FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of December, 2023

Brazilian

Distribution Company

(Translation of Registrant’s Name Into English)

Av. Brigadeiro Luiz Antonio,

3142 São Paulo, SP 01402-901

Brazil

(Address of Principal Executive Offices)

(Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F)

Form 20-F X Form

40-F

(Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule

101 (b) (1)):

Yes ___ No X

(Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule

101 (b) (7)):

Yes ___ No X

(Indicate

by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes ___ No X

COMPANHIA

BRASILEIRA DE DISTRIBUIÇÃO

Publicly

traded company

CNPJ/MF

Nº 47.508.411/0001-56

NIRE 35.300.089.901

MATERIAL FACT

Companhia Brasileira de Distribuição

(the “Company”), in compliance with Brazilian law no. 6.404, of December 15, 1976, and resolution no. 44 of the Brazilian

Securities Commission (Comissão de Valores Mobiliários – CVM), of August 23, 2021, hereby informs its shareholders

and the market that it is has initiated preliminary work efforts towards a potential primary equity offering, pursuant to CVM resolution

no. 160, of July 13, 2022 (the “Potential Offering”), and has engaged financial institutions to evaluate the feasibility

and the terms of the Potential Offering.

The Potential Offering is part of the Company’s

plan to optimize its capital structure, which also consisted of the sale of non-core assets, including the sale of its 34% equity interest

in Cnova N.V., and the sale of its 13.3% equity interest in Almacenes Éxito S.A. expected to close in January 2024, as also disclosed

to the market on the date hereof. If the Potential Offering is consummated, the Company intends to invest the proceeds therefrom to reduce

the Company’s indebtedness and, as a result, reduce its financial leverage.

In light of the Company’s preliminary

work efforts and strategic planning towards the Potential Offering, the Company has, on the date of this material fact notice, convened

an extraordinary shareholders’ meeting, to be held on January 11, 2024, to deliberate on, among other matters: (i) an increase in

the Company’s authorized capital to up to 800 million common shares; and (ii) the proposal by the Company’s management to

elect a new slate for the Company’s board of directors, which would be conditioned upon the closing of the Potential Offering. Newly

elected directors would commence their term 30 calendar days after the closing of the Potential Offering.

The new slate proposed by the Company’s

management to be elected at the extraordinary shareholders’ meeting results from a unified decision by the Company’s management

and the Company’s current controlling shareholder, Casino Guichard Perrachon (“Casino”). The slate is composed

of nine members, of whom six would be independent members – (i) Mr. Eleazar de Carvalho Filho, (ii) Mr. Luiz Augusto de Castro

Neves and (iii) Mr. Renan Bergmann, current independent board members to be reelected, and (iv) Mr. José Luis Gutierrez, (v) Mrs.

Márcia Nogueira de Mello and (vi) Mrs. Rachel Maia, who would be new independent board members – and two members appointed

by Casino – (vii) Mr. Christophe José Hidalgo and (viii) Mr. Philippe Alarcon – in addition to one member, (ix) Mr.

Marcelo Ribeiro Pimentel, who would be a representative of the Company’s management and would remain on the board of directors.

Further, the proposed slate will appoint Mr. Renan Bergmann as chairman of the board of directors. The proposed composition of the board

of directors conforms with the potential dilution of Casino’s equity interest in the Company.

The Potential Offering and its terms and

conditions remain under review by the Company and are subject to applicable corporate and third-party approvals, macroeconomic and political

conditions in Brazil and abroad, investor interest among other factors not under the Company’s control.

The Company will keep its shareholders

and the market informed of developments relating to the Potential Offering.

This material fact notice (i) is merely informative

and should under no circumstances be construed as, nor constitute, an investment recommendation or an offer to sell or an offer to purchase

any of the Company’s securities in Brazil, the United States or any other jurisdiction; and (ii) is not intended to be published

or distributed, directly or indirectly, in the United States or in any other jurisdiction, and is for informational purposes only. The

securities mentioned in this material fact notice have not been and will not be registered under the U.S. Securities Act of 1933, as amended

(the “Securities Act”), or any other U.S. federal or state securities law, and may not be offered or sold in the United

States absent registration or an applicable exemption from registration requirements under the Securities Act.

São Paulo, December 10, 2023

Rafael Russowsky

Vice-President of Finance and Investor Relations

Officer

SIGNATURES

Pursuant

to the requirement of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| |

|

|

| |

|

COMPANHIA BRASILEIRA DE DISTRIBUIÇÃO

|

| Date: December

10, 2023 |

By: /s/ Marcelo Pimentel

|

| |

|

Name: |

Marcelo Pimentel |

| |

|

Title: |

Chief Executive Officer |

| |

|

|

|

| |

|

By: /s/

Rafael Sirotsky Russowsky |

| |

|

Name: |

Rafael Sirotsky Russowsky |

| |

|

Title: |

Investor Relations Officer |

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements.

These statements are statements that are not historical facts, and are based on management's current view and estimates offuture

economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes",

"estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended

to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal

operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends

affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect

the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected

events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic

and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual

results to differ materially from current expectations.

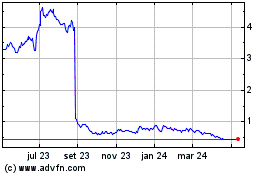

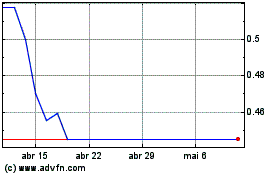

Companhia Brasileira de ... (NYSE:CBD)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Companhia Brasileira de ... (NYSE:CBD)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025