0001465885FALSE00014658852023-12-062023-12-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 6, 2023

Western Asset Mortgage Capital Corporation

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

Delaware

(STATE OF INCORPORATION) | | | | | | | | |

| 001-35543 | | 27-0298092 |

| (COMMISSION FILE NUMBER) | | (IRS EMPLOYER ID. NUMBER) |

| | | | | | | | |

385 East Colorado Boulevard, | | 91101 |

Pasadena, California | | (ZIP CODE) |

| (ADDRESS OF PRINCIPAL EXECUTIVE OFFICES) | | |

(626) 844-9400

(REGISTRANT’S TELEPHONE NUMBER, INCLUDING AREA CODE)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

| Common Stock, $0.01 par value | | WMC | | New York Stock Exchange |

Introductory Note

This Current Report on Form 8-K is being filed in connection with the consummation on December 6, 2023 (the “Closing Date”) of the transactions contemplated by the Agreement and Plan of Merger, dated as of August 8, 2023 (the “Merger Agreement”), by and among Western Asset Mortgage Capital Corporation, a Delaware corporation (“WMC”), AG Mortgage Investment Trust, Inc., a Maryland corporation (“MITT”), AGMIT Merger Sub, LLC, a Delaware limited liability company and wholly owned subsidiary of MITT (“Merger Sub”), and, solely for the limited purposes set forth in the Merger Agreement, AG REIT Management, LLC, a Delaware limited liability company (“MITT Manager”). Pursuant to the Merger Agreement, on the Closing Date, WMC merged with and into Merger Sub (the “Merger”), with Merger Sub surviving as a wholly owned subsidiary of MITT. The combined company will continue to operate under the name “AG Mortgage Investment Trust, Inc.,” and its shares of common stock, par value $0.01 per share (“MITT Common Stock”), will continue to trade on the New York Stock Exchange (the “NYSE”) under the ticker symbol “MITT.” The following events took place in connection with the consummation of the Merger.

Item 1.02 Termination of a Material Definitive Agreement.

The information set forth under Item 2.01 of this Current Report on Form 8-K is incorporated by reference into this Item 1.02.

Pursuant to the WMC Management Agreement Amendment, dated as of August 8, 2023, the WMC Management Agreement, dated as of May 9, 2012, as amended by that certain Amendment to the WMC Management Agreement, dated as of August 3, 2016, each by and between WMC and Western Asset Management Company, LLC (the “WMC Management Agreement”), was terminated upon completion of the transactions contemplated by the Merger Agreement. As a result of the completion of the transactions contemplated by the Merger Agreement and the termination of the WMC Management Agreement, WMC paid Western Asset Management Company, LLC a termination fee of $7,000,000. Following the Effective Time, MITT will pay Western Asset Management Company, LLC any accrued but unpaid management fees and unreimbursed expenses.

The material terms and description of any material relationship between WMC or its affiliates and any related party in connection with the WMC Management Agreement are more fully described in WMC’s Quarterly Report on Form 10-Q filed with the SEC on November 8, 2023, which description is incorporated herein by reference. The foregoing description of the WMC Management Agreement, the amendments thereto and the transactions contemplated thereby is only a summary, does not purport to be complete and is subject to, and qualified in its entirety by, reference to the full text of the WMC Management Agreement and the amendments thereto, which are attached as Exhibit 10.4 to WMC’s Quarterly Report on Form 10-Q, filed with the SEC on August 14, 2012, Exhibit 10.1 to WMC’s Quarterly Report on Form 10-Q, filed with the SEC on August 5, 2016, and Exhibit 10.1 to WMC’s Current Report on Form 8-K, filed with the SEC on August 9, 2023, and are incorporated herein by reference.

Item 2.01 Completion of Acquisition or Disposition of Assets.

The information contained in the Introductory Note of this Current Report on Form 8-K is incorporated herein by reference to this Item 2.01.

On December 6, 2023, the Merger was completed pursuant to the terms of the Merger Agreement. On the Closing Date, WMC merged with and into Merger Sub, with Merger Sub continuing as the surviving company. As contemplated by the Merger Agreement, the certificate of merger was filed with the Secretary of State of the State of Delaware, and the Merger was effective at 8:15 a.m., Eastern Time, on the Closing Date (the “Effective Time”).

Pursuant to the terms and subject to the conditions set forth in the Merger Agreement, at the Effective Time, each outstanding share of WMC common stock, par value $0.01 per share (“WMC Common Stock”), was converted into the right to receive the following (the “Per Share Merger Consideration”): (i) from MITT, 1.498 shares of MITT Common Stock; and (ii) from MITT Manager, a cash amount equal to $0.92 (the “Per Share Additional Manager Consideration”). No fractional shares of MITT Common Stock were issued in the Merger, and the value of any fractional interests to which a former holder of shares of WMC Common Stock is otherwise entitled will be paid in cash in accordance with the Merger Agreement.

Pursuant to the Merger Agreement, the amount of the Per Share Additional Manager Consideration was reduced by the smallest amount (rounded to the nearest cent) necessary to cause the Per Share Additional Manager Consideration to be less than 10% of the total value of the Per Share Merger Consideration received by a holder of WMC Common Stock under the Merger Agreement. Pursuant to the Fourth Amendment to Management Agreement, dated as of August 8, 2023, by and between MITT and MITT Manager, which amends the existing Management Agreement, dated as of June 29, 2011 (as amended, the “Existing MITT Management Agreement”), MITT Manager will waive its right to seek reimbursement from MITT for any expenses otherwise reimbursable by MITT under the Existing MITT Management Agreement in an amount equal

to approximately $1.3 million, which is the excess of $7.0 million over the aggregate Per Share Additional Manager Consideration paid by MITT Manager to the holders of WMC Common Stock under the Merger Agreement.

Additionally, each outstanding share of WMC’s restricted common stock and each WMC restricted stock unit (each, a “WMC Equity Award”) vested in full immediately prior to the Effective Time and, as of the Effective Time, was considered outstanding for all purposes of the Merger Agreement, including the right to receive the Per Share Merger Consideration, except that WMC Equity Awards granted to certain members of the WMC board of directors at WMC’s 2023 annual stockholders’ meeting (collectively, the “2023 WMC Director Awards”) were treated as follows: (i) for M. Christian Mitchell and Lisa G. Quateman, who were appointed to the MITT board of directors as of the Effective Time pursuant to the Merger Agreement, the 2023 WMC Director Awards were equitably adjusted effective as of the Effective Time into awards relating to shares of MITT Common Stock that have the same value, vesting terms and other terms and conditions as applied to the corresponding WMC restricted stock units immediately prior to the Effective Time and (ii) for the other members of the WMC board of directors, the 2023 WMC Director Awards accelerated and vested pro-rata effective as of immediately prior to the Effective Time based on a fraction, the numerator of which was 167 (the number of days between the grant date and the Closing Date) and the denominator of which was 365, and the remaining unvested portion of such 2023 WMC Director Awards was cancelled without any consideration.

The issuance of shares of MITT Common Stock to the former stockholders of WMC was registered under the Securities Act of 1933, as amended (the “Securities Act”), pursuant to a registration statement on Form S-4 (File No. 333-274319), as amended, filed by MITT with the SEC and declared effective on September 29, 2023 (the “Registration Statement”). The joint proxy statement/prospectus included in the Registration Statement contains additional information about the Merger, the Merger Agreement and the transactions contemplated thereby.

Per the terms of the transactions contemplated by the Merger Agreement, approximately 9.2 million shares of MITT Common Stock will be issued in connection with the Merger to former WMC common stockholders, and former WMC common stockholders will own approximately 31% of the common equity of MITT as the combined company following the consummation of the Merger.

The foregoing description of the Merger and the other transactions contemplated by the Merger Agreement is only a summary, does not purport to be complete and is subject to, and qualified in its entirety by, reference to the full text of the Merger Agreement, which was previously filed as Exhibit 2.1 to WMC’s Current Report on Form 8-K filed with the SEC on August 9, 2023, and is incorporated herein by reference.

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

The information set forth in the Introductory Note and under Item 2.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.01.

As a result of the Merger, shares of WMC Common Stock ceased to trade on the NYSE prior to market open on December 6, 2023, and became eligible for delisting from the NYSE and termination of registration under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). WMC has requested that the NYSE file a Notification of Removal from Listing and/or Registration under Section 12(b) of the Exchange Act on Form 25 with the SEC to delist shares of WMC Common Stock from the NYSE. After the Form 25 becomes effective, MITT plans to file a Form 15 with the SEC on behalf of WMC to terminate the registration of shares of WMC Common Stock under the Exchange Act and suspend its reporting obligations with the SEC with respect to the WMC Common Stock.

Item 3.03 Material Modification to Rights of Security Holders.

The information set forth in the Introductory Note and under Items 2.01, 3.01 and 5.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.03.

As a result of the consummation of the Merger and at the Effective Time, holders of shares of WMC Common Stock immediately prior to the Effective Time ceased to have any rights as stockholders of WMC (other than their right to receive the Per Share Merger Consideration from MITT and MITT Manager, or as otherwise provided by the Merger Agreement or by law).

The rights of holders of MITT Common Stock are governed by MITT’s Articles of Amendment and Restatement, as amended, including the Articles Supplementary thereto, and MITT’s Amended and Restated Bylaws. The description of MITT Common Stock has previously been set forth in the section entitled “Description of MITT Capital Stock” in the definitive joint proxy statement/prospectus, which section is hereby incorporated by reference into this Item 3.03.

Item 5.01 Changes in Control of Registrant.

The information set forth in the Introductory Note and the information set forth under Items 2.01, 3.03 and 5.02 of this Current Report on Form 8-K is incorporated by reference into this Item 5.01.

As a result of the consummation of the Merger, a change in control of WMC occurred, and WMC merged with and into Merger Sub, with Merger Sub surviving as a wholly owned subsidiary of MITT.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

The information set forth in the Introductory Note and Item 2.01 of this Current Report on Form 8-K is incorporated by reference into this Item 5.02.

As of the Effective Time, as contemplated by the Merger Agreement (and not because of any disagreement with WMC), WMC’s directors ceased serving in such capacity. These directors are James W. Hirschmann III, Bonnie M. Wongtrakool, M. Christian Mitchell, Edward D. Fox, Jr., Ranjit M. Kripalani and Lisa G. Quateman. In addition, at the Effective Time, each of the executive officers of WMC, Bonnie M. Wongtrakool, Greg Handler, Robert W. Lehman and Elliott Neumayer, ceased to be an executive officer of WMC.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit No. | Description |

| 2.1 | Agreement and Plan of Merger, dated as of August 8, 2023, by and among Western Asset Mortgage Capital Corporation, AG Mortgage Investment Trust, Inc., AGMIT Merger Sub, LLC and AG REIT Management, LLC, incorporated by reference to Exhibit 2.1 to the Current Report on Form 8-K, filed by Western Asset Mortgage Capital Corporation on August 9, 2023.* |

| 10.1 | Management Agreement, dated May 9, 2012, between Western Asset Mortgage Capital Corporation and Western Asset Management Company, incorporated by reference to Exhibit 10.4 to the Quarterly Report on Form 10-Q, filed by Western Asset Mortgage Capital Corporation on August 14, 2012. |

| 10.2 | Amendment to the Management Agreement between Western Asset Mortgage Capital Corporation and Western Asset Management Company, dated August 3, 2016, incorporated by reference to Exhibit 10.1 to the Quarterly Report on Form 10-Q, filed by Western Asset Mortgage Capital Corporation August 5, 2016. |

| 10.3 | |

| 104.1 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

*Pursuant to Item 601(a)(5) of Regulation S-K, certain schedules have been omitted. WMC agrees to furnish supplementally a copy of any omitted schedule to the SEC upon request.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | | | | | | | |

| | WESTERN ASSET MORTGAGE CAPITAL CORPORATION |

| | | |

| | | |

| | By: | /s/ Robert W. Lehman | |

| | | Name: | Robert W. Lehman | |

| | | Title: | Chief Financial Officer | |

Date: December 6, 2023

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

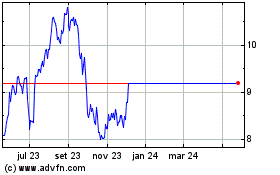

Western Asset Mortgage C... (NYSE:WMC)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Western Asset Mortgage C... (NYSE:WMC)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024