Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

10 Janeiro 2024 - 10:59AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of January 2024

Commission File No. 001-35193

Grifols, S.A.

(Translation of registrant’s name into English)

Avinguda de la Generalitat, 152-158

Parc de Negocis Can Sant Joan

Sant Cugat del Valles 08174

Barcelona, Spain

(Address of registrant’s principal executive

office)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Grifols, S.A.

TABLE OF CONTENTS

|

Grifols, S.A.

Avinguda de la Generalitat 152-158

08174 Sant Cugat

del Vallès

Barcelona - SPAIN

Tel. [34] 935 710 500

Fax [34] 935 710 267

www.grifols.com

|

Pursuant to the provisions of Article

227 of Law 6/2023 of March 17, on Securities Markets and Investment Services, Grifols, S.A. (“Grifols” or the “Company”)

hereby informs about the following

OTHER RELEVANT INFORMATION

As a continuation of the communications

filed yesterday by the Company as a consequence of the Gotham City Research report, Grifols wants to inform of the following:

| · | Mr. Thomas Glanzmann, the current Chief Executive Officer (CEO) and Executive Chairman of the Board of

Directors of Grifols, joined the Board of the Company in 2006. He has since then been an important contributor in the Company’s

growth and development. |

| · | The Board of the Company fully supports Mr. Thomas Glanzmann since he was appointed to his positions. |

| · | All relevant transactions described in the mentioned report published yesterday have been unanimously

approved by the Board of Directors and its various Committees, and they include all the necessary supporting information and documentation,

including valuations and third-party opinions. |

| · | The Gotham report questions the price paid for donor center acquisitions, which is difficult to understand

without having the adequate information. As with the purchase of any business, the price paid is not only the price of the assets, but

also their ability to generate profit. |

| · | Regarding Immunotek Bio Centers, LLC (“Immunotek”), there is an agreement with Immunotek

for the construction and development of 28 new centers in the USA. Immunotek will build and develop these centers, with Grifols having

the option to purchase them after 3 years from their commissioning. This means that Grifols will have no obligation to finance the ramp

up of the centers and the related plasma collected during the first 2 years. Please note that plasma collected during the ramp up period

can’t be used for fractionation. The $124 million payments referred to those advances for the construction of the centers and include

both the construction and the start-up costs until the opening. This contract and accounting treatment has been audited and fully disclosed

within our annual accounts. The value of this agreement is in line with market prices. |

| · | It has been stated that the acquisition price for the purchase of 25 matured plasma centers is higher

than the cost/capex of building one center from scratch. It should be clarified that the time required for a center to become volume mature

is 3-5 years, as explained in the previous paragraph. The price per liter paid was aligned with market comparables and third party valuation

reports. |

Grifols has been involved in the plasma business

for more than 100 years, understands the business and the dynamics, and its main focus has been and will always be the safety of its products

and the well-being of its donors and patients.

The Company will initiate legal actions against

Gotham City Research for the significant financial and reputational damage caused to the Company and to all its stakeholders, as well

as creating great concerns among patients and donors.

| In Barcelona, on January 10, 2024 |

|

| |

|

| |

|

| Nuria Martín Barnés |

|

| Secretary of the Board of Directors |

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

| |

Grifols, S.A. |

| |

|

|

| |

By: |

/s/ David I. Bell |

| |

|

Name: |

David I. Bell |

| |

|

Title: |

Authorized Signatory |

Date: January 10, 2024

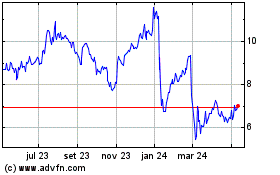

Grifols (NASDAQ:GRFS)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

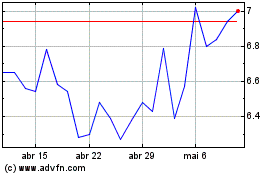

Grifols (NASDAQ:GRFS)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025