Page 2 of 32 Table of Contents Page Executive Summary 3 Corporate Information 6 Consolidated Balance Sheets 8 Consolidated Statements of Operations 9 Funds from Operations & Adjusted Funds from Operations 10 Consolidated Same-Store Property Performance 11 NOI Detail 12 Debt Summary & Debt Metrics 13 Debt Maturities, Composition & Hedging Instruments 14 Debt Covenant Compliance 15 Existing Portfolio Summary 16 Office Properties by Location 17 Office Properties Occupancy Detail 18 15 Largest Office Tenants 19 Studio Properties & Services 20 Office Leasing Activity 21 Expiring Office Leases Summary 22 Uncommenced, Backfilled & Expiring Office Leases—Next Eight Quarters 23 Under Construction & Future Development Pipeline 25 Consolidated & Unconsolidated Ventures 26 Definitions 27 Non-GAAP Reconciliations 30 Hudson Pacific Properties, Inc. is referred to herein as the “Company,” “Hudson Pacific,” “HPP,” “we,” “us,” or “our.” This Supplemental Information contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Future events and actual results, financial and otherwise, may differ materially from the results discussed in the forward-looking statements. You should not rely on forward-looking statements as predictions of future events. Forward-looking statements involve numerous risks and uncertainties that could significantly affect anticipated results in the future and, accordingly, such results may differ materially from those expressed in any forward-looking statement made by us. These risks and uncertainties include, but are not limited to: adverse economic or real estate developments in our target markets; general economic conditions; defaults on, early terminations of or non-renewal of leases by tenants; fluctuations in interest rates and increased operating costs; our failure to obtain necessary outside financing, including as a result of further downgrades in the credit ratings of our unsecured indebtedness; our failure to comply with the covenants contained in the agreements governing our outstanding indebtedness; our failure to generate sufficient cash flows to service our outstanding indebtedness, repay indebtedness when due and maintain dividend payments; lack or insufficient amounts of insurance; decreased rental rates or increased vacancy rates; strikes or work stoppages; difficulties in identifying properties to acquire and completing acquisitions; our failure to successfully operate acquired properties and operations; our failure to maintain our status as a REIT; the loss of key personnel; environmental uncertainties and risks related to adverse weather conditions and natural disasters; financial market and foreign currency fluctuations; risks related to acquisitions generally, including the diversion of management’s attention from ongoing business operations and the impact on customers, tenants, lenders, operating results and business; the inability to successfully integrate acquired properties, realize the anticipated benefits of acquisitions or capitalize on value creation opportunities; changes in the tax laws and uncertainty as to how those changes may be applied; changes in real estate and zoning laws and increases in real property tax rates; an epidemic or pandemic, and the measures that international, federal, state and local governments, agencies, law enforcement and/or health authorities may implement to address it, which may precipitate or exacerbate one or more of the above-mentioned factors and/or other risks, and significantly disrupt or prevent us from operating our business in the ordinary course for an extended period; and other factors affecting the real estate industry generally. These factors are not exhaustive. For a discussion of important risks related to Hudson Pacific’s business and an investment in its securities, including risks that could cause actual results and events to differ materially from results and events referred to in the forward-looking information, see the discussion under the caption “Risk Factors” in the Company’s Annual Report on Form 10-K as well as other risks described in documents we file with the Securities and Exchange Commission, or SEC. You are cautioned that the information contained herein speaks only as of the date hereof and Hudson Pacific assumes no obligation to update any forward-looking information, whether as a result of new information, future events or otherwise. This Supplemental Information also includes non-GAAP financial measures, which are accompanied by what we consider the most directly comparable financial measures calculated and presented in accordance with GAAP. In addition, quantitative reconciliations of the differences between the most directly comparable GAAP and non-GAAP financial measures presented are also provided within this Supplemental Information. Definitions of these non-GAAP financial measures, along with that of HPP’s Share of certain of these measures, can be found in the Definitions section of this Supplemental information.

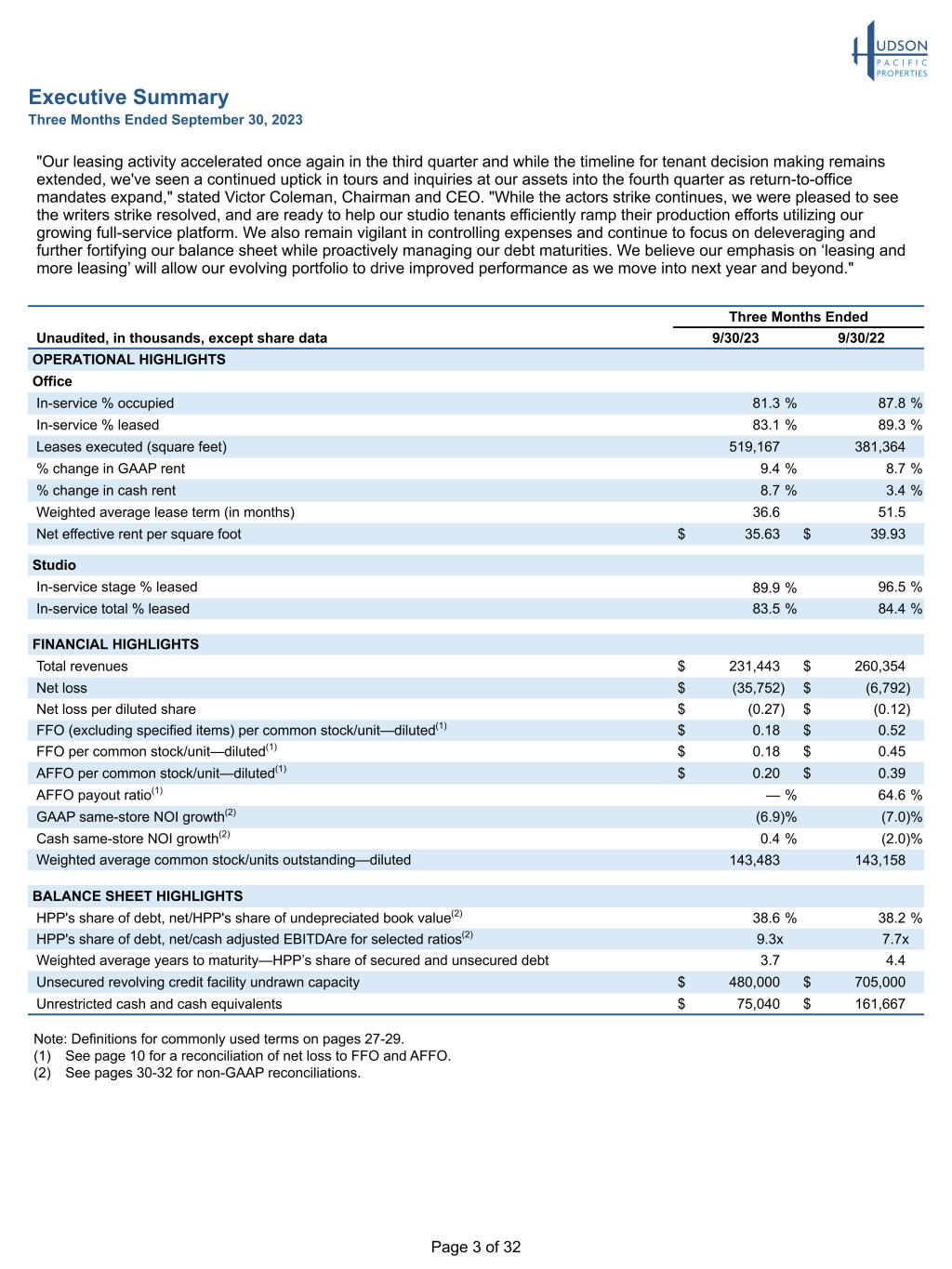

Page 3 of 32 Executive Summary Three Months Ended September 30, 2023 "Our leasing activity accelerated once again in the third quarter and while the timeline for tenant decision making remains extended, we've seen a continued uptick in tours and inquiries at our assets into the fourth quarter as return-to-office mandates expand," stated Victor Coleman, Chairman and CEO. "While the actors strike continues, we were pleased to see the writers strike resolved, and are ready to help our studio tenants efficiently ramp their production efforts utilizing our growing full-service platform. We also remain vigilant in controlling expenses and continue to focus on deleveraging and further fortifying our balance sheet while proactively managing our debt maturities. We believe our emphasis on ‘leasing and more leasing’ will allow our evolving portfolio to drive improved performance as we move into next year and beyond." Three Months Ended Unaudited, in thousands, except share data 9/30/23 9/30/22 OPERATIONAL HIGHLIGHTS Office In-service % occupied 81.3 % 87.8 % In-service % leased 83.1 % 89.3 % Leases executed (square feet) 519,167 381,364 % change in GAAP rent 9.4 % 8.7 % % change in cash rent 8.7 % 3.4 % Weighted average lease term (in months) 36.6 51.5 Net effective rent per square foot $ 35.63 $ 39.93 Studio In-service stage % leased 89.9 % 96.5 % In-service total % leased 83.5 % 84.4 % FINANCIAL HIGHLIGHTS Total revenues $ 231,443 $ 260,354 Net loss $ (35,752) $ (6,792) Net loss per diluted share $ (0.27) $ (0.12) FFO (excluding specified items) per common stock/unit—diluted(1) $ 0.18 $ 0.52 FFO per common stock/unit—diluted(1) $ 0.18 $ 0.45 AFFO per common stock/unit—diluted(1) $ 0.20 $ 0.39 AFFO payout ratio(1) — % 64.6 % GAAP same-store NOI growth(2) (6.9) % (7.0) % Cash same-store NOI growth(2) 0.4 % (2.0) % Weighted average common stock/units outstanding—diluted 143,483 143,158 BALANCE SHEET HIGHLIGHTS HPP's share of debt, net/HPP's share of undepreciated book value(2) 38.6 % 38.2 % HPP's share of debt, net/cash adjusted EBITDAre for selected ratios(2) 9.3x 7.7x Weighted average years to maturity—HPP’s share of secured and unsecured debt 3.7 4.4 Unsecured revolving credit facility undrawn capacity $ 480,000 $ 705,000 Unrestricted cash and cash equivalents $ 75,040 $ 161,667 Note: Definitions for commonly used terms on pages 27-29. (1) See page 10 for a reconciliation of net loss to FFO and AFFO. (2) See pages 30-32 for non-GAAP reconciliations.

Page 4 of 32 Executive Summary (continued) Three Months Ended September 30, 2023 Financial Results Compared to Third Quarter 2022 • Total revenue of $231.4 million compared to $260.4 million, primarily due to the sales of 6922 Hollywood, Skyway Landing and Northview Center, previously communicated tenant move-outs at Skyport Plaza and 10900-10950 Washington, as well as a reduction in studio service and other revenue due to the related union strikes • Net loss attributable to common stockholders of $37.6 million, or $0.27 per diluted share, compared to net loss of $17.3 million, or $0.12 per diluted share, due to the aforementioned asset sales and tenant move-outs, higher operating expenses associated with the Quixote acquisition and higher interest expense • FFO, excluding specified items, of $26.1 million, or $0.18 per diluted share, compared to $74.1 million, or $0.52 per diluted share. There were no specified items for the third quarter 2023. Prior year specified items consisted of transaction-related expenses of $9.3 million, or $0.07 per diluted share, and prior-period property tax expense of $0.4 million, or $0.00 per diluted share • FFO of $26.1 million, or $0.18 per diluted share, compared to $64.4 million, or $0.45 per diluted share • AFFO of $28.1 million, or $0.20 per diluted share, compared to $55.8 million, or $0.39 per diluted share • Same-store cash NOI of $126.7 million, up 0.4% compared to $126.2 million, mostly attributable to significant office lease commencements at One Westside and Harlow, which drove same-store office NOI growth of 3.5% Leasing • Executed 53 new and renewal leases totaling 519,167 square feet, including significant tenant renewals: ◦ 140,000-square-foot renewal at Met Park North ◦ 75,000-square-foot renewal of Bank of Montreal (BMO) at Bentall Centre ◦ 50,000-square-foot renewal of Poshmark at Towers at Shore Center • GAAP and cash rents increased 9.4% and 8.7%, respectively, from prior levels, primarily due to the strength of leasing in the Seattle and Vancouver markets • In-service office portfolio ended the quarter at 81.3% occupied and 83.1% leased, with the decrease primarily attributable to known-vacate Block's 469,000-square-foot lease expiration at 1455 Market, as well as the sales of 3401 Exposition and 604 Arizona • On average over the trailing 12 months, the in-service studio portfolio was 83.5% leased, and the related 35 stages were 89.9% leased, with the sequential change attributable to a single tenant vacating 6 stages at Sunset Las Palmas due to the strike Transactions • Sold 3401 Exposition office property in Los Angeles, California for $40.0 million before closing adjustments • Sold 604 Arizona office property in Santa Monica, California for $32.5 million before closing adjustments • Entered into a joint venture with Vornado and Blackstone to own the leasehold interest for Pier 94 in Manhattan, New York, and develop and operate a 6-stage, 232,000-square-foot purpose-built Sunset Studios facility, representing an expected $38.5 million total capital requirement for Hudson Pacific Development • Commenced construction on Sunset Pier 94 Studios with delivery anticipated by year-end 2025 Balance Sheet as of September 30, 2023 • $555.0 million of total liquidity comprised of $75.0 million of unrestricted cash and cash equivalents and $480.0 million of undrawn capacity under the unsecured revolving credit facility • $90.0 million, $22.3 million and $183.1 million of undrawn capacity under construction loans secured by One Westside/Westside Two, Sunset Glenoaks Studios and Sunset Pier 94 Studios, respectively • HPP's share of net debt to HPP's share of undepreciated book value was 38.6% with 77.1% of debt fixed or capped and no material maturities until the loan secured by One Westside, which is 100% leased to Google through 2036, matures in December 2024 • Repaid $50.0 million of Series E notes, and applied net proceeds from the sales of 3401 Exposition and 604 Arizona to repay amounts outstanding on the unsecured revolving credit facility Note: Definitions for commonly used terms on pages 27-29.

Page 5 of 32 Executive Summary (continued) Three Months Ended September 30, 2023 Note: Definitions for commonly used terms on pages 27-29. Dividend • The Company's Board of Directors suspended payment of a quarterly dividend on its common stock and declared and paid a dividend on its 4.750% Series C cumulative preferred stock of $0.296875 per share ESG Leadership • Subsequent to the quarter, earned top rankings in the 2023 GRESB Real Estate Assessment for sustainability accomplishments, marking the Company's third consecutive year as a Regional Sector Leader in the Office, Americas peer group, and fifth consecutive year earning a Green Star designation as well as the highest 5-star rating

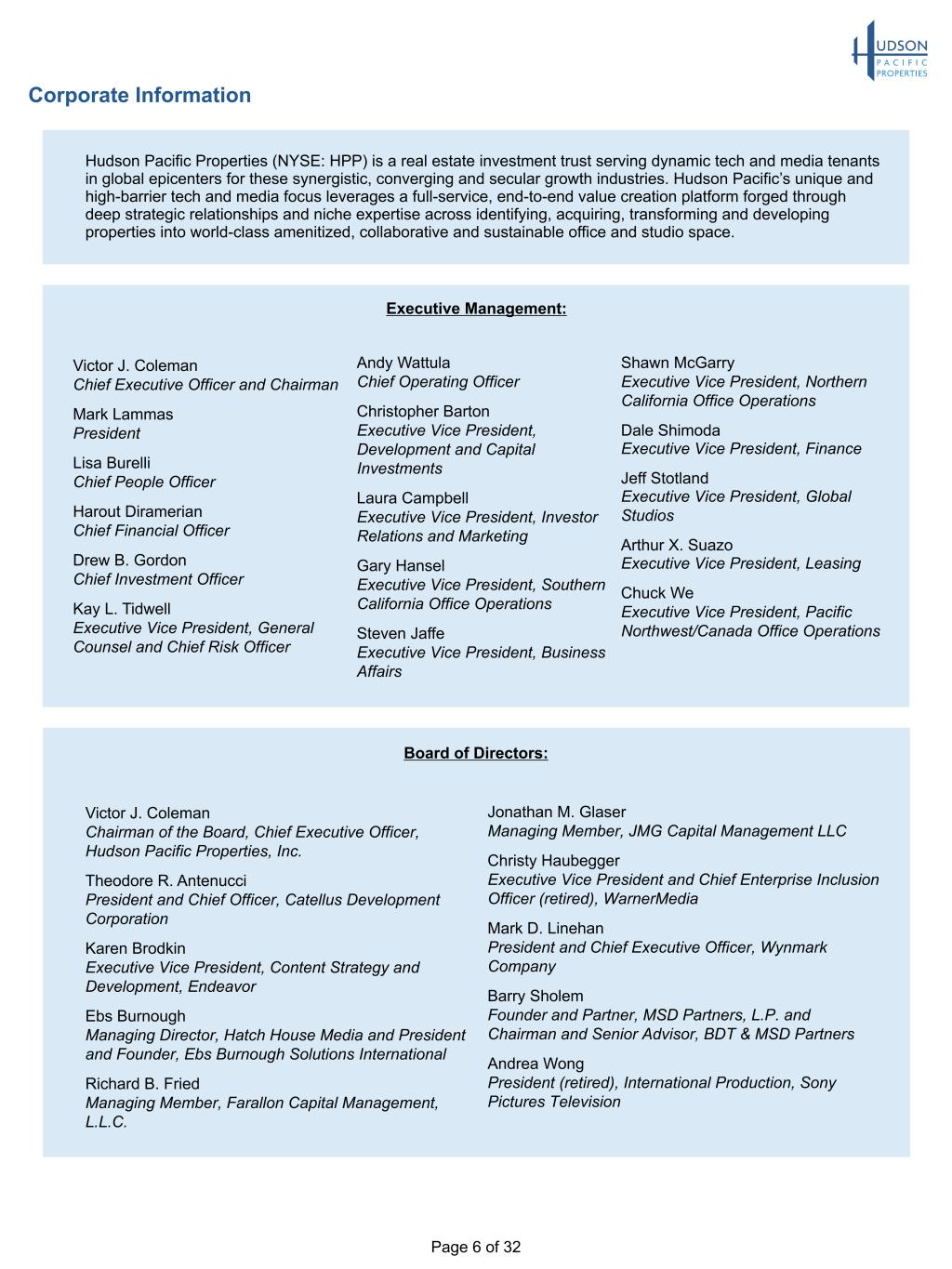

Page 6 of 32 Corporate Information Executive Management: Victor J. Coleman Chief Executive Officer and Chairman Mark Lammas President Lisa Burelli Chief People Officer Harout Diramerian Chief Financial Officer Drew B. Gordon Chief Investment Officer Kay L. Tidwell Executive Vice President, General Counsel and Chief Risk Officer Hudson Pacific Properties (NYSE: HPP) is a real estate investment trust serving dynamic tech and media tenants in global epicenters for these synergistic, converging and secular growth industries. Hudson Pacific’s unique and high-barrier tech and media focus leverages a full-service, end-to-end value creation platform forged through deep strategic relationships and niche expertise across identifying, acquiring, transforming and developing properties into world-class amenitized, collaborative and sustainable office and studio space. Victor J. Coleman Chairman of the Board, Chief Executive Officer, Hudson Pacific Properties, Inc. Theodore R. Antenucci President and Chief Officer, Catellus Development Corporation Karen Brodkin Executive Vice President, Content Strategy and Development, Endeavor Ebs Burnough Managing Director, Hatch House Media and President and Founder, Ebs Burnough Solutions International Richard B. Fried Managing Member, Farallon Capital Management, L.L.C. Andy Wattula Chief Operating Officer Christopher Barton Executive Vice President, Development and Capital Investments Laura Campbell Executive Vice President, Investor Relations and Marketing Gary Hansel Executive Vice President, Southern California Office Operations Steven Jaffe Executive Vice President, Business Affairs Shawn McGarry Executive Vice President, Northern California Office Operations Dale Shimoda Executive Vice President, Finance Jeff Stotland Executive Vice President, Global Studios Arthur X. Suazo Executive Vice President, Leasing Chuck We Executive Vice President, Pacific Northwest/Canada Office Operations Jonathan M. Glaser Managing Member, JMG Capital Management LLC Christy Haubegger Executive Vice President and Chief Enterprise Inclusion Officer (retired), WarnerMedia Mark D. Linehan President and Chief Executive Officer, Wynmark Company Barry Sholem Founder and Partner, MSD Partners, L.P. and Chairman and Senior Advisor, BDT & MSD Partners Andrea Wong President (retired), International Production, Sony Pictures Television Board of Directors:

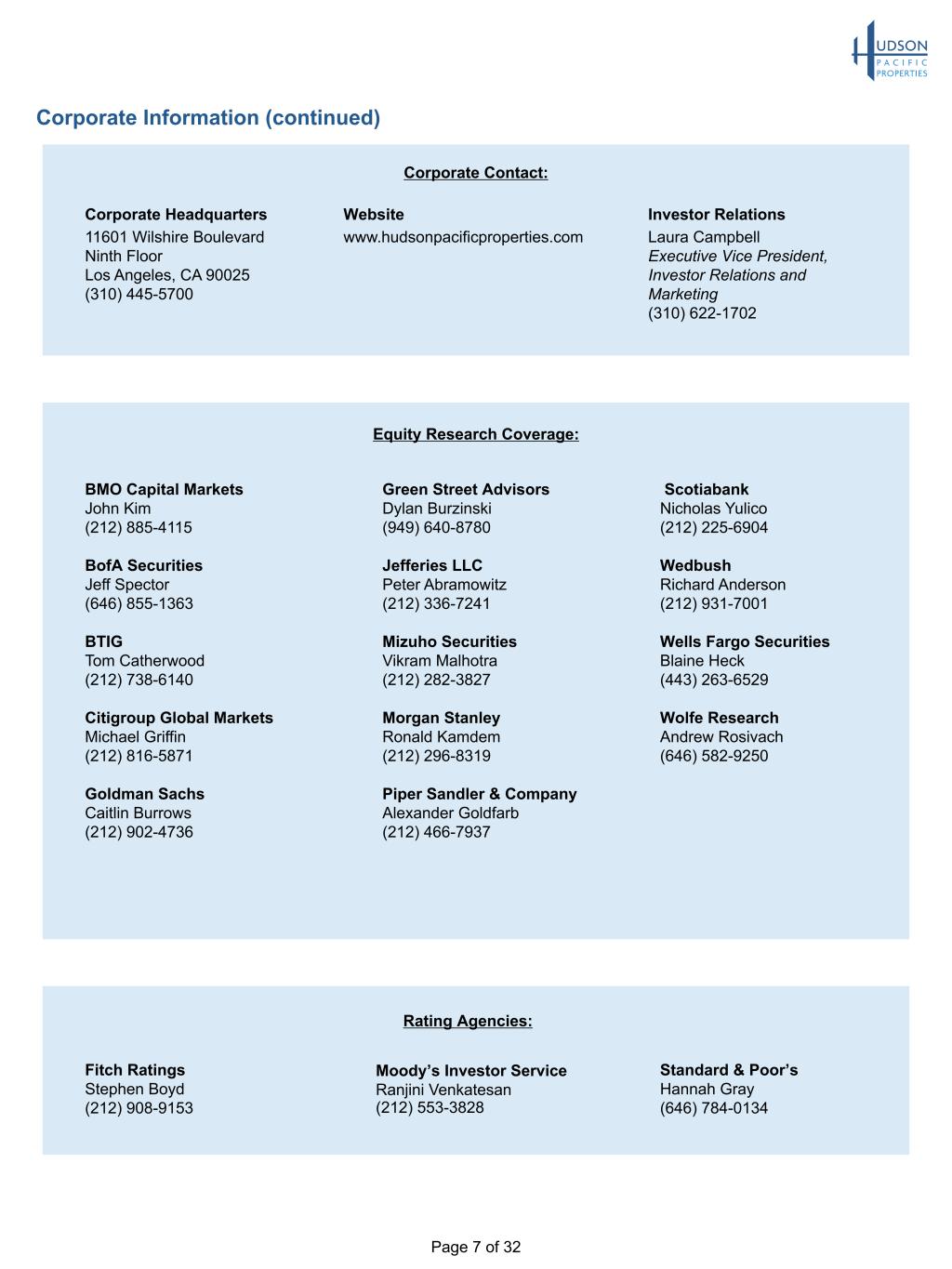

Page 7 of 32 Corporate Information (continued) BMO Capital Markets John Kim (212) 885-4115 BofA Securities Jeff Spector (646) 855-1363 BTIG Tom Catherwood (212) 738-6140 Citigroup Global Markets Michael Griffin (212) 816-5871 Goldman Sachs Caitlin Burrows (212) 902-4736 Scotiabank Nicholas Yulico (212) 225-6904 Wedbush Richard Anderson (212) 931-7001 Wells Fargo Securities Blaine Heck (443) 263-6529 Wolfe Research Andrew Rosivach (646) 582-9250 Fitch Ratings Stephen Boyd (212) 908-9153 Moody’s Investor Service Ranjini Venkatesan (212) 553-3828 Standard & Poor’s Hannah Gray (646) 784-0134 Equity Research Coverage: Green Street Advisors Dylan Burzinski (949) 640-8780 Jefferies LLC Peter Abramowitz (212) 336-7241 Mizuho Securities Vikram Malhotra (212) 282-3827 Morgan Stanley Ronald Kamdem (212) 296-8319 Piper Sandler & Company Alexander Goldfarb (212) 466-7937 Rating Agencies: Corporate Contact: Corporate Headquarters 11601 Wilshire Boulevard Ninth Floor Los Angeles, CA 90025 (310) 445-5700 Website www.hudsonpacificproperties.com Investor Relations Laura Campbell Executive Vice President, Investor Relations and Marketing (310) 622-1702

Page 8 of 32 Consolidated Balance Sheets In thousands, except share data 9/30/23 12/31/22 (Unaudited) ASSETS Investment in real estate, net $ 7,096,199 $ 7,175,301 Non-real estate property, plant and equipment, net 115,903 130,289 Cash and cash equivalents 75,040 255,761 Restricted cash 19,054 29,970 Accounts receivable, net 19,330 16,820 Straight-line rent receivables, net 290,938 279,910 Deferred leasing costs and intangible assets, net 359,870 393,842 Operating lease right-of-use assets 391,177 401,051 Prepaid expenses and other assets, net 119,494 98,837 Investment in unconsolidated real estate entities 236,248 180,572 Goodwill 263,549 263,549 Assets associated with real estate held for sale — 93,238 TOTAL ASSETS $ 8,986,802 $ 9,319,140 LIABILITIES AND EQUITY Liabilities Unsecured and secured debt, net $ 4,417,020 4,585,862 Joint venture partner debt 66,136 66,136 Accounts payable, accrued liabilities and other 267,426 264,098 Operating lease liabilities 393,773 399,801 Intangible liabilities, net 29,247 34,091 Security deposits, prepaid rent and other 86,980 83,797 Liabilities associated with real estate held for sale — 665 Total liabilities 5,260,582 5,434,450 Redeemable preferred units of the operating partnership 9,815 9,815 Redeemable non-controlling interest in consolidated real estate entities 115,580 125,044 Equity HPP stockholders' equity: 4.750% Series C cumulative redeemable preferred stock, $0.01 par value, $25.00 per share liquidation preference,18,400,000 authorized; 17,000,000 shares outstanding at 9/30/23 and 12/31/22 425,000 425,000 Common stock, $0.01 par value, 481,600,000 authorized, 140,937,702 shares and 141,054,478 shares outstanding at 9/30/23 and 12/31/22, respectively 1,403 1,409 Additional paid-in capital 2,748,309 2,889,967 Accumulated other comprehensive income (loss) 4,178 (11,272) Total HPP stockholders’ equity 3,178,890 3,305,104 Non-controlling interest—members in consolidated real estate entities 345,058 377,756 Non-controlling interest—units in the operating partnership 76,877 66,971 Total equity 3,600,825 3,749,831 TOTAL LIABILITIES AND EQUITY $ 8,986,802 $ 9,319,140

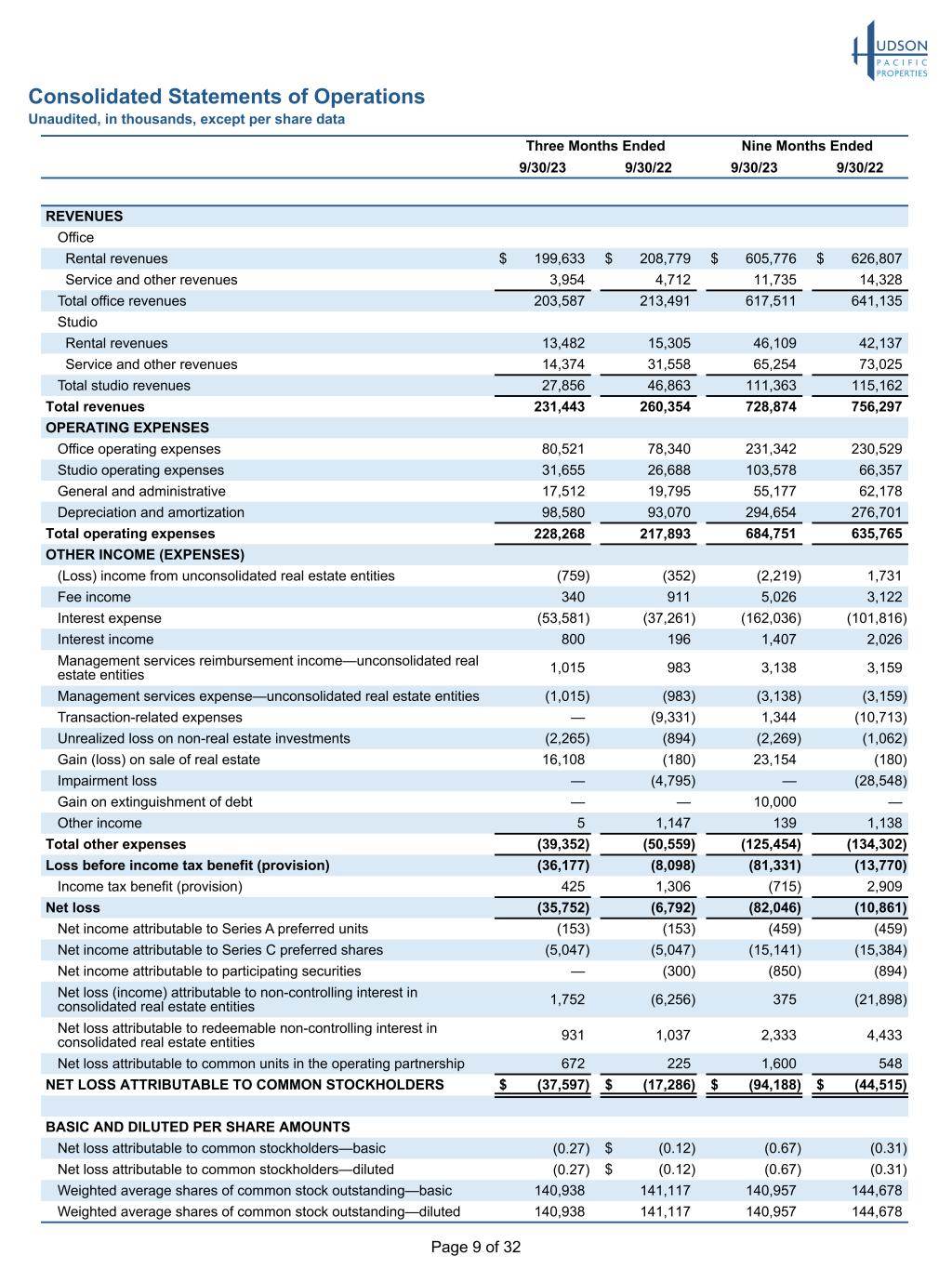

Page 9 of 32 Consolidated Statements of Operations Unaudited, in thousands, except per share data Three Months Ended Nine Months Ended 9/30/23 9/30/22 9/30/23 9/30/22 REVENUES Office Rental revenues $ 199,633 $ 208,779 $ 605,776 $ 626,807 Service and other revenues 3,954 4,712 11,735 14,328 Total office revenues 203,587 213,491 617,511 641,135 Studio Rental revenues 13,482 15,305 46,109 42,137 Service and other revenues 14,374 31,558 65,254 73,025 Total studio revenues 27,856 46,863 111,363 115,162 Total revenues 231,443 260,354 728,874 756,297 OPERATING EXPENSES Office operating expenses 80,521 78,340 231,342 230,529 Studio operating expenses 31,655 26,688 103,578 66,357 General and administrative 17,512 19,795 55,177 62,178 Depreciation and amortization 98,580 93,070 294,654 276,701 Total operating expenses 228,268 217,893 684,751 635,765 OTHER INCOME (EXPENSES) (Loss) income from unconsolidated real estate entities (759) (352) (2,219) 1,731 Fee income 340 911 5,026 3,122 Interest expense (53,581) (37,261) (162,036) (101,816) Interest income 800 196 1,407 2,026 Management services reimbursement income—unconsolidated real estate entities 1,015 983 3,138 3,159 Management services expense—unconsolidated real estate entities (1,015) (983) (3,138) (3,159) Transaction-related expenses — (9,331) 1,344 (10,713) Unrealized loss on non-real estate investments (2,265) (894) (2,269) (1,062) Gain (loss) on sale of real estate 16,108 (180) 23,154 (180) Impairment loss — (4,795) — (28,548) Gain on extinguishment of debt — — 10,000 — Other income 5 1,147 139 1,138 Total other expenses (39,352) (50,559) (125,454) (134,302) Loss before income tax benefit (provision) (36,177) (8,098) (81,331) (13,770) Income tax benefit (provision) 425 1,306 (715) 2,909 Net loss (35,752) (6,792) (82,046) (10,861) Net income attributable to Series A preferred units (153) (153) (459) (459) Net income attributable to Series C preferred shares (5,047) (5,047) (15,141) (15,384) Net income attributable to participating securities — (300) (850) (894) Net loss (income) attributable to non-controlling interest in consolidated real estate entities 1,752 (6,256) 375 (21,898) Net loss attributable to redeemable non-controlling interest in consolidated real estate entities 931 1,037 2,333 4,433 Net loss attributable to common units in the operating partnership 672 225 1,600 548 NET LOSS ATTRIBUTABLE TO COMMON STOCKHOLDERS $ (37,597) $ (17,286) $ (94,188) $ (44,515) BASIC AND DILUTED PER SHARE AMOUNTS Net loss attributable to common stockholders—basic (0.27) $ (0.12) (0.67) (0.31) Net loss attributable to common stockholders—diluted (0.27) $ (0.12) (0.67) (0.31) Weighted average shares of common stock outstanding—basic 140,938 141,117 140,957 144,678 Weighted average shares of common stock outstanding—diluted 140,938 141,117 140,957 144,678

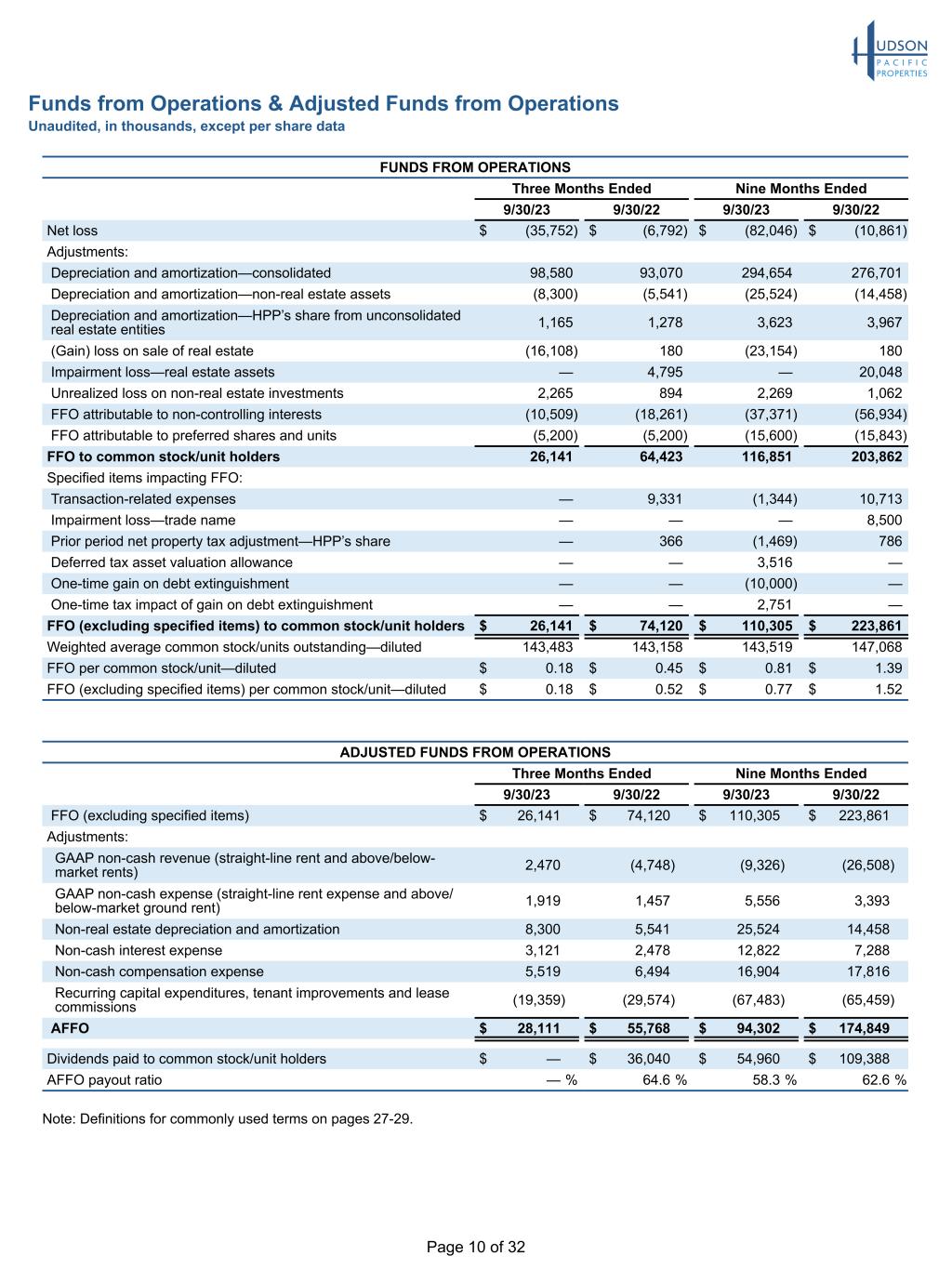

Page 10 of 32 Funds from Operations & Adjusted Funds from Operations Unaudited, in thousands, except per share data FUNDS FROM OPERATIONS Three Months Ended Nine Months Ended 9/30/23 9/30/22 9/30/23 9/30/22 Net loss $ (35,752) $ (6,792) $ (82,046) $ (10,861) Adjustments: Depreciation and amortization—consolidated 98,580 93,070 294,654 276,701 Depreciation and amortization—non-real estate assets (8,300) (5,541) (25,524) (14,458) Depreciation and amortization—HPP’s share from unconsolidated real estate entities 1,165 1,278 3,623 3,967 (Gain) loss on sale of real estate (16,108) 180 (23,154) 180 Impairment loss—real estate assets — 4,795 — 20,048 Unrealized loss on non-real estate investments 2,265 894 2,269 1,062 FFO attributable to non-controlling interests (10,509) (18,261) (37,371) (56,934) FFO attributable to preferred shares and units (5,200) (5,200) (15,600) (15,843) FFO to common stock/unit holders 26,141 64,423 116,851 203,862 Specified items impacting FFO: Transaction-related expenses — 9,331 (1,344) 10,713 Impairment loss—trade name — — — 8,500 Prior period net property tax adjustment—HPP’s share — 366 (1,469) 786 Deferred tax asset valuation allowance — — 3,516 — One-time gain on debt extinguishment — — (10,000) — One-time tax impact of gain on debt extinguishment — — 2,751 — FFO (excluding specified items) to common stock/unit holders $ 26,141 $ 74,120 $ 110,305 $ 223,861 Weighted average common stock/units outstanding—diluted 143,483 143,158 143,519 147,068 FFO per common stock/unit—diluted $ 0.18 $ 0.45 $ 0.81 $ 1.39 FFO (excluding specified items) per common stock/unit—diluted $ 0.18 $ 0.52 $ 0.77 $ 1.52 Note: Definitions for commonly used terms on pages 27-29. ADJUSTED FUNDS FROM OPERATIONS Three Months Ended Nine Months Ended 9/30/23 9/30/22 9/30/23 9/30/22 FFO (excluding specified items) $ 26,141 $ 74,120 $ 110,305 $ 223,861 Adjustments: GAAP non-cash revenue (straight-line rent and above/below- market rents) 2,470 (4,748) (9,326) (26,508) GAAP non-cash expense (straight-line rent expense and above/ below-market ground rent) 1,919 1,457 5,556 3,393 Non-real estate depreciation and amortization 8,300 5,541 25,524 14,458 Non-cash interest expense 3,121 2,478 12,822 7,288 Non-cash compensation expense 5,519 6,494 16,904 17,816 Recurring capital expenditures, tenant improvements and lease commissions (19,359) (29,574) (67,483) (65,459) AFFO $ 28,111 $ 55,768 $ 94,302 $ 174,849 Dividends paid to common stock/unit holders $ — $ 36,040 $ 54,960 $ 109,388 AFFO payout ratio — % 64.6 % 58.3 % 62.6 %

Page 11 of 32 Consolidated Same-Store Property Performance Unaudited, in thousands, except number of properties and square feet SAME-STORE ANALYSIS Three Months Ended Nine Months Ended 9/30/23 9/30/22 % Change 9/30/23 9/30/22 % Change Same-store office statistics Number of properties 42 42 41 41 Square feet 12,161,577 12,161,577 11,978,454 11,978,454 Average % occupied 84.5 % 88.3 % 85.5 % 90.3 % Same-store studio statistics Number of properties 3 3 3 3 Square feet 1,231,335 1,231,335 1,231,335 1,231,335 Average % leased 83.5 % 84.4 % 83.5 % 84.4 % Same-store NOI(1) Office revenues $ 193,204 $ 194,805 (0.8) % $ 574,095 $ 573,161 0.2 % Office expenses 74,436 70,555 5.5 211,116 201,600 4.7 Same-store office NOI 118,768 124,250 (4.4) 362,979 371,561 (2.3) Studio revenues 14,360 22,265 (35.5) 54,309 63,315 (14.2) Studio expenses 8,993 13,150 (31.6) 30,533 36,971 (17.4) Same-store studio NOI 5,367 9,115 (41.1) 23,776 26,344 (9.7) Total same-store NOI $ 124,135 $ 133,365 (6.9) % $ 386,755 $ 397,905 (2.8) % SAME-STORE ANALYSIS (CASH BASIS) Three Months Ended Nine Months Ended 9/30/23 9/30/22 % Change 9/30/23 9/30/22 % Change Same-store NOI (cash basis) Office cash revenues $ 194,847 $ 186,876 4.3 % $ 559,831 $ 533,895 4.9 % Office cash expenses 73,349 69,453 5.6 207,794 198,299 4.8 Same-store office NOI (cash basis) 121,498 117,423 3.5 352,037 335,596 4.9 Studio cash revenues 14,053 21,834 (35.6) 53,110 61,666 (13.9) Studio cash expenses 8,879 13,080 (32.1) 30,194 36,763 (17.9) Same-store studio NOI (cash basis) 5,174 8,754 (40.9) 22,916 24,903 (8.0) Total same-store NOI (cash basis) $ 126,672 $ 126,177 0.4 % $ 374,953 $ 360,499 4.0 % Note: Definitions for commonly used terms on pages 27-29. (1) See page 30 for non-GAAP reconciliations.

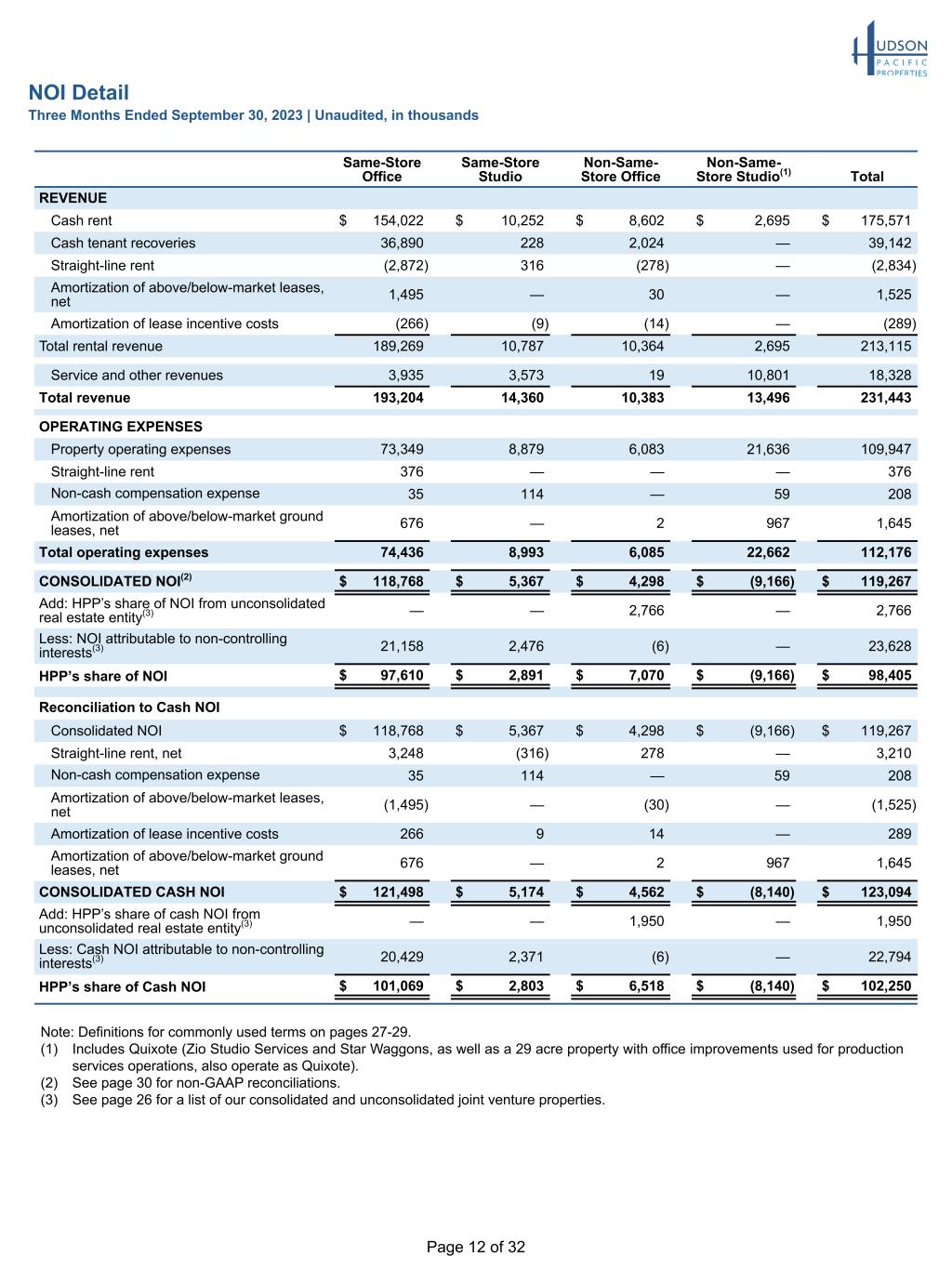

Page 12 of 32 NOI Detail Three Months Ended September 30, 2023 | Unaudited, in thousands Same-Store Office Same-Store Studio Non-Same- Store Office Non-Same- Store Studio(1) Total REVENUE Cash rent $ 154,022 $ 10,252 $ 8,602 $ 2,695 $ 175,571 Cash tenant recoveries 36,890 228 2,024 — 39,142 Straight-line rent (2,872) 316 (278) — (2,834) Amortization of above/below-market leases, net 1,495 — 30 — 1,525 Amortization of lease incentive costs (266) (9) (14) — (289) Total rental revenue 189,269 10,787 10,364 2,695 213,115 Service and other revenues 3,935 3,573 19 10,801 18,328 Total revenue 193,204 14,360 10,383 13,496 231,443 OPERATING EXPENSES Property operating expenses 73,349 8,879 6,083 21,636 109,947 Straight-line rent 376 — — — 376 Non-cash compensation expense 35 114 — 59 208 Amortization of above/below-market ground leases, net 676 — 2 967 1,645 Total operating expenses 74,436 8,993 6,085 22,662 112,176 CONSOLIDATED NOI(2) $ 118,768 $ 5,367 $ 4,298 $ (9,166) $ 119,267 Add: HPP’s share of NOI from unconsolidated real estate entity(3) — — 2,766 — 2,766 Less: NOI attributable to non-controlling interests(3) 21,158 2,476 (6) — 23,628 HPP’s share of NOI $ 97,610 $ 2,891 $ 7,070 $ (9,166) $ 98,405 Reconciliation to Cash NOI Consolidated NOI $ 118,768 $ 5,367 $ 4,298 $ (9,166) $ 119,267 Straight-line rent, net 3,248 (316) 278 — 3,210 Non-cash compensation expense 35 114 — 59 208 Amortization of above/below-market leases, net (1,495) — (30) — (1,525) Amortization of lease incentive costs 266 9 14 — 289 Amortization of above/below-market ground leases, net 676 — 2 967 1,645 CONSOLIDATED CASH NOI $ 121,498 $ 5,174 $ 4,562 $ (8,140) $ 123,094 Add: HPP’s share of cash NOI from unconsolidated real estate entity(3) — — 1,950 — 1,950 Less: Cash NOI attributable to non-controlling interests(3) 20,429 2,371 (6) — 22,794 HPP’s share of Cash NOI $ 101,069 $ 2,803 $ 6,518 $ (8,140) $ 102,250 Note: Definitions for commonly used terms on pages 27-29. (1) Includes Quixote (Zio Studio Services and Star Waggons, as well as a 29 acre property with office improvements used for production services operations, also operate as Quixote). (2) See page 30 for non-GAAP reconciliations. (3) See page 26 for a list of our consolidated and unconsolidated joint venture properties.

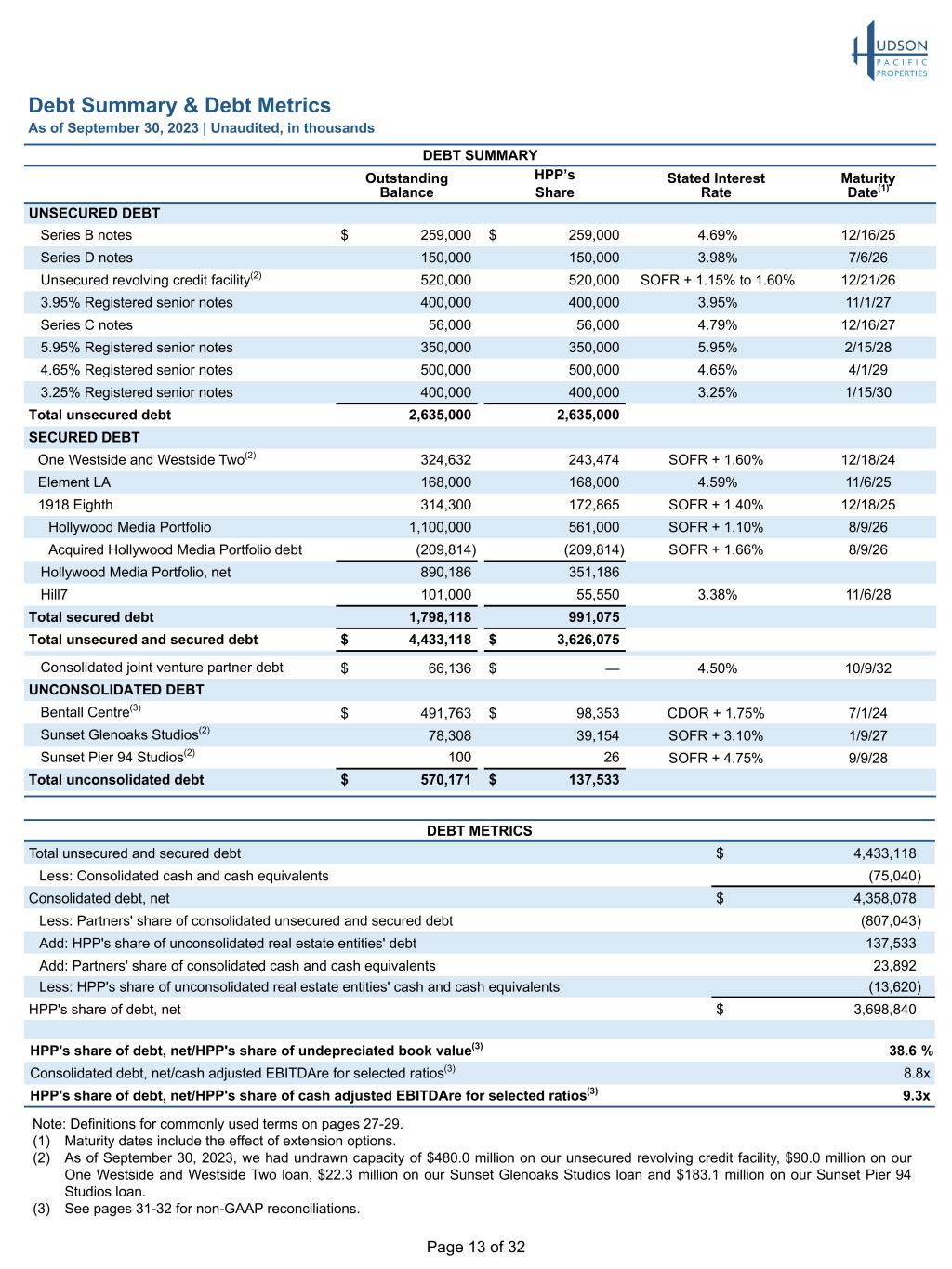

Page 13 of 32 Debt Summary & Debt Metrics As of September 30, 2023 | Unaudited, in thousands DEBT SUMMARY Outstanding Balance HPP’s Share Stated Interest Rate Maturity Date(1) UNSECURED DEBT Series B notes $ 259,000 $ 259,000 4.69% 12/16/25 Series D notes 150,000 150,000 3.98% 7/6/26 Unsecured revolving credit facility(2) 520,000 520,000 SOFR + 1.15% to 1.60% 12/21/26 3.95% Registered senior notes 400,000 400,000 3.95% 11/1/27 Series C notes 56,000 56,000 4.79% 12/16/27 5.95% Registered senior notes 350,000 350,000 5.95% 2/15/28 4.65% Registered senior notes 500,000 500,000 4.65% 4/1/29 3.25% Registered senior notes 400,000 400,000 3.25% 1/15/30 Total unsecured debt 2,635,000 2,635,000 SECURED DEBT One Westside and Westside Two(2) 324,632 243,474 SOFR + 1.60% 12/18/24 Element LA 168,000 168,000 4.59% 11/6/25 1918 Eighth 314,300 172,865 SOFR + 1.40% 12/18/25 Hollywood Media Portfolio 1,100,000 561,000 SOFR + 1.10% 8/9/26 Acquired Hollywood Media Portfolio debt (209,814) (209,814) SOFR + 1.66% 8/9/26 Hollywood Media Portfolio, net 890,186 351,186 Hill7 101,000 55,550 3.38% 11/6/28 Total secured debt 1,798,118 991,075 Total unsecured and secured debt $ 4,433,118 $ 3,626,075 Consolidated joint venture partner debt $ 66,136 $ — 4.50% 10/9/32 UNCONSOLIDATED DEBT Bentall Centre(3) $ 491,763 $ 98,353 CDOR + 1.75% 7/1/24 Sunset Glenoaks Studios(2) 78,308 39,154 SOFR + 3.10% 1/9/27 Sunset Pier 94 Studios(2) 100 26 SOFR + 4.75% 9/9/28 Total unconsolidated debt $ 570,171 $ 137,533 Note: Definitions for commonly used terms on pages 27-29. (1) Maturity dates include the effect of extension options. (2) As of September 30, 2023, we had undrawn capacity of $480.0 million on our unsecured revolving credit facility, $90.0 million on our One Westside and Westside Two loan, $22.3 million on our Sunset Glenoaks Studios loan and $183.1 million on our Sunset Pier 94 Studios loan. (3) See pages 31-32 for non-GAAP reconciliations. DEBT METRICS Total unsecured and secured debt $ 4,433,118 Less: Consolidated cash and cash equivalents (75,040) Consolidated debt, net $ 4,358,078 Less: Partners' share of consolidated unsecured and secured debt (807,043) Add: HPP's share of unconsolidated real estate entities' debt 137,533 Add: Partners' share of consolidated cash and cash equivalents 23,892 Less: HPP's share of unconsolidated real estate entities' cash and cash equivalents (13,620) HPP's share of debt, net $ 3,698,840 HPP's share of debt, net/HPP's share of undepreciated book value(3) 38.6 % Consolidated debt, net/cash adjusted EBITDAre for selected ratios(3) 8.8x HPP's share of debt, net/HPP's share of cash adjusted EBITDAre for selected ratios(3) 9.3x

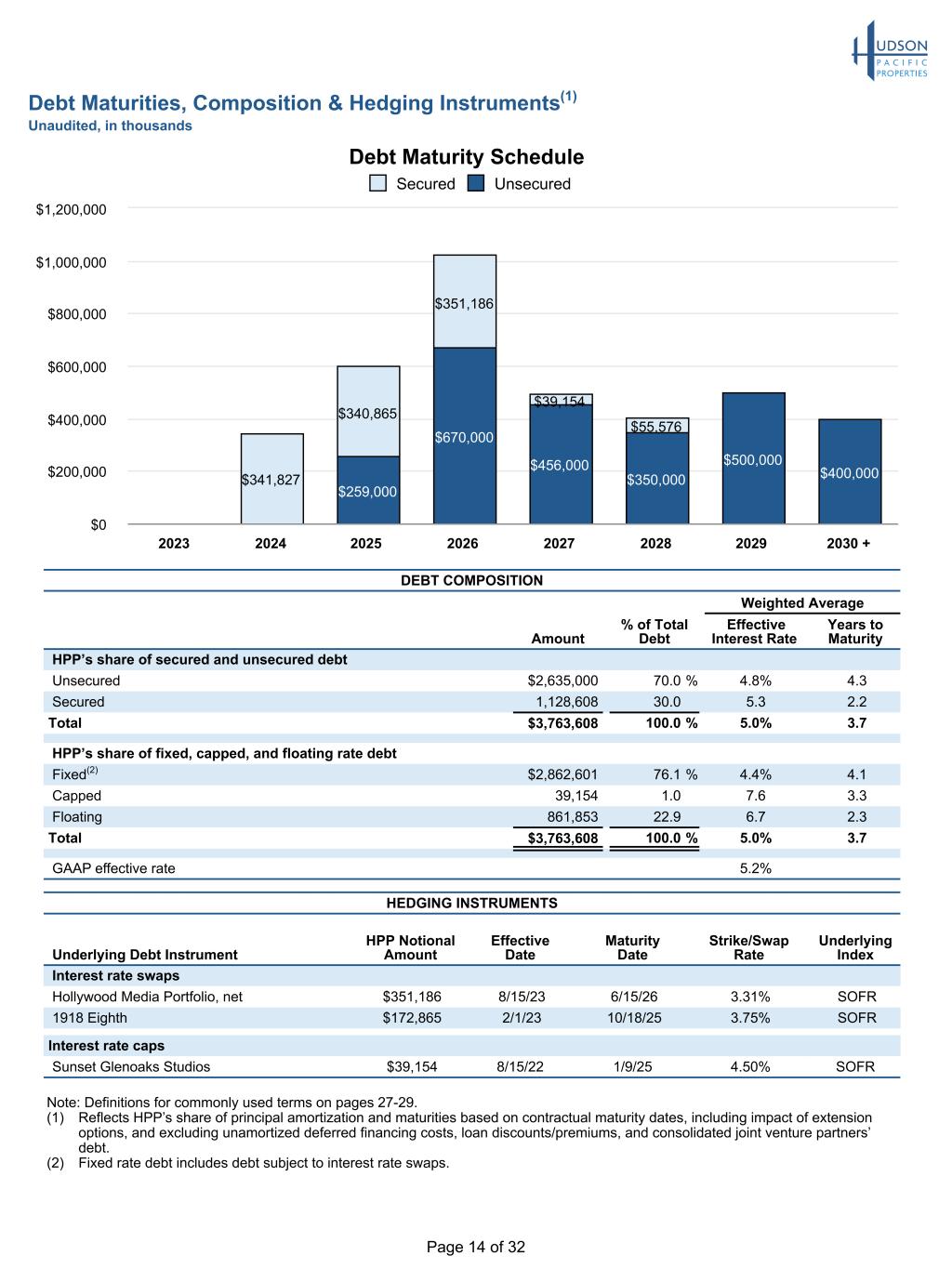

Page 14 of 32 Debt Maturities, Composition & Hedging Instruments(1) Unaudited, in thousands DEBT COMPOSITION Weighted Average Amount % of Total Debt Effective Interest Rate Years to Maturity HPP’s share of secured and unsecured debt Unsecured $2,635,000 70.0 % 4.8% 4.3 Secured 1,128,608 30.0 5.3 2.2 Total $3,763,608 100.0 % 5.0% 3.7 HPP’s share of fixed, capped, and floating rate debt Fixed(2) $2,862,601 76.1 % 4.4% 4.1 Capped 39,154 1.0 7.6 3.3 Floating 861,853 22.9 6.7 2.3 Total $3,763,608 100.0 % 5.0% 3.7 GAAP effective rate 5.2% Debt Maturity Schedule $259,000 $670,000 $456,000 $350,000 $500,000 $400,000$341,827 $340,865 $351,186 $39,154 $55,576 Secured Unsecured 2023 2024 2025 2026 2027 2028 2029 2030 + $0 $200,000 $400,000 $600,000 $800,000 $1,000,000 $1,200,000 Note: Definitions for commonly used terms on pages 27-29. (1) Reflects HPP’s share of principal amortization and maturities based on contractual maturity dates, including impact of extension options, and excluding unamortized deferred financing costs, loan discounts/premiums, and consolidated joint venture partners’ debt. (2) Fixed rate debt includes debt subject to interest rate swaps. HEDGING INSTRUMENTS Underlying Debt Instrument HPP Notional Amount Effective Date Maturity Date Strike/Swap Rate Underlying Index Interest rate swaps Hollywood Media Portfolio, net $351,186 8/15/23 6/15/26 3.31% SOFR 1918 Eighth $172,865 2/1/23 10/18/25 3.75% SOFR Interest rate caps Sunset Glenoaks Studios $39,154 8/15/22 1/9/25 4.50% SOFR

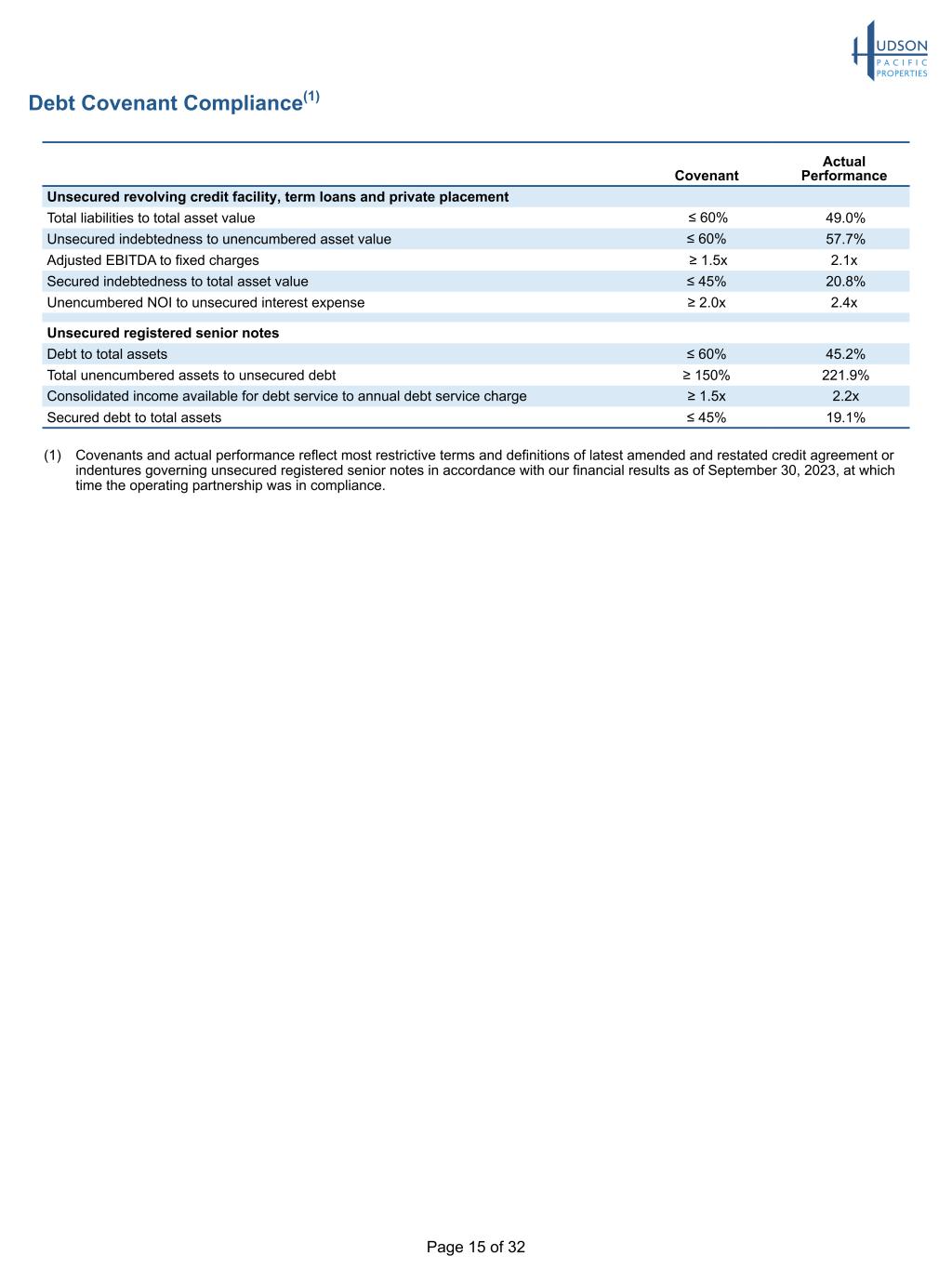

Page 15 of 32 Debt Covenant Compliance(1) Covenant Actual Performance Unsecured revolving credit facility, term loans and private placement Total liabilities to total asset value ≤ 60% 49.0% Unsecured indebtedness to unencumbered asset value ≤ 60% 57.7% Adjusted EBITDA to fixed charges ≥ 1.5x 2.1x Secured indebtedness to total asset value ≤ 45% 20.8% Unencumbered NOI to unsecured interest expense ≥ 2.0x 2.4x Unsecured registered senior notes Debt to total assets ≤ 60% 45.2% Total unencumbered assets to unsecured debt ≥ 150% 221.9% Consolidated income available for debt service to annual debt service charge ≥ 1.5x 2.2x Secured debt to total assets ≤ 45% 19.1% (1) Covenants and actual performance reflect most restrictive terms and definitions of latest amended and restated credit agreement or indentures governing unsecured registered senior notes in accordance with our financial results as of September 30, 2023, at which time the operating partnership was in compliance.

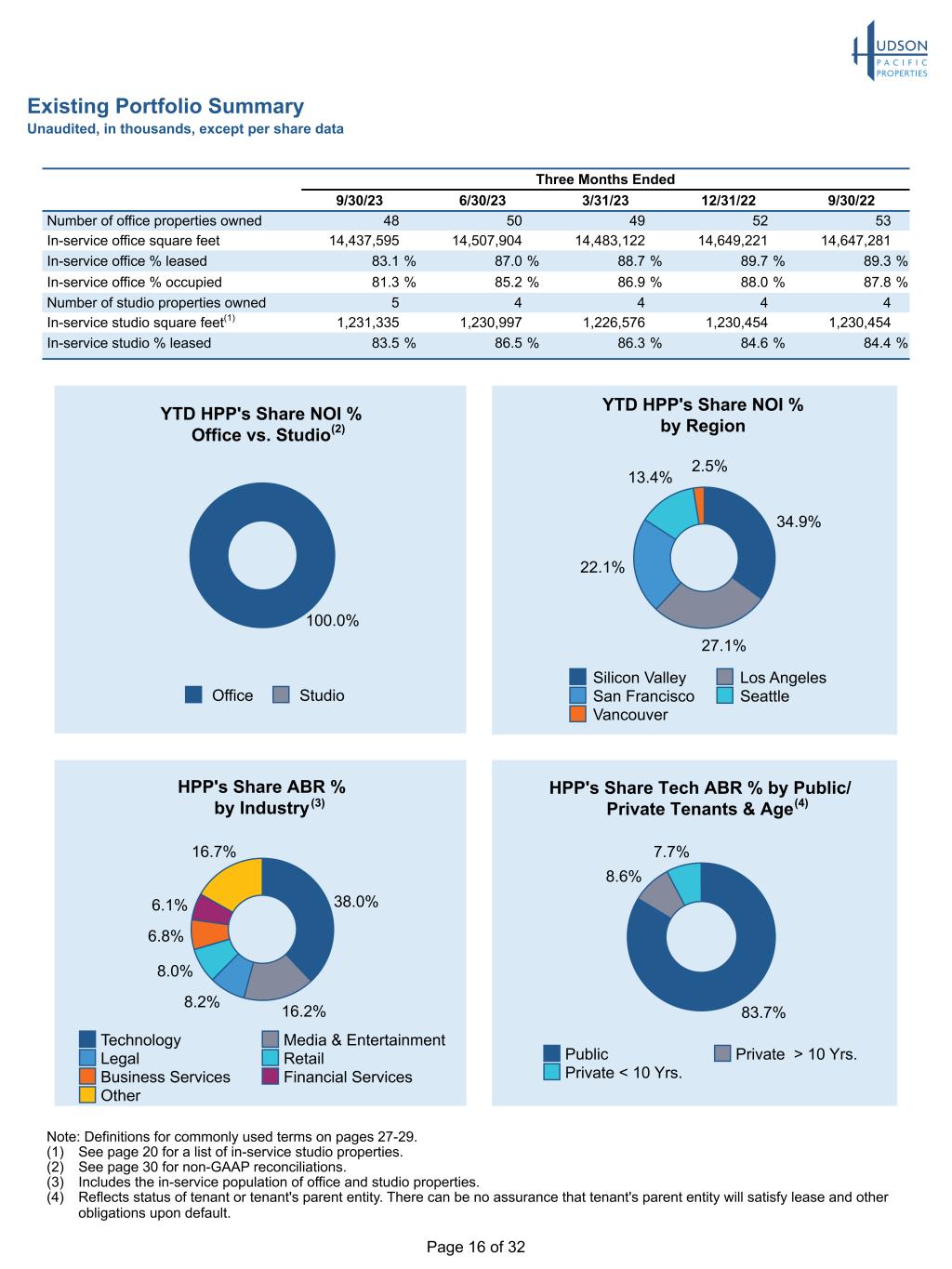

Page 16 of 32 Existing Portfolio Summary Unaudited, in thousands, except per share data Three Months Ended 9/30/23 6/30/23 3/31/23 12/31/22 9/30/22 Number of office properties owned 48 50 49 52 53 In-service office square feet 14,437,595 14,507,904 14,483,122 14,649,221 14,647,281 In-service office % leased 83.1 % 87.0 % 88.7 % 89.7 % 89.3 % In-service office % occupied 81.3 % 85.2 % 86.9 % 88.0 % 87.8 % Number of studio properties owned 5 4 4 4 4 In-service studio square feet(1) 1,231,335 1,230,997 1,226,576 1,230,454 1,230,454 In-service studio % leased 83.5 % 86.5 % 86.3 % 84.6 % 84.4 % HPP's Share ABR % by Industry 38.0% 16.2%8.2% 8.0% 6.8% 6.1% 16.7% Technology Media & Entertainment Legal Retail Business Services Financial Services Other YTD HPP's Share NOI % by Region 34.9% 27.1% 22.1% 13.4% 2.5% Silicon Valley Los Angeles San Francisco Seattle Vancouver HPP's Share Tech ABR % by Public/ Private Tenants & Age 83.7% 8.6% 7.7% Public Private > 10 Yrs. Private < 10 Yrs. YTD HPP's Share NOI % Office vs. Studio 100.0% Office Studio Note: Definitions for commonly used terms on pages 27-29. (1) See page 20 for a list of in-service studio properties. (2) See page 30 for non-GAAP reconciliations. (3) Includes the in-service population of office and studio properties. (4) Reflects status of tenant or tenant's parent entity. There can be no assurance that tenant's parent entity will satisfy lease and other obligations upon default. (2) (4)(3)

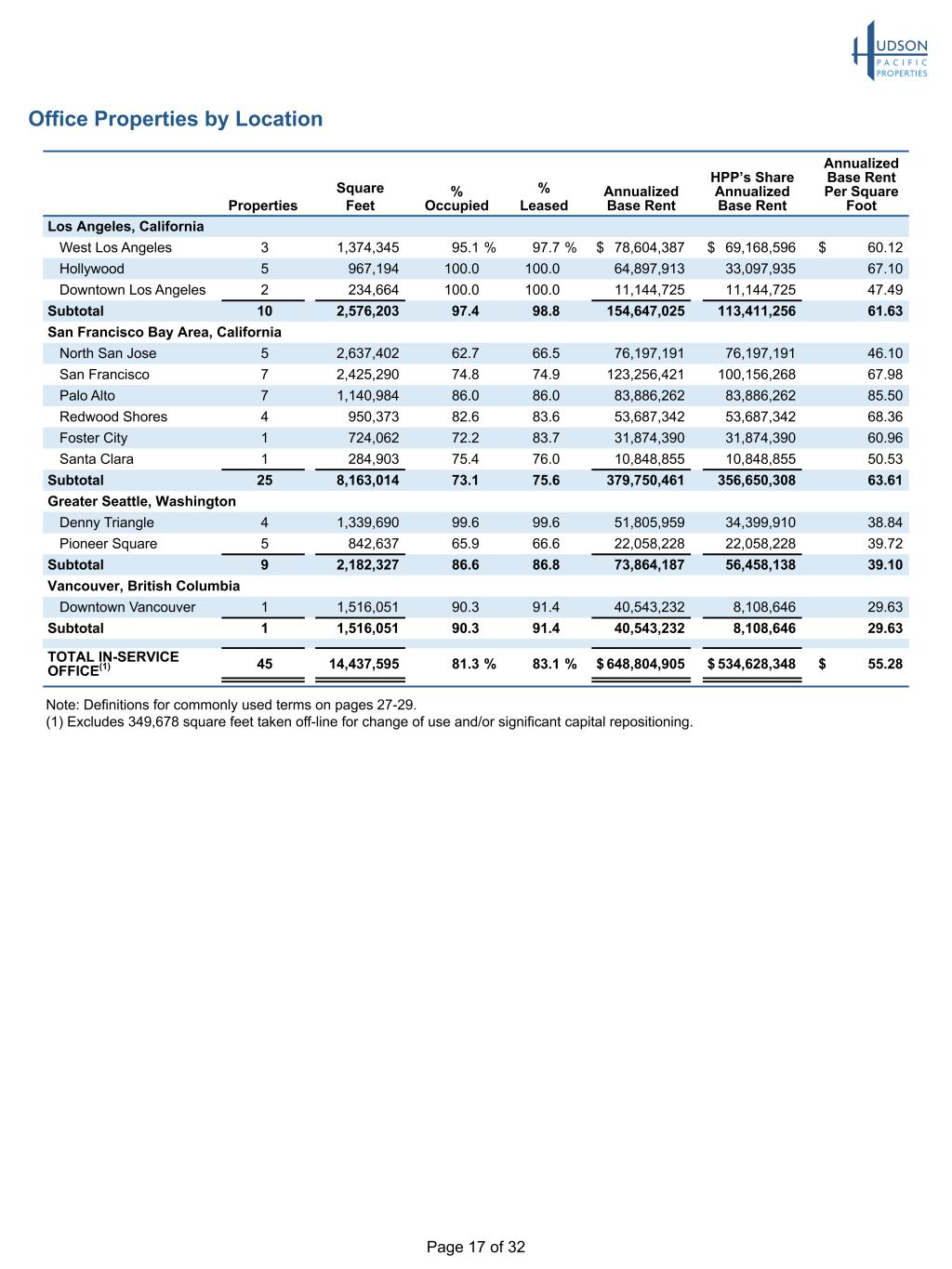

Page 17 of 32 Office Properties by Location Note: Definitions for commonly used terms on pages 27-29. (1) Excludes 349,678 square feet taken off-line for change of use and/or significant capital repositioning. Properties Square Feet % Occupied % Leased Annualized Base Rent HPP’s Share Annualized Base Rent Annualized Base Rent Per Square Foot Los Angeles, California West Los Angeles 3 1,374,345 95.1 % 97.7 % $ 78,604,387 $ 69,168,596 $ 60.12 Hollywood 5 967,194 100.0 100.0 64,897,913 33,097,935 67.10 Downtown Los Angeles 2 234,664 100.0 100.0 11,144,725 11,144,725 47.49 Subtotal 10 2,576,203 97.4 98.8 154,647,025 113,411,256 61.63 San Francisco Bay Area, California North San Jose 5 2,637,402 62.7 66.5 76,197,191 76,197,191 46.10 San Francisco 7 2,425,290 74.8 74.9 123,256,421 100,156,268 67.98 Palo Alto 7 1,140,984 86.0 86.0 83,886,262 83,886,262 85.50 Redwood Shores 4 950,373 82.6 83.6 53,687,342 53,687,342 68.36 Foster City 1 724,062 72.2 83.7 31,874,390 31,874,390 60.96 Santa Clara 1 284,903 75.4 76.0 10,848,855 10,848,855 50.53 Subtotal 25 8,163,014 73.1 75.6 379,750,461 356,650,308 63.61 Greater Seattle, Washington Denny Triangle 4 1,339,690 99.6 99.6 51,805,959 34,399,910 38.84 Pioneer Square 5 842,637 65.9 66.6 22,058,228 22,058,228 39.72 Subtotal 9 2,182,327 86.6 86.8 73,864,187 56,458,138 39.10 Vancouver, British Columbia Downtown Vancouver 1 1,516,051 90.3 91.4 40,543,232 8,108,646 29.63 Subtotal 1 1,516,051 90.3 91.4 40,543,232 8,108,646 29.63 TOTAL IN-SERVICE OFFICE(1) 45 14,437,595 81.3 % 83.1 % $ 648,804,905 $ 534,628,348 $ 55.28

Page 18 of 32 Office Properties Occupancy Detail Submarket Square Feet % Occupied % Leased Los Angeles, California One Westside West Los Angeles 590,403 100.0 % 100.0 % 11601 Wilshire West Los Angeles 499,905 86.6 93.6 Element LA West Los Angeles 284,037 100.0 100.0 ICON Hollywood 326,792 100.0 100.0 EPIC Hollywood 301,127 100.0 100.0 Harlow Hollywood 129,931 100.0 100.0 6040 Sunset Hollywood 114,958 100.0 100.0 CUE Hollywood 94,386 100.0 100.0 Fourth & Traction Downtown Los Angeles 131,701 100.0 100.0 Maxwell Downtown Los Angeles 102,963 100.0 100.0 San Francisco Bay Area, California Concourse North San Jose 945,346 80.5 86.8 Gateway North San Jose 610,416 67.6 70.3 Metro Plaza North San Jose 447,116 53.9 58.8 Skyport Plaza North San Jose 418,667 5.4 6.1 1740 Technology North San Jose 215,857 100.0 100.0 1455 Market San Francisco 1,033,682 51.7 51.7 Rincon Center San Francisco 533,103 97.6 97.6 Ferry Building San Francisco 266,259 97.3 98.3 901 Market San Francisco 205,571 79.0 79.0 875 Howard San Francisco 191,201 100.0 100.0 625 Second San Francisco 138,354 64.2 64.2 275 Brannan San Francisco 57,120 100.0 100.0 Palo Alto Square Palo Alto 317,874 91.9 91.9 3400 Hillview Palo Alto 207,857 100.0 100.0 Foothill Research Center Palo Alto 195,121 93.6 93.6 Page Mill Hill Palo Alto 178,179 53.6 53.6 Clocktower Square Palo Alto 100,655 100.0 100.0 Page Mill Center Palo Alto 94,539 58.8 58.8 3176 Porter Palo Alto 46,759 100.0 100.0 Towers at Shore Center Redwood Shores 335,332 89.0 91.6 Shorebreeze Redwood Shores 230,932 79.6 79.6 555 Twin Dolphin Redwood Shores 200,986 71.2 71.2 333 Twin Dolphin Redwood Shores 183,123 87.4 87.4 Metro Center Foster City 724,062 72.2 83.7 Techmart Santa Clara 284,903 75.4 76.0 Seattle, Washington 1918 Eighth Denny Triangle 667,733 99.4 99.4 Hill7 Denny Triangle 285,310 99.6 99.6 5th & Bell Denny Triangle 197,136 100.0 100.0 Met Park North Denny Triangle 189,511 99.7 99.7 505 First Pioneer Square 287,907 36.0 36.0 83 King Pioneer Square 184,083 66.4 66.4 450 Alaskan Pioneer Square 171,026 99.5 99.5 411 First Pioneer Square 163,716 75.4 79.2 Vancouver, British Columbia Bentall Centre Downtown Vancouver 1,516,051 90.3 91.4 TOTAL IN-SERVICE OFFICE 14,437,595 81.3 % 83.1 % Note: Definitions for commonly used terms on pages 27-29.

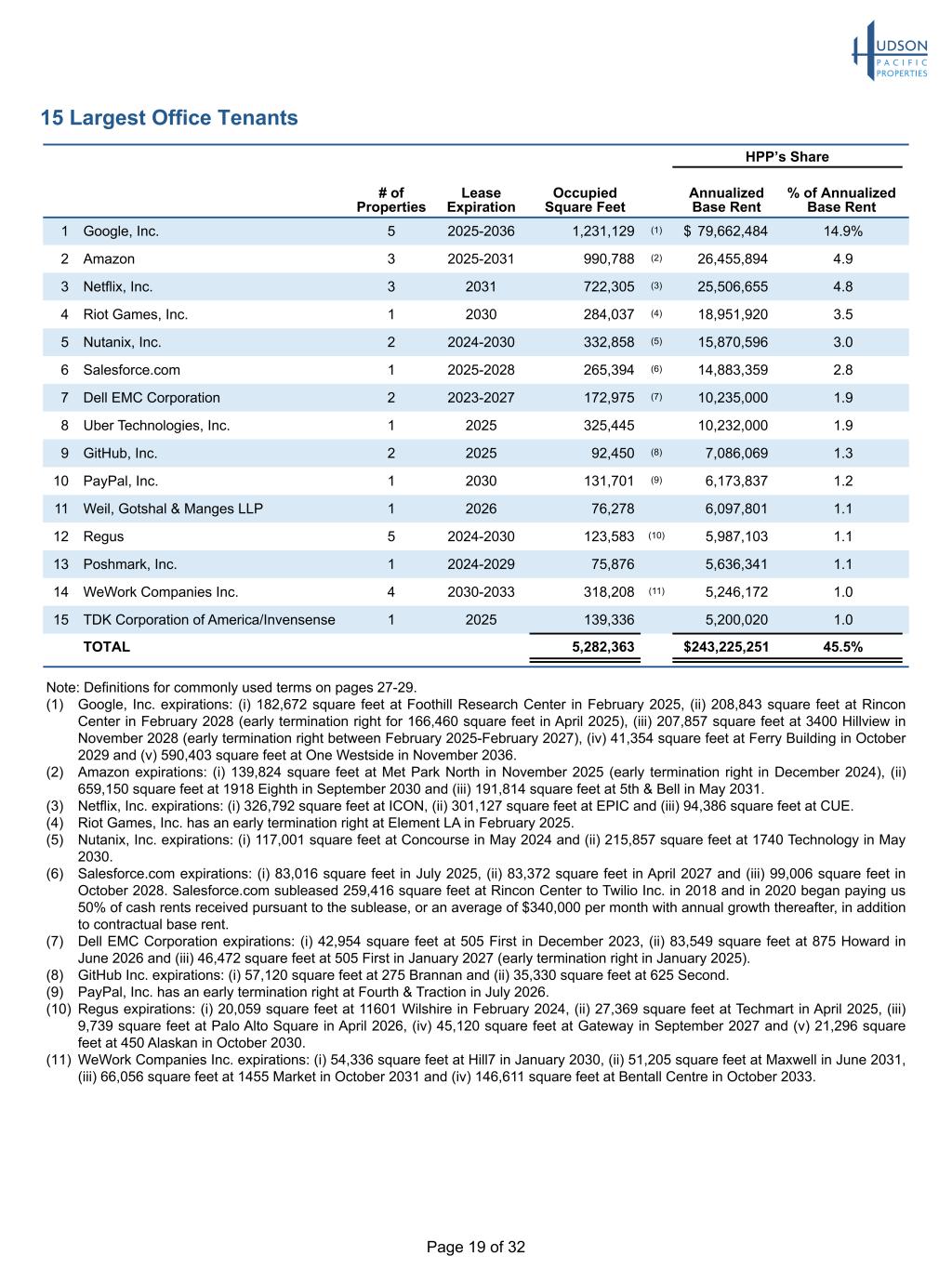

Page 19 of 32 Note: Definitions for commonly used terms on pages 27-29. (1) Google, Inc. expirations: (i) 182,672 square feet at Foothill Research Center in February 2025, (ii) 208,843 square feet at Rincon Center in February 2028 (early termination right for 166,460 square feet in April 2025), (iii) 207,857 square feet at 3400 Hillview in November 2028 (early termination right between February 2025-February 2027), (iv) 41,354 square feet at Ferry Building in October 2029 and (v) 590,403 square feet at One Westside in November 2036. (2) Amazon expirations: (i) 139,824 square feet at Met Park North in November 2025 (early termination right in December 2024), (ii) 659,150 square feet at 1918 Eighth in September 2030 and (iii) 191,814 square feet at 5th & Bell in May 2031. (3) Netflix, Inc. expirations: (i) 326,792 square feet at ICON, (ii) 301,127 square feet at EPIC and (iii) 94,386 square feet at CUE. (4) Riot Games, Inc. has an early termination right at Element LA in February 2025. (5) Nutanix, Inc. expirations: (i) 117,001 square feet at Concourse in May 2024 and (ii) 215,857 square feet at 1740 Technology in May 2030. (6) Salesforce.com expirations: (i) 83,016 square feet in July 2025, (ii) 83,372 square feet in April 2027 and (iii) 99,006 square feet in October 2028. Salesforce.com subleased 259,416 square feet at Rincon Center to Twilio Inc. in 2018 and in 2020 began paying us 50% of cash rents received pursuant to the sublease, or an average of $340,000 per month with annual growth thereafter, in addition to contractual base rent. (7) Dell EMC Corporation expirations: (i) 42,954 square feet at 505 First in December 2023, (ii) 83,549 square feet at 875 Howard in June 2026 and (iii) 46,472 square feet at 505 First in January 2027 (early termination right in January 2025). (8) GitHub Inc. expirations: (i) 57,120 square feet at 275 Brannan and (ii) 35,330 square feet at 625 Second. (9) PayPal, Inc. has an early termination right at Fourth & Traction in July 2026. (10) Regus expirations: (i) 20,059 square feet at 11601 Wilshire in February 2024, (ii) 27,369 square feet at Techmart in April 2025, (iii) 9,739 square feet at Palo Alto Square in April 2026, (iv) 45,120 square feet at Gateway in September 2027 and (v) 21,296 square feet at 450 Alaskan in October 2030. (11) WeWork Companies Inc. expirations: (i) 54,336 square feet at Hill7 in January 2030, (ii) 51,205 square feet at Maxwell in June 2031, (iii) 66,056 square feet at 1455 Market in October 2031 and (iv) 146,611 square feet at Bentall Centre in October 2033. HPP’s Share # of Properties Lease Expiration Occupied Square Feet Annualized Base Rent % of Annualized Base Rent 1 Google, Inc. 5 2025-2036 1,231,129 (1) $ 79,662,484 14.9% 2 Amazon 3 2025-2031 990,788 (2) 26,455,894 4.9 3 Netflix, Inc. 3 2031 722,305 (3) 25,506,655 4.8 4 Riot Games, Inc. 1 2030 284,037 (4) 18,951,920 3.5 5 Nutanix, Inc. 2 2024-2030 332,858 (5) 15,870,596 3.0 6 Salesforce.com 1 2025-2028 265,394 (6) 14,883,359 2.8 7 Dell EMC Corporation 2 2023-2027 172,975 (7) 10,235,000 1.9 8 Uber Technologies, Inc. 1 2025 325,445 10,232,000 1.9 9 GitHub, Inc. 2 2025 92,450 (8) 7,086,069 1.3 10 PayPal, Inc. 1 2030 131,701 (9) 6,173,837 1.2 11 Weil, Gotshal & Manges LLP 1 2026 76,278 6,097,801 1.1 12 Regus 5 2024-2030 123,583 (10) 5,987,103 1.1 13 Poshmark, Inc. 1 2024-2029 75,876 5,636,341 1.1 14 WeWork Companies Inc. 4 2030-2033 318,208 (11) 5,246,172 1.0 15 TDK Corporation of America/Invensense 1 2025 139,336 5,200,020 1.0 TOTAL 5,282,363 $ 243,225,251 45.5% 15 Largest Office Tenants

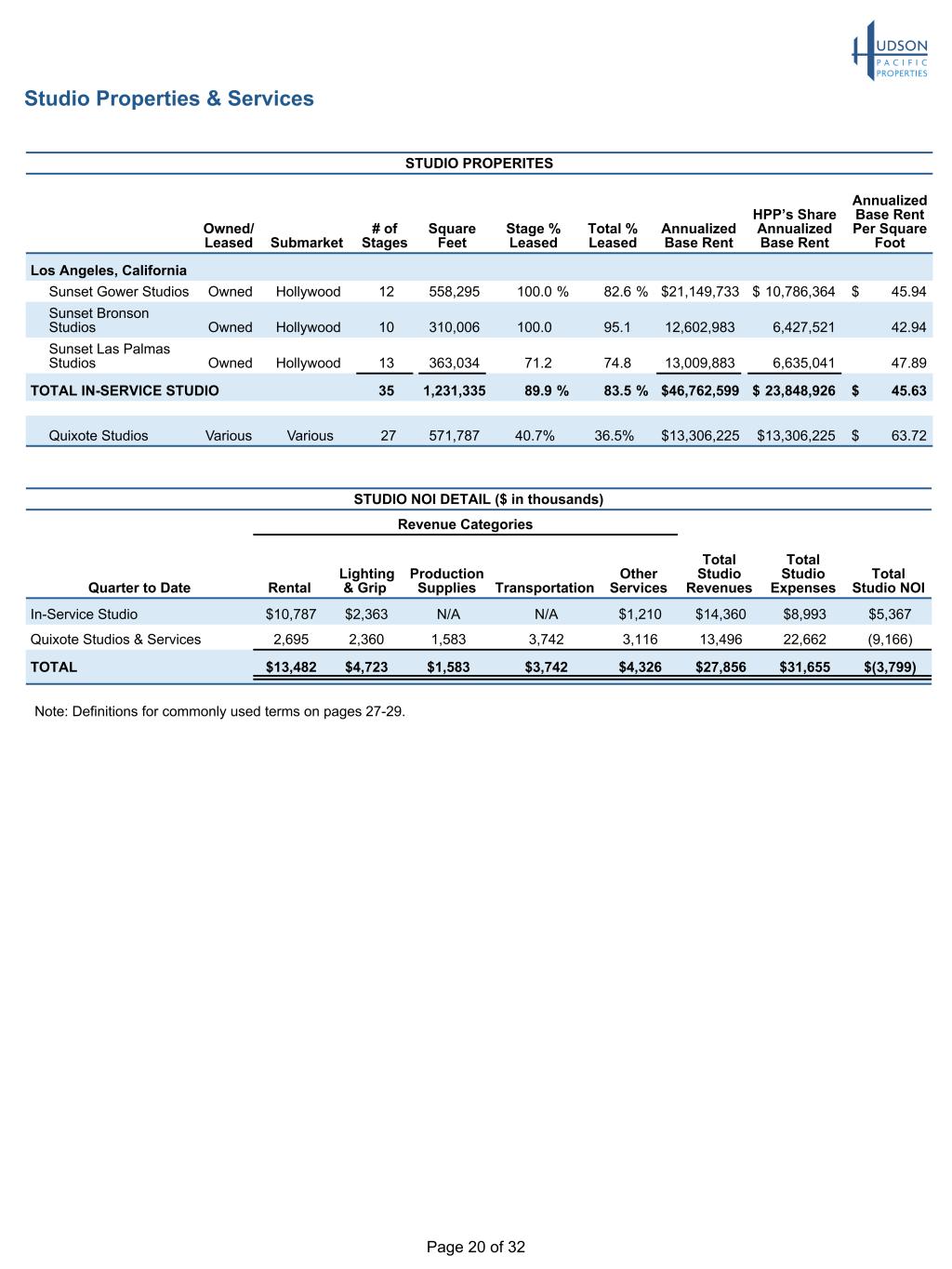

Page 20 of 32 Note: Definitions for commonly used terms on pages 27-29. STUDIO PROPERITES Owned/ Leased Submarket # of Stages Square Feet Stage % Leased Total % Leased Annualized Base Rent HPP’s Share Annualized Base Rent Annualized Base Rent Per Square Foot Los Angeles, California Sunset Gower Studios Owned Hollywood 12 558,295 100.0 % 82.6 % $ 21,149,733 $ 10,786,364 $ 45.94 Sunset Bronson Studios Owned Hollywood 10 310,006 100.0 95.1 12,602,983 6,427,521 42.94 Sunset Las Palmas Studios Owned Hollywood 13 363,034 71.2 74.8 13,009,883 6,635,041 47.89 TOTAL IN-SERVICE STUDIO 35 1,231,335 89.9 % 83.5 % $ 46,762,599 $ 23,848,926 $ 45.63 Quixote Studios Various Various 27 571,787 40.7% 36.5% $13,306,225 $13,306,225 $ 63.72 Studio Properties & Services STUDIO NOI DETAIL ($ in thousands) Revenue Categories Quarter to Date Rental Lighting & Grip Production Supplies Transportation Other Services Total Studio Revenues Total Studio Expenses Total Studio NOI In-Service Studio $10,787 $2,363 N/A N/A $1,210 $14,360 $8,993 $5,367 Quixote Studios & Services 2,695 2,360 1,583 3,742 3,116 13,496 22,662 (9,166) TOTAL $13,482 $4,723 $1,583 $3,742 $4,326 $27,856 $31,655 $(3,799)

Page 21 of 32 Office Leasing Activity Dollars reflected are per square foot Three Months Ended 9/30/23 Nine Months Ended 9/30/23 Gross Leasing Activity New cash rate $31.25 $42.85 Renewal cash rate $43.53 $50.89 New square feet leased 102,101 462,622 Renewal square feet leased 417,066 803,845 Total square feet leased 519,167 1,266,467 Leases expired and terminated Contractual expiration square feet 627,357 1,279,269 Early termination square feet 51,891 301,021 Total square feet expired/terminated 679,248 1,580,290 GAAP rent expiring rate $36.10 $44.60 GAAP rent new/renewal rate $39.48 $45.17 % change in GAAP rent 9.4 % 1.3 % Cash rent expiring rate $40.00 $50.41 Cash rent new/renewal rate $43.46 $49.76 % change in cash rent 8.7 % (1.3) % Tenant improvements & leasing commissions (total / annual) New leases $26.45 / $9.81 $47.22 / $9.85 Renewal leases $8.74 / $2.78 $12.05 / $4.48 Blended $12.18 / $3.99 $24.90 / $7.20 Net effective rent New leases $21.65 $31.21 Renewal leases $39.01 $44.09 Blended $35.63 $39.38 Weighted average lease term (in months) New leases 32.3 57.5 Renewal leases 37.7 32.3 Blended 36.6 41.5 Note: Definitions for commonly used terms on pages 27-29.

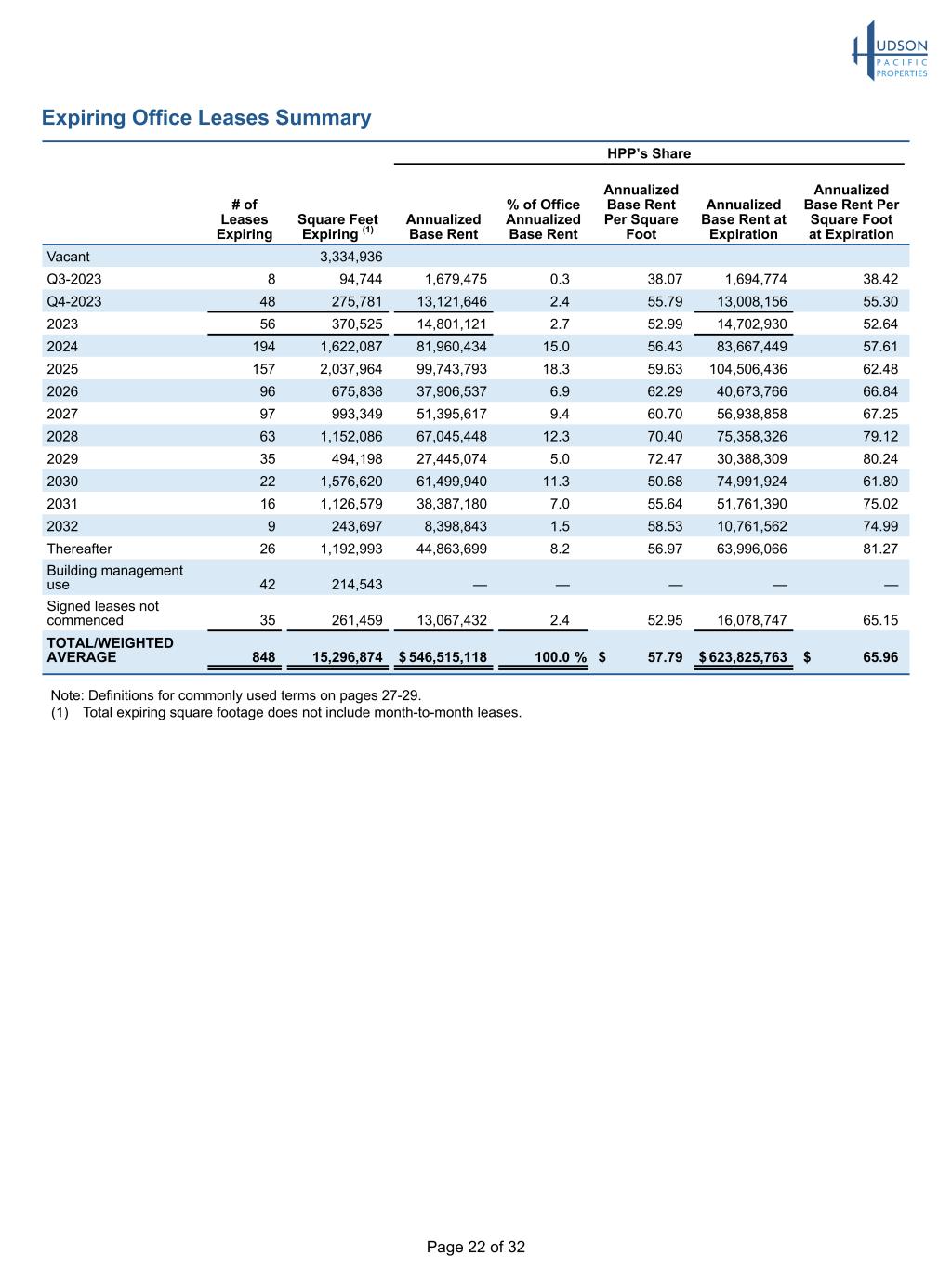

Page 22 of 32 Expiring Office Leases Summary HPP’s Share # of Leases Expiring Square Feet Expiring (1) Annualized Base Rent % of Office Annualized Base Rent Annualized Base Rent Per Square Foot Annualized Base Rent at Expiration Annualized Base Rent Per Square Foot at Expiration Vacant 3,334,936 Q3-2023 8 94,744 1,679,475 0.3 38.07 1,694,774 38.42 Q4-2023 48 275,781 13,121,646 2.4 55.79 13,008,156 55.30 2023 56 370,525 14,801,121 2.7 52.99 14,702,930 52.64 2024 194 1,622,087 81,960,434 15.0 56.43 83,667,449 57.61 2025 157 2,037,964 99,743,793 18.3 59.63 104,506,436 62.48 2026 96 675,838 37,906,537 6.9 62.29 40,673,766 66.84 2027 97 993,349 51,395,617 9.4 60.70 56,938,858 67.25 2028 63 1,152,086 67,045,448 12.3 70.40 75,358,326 79.12 2029 35 494,198 27,445,074 5.0 72.47 30,388,309 80.24 2030 22 1,576,620 61,499,940 11.3 50.68 74,991,924 61.80 2031 16 1,126,579 38,387,180 7.0 55.64 51,761,390 75.02 2032 9 243,697 8,398,843 1.5 58.53 10,761,562 74.99 Thereafter 26 1,192,993 44,863,699 8.2 56.97 63,996,066 81.27 Building management use 42 214,543 — — — — — Signed leases not commenced 35 261,459 13,067,432 2.4 52.95 16,078,747 65.15 TOTAL/WEIGHTED AVERAGE 848 15,296,874 $ 546,515,118 100.0 % $ 57.79 $ 623,825,763 $ 65.96 Note: Definitions for commonly used terms on pages 27-29. (1) Total expiring square footage does not include month-to-month leases.

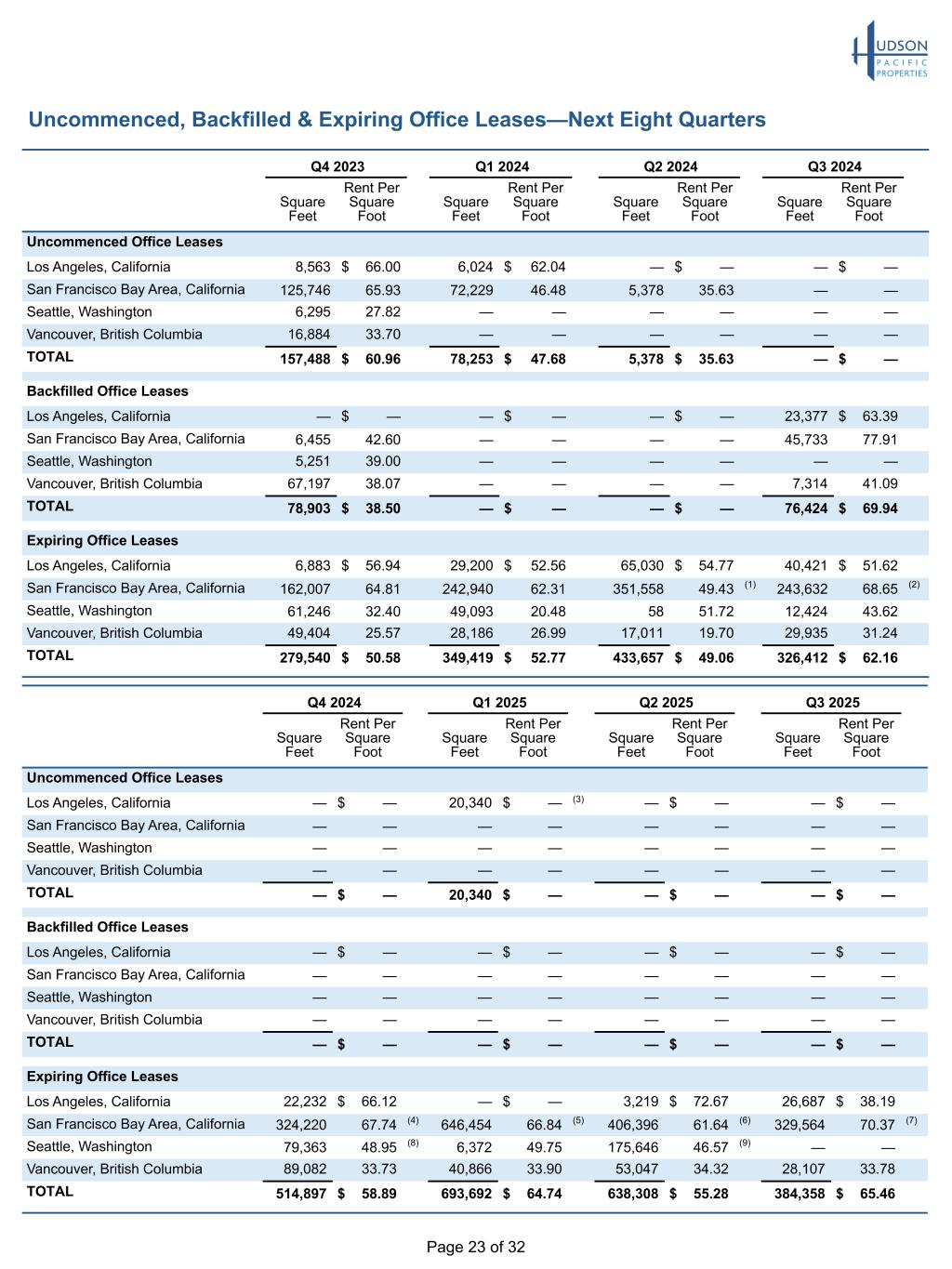

Page 23 of 32 Uncommenced, Backfilled & Expiring Office Leases—Next Eight Quarters Q4 2023 Q1 2024 Q2 2024 Q3 2024 Square Feet Rent Per Square Foot Square Feet Rent Per Square Foot Square Feet Rent Per Square Foot Square Feet Rent Per Square Foot Uncommenced Office Leases Los Angeles, California 8,563 $ 66.00 6,024 $ 62.04 — $ — — $ — San Francisco Bay Area, California 125,746 65.93 72,229 46.48 5,378 35.63 — — Seattle, Washington 6,295 27.82 — — — — — — Vancouver, British Columbia 16,884 33.70 — — — — — — TOTAL 157,488 $ 60.96 78,253 $ 47.68 5,378 $ 35.63 — $ — Backfilled Office Leases Los Angeles, California — $ — — $ — — $ — 23,377 $ 63.39 San Francisco Bay Area, California 6,455 42.60 — — — — 45,733 77.91 Seattle, Washington 5,251 39.00 — — — — — — Vancouver, British Columbia 67,197 38.07 — — — — 7,314 41.09 TOTAL 78,903 $ 38.50 — $ — — $ — 76,424 $ 69.94 Expiring Office Leases Los Angeles, California 6,883 $ 56.94 29,200 $ 52.56 65,030 $ 54.77 40,421 $ 51.62 San Francisco Bay Area, California 162,007 64.81 242,940 62.31 351,558 49.43 (1) 243,632 68.65 (2) Seattle, Washington 61,246 32.40 49,093 20.48 58 51.72 12,424 43.62 Vancouver, British Columbia 49,404 25.57 28,186 26.99 17,011 19.70 29,935 31.24 TOTAL 279,540 $ 50.58 349,419 $ 52.77 433,657 $ 49.06 326,412 $ 62.16 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Square Feet Rent Per Square Foot Square Feet Rent Per Square Foot Square Feet Rent Per Square Foot Square Feet Rent Per Square Foot Uncommenced Office Leases Los Angeles, California — $ — 20,340 $ — (3) — $ — — $ — San Francisco Bay Area, California — — — — — — — — Seattle, Washington — — — — — — — — Vancouver, British Columbia — — — — — — — — TOTAL — $ — 20,340 $ — — $ — — $ — Backfilled Office Leases Los Angeles, California — $ — — $ — — $ — — $ — San Francisco Bay Area, California — — — — — — — — Seattle, Washington — — — — — — — — Vancouver, British Columbia — — — — — — — — TOTAL — $ — — $ — — $ — — $ — Expiring Office Leases Los Angeles, California 22,232 $ 66.12 — $ — 3,219 $ 72.67 26,687 $ 38.19 San Francisco Bay Area, California 324,220 67.74 (4) 646,454 66.84 (5) 406,396 61.64 (6) 329,564 70.37 (7) Seattle, Washington 79,363 48.95 (8) 6,372 49.75 175,646 46.57 (9) — — Vancouver, British Columbia 89,082 33.73 40,866 33.90 53,047 34.32 28,107 33.78 TOTAL 514,897 $ 58.89 693,692 $ 64.74 638,308 $ 55.28 384,358 $ 65.46

Page 24 of 32 Uncommenced, Backfilled & Expiring Office Leases—Next Eight Quarters (continued) Note: Definitions for commonly used terms on pages 27-29. (1) Includes Nutanix, Inc. expiration at Concourse for 117,001 square feet in May 2024. (2) Includes Door Dash, Inc. at 901 Market for 50,821 square feet in August 2024. (3) Total uncommenced square footage consists of space to be occupied by the Company’s management office. (4) Includes Bank of America at 1455 Market for 68,991 square feet in December 2024. (5) Includes Uber Technologies, Inc. at 1455 Market for 325,445 square feet and Google, Inc. at Foothill Research Center for 182,672 square feet both in February 2025. (6) Includes TDK Corporation of America/Invensense at Concourse for 139,336 square feet in April 2025 and Github, Inc. at 275 Brannan for 57,120 square feet in June 2025. (7) Includes Salesforce.com at Rincon Center for 83,016 square feet in July 2025. (8) Includes RealSelf, Inc. at 83 King for 74,700 square feet in December 2024. (9) Includes HBO Code Labs, Inc. at Hill7 for 112,222 square feet in May 2025.

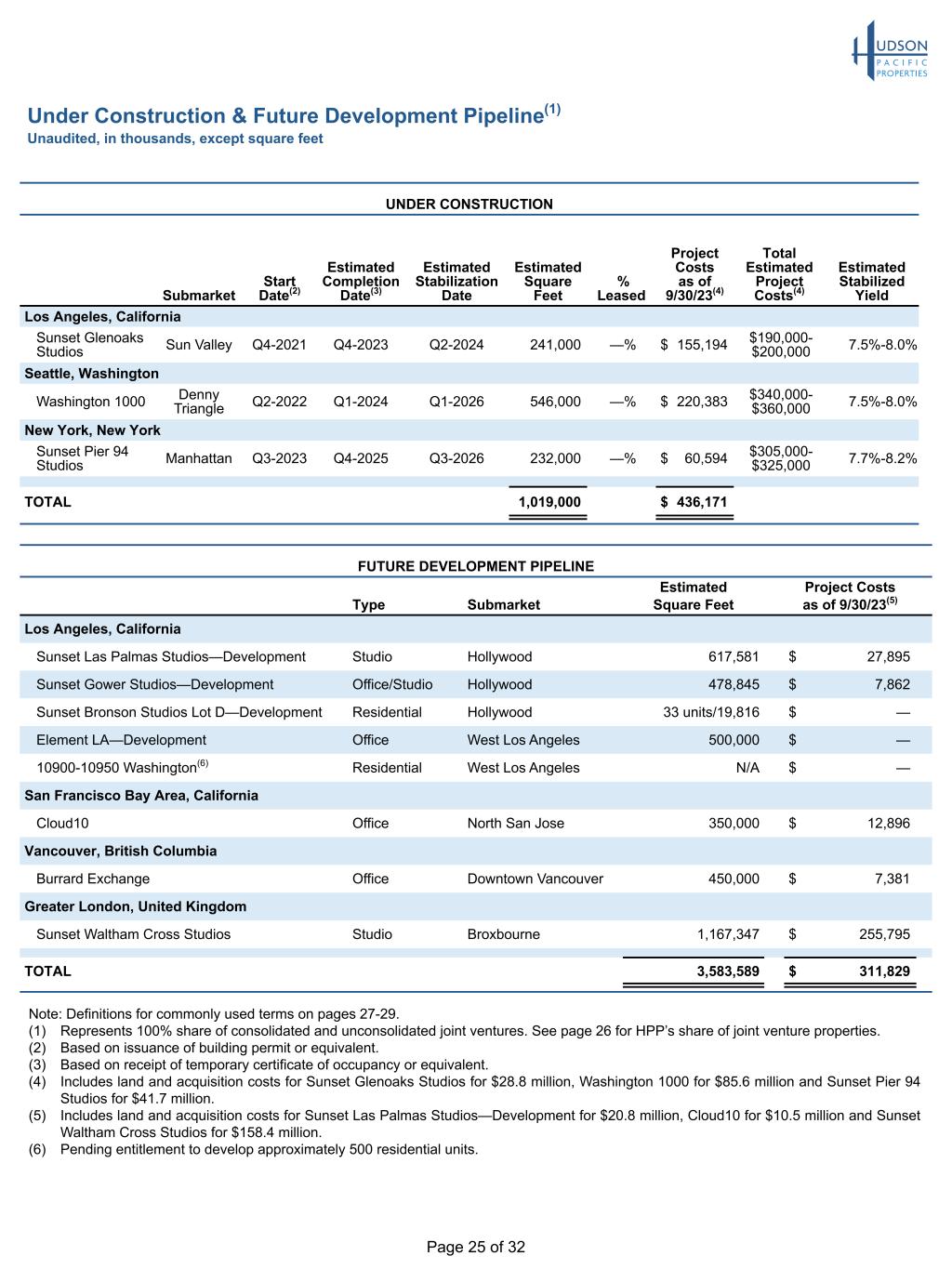

Page 25 of 32 Under Construction & Future Development Pipeline(1) Unaudited, in thousands, except square feet Note: Definitions for commonly used terms on pages 27-29. (1) Represents 100% share of consolidated and unconsolidated joint ventures. See page 26 for HPP’s share of joint venture properties. (2) Based on issuance of building permit or equivalent. (3) Based on receipt of temporary certificate of occupancy or equivalent. (4) Includes land and acquisition costs for Sunset Glenoaks Studios for $28.8 million, Washington 1000 for $85.6 million and Sunset Pier 94 Studios for $41.7 million. (5) Includes land and acquisition costs for Sunset Las Palmas Studios—Development for $20.8 million, Cloud10 for $10.5 million and Sunset Waltham Cross Studios for $158.4 million. (6) Pending entitlement to develop approximately 500 residential units. UNDER CONSTRUCTION Submarket Start Date(2) Estimated Completion Date(3) Estimated Stabilization Date Estimated Square Feet % Leased Project Costs as of 9/30/23(4) Total Estimated Project Costs(4) Estimated Stabilized Yield Los Angeles, California Sunset Glenoaks Studios Sun Valley Q4-2021 Q4-2023 Q2-2024 241,000 —% $ 155,194 $190,000- $200,000 7.5%-8.0% Seattle, Washington Washington 1000 Denny Triangle Q2-2022 Q1-2024 Q1-2026 546,000 —% $ 220,383 $340,000- $360,000 7.5%-8.0% New York, New York Sunset Pier 94 Studios Manhattan Q3-2023 Q4-2025 Q3-2026 232,000 —% $ 60,594 $305,000- $325,000 7.7%-8.2% TOTAL 1,019,000 $ 436,171 FUTURE DEVELOPMENT PIPELINE Type Submarket Estimated Square Feet Project Costs as of 9/30/23(5) Los Angeles, California Sunset Las Palmas Studios—Development Studio Hollywood 617,581 $ 27,895 Sunset Gower Studios—Development Office/Studio Hollywood 478,845 $ 7,862 Sunset Bronson Studios Lot D—Development Residential Hollywood 33 units/19,816 $ — Element LA—Development Office West Los Angeles 500,000 $ — 10900-10950 Washington(6) Residential West Los Angeles N/A $ — San Francisco Bay Area, California Cloud10 Office North San Jose 350,000 $ 12,896 Vancouver, British Columbia Burrard Exchange Office Downtown Vancouver 450,000 $ 7,381 Greater London, United Kingdom Sunset Waltham Cross Studios Studio Broxbourne 1,167,347 $ 255,795 TOTAL 3,583,589 $ 311,829

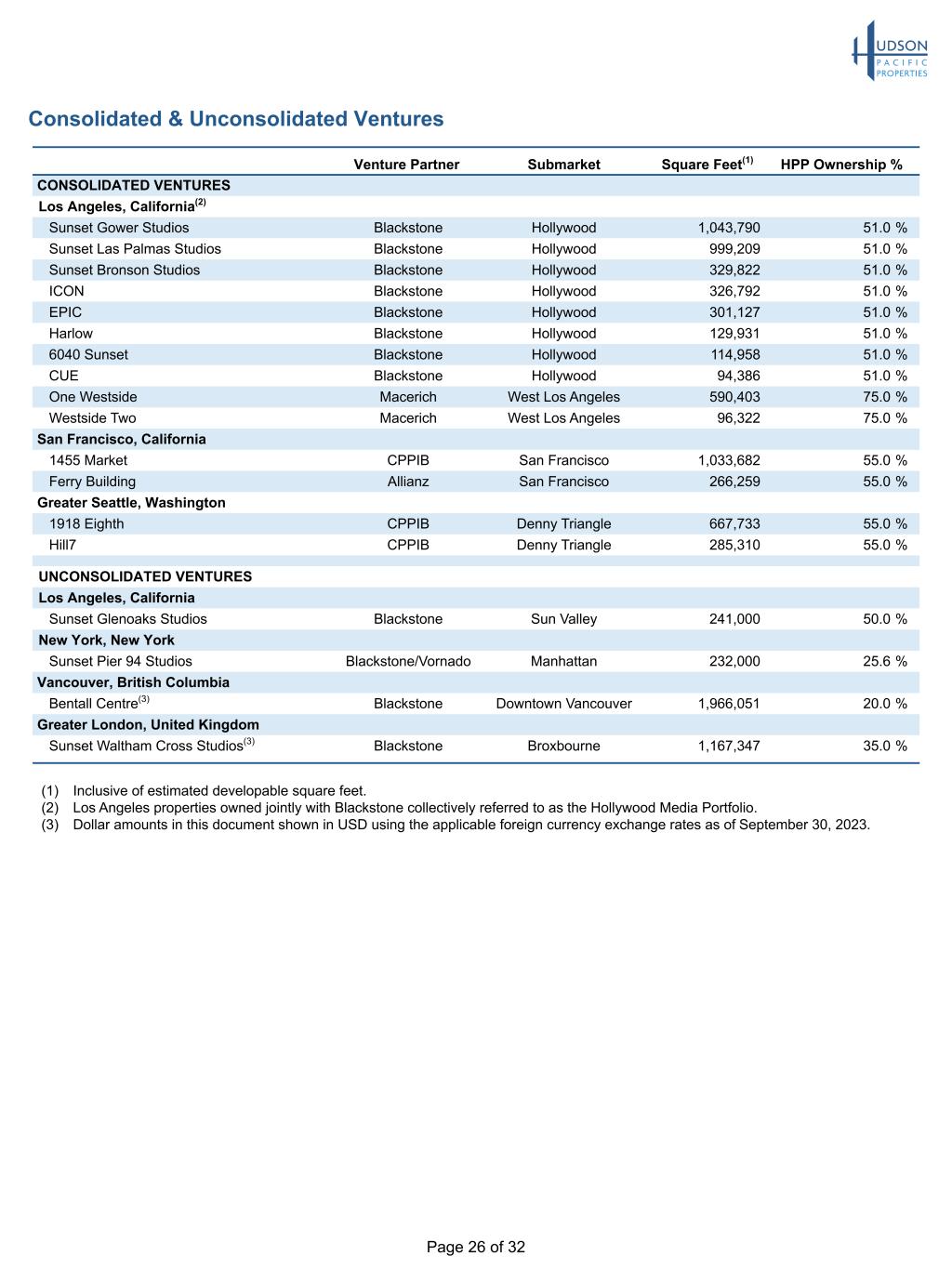

Page 26 of 32 Consolidated & Unconsolidated Ventures Venture Partner Submarket Square Feet(1) HPP Ownership % CONSOLIDATED VENTURES Los Angeles, California(2) Sunset Gower Studios Blackstone Hollywood 1,043,790 51.0 % Sunset Las Palmas Studios Blackstone Hollywood 999,209 51.0 % Sunset Bronson Studios Blackstone Hollywood 329,822 51.0 % ICON Blackstone Hollywood 326,792 51.0 % EPIC Blackstone Hollywood 301,127 51.0 % Harlow Blackstone Hollywood 129,931 51.0 % 6040 Sunset Blackstone Hollywood 114,958 51.0 % CUE Blackstone Hollywood 94,386 51.0 % One Westside Macerich West Los Angeles 590,403 75.0 % Westside Two Macerich West Los Angeles 96,322 75.0 % San Francisco, California 1455 Market CPPIB San Francisco 1,033,682 55.0 % Ferry Building Allianz San Francisco 266,259 55.0 % Greater Seattle, Washington 1918 Eighth CPPIB Denny Triangle 667,733 55.0 % Hill7 CPPIB Denny Triangle 285,310 55.0 % UNCONSOLIDATED VENTURES Los Angeles, California Sunset Glenoaks Studios Blackstone Sun Valley 241,000 50.0 % New York, New York Sunset Pier 94 Studios Blackstone/Vornado Manhattan 232,000 25.6 % Vancouver, British Columbia Bentall Centre(3) Blackstone Downtown Vancouver 1,966,051 20.0 % Greater London, United Kingdom Sunset Waltham Cross Studios(3) Blackstone Broxbourne 1,167,347 35.0 % (1) Inclusive of estimated developable square feet. (2) Los Angeles properties owned jointly with Blackstone collectively referred to as the Hollywood Media Portfolio. (3) Dollar amounts in this document shown in USD using the applicable foreign currency exchange rates as of September 30, 2023.

Page 27 of 32 Definitions Adjusted EBITDAre: Adjusted EBITDAre represents net income (loss) before interest, income taxes, depreciation and amortization, and before our share of interest and depreciation from unconsolidated real estate entities and further adjusted to eliminate the impact of certain non-cash items and items that we do not consider indicative of our ongoing performance. We believe that Adjusted EBITDAre is useful because it allows investors and management to evaluate and compare our performance from period to period in a meaningful and consistent manner, in addition to standard financial measurements under GAAP. Adjusted EBITDAre is not a measurement of financial performance under GAAP and should not be considered as an alternative to income attributable to common shareholders, as an indicator of operating performance or any measure of performance derived in accordance with GAAP. Our calculation of Adjusted EBITDAre may be different from the calculation used by other companies and, accordingly, comparability may be limited. Adjusted Funds from Operations (“AFFO”): Non-GAAP financial measure we believe is a useful supplemental measure of our performance. We compute AFFO by adding to FFO (excluding specified items) HPP’s share of non-cash compensation expense and amortization of deferred financing costs, and subtracting recurring capital expenditures related to HPP’s share of tenant improvements and leasing commissions (excluding pre-existing obligations on contributed or acquired properties funded with amounts received in settlement of prorations), and eliminating the net effect of HPP’s share of straight-line rents, amortization of lease buy-out costs, amortization of above-and below-market lease intangible assets and liabilities, amortization of above-and below-market ground lease intangible assets and liabilities and amortization of loan discounts/premiums. AFFO is not intended to represent cash flow for the period. We believe that AFFO provides useful information to the investment community about our financial position as compared to other REITs since AFFO is a widely reported measure used by other REITs. However, other REITs may use different methodologies for calculating AFFO and, accordingly, our AFFO may not be comparable to other REITs. Annualized Base Rent (“ABR”): For office properties, calculated by multiplying (i) cash base rents under commenced leases excluding tenant reimbursements as of September 30, 2023 by (ii) 12. On a per square foot basis, ABR is divided by square footage under commenced leases as of September 30, 2023. For all expiration years, ABR is calculated as (i) cash base rents at expiration under commenced leases divided by (ii) square footage under commenced leases as of September 30, 2023. The methodology is the same when calculating ABR per square foot either in place or at expiration for uncommenced leases. Rent data is presented without regard to cancellation options. Where applicable, rental rates converted to USD using the foreign currency exchange rate as of September 30, 2023. For studio properties, ABR reflects actual base rent for the 12 months ended September 30, 2023, excluding tenant reimbursements. ABR per leased square foot calculated as (i) annual base rent divided by (ii) square footage under lease as of September 30, 2023. Average Percent Occupied: For same-store office properties, represents the average percent occupied during the three months ended September 30, 2023. For same-store studio properties, represents the average percent leased for the 12 months ended September 30, 2023 Backfilled Office Leases: Defined as new leases with respect to occupied space executed on or prior to September 30, 2023, but with commencement dates after September 30, 2023, and within the next eight quarters. Cash Rent Growth: Initial stabilized cash rents on new and renewal leases compared to expiring cash rents in the same space. New leases are only included if the same space was leased within the previous 12 months. Excludes tenants paying percentage rent in lieu of base rent. Consolidated Debt: Consolidated unsecured and secured debt. Consolidated Debt, Net: Similar to consolidated debt, less consolidated cash and cash equivalents. Consolidated Unsecured and Secured Debt: Excludes joint venture partner debt, unamortized deferred financing costs and unamortized loan discounts/premiums related to our registered senior debt. Includes full amount of debt related to the Hill7, Hollywood Media Portfolio and 1918 Eighth joint ventures. Dilutive Shares: Represents an estimate of the total shares and units issuable under our 2021, 2022 and 2023 Performance Stock Unit (“PSU”) Plans as of quarter end, based on the projected award potential of such programs as of the end of such periods, calculated in accordance with Accounting Standards Codification (“ASC”) 260, Earnings Per Share. Effective Interest Rate: Interest rate with respect to indebtedness calculated based on a 360-day year for actual days elapsed. Debt with a variable interest rate component reflects SOFR or CDOR as of September 30, 2023, except to the extent that such debt is subject to a rate which has been fixed pursuant to a swap is above the capped rate, in which case the rate is calculated based on the swapped or capped rate, as applicable. Page 14 details our interest rate hedging instruments. We have an option to make an irrevocable election to change the interest rate depending on our credit rating or a specified base rate plus an applicable margin. As of September 30, 2023, no such election had been made.

Page 28 of 32 Definitions (continued) Estimated Stabilized Yield: Calculated as the quotient of estimated NOI and our investment in a property once project stabilizes and initial rental concessions, if any, have elapsed, excluding the impact of leverage. Cash rents related to development and redevelopment projects are expected to increase over time and average cash yields are expected to be greater than estimated initial stabilized yields. Our estimates for cash yields and total costs at completion represent our current estimates, which may be updated upon project completion or sooner, if there are significant changes to expected yields or costs. We caution against placing undue reliance on the estimated stabilized yields which are based solely on our estimates, using data available to us during the development process. The amount of total investment required to reach stabilized occupancy may differ substantially from our estimates due to various factors. We can provide no assurance that the actual stabilized yields will be consistent with the estimated stabilized yields set forth herein. Estimated Project Costs: Estimated project costs exclude interest costs capitalized in accordance with ASC 835-20-50-1, personnel costs capitalized in accordance with ASC 970-360-25 and operating expenses capitalized in accordance with ASC 970-340. Estimated Square Feet: Represents management’s estimate of leasable square footage, which may be less or more than the Building Owners and Managers Association (BOMA) rentable area. Square footage may change over time due to re-measurement or re-leasing. For land properties, square footage represents management’s estimate of developable square footage, the majority of which remains subject to entitlement approvals not yet obtained. Estimated Stabilization Date: Based on management’s estimate of stabilized occupancy (92.0%). Occupancy for stabilization purposes defined as the commencement of cash rental payments. Funds from Operations (“FFO”): We calculate FFO in accordance with the White Paper on FFO approved by the Board of Governors of the National Association of Real Estate Investment Trusts. The White Paper defines FFO as net income or loss calculated in accordance with GAAP, excluding gains and losses from sales of depreciable real estate and impairment write-downs associated with depreciable real estate, plus the HPP’s share of real estate-related depreciation and amortization, excluding amortization of deferred financing costs and depreciation of non-real estate assets. The calculation of FFO includes the HPP’s share of amortization of deferred revenue related to tenant-funded tenant improvements and excludes the depreciation of the related tenant improvement assets. FFO is a non-GAAP financial measure we believe is a useful supplemental measure of our operating performance. The exclusion from FFO of gains and losses from the sale of operating real estate assets allows investors and analysts to readily identify the operating results of the assets that form the core of our activity and assists in comparing those operating results between periods. Also, because FFO is generally recognized as the industry standard for reporting the operations of REITs, it facilitates comparisons of operating performance to other REITs. However, other REITs may use different methodologies to calculate FFO, and accordingly, our FFO may not be comparable to all other REITs. Implicit in historical cost accounting for real estate assets in accordance with GAAP is the assumption that the value of real estate assets diminishes predictably over time. Since real estate values have historically risen or fallen with market conditions, many industry investors and analysts have considered presentations of operating results for real estate companies using historical cost accounting alone to be insufficient. Because FFO excludes depreciation and amortization of real estate assets, we believe that FFO along with the required GAAP presentations provides a more complete measurement of our performance relative to our competitors and a more appropriate basis on which to make decisions involving operating, financing and investing activities than the required GAAP presentations alone would provide. We use FFO per share to calculate annual cash bonuses for certain employees. However, FFO should not be viewed as an alternative measure of our operating performance because it does not reflect either depreciation and amortization costs or the level of capital expenditures and leasing costs necessary to maintain the operating performance of our properties, which are significant economic costs and could materially impact our results from operations. GAAP Effective Rate: Similar to effective interest rate except it includes the amortization of deferred financing costs and loan discounts/ premiums. HPP’s Share: Non-GAAP financial measures calculated as the measure on a consolidated basis, in accordance with GAAP, plus our Operating Partnership’s share of the measure from our unconsolidated joint ventures (calculated based upon the Operating Partnership’s percentage ownership interest), minus our partners’ share of the measure from our consolidated joint ventures (calculated based upon the partners’ percentage ownership interests). We believe that presenting HPP’s share of these measures provides useful information to investors regarding the Company’s financial condition and/or results of operations because we have several significant joint ventures, and in some cases, we exercise significant influence over, but do not control, the joint venture. In such instances, GAAP requires us to account for the joint venture entity using the equity method of accounting, which we do not consolidate for financial reporting purposes. In other cases, GAAP requires us to consolidate the venture even though our partner(s) own(s) a significant percentage interest. HPP’s Share of Debt: Similar to consolidated debt except it includes HPP’s share of unconsolidated joint venture debt and excludes partners’ share of consolidated joint venture partner debt.

Page 29 of 32 In-Service Properties: Owned properties, excluding repositioning, redevelopment, development and held for sale properties. Net Effective Rent: Weighted average initial annual cash rent, net of annualized concessions (i.e. free rent), tenant improvements and lease commissions. Net Operating Income (“NOI”): We evaluate performance based upon property NOI from continuing operations. NOI is not a measure of operating results or cash flows from operating activities or cash flows as measured by GAAP and should not be considered an alternative to income from continuing operations, as an indication of our performance, or as an alternative to cash flows as a measure of liquidity, or our ability to make distributions. All companies may not calculate NOI in the same manner. We consider NOI to be a useful performance measure to investors and management because when compared across periods, NOI reflects the revenues and expenses directly associated with owning and operating our properties and the impact to operations from trends in occupancy rates, rental rates and operating costs, providing a perspective not immediately apparent from income from continuing operations. We calculate NOI as net income (loss) excluding corporate general and administrative expenses, depreciation and amortization, impairments, gains/losses on sales of real estate, interest expense, transaction-related expenses and other non-operating items. We define NOI as operating revenues (rental revenues, other property-related revenue, tenant recoveries and other operating revenues), less property-level operating expenses (external management fees, if any, and property-level general and administrative expenses). NOI on a cash basis is NOI adjusted to exclude the effect of straight- line rent and other non-cash adjustments required by GAAP. We believe that NOI on a cash basis is helpful to investors as an additional measure of operating performance because it eliminates straight-line rent and other non-cash adjustments to revenue and expenses. Operating Partnership: The Company conducts all of its operations through the Operating Partnership, Hudson Pacific Properties, L.P., and serves as its sole general partner. As of September 30, 2023, the Company owned 97.2% of the ownership interest in the Operating Partnership, including unvested restricted units. Outstanding Balance: Outstanding debt balances including partners’ share of consolidated entities and excludes unamortized deferred financing costs and loan discounts/premiums. Percent Occupied/Leased: For office properties, calculated as (i) square footage under commenced leases as of September 30, 2023, divided by (ii) total square feet, expressed as a percentage, whereas percent leased includes uncommenced leases. For studio properties, percent leased reflects the average percent leased for the 12 months ended September 30, 2023. Project Costs: Exclude interest costs capitalized in accordance with Accounting Standards Codification (“ASC”) 835-20-50-1, personnel costs capitalized in accordance with ASC 970-360-25 and operating expenses capitalized in accordance with ASC 970-340. Same-Store Office: Same-store office for the three months ended September 30, 2023 defined as all properties owned and included in our stabilized office portfolio as of July 1, 2022 and still owned and included in the stabilized office portfolio as of September 30, 2023. Same- store office for the nine months ended September 30, 2023 defined as all properties owned and included in our stabilized office portfolio as of January 1, 2022 and still owned and included in the stabilized office portfolio as of September 30, 2023. Same-Store Studio: Same-store studio for the three months ended September 30, 2023 defined as all properties owned and included in our stabilized studio portfolio as of July 1, 2022 and still owned and included in the stabilized studio portfolio as of September 30, 2023. Same- store studio for the nine months ended September 30, 2023 defined as all properties owned and included in our stabilized studio portfolio as of January 1, 2022 and still owned and included in the stabilized studio portfolio as of September 30, 2023. Straight-Line Rent Growth: Represents a comparison between initial straight-line rents on new and renewal leases as compared to the straight-line rents on expiring leases in the same space. New leases are only included if the same space was leased within the previous 12 months. Excludes tenants paying percentage rent in lieu of base rent. Uncommenced Office Leases: Defined as new leases with respect to vacant space executed on or prior to September 30, 2023, but with commencement dates after September 30, 2023 and within the next eight quarters. Definitions (continued)

Page 30 of 32 Non-GAAP Reconciliations Unaudited, in thousands RECONCILIATION OF NET LOSS TO NOI Three Months Ended Nine Months Ended 9/30/23 9/30/22 9/30/23 9/30/22 Net loss $ (35,754) $ (6,792) $ (82,047) $ (10,861) Adjustments: Loss (income) from unconsolidated real estate entities 759 352 2,219 (1,731) Fee income (340) (911) (5,026) (3,122) Interest expense 53,581 37,261 162,036 101,816 Interest income (800) (196) (1,407) (2,026) Management services reimbursement income—unconsolidated real estate entities (1,015) (983) (3,138) (3,159) Management services expense—unconsolidated real estate entities 1,015 983 3,138 3,159 Transaction-related expenses — 9,331 (1,344) 10,713 Unrealized loss on non-real estate investments 2,265 894 2,269 1,062 (Gain) loss on sale of real estate (16,108) 180 (23,154) 180 Impairment loss — 4,795 — 28,548 Gain on extinguishment of debt — — (10,000) — Other income (3) (1,147) (138) (1,138) Income tax (benefit) provision (425) (1,306) 715 (2,909) General and administrative 17,512 19,795 55,177 62,178 Depreciation and amortization 98,580 93,070 294,654 276,701 NOI $ 119,267 $ 155,326 $ 393,954 $ 459,411 Add: HPP’s share of NOI from unconsolidated real estate entities 2,766 2,719 8,307 10,170 Less: NOI attributable to non-controlling interests 23,628 24,253 75,385 71,391 HPP’s Share of NOI $ 98,405 $ 133,792 $ 326,876 $ 398,190 NOI Detail Same-store office cash revenues $ 194,847 $ 186,876 $ 559,831 $ 533,895 Straight-line rent (2,872) 6,614 10,397 34,175 Amortization of above/below-market leases, net 1,495 1,645 4,676 6,216 Amortization of lease incentive costs (266) (330) (809) (1,125) Same-store office revenues 193,204 194,805 574,095 573,161 Same-store studios cash revenues 14,053 21,834 53,110 61,666 Straight-line rent 316 440 1,227 1,677 Amortization of lease incentive costs (9) (9) (28) (28) Same-store studio revenues 14,360 22,265 54,309 63,315 Same-store revenues 207,564 217,070 628,404 636,476 Same-store office cash expenses 73,349 69,453 207,794 198,299 Straight-line rent 376 402 1,189 1,208 Non-cash compensation expense 35 25 105 74 Amortization of above/below-market ground leases, net 676 675 2,028 2,019 Same-store office expenses 74,436 70,555 211,116 201,600 Same-store studio cash expenses 8,879 13,080 30,194 36,763 Non-cash compensation expense 114 70 339 208 Same-store studio expenses 8,993 13,150 30,533 36,971 Same-store expenses 83,429 83,705 241,649 238,571 Same-store NOI 124,135 133,365 386,755 397,905 Non-same-store NOI (4,868) 21,961 7,199 61,506 NOI $ 119,267 $ 155,326 $ 393,954 $ 459,411

Page 31 of 32 Non-GAAP Reconciliations (continued) Unaudited, in thousands RECONCILIATIONS OF NET LOSS TO ADJUSTED EBITDARE (ANNUALIZED) AND TOTAL UNSECURED AND SECURED DEBT TO CONSOLIDATED DEBT, NET AND HPP’S SHARE OF DEBT, NET Three Months Ended 9/30/23 9/30/22 Net loss $ (35,752) $ (6,792) Interest income—consolidated (800) (196) Interest expense—consolidated 53,581 37,261 Depreciation and amortization—consolidated 98,580 93,070 EBITDA 115,609 123,343 Unconsolidated real estate entities depreciation and amortization 1,165 1,278 Unconsolidated real estate entities interest expense 1,788 1,214 EBITDAre 118,562 125,835 Impairment loss — 4,795 Unrealized loss on non-real estate investments 2,265 894 (Gain) loss on sale of real estate (16,108) 180 Other income (5) (1,147) Transaction-related expenses — 9,331 Non-cash compensation expense 5,522 6,494 Straight-line rent receivables, net 4,200 (5,379) Non-cash amortization of above/below-market leases, net (1,525) (1,701) Non-cash amortization of above/below-market ground leases, net 687 687 Amortization of lease incentive costs 289 359 Income tax provision (benefit) (425) (1,306) Adjusted EBITDAre 113,462 139,042 Prior period net property tax adjustment — 481 Adjusted EBITDAre (excluding specified items) 113,462 139,523 Studio cash NOI(1) 3,025 (9,235) Office adjusted EBITDAre 116,487 130,288 x Annualization factor 4 4 Annualized office adjusted EBITDAre 465,948 521,152 Trailing 12-month studio cash NOI(1) 29,444 33,789 Cash adjusted EBTIDAre for selected ratios 495,392 554,941 Less: Partners’ share of cash adjusted EBITDAre (96,187) (76,212) HPP’s share of cash adjusted EBITDAre $ 399,205 $ 478,729 Total consolidated unsecured and secured debt 4,433,118 4,476,575 Less: Consolidated cash and cash equivalents (75,040) (161,667) Consolidated debt, net $ 4,358,078 $ 4,314,908 Less: Partners’ share of debt, net (659,238) (648,641) HPP’s share of debt, net $ 3,698,840 $ 3,666,267 Consolidated debt, net/cash adjusted EBITDAre for selected ratios 8.8x 7.8x HPP’s share of debt, net/HPP’s share of cash adjusted EBITDAre for selected ratios 9.3x 7.7x (1) Studio cash NOI and trailing 12-month studio cash NOI for the calculation of cash adjusted EBITDAre for the three months ended September 30, 2023 includes the studio cash NOI contribution from In-Service Studio and Quixote Studios & Services.

Page 32 of 32 Non-GAAP Reconciliations (continued) Unaudited, in thousands RECONCILIATIONS OF TOTAL ASSETS TO HPP’S SHARE OF UNDEPRECIATED BOOK VALUE AND TOTAL UNSECURED AND SECURED DEBT TO HPP’S SHARE OF DEBT, NET 9/30/23 9/30/22 Total assets $ 8,986,802 $ 9,320,419 Add: Accumulated depreciation 1,779,599 1,540,455 Add: Accumulated amortization 206,284 162,493 Less: Partners’ share of consolidated undepreciated book value (1,545,375) (1,546,427) Less: Investment in unconsolidated real estate entities (236,248) (154,144) Add: HPP’s share of unconsolidated undepreciated book value 390,229 281,675 HPP’s share of undepreciated book value $ 9,581,291 $ 9,604,471 Total consolidated unsecured and secured debt $ 4,433,118 $ 4,476,575 Less: Consolidated cash and cash equivalents (75,040) (161,667) Consolidated debt, net $ 4,358,078 $ 4,314,908 Less: Partners’ share of debt, net (659,238) (648,641) HPP’s share of debt, net $ 3,698,840 $ 3,666,267 HPP’s share of debt, net/HPP’s share of undepreciated book value 38.6 % 38.2 %