Form SC14D9C - Written communication relating to third party tender offer

11 Dezembro 2023 - 5:28PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14D-9

(RULE 14d-101)

SOLICITATION/RECOMMENDATION STATEMENT

UNDER SECTION 14(d)(4) OF THE SECURITIES

ACT OF 1934

Almacenes Éxito S.A.

(Name of Subject

Company)

Companhia Brasileira de Distribuição

(Name of Person Filing Statement)

Brazilian Distribution Company

(Translation of Person Filing Statement’s Name

into English)

Common Shares, par value of COP 3.33 per common

share

American Depositary Shares, each representing eight

common shares

(Title of Class of Securities)

02028M105*

(CUSIP Number of Class of Securities)

Rafael Sirotsky

Russowsky

Chief Financial

Officer and Investor Relations Officer

Companhia

Brasileira de Distribuição

Avenida Brigadeiro Luiz Antonio, 3142

01402-901 São Paulo, SP, Brazil

+55 11 3886-0421

(Name, Address and Telephone Number of Person Authorized

to Receive Notices and Communications

on Behalf of the Person(s) Filing Statement)

With copies to:

John Vetterli

Karen Katri

White & Case LLP

1221 Avenue of the Americas

New York, New York 10020

(212) 819-8200

| ☒ | Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

| * | The CUSIP number is for the American Depositary Shares relating to the common shares. No CUSIP number exists for the underlying common

shares, because such shares are not traded in the United States. |

This Schedule

14D-9 consists of a communication by Companhia Brasileira de Distribuição (known as “GPA”), which is attached

hereto as Exhibit 99.1, concerning recent developments relating to a proposed tender

offer for common shares of Almacenes Éxito S.A. (“Éxito”) (including common shares represented by American Depositary

Shares) by Cama Commercial Group, Corp. (the “Buyer”).

Important Information

The tender offer described in this communication

has not yet commenced. This communication is provided for informational purposes only and does not constitute an offer to purchase or

the solicitation of an offer to sell any shares or other securities. If and at the time a tender offer is commenced, the Buyer has advised

us that it intends to file with the U.S. Securities and Exchange Commission (the “SEC”) a Tender Offer Statement on Schedule

TO containing an offer to purchase, a form of letter of transmittal and other documents relating to the tender offer, and Éxito

will file with the SEC a Solicitation/Recommendation Statement on Schedule 14D-9 with respect to the tender offer.

U.S. INVESTORS AND SECURITY HOLDERS ARE

URGED TO READ THE TENDER OFFER STATEMENT, OFFER TO PURCHASE, SOLICITATION/RECOMMENDATION STATEMENT AND ALL OTHER RELEVANT DOCUMENTS THAT

WILL BE FILED WITH THE SEC REGARDING THE PROPOSED TRANSACTION CAREFULLY BEFORE MAKING A DECISION CONCERNING THE TENDER OFFER AS THEY WILL

CONTAIN IMPORTANT INFORMATION ABOUT THE TENDER OFFER.

Such documents, and other documents filed with

the SEC by the Buyer and Éxito, may be obtained by U.S. shareholders without charge after they have been filed at the SEC’s

website at www.sec.gov. The offer to purchase and related materials may also be obtained (when available) for free by U.S. shareholders

by contacting the information agent for the tender offer that will be named in the Tender Offer Statement on Schedule TO.

This communication

shall not constitute a tender offer in any country or jurisdiction in which such offer would be considered unlawful or otherwise violate

any applicable laws or regulations.

Forward-Looking

Statements

This communication

contains forward-looking statements related to a pre-agreement for the purchase of and the proposed tender offer for shares of Éxito.

Words such as “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “intend,”

“may,” “plan,” “project,” “predict,” “should,” “would” and “will”

and variations of such words and similar expressions are intended to identify such forward-looking statements. Such statements are based

on GPA’s expectations as of the date they were first made and involve risks and uncertainties that could cause actual results to

differ materially from those expressed or implied in our forward-looking statements. Such risks and uncertainties include, among others,

the outcome and timing of regulatory reviews and the timing of the launch and completion of the tender offer. Readers are cautioned not

to place undue reliance on these forward-looking statements, which speak only as of their dates. Unless as otherwise stated or required

by applicable law, GPA undertakes no obligation and does not intend to update these forward-looking statements, whether as a result of

new information, future events or otherwise.

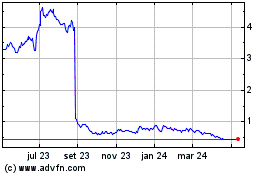

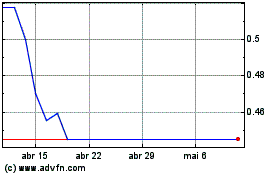

Companhia Brasileira de ... (NYSE:CBD)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Companhia Brasileira de ... (NYSE:CBD)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025