true

FY

0001454742

No

Yes

Yes

Yes

0001454742

2022-01-01

2022-12-31

0001454742

2022-06-30

0001454742

2023-04-07

0001454742

2022-12-31

0001454742

2021-12-31

0001454742

us-gaap:RelatedPartyMember

2022-12-31

0001454742

us-gaap:RelatedPartyMember

2021-12-31

0001454742

us-gaap:SeriesAPreferredStockMember

2022-12-31

0001454742

us-gaap:SeriesAPreferredStockMember

2021-12-31

0001454742

us-gaap:SeriesBPreferredStockMember

2022-12-31

0001454742

us-gaap:SeriesBPreferredStockMember

2021-12-31

0001454742

us-gaap:SeriesCPreferredStockMember

2022-12-31

0001454742

us-gaap:SeriesCPreferredStockMember

2021-12-31

0001454742

us-gaap:SeriesDPreferredStockMember

2022-12-31

0001454742

us-gaap:SeriesDPreferredStockMember

2021-12-31

0001454742

us-gaap:SeriesEPreferredStockMember

2022-12-31

0001454742

us-gaap:SeriesEPreferredStockMember

2021-12-31

0001454742

2021-01-01

2021-12-31

0001454742

2020-12-31

0001454742

us-gaap:PreferredClassAMember

us-gaap:PreferredStockMember

2020-12-31

0001454742

us-gaap:PreferredClassBMember

us-gaap:PreferredStockMember

2020-12-31

0001454742

GMER:PreferredClassCMember

us-gaap:PreferredStockMember

2020-12-31

0001454742

GMER:PreferredClassDMember

us-gaap:PreferredStockMember

2020-12-31

0001454742

GMER:PreferredClassEMember

us-gaap:PreferredStockMember

2020-12-31

0001454742

us-gaap:CommonStockMember

2020-12-31

0001454742

us-gaap:WarrantMember

2020-12-31

0001454742

us-gaap:AdditionalPaidInCapitalMember

2020-12-31

0001454742

us-gaap:RetainedEarningsMember

2020-12-31

0001454742

us-gaap:PreferredClassAMember

us-gaap:PreferredStockMember

2021-12-31

0001454742

us-gaap:PreferredClassBMember

us-gaap:PreferredStockMember

2021-12-31

0001454742

GMER:PreferredClassCMember

us-gaap:PreferredStockMember

2021-12-31

0001454742

GMER:PreferredClassDMember

us-gaap:PreferredStockMember

2021-12-31

0001454742

GMER:PreferredClassEMember

us-gaap:PreferredStockMember

2021-12-31

0001454742

us-gaap:CommonStockMember

2021-12-31

0001454742

us-gaap:WarrantMember

2021-12-31

0001454742

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001454742

us-gaap:RetainedEarningsMember

2021-12-31

0001454742

us-gaap:PreferredClassAMember

us-gaap:PreferredStockMember

2021-01-01

2021-12-31

0001454742

us-gaap:PreferredClassBMember

us-gaap:PreferredStockMember

2021-01-01

2021-12-31

0001454742

GMER:PreferredClassCMember

us-gaap:PreferredStockMember

2021-01-01

2021-12-31

0001454742

GMER:PreferredClassDMember

us-gaap:PreferredStockMember

2021-01-01

2021-12-31

0001454742

GMER:PreferredClassEMember

us-gaap:PreferredStockMember

2021-01-01

2021-12-31

0001454742

us-gaap:CommonStockMember

2021-01-01

2021-12-31

0001454742

us-gaap:WarrantMember

2021-01-01

2021-12-31

0001454742

us-gaap:AdditionalPaidInCapitalMember

2021-01-01

2021-12-31

0001454742

us-gaap:RetainedEarningsMember

2021-01-01

2021-12-31

0001454742

us-gaap:PreferredClassAMember

us-gaap:PreferredStockMember

2022-01-01

2022-12-31

0001454742

us-gaap:PreferredClassBMember

us-gaap:PreferredStockMember

2022-01-01

2022-12-31

0001454742

GMER:PreferredClassCMember

us-gaap:PreferredStockMember

2022-01-01

2022-12-31

0001454742

GMER:PreferredClassDMember

us-gaap:PreferredStockMember

2022-01-01

2022-12-31

0001454742

GMER:PreferredClassEMember

us-gaap:PreferredStockMember

2022-01-01

2022-12-31

0001454742

us-gaap:CommonStockMember

2022-01-01

2022-12-31

0001454742

us-gaap:WarrantMember

2022-01-01

2022-12-31

0001454742

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-12-31

0001454742

us-gaap:RetainedEarningsMember

2022-01-01

2022-12-31

0001454742

us-gaap:PreferredClassAMember

us-gaap:PreferredStockMember

2022-12-31

0001454742

us-gaap:PreferredClassBMember

us-gaap:PreferredStockMember

2022-12-31

0001454742

GMER:PreferredClassCMember

us-gaap:PreferredStockMember

2022-12-31

0001454742

GMER:PreferredClassDMember

us-gaap:PreferredStockMember

2022-12-31

0001454742

GMER:PreferredClassEMember

us-gaap:PreferredStockMember

2022-12-31

0001454742

us-gaap:CommonStockMember

2022-12-31

0001454742

us-gaap:WarrantMember

2022-12-31

0001454742

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001454742

us-gaap:RetainedEarningsMember

2022-12-31

0001454742

2017-01-01

2017-12-31

0001454742

us-gaap:FairValueInputsLevel1Member

2022-12-31

0001454742

us-gaap:FairValueInputsLevel2Member

2022-12-31

0001454742

us-gaap:FairValueInputsLevel3Member

2022-12-31

0001454742

us-gaap:FairValueInputsLevel1Member

2021-12-31

0001454742

us-gaap:FairValueInputsLevel2Member

2021-12-31

0001454742

us-gaap:FairValueInputsLevel3Member

2021-12-31

0001454742

us-gaap:ConvertibleDebtMember

GMER:HGTCapitalLLCMember

2015-04-15

0001454742

us-gaap:ConvertibleDebtMember

GMER:FirstPaymentMember

GMER:HGTCapitalLLCMember

2015-04-01

2015-06-30

0001454742

us-gaap:ConvertibleDebtMember

GMER:RemainingPaymentMember

GMER:HGTCapitalLLCMember

2015-04-01

2015-06-30

0001454742

us-gaap:ConvertibleDebtMember

GMER:HGTCapitalLLCMember

2015-04-14

2015-04-15

0001454742

GMER:ConvertiblePromissoryNoteMember

GMER:HGTCapitalLLCMember

2018-09-21

0001454742

GMER:ConvertiblePromissoryNoteMember

GMER:HGTCapitalLLCMember

2018-09-20

2018-09-21

0001454742

GMER:HGTCapitalLLCMember

2018-11-27

2018-11-29

0001454742

GMER:HGTCapitalLLCMember

2020-08-16

2020-08-17

0001454742

GMER:HGTCapitalLLCMember

2020-09-08

2020-09-09

0001454742

GMER:HGTCapitalLLCMember

2020-11-10

2020-11-11

0001454742

GMER:HGTCapitalLLCMember

2020-12-17

2020-12-18

0001454742

GMER:HGTCapitalLLCMember

2021-06-24

2021-06-25

0001454742

us-gaap:ConvertibleNotesPayableMember

GMER:ViaOneServicesLLCMember

2021-09-01

2021-09-30

0001454742

GMER:ViaOneServicesLLCMember

us-gaap:ConvertibleNotesPayableMember

2021-09-30

0001454742

GMER:SeriesEConvertiblePreferredStockMember

GMER:ViaOneServicesLLCMember

GMER:RevolvingNoteMember

2021-01-01

2021-12-31

0001454742

GMER:NewEmployeeServiceAgreementMember

GMER:ViaOneServicesLLCMember

2021-09-01

2021-09-30

0001454742

GMER:NewEmployeeServiceAgreementMember

GMER:ViaOneServicesLLCMember

2021-09-30

0001454742

GMER:NewEmployeeServiceAgreementMember

GMER:ViaOneServicesLLCMember

GMER:SeriesEConvertiblePreferredStockMember

2021-01-01

2021-12-31

0001454742

GMER:LincolnMember

us-gaap:SeriesBPreferredStockMember

2021-03-07

2021-03-08

0001454742

GMER:LincolnMember

us-gaap:SeriesBPreferredStockMember

2021-03-17

2021-03-18

0001454742

us-gaap:SeriesBPreferredStockMember

GMER:WilliamSchultzMember

2021-07-20

2021-07-21

0001454742

GMER:DavidBDorwartMember

2021-08-23

2021-08-24

0001454742

GMER:EricBrownMember

2021-08-23

2021-08-24

0001454742

GMER:JordanAxtMember

2021-08-23

2021-08-24

0001454742

GMER:DomenicEdwardFontanaMember

2021-08-23

2021-08-24

0001454742

GMER:JohnDHilzendagerMember

2021-08-23

2021-08-24

0001454742

GMER:AlexandraMDorwartMember

2021-08-23

2021-08-24

0001454742

GMER:MarjorieGreenhalghDorwartMember

2021-08-23

2021-08-24

0001454742

GMER:FrancesLynnMartinMember

2021-08-23

2021-08-24

0001454742

GMER:KaitlynKazanjianMember

2021-08-23

2021-08-24

0001454742

GMER:ElizabethVanFossenMember

2021-08-23

2021-08-24

0001454742

GMER:DouglasWathenMember

2021-08-23

2021-08-24

0001454742

GMER:TimBergmanMember

2021-08-23

2021-08-24

0001454742

GMER:SamuelJosephSchwietersMember

2021-08-23

2021-08-24

0001454742

GMER:RobertWelchMember

2021-08-23

2021-08-24

0001454742

GMER:NunoNetoMember

2021-08-23

2021-08-24

0001454742

GMER:MariaIriarteUriarteMember

2021-08-23

2021-08-24

0001454742

GMER:InfinityGlobalConsultingGroupIncMember

2021-08-23

2021-08-24

0001454742

GMER:NetleonTechnologiesPrivateLimitedMember

2021-09-02

2021-09-03

0001454742

GMER:WholePlantSystemsLLCMember

2021-09-02

2021-09-03

0001454742

GMER:JRamsdellConsultingMember

2021-09-02

2021-09-03

0001454742

GMER:ArmisticeCapitalLLCMember

us-gaap:PrivatePlacementMember

2021-11-15

2021-11-16

0001454742

GMER:IroquoisCapitalInvestmentGroupLLCMember

us-gaap:PrivatePlacementMember

2021-11-15

2021-11-16

0001454742

GMER:IroquoisMasterFundLTDMember

us-gaap:PrivatePlacementMember

2021-11-15

2021-11-16

0001454742

GMER:BiggerCapitalFundLPMember

us-gaap:PrivatePlacementMember

2021-11-15

2021-11-16

0001454742

GMER:DistrictTwoCapitalFundLPMember

us-gaap:PrivatePlacementMember

2021-11-15

2021-11-16

0001454742

GMER:ArmisticeCapitalLLCMember

us-gaap:WarrantMember

2021-12-26

2021-12-27

0001454742

GMER:ViaOneEmployeesMember

2022-08-17

2022-08-17

0001454742

GMER:ViaOneEmployeesMember

2022-08-23

2022-08-23

0001454742

GMER:ViaOneEmployeesMember

2022-09-13

2022-09-13

0001454742

GMER:ViaOneEmployeesMember

2022-10-05

2022-10-05

0001454742

GMER:ViaOneEmployeesMember

2022-11-08

2022-11-08

0001454742

GMER:ViaOneEmployeesMember

2022-12-21

2022-12-21

0001454742

srt:MaximumMember

2022-12-31

0001454742

us-gaap:SeriesCPreferredStockMember

2022-01-01

2022-12-31

0001454742

us-gaap:SeriesDPreferredStockMember

2022-01-01

2022-12-31

0001454742

GMER:HGTCapitalLLCMember

2022-12-31

0001454742

us-gaap:PrivatePlacementMember

GMER:ArmisticeCapitalLLCMember

2022-12-31

0001454742

us-gaap:PrivatePlacementMember

GMER:SabbyManagementMember

2022-12-31

0001454742

us-gaap:PrivatePlacementMember

2022-12-31

0001454742

GMER:SilverLiningsManagementLLCMember

2016-04-07

0001454742

GMER:SilverLiningsManagementLLCMember

2016-04-06

2016-04-07

0001454742

us-gaap:SeriesBPreferredStockMember

2021-01-01

2021-12-31

0001454742

GMER:ViaOneServicesLLCMember

2016-11-30

0001454742

GMER:ViaOneServicesLLCMember

2017-01-31

0001454742

GMER:ViaOneServicesLLCMember

2017-03-01

0001454742

GMER:ViaOneServicesLLCMember

2017-05-05

0001454742

GMER:ViaOneServicesLLCMember

2017-08-31

2017-09-01

0001454742

GMER:ViaOneServicesLLCMember

2017-12-31

0001454742

GMER:ViaOneServicesLLCMember

2017-01-01

2017-12-31

0001454742

GMER:ViaOneServicesLLCMember

GMER:LineOfCreditAgreementMember

2018-09-27

0001454742

GMER:ViaOneServicesLLCMember

GMER:LineOfCreditAgreementMember

2018-09-26

2018-09-27

0001454742

GMER:ViaOneServicesLLCMember

2021-09-01

2021-09-30

0001454742

GMER:ViaOneServicesLLCMember

2021-09-30

0001454742

GMER:OriginalEmployeeServiceAgreementMember

us-gaap:SeriesEPreferredStockMember

2021-01-01

2021-12-31

0001454742

GMER:NewEmployeeServiceAgreementMember

us-gaap:SeriesEPreferredStockMember

2021-01-01

2021-12-31

0001454742

GMER:PromissoryNoteMember

us-gaap:SeriesEPreferredStockMember

2021-01-01

2021-12-31

0001454742

GMER:RevolvingConvertibleNoteMember

us-gaap:SeriesEPreferredStockMember

2021-01-01

2021-12-31

0001454742

2017-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

GMER:Days

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D. C. 20549

Form

10-K/A

(Amendment No. 2)

☒

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the fiscal year ended December 31, 2022

☐ TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission

File Number: 000-53949

Good

Gaming, Inc.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

37-1902603 |

(State or other jurisdiction

of incorporation) |

|

(IRS Employer

Identification Number) |

415

McFarlan Road, Suite 108

Kennett

Square, PA 19348

(Address

of principal executive offices and Zip Code)

(844)

419-7445

Registrant’s

telephone number, including area code

(Former

name, former address and former fiscal year, if changed since last report)

| Securities

registered pursuant to Section 12(b) of the Act: |

|

Securities

registered pursuant to section 12(g) of the Act: |

| NONE |

|

COMMON

STOCK |

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ NO

☒

Indicate

by check mark if the registrant is required to file reports pursuant to Section 13 or Section 15(d) of the Act: YES ☒ NO ☐

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data

File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding

12 months (or for such shorter period that the registrant was required to submit and post such files). YES ☒ NO ☐

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained

herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated

by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company”

in Rule 12b-2 of the Exchange Act.

| Large

Accelerated Filer |

|

☐ |

|

Accelerated

Filer |

|

☐ |

| |

|

|

|

|

|

|

| Non-accelerated

Filer |

|

☒ |

|

Smaller

Reporting Company |

|

☒ |

| |

|

|

|

|

|

|

| |

|

|

|

Emerging

Growth Company |

|

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the

registered public accounting firm that prepared or issued its audit report. ☐

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statement of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate

by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation

received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ☐ NO

☒

State

the aggregate market value of voting and non-voting common equity held by non-affiliates computed by reference to the price at which

the common equity was sold, or the average bid and asked price of such common equity, as of June 30, 2022: $4,536,775.

State

the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date: 113,142,559

as of April 7, 2023.

Explanatory

Note

Good

Gaming, Inc. (together with its subsidiary, the “Company” sometimes referred to as “we”, “us” or

“our”) is filing this Amendment No. 2 (“Amendment No. 2” or “Form 10K/A”) to its Annual Report on

Form 10-K for the period ended December 31, 2022, originally filed on April 7, 2023 (the “Original Form 10-K”), solely to include the audit opinion for the period ended December 31, 2021 with the audit opinion for the period ended December 31, 2022.

No other changes have been made to the Form 10K.

Except

as described above, no attempt has been made in this Amendment No. 2 to modify or update the other disclosures in the Original Form 10-K.

Amendment No. 2 continues to speak as of the date of the Original Form 10-K, and the Company has not updated the disclosures contained

therein to reflect any events which occurred at a date subsequent to the filing of the Original Form 10-K. Accordingly, Amendment No.

2 should be read in conjunction with the Original Form 10-K.

FORWARD

LOOKING STATEMENTS

This

Annual Report on Form 10-K contains “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995, all of which are subject to risks and uncertainties. Forward-looking statements can be identified by the use of words

such as “expects,” “plans,” “will,” “forecasts,” “projects,” “intends,”

“estimates,” and other words of similar meaning. One can identify them by the fact that they do not relate strictly to historical

or current facts. These statements are likely to address our growth strategy, financial results and product and development programs.

One must carefully consider any such statement and should understand that many factors could cause actual results to differ from our

forward looking statements. These factors may include inaccurate assumptions and a broad variety of other risks and uncertainties, including

some that are known and some that are not. No forward looking statement can be guaranteed and actual future results may vary materially.

These

risks and uncertainties, many of which are beyond our control, include, and are not limited to:

| |

● |

our

growth strategies; |

| |

|

|

| |

● |

our

anticipated future operations and profitability; |

| |

|

|

| |

● |

our

future financing capabilities and anticipated need for working capital; |

| |

|

|

| |

● |

the

anticipated trends in our industry; |

| |

|

|

| |

● |

acquisitions

of other companies or assets that we might undertake in the future; |

| |

|

|

| |

● |

current

and future competition. |

In

addition, factors that could cause or contribute to such differences include, but are not limited to, those discussed in this Annual

Report on Form 10-K, and in particular, the risks discussed under the caption “Management’s Discussion and Analysis of Financial

Condition and Results of Operations,” as well as those discussed in other documents we file with the SEC. We undertake no obligation

to revise or publicly release the results of any revisions to these forward-looking statements, except as required by law. Given these

risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements.

PART

I

ITEM

1. BUSINESS

General

The

Company was incorporated on November 3, 2008 under the laws of the State of Nevada, to engage in certain business services. Our goal,

at the time, was to become a leading tournament gaming provider as well as an online destination, targeting over 250 million e-sports

players and participants worldwide that want to compete at the high school or college level. We are a developmental stage business, have

generated limited revenues to date and have a history of operating losses.

The

Good Gaming platform was established in early 2014 by its founding members who recognized the need that millions of gamers worldwide

desired to play games at competitive levels. The founders recognized that there was no structure or organization on a large scale for

amateur gamers while professional e-sports was quickly establishing itself.

Good

Gaming effectively built the business infrastructure for the rapidly growing esports industry, similar to the high school and college

athletic industry. Good Gaming was designed to be the gateway for amateur e-sports athletes to compete at the semi-professional level,

improve their gaming skills, and interact with veteran gamers globally in a destination site and social networking framework.

Good

Gaming differs from the professional level of the e-sports industry by focusing on more than 250 million gamers that fall below the professional

level but are above the casual level, classified as “amateurs.” Good Gaming distinguishes itself from its direct and indirect

competitors by being the first company to offer multi-game, multi-console services at the amateur e-sports level. The Company was not

exclusive to any particular hardware or software vendor.

On

May 4, 2016, the Company announced that it had completed its first closed public beta testing of their 2.0 tournament platform to determine

the functionality, speed, ease of use, and accuracy of the system and are preparing to enter into full-blown production.

On

February 18, 2016, the Company, formerly HDS International Corp., acquired the assets of Good Gaming, Inc. from CMG Holdings Group, Inc.

(OTCQB: CMGO). On that date, the Company’s former CEO, Paul Rauner, resigned. The Company appointed Vikram Grover to the positions

of CEO and Director of the board of directors (the “Board”). Vikram Grover is a former Wall Street analyst and investment

banker with more than 20 years of experience in telecommunications, media and technology. In addition, David Dorwart was elected by the

majority shareholders to the Company’s Board. Mr. Dorwart is the Co-Founder and Chairman of Assist Wireless, Inc., a provider of

lifeline wireless services to tens of thousands of subscribers primarily in the Midwest.

On

June 27, 2017 the Board of Directors of the Company appointed David B. Dorwart as the Company’s Chief Executive Officer. On June

21, 2017, Mr. Dorwart was appointed to serve as the Chairman of the Board of Directors. David B. Dorwart, Chairman and CEO of Good Gaming,

Inc., brings over 31 years of start-up entrepreneurism and executive level management to the Company. Mr. Dorwart was a Co-Founder and

CEO of dPi Teleconnect, a prepaid wireless provider, for 10 years. During his tenure, Mr. Dorwart grew that company from a start-up to

$75 million in revenues before selling it. Over the last 9 years, Mr. Dorwart has been involved with several other successful projects

including Assist Wireless, Brooklet Energy Distribution, PayGo Distributors and Britton & Associates. Mr. Dorwart is currently the

Chairman and Co-Founder of ViaOne Services, a company which specializes in wireless communications and provides intricate multi-faceted

services for start-up companies utilizing industry experts. By virtue of the ownership of this Series C Preferred Stock, ViaOne is the

Company’s principal stockholder.

On

June 27, 2017, the Company also bolstered its Board of Directors with executive level professionals by adding two seasoned individuals

who specialize in organization and finance as well as the branding and marketing of established and emerging organizations which are

poised to show significant growth.

Domenic

Fontana is currently SeniorVice President of ViaOne Services and a board member. He is an experienced CPA and financial executive who

has worked in progressively more advanced executive roles throughout his career. Having worked at Verizon, Ebay and now ViaOne Services

over the last 13 years, Mr. Fontana has developed intimate and extensive knowledge of executive level management and the telecommunications

industry. Mr. Fontana has worked in all aspects of Finance, Accounting, Treasury, and Operations.

Jordan

Axt, a board member, is a results-producing marketing professional with over 14 years of experience successfully developing marketing

and branding strategies. Mr. Axt has been consistently noted by executives, colleagues, and journalists for his specific expertise in

bringing products and services online with a comprehensive digital go-to-market strategy. Mr. Axt has previously held executive level

positions as Director of Marketing for ProfitPoint Inc. and Clutch Holdings LLC. Mr. Axt is currently Vice President of Marketing of

ViaOne Services where he develops all marketing and customer acquisition strategies for 14 consumer facing brands.

On

July 10, 2017, the Company’s Board of Directors elected David Dorwart its CEO. Additionally, the Board of Directors approved Domenic

Fontana and Jordan Axt to the Company’s Board of Directors.

On

August 8, 2017, the Board of Directors of the Company accepted Vikram Grover’s resignation as the Treasurer of the Company and

as a member of the Board, effective immediately.

On

August 8, 2017, the Board of the Company accepted Barbara Laken’s resignation as the Secretary of the Company and as a member on

the Board, effective immediately.

On

August 9, 2017, the Company announced a strategic review of its business, which prompted improvements to its business model and a reduction

in expenses designed to accelerate its move to free cash flow generation.

On

August 29, 2017, Eric Brown became the Chief Operating Officer.

In

September 2017, the Company began focusing on its Minecraft server by enhancing the development staff and launched an offering of microtransactions

after it saw the opportunity to generate revenue without adding a great deal of overhead. The initial offering of microtransactions exceeded

revenue expectations and the Company has continued to expand the Minecraft server offerings. The Company also began pursuing the acquisition

of additional Minecraft servers that were already established to begin scaling this effort.

In

December 2017, the Company began exploring potential partnerships with various franchise opportunities related to both LAN centers and

Virtual Reality centers. Financial analysis and research on these opportunities are ongoing.

On

March 21, 2018, the Company acquired Crypto Strategies Group, Inc. for consideration of $500. The Company intends to diversify its business

and enter into the cryptocurrency market through such acquisition.

On

December 12, 2018, the Company dissolved Crypto Strategies Group, Inc.

In

March 2019, the Company discontinued Minecade and Olimpo servers and decided to focus on the core Good Gaming servers.

On

March 11, 2019, Eric Brown resigned from the Chief Operating Officer’s position.

On

March 19, 2021, the Company formulated a new plan to create a new game called “MicroBuddies™” that combines Ethereum

ERC721 NFTs (Non-fungible tokens), non-standard ERC20 tokens (GOO™), and strategic gameplay to replicate and create unique and

rare NFTs. The game will be played online via the MicroBuddies website and blockchain transactions take place on the Polygon Network.

On

May 25th, 2021, Good Gaming, Inc. filed for a trademark on MicroBuddies™ and other related game terms.

On

May 28th, 2021, the initial launch of MicroBuddies™ began with the “Genesis Event”, which is the sale of Nano Factory

Tokens at a discounted rate of 0.05 Ethereum. We expect to raise the prices of Nano Factory Token prices to 0.15 Ethereum prior to the

full game launch in Q3 2021. Nano Factory Tokens obtained during the Genesis Event will be used to synthesize a Generation 0 Microbuddy™

when the game fully launches in the 4th Quarter of 2021. Nano Factory Tokens are limited to 3 purchases per wallet. Unsold Nano Factory

Tokens will be destroyed and no Nano Factory Tokens will be made available ever again.

On

September 14, 2021, Good Gaming, Inc. met all qualifications and have been accepted by OTC Markets to uplist from Pink Sheet Current

to the OTCQB tier for trading.

On

September 23, 2021, the Company announced that MicroBuddies™ will be launched on the mainnet using Polygon, which is an Ethereum

compatible blockchain building platform that provides a secure and lower-cost alternative to Ethereum’s escalating gas fees and

wait times. The Company also announced October 5, 2021, as it’s the official launch date for beta testing to begin.

On

November 11, 2021, the Company entered into a securities purchase agreement with several institutional and accredited investors pursuant

to which the Company will sell to the Investors in a private placement an aggregate of (i) 15,922,156 shares of common stock, (ii) pre-funded

warrants to purchase up to an aggregate of 4,811,181 shares of common stock and (iii) warrants to purchase up to an aggregate of 20,733,337

shares of common stock for gross proceeds to the Company of approximately $3,100,000. The combined purchase price for one share of common

stock and a warrant to purchase one share of common stock is $0.15 and the combined purchase price for one pre-funded warrant to purchase

one share of common stock and a warrant to purchase one share of common stock is 0.1499.

On

December 13, 2021, the Company announced that the mainnet launch of the “MicroBuddies™” NFT game will be on Friday,

December 17, 2021 at 7:00 PM EST. This announcement comes after more than 95% of players involved in Beta I and Beta II testing programs

voted to launch the game at this time, based on gameplay and user experience.

On

December 21, 2021, the Company filed Amended and Restated Articles of Incorporation with the Secretary of State of the State of Nevada

in order to increase the total number of authorized shares of the Company from two hundred two million two hundred fifty thousand (202,250,000)

authorized shares to two hundred five million (205,000,000) authorized shares. Addition to that, the Company filed a Certificate of Designation

with the Secretary of State of the State of Nevada, which established two million seven hundred fifty thousand (2,750,000) shares of

the Company’s Series E Convertible Preferred Stock. Each of the Series E Shares are convertible at the option of the holder at

any time into 1,000 shares of the Company’s common stock. The holders of the Series E Shares will vote together with the common

stock on an as-converted basis. The Series E Shares are not entitled to any dividend except that in the event that the Board of Directors

of the Company declares a dividend to any other class of stock, Series E Shares are entitled to a dividend equal to what they would receive

on an as converted to common stock basis.

On

January 10, 2022, David Sterling was appointed as Chief Operating Officer of the Company.

Technology

In

2016, the Company completed its 2.0 tournament platform and thereafter ran dozens of robotic internal test tournaments and held numerous

free-to-play tournaments on large scales with its partner The Syndicate, the owner of the world’s longest-running online gaming

guild that has 1,200 members worldwide. Good Gaming conducted two closed public beta tournaments of hundreds of participants in May 2016

in order to fully vet the system. After making roughly 100 fixes and changes to the system, it now runs smoothly. The system is designed

to scale to 512,000 concurrent competitors. The Company has updated the system to handle team tournaments, which will further expand

its opportunity to popular titles that have tens of millions of active players and has recently launched titles that have the potential

for cross-platform play among Gaming PC, Microsoft Xbox and Sony PlayStation.

In

2017, the Company ran hundreds of tournaments on a regular basis with a dedicated customer base of over 30,000 members. Additionally,

the Company expanded its website by offering content relevant to the member base with information relating to game play strategy and

game news. This generated nearly 100,000 unique visits per month. In an effort to monetize that traffic, the Company employed the use

of Google display advertising and tested a subscription model. After careful evaluation of the Company’s strategy, management decided

to move away from free tournaments and custom content and focus on growing and monetizing our Minecraft server, which has grown substantially

in popularity. This decision was a result of comprehensive competitive analysis and evaluations made in how the esports industry was

shifting in its space. Tournaments and custom content are currently suspended while the Company grows revenue and focuses on expanding

its efforts with Minecraft. The Company has also aggressively evaluated several business models and acquisition opportunities to resume

its previous success as it is related to tournaments.

In

2018, the Company acquired the Minecade and Olimpo Minecraft servers in order to deliver on expansion efforts. This move, coupled with

continued advancement of the core Good Gaming Minecraft server substantially increased revenues and traffic. By the end of the year,

the Company struck a deal with a prominent Minecraft influencer, which resulted in the single highest monthly earnings achieved within

the Minecraft division, to date.

In

2019, following a severe downturn of business in the Minecraft sector, the Company decided to temporarily suspend the Minecade and Olimpo

networks and refocus its efforts back on the core Good Gaming server. Much of the year was spent upgrading and overhauling the server’s

existing infrastructure, which had grown stale over prior years. The Company adapted its strategy to target long term success and consistency

through major innovations in the SkyBlock and Prison game modes, and began work towards an ambitious full recode of the Minecade server.

In

2020, the Company finalized its infrastructure overhaul for use in upcoming releases. A new, experimental version of Prison, Prison MMO,

was launched as an early access game mode in February 2020. Prison MMO is designed to be a self-sustaining Minecraft game mode which

incorporates elements of the Massively Multiplayer Online video game genre. The Company expects steady growth from this mode as it continues

developing Prison MMO. On April 1st, 2020, the company released its first iteration of a new SkyBlock gamemode, SkyBlock Spring,

to some strong success. During the third quarter of 2020, the Company implemented a new workflow management style and released its summer

edition of SkyBlock. The release of the summer edition signified a renewed focus on consistent growth through regular, player focused

updates. The Company’s fall release of Prison in October 2020 resulted in its single highest revenue producing month of the year,

to date.

In

2021, the Company kicked off the first quarter with major upgrades to its Winter edition of SkyBlock along with the release of its Winter

edition of Prison. The Company used this period to experiment with new release schedules and game mechanics with the goal of identifying

how to further strengthen future releases. Additionally, the Company formulated a new plan to create a new game called “MicroBuddies™”

that combines Ethereum ERC721 NFTs (Non-fungible tokens), non-standard ERC20 tokens (GOO™), and strategic gameplay to replicate

and create unique and rare NFTs. The game will be played online via the MicroBuddies website and blockchain transactions take place on

the Polygon Network.The game was launched on December 17, 2021 after more than 95% of players involved in Beta 1 and 2 testing programs

voted to launch the game based on gameplay and user experience.

In

2022, the Company expanded its development portfolio to include the Roblox gaming platform. Towards the end of 2022, the Company released

a Roblox™” version of the popular Minecraft™” title “Super Craft Brothers Brawl™” and “Treasure

Island” featuring the “MicroBuddies™”. The Company was able to gather important player feedback to help continue

development to include player feedback regarding the titles’ feature set and functionality. In 2023, the Company plans to continue

development of both of these titles and release final versions on the Roblox™” platform. In addition to the Super Craft Brothers

Brawl™” and “Treasure Island” titles, the Company signed the first game publishing deal with a well known Roblox™”

creator Joshua Mckittrick to bring his horror themed creations to the Roblox™” platform. Joshua has created Roblox™”

titles which have garnered over 100 million visits and tens of thousands of views on YouTube from creators making fan videos and reviews

of his titles. The Company also announced the establishment of a Family themed brand for the Roblox™” platform called “Family

Games presented by Good Gaming” This brand will develop and publish a series of titles targeting the “All Ages’ category

on the Roblox™” platform.

The

Company also signed a development partnership agreement with Meraki Studios B.V.,

a leader in the development of high end Minecraft gaming experiences, to produce new gaming experiences around their

Prison™”, SkyBlock™” and Super Craft Brothers Brawl™” properties. Each of these brands will have

multiple releases during 2023. The releases will feature an update to the Minecraft 1.19 software version which will bring improved

graphics, functionality and revenue generating opportunities.

Business

Strategy

In

the past, our management team’s business strategy was to be a full-service company providing best in class Esports gaming tournaments

and Minecraft experiences. With the onset of the pandemic, the Esports industry has suffered a considerable amount of lost business opportunities.

We were not immune to the effects of the pandemic on our Esports business. In addition, the size of the PC-based Minecraft gaming community

has shrunk considerably. We have taken a hard look at both the Esports and Minecraft business verticals and determined that both strategies

are no longer in the best interest of the company and our shareholders. We feel that both the Esports and Minecraft verticals do not

have significant upside in the future. As so, the Esports and Minecraft business verticals will not comprise a meaningful segment of

our ongoing business strategy. We will not designate any future investment in either of these verticals for the foreseeable future.

With

the rise in the popularity of the crypto-currency and blockchain technologies, the Company has decided to invest in the creation of its

new game, “MicroBuddies™” which combines Ethereum ERC721 NFTs (Non-fungible tokens), non-standard ERC20 tokens (GOO™),

and strategic, long-tail web browser gameplay to replicate and create unique and collectible NFTs. ERC20 “GOO™” tokens

are limited to use as an in-game currency only. This strategy will allow us to enter the emerging NFT and blockchain gaming space. Initial

revenues from “MicroBuddies™” will come from the sale of Nano Factory Tokens that will be used to synthesize generation

0 of “MicroBuddies™”. Ongoing “MicroBuddies™” revenues will be generated from a 5% royalty on all

of the sales of “MicroBuddy™” NFTs in third-party marketplaces and a.0.01 MATIC per “MicroBuddy™”

replication Microbuddies In 2022, we will introduce additional initiatives around the “MicroBuddies™ intellectual property.

We expect the ancillary”MicroBuddies™” initiatives to create consistent, recurring revenue over the life of the project.

Moving

forward, we are going to expand the “MicroBuddies™” intellectual property to metaverse/virtual world social gaming

experiences. There are many current and emerging metaverse/virtual world platforms. Some existing platforms already have greater than

one hundred million users while other platforms are slated to launch later in 2022 or in 2023. We see building “MicroBuddies™”

themed gaming experiences in these types of metaverses/virtual worlds as a solid strategy to create long tail revenue engines while exposing

the “MicroBuddies™” franchise to large, diverse audiences. In 2023, the Company will complete multiple gaming experiences

featuring the Microbuddies for the Roblox platform. In the near future, other gaming platforms will be considered for gaming experiences

in order to broaden the audience reach and recognizability of the “MicroBuddies™” IP. Also in 2023, the Company will

build cross-platform gaming experiences around the “Super Craft Brothers Brawl™” (“SCBB”) IP. The SCBB

franchise features a host of distinct characters and personalities that have resonated with Minecraft players for many years. The Company

will develop multi-platform gaming experiences featuring these characters with the intent of introducing these characters to new audiences

in an effort to grow their popularity and create new revenue opportunities for the brand.

2023

will be a year of multi-faceted business development for the Company. In addition to continuing to expand its footprint on the Minecraft™

and Roblox™ gaming platforms, the Company is targeting new platforms for its character properties and themed gaming experiences.

The Company will also continue to build its publishing business by signing agreements with well-established creators to bring their properties

to multiple platforms. The Company is planning to execute numerous business agreements to expand the total addressable market for its

products which will create new avenues for revenue and profit generation.

Insurance

Policies

We

do not currently maintain any insurance but are in the process of obtaining the appropriate insurance to support our business operations.

Employees

We

have three full-time consultants, and four part-time contractors working on various Good Gaming initiatives. The full-time consultants

consist of one Chief Operating Officer, one Gaming Director and one Operations Manager. The part-time consultant team consists of two

QA staff, one Video Engineer and a Marketing Coordinator. Pursuant to our Management Services Agreement with ViaOne Services LLC, certain

employees of ViaOne are deemed to be consultants of the Company.

Offices

Our

executive offices are located at 415 McFarlan Rd, Suite 108, Kennett Square, PA 19501. Our telephone number is (844) 419-7445.

Additional

Information

The

Company is subject to the information requirements of the Exchange Act, and, in accordance therewith, file annual, quarterly, and special

reports, proxy statements and other information with the Commission. The Commission maintains an internet website at http://www.sec.gov

that contains reports, proxy and information statements and other information regarding issuers that file electronically with the Commission.

The periodic reports, proxy statements and other information that the Company files with the Commission are available for inspection

on the Commission’s website free of charge as soon as reasonably practicable after they are electronically filed with or furnished

to the Commission.

The

Company maintains a website at www.good-gaming.com where you may also access these materials free of charge. We have included our website

address as an inactive textual reference only and the information contained in, and that can be accessed through, our website is not

incorporated into and is not part of this report on Form 10-K.

ITEM

1A. RISK FACTORS

We

are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this

item.

ITEM

1B. UNRESOLVED STAFF COMMENTS

Not

applicable.

ITEM

2. PROPERTIES

We

do not currently rent or lease any real property.

ITEM

3. LEGAL PROCEEDINGS

We

are currently not aware of any such legal proceedings or claims that we believe will have a material adverse effect on our business,

financial condition or operating results. From time to time, we may become involved in various lawsuits and legal proceedings, which

arise in the ordinary course of business. Litigation is subject to inherent uncertainties, and an adverse result in these or other matters

may arise from time to time that may harm our business.

ITEM

4. MINE SAFETY DISCLOSURES

Not

Applicable.

PART

II

ITEM

5. MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our

common stock commenced trading on the over-the-counter Bulletin Board on October 7, 2009. It currently trades under the symbol “GMER”.

Over-the-counter market quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions. There is no public trading market for our securities.

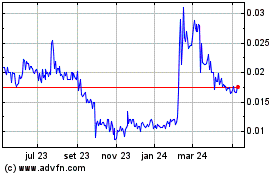

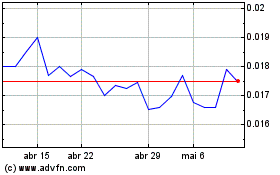

Following is a table of the high bid price and the low bid price for each quarter during the last two fiscal years.

| 2021 | |

High Bid | | |

Low Bid | |

| First Quarter, Ending March 31 | |

$ | 0.1400 | | |

$ | 0.0333 | |

| Second Quarter, Ending June 30 | |

$ | 0.2495 | | |

$ | 0.0163 | |

| Third Quarter, Ending September 30 | |

$ | 0.7500 | | |

$ | 0.1736 | |

| Fourth Quarter, Ending December 31 | |

$ | 0.3780 | | |

$ | 0.0502 | |

| 2022 | |

High Bid | | |

Low Bid | |

| First Quarter, Ending March 31 | |

$ | 0.1000 | | |

$ | 0.0200 | |

| Second Quarter, Ending June 30 | |

$ | 0.0855 | | |

$ | 0.0356 | |

| Third Quarter, Ending September 30 | |

$ | 0.0820 | | |

$ | 0.0206 | |

| Fourth Quarter, Ending December 31 | |

$ | 0.0895 | | |

$ | 0.0259 | |

Holders

As

of March 31, 2023, we have 113,142,559 shares of our common stock issued and outstanding held by 93 stockholders of record.

As

of March 31, 2023, we had 7,500 shares of Series A Preferred Stock issued and outstanding, 19,296 shares of Series B Preferred Stock

issued and outstanding, 1 share of Series C Preferred Stock issued and outstanding, 0 share of Series D Preferred Stock issued and outstanding,

and 57,663 shares of Series E Preferred Stock issued and outstanding.

Dividends

We

have never declared or paid cash dividends. We currently intend to retain all future earnings for the operation and expansion of our

business and do not anticipate paying cash dividends on the common stock in the foreseeable future. Any payment of cash dividends in

the future will be at the discretion of our Board of Directors and will depend upon our results of operations, earnings, capital requirements,

contractual restrictions and other factors deemed relevant by our directors. In addition, our Series D shares have cumulative dividend

preference.

Securities

Authorized for Issuance Under Equity Compensation Plans

On

July 18, 2012, a Registration Statement on Form S-8 (the “Registration Statement”) was filed by us together with our 2012

Non-Qualified Stock Option Plan (the “Plan”) relating to 30,000,000 shares of our common stock, par value $0.001 per share,

to be offered and sold to accounts of eligible persons. The original plan filed on July 18, 2012 is still valid but the Company will

not issue any more securities under the Plan as we have adopted a new plan.

On

April 30, 2018, the holder of one (1) share of Series C Preferred Stock of the Company that entitles such holder to vote a majority of

the issued and outstanding voting securities of the Company’s approved by written consent that the Company adopts the 2018 Stock

Incentive Plan (the “2018 Plan”) under which the Board may decide at its sole discretion to grant equity awards to certain

employees and consultants as set forth in the 2018 Plan. The description of the 2018 Plan does not purport to be complete and is incorporated

herein by reference to a current report on form 8-K filed with the Securities and Exchange Commission on May 4, 2018.

On

March 7, 2022, the holder of one (1) share of Series C Preferred Stock of the Company that entitles such holder to vote a majority of

the issued and outstanding voting securities of the Company’s approved by written consent that the Company adopt 2022 Stock Incentive

Plan (the “2022 Plan”), which replaced the 2018 Stock Incentive Plan. There are 30,000,000 shares authorized under the 2022

Plan, which is an increase from 10,000,000 authorized under the 2018 Plan. Under the 2022 Plan, the board of directors of the Company

(the “Board”) may decide at its sole discretion to grant equity awards to certain employees and consultants, including employees

and consultants of ViaOne Services, Inc., who are also deemed consultants of the Company.

Penny

Stock Regulations and Restrictions on Marketability

The

SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally

equity securities with a market price of less than $5. Securities are registered on certain national securities exchanges or quoted on

the OTC Markets which provides the current price and volume information. The penny stock rules require a broker-dealer, prior to a

transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the SEC, that: (a) contains a description

of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading, (b) contains a description

of the broker’s or dealer’s duties to the customer and of the rights and remedies available to the customer with respect

to a violation of such duties or other requirements of the securities laws, (c) contains a brief, clear, narrative description of a dealer

market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price, (d) contains

a toll-free telephone number for inquiries on disciplinary actions, (e) defines significant terms in the disclosure document or in the

conduct of trading in penny stocks, and (f) contains such other information and is in such form, including language, type size and format,

as the SEC shall require by rule or regulation.

The

broker-dealer must also provide, prior to effecting any transaction in a penny stock, the customer with (a) bid and offer quotations

for the penny stock, (b) the compensation of the broker-dealer and its salesperson in the transaction, (c) the number of shares to which

such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock, and

(d) a monthly account statement showing the market value of each penny stock held in the customer’s account.

In

addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer

must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s

written acknowledgment of the receipt of a risk disclosure statement, a written agreement as to transactions involving penny stocks,

and a signed and dated copy of a written suitability statement.

These

disclosure requirements may have the effect of reducing the trading activity for our common stock. Therefore, stockholders may have difficulty

selling their shares of our common stock.

Common

Stock

Our

Articles of Incorporation authorize the Company to issue up to 100,000,000 shares of common stock, $0.001 par value. On May 3, 2018,

the Company increased its authorized shares of common stock from 100,000,000 to 200,000,000. Each holder of our common stock is entitled

to one (1) vote for each share held on record on all voting matters we present for a vote of stockholders, including the election of

directors. Holders of common stock have no cumulative voting rights or preemptive rights to purchase or subscribe for any stock or other

securities, and there are no conversion rights or redemption or sinking fund provisions with respect to our common stock. All shares

of the Company’s common stock are entitled to share equally in dividends from sources legally available when, and if, declared

by the Company’s Board of Directors.

Our

Board of Directors is authorized to issue additional shares of common stock not to exceed the amount authorized by the Articles of Incorporation,

on such terms and conditions and for such consideration as the Board may deem appropriate without further stockholder action.

In

the event of our liquidation or dissolution, all shares of the Company’s common stock are entitled to share equally in our assets

available for distribution to stockholders. However, the rights, preferences and privileges of the holders of our common stock are subject

to, and may be adversely affected by, the rights of the holders of shares of preferred stock that have been issued or shares of preferred

stock that our Board of Directors may decide to issue in the future.

Preferred

Stock

Our

Articles of Incorporation initially authorized us to issue up to 2,250,350 shares of preferred stock, $0.001 par value. On December 21,

2021, the Company filed the amendment to increase the authorized shares of preferred stock to 5,000,000 shares. Of the 5,000,000 authorized

shares of preferred stock, the total number of shares of Series A Preferred Stock the Corporation shall have the authority to issue is

2,000,000, with a stated par value of $0.001 per share, the total number of shares of Series B Preferred Stock the Corporation shall

have the authority to issue is 249,999, with a stated par value of $0.001 per share, the total number of shares of Series C Preferred

Stock the Corporation shall have the authority to issue is 1, with a stated par value of $0.001 per share, the total number of shares

of Series D Preferred Stock the Corporation shall have the authority to issue is 350, with a stated par value of $0.001 per share, and

the total number of shares of Series E Preferred Stock the Corporation shall have the authority to issue is 2,750,000, with a stated

par value of $0.001 per share. Our Board of Directors is authorized, without further action by the shareholders, to issue shares of preferred

stock and to fix the designations, number, rights, preferences, privileges and restrictions thereof, including dividend rights, conversion

rights, voting rights, terms of redemption, liquidation preferences and sinking fund terms. We believe that the Board of Directors’

power to set the terms of, and our ability to issue preferred stock, will provide flexibility in connection with possible financing or

acquisition transactions in the future. The issuance of preferred stock, however, could adversely affect the voting power of holders

of common stock and decrease the amount of any liquidation distribution to such holders. The presence of outstanding preferred stock

could also have the effect of delaying, deterring or preventing a change in control of our company.

As

of March 31, 2023, we had 7,500 shares of our Series A preferred stock, 19,296 shares of Series B preferred stock, 1 share of Series

C preferred stock, 0 share of Series D preferred stock, and 57,663 shares of Series E preferred stock issued and outstanding.

The

7,500 issued and outstanding shares of Series A Preferred Stock are convertible into shares of common stock at a rate of 20 common shares

for each Series A Preferred Share. The 19,296 issued and outstanding shares of Series B Preferred Stock are convertible into shares of

common stock at a rate of 200 common shares for each Series B Preferred Share. The 57,663 issued and outstanding shares of Series E Preferred

Stock are convertible into shares of common stock at a rate of 1,000 common shares for each Series E Preferred Share. If all of our Series

A, B and E Preferred Stock are converted into shares of common stock, the number of issued and outstanding shares of our common stock

will increase by 61,672,201 shares.

The

one issued and outstanding shares of Series C Preferred Stock has voting rights equivalent to 51% of all shares entitled to vote and

is held by ViaOne Services LLC, a Company controlled by our CEO.

The

Series D Preferred Stock can be convertible into shares of common stock at the lower of the Fixed Conversion Price ($.06 per share) or

at the VWAP which shall be defined as the average of the five (5) lowest closing prices during the 20 days prior to conversion. We did

not have any shares of Series D preferred stock issued and outstanding as of March 31, 2023.

The

holders of Series A, Series B, Series C, Series D and Series E have a liquidation preference to the common shareholders.

Options

We

have not issued and do not have any outstanding options to purchase shares of our common stock.

Registration

Rights

As

of December 31, 2022, there are no other outstanding registration rights or similar agreements.

Convertible

Securities

On

April 15, 2015, the Company issued a convertible debenture with the principal amount of $100,000 to HGT Capital, LLC (“HGT”),

a non-related party. During the quarter ended June 30, 2015, the Company received the first $50,000 in payment. The remaining $50,000

payment would be made at the request of the borrower. No additional payments have been made as of September 30, 2018. Under the terms

of the debentures, the amount was unsecured and was due on October 16, 2016. The note is currently in default and bears interest of 22%

per annum. It was convertible into shares of common stock any time after the maturity date at a conversion rate of 50% of the average

of the five lowest closing bid prices of the Company’s common stock for the thirty trading days ending one trading day prior to

the date the conversion notice was sent by the holder to the Company. On September 21, 2018, the Company entered into a modification

agreement with HGT with respect to the convertible promissory note which has a balance of $107,238. Pursuant to such modification agreement,

all defaults were waived and it was agreed that such note will convert at a 25% discount to the market rather than the default rate.

HGT also agreed to certain sale restrictions which limit the number of shares that they can sell in any month for the next three months.

HGT also agreed to dismiss, with prejudice, the lawsuit that it had filed against the Company. On November 29, 2018, HGT converted $6,978

of a convertible note into 1,655,594 shares of the Company’s common stock. On August 17, 2020, HGT converted $5,833 of notes into

2,645,449 shares of the Company’s common stock. On September 9, 2020, HGT converted $11,822 of notes into 2,775,076 shares of the

Company’s common stock. On November 11, 2020, HGT converted $25,239 of notes into 2,911,055 shares of the Company’s common

stock. On December 18, 2020, HGT converted $40,126 of notes into 3,053,696 shares of the Company’s common stock. On June 25, 2021,

HGT converted the remaining note balance of $17,240 into 1,257,476 shares of the Company’s common stock.

The

Company entered into a line of credit agreement (“Line Of Credit”) with ViaOne on September 27, 2018 (the “Effective

Date”). This Line of Credit dated as of, was entered into by and between the Company and ViaOne. The Company had an immediate need

for additional capital and asked ViaOne to make a new loan(s) in an initial amount of $25,000 on the Effective Date (the “New Loan”).

The Company may need additional capital and ViaOne has agreed pursuant to this Line of Credit to provide for additional advances, although

ViaOne shall have no obligation to make any additional loans. Any further New Loans shall be memorialized in a promissory note with substantially

the same terms as the New Loan and shall be secured by all of the assets of the Company. On or before the Effective Date, the Company

may request in writing to ViaOne that it loan the Company additional sums of up to $250,000 and within five days of such request(s),

ViaOne shall have the right, but not an obligation, to make additional loans to the Company and the Company shall in turn immediately

issue a note in the amount of such loan. In consideration for making the New Loan, the Company entered into a security agreement whereby

ViaOne received a senior security interest in all of the assets of the Company.

On

September 30, 2021, the Company and ViaOne Services, LLC entered into a revolving convertible promissory note (the “Revolving Note”).

The Company agrees to pay ViaOne the principal sum of $1,000,000 or such a smaller amount as ViaOne may advance to the Company from time

to time under the Revolving Note, which is subject to a simple interest rate of 8% per annum and will expire earlier on demand or the

third anniversary of the Original Issue Date. The Revolving Note (and any unpaid interest or liquidated damages amount) may be converted

into shares of Common Stock at a conversion price of eighty-five percent (85%) of the VWAP for the five (5) trading days immediately

prior to the date of the notice of conversion. On December 31, 2021, the Company amended the note to allow for the conversion of the

Note into shares of the Company’s Series E Preferred Stocks. Effective December 31, 2021, ViaOne Services, LLC converted the Revolving

Note into 6,730 shares of the Company’s Series E Convertible Preferred Stock, terminating the Revolving Note.

On

September 30, 2021, the Company entered into a new Employee Services Agreement with ViaOne effective as of September 1, 2021 (the “Effective

Date”). For a monthly management fee of $42,000 (the “Monthly Management Fee”), ViaOne shall provide to the Company

services related to Company’s human resources, payroll, marketing, advertising, accounting, and financial services for a period

of one year beginning on the Effective Date and automatically renewing for successive terms of one year each unless either party provides

90 days’ notice. ViaOne has the right to convert part or all of the Monthly Management Fee into shares of the Company’s common

stock, par value $0.001 per share at a Conversion Rate equal to 125% of the Conversion Amount, divided by the Conversion Price. The Conversion

Price means, with respect to Management Fee, 85% of the volume weighted average price (“VWAP”) for the 5 trading days immediately

prior to the date of the notice of conversion. On December 31, 2021, the Company amended the note to allow for the conversion of the

Note into shares of the Company’s Series E Preferred Stocks. Effective December 31, 2021, ViaOne Services, LLC converted the new

Employee Services Agreement Note into 1,557 shares of the Company’s Series E Convertible Preferred Stock.

Related

Party Transactions

On

or around April 7, 2016, Silver Linings Management, LLC funded the Company $13,440 in the form of convertible debentures secured by certain

high-powered gaming machines purchased from XIDAX. Such note bore interest at a rate of 10% per annum, payable in cash or kind at the

option of the Company, matured on April 1, 2018, and was convertible into Series B Preferred shares at the option of the holder at any

time. Effective December 31, 2021, the Note was converted into 1,680 shares of Series B preferred stock.

On

November 30, 2016, ViaOne purchased a Secured Promissory Note equal to a maximum initial principal amount of $150,000 issued by the Company

to ViaOne. As additional advances were made by ViaOne to the Company, the principal amount of the Note was increased to $225,000 and

$363,000 by amendments dated January 31, 2017, and March 1, 2017, respectively.

On

May 5, 2017, ViaOne delivered a default notice to the Company pursuant to Section 6 of the Note Purchase Agreement but has subsequently

extended the due date and has increased the funding up to One Million ($1,000,000) dollars. After giving the Company a fifteen (15) day

notice period to cure the default under the Stock Pledge Agreement, dated November 30, 2016, entered by and among the Company, CMG, and

ViaOne (“Pledge Agreement”), ViaOne took possession of the Series C Stock, which was subject of the Pledge Agreement.

The

Secured Promissory Note as amended increased from time to time due to additional advances provided to the Company by ViaOne.

On

September 1, 2017, the Company executed an amended Employee Services Agreement with ViaOne which stipulated that ViaOne would continue

providing to the Company services relating to the Company’s human resources, marketing, advertising, accounting, and financing

for a monthly management fee of $25,000. This agreement was amended on January 1, 2018. The accrued monthly management fees, $100,000

at December 31, 2017, are convertible by ViaOne into the Company’s common stock at a rate of 125% of the accrued fees at a conversion

price of (i) $0.05 per share; or (ii) the volume-weighted adjusted price (“VWAP”) of the common stock on the 14th day of

each month if the 14th of that month is a trading day. In the event the 14th day of a month falls on a Saturday, Sunday, or a trading

holiday, the VWAP of the Common Stock will be valued on the last trading day before the 14th day of the month. The agreement was terminated

on August 31, 2021.

On

September 27, 2018, the Company and ViaOne entered into a Line of Credit Agreement (the “LOC Agreement”), pursuant to which

the Company issued a secured promissory note with the initial principal amount of $25,000 to ViaOne in exchange for a loan of $25,000

(the “Initial Loan Amount”). In accordance with this Agreement, the Company may request ViaOne to provide loans of up to

$250,000, including the Initial Loan Amount, and ViaOne has the right to decide whether it will honor such request. The Initial Loan

Amount became due on September 30, 2019 (the “Maturity Date”) and bore an interest rate of 8.0% per annum. The unpaid principal

and interest of the Promissory Note after the Maturity Date accrued interest at a rate of 18.0% per annum. The principal amount of the

Promissory Note may increase from time to time up to $250,000 in accordance with the terms and conditions of the Agreement. In connection

with the Agreement and Promissory Note, the Company and ViaOne executed a security agreement dated September 27, 2018, whereby the Company

granted ViaOne a security interest in all of its assets, including without limitation, cash, inventory, account receivables, real property,

and intellectual properties, to secure the repayment of the loans made pursuant to the LOC Agreement and Promissory Note.

On

September 30, 2021, the Company entered into a new Employee Services Agreement with ViaOne effective as of September 1, 2021 (the “Effective

Date”). For a monthly management fee of $42,000 (the “Monthly Management Fee”), ViaOne shall provide to the Company

services related to Company’s human resources, payroll, marketing, advertising, accounting, and financial services for a period

of one year beginning on the Effective Date and automatically renewing for successive terms of one year each unless either party provides

90 days’ notice. ViaOne has the right to convert part or all of the Monthly Management Fee into shares of the Company’s common

stock, par value $0.001 per share at a Conversion Rate equal to 125% of the Conversion Amount, divided by the Conversion Price. The Conversion

Price means, with respect to Management Fee, 85% of the volume weighted average price (“VWAP”) for the 5 trading days immediately

prior to the date of the notice of conversion.

On

September 30, 2021, the Company and ViaOne entered into a revolving convertible promissory note (the “Revolving Note”). The

Company agrees to pay ViaOne the principal sum of $1,000,000 or such a smaller amount as ViaOne may advance to the Company from time

to time under the Revolving Note, which is subject to a simple interest rate of 8% per annum and will expire earlier on demand or the

third anniversary of the Original Issue Date. The Company granted ViaOne warrants to purchase the 1,000,000 shares of Common Stocks at

an exercise price of $0.42, a premium of 20% to the closing bid price of the Common Stock the trading day prior to the execution of the

Revolving Note. Payment of all obligations under the Revolving Note is secured by a security interest granted to ViaOne by the Company

in all of the right, title and interest of the Company in all of the assets of the Company currently owned or acquired hereafter. The

Revolving Note (and any unpaid interest or liquidated damages amount) may be converted into shares of Common Stock at a conversion price

of eighty-five percent (85%) of the VWAP for the five (5) trading days immediately prior to the date of the notice of conversion. The

Revolving Note contains customary events of default, including, among others, the failure by the Company to make a payment of principal

or interest when due. Following an event of default, ViaOne is entitled to accelerate the entire indebtedness under the Revolving Note.

The restrictions are also subject to certain additional qualifications and carve outs, as set forth in the Revolving Note.

On

December 31, 2021, the Company amended the both original and new Employee Service Agreements, Secured Promissory Note, and Revolving

Convertible Promissory Note to allow for the conversion of Notes into shares of the Company’s Series E Preferred Stocks. Effective

December 31, 2021, the original Employee Service Agreement was converted into 24,540 shares of the Company’s Series E Preferred

Stocks and the new Employee Service Agreement was converted into 1,557 shares of the Company’s Series E Preferred Stocks. Additionally,

Secured Promissory Note and Revolving Convertible Note were converted into 24,836 and 6,730 shares of the Company’s Series E Preferred

Stocks, respectively.

As

of December 31, 2022, the Company owed nothing to ViaOne Services.

The

Company’s Chairman and Chief Executive Officer is the Chairman of ViaOne.

Shares

Eligible for Future Sale

As

of March 31, 2023, we had 113,142,559 shares of our common stock issued and outstanding, a breakdown of which follows:

| ● |

96,294,840

shares are freely tradable without restrictions (commonly referred to as the “public float”) |

| |

|

| ● |

16,847,719

shares are currently subject to the restrictions and sale limitations imposed by Rule 144. |

From

time to time, certain of our stockholders may be eligible to sell some or all of their restricted shares of our common stock by means

of ordinary brokerage transactions in the open market pursuant to Rule 144, promulgated under the Securities Act, subject to certain

volume restrictions and restrictions on the manner of sale. In general, pursuant to Rule 144, non-affiliate stockholders may sell freely

after six months subject only to the current public information requirement. Affiliates may sell after six months subject to the Rule

144 volume, manner of sale, current public information and notice requirements.

The

eventual availability for sale of substantial amounts of our common stock under Rule 144 could adversely affect prevailing market prices

for our securities and cause you to lose most, if not all, of your investment in our business.

Transfer

Agent

Our

transfer agent is Securities Transfer Corporation with its principal address at 2901 N Dallas Parkway, Suite 380, Plano, TX 75093. Its

telephone number is (469) 633-0101. Investors may reach our transfer agent at info@stctransfer.com.

Recent

Sales of Unregistered Securities

On

March 8, 2021, Lincoln Acquisition converted 18,000 shares of Class B Preferred Stock into 3,600,000 of the Company’s common

stock.

On

May 18, 2021, Lincoln Acquisition converted 29,881 shares of Class B Preferred Stock into 5,976,200 of the Company’s common

stock.

On

June 25, 2021, HGT converted $17,240 of a convertible note into 1,257,476 shares of the Company’s common stock.

On

July 21, 2021, William Schultz converted 2,500 shares of Class B Preferred Stock into 500,000 of the Company’s common

stock.

On

December 31, 2021, ViaOne Services converted $1,241,783 of a Secured Promissory Note into 24,836 shares of Company’s Class E

Preferred Stock.

On

December 31, 2021, ViaOne Services converted $1,227,000 of a Original Employee Service Agreement Note into 24,540 shares of Company’s

Class E Preferred Stock.

On

December 31, 2021, ViaOne Services converted $84,000 of a New Employee Service Agreement Note into 1,557 shares of Company’s Class

E Preferred Stock.

On

December 31, 2021, ViaOne Services converted $362,967 of a Revolving Convertible Promissory Note into 6,730 shares of Company’s

Class E Preferred Stock.

On

December 31, 2021, Silver Lining converted $13,440 of a convertible note into 1,680 shares of Company’s Class B Preferred Stock.

On

July 26, 2022, William Crusoe converted 1,000 Class B Preferred Stock into common stock.

Purchases

of Equity Securities by the Issuer and Affiliated Purchases

During

each month within the fourth quarter of the fiscal year ended December 31, 2022, neither we nor any “affiliated purchaser”,