false

0001595527

0001595527

2023-12-28

2023-12-28

0001595527

us-gaap:CommonStockMember

2023-12-28

2023-12-28

0001595527

us-gaap:RightsMember

2023-12-28

2023-12-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 28, 2023

American

Strategic Investment Co.

(Exact Name of Registrant as Specified in Charter)

|

Maryland |

|

001-39448 |

|

46-4380248 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

| |

|

|

|

|

|

222 Bellevue Ave,

Newport, Rhode Island 02840 |

| (Address, including zip code, of Principal Executive Offices) |

| |

| Registrant’s telephone number, including area code: (212)

415-6500 |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

|

Title

of each class: |

|

Trading

Symbol(s) |

|

Name

of each exchange on which

registered |

| Class

A common stock, $0.01 par value per share |

|

NYC |

|

New

York Stock Exchange |

| Class

A Preferred Stock Purchase Rights |

|

true |

|

New

York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02 Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

Resignation of Director

Abby M. Wenzel

On December 28, 2023,

Ms. Abby M. Wenzel resigned as a Class I Director of the American Strategic Investment Co.

(the “Company”), effective December 28, 2023. Ms. Wenzel’s resignation from the Board is not the result of any disagreement

with the Company. In connection with such resignation, the board of directors of the Company (the “Board”) approved amendments

to certain award agreements by and between the Company and Ms. Wenzel to accelerate the vesting of all unvested restricted shares granted

to Ms. Wenzel for service on the Board under the Company’s 2017 Amended and Restated Employee and Director Incentive Restricted

Share Plan and the Company’s 2020 Omnibus Incentive Compensation Plan such that all such shares vested upon the effectiveness of

Ms. Wenzel’s resignation.

Appointment of Director

Nicholas Radesca

On December 28, 2023,

the Board appointed Mr. Nicholas Radesca to serve as a member of the Board, effective December 28, 2023, to fill the vacancy created by

the resignation of Ms. Wenzel. Mr. Radesca will serve as a Class I Director for the remainder of Ms. Wenzel’s term, which expires

on the date of the Company’s 2024 Annual Meeting of Stockholders, and until his successor has been duly elected and qualified, subject

to his earlier death, resignation, retirement, disqualification or removal.

The board determined

that Mr. Radesca is “independent” as defined under the listing standards of the New York Stock Exchange (“NYSE”)

and the Company’s corporate governance guidelines. The Board appointed Mr. Radesca to serve on the Board’s Audit Committee,

Compensation Committee and Nominating and Governance Committee, to fill the vacancies created by the resignation of Ms. Wenzel, and to

serve as the Chair of the Compensation Committee, which position had been held by Ms. Wenzel. The Board designated him as an “audit

committee financial expert” as defined by the Securities and Exchange Commission (“SEC”).

Mr. Radesca, 58, served

as an independent director of G&P Acquisition Corp. from January 2021 to December 2022, and has decades of public company experience

as chief financial officer of numerous companies, including serving as interim chief financial officer of the Company from June 2015 through

November 2017 and as chief financial officer of AR Global Investments, LLC (“AR Global”) from January 2014 through November

2017, which is the parent company of New York City Advisors, LLC, the Company’s advisor, and New York City Properties, LLC, the

Company’s property manager. Prior to joining the predecessor to AR Global, in December 2012, Mr. Radesca was employed by Solar Capital

Management, LLC, from March 2008 to May 2012, where he served as the chief financial officer and corporate secretary for Solar Capital

Ltd. and its predecessor company, and Solar Senior Capital Ltd., both of which are publicly traded business development companies. From

2006 to February 2008, Mr. Radesca served as the chief accounting officer at iStar Financial Inc. (“iStar”), a publicly traded

commercial REIT, where his responsibilities included overseeing accounting, tax and SEC reporting. Prior to iStar, Mr. Radesca served

in various senior accounting and financial reporting roles at Fannie Mae, Del Monte Foods Company, Providian Financial Corporation and

Bank of America. Mr. Radesca has 25 years of experience in financial reporting and accounting and is a licensed certified public accountant

in New York and Virginia. Mr. Radesca holds a B.S. in accounting from the New York Institute of Technology and an M.B.A. from the California

State University, East Bay.

The Board believes that

Mr. Radesca’s extensive background in real estate, credit, M&A and operating businesses make him well qualified to serve on

the Board.

There are no family relationships

between Mr. Radesca and any director or executive officer of the Company, there are no arrangements or understandings between Mr. Radesca

and any other persons or entities pursuant to which Mr. Radesca was appointed as a director of the Company. Since

the beginning of Company’s last fiscal year, the Company has not engaged in any transaction, or any currently proposed transaction,

in which Mr. Radesca had or will have a direct or indirect material interest that would require

disclosure pursuant to Item 404(a) of Regulation S-K promulgated by the SEC.

Effective upon appointment,

Mr. Radesca became eligible to receive the standard compensation provided by the Company to its other non-employee directors, including

a pro-rated annual retainer based on the date he joins the Board, as most recently disclosed in the Company’s definitive proxy statement

for its 2023 annual meeting of shareholders filed with the SEC on April 18, 2023 (the “2023 Proxy Statement”). In addition,

in connection with his appointment, Mr. Radesca will enter into the Company’s standard indemnification agreement, as described in

the Company’s 2023 Proxy Statement, and filed as Exhibit 10.10 of the Company’s Annual Report on Form 10-K filed with the

SEC on March 16, 2023.

Item 7.01 Regulation FD Disclosure

On December 29, 2023,

the Company issued a press release relating to the matters described in Item 5.02 of this Current Report on Form 8-K. A copy of the press

release is attached to this Current Report on Form 8-K as Exhibit 99.1 and incorporated by reference in this Item 7.01. The information

contained in this Item 7.01, including Exhibit 99.1, is furnished and shall not be deemed “filed” for purposes of Section

18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that

Section, nor shall it be deemed incorporated by reference into any registration statement or other filing under the Securities Act of

1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing, except as shall be expressly incorporated

by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

American Strategic Investment Co. |

| |

|

|

| Date: December 29, 2023 |

By: |

/s/ Michael Anderson |

| |

|

Michael Anderson |

| |

|

Chief Executive Officer |

Exhibit 99.1

FOR IMMEDIATE RELEASE

AMERICAN STRATEGIC INVESTMENT CO. ANNOUNCES

CHANGES TO BOARD OF DIRECTORS

NEW YORK –December 29, 2023 - American

Strategic Investment Co. (NYSE: NYC) (“ASIC” or the “Company”) announces the following changes to its Board of

Directors.

Board member Abby Wenzel has announced that she

will resign from the ASIC Board effective December 28, 2023, after serving as a director for more than nine years. Nicholas Radesca has

been appointed to the Board as an independent director with immediate effect. Mr. Radesca has a long history of board memberships and

has held numerous executive roles.

Commenting on Ms. Wenzel’s departure, Chief

Executive Officer Michael Anderson said, “On behalf of our shareholders, we wish to acknowledge with gratitude Abby’s significant

contribution to ASIC over the past nine years. In her role, Abby’s leadership and steady hand have been vital in guiding the business

through significant changes and challenges.”

Mr. Radesca, 58, has decades of public company

experience as chief financial officer of numerous companies, including serving as interim chief financial officer of the Company and as

chief financial officer of AR Global and related companies, all of which ended in 2017. He brings to the Company a deep background in

real estate, credit, M&A and operating businesses, which the Board believes will bring great value to the Company as it continues

to evaluate investment opportunities beyond its current portfolio of assets.

Commenting on Mr. Radesca’s appointment,

Chief Executive Officer Michael Anderson said, “We are pleased to welcome Nick back to ASIC and expect his contributions to be very

valuable in this new phase of the Company. He joins a board with diverse set of experiences and expertise and believe he will be a great

addition.”

About the Company

American Strategic Investment Co. owns a portfolio of commercial real

estate. Additional information about ASIC can be found on its website at AmericanStrategicInvestment.com.

Forward-Looking Statements

The statements in this press release

that are not historical facts may be forward-looking statements. These forward-looking statements involve risks and uncertainties that

could cause actual results or events to be materially different. The words “may,” “will,” “seeks,”

“anticipates,” “believes,” “expects,” “estimates,” “projects,” “plans,”

“intends,” “should” and similar expressions are intended to identify forward-looking statements, although not

all forward-looking statements contain these identifying words. These forward-looking statements are subject to a number of risks, uncertainties

and other factors, many of which are outside of the Company’s control, which could cause actual results to differ materially from

the results contemplated by the forward-looking statements. These risks and uncertainties include (a) the anticipated benefits of the

Company’s election to terminate its status as a real estate investment trust, (b) whether the Company will be able to successfully

acquire new assets or businesses, (c) the potential adverse effects of (i) a resurgence of the global COVID-19 pandemic, including actions

taken to contain or treat COVID-19, (ii) the geopolitical instability due to the ongoing military conflict between Russia and Ukraine

and Israel and Hamas, including related sanctions

and other penalties imposed by the U.S. and European Union, and the related impact on the Company, the Company’s tenants, and the

global economy and financial markets, and (iii) inflationary conditions and higher interest rate environment, and (d) that any potential

future acquisition is subject to market conditions and capital availability and may not be completed on favorable terms, or at all, as

well as those risks and uncertainties set forth in the Risk Factors section of the Company’s Annual Report on Form 10-K for the

year ended December 31, 2022 filed on March 16, 2023 and all other filings with the Securities

and Exchange Commission after that date, as such risks, uncertainties and other important factors may be updated from time to time in

the Company’s subsequent filings with the Securities and Exchange Commission. Further, forward-looking

statements speak only as of the date they are made, and the Company undertakes no obligation to update or revise any forward-looking statement

to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results, unless required to do so

by law.

Contacts:

Investor Relations

info@ar-global.com

(866) 902-0063

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_RightsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

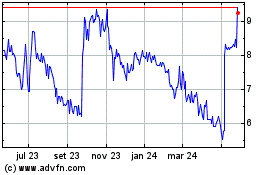

American Strategic Inves... (NYSE:NYC)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

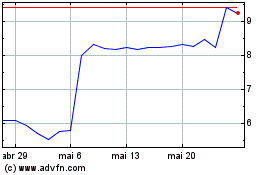

American Strategic Inves... (NYSE:NYC)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025