and shareholders’ equity | |

| 46,483 | | |

| 56,026 | |

Commitments

(note 9)

The

accompanying notes are an integral part of these condensed interim consolidated financial statements.

Approved

by the Board of Directors

| /s/

Carolyn Egbert |

|

/s/

Dennis Turpin |

| Carolyn Egbert, Chair of

the Board |

|

Dennis Turpin, Director |

Aeterna

Zentaris Inc.

Condensed

Interim Consolidated Statements of Changes in Shareholders’ Equity

For

the six months ended June 30, 2023, and 2022

(In

thousands of US dollars)

(Unaudited)

| | |

Share capital | | |

Warrants | | |

Contributed surplus | | |

Deficit | | |

Accumulated other comprehensive loss | | |

Total | |

| | |

$ | | |

$ | | |

$ | | |

$ | | |

$ | | |

$ | |

| Balance – January 1, 2023 | |

| 293,410 | | |

| 5,085 | | |

| 90,332 | | |

| (352,084 | ) | |

| (967 | ) | |

| 35,776 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| (6,772 | ) | |

| - | | |

| (6,772 | ) |

| Other comprehensive loss: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation adjustments | |

| - | | |

| - | | |

| - | | |

| - | | |

| (167 | ) | |

| (167 | ) |

| Actuarial loss on defined benefit plans (note 4) | |

| - | | |

| - | | |

| - | | |

| (80 | ) | |

| - | | |

| (80 | ) |

| Comprehensive loss | |

| | | |

| | | |

| | | |

| (6,852 | ) | |

| (167 | ) | |

| (7,019 | ) |

| Share-based compensation costs | |

| - | | |

| - | | |

| 322 | | |

| - | | |

| - | | |

| 322 | |

| Balance – June 30, 2023 | |

| 293,410 | | |

| 5,085 | | |

| 90,654 | | |

| (358,936 | ) | |

| (1,134 | ) | |

| 29,079 | |

| | |

Share capital | | |

Warrants | | |

Contributed surplus | | |

Deficit | | |

Accumulated other comprehensive loss | | |

Total | |

| | |

$ | | |

$ | | |

$ | | |

$ | | |

$ | | |

$ | |

| Balance – January 1, 2022 | |

| 293,410 | | |

| 5,085 | | |

| 89,788 | | |

| (334,619 | ) | |

| (678 | ) | |

| 52,986 | |

| Balance – Value | |

| 293,410 | | |

| 5,085 | | |

| 89,788 | | |

| (334,619 | ) | |

| (678 | ) | |

| 52,986 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| (6,856 | ) | |

| - | | |

| (6,856 | ) |

| Other comprehensive loss: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation adjustments | |

| - | | |

| - | | |

| - | | |

| - | | |

| 79 | | |

| 79 | |

| Actuarial gain on defined benefit plans | |

| - | | |

| - | | |

| - | | |

| 8,025 | | |

| - | | |

| 8,025 | |

| Comprehensive income | |

| | | |

| | | |

| | | |

| 1,169 | | |

| 79 | | |

| 1,248 | |

| Comprehensive income (loss) | |

| | | |

| | | |

| | | |

| 1,169 | | |

| 79 | | |

| 1,248 | |

| Share-based compensation costs | |

| - | | |

| - | | |

| 60 | | |

| - | | |

| - | | |

| 60 | |

| Balance – June 30, 2022 | |

| 293,410 | | |

| 5,085 | | |

| 89,848 | | |

| (333,450 | ) | |

| (599 | ) | |

| 54,294 | |

| Balance – Value | |

| 293,410 | | |

| 5,085 | | |

| 89,848 | | |

| (333,450 | ) | |

| (599 | ) | |

| 54,294 | |

The

accompanying notes are an integral part of these condensed interim consolidated financial statements.

Aeterna

Zentaris Inc.

Condensed

Interim Consolidated Statements of Loss and Comprehensive Loss

For

the three and six months ended June 30, 2023, and 2022

(In

thousands of US dollars, except share and per share data)

(Unaudited)

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

Three months ended

June 30, | | |

Six months ended

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

$ | | |

$ | | |

$ | | |

$ | |

| Revenues (note 3) | |

| 2,246 | | |

| (222 | ) | |

| 4,374 | | |

| 1,295 | |

| | |

| | | |

| | | |

| | | |

| | |

| Expenses | |

| | | |

| | | |

| | | |

| | |

| Cost of sales | |

| 139 | | |

| 13 | | |

| 156 | | |

| 92 | |

| Research and development | |

| 2,929 | | |

| 2,398 | | |

| 6,941 | | |

| 4,788 | |

| Selling, general and administrative | |

| 2,033 | | |

| 2,083 | | |

| 4,339 | | |

| 3,944 | |

| Total expenses | |

| 5,101 | | |

| 4,494 | | |

| 11,436 | | |

| 8,824 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (2,855 | ) | |

| (4,716 | ) | |

| (7,062 | ) | |

| (7,529 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Gain (loss) due to changes in foreign currency exchange rates | |

| 27 | | |

| 502 | | |

| (32 | ) | |

| 676 | |

| Interest income | |

| 307 | | |

| - | | |

| 320 | | |

| - | |

| Other finance income (costs) | |

| 3 | | |

| (2 | ) | |

| 2 | | |

| (3 | ) |

| Net finance income | |

| 337 | | |

| 500 | | |

| 290 | | |

| 673 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss before income taxes | |

| (2,518 | ) | |

| (4,216 | ) | |

| (6,772 | ) | |

| (6,856 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Income tax recovery | |

| - | | |

| - | | |

| - | | |

| - | |

| Net loss | |

| (2,518 | ) | |

| (4,216 | ) | |

| (6,772 | ) | |

| (6,856 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other comprehensive loss: | |

| | | |

| | | |

| | | |

| | |

| Items that may be reclassified subsequently to profit or loss: | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation adjustments | |

| 3 | | |

| 42 | | |

| (167 | ) | |

| 79 | |

| Items that will not be reclassified to profit or loss: | |

| | | |

| | | |

| | | |

| | |

| Actuarial gain on defined benefit plans (note 4) | |

| 83 | | |

| 5,276 | | |

| (80 | ) | |

| 8,025 | |

| Comprehensive (loss) income | |

| (2,432 | ) | |

| 1,102 | | |

| (7,019 | ) | |

| 1,248 | |

| | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted loss per share (note 7) | |

| (0.52 | ) | |

| (0.87 | ) | |

| (1.39 | ) | |

| (1.41 | ) |

| Basic loss per share (note 7) | |

| (0.52 | ) | |

| (0.87 | ) | |

| (1.39 | ) | |

| (1.41 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of shares outstanding (basic and diluted) | |

| 4,855,876 | | |

| 4,855,876 | | |

| 4,855,876 | | |

| 4,855,876 | |

| Weighted average number of shares outstanding, basic | |

| 4,855,876 | | |

| 4,855,876 | | |

| 4,855,876 | | |

| 4,855,876 | |

The

accompanying notes are an integral part of these condensed interim consolidated financial statements.

Aeterna

Zentaris Inc.

Condensed

Interim Consolidated Statements of Cash Flows

For

the three and six months ended June 30, 2023, and 2022

(In

thousands of US dollars)

(Unaudited)

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

Three months ended | | |

Six months ended | |

| | |

June 30, | | |

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

$ | | |

$ | | |

$ | | |

$ | |

| Cash flows from operating activities | |

| | | |

| | | |

| | | |

| | |

| Net loss for the period | |

| (2,518 | ) | |

| (4,216 | ) | |

| (6,772 | ) | |

| (6,856 | ) |

| Items not affecting cash and cash equivalents: | |

| | | |

| | | |

| | | |

| | |

| Provisions | |

| 18 | | |

| 7 | | |

| 10 | | |

| 5 | |

| Depreciation and amortization | |

| 44 | | |

| 35 | | |

| 84 | | |

| 71 | |

| Share-based compensation costs | |

| 306 | | |

| 33 | | |

| 323 | | |

| 60 | |

| Employee future benefits | |

| 130 | | |

| 98 | | |

| 265 | | |

| 197 | |

| Amortization of deferred revenues | |

| (794 | ) | |

| 124 | | |

| (1,554 | ) | |

| (704 | ) |

| Net foreign exchange differences | |

| (9 | ) | |

| (513 | ) | |

| (1 | ) | |

| (687 | ) |

| Other non-cash items | |

| 5 | | |

| 495 | | |

| 5 | | |

| 509 | |

| Refund (payment) of income taxes | |

| 647 | | |

| (51 | ) | |

| 647 | | |

| 830 | |

| Changes in operating assets and liabilities (note 6) | |

| (2,122 | ) | |

| (862 | ) | |

| (1,361 | ) | |

| 264 | |

| Net cash used in operating activities | |

| (4,293 | ) | |

| (4,850 | ) | |

| (8,354 | ) | |

| (6,311 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Cash flows from financing activities | |

| | | |

| | | |

| | | |

| | |

| Payments on lease liabilities | |

| (42 | ) | |

| (34 | ) | |

| (80 | ) | |

| (68 | ) |

| Net cash used in financing activities | |

| (42 | ) | |

| (34 | ) | |

| (80 | ) | |

| (68 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Cash flows from investing activities | |

| | | |

| | | |

| | | |

| | |

| Purchase of property and equipment | |

| (3 | ) | |

| (42 | ) | |

| (5 | ) | |

| (48 | ) |

| Net cash used in investing activities | |

| (3 | ) | |

| (42 | ) | |

| (5 | ) | |

| (48 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Effect of exchange rate changes on cash and cash equivalents | |

| (36 | ) | |

| (513 | ) | |

| 14 | | |

| (716 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net change in cash and cash equivalents | |

| (4,374 | ) | |

| (5,439 | ) | |

| (8,425 | ) | |

| (7,143 | ) |

| Cash and cash equivalents – Beginning of period | |

| 46,560 | | |

| 63,596 | | |

| 50,611 | | |

| 65,300 | |

| Cash and cash equivalents – End of period | |

| 42,186 | | |

| 58,157 | | |

| 42,186 | | |

| 58,157 | |

The

accompanying notes are an integral part of these condensed interim consolidated financial statements.

Aeterna

Zentaris Inc.

Notes

to the Condensed Interim Consolidated Financial Statements

As

of June 30, 2023, and for the three and six months ended June 30, 2023, and 2022

(In

thousands of US dollars, except share and per share data and as otherwise noted)

(Unaudited)

1. Business overview

Summary

of business

Aeterna

Zentaris is a specialty biopharmaceutical company commercializing and developing therapeutics and diagnostic tests. The Company’s

lead product, Macrilen® (macimorelin), is the first and only U.S. Food and Drug Administration (“FDA”) and

European Medicines Agency (“EMA”) approved oral test indicated for the diagnosis of patients with adult growth hormone deficiency

(“AGHD”). Macimorelin is currently marketed under the tradename Ghryvelin™ in the European Economic Area and the United

Kingdom through an exclusive licensing agreement with Pharmanovia. The Company’s several other license and commercialization partners

are also seeking approval for commercialization of macimorelin in Israel and the Palestinian Authority, the Republic of Korea, Turkey

and several non-European Union Balkan countries. The Company is actively pursuing business development opportunities for the commercialization

of macimorelin in North America, Asia and the rest of the world.

The

Company is also dedicated to the development of therapeutic assets and has taken steps to establish a pre-clinical pipeline to potentially

address unmet medical needs across several indications with a focus on rare or orphan indications.

These

unaudited condensed interim consolidated financial statements were approved by the Board of Directors (the “Board”) on August

8, 2023.

2. Basis of presentation

These

unaudited condensed interim consolidated financial statements have been prepared in accordance with IAS 34, Interim Financial Reporting

as issued by the International Accounting Standards Board.

The

unaudited condensed interim consolidated financial statements do not include all the notes normally included in annual consolidated financial

statements. Accordingly, these unaudited condensed interim consolidated financial statements should be read in conjunction with the Company’s

annual consolidated financial statements as of and for the year ended December 31, 2022.

The

accounting policies used in these condensed interim consolidated financial statements are consistent with those presented in the Company’s

annual consolidated financial statements.

New

standards and amendments

Effective

January 1, 2023, the Company adopted the Disclosure of Accounting Policies (amendments to IAS 1 and IFRS Practice Statement 2). The amendments

to IAS 1 require that the Company discloses its material accounting policies instead of its significant accounting policies. As a result

of the adoption of these amendments, there were no adjustments to the presentation or amounts recognized in the interim financial statements.

Critical

accounting estimates and judgements

The

preparation of condensed interim consolidated financial statements in accordance with IFRS requires management to make judgements, estimates

and assumptions that affect the reported amounts of the Company’s assets, liabilities, revenues, expenses and related disclosures.

Judgements, estimates and assumptions are based on historical experience, expectations, current trends and other factors that management

believes to be relevant at the time at which the Company’s condensed interim consolidated financial statements are prepared.

Aeterna

Zentaris Inc.

Notes

to the Condensed Interim Consolidated Financial Statements

As

of June 30, 2023, and for the three and six months ended June 30, 2023, and 2022

(In

thousands of US dollars, except share and per share data and as otherwise noted)

(Unaudited)

Management

reviews, on a regular basis, the Company’s accounting policies, assumptions, estimates and judgements in order to ensure that the

condensed interim consolidated financial statements are presented fairly and in accordance with IFRS applicable to interim financial

statements. Critical accounting estimates and assumptions, as well as critical judgements used in applying accounting policies in the

preparation of the Company’s condensed interim consolidated financial statements, were the same as those applied to the Company’s

annual consolidated financial statements as of and for the year ended December 31, 2022.

3. Revenue

The

Company derives revenue from the transfer of goods and services over time and at a point in time in the following categories:

Summary

of revenue from transfer of goods and services

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

Three months ended | | |

Six months ended | |

| | |

June 30, | | |

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| $ | | |

| $ | | |

| $ | | |

| $ | |

| License fees | |

| 795 | | |

| (206 | ) | |

| 1,554 | | |

| 226 | |

| Development services | |

| 1,402 | | |

| (77 | ) | |

| 2,741 | | |

| 889 | |

| Product sales | |

| - | | |

| - | | |

| - | | |

| 57 | |

| Royalties | |

| 7 | | |

| 24 | | |

| 26 | | |

| 43 | |

| Supply chain | |

| 42 | | |

| 37 | | |

| 53 | | |

| 80 | |

| Total | |

| 2,246 | | |

| (222 | ) | |

| 4,374 | | |

| 1,295 | |

The

Company recorded revenue for the transfer of services over time for the three-months ended June 30, 2023, of $2,197 (2022 – ($283))

and the six-months ended June 30, 2023, of $4,295 (2022 - $1,115). While revenue recorded at a point in time for the three-months ended

June 30, 2023, was $49 (2022 – $61) and the six-months ended June 30, 2023, was $79 (2022 - $180).

Pharmanovia:

On

March 15, 2023, with the Company’s consent, Consilient Health (“CH”) entered into an assignment agreement with Pharmanovia

to transfer the current licensing agreement for the commercialization of macimorelin in the European Economic Area and the United Kingdom

to Pharmanovia, as well as the current supply agreement pursuant to which the Company agreed to provide the licensed product (together,

the “Assignment Agreement”). Also on March 15, 2023, the Company and Pharmanovia entered into an amendment agreement, pursuant

to which the Company provided its acknowledgement and consent to the Assignment Agreement and agreed to certain amended terms which do

not materially differ from the previous license and supply agreement with CH. Subsequent to the execution of the Assignment Agreement,

the aggregate amount of the transaction price allocated to the Company’s unsatisfied performance obligations was $1,658 (€1,540),

comprised of; the combined adult indication performance obligation of $1,233 (€1,145), and the combined pediatric indication performance

obligation of $425 (€395). The Company will continue to recognize revenue over time using an output method based on units of licensed

product supplied to Pharmanovia. The total units that the Company expects to supply to Pharmanovia is an estimate, based on current projections

and anticipated market demand, and therefore will be a significant judgement that will be relied upon when using the outputs method to

recognize revenue.

Aeterna

Zentaris Inc.

Notes

to the Condensed Interim Consolidated Financial Statements

As

of June 30, 2023, and for the three and six months ended June 30, 2023, and 2022

(In

thousands of US dollars, except share and per share data and as otherwise noted)

(Unaudited)

Novo

Nordisk Health Care AG:

On

August 26, 2022, Novo provided the Company with a notice of termination of the Novo Amendment. Under the terms of the Novo Amendment,

the termination was effective May 23, 2023, upon the completion of a 270-day notice period (“notice period”). Upon termination,

the rights and licenses granted by the Company to Novo under the Novo Amendment returned to the Company, and the Company regained full

rights to continue the clinical development and future commercialization of Macrilen™. Following the notice of termination and

throughout the 270-day notice period, as per the terms of the Novo Amendment, Novo continued to fund DETECT-trial costs up to $10.1 million

(€9.4 million). As of May 23, 2023, the Company recognized all remaining license fees associated with the Pediatric indication and

development services revenue previously recorded in deferred revenue.

Liabilities

related to contracts with customers

The

following table provides a summary of deferred revenue balances:

Summary

of deferred revenue

| | |

June 30, 2023 | |

| | |

Current | | |

Non-current | | |

Total | |

| | |

$ | | |

$ | | |

$ | |

| Novo Nordisk Health Care | |

| - | | |

| - | | |

| - | |

| Pharmanovia | |

| 193 | | |

| 1,459 | | |

| 1,652 | |

| NK Meditech | |

| 9 | | |

| 121 | | |

| 130 | |

| | |

| 202 | | |

| 1,580 | | |

| 1,782 | |

| | |

December 31, 2022 | |

| | |

Current | | |

Non-current | | |

Total | |

| | |

$ | | |

$ | | |

$ | |

| Novo Nordisk Health Care | |

| 2,914 | | |

| - | | |

| 2,914 | |

| Consilient Health | |

| 35 | | |

| 1,556 | | |

| 1,591 | |

| NK Meditech | |

| - | | |

| 128 | | |

| 128 | |

| | |

| 2,949 | | |

| 1,684 | | |

| 4,633 | |

Aeterna

Zentaris Inc.

Notes

to the Condensed Interim Consolidated Financial Statements

As

of June 30, 2023, and for the three and six months ended June 30, 2023, and 2022

(In

thousands of US dollars, except share and per share data and as otherwise noted)

(Unaudited)

4. Employee future benefits

The

change in the Company’s employee future benefit obligations is summarized as follows:

Summary

of net defined benefit liability asset

| | |

benefit plans | | |

benefit plans | | |

Total | | |

Total | |

| | |

Six months ended June 30, 2023 | | |

Year ended

December 31,

2022 | |

| | |

Pension | | |

Other | | |

| | |

| |

| | |

benefit plans | | |

benefit plans | | |

Total | | |

Total | |

| | |

$ | | |

$ | | |

$ | | |

$ | |

| Change in plan liabilities | |

| | | |

| | | |

| | | |

| | |

| Balances – Beginning of the period | |

| 21,657 | | |

| 93 | | |

| 21,750 | | |

| 29,412 | |

| Current service cost | |

| 63 | | |

| 6 | | |

| 69 | | |

| 142 | |

| Interest cost | |

| 400 | | |

| 2 | | |

| 402 | | |

| 295 | |

| Actuarial loss (gain) from changes in financial assumptions | |

| 143 | | |

| - | | |

| 143 | | |

| (5,915 | ) |

| Benefits paid | |

| (380 | ) | |

| - | | |

| (380 | ) | |

| (752 | ) |

| Impact of foreign exchange rate changes | |

| 261 | | |

| 1 | | |

| 262 | | |

| (1,432 | ) |

| Balances – End of the period | |

| 22,144 | | |

| 102 | | |

| 22,246 | | |

| 21,750 | |

| | |

| | | |

| | | |

| | | |

| | |

| Change in plan assets | |

| | | |

| | | |

| | | |

| | |

| Balances – Beginning of the period | |

| 10,591 | | |

| - | | |

| 10,591 | | |

| 11,927 | |

| Interest income from plan assets | |

| 198 | | |

| - | | |

| 198 | | |

| 120 | |

| Employer contributions | |

| 14 | | |

| - | | |

| 14 | | |

| 45 | |

| Employee contributions | |

| 8 | | |

| - | | |

| 8 | | |

| 10 | |

| Benefits paid | |

| (136 | ) | |

| - | | |

| (136 | ) | |

| (247 | ) |

| Remeasurement of plan assets | |

| 63 | | |

| - | | |

| 63 | | |

| (641 | ) |

| Impact of foreign exchange rate changes | |

| 127 | | |

| - | | |

| 127 | | |

| (623 | ) |

| Balances – End of the period | |

| 10,865 | | |

| - | | |

| 10,865 | | |

| 10,591 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net liability of the unfunded plans | |

| 10,867 | | |

| 102 | | |

| 10,969 | | |

| 10,787 | |

| Net liability of the funded plans | |

| 412 | | |

| - | | |

| 412 | | |

| 372 | |

| Net amount recognized as Employee future benefits | |

| 11,279 | | |

| 102 | | |

| 11,381 | | |

| 11,159 | |

| | |

| | | |

| | | |

| | | |

| | |

| Amounts recognized: | |

| | | |

| | | |

| | | |

| | |

| In net loss | |

| 257 | | |

| 8 | | |

| 265 | | |

| 295 | |

| Actuarial (loss) gain on defined benefit plans in other comprehensive (loss) income | |

| (80 | ) | |

| - | | |

| (80 | ) | |

| 5,262 | |

The

calculation of the employee future benefit obligation is sensitive to the discount rate assumption and other assumptions such as the

rate of the pension benefit increase. Discount rates were 3.70% as of June 30, 2023, and 3.75% as of December 31, 2022, causing the variances

in the actuarial loss (gain) on defined benefit plan during the six months ended June 30, 2023.

Aeterna

Zentaris Inc.

Notes

to the Condensed Interim Consolidated Financial Statements

As

of June 30, 2023, and for the three and six months ended June 30, 2023, and 2022

(In

thousands of US dollars, except share and per share data and as otherwise noted)

(Unaudited)

5. Shareholders’ equity

Share

capital

The

Company has authorized an unlimited number of common shares (being voting and participating shares) with no par value, as well as an

unlimited number of preferred, first and second ranking shares, issuable in series, with rights and privileges specific to each class,

with no par value.

Summary

of share capital

| | |

Common shares | | |

Amount | |

| | |

# | | |

$ | |

| Balance – December 31, 2022 | |

| 4,855,876 | | |

| 293,410 | |

| | |

| | | |

| | |

| | |

| - | | |

| - | |

| Balance – June 30, 2023 | |

| 4,855,876 | | |

| 293,410 | |

On

July 15, 2022, the Company’s shareholders and board of directors approved an amendment to the Company’s articles of incorporation

to effect a 1-for-25 share consolidation (reverse split) of the Company’s common shares. The Company’s outstanding stock

options, DSUs and warrants were also adjusted to reflect the 1-for-25 share consolidation (reverse split) of the Company’s common

shares. Accordingly, all common shares, DSU, warrants, stock options and per share amounts in these

interim condensed consolidated financial statements have been retroactively adjusted for all periods presented to give effect to the

share consolidation (reverse split). Outstanding warrant and stock options were proportionately reduced and the respective exercise

prices, if applicable, were proportionately increased. The share consolidation (reverse split) was affected on July 21, 2022.

Share-based

compensation

On

January 17, 2023, the Company granted 14,000 (2022 – 2,000) stock options under the Long-Term Incentive Plan. The stock options

have a term of seven years and will vest over a period of three years. The fair value at grant date is estimated using a Black-Scholes

option pricing model, considering the terms and conditions upon which the options were granted, using the following assumptions:

Summary of assumptions to determine share-based compensation costs over the life of awards

| | |

June 30,

2023 | | |

June 30,

2022 | |

| Expected dividend yield | |

$ | 0.00 | | |

$ | 0.00 | |

| Expected volatility | |

| 104.46 | % | |

| 115.75 | % |

| Risk-free annual interest rate | |

| 3.56 | % | |

| 1.59 | % |

| Expected life (years) | |

| 5.45 | | |

| 5.72 | |

| Share price | |

$ | 3.75 | | |

$ | 8.88 | |

| Exercise price | |

$ | 3.75 | | |

$ | 8.88 | |

| Grant date fair value | |

$ | 2.99 | | |

$ | 7.47 | |

The

expected volatility of these stock options was determined using historical volatility rates and the expected life was determined using

the weighted average life of past options issued.

Aeterna

Zentaris Inc.

Notes

to the Condensed Interim Consolidated Financial Statements

As

of June 30, 2023, and for the three and six months ended June 30, 2023, and 2022

(In

thousands of US dollars, except share and per share data and as otherwise noted)

(Unaudited)

The

compensation expense for the three months ended June 30, 2023, was $22 (2022 – $33) and the six months ended June 30, 2023, was

$39 (2022 – $60) recognized over the vesting period. Option activity for the six months ended June 30, 2023, and 2022, was as follows:

Summary of number and weighted average exercise prices of share options

| | |

Stock options | | |

Weighted average exercise price | |

| | |

# | | |

$ | |

| Balance – January 1, 2023 | |

| 42,030 | | |

| 20.05 | |

| Granted | |

| 14,000 | | |

| 3.75 | |

| Cancelled / Forfeited | |

| - | | |

| - | |

| Balance – June 30, 2023 | |

| 56,030 | | |

| 15.98 | |

| | |

Stock options | | |

Weighted average exercise price | |

| | |

# | | |

$ | |

| Balance – January 1, 2022 | |

| 43,455 | | |

| 22.00 | |

| Granted | |

| 2,000 | | |

| 8.88 | |

| Cancelled / Forfeited | |

| (2,399 | ) | |

| 10.98 | |

| Balance – June 30, 2022 | |

| 43,056 | | |

| 21.95 | |

Deferred

share units

On

June 14, 2023, the Company granted 100,000 (2022 – nil) DSUs under the Long-Term Incentive Plan. The compensation expense for the

three and six months ended June 30, 2023, was $284 (2022 - $nil) and is presented in selling, general and administrative expenses. DSU

activity for the six months ended June 30, 2023, are:

Summary

of DSU activity

| | |

2023 | | |

2022 | |

| | |

# | | |

# | |

| Balance – January 1, | |

| 96,920 | | |

| 16,920 | |

| Granted | |

| 100,000 | | |

| - | |

| Balance – June 30, | |

| 196,920 | | |

| 16,920 | |

Aeterna

Zentaris Inc.

Notes

to the Condensed Interim Consolidated Financial Statements

As

of June 30, 2023, and for the three and six months ended June 30, 2023, and 2022

(In

thousands of US dollars, except share and per share data and as otherwise noted)

(Unaudited)

6. Supplemental disclosure of cash flow information

Disclosure

of changes in operating assets and liabilities

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

Three months ended | | |

Six months ended | |

| | |

June 30, | | |

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

$ | | |

$ | | |

$ | | |

$ | |

| Changes in operating assets and liabilities: | |

| | | |

| | | |

| | | |

| | |

| Trade and other receivables | |

| 199 | | |

| (255 | ) | |

| 402 | | |

| 220 | |

| Inventory | |

| 135 | | |

| - | | |

| 140 | | |

| (206 | ) |

| Prepaid expenses and other current assets | |

| (748 | ) | |

| (1,471 | ) | |

| (122 | ) | |

| (759 | ) |

| Payables and accrued liabilities | |

| (398 | ) | |

| (40 | ) | |

| (163 | ) | |

| 119 | |

| Deferred revenues | |

| (1,205 | ) | |

| 1,001 | | |

| (1,359 | ) | |

| 1,008 | |

| Provision for restructuring and other costs | |

| 4 | | |

| - | | |

| (5 | ) | |

| - | |

| Employee future benefits | |

| (109 | ) | |

| (97 | ) | |

| (254 | ) | |

| (118 | ) |

| Increase (decrease) in

operating assets and liabilities | |

| (2,122 | ) | |

| (862 | ) | |

| (1,361 | ) | |

| 264 | |

7. Net loss per share

The

following table sets forth pertinent data relating to the computation of basic and diluted net loss per share attributable to common

shareholders.

Summary of pertinent data relating to computation of basic and diluted net loss per share

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

Three months ended | | |

Six months ended | |

| | |

June 30, | | |

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

$ | | |

$ | | |

$ | | |

$ | |

| Net loss | |

| (2,518 | ) | |

| (4,216 | ) | |

| (6,772 | ) | |

| (6,856 | ) |

| Basic and diluted weighted-average shares outstanding | |

| 4,855,876 | | |

| 4,855,876 | | |

| 4,855,876 | | |

| 4,855,876 | |

| Basic weighted-average shares outstanding | |

| 4,855,876 | | |

| 4,855,876 | | |

| 4,855,876 | | |

| 4,855,876 | |

| | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted loss per share | |

| (0.52 | ) | |

| (0.87 | ) | |

| (1.39 | ) | |

| (1.41 | ) |

| Basic loss per share | |

| (0.52 | ) | |

| (0.87 | ) | |

| (1.39 | ) | |

| (1.41 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Items excluded from the calculation of diluted net loss per share due to their anti-dilutive effect: | |

| | | |

| | | |

| | | |

| | |

| Stock options and DSUs | |

| 252,950 | | |

| 62,375 | | |

| 252,950 | | |

| 62,375 | |

| Warrants | |

| 457,648 | | |

| 457,648 | | |

| 457,648 | | |

| 457,648 | |

| Anti-dilutive shares | |

| | | |

| | | |

| | | |

| | |

8. Segment information

The

Company operates in a single operating segment, being the biopharmaceutical segment.

Aeterna

Zentaris Inc.

Notes

to the Condensed Interim Consolidated Financial Statements

As

of June 30, 2023, and for the three and six months ended June 30, 2023, and 2022

(In

thousands of US dollars, except share and per share data and as otherwise noted)

(Unaudited)

9. Commitments

Significant

expenditure contracted for at the end of the reporting period but not recognized as liabilities is as follows:

Schedule

of expected future minimum lease payments

| | |

TOTAL | |

| | |

$ | |

| Less than 1 year | |

| 7,586 | |

| 1 - 3 years | |

| 151 | |

| 4 - 5 years | |

| 37 | |

| More than 5 years | |

| - | |

| Total | |

| 7,774 | |

In

2021, the Company executed various agreements including in-licensing and similar arrangements with development partners. Such agreements

may require the Company to make payments on achievement of stages of development, launch or revenue milestones, although the Company

generally has the right to terminate these agreements at no penalty. The Company may have to pay up to $38,887 upon achieving certain

sales volumes, regulatory or other milestones related to specific products.

Exhibit

99.2

Management’s

Discussion and Analysis of Financial Condition and Results of Operations

Introduction

This

Management’s Discussion and Analysis (“MD&A”) provides a review of the results of operations, financial condition

and cash flows of Aeterna Zentaris Inc. for the three and six-month periods ended June 30, 2023. In this MD&A, “Aeterna Zentaris”,

“Aeterna”, the “Company”, “we”, “us” and “our” mean Aeterna Zentaris Inc.

and its subsidiaries. This discussion should be read in conjunction with the information contained in the Company’s unaudited condensed

interim consolidated financial statements and the notes thereto as of June 30, 2023, and for the three and six-month periods ended June

30, 2023 and 2022. Our unaudited condensed interim consolidated financial statements have been prepared in accordance with International

Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) applicable

to the preparation of interim financial statements, including IAS 34 interim financial reporting.

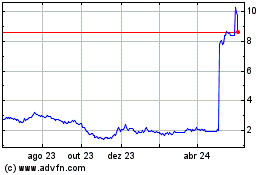

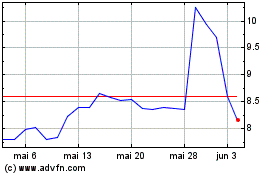

The

Company’s common shares are listed on both The Nasdaq Capital Market (“Nasdaq”) and on the Toronto Stock Exchange (“TSX”)

under the symbol “AEZS”. All amounts in this MD&A are presented in thousands of United States (“U.S.”) dollars,

except for share and per share data, or as otherwise noted. This MD&A was approved by the Company’s Board of Directors (the

“Board”) on August 8, 2023. This MD&A is dated August 8, 2023.

About

Forward-Looking Statements

This

document contains statements that may constitute forward-looking statements within the meaning of U.S. and Canadian securities legislation

and regulations, and such statements are made pursuant to the safe-harbor provision of the U.S. Private Securities Litigation Reform

Act of 1995. In some cases, these forward-looking statements can be identified by words or phrases such as “forecast”, “may”,

“will”, “expect”, anticipate”, “estimate”, “intend”, “plan”, “indicate”,

“believe”, “direct”, or “likely”, or the negative of these terms, or other similar expressions intended

to identify forward-looking statements. In addition, any statements that refer to expectations, intentions, projections and other characterizations

of future events or circumstances contain forward-looking information.

Forward-looking

statements are based on the opinions and estimates of the Company as of the date of this MD&A, and they are subject to known and

unknown risks, uncertainties, assumptions and other factors that may cause the actual results, level of activity, performance or achievements

to be materially different from those expressed or implied by such forward-looking statements, including but not limited to the factors

described under Item 3, D. – “Risk factors” in our most

recent Annual Report on Form 20-F and those relating to: Aeterna’s expectations with respect to the DETECT-trial (as defined below)

(including regarding the enrollment of subjects in the DETECT-trial, the application of the macimorelin growth hormone stimulation tests

and the completion of the DETECT-trial); Aeterna’s expectations regarding conducting pre-clinical research to identify and characterize

an AIM Biologicals-based development candidate for the treatment of neuromyelitis optica spectrum disorder (“NMOSD”), as

well as Parkinson’s disease (“PD”), and developing a manufacturing process for selected candidates; Aeterna’s

expectations regarding conducting assessments in relevant PD models; the University of Queensland’s undertaking a subsequent investigator

initiated clinical trial evaluating macimorelin as a potential therapeutic for the treatment of amyotrophic lateral sclerosis (“ALS”),

also known as Lou Gehrig’s disease, and Aeterna’s formulating a pre-clinical development plan for same; the commencement

of Aeterna’s formal pre-clinical development of AEZS-150 (as a potential therapeutic in chronic hypoparathyroidism as defined below)

in preparation for a potential investigational new drug (“IND”) filing for conducting the first in-human clinical study of

AEZS-150; and the impacts associated with the termination of the license agreement with Novo Nordisk Healthcare AG (“Novo Nordisk”

or “Novo”), as discussed below.

Forward-looking

statements involve known and unknown risks and uncertainties and other factors which may cause the actual results, performance or achievements

stated herein to be materially different from any future results, performance or achievements expressed or implied by the forward-looking

information. Such risks and uncertainties include, among others: our reliance on the success of the pediatric clinical trial in the European

Union and U.S. for Macrilen® (macimorelin); potential delays associated with the completion of the DETECT-trial; we may

be unable to enroll the expected number of subjects in the DETECT-trial, and the result of the DETECT-trial may not support receipt of

regulatory approval in childhood-onset growth hormone deficiency (“CGHD”); results from ongoing or planned pre-clinical studies

of macimorelin by the University of Queensland or for our other products under development may not be successful or may not support advancing

the product to human clinical trials; our ability to raise capital and obtain financing to continue our currently planned operations;

our dependence on the success of Macrilen® (macimorelin) and related out-licensing arrangements, including the continued

availability of funds and resources to successfully commercialize the product; our ability to enter into additional out-licensing, development,

manufacturing, marketing and distribution agreements with other pharmaceutical companies and to keep such agreements in effect; and our

ability to continue to list our common shares on the Nasdaq or the TSX. These risk factors are not intended to represent a complete list

of the risk factors that could affect the Company. These factors and assumptions, however, should be considered carefully. More detailed

information about these and other factors is included under Item 3, D. – “Risk

factors” in our most recent Annual Report on Form 20-F.

Although

the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in

forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. Many of these

factors are beyond our control. There can be no assurance that such statements will prove to be accurate, as actual results and future

events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking

statements. The Company does not undertake to update any forward-looking statements contained herein, except as required by applicable

securities laws. New factors emerge from time to time, and it is not possible for the Company to predict all of these factors, or to

assess in advance the impact of each such factor on the Company’s business or the extent to which any factor, or combination of

factors, may cause actual results to differ materially from those contained in any forward-looking statement.

Certain

forward-looking statements contained herein about prospective results of operations, financial position or cash flows may constitute

a financial outlook. Such statements are based on assumptions about future events, are given as of the date hereof and are based on economic

conditions, proposed courses of action and management’s assessment of currently available relevant information. The Company’s

management has approved the financial outlook as of the date hereof. Readers are cautioned that such financial outlook information contained

herein should not be used for purposes other than for which it is disclosed herein.

About

Material Information

This

MD&A includes information that we believe to be material to investors after considering all circumstances. We consider information

and disclosures to be material if they result in, or would reasonably be expected to result in, a significant change in the market price

or value of our securities, or where it is likely that a reasonable investor would consider the information and disclosures to be important

in making an investment decision.

We

are a reporting issuer under the securities legislation of all of the provinces of Canada, and our securities are registered with the

U.S. Securities and Exchange Commission (“SEC”). We are therefore required to file or furnish continuous disclosure information,

such as interim and annual financial statements, management’s discussion and analysis, proxy or information circulars, annual reports

on Form 20-F, material change reports and press releases with the appropriate securities regulatory authorities. Additional information

about the Company and copies of these documents may be obtained free of charge upon request from our Corporate Secretary or on the Internet

at the following addresses: www.zentaris.com, www.sedarplus.caand www.sec.gov.

Company

Overview

Aeterna

Zentaris is a specialty biopharmaceutical company commercializing and developing therapeutics and diagnostic tests. The Company’s

lead product, Macrilen® (macimorelin), is the first and only U.S. Food and Drug Administration (“FDA”) and

European Medicines Agency (“EMA”) approved oral test indicated for the diagnosis of patients with adult growth hormone deficiency

(“AGHD”). Macimorelin is currently marketed under the tradename Ghryvelin™ in the European Economic Area and the United

Kingdom through an exclusive licensing agreement with Pharmanovia. The Company’s several other license and commercialization partners

are also seeking approval for commercialization of macimorelin in Israel and the Palestinian Authority, the Republic of Korea, Turkey

and several non-European Union Balkan countries. The Company is actively pursuing business development opportunities for the commercialization

of macimorelin in North America, Asia and the rest of the world. We are also leveraging the clinical success and compelling safety profile

of macimorelin to develop the compound for the diagnosis of CGHD, an area of significant unmet need.

The

Company is also dedicated to the development of therapeutic assets and has established a pre-clinical development pipeline to potentially

address unmet medical needs across a number of indications, with a focus on rare or orphan indications, including, Neuromyelitis Optica

Spectrum Disorder (NMOSD), Parkinson’s Disease (PD), chronic hypoparathyroidism and ALS (Lou Gehrig’s Disease).

Key

Operational Developments

Macimorelin

Commercialization Program

On

March 15, 2023, with the Company’s consent, Consilient Health Limited (“CH”) entered into an assignment agreement with

Atnahs Pharma UK Ltd. (Pharmanovia) to transfer the current licensing agreement for the commercialization of macimorelin in the European

Economic Area and the United Kingdom to Pharmanovia, as well as the current supply agreement pursuant to which the Company agreed to

provide the licensed product. Also on March 15, 2023, the Company and Pharmanovia entered into an amendment agreement, pursuant to which

the Company provided its acknowledgement and consent to the Assignment Agreement and agreed to certain amended terms which do not materially

differ from the previous license and supply agreement with CH. To date, we have received total pricing milestone payments from CH of

$0.5 million (€0.5 million) relating to Ghryvelin™ approved list prices in the United Kingdom, German and Spain. We shipped

initial batches of macimorelin (Ghryvelin™) to Consilient in the first quarter of 2022. Consilient launched the product meanwhile

in the United Kingdom, Sweden, Denmark, Finland, Germany and Austria. More EU countries will follow pending re-imbursement negotiations.

On April 19, 2022, we announced that European Patent Office had issued a patent providing intellectual property protection of macimorelin

in 27 countries within the European Union as well as additional European non-EU countries, such as the UK and Turkey, for macimorelin

(Ghryvelin™; Macrilen®) for use to diagnose GHD in adults.

On

May 9, 2023, the USPTO issued patent US11,644,474 to the Company protecting the use of macimorelin for the diagnosis of GHD in pediatrics.

Since

November 2020, Novo marketed macimorelin under the tradename Macrilen® through a license agreement and an amended license

agreement (collectively the “Novo Amendment”) for the diagnosis of AGHD. On August 26, 2022, the Company announced that Novo

had exercised its right to terminate the Novo Amendment. Following a 270-day notice period, Aeterna regained full rights to Macrilen®

in the U.S. and Canada on May 23, 2023, and the sales of Macrilen® are temporarily discontinued in the U.S. commercial market

for the diagnosis of AGHD, until an anticipated re-launch with an alternate commercialization partner. The Company continues to actively

strategize and seek alternate development and commercialization partners for Macrilen® in the U.S. and other territories. The decision

to temporarily discontinue sales of Macrilen® in the United States does not have any impact on the sales and commercialization efforts

in the UK and European Economic Area.

On

June 25, 2020, we announced that we entered into an exclusive distribution and related quality agreement with MegaPharm Ltd., a leading

Israel-based biopharmaceutical company, for the commercialization in Israel and in the Palestinian Authority of macimorelin, to be used

in the diagnosis of patients with AGHD and in clinical development for the diagnosis of CGHD. Under the terms of the agreement, MegaPharm

Ltd. will be responsible for obtaining registration to market macimorelin in Israel and the Palestinian Authority, while the Company

will be responsible for manufacturing, product supply, quality assurance and control, regulatory support, and maintenance of the relevant

intellectual property. In June 2021, MegaPharm Ltd. filed an application to the Ministry of Health of Israel for regulatory approval

of macimorelin in Israel, which was approved in November 2022.

We

entered into license and supply agreements with NK Meditech Ltd. (“NK”), a subsidiary of PharmBio Korea, effective November

30, 2021, and a distribution and commercialization agreement with ER Kim Pharmaceuticals Bulgaria Eood (“ER-Kim”), effective

February 1, 2022. The agreements with NK are related to the development and commercialization of macimorelin for the diagnosis of AGHD

and CGHD in the Republic of Korea, while the agreement with ER-Kim is related to the commercialization of macimorelin for the diagnosis

of growth hormone deficiency in children and adults in Turkey and some non-European Union Balkan countries.

Macimorelin

Clinical Program

On

January 28, 2020, we announced the successful completion of patient recruitment for the first pediatric study of macimorelin as a growth

hormone stimulation test for the evaluation of GHD in children. This study, AEZS-130-P01 (“Study P01”), was the first of

two studies as agreed with the EMA in our Pediatric Investigation Plan (the “PIP”) for macimorelin as a GHD diagnostic. Macimorelin,

a ghrelin agonist, is an orally active small molecule that stimulates the secretion of growth hormone from the pituitary gland into the

circulatory system. The goal of Study P01 was to establish a dose that can both be safely administered to pediatric patients and cause

a clear rise in growth hormone concentration in subjects ultimately diagnosed as not having GHD. The recommended dose derived from Study

P01 is being evaluated in the pivotal second study, Study P02, on diagnostic efficacy and safety (the “DETECT-trial”). Study

P01 was an international, multicenter study, which was conducted in Hungary, Poland, Ukraine, Serbia, Belarus and Russia. Study P01 was

an open label, group comparison, dose escalation trial designed to investigate the safety, tolerability, and pharmacokinetic/pharmacodynamic

(“PK/PD”) of macimorelin acetate after ascending single oral doses of macimorelin at 0.25, 0.5, and 1.0 milligram per kilogram

body weight in pediatric patients from 2 to less than 18 years of age with suspected CGHD. We enrolled a total of 24 pediatric patients

across the three cohorts of the study. Per study protocol, all enrolled patients completed four study visits after successful completion

of the screening period. At Visit 1 and Visit 3, a provocative growth hormone stimulation test was conducted according to the study sites’

local practices. At Visit 2, the macimorelin test was performed, and following the oral administration of the macimorelin solution, blood

samples were taken at predefined times for PK/PD assessment. Visit 4 was a safety follow-up visit at study end.

The

final study results from Study P01 were published in the second quarter of 2020 indicating positive safety and tolerability data for

use of macimorelin in CGHD, as well as PK/PD data observed in a range as expected from the adult studies.

On

April 7, 2020, we announced the decision of the EMA to accept our modification request of our PIP as originally approved in March 2017,

which covered the conduct of two pediatric studies and defined relevant key elements in the outline of these studies. We believe this

EMA decision supports the development of one globally harmonized study protocol for test validation, specifically Study P02, which we

expect to be accepted both in Europe and the U.S.

In

late 2020, we entered into the start-up phase for the clinical safety and efficacy study, AEZS-130-P02 (“DETECT-trial”),

evaluating macimorelin for the diagnosis of CGHD. The DETECT-trial is an open-label, single dose, multicenter and multinational study

expected to enroll approximately 100 subjects worldwide (incl. sites in U.S: and EU), with at least 40 pre-pubertal and 40 pubertal subjects.

The study design is expected to be suitable to support a claim for potential stand-alone testing, if successful. On April 22, 2021, the

U.S. FDA Investigational New Drug Application associated with this clinical trial became active, (see: https://clinicaltrials.gov/ct2/show/NCT04786873),

and on May 13, 2021, we announced the opening of the first clinical site in the U.S. Under the Novo Amendment, and following Novo’s

notice to terminate the Novo Amendment, Novo will fund DETECT-trial costs up to $10.1 million (€9.4 million). Any additional trial

costs incurred over $10.1 million (€9.4 million) will be paid by Aeterna.

On

January 26, 2022, we announced that the DETECT-trial had experienced unavoidable delays in site initiation and patient enrollment due

to the rise of the Omicron variant in the COVID-19 pandemic. Furthermore, in February 2022, due to the Russian invasion of Ukraine, the

clinical trial activities planned in both Russia and Ukraine were halted and consequently, no patients have been enrolled in either of

these countries’ clinical sites to date. On January 17, 2023, we provided a business update, highlighting that bolstered enrollment

was expected by the engagement of an additional Clinical Research Organization (CRO) and the replacement of inactive countries and sites

with three new countries (Armenia, Slovakia, and Turkey) as well as additional sites in the U.S. In March 2023, we received approval

for and activated our first site in Slovakia and expect the approval and activation of sites in Armenia and Turkey to follow in Q3, 2023.

We expect enrollment in our DETECT-trial to be completed by the end of 2023.

Pipeline

Expansion Opportunities

AIM

Biologicals: Targeted, highly specific autoimmunity modifying therapeutics for the potential treatment of neuromyelitis optica spectrum

disorder and Parkinson’s disease

AIM

Biologicals is based on a natural process during pregnancy, which induces immunogenic tolerance of the maternal immune system to the

partially foreign fetal antigens. Fetal proteins are processed and presented on certain immunosuppressive major histocompatibility complex

class I molecules to induce this tolerance. In an autoimmune disease the immune system is misdirected and targets the body’s own

protein. With AIM Biologicals, we aim to restore the tolerance against such proteins to treat autoimmune diseases. Our AIM Biologics

program is focused on the rare and orphan indication NMOSD and the second most common neurodegenerative disorder, Parkinson’s disease.

In

January 2021, we entered into an exclusive patent license and research agreement with the University of Wuerzburg, Germany, for worldwide

rights to develop, manufacture, and commercialize AIM Biologicals for the potential treatment of NMOSD. Additionally, we have engaged

Prof. Dr. Joerg Wischhusen from the University Hospital in Wuerzburg as well as neuro-immunologist Dr. Michael Levy from the Massachusetts

General Hospital in Boston as consultants for scientific support and advice in the field of inflammatory central nervous system “CNS”

disorders, autoimmune diseases of the nervous system, and NMOSD. In September 2021, we entered into an additional exclusive license with

the University of Wuerzburg for early pre-clinical development towards the potential treatment of Parkinson’s disease. On May 12,

2022 we announced positive pre-clinical results in an innovative mouse model of Parkinson’s disease, where treatment with α-Synuclein

specific AIM Biologicals showed a trend towards improved motoric function, as well as significant induction of regulatory T cells and

rescue of substantia nigra neurons. The data were presented at IMMUNOLOGY2022™, the annual event of the American Association of

Immunologists, held on May 6-10, 2022 in Portland, Oregon. On June 13, 2022, we announced that we had achieved proof-of-concept for the

treatment of NMOSD in both in-vitro and in mouse models. These findings were presented at the 13th International Congress on Autoimmunity

on June 10-13, 2022, in Athens, Greece. In October 2022, we entered into a research and development agreement with Massachusetts General

Hospital (MGH) in Boston and Dr. Michael Levy, to conduct pre-clinical ex-vivo and in-vivo studies in NMOSD.

NMOSD

is an autoimmune disease targeting the protein aquaporin 4, primarily found in optic nerves and the spinal cord. The disease leading

to blindness and paralysis has a prevalence of 0.7-10 in 100,000, more common in persons with Asian or African compared to European ancestors,

and nine times more prevalent among women compared to men. NMOSD progresses in often life-threatening relapses, which are aggressively

treated with high-dose steroids and plasmapheresis. Current treatment options include treatment with immunosuppressive monoclonal antibodies,

which carries risk of serious infections. Our pre-clinical plans include expanding the already available proof-of-concept data for the

treatment of NMOSD in both in-vitro and in-vivo assessments to select an AIM Biologicals-based development candidate; and

manufacturing process development for the selected candidate.

Parkinson’s

disease is a neurological disease commonly associated with motoric problems with a slow and fast progression form. It is the second most

common neurodegenerative disease affecting 10 million people worldwide. The hallmark of PD is the neuronal inclusion of mainly α-synuclein

protein (αSyn) associated with the death of dopamine-producing cells. Dopaminergic medication is the mainstay treatment of PD symptoms,

but currently there is no pharmacological therapy to prevent or delay disease progression leading to alternate treatments, such as deep

brain stimulation with short electric bursts, being investigated for the treatment of symptoms. For the development of AIM Biologicals

as potential PD therapeutics, Aeterna plans utilizes, among others, an innovative animal model on neurodegeneration by α-synuclein-specific

T cells in AAV-A53T-α-synuclein Parkinson’s disease mice, which has recently been published by University of Wuerzburg researchers.

We are continuing in-vitro and in-vivo testing of antigen-specific AIM Biologics candidate molecules for the potential

treatment of Parkinson’s disease.

AEZS-150

- Delayed Clearance (“DC”) Parathyroid Hormone (“PTH”) (“DC-PTH”) Fusion Polypeptides: Potential

treatment for chronic hypoparathyroidism

On

March 11, 2021, we entered into an exclusive license agreement with The University of Sheffield, United Kingdom, for the intellectual

property relating to PTH fusion polypeptides covering the field of human use, which will initially be studied by Aeterna for the potential

therapeutic treatment of chronic hypoparathyroidism (“HypoPT”). Under the terms of the exclusive patent and know-how license

agreement entered into with the University of Sheffield, we obtained worldwide rights to develop, manufacture and commercialize PTH fusion

polypeptides covered by the licensed patent applications for all human uses for an up-front cash payment, and milestone payments to be

paid upon the achievement of certain development, regulatory and sales milestones, as well as low single digit royalty payments on net

sales of those products and certain fees payable in connection with sublicensing. We will be responsible for the further development,

manufacturing, approval, and commercialization of the licensed products. We also engaged the University of Sheffield under a research

contract to conduct certain research activities to be funded by Aeterna, the results of which will be included within the scope of the

license granted to Aeterna.

The

researchers at the University of Sheffield have developed a method to increase the serum clearance time of peptides, which the Company