0001513525

false

0001513525

2023-08-21

2023-08-21

0001513525

ADIL:CommonStockParValue0.001PerShareMember

2023-08-21

2023-08-21

0001513525

ADIL:WarrantsToPurchaseSharesOfCommonStockParValue0.001PerShareMember

2023-08-21

2023-08-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (date of earliest event reported):

August 21, 2023

Adial Pharmaceuticals, Inc.

(Exact name of registrant as specified in charter)

| Delaware |

|

001-38323 |

|

82-3074668 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

1180 Seminole Trail, Ste 495

Charlottesville, VA 22901

(Address of principal executive offices and zip

code)

(434) 422-9800

(Registrant’s telephone number including

area code)

N/A

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbols |

|

Name

of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

ADIL |

|

The

Nasdaq Stock Market LLC

(Nasdaq Capital Market) |

| |

|

|

|

|

| Warrants

to Purchase Shares of Common Stock, par value $0.001 per share |

|

ADILW |

|

The

Nasdaq Stock Market LLC

(Nasdaq Capital Market) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by checkmark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02 Results of Operations and Financial

Condition.

On August 21, 2023, Adial Pharmaceuticals, Inc.,

a Delaware corporation (the “Company”), issued a press release that included financial information for the fiscal quarter

ended June 30, 2023. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Item 2.02 and in the press

release attached as Exhibit 99.1 to this Current Report on Form 8-K shall not be deemed to be “filed” for purposes of Section

18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2)

of the Securities Act of 1933, as amended. The information contained in this Item 2.02 and in the press release attached as Exhibit 99.1

to this Current Report on Form 8-K shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission

made by the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The following

exhibits are furnished with this Current Report on Form 8-K:

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: August 21, 2023 |

ADIAL PHARMACEUTICALS, INC. |

| |

|

| |

By: |

/s/ Cary J. Claiborne |

| |

Name: |

Cary J. Claiborne |

| |

Title: |

President and Chief Executive Officer |

2

Exhibit

99.1

Adial

Pharmaceuticals Reports Second Quarter 2023 Financial Results

and Provides Business Update

Reported

Positive Feedback from US and EU Regulatory Meetings

Sale

of Purnovate Significantly Reduces Cash Burn Rate

Charlottesville,

VA – August 21, 2023 – Adial Pharmaceuticals, Inc. (NASDAQ: ADIL; ADILW) (“Adial” or the “Company”),

a clinical-stage biopharmaceutical company focused on developing therapies for the treatment and prevention of addiction and related

disorders, today provided a business update and reported its financial results for the second quarter of 2023.

Cary

Claiborne, President and Chief Executive Officer of Adial, stated, “We continue to advance AD04 to meaningful inflection points

and recently received favorable feedback from our US and EU regulatory meetings. Following the feedback, we made a strategic decision

to focus our efforts on obtaining FDA approval, as the US standard should translate to acceptance in other international markets. In

addition, the FDA confirmed the primary endpoint based on Percentage of No Heavy Drinking Days (PNHDD)-patients who reduced their alcohol

consumption to zero heavy drinking days in the last two months of a six-month study. Furthermore, the FDA acknowledged that our post

hoc analysis showing a statistically and clinical meaningful effect in specific genetic subtypes was positive and promising but requested

additional data to support an NDA submission. As a result, we are currently planning to conduct two Phase 3 trials with AD04 in parallel

to support potential approval in the shortest timeframe possible. Toward this end, and now having received regulatory feedback, we are

progressing our partnering discussions and intend to provide further updates as appropriate. Overall, we remain confident in AD04’s

ability to address a significant unmet need for patients suffering from alcohol use disorder, representing an addressable market of approximately

$40 billion in the U.S. alone. Moreover, the sale of our Purnovate business during the quarter provided non-dilutive funding and significantly

reduced our current cash burn rate. Overall, we believe we are well positioned to execute on our development strategy, as well as reach

meaningful milestones that we believe will drive significant value for shareholders.”

Other

Recent Developments

Purnovate

On

May 16, 2023, Adovate, LLC, exercised its option for the purchase of the assets and business of the Company’s wholly owned subsidiary,

Purnovate, Inc. The Option Agreement provides that the parties will enter into a final acquisition agreement for the sale of the Purnovate

assets under previously agreed financial terms. Adovate was recently formed by William Stilley, co-founder and former CEO of Adial, for

the sole purpose of acquiring, funding and advancing the Purnovate assets.

Adial

received an upfront payment of $450 thousand on the notification date (May 8, 2023). After a final acquisition agreement is signed Adial

will receive approximately $1.1 million for Purnovate expenditures incurred and paid by Adial after December 1, 2022. During the quarter

Adial received $350 thousand in advance payment for reimbursement of those expenditures. Any Purnovate expenses incurred subsequent to

May 15, 2023, are now the responsibility of Adovate. In addition, the Company will be entitled to receive up to approximately $11 million

in development and approval milestones for each compound (up to $33 million in total development and approval milestones for the first

three compounds alone), as well as a total of $50 million in additional commercial milestones, for a total consideration of up to $83

million with potential milestone payments on additional compounds. Additionally, the Company will receive a single digit royalty and

has received a 19.9% equity stake in Adovate.

The

transaction was independently evaluated and unanimously approved, first by the Adial Audit Committee of the Board of Directors, and then

by its full Board of Directors, with Mr. Stilley, a current board member, abstaining from the vote.

Second

Quarter 2023 Financial Results

| ● | Cash

Position: As of June 30, 2023, cash and cash equivalents were $1.2 million compared to $4.0

million as of December 31, 2022. The Company believes that its existing cash and cash equivalents,

as well as the impact of the agreement to sell its Purnovate’s Assets and Business,

will fund its operating expenses into the first quarter of 2024. Under the agreement, the

Company received non-dilutive funding and the sale has significantly reduced its current

cash burn rate. |

| ● | Research

and Development expenses decreased by $250 thousand (37%) in the three months ended June

30, 2023 compared to the three months ended June 30, 2022. This decrease was driven partly

by a reduction of approximately $96 thousand in direct development costs of AD04 as trial

activities, which were winding down in the second quarter of 2022, were no longer taking

place in the second quarter of 2023, replaced by less expensive regulatory consultations

and data analysis. In addition, a one-time accrual of $155 thousand for a royalty due the

University of Virginia Patent Foundation took place in the second quarter of 2022. |

| ● | General

and Administration expenses decreased by $1.5 million (59%) in the three months ended June

30, 2023 compared to the three months ended June 30, 2022. This decrease was primarily due

to expense reductions of approximately $0.9 million and lower equity compensation expense

of approximately $0.4 million, which were due to reduced bonus payments and headcount. |

| ● | Net

Income was $1.1 million for the three months ended June 30, 2023, compared to a net loss

of $3.8 million for the three months ended June 30, 2022. Net Income for the second quarter

of 2023 included a gain of $2.66 million as a result of the Purnovate Sale. |

About

Adial Pharmaceuticals, Inc.

Adial

Pharmaceuticals is a clinical-stage biopharmaceutical company focused on the development of therapies for the treatment and prevention

of addiction and related disorders. The Company’s lead investigational new drug product, AD04, is a genetically targeted, serotonin-3

receptor antagonist, therapeutic agent for the treatment of Alcohol Use Disorder (AUD) in heavy drinking patients and was recently investigated

in the Company’s ONWARD™ pivotal Phase 3 clinical trial for the potential treatment of AUD in subjects with certain target

genotypes (estimated to be approximately one-third of the AUD population) identified using the Company’s proprietary companion

diagnostic genetic test. ONWARD showed promising results in reducing heavy drinking in heavy drinking patients, and no overt safety or

tolerability concerns. AD04 is also believed to have the potential to treat other addictive disorders such as Opioid Use Disorder, gambling,

and obesity. The Company is also developing adenosine analogs for the treatment of pain and other disorders. Additional information is

available at www.adial.com.

Forward

Looking Statements

This

communication contains certain “forward-looking statements” within the meaning of the U.S. federal securities laws. Such statements

are based upon various facts and derived utilizing numerous important assumptions and are subject to known and unknown risks, uncertainties

and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance

or achievements expressed or implied by such forward-looking statements. Statements preceded by, followed by or that otherwise include

the words “believes,” “expects,” “anticipates,” “intends,” “projects,” “estimates,”

“plans” and similar expressions or future or conditional verbs such as “will,” “should,” “would,”

“may” and “could” are generally forward-looking in nature and not historical facts, although not all forward-looking

statements include the foregoing. The forward-looking statements include statements regarding FDA approval translating to acceptance

in other international markets, plans to conduct two Phase 3 trials with AD04 in parallel to support potential approval in the shortest

timeframe possible, progressing with partnering discussions and providing further updates as appropriate, AD04’s ability to address

a significant unmet need for patients suffering from alcohol use disorder, representing an addressable market of approximately $40 billion

in the U.S. alone, being well positioned to execute on the Company’s development strategy and reach meaningful milestones that

will drive significant value for shareholders and the potential of AD04 to treat other addictive disorders such as opioid use disorder,

gambling, and obesity. Any forward-looking statements included herein reflect our current views, and they involve certain risks and uncertainties,

including, among others, our ability to pursue our regulatory strategy, our ability to advance ongoing partnering discussions, our ability

to obtain regulatory approvals for commercialization of product candidates or to comply with ongoing regulatory requirements, our ability

to develop strategic partnership opportunities and maintain collaborations, our ability to obtain or maintain the capital or grants necessary

to fund our research and development activities, our ability to retain our key employees or maintain our Nasdaq listing, our ability

to complete clinical trials on time and achieve desired results and benefits as expected, regulatory limitations relating to our ability

to promote or commercialize our product candidates for specific indications, acceptance of our product candidates in the marketplace

and the successful development, marketing or sale of our products, our ability to maintain our license agreements, the continued maintenance

and growth of our patent estate and our ability to retain our key employees or maintain our Nasdaq listing,. These risks should not be

construed as exhaustive and should be read together with the other cautionary statement included in our Annual Report on Form 10-K for

the year ended December 31, 2022, subsequent Quarterly Reports on Form 10-Q and current reports on Form 8-K filed with the Securities

and Exchange Commission. Any forward-looking statement speaks only as of the date on which it was initially made. We undertake no obligation

to publicly update or revise any forward-looking statement, whether as a result of new information, future events, changed circumstances

or otherwise, unless required by law.

Contact:

Crescendo

Communications, LLC

David

Waldman / Alexandra Schilt

Tel:

212-671-1020

Email:

ADIL@crescendo-ir.com

v3.23.2

Cover

|

Aug. 21, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 21, 2023

|

| Entity File Number |

001-38323

|

| Entity Registrant Name |

Adial Pharmaceuticals, Inc.

|

| Entity Central Index Key |

0001513525

|

| Entity Tax Identification Number |

82-3074668

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1180 Seminole Trail

|

| Entity Address, Address Line Two |

Ste 495

|

| Entity Address, City or Town |

Charlottesville

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

22901

|

| City Area Code |

434

|

| Local Phone Number |

422-9800

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Common Stock, par value $0.001 per share |

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

ADIL

|

| Security Exchange Name |

NASDAQ

|

| Warrants to Purchase Shares of Common Stock, par value $0.001 per share |

|

| Title of 12(b) Security |

Warrants

to Purchase Shares of Common Stock, par value $0.001 per share

|

| Trading Symbol |

ADILW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ADIL_CommonStockParValue0.001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ADIL_WarrantsToPurchaseSharesOfCommonStockParValue0.001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

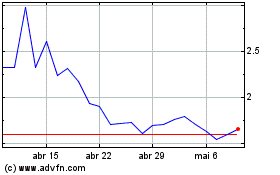

Adial Pharmaceuticals (NASDAQ:ADIL)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Adial Pharmaceuticals (NASDAQ:ADIL)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025