Form SC 13D/A - General statement of acquisition of beneficial ownership: [Amend]

27 Outubro 2023 - 5:30PM

Edgar (US Regulatory)

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| SCHEDULE 13D/A |

| |

| Under the Securities Exchange Act of 1934 |

| (Amendment No. 3)* |

| |

|

Sequans

Communications S.A. |

| (Name of Issuer) |

| |

|

Ordinary

Shares, nominal value €0.01 per share |

| (Title of Class of Securities) |

| |

|

817323207** |

| (CUSIP Number) |

| |

| B. Riley Asset Management, LLC |

| 3811 Turtle Creek Boulevard, Suite 2100 |

| Dallas, TX 75219 |

| |

| Eleazer Klein, Esq. |

| Adriana Schwartz, Esq. |

| Schulte Roth & Zabel LLP |

| 919 Third Avenue |

| New York, NY 10022 |

|

(212)

756-2000 |

| (Name, Address and Telephone Number of Person |

| Authorized to Receive Notices and Communications) |

| |

|

April

3, 2023, August 4, 2023 and September 26, 2023 |

| (Date of Event Which Requires Filing of This Statement) |

| |

If the filing person has previously filed

a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of

Rule 13d-1(e), Rule 13d-1(f) or Rule 13d-1(g), check the following box. ¨

(Page 1 of 8

Pages)

______________________________

* The remainder of this cover page shall

be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any

subsequent amendment containing information which would alter disclosures provided in a prior cover page.

** The Ordinary Shares have no CUSIP

number. The CUSIP number for the Issuer’s American Depositary Shares, each representing four Ordinary Shares, is 817323207.

The information required on the remainder

of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934

(“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of

the Act (however, see the Notes).

| CUSIP No. 817323207 | SCHEDULE 13D/A | Page 2 of 8 Pages |

| 1 |

NAME OF REPORTING PERSON

B. Riley Asset Management,

LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

AF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

-0- |

| 8 |

SHARED VOTING POWER

45,013,764 ordinary

shares (represented by 11,253,411 ADSs)* |

| 9 |

SOLE DISPOSITIVE POWER

-0- |

| 10 |

SHARED DISPOSITIVE POWER

45,013,764 ordinary

shares (represented by 11,253,411 ADSs)* |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED

BY EACH REPORTING PERSON

45,013,764 ordinary

shares (represented by 11,253,411 ADSs)* |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11)

18.5%* |

| 14 |

TYPE OF REPORTING PERSON

IA |

| |

|

|

|

|

*As of the date hereof and

as of September 26, 2023. As of August 4, 2023, the Reporting Persons beneficially owned 36,533,200 Shares (as defined below) (represented

by 9,133,300ADSs), representing 15.6% of the Shares, based on 233,824,336 Shares outstanding as of June 30, 2023, as reported in the

Issuer’s Press Release, attached as Exhibit 99.1 to the Report of Foreign Private Issuer filed on Form 6-K with the Securities

and Exchange Commission (“SEC”) on August 7, 2023. As of April 3, 2023, the Reporting Persons beneficially owned 36,533,200

Shares (represented by 9,133,300 ADSs), representing 15.7% of the Shares, based on 233,093,250 Shares outstanding as of April 3, 2023,

which is the sum of (i) 194,258,298 Shares outstanding as of March 31, 2023, as reported in the Issuer’s Press Release, included

as Exhibit 99.1 to the Report of Foreign Private Issuer on Form 6-K filed with the SEC on May 7, 2023 and (ii) 38,834,952 Shares underlying

the 9,708,738 ADSs issued in a private placement as disclosed in the Report of Foreign Private Issuer on Form 6-K filed with the SEC

on April 4, 2023.

| CUSIP No. 817323207 | SCHEDULE 13D/A | Page 3 of 8 Pages |

| 1 |

NAME OF REPORTING PERSON

Wes Cummins |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

AF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

-0- |

| 8 |

SHARED VOTING POWER

45,013,764 (represented by 11,253,411 ADSs)* |

| 9 |

SOLE DISPOSITIVE POWER

-0- |

| 10 |

SHARED DISPOSITIVE POWER

45,013,764 (represented by 11,253,411 ADSs)* |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED

BY EACH REPORTING PERSON

45,013,764 (represented by 11,253,411 ADSs)* |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11)

18.5%* |

| 14 |

TYPE OF REPORTING PERSON

IN |

| |

|

|

|

|

*As of the date hereof

and as of September 26, 2023. As of August 4, 2023, the Reporting Persons beneficially owned 36,533,200 Shares (represented by

9,133,300 ADSs), representing 15.6% of the Shares, based on 233,824,336 Shares outstanding as of June 30, 2023, as reported in the

Issuer’s Press Release, attached as Exhibit 99.1 to the Issuer’s Report filed on Form 6-K with the SEC on August 7,

2023. As of April 3, 2023, the Reporting Persons beneficially owned 36,533,200 Shares (represented by 9,133,300 ADSs), representing

15.7% of the Shares, based on 233,093,250 Shares outstanding as of April 3, 2023, which is the sum of (i) 194,258,298 Shares

outstanding as of March 31, 2023, as reported in the Issuer’s Press Release, included as Exhibit 99.1 to the Issuer’s

Report on Form 6-K filed with the SEC on May 7, 2023 and (ii) 38,834,952 Shares underlying the 9,708,738 ADSs issued in a private

placement as disclosed in the Issuer’s Report on Form 6-K filed with the SEC on April 4, 2023.

| CUSIP No. 817323207 | SCHEDULE 13D/A | Page 4 of 8 Pages |

The following

constitutes Amendment No. 3 (“Amendment No. 3”) to the Schedule 13D filed by the undersigned on March 24, 2022 with

respect to the ordinary shares, nominal value €0.01 per share (the “Shares”) of the Issuer (the “Original

Schedule 13D”), as amended by Amendment No. 1 filed on September 6, 2023 (“Amendment No. 1”) and

Amendment No. 2 filed on December 5, 2023 (“Amendment No. 2” and, together with Amendment No. 1, the “Schedule

13D”). This Amendment No. 3 amends the Original Schedule 13D as specifically set forth herein. Capitalized terms used and not

otherwise defined in this Amendment No. 3 have the meanings set forth in the Schedule 13D.

| Item 3. |

SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION |

| |

|

| Item 3 of the Schedule 13D is hereby amended and restated as follows: |

| |

|

| |

Funds for the

purchase of the ADSs reported herein were derived from general working capital of the BRAM Funds and Accounts. A total of

approximately $32,396,929, including brokerage commissions, was paid to acquire the Shares reported herein, as beneficially owned by

the Reporting Persons as of September 26, 2023 and as of the date hereof. A total of approximately $26,396,930, including brokerage

commissions, was paid to acquire the Shares reported herein, as beneficially owned by the Reporting Persons as of August 4, 2023 and

as of April 3, 2023.

The Reporting

Persons have and may effect purchases of ADSs through margin accounts maintained with prime brokers, which extend margin credit as

and when required to open or carry positions in their margin accounts, subject to applicable federal margin regulations, stock

exchange rules and such firms’ credit policies. Positions in the Shares may be held in margin accounts and may be pledged as

collateral security for the repayment of debit balances in such accounts. |

| Item 4. |

PURPOSE OF TRANSACTION |

| |

|

| Item 4 of the Schedule 13D is hereby amended and supplemented by the addition of the following: |

| |

|

| |

April 2023

Securities Purchase Agreement and Registration Rights Agreement |

| |

|

| |

As disclosed in

the Report of Foreign Private Issuer on Form 6-K filed by the Issuer with the SEC on April 4, 2023, on April 3, 2023, the Issuer

entered into a Securities Purchase Agreement (the “April Purchase Agreement”) with certain existing shareholders,

including the BRAM Funds and Accounts (the “April Purchasers”). The BRAM Funds and Accounts purchased an

aggregate of 3,930,663 ADSs at a price of $2.06 per ADS pursuant to the April Purchase Agreement. |

| |

|

| |

In connection with

the April Purchase Agreement, the Issuer and the April Purchasers entered into a Registration Rights Agreement, dated April 12, 2023 (the

“April Registration Rights Agreement” and, together with the April Purchase Agreement, the “April Agreements”),

which grants customary registration rights to the April Purchasers with respect to the Shares acquired under the April Purchase Agreement. |

| |

|

| CUSIP No. 817323207 | SCHEDULE 13D/A | Page 5 of 8 Pages |

| |

The foregoing

summary of the April Agreements does not purport to be complete and is subject to, and is qualified in its entirety by, the full text

of the April Purchase Agreement and the April Registration Rights Agreements, which are attached as Exhibit 99.2 and Exhibit 99.3,

respectively, to this Schedule 13D.

Tender and Support

Agreement

As disclosed

in the Report of Foreign Private Issuer filed by the Issuer with the SEC on August 7, 2023, on August 4, 2023, 272 Capital Master

Fund, LTD (“272”), a BRAM Fund, entered into a Tender and Support Agreement (the “Support Agreement”)

with Renesas Electronics Corporation, a Japanese corporation (“Renesas”), in connection with the Memorandum of

Understanding (as amended from time to time, including by that certain Amendment No. 1 to the MoU, dated September 2, 2023, the “MoU”)

entered into by the Issuer and Renesas.

The MoU,

which has been approved by the board of directors of the Issuer, provides, among other things, for Renesas and the Issuer to engage

in a series of transactions pursuant to which, among other transactions, Renesas would seek to acquire (through an affiliate) all of

the issued and outstanding Shares of the Issuer, including ADSs, including restricted Shares, and Shares issuable upon the exercise

of any outstanding options, warrants, convertible securities or rights to purchase, subscribe for, or be allocated Shares, pursuant

to a cash tender offer (the “Offer”) (i) at a price of $3.03 per ADS or approximately $0.7575 per Share, and (ii)

with respect to the Company Share Options, Company RSAs and Company Warrants (as such terms are defined in the MoU), implement the

cash payment arrangement and the various other liquidity mechanisms described in the MoU, each upon the terms and subject to the

conditions set forth in the MoU. On September 11, 2023, the Issuer commenced the Offer and on October 5, 2023, the Issuer announced

an extension of the expiration date of the Offer until one minute after 11:59 p.m., New York City time, on October 23, 2023, and on

October 20, 2023, the Issuer announced a further extension of the offer until one minute after 11:59 p.m., New York City time, on

November 6, 2023 unless further extended or earlier terminated in accordance with the MoU.

Pursuant

to the Support Agreement, 272 agreed to, among other things, tender all of the 3,590,803 ADSs (representing 14,363,212 Shares) held

by it at the time of signing the Support Agreement and any additional ADSs or Shares acquired by it prior to the expiration of the

Offer (with certain exceptions) into the Offer in the applicable manner set forth in the MoU. 272 currently holds a total of

5,710,944 ADSs representing 22,843,776 Shares, as of the date hereof. In addition, 272 has agreed to vote in favor of the

transactions contemplated by the MoU at any meeting of shareholders, and thereat against (i) any action or agreement that 272 knows

is reasonably likely to result in a breach of any representation, warranty, covenant or obligation of the Issuer in the MoU, (ii)

any Alternate Proposal (as defined in the MoU), (iii) any amendment to the Issuer’s organizational documents that is

prohibited by the MoU, (iv) any change in the Issuer’s authorized capitalization or corporate structure, and (v) any other

action that would reasonably be expected to, or is intended to, impeded, prevent, delay or adversely affect the Offer or the other

transactions contemplated by the MoU or the Support Agreement. The Support Agreement terminates upon the occurrence of certain

events, including the termination of the MoU in accordance with its terms. |

| CUSIP No. 817323207 | SCHEDULE 13D/A | Page 6 of 8 Pages |

| |

|

| |

The foregoing description

of the Support Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the form of

the Support Agreement, a copy of which is included as Exhibit 99.4 hereto and incorporated by reference herein. |

| |

|

| |

September 2023 Securities Purchase Agreement and Registration Rights Agreement |

| |

|

| |

As disclosed in the Report of Foreign Private Issuer filed

by the Issuer with the SEC on October 2, 2023, on September 26, 2023, the Issuer entered into a Securities Purchase Agreement (the “September

Purchase Agreement”) with 272 pursuant to which 272 purchased an aggregate of 2,120,141 ADSs at a price of $2.83 per ADS (the

“September Private Placement”). |

| |

|

| |

In connection with

the September Purchase Agreement, the Issuer and 272 entered into a Registration Rights Agreement, dated September 29, 2023 (the “September

Registration Rights Agreement” and, together with the September Purchase Agreement, the “September Agreements”),

which grants customary registration rights to 272 with respect to the Shares acquired under the September Purchase Agreement. |

| |

|

| |

The foregoing summary

of the September Agreements does not purport to be complete and is subject to, and is qualified in its entirety by, the full text of the

September Agreements, which is attached as Exhibit 99.5 to this Schedule 13D. |

| Item 5. |

INTEREST IN SECURITIES OF THE ISSUER |

| |

|

| Items 5(a)-(c) of the Schedule 13D are hereby amended and restated in their entirety as follows: |

| |

|

| (a) |

See rows

(11) and (13) of the cover pages to this Schedule 13D for the aggregate number of Shares and percentages of the Shares beneficially

owned by the Reporting Persons. The aggregate percentages of Shares reported to be beneficially owned by the Reporting

Persons as of the date hereof and as of September 26, 2023 is based upon 242,681,214 Shares outstanding, which is the sum of (i)

234,200,650 Shares outstanding as of September 6, 2023, as reported in the Issuer’s Solicitation/Recommendation Statement on

Schedule 14D-9 filed with the SEC on September 11, 2023 and (ii) 8,480,564 Shares issued in connection with the September

Private Placement. |

| |

|

| CUSIP No. 817323207 | SCHEDULE 13D/A | Page 7 of 8 Pages |

| (b) |

See rows (7) through (10) of the cover pages to this Schedule 13D for the number of Shares as to which each Reporting Person has the sole or shared power to vote or direct the vote and sole or shared power to dispose or to direct the disposition. |

| |

|

| (c) |

Other than as described in Item 4, the Reporting Persons have not effected any transactions in the Shares during the 60 days prior to (i) April 3, 2023, (ii) August 4, 2023, (iii) September 26, 2023 or (iv) the date hereof. |

| Item 6. |

CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER |

| |

|

| Item 6 of the Schedule 13D is hereby amended and supplemented by the addition of the following: |

| |

|

| |

Item 4 of this Amendment No. 3 is incorporated by reference herein. |

| Item 7. |

MATERIAL TO BE FILED AS EXHIBITS |

| |

|

| Item 7 of the Schedule 13D is hereby amended and supplemented by the addition of the following: |

| |

|

| Exhibit 99.2 |

April Purchase Agreement (incorporated by reference to Exhibit 4.3 to the Registration Statement on Form F-3 filed with the SEC by the Issuer on May 12, 2023). |

| |

|

| Exhibit 99.3 |

April Registration Rights Agreement (incorporated by reference to Exhibit 4.4 to the Registration Statement on Form F-3 filed with the SEC by the Issuer on May 12, 2023). |

| |

|

| Exhibit 99.4 |

Support Agreement (incorporated by reference to Exhibit 99.3 to the Issuer’s Report on Form 6-K, filed with the SEC on August 7, 2023). |

| |

|

| Exhibit 99.5 |

September Purchase Agreement and September Registration Rights Agreement (incorporated by reference to Exhibit (e)(62) to the Solicitation/Recommendation Statement on Schedule 14D-9/A filed with the SEC by the Issuer on October 4, 2023). |

| CUSIP No. 817323207 | SCHEDULE 13D/A | Page 8 of 8 Pages |

SIGNATURES

After

reasonable inquiry and to the best of his or its knowledge and belief, the undersigned certifies that the information set forth in this

statement is true, complete and correct.

Date: October 27, 2023

| B. Riley Asset Management, LLC |

|

|

| |

|

|

| |

|

|

| /s/ Wes Cummins |

|

|

| Name: Wes Cummins |

|

|

| Title: President |

|

|

| |

|

|

| /s/ Wes Cummins |

|

|

| WES CUMMINS |

|

|

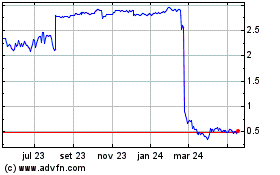

Sequans Communications (NYSE:SQNS)

Gráfico Histórico do Ativo

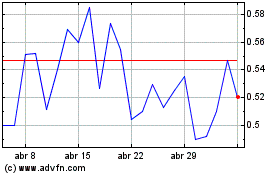

De Nov 2024 até Dez 2024

Sequans Communications (NYSE:SQNS)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024