0001604738falsetrue00016047382023-12-052023-12-050001604738us-gaap:CommonStockMember2023-12-052023-12-050001604738ainc:PreferredStockPurchaseRightMember2023-12-052023-12-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): December 5, 2023

ASHFORD INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Nevada | | 001-36400 | | 84-2331507 |

(State or other jurisdiction of incorporation

or organization) | | (Commission

File Number) | | (IRS employer

identification number) |

| 14185 Dallas Parkway | | | | |

| Suite 1200 | | | | |

| Dallas | | | | |

| Texas | | | | 75254 |

| (Address of principal executive offices) | | | | (Zip code) |

Registrant’s telephone number, including area code: (972) 490-9600

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock | | AINC | | NYSE American LLC |

| Preferred Stock Purchase Rights | | | | NYSE American LLC |

ITEM 5.02 DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS.

On December 5, 2023, Mark Nunneley, Chief Accounting Officer of Ashford Inc. (the “Company”), announced to the Board of Directors (the “Board”) of the Company his intention to voluntarily step down from his role as the Chief Accounting Officer and all other positions he holds with the Company and its subsidiaries, affiliated entities, and entities that it advises to become Senior Managing Director of the Company on a full-time basis, in which role he will provide strategic advice to the Company and be responsible for special projects as requested by the Company. Mr. Nunneley’s transition will be effective December 31, 2023 (the “Effective Date”).

Mr. Nunneley and the Company have entered into a Letter Agreement (the “Letter Agreement”) describing the terms of Mr. Nunneley’s new role. Pursuant to the Letter Agreement, which has no specified term, the existing Amended and Restated Employment Agreement dated September 13, 2017 between Mr. Nunneley and Ashford Hospitality Advisors, LLC (the “Employment Agreement”) generally will terminate on the Effective Date.

During the term of the Letter Agreement, Mr. Nunneley will act as a strategic advisor to the Company, Monty Bennett and the Board, and Mr. Nunneley generally will continue to be eligible for incentive compensation in respect of 2023 in accordance with the existing terms of the Employment Agreement as though it were not being terminated. Additionally, pursuant to the Letter Agreement:

•Mr. Nunneley will receive an annualized base salary of $400,000.00, less legally required and authorized deductions and withholdings;

•certain provisions of the Employment Agreement, such as its confidentiality, indemnification, cooperation, non-competition and non-solicitation provisions, shall survive and continue to apply in accordance with their terms; and

•subject to execution of a release of claims, the Company shall make a special payment to Mr. Nunneley upon the termination of his employment for any reason equal to the sum of (i) his annual base salary for 2023, and (ii) the average of the annual incentive bonuses he received (or will receive) in respect of 2021, 2022 and 2023, less legally required and authorized deductions and withholdings, to be paid in twelve (12) substantially equal monthly installments.

Mr. Nunneley will not be otherwise eligible to participate in any bonus, equity, or other incentive compensation program after the Effective Date, though his existing incentive awards that continue past the Effective Date will continue to apply in accordance with their existing terms.

The foregoing description of the Letter Agreement is qualified in its entirety by the complete text of the Letter Agreement, which is attached hereto as Exhibit 99.1.

On December 7, 2023, Justin Coe, the Company’s current Senior Vice President of Accounting, was appointed to fill the role of Chief Accounting Officer at the Company, effective January 1, 2024.

Mr. Coe, age 40, has served as the Company’s Senior Vice President of Accounting since July 2015. As Senior Vice President of Accounting, Mr. Coe was responsible for overseeing most of the accounting functions for the Company and each of its advised platforms, including Ashford Hospitality Trust, Inc and Braemar Hotels & Resorts Inc. Such functions include tax, financial reporting, corporate controller, portfolio accounting, internal audit, information systems, acquisitions and special projects. Prior to joining the Company, Mr. Coe was a Senior Manager at Ernst & Young LLP and served since 2006 in various Assurance and Advisory roles for public and private companies in the airline, real estate, medical device and other industries domestically and internationally. Mr. Coe holds Bachelor of Business Administration and Master of Accountancy degrees from Texas State University – San Marcos and is a licensed certified public accountant (CPA) in the state of Texas.

There is no arrangement or understanding between Mr. Coe and any other persons in connection with Mr. Coe’s appointment as Chief Accounting Officer, and Mr. Coe has no family relationship with any director or executive officer of the Company. Mr. Coe has no direct or indirect material interest in any transaction with the Company that is reportable under Item 404(a) of Regulation S-K, nor have any such transactions been proposed.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

| | | | | | | | | | | |

| Exhibit Number | | Description | | | |

| | | | | |

| 99.1 | | | | | |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

SIGNATURE

Pursuant to the requirements of Section 12 of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: December 7, 2023 | | | | | | | | |

| ASHFORD INC. |

| | |

| By: | /s/ ALEX ROSE |

| | Alex Rose |

| | Executive Vice President, General Counsel & Secretary |

| | | | | | | | | | | | | | | | | | | | |

| |

| | | | | | 14185 Dallas Parkway |

| | | | | | Suite 1200 |

| | | | | | Dallas, Texas 75254 |

| | | | | | (972) 490-9600 |

| | | | | | |

December 7, 2023

Via email to mnunneley@ashfordinc.com

Mark Nunneley

14185 Dallas Parkway, Suite 1200

Dallas, TX 75254

Re: New employment arrangements

Dear Mark:

This letter confirms our discussions about your new role with Ashford Hospitality Advisors, LLC (the “Company”) and Ashford Inc. (“AINC”).

Background

You indicated your desire to step down from your current role as Chief Accounting Officer of the Company, AINC, Ashford Hospitality Trust, Inc., and Braemar Hotels & Resorts Inc. The Company and AINC desire that you remain employed by the Company in a full-time role with the title of Senior Managing Director of Ashford Inc., in which role you will act strategic advisor to me and the AINC Board of Directors and take on special projects as requested by me or the Board, and you have agreed to do so.

Accordingly, you and the Company have mutually agreed that you will resign as the Chief Accounting Officer (and from any other positions you may hold in AINC, its affiliates or subsidiaries, and any entities advised by AINC (collectively, the “Ashford-Related Entities”)) effective December 31, 2023, and that the Amended and Restated Employment Agreement dated September 13, 2017 (the “Employment Agreement”), will terminate on the same day without further obligation except as specifically noted below. Your new role with the Company and AINC will begin January 1, 2024 (the “Effective Date”).

Terms and Conditions of Continued Employment:

Compensation: On the Effective Date, your annualized base salary will be $400,000.00, less legally required and authorized deductions and withholdings, which will be paid in installments in accordance with the general payroll practices of the Company.

Incentive Compensation for FY23: You will receive an Incentive Bonus (defined in the Employment Agreement) and discretionary grants under one or more Ashford-Related Entities’ incentive compensation plans for FY23 in accordance with the Employment Agreement, as though the Employment Agreement was not being terminated.

Benefits; Paid Leave: You remain eligible to participate in the employee benefit plans available to all full-time employees of the Company, in accordance with the provisions of such plans. You will continue to receive paid vacation based on your current annual accrual, to be accrued and used in accordance with the Company’s vacation policy, and be eligible for other paid leave policies that are available to all full-time Company employees.

Policies; Conduct: You will continue to be expected to comply with the Company’s and AINC’s personnel, operational, and compliance policies, the Code of Business Conduct and Ethics, and expectations of professional and ethical conduct.

Continuing and Incorporated Obligations under the Employment Agreement: You acknowledge and agree that you have continuing obligations under Section 9 (CONFIDENTIAL INFORMATION) and Section 15 (COOPERATION IN FUTURE MATTERS) of the Employment Agreement. The Company acknowledges and agrees that it has continuing obligations under Section 14 (INDEMNIFICATION) of the Employment Agreement. You and the Company agree that Section 10 (NON-COMPETITION, NON-SOLICITATION AND NON-INTERFERENCE), Section 13 (DISPUTES), Section 16(l) (NON-DISPARAGEMENT) of the Employment Agreement are incorporated into this letter agreement as if they were repeated in full. Finally, you and the Company agree that any reference to the “Term” in the sections referenced in this paragraph means the period from the Effective Date until your employment ends for any reason; any reference to “Date of Termination” in the sections referenced in this paragraph means the last day of your employment with the Company; any reference to “Agreement” in the sections referenced in this paragraph means this letter agreement; and any reference to “Ashford Prime” in the sections referenced in this paragraph means Braemar.

For purposes of clarity only, nothing in these continuing and incorporated obligations or any policy of any of the Ashford-Related Entities is intended to or does prohibit you or any of the Ashford-Related Entities from (i) reporting to, communicating with, responding to an inquiry from, cooperating with, providing truthful information to, or otherwise participating in an investigation being conducted by any law enforcement agency, governmental agency, or regulatory body (such as the U.S. Department of Justice, the Securities and Exchange Commission, the Equal Employment Opportunity

Commission, the U.S. Department of Labor, or another federal or state law enforcement, regulatory, or fair employment practices agency) regarding a possible or alleged violation of law or regulation and, with respect to the Executive, without prior authorization of or notice to any of the Ashford-Related Entities; (ii) giving truthful testimony or making truthful statements under oath in response to a subpoena or other valid legal process or in any legal proceeding; or (iii) otherwise responding truthfully in response to inquiries by law enforcement agencies, governmental agencies, or regulatory bodies.

Special Payment: In appreciation of your past service and willingness to continue employment with the Company on these terms and conditions, the Company agrees to make a one-time payment to you equal to the sum of (x) your annual base salary for FY23 and (y) the average of the Incentive Bonuses received by you in FY22, FY23 and FY24, less legally required and authorized deductions and withholdings (the “Special Payment”), in connection with the termination of your employment with the Company for any reason, including by reason of your death, on the following terms and conditions:

•Your termination from employment must constitute a “separation from service” within the meaning of Section 409A of the Internal Revenue Code (“Code Section 409A”) and the regulations and other guidance thereunder.

•You (or your representative or estate, if applicable) must execute and return to the Company a separation agreement containing a waiver and release of claims in the form prescribed by the Company (the “Release”) on or prior to the 50th day following the date of termination, or such shorter time as may be prescribed in the Release, and not revoke the Release.

•Subject to the satisfaction of the prior two conditions, the Special Payment will be paid to you in twelve (12) substantially equal monthly installments (each of which installments may be made in the Company’s discretion over one or more of the Company’s payroll dates in such month) beginning in the first month after the month in which you terminate employment, provided, that the first installment payment shall be paid, without interest, on the Company’s first regular payroll date that is at least five (5) business days after the Release has become fully enforceable and irrevocable and include any installments (or fraction thereof) that would have been paid had the first installment been payable on the Company’s first payroll date in the first month after the month in which you terminate employment, and provided further, that if any portion of the Special Payment constitutes “nonqualified deferred compensation” for purposes of Code Section 409A and the period in you have to review and revoke the Release begins in one calendar year and ends in another calendar year, the first installment of the Special Payment shall begin in such second calendar year and shall include payment of any amount that otherwise would be paid earlier absent this provision, and each payment hereunder shall be deemed a separate payment for purposes of Code Section 409A.

•Notwithstanding the above, to the extent that the AINC Board reasonably determines, in its sole discretion, that any installment of the Special Payment would be subject to the additional tax imposed under Code Section 409A(a)(1)(B)

or a successor or comparable provision if your receipt of such payment is not delayed until the earlier of (x) the date that is six (6) months following the date of your termination or (y) the date of your death (such date being the “Section 409A Payment Date”), then such installment payment shall be accumulated and paid without interest on the Section 409A Payment Date. For purposes of Code Section 409A, each installment payment provided under this Agreement shall be treated as a separate payment.

No Term of Employment: Your and the Company’s employment relationship is not for a specific term, and either you or the Company may terminate the employment relationship at any time, for any reason, and without or without advance notice. I do request that you give the Company at least 30 days’ advance notice of your departure as a professional courtesy.

Other Matters: You will not be eligible to participate in any bonus, equity, or other incentive compensation plan or program after the Effective Date. Any outstanding awards issued under any equity incentive plan of any of the Ashford-Related Entities, will continue to be governed by the awards and plan documents.

Please sign below to indicate your agreement with these terms and conditions.

Sincerely,

/s/ MONTY J. BENNETT

Monty J. Bennett

Ashford Inc., CEO and Chairman

AGREED:

/s/ MARK NUNNELEY

Mark Nunneley

December 7, 2023

Date Signed

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ainc_PreferredStockPurchaseRightMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

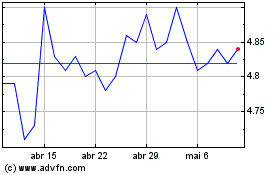

Ashford (AMEX:AINC)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Ashford (AMEX:AINC)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024