FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of December, 2023

Brazilian

Distribution Company

(Translation of Registrant’s Name Into English)

Av. Brigadeiro Luiz Antonio,

3142 São Paulo, SP 01402-901

Brazil

(Address of Principal Executive Offices)

(Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F)

Form 20-F X Form

40-F

(Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule

101 (b) (1)):

Yes ___ No X

(Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule

101 (b) (7)):

Yes ___ No X

(Indicate

by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes ___ No X

COMPANHIA

BRASILEIRA DE DISTRIBUIÇÃO

Publicly

traded company

CNPJ/MF

Nº 47.508.411/0001-56

NIRE 35.300.089.901

NOTICE TO THE MARKET

Companhia Brasileira de Distribuição

(“GPA” or “Company”), pursuant to Law No. 6,404 of December 15, 1976, as in force and the Resolution

of the Brazilian Securities and Exchange Commission (“CVM”) No. 44 of August 23, 2021, and in line with the material

fact disclosed on October 16, 2023 and the notice to the market disclosed on November 6, 2023, referring to the process of sale of the

entire stake in Almacenes Éxito S.A (“Éxito”), corresponding to 13.31% of Éxito’s share

capital, to the Calleja Group (“Buyer”), hereby informs its shareholders and the market that:

On this date, the Buyer published in the Colombian

newspaper El Colombiano, the first notice of the Tender Offer that will be launched in Colombia (“Colombian TO”) with

the objective of acquiring 100% of Éxito’s share capital, subject to the condition of acquiring at least 51% of Éxito’s

share capital (“Transaction”).

According to information published by the Buyer,

the Colombian TO will be open between December 18, 2023, and January 19, 2024, with settlement expected to occur at the end of January

2024.

As previously announced, the Buyer expects to

launch a tender offer in the United States (“U.S. TO”), as part of the Transaction. On this date, the U.S. TO has not

yet started, and the Buyer has not disclosed the dates on which the U.S. TO will be open.

It is worth noting that the tender offer will

take place in Colombia and is expected to take place in United States. Holders of Brazilian Depositary Receipts (“BDRs”)

in Brazil will have the chance to contact their brokers or the depositary bank of the BDRs program via email dr.itau@itau-unibanco.com.br

to convert their BDRs into shares in Colombia and/or into American Depositary Receipts (“ADRs”) in United States in

the case they opt to participate in the tender offer.

GPA will keep the market and its shareholders

informed of any new material facts related to these matters.

São Paulo, December 10, 2023.

Rafael Russowsky

Vice-President of Finance and Investor Relations Officer

This communication is for informational purposes only under the current

applicable laws and regulations, and is neither an offer to sell nor a solicitation of an offer to buy the securities described herein,

nor shall there be any sale of these securities in any jurisdiction in which such an offer, solicitation or sale would be unlawful prior

to registration or qualification under the securities laws of any such jurisdiction.

Forward-Looking Statements

This communication contains forward-looking

statements related to a pre-agreement for the purchase of and the proposed tender offer for shares of Éxito. Words such as “anticipate,”

“believe,” “estimate,” “expect,” “forecast,” “intend,” “may,”

“plan,” “project,” “predict,” “should,” “would” and “will” and

variations of such words and similar expressions are intended to identify such forward-looking statements. Such statements are based on

GPA’s expectations as of the date they were first made and involve risks and uncertainties that could cause actual results to differ

materially from those expressed or implied in our forward-looking statements. Such risks and uncertainties include, among others, the

outcome and timing of regulatory reviews and the timing of the launch and completion of the tender offer. Readers are cautioned not to

place undue reliance on these forward-looking statements, which speak only as of their dates. Unless as otherwise stated or required by

applicable law, GPA undertakes no obligation and does not intend to update these forward-looking statements, whether as a result of new

information, future events or otherwise.

Important Information for U.S. Investors

The tender offer described in this communication

has not yet commenced. This communication is provided for informational purposes only and does not constitute an offer to purchase or

the solicitation of an offer to sell any shares or other securities. If and at the time a tender offer is commenced, the Buyer has advised

us that it intends to file with the U.S. Securities and Exchange Commission (the “SEC”) a Tender Offer Statement on Schedule

TO containing an offer to purchase, a form of letter of transmittal and other documents relating to the tender offer, and Éxito

will file with the SEC a Solicitation/Recommendation Statement on Schedule 14D-9 with respect to the tender offer.

U.S. INVESTORS AND SECURITY HOLDERS ARE

URGED TO READ THE TENDER OFFER STATEMENT, OFFER TO PURCHASE, SOLICITATION/RECOMMENDATION STATEMENT AND ALL OTHER RELEVANT DOCUMENTS THAT

WILL BE FILED WITH THE SEC REGARDING THE PROPOSED TRANSACTION CAREFULLY BEFORE MAKING A DECISION CONCERNING THE TENDER OFFER AS THEY WILL

CONTAIN IMPORTANT INFORMATION ABOUT THE TENDER OFFER.

Such documents, and other documents filed

with the SEC by the Buyer and Éxito, may be obtained by U.S. shareholders without charge after they have been filed at the SEC’s

website at www.sec.gov. The offer to purchase and related materials may also be obtained (when available) for free by U.S. shareholders

by contacting the information agent for the tender offer that will be named in the Tender Offer Statement on Schedule TO.

SIGNATURES

Pursuant

to the requirement of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| |

|

|

| |

|

COMPANHIA BRASILEIRA DE DISTRIBUIÇÃO

|

| Date: December

10, 2023 |

By: /s/ Marcelo Pimentel

|

| |

|

Name: |

Marcelo Pimentel |

| |

|

Title: |

Chief Executive Officer |

| |

|

|

|

| |

|

By: /s/

Rafael Sirotsky Russowsky |

| |

|

Name: |

Rafael Sirotsky Russowsky |

| |

|

Title: |

Investor Relations Officer |

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements.

These statements are statements that are not historical facts, and are based on management's current view and estimates offuture

economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes",

"estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended

to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal

operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends

affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect

the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected

events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic

and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual

results to differ materially from current expectations.

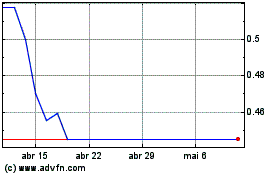

Companhia Brasileira de ... (NYSE:CBD)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

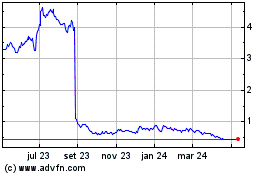

Companhia Brasileira de ... (NYSE:CBD)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025