Form NT 10-Q - Notification of inability to timely file Form 10-Q or 10-QSB

09 Novembro 2023 - 6:06PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________________________

FORM 12b-25

| | |

SEC FILE NUMBER

1-11657 |

CUSIP NUMBER

899896104 |

NOTIFICATION OF LATE FILING

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Check One) | ☐ | Form 10-K | ☐ | Form 20-F | ☐ | Form 11-K | ☒ | Form 10-Q | ☐ | Form 10-D | ☐ | Form N-CEN | ☐ | Form N-CSR |

| For Period Ended: September 30, 2023 |

| ☐ | Transition Report on Form 10-K |

| ☐ | Transition Report on Form 20-F |

| ☐ | Transition Report on Form 11-K |

| ☐ | Transition Report on Form 10-Q |

For the Transitional Period Ended: Not applicable

Nothing in this form shall be construed to imply that the Commission has verified any information contained herein.

If the notification relates to a portion of the filing checked above, identify the Item(s) to which the notification relates: Not applicable

| | |

| PART I - REGISTRANT INFORMATION |

|

| Tupperware Brands Corporation |

| Full Name of Registrant |

|

| Not applicable |

| Former Name if Applicable |

|

| 14901 South Orange Blossom Trail |

Address of Principal Executive Office (Street and Number) |

|

| Orlando, Florida 32837 |

| City, State and Zip Code |

|

PART II - RULES 12b-25(b) AND (c)

If the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b), the following should be completed. (Check box if appropriate)

| | | | | | | | |

| ☐ | (a) | The reasons described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense; |

| (b) | The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, 11-K Form N-CEN or Form N-CSR, or portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report of transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will be filed on or before the fifth calendar day following the prescribed due date; and |

| (c) | The accountant's statement or other exhibit required by Rule 12b-25(c) has been attached if applicable. |

PART III - NARRATIVE

State below in reasonable detail the reasons why Forms 10-K, 20-F, 11-K, 10-Q, N-CEN, N-CSR or the transition report or portion thereof, could not be filed within the prescribed time period.

Tupperware Brands Corporation (the “Company”) is unable to file its Quarterly Report on Form 10-Q for the quarter ended September 30, 2023 (the “Q3 Form 10-Q”) by the prescribed due date.

The Company previously disclosed that it incurred significant delays in the filing of its Annual Report on Form 10-K for the fiscal year ended December 31, 2022 (the “2022 Form 10-K”) due to the identification of multiple prior period misstatements and material weaknesses in internal control over financial reporting for the periods covered by the 2022 Form 10-K. The Company filed the 2022 Form 10-K on October 13, 2023 and is continuing its work to complete the consolidated financial statements for the Quarterly Report on Form 10-Q for the quarter ended April 1, 2023 (the “Q1 Form 10-Q”), and the quarter ended July 1, 2023 (the “Q2 Form 10-Q”). Furthermore, as previously disclosed in its 2022 Form 10-K, as a result of the Company’s challenging financial condition and extensive efforts to complete the restatement of the historical Consolidated Financial Statements, the Company’s accounting department has experienced, and continues to experience, significant attrition, including recent departures in key control positions within the accounting department and other supporting departments. The employee attrition has resulted in resource and skill set gaps, strained resources, and a loss of continuity of knowledge – all of which have contributed to delays in the filing of the Q1 Form 10-Q and the Q2 Form 10-Q.

In addition, as previously disclosed in a Current Report on Form 8-K filed October 27, 2023, the Company’s former independent auditor informed the Company that it was declining to stand for re-appointment as the Company’s registered public accounting firm for the integrated audit of the fiscal year ending December 30, 2023. The former auditor’s decision was not the result of a dispute between the Company and the former auditor. The former auditor’s reports on the Company’s financial statements for the fiscal years ended December 31, 2022 and December 25, 2021 contained no adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles, except that the report for the fiscal year ended December 31, 2022 included an explanatory paragraph indicating that there was substantial doubt about the Company’s ability to continue as a going concern. The Company is in the process of retaining a new independent auditor for fiscal year 2023 periodic reports, which is causing further delays.

Due to the time and effort required to finalize and file the Q1 Form 10-Q and Q2 Form 10-Q combined with the Company’s efforts to retain a new independent auditor, the Company will be unable, without unreasonable effort or expense, to complete and file the Q3 Form 10-Q within the prescribed time period.

As previously disclosed in the Company’s 2022 Form 10-K, on April 3, 2023 the Company received written notice from the New York Stock Exchange (“NYSE”) indicating the Company was not in compliance with Section 802.01E of the NYSE Listed Company Manual, as a result of the Company’s failure to timely file the 2022 Form 10-K with the Securities and Exchange Commission (“SEC”). The Company was initially granted a six month cure period following the 2022 Form 10-K filing due date to become current in its SEC periodic filings. Due to the delays described above, the Company was unable to become current in its SEC periodic filings within the six month period. On September 20, 2023, the Company submitted a late filer extension request for an additional six-month cure period in which the Company would be required to file the 2022 Form 10-K as well as the Q1 Form 10-Q, Q2 Form 10-Q, and Q3 Form 10-Q. On October 3, 2023, the NYSE granted the Company’s request for an extension to the compliance period through March 31, 2024 for the filing of the Q1 Form 10-Q, Q2 Form 10-Q, and Q3 Form 10-Q.

The Company is endeavoring to complete its financial close process and file its Q1 Form 10-Q and Q2 Form 10-Q as promptly as possible and intends to file its Q3 Form 10-Q as promptly as possible after filing the Q2 Form 10-Q, however there can be no assurance with respect to the timing of completion of the filings.

Forward-Looking Statements

This Form 12b-25 includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including with respect to the timing of the filing of the Q1 Form 10-Q, Q2 Form 10-Q and the Q3 Form 10-Q, preliminary estimated revenues for the quarter ended September 30, 2023, and the Company retaining a new independent auditor. Such forward-looking statements are based on assumptions about many important factors, including the following, which could cause actual results to differ materially from those in the forward-looking statements: whether the Company will identify additional errors in previously issued financial statements, the accuracy of its assumptions underlying its revenue estimation for the quarter ended September 30, 2023, the length of time it will take the Company to engage a new auditor, and other risks identified in the Company’s most recent filing on Form 10-K and other SEC filings, all of which are available on the Company’s website. The Company does not undertake to update its forward-looking statements unless otherwise required by the federal securities laws.

PART IV - OTHER INFORMATION

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Name and telephone number of person to contact in regard to this notification |

| Mariela Matute | | 407 | | 826-8899 | | | | |

| (Name) | | (Area Code) | | (Telephone Number) | | | | |

| | | | | | | | | |

| (2) | Have all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s) been filed? |

| If answer is no, identify report(s). | ☐ | Yes | ☒ | No |

| Form 10-Q for the quarter ended April 1, 2023 | | | | |

| Form 10-Q for the quarter ended July 1, 2023 | | | | |

| |

| (3) | Is it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be reflected |

| by the earnings statements to be included in the subject report or portion thereof? | ☒ | Yes | ☐ | No |

| If so, attach an explanation of the anticipated change, both narratively and quantitatively, and, if appropriate, state the reasons why a reasonable estimate of the results cannot be made.

While the Company is still completing its third quarter 2023 financial close process, it expects that its Q3 Form 10-Q will reflect a material decline in revenues for the quarter ended September 30, 2023 as compared to the quarter ended September 24, 2022. The Company believes that its preliminary estimated revenue results for the quarter ended September 30, 2023 will be within the range of $250 - $260 million. The Company is still completing its financial statement close process for the Q3 Form 10-Q given the reasons noted in Part III above and, therefore, no reasonable quantitative estimate of the changes can be made at this time. |

| | | | | | | | | | | | | | |

| Tupperware Brands Corporation | |

| (Name of Registrant as Specified in Charter) | |

| | | | |

| has caused this notification to be signed on its behalf by the undersigned hereunto duly authorized. |

| | | | |

| Date: | November 9, 2023 | By: | /s/ Mariela Matute |

| | | | Mariela Matute |

| | | | Chief Financial Officer |

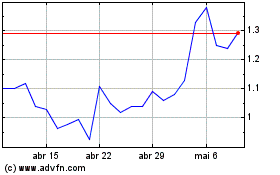

Tupperware Brands (NYSE:TUP)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Tupperware Brands (NYSE:TUP)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024