Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

16 Agosto 2023 - 6:19PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 Or 15d-16 Of

The Securities Exchange Act Of 1934

For the month of August 2023

Commission File Number: 001-14950

ULTRAPAR HOLDINGS INC.

(Translation of Registrant’s Name into English)

Brigadeiro Luis Antonio Avenue, 1343, 9th Floor

São Paulo, SP, Brazil 01317-910

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ____X____ Form 40-F ________

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ________ No ____X____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ________ No ____X____

ULTRAPAR HOLDINGS INC.

TABLE OF CONTENTS

ITEM

ULTRAPAR PARTICIPAÇÕES S.A.

Approval by CADE of the consortium between Ultragaz and Supergasbrás

São Paulo, August 16, 2023 – Ultrapar Participações S.A. (B3: UGPA3 / NYSE: UGP, “Ultrapar”), in addition to the market announcement disclosed on July 12, 2022, informs that the Administrative Court of the Administrative Council of Economic Defense (CADE) approved the consortium agreements between Cia Ultragaz S.A. (“Ultragaz”) and Supergasbrás Energia Ltda., for sharing part of its operations and infrastructure of LGP storage and filling bases, through the execution of a Merger Control Agreement, which preserves the rationale of the consortium.

The consortium will provide greater supply security and service levels to customers and resellers in the regions served. There will be no changes in the commercial operation of both companies.

From a financial point of view, the benefits of the agreement will come from the rationalization of future investments for the construction of new bases, since Ultragaz will expand its presence from 19 to 24 filling bases. In addition, operating synergies are estimated arising from the optimization of logistics routes and the reduction of costs with operations, filling and storage by third parties. The costs related to the implementation of the consortium are already included in Ultragaz's investment plan for 2023, as disclosed in the market announcement of December 14, 2022.

Ultrapar will keep the market and its shareholders duly informed of any relevant updates related to this announcement.

Rodrigo de Almeida Pizzinatto

Chief Financial and Investor Relations Officer

Ultrapar Participações S.A.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: August 16, 2023

|

ULTRAPAR HOLDING INC. |

|

By: /s/ Rodrigo de Almeida Pizzinatto

|

|

Name: Rodrigo de Almeida Pizzinatto

|

|

Title: Chief Financial and Investor Relations Officer

|

(Market announcement)

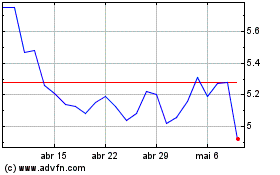

Ultrapar Participacoes (NYSE:UGP)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Ultrapar Participacoes (NYSE:UGP)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024