Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

23 Janeiro 2024 - 8:04AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of January 2024

Commission File Number: 001-39436

KE Holdings Inc.

(Registrant’s Name)

Oriental Electronic Technology Building,

No. 2 Chuangye Road, Haidian District,

Beijing 100086

People’s Republic of China

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F ⌧ Form 40-F ¨

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

KE Holdings Inc. |

| |

|

|

|

| |

|

|

|

| |

By |

: |

/s/ XU Tao |

| |

Name |

: |

XU Tao |

| |

Title |

: |

Chief Financial Officer |

Date: January 23, 2024

Exhibit 99.1

| FF304

Page 1 of 7 v 1.2.5

Next Day Disclosure Return

(Equity issuer - changes in issued share capital and/or share buybacks)

Instrument: Equity issuer Status: New Submission

Name of Issuer: KE Holding Inc.

Date Submitted: 17 January 2024

Section I must be completed by a listed issuer where there has been a change in its issued share capital which is discloseable pursuant to rule 13.25A of the Main Board Rules (the “Main Board

Listing Rules”) / rule 17.27A of the GEM Rules (the “GEM Listing Rules”) Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (the “Exchange”)

Section I

1. Class of shares WVR ordinary shares Type of shares A Listed on SEHK (Note 11) Yes

Stock code (if listed) 02423 Description

Issues of shares

(Notes 6 and 7) No. of shares

Issued shares as a %

of existing number of

issued shares before

relevant share issue

(Notes 4, 6 and 7)

Issue price per share

(Notes 1 and 7)

Closing market price per

share of the immediately

preceding business day

(Note 5)

% discount(-)/

premium of issue

price to market price

(Note 7)

Opening balance as at (Note 2) 12 January 2024 3,571,960,220

1). Repurchase of shares (or other securities) but not

cancelled

Date of changes 01 November 2023

1,500,000 % %

2). Repurchase of shares (or other securities) but not

cancelled

Date of changes 02 November 2023

1,500,000 % %

3). Repurchase of shares (or other securities) but not

cancelled

Date of changes 03 November 2023

300,000 % %

4). Repurchase of shares (or other securities) but not

cancelled

Date of changes 06 November 2023

300,000 % % |

| FF304

Page 2 of 7 v 1.2.5

5). Repurchase of shares (or other securities) but not

cancelled

Date of changes 07 November 2023

1,500,000

%

%

6). Repurchase of shares (or other securities) but not

cancelled

Date of changes 08 November 2023

1,500,000

%

%

7). Repurchase of shares (or other securities) but not

cancelled

Date of changes 09 November 2023

1,496,802

%

%

8). Repurchase of shares (or other securities) but not

cancelled

Date of changes 10 November 2023

4,051,458

%

%

9). Repurchase of shares (or other securities) but not

cancelled

Date of changes 13 November 2023

1,499,688

%

%

10). Repurchase of shares (or other securities) but not

cancelled

Date of changes 14 November 2023

342,387

%

%

11). Repurchase of shares (or other securities) but not

cancelled

Date of changes 16 November 2023

1,164,279

%

%

12). Repurchase of shares (or other securities) but not

cancelled

Date of changes 27 November 2023

955,146

%

%

13). Repurchase of shares (or other securities) but not

cancelled

Date of changes 28 November 2023

378,348

%

%

14). Repurchase of shares (or other securities) but not

cancelled

Date of changes 29 November 2023

377,922

%

%

15). Repurchase of shares (or other securities) but not

cancelled 376,245

%

% |

| FF304

Page 3 of 7 v 1.2.5

Date of changes 30 November 2023

16). Repurchase of shares (or other securities) but not

cancelled

Date of changes 01 December 2023

381,615

%

%

17). Repurchase of shares (or other securities) but not

cancelled

Date of changes 04 December 2023

386,571

%

%

18). Repurchase of shares (or other securities) but not

cancelled

Date of changes 05 December 2023

1,974,447

%

%

19). Repurchase of shares (or other securities) but not

cancelled

Date of changes 08 December 2023

989,820

%

%

20). Repurchase of shares (or other securities) but not

cancelled

Date of changes 11 December 2023

396,480

%

%

21). Repurchase of shares (or other securities) but not

cancelled

Date of changes 15 December 2023

380,520

%

%

22). Repurchase of shares (or other securities) but not

cancelled

Date of changes 21 December 2023

391,590

%

%

23). Repurchase of shares (or other securities) but not

cancelled

Date of changes 22 December 2023

1,922,814

%

%

24). Repurchase of shares (or other securities) but not

cancelled

Date of changes 02 January 2024

381,876

%

%

25). Repurchase of shares (or other securities) but not

cancelled

Date of changes 03 January 2024

379,254

%

% |

| FF304

Page 4 of 7 v 1.2.5

26). Repurchase of shares (or other securities) but not

cancelled

Date of changes 04 January 2024

382,305 % %

27). Repurchase of shares (or other securities) but not

cancelled

Date of changes 05 January 2024

393,189 % %

28). Repurchase of shares (or other securities) but not

cancelled

Date of changes 08 January 2024

920,058 % %

29). Repurchase of shares (or other securities) but not

cancelled

Date of changes 09 January 2024

1,010,046 % %

30). Repurchase of shares (or other securities) but not

cancelled

Date of changes 10 January 2024

1,011,828 % %

31). Repurchase of shares (or other securities) but not

cancelled

Date of changes 11 January 2024

1,013,676 % %

32). Repurchase of shares (or other securities) but not

cancelled

Date of changes 12 January 2024

1,015,320 % %

33). Repurchase of shares (or other securities) but not

cancelled

Date of changes 16 January 2024

1,056,240 0.028 % %

Closing balance as at (Note 8) 16 January 2024 3,571,960,220 |

| FF304

Page 5 of 7 v 1.2.5

N/A

Notes to Section I:

1. Where shares have been issued at more than one issue price per share, a weighted average issue price per share should be given.

2. Please insert the closing balance date of the last Next Day Disclosure Return published pursuant to Main Board Rule 13.25A / GEM Rule 17.27A or Monthly Return pursuant to Main

Board Rule 13.25B / GEM Rule 17.27B, whichever is the later.

3. Please set out all changes in issued share capital requiring disclosure pursuant to Main Board Rule 13.25A / GEM Rule 17.27A together with the relevant dates of issue. Each category

will need to be disclosed individually with sufficient information to enable the user to identify the relevant category in the listed issuer's Monthly Return. For example, multiple issues of

shares as a result of multiple exercises of share options under the same share option scheme or of multiple conversions under the same convertible note must be aggregated and

disclosed as one category. However, if the issues resulted from exercises of share options under 2 share option schemes or conversions of 2 convertible notes, these must be disclosed

as 2 separate categories.

4. The percentage change in the number of issued shares of listed issuer is to be calculated by reference to the listed issuer's total number of shares in issue (excluding for such purpose

any shares repurchased or redeemed but not yet cancelled) as it was immediately before the earliest relevant event which has not been disclosed in a Monthly Return or Next Day

Disclosure Return.

5. Where trading in the shares of the listed issuer has been suspended, “closing market price per share of the immediately preceding business day” should be construed as “closing market

price per share of the business day on which the shares were last traded”.

6. In the context of a repurchase of shares:

■ “issues of shares” should be construed as “repurchases of shares”; and

■ “issued shares as a % of existing number of shares before relevant share issue” should be construed as “repurchased shares as a % of existing number of shares before

relevant share repurchase”.

7. In the context of a redemption of shares:

■ “issues of shares” should be construed as “redemptions of shares”;

■ “issued shares as a % of existing number of shares before relevant share issue” should be construed as “redeemed shares as a % of existing number of shares before relevant

share redemption”; and

■ “issue price per share” should be construed as “redemption price per share”.

8. The closing balance date is the date of the last relevant event being disclosed.

9. Items (i) to (viii) are suggested forms of confirmation which may be amended to meet individual cases.

10. “Identical” means in this context:

■ the securities are of the same nominal value with the same amount called up or paid up;

■ they are entitled to dividend/interest at the same rate and for the same period, so that at the next ensuing distribution, the dividend/interest payable per unit will amount to

exactly the same sum (gross and net); and

■ they carry the same rights as to unrestricted transfer, attendance and voting at meetings and rank pari passu in all other respects. |

| FF304

Page 6 of 7 v 1.2.5

11. SEHK refers to Stock Exchange of Hong Kong. |

| FF304

Page 7 of 7 v 1.2.5

Section II must also be completed by a listed issuer where it has made a repurchase of shares which is discloseable under Main Board Rule 10.06(4)(a) / GEM Rule 13.13(1).

The issuer has Purchase report or additional information for issuer whose primary listing is on the Exchange

Section II

1. Class of shares WVR ordinary shares Type of shares A Listed on SEHK (Note) Yes

Stock code (if listed) 02423 Description

A. Purchase report

Trading date Number of securities

purchased

Method of purchase

(Note)

Price per share or highest price

paid $ Lowest price paid $ Total paid $

1). 16 January 2024 1,056,240 On another stock exchange

New York Stock Exchange

USD 4.8 USD 4.7 USD 4,999,994

Total number of securities

purchased 1,056,240 Total paid $ USD 4,999,994

B. Additional information for issuer whose primary listing is on the Exchange

1). Number of such securities purchased on the Exchange in the year to date (since ordinary resolution) (a)

2). % of number of shares in issue at time ordinary resolution passed acquired on the Exchange since date of resolution

( (a) x 100 )/ Number of shares in issue

%

We hereby confirm that the repurchases set out in A above which were made on another stock exchange were made in accordance with the applicable Main Board Listing Rules and there have

been no material changes to the particulars contained in the Explanatory Statement dated 27 April 2023 which has been filed with the Exchange. We also confirm that any purchases set out in A

above which were made on another stock exchange were made in accordance with the applicable rules applying to purchases made on that other exchange.

Remarks: B1) Number of such securities purchased on the above said exchange since the ordinary resolution passed at the annual general meeting held on June 15, 2023 is

95,617,377.

B2) % of number of shares in issue at time the ordinary resolution passed acquired on the above said exchange since date of resolution is 2.525%.

Note to Section II: Please state whether on the Exchange, on another stock exchange (stating the name of the exchange), by private arrangement or by general offer.

Submitted by: Siting Li

(Name)

Title: Joint Company Secretary

(Director, Secretary or other Duly Authorised Officer) |

Exhibit 99.2

| FF304

Page 1 of 7 v 1.2.5

Next Day Disclosure Return

(Equity issuer - changes in issued share capital and/or share buybacks)

Instrument: Equity issuer Status: New Submission

Name of Issuer: KE Holding Inc.

Date Submitted: 18 January 2024

Section I must be completed by a listed issuer where there has been a change in its issued share capital which is discloseable pursuant to rule 13.25A of the Main Board Rules (the “Main Board

Listing Rules”) / rule 17.27A of the GEM Rules (the “GEM Listing Rules”) Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (the “Exchange”)

Section I

1. Class of shares WVR ordinary shares Type of shares A Listed on SEHK (Note 11) Yes

Stock code (if listed) 02423 Description

Issues of shares

(Notes 6 and 7) No. of shares

Issued shares as a %

of existing number of

issued shares before

relevant share issue

(Notes 4, 6 and 7)

Issue price per share

(Notes 1 and 7)

Closing market price per

share of the immediately

preceding business day

(Note 5)

% discount(-)/

premium of issue

price to market price

(Note 7)

Opening balance as at (Note 2) 16 January 2024 3,571,960,220

1). Repurchase of shares (or other securities) but not

cancelled

Date of changes 01 November 2023

1,500,000 % %

2). Repurchase of shares (or other securities) but not

cancelled

Date of changes 02 November 2023

1,500,000 % %

3). Repurchase of shares (or other securities) but not

cancelled

Date of changes 03 November 2023

300,000 % %

4). Repurchase of shares (or other securities) but not

cancelled

Date of changes 06 November 2023

300,000 % % |

| FF304

Page 2 of 7 v 1.2.5

5). Repurchase of shares (or other securities) but not

cancelled

Date of changes 07 November 2023

1,500,000

%

%

6). Repurchase of shares (or other securities) but not

cancelled

Date of changes 08 November 2023

1,500,000

%

%

7). Repurchase of shares (or other securities) but not

cancelled

Date of changes 09 November 2023

1,496,802

%

%

8). Repurchase of shares (or other securities) but not

cancelled

Date of changes 10 November 2023

4,051,458

%

%

9). Repurchase of shares (or other securities) but not

cancelled

Date of changes 13 November 2023

1,499,688

%

%

10). Repurchase of shares (or other securities) but not

cancelled

Date of changes 14 November 2023

342,387

%

%

11). Repurchase of shares (or other securities) but not

cancelled

Date of changes 16 November 2023

1,164,279

%

%

12). Repurchase of shares (or other securities) but not

cancelled

Date of changes 27 November 2023

955,146

%

%

13). Repurchase of shares (or other securities) but not

cancelled

Date of changes 28 November 2023

378,348

%

%

14). Repurchase of shares (or other securities) but not

cancelled

Date of changes 29 November 2023

377,922

%

%

15). Repurchase of shares (or other securities) but not

cancelled 376,245

%

% |

| FF304

Page 3 of 7 v 1.2.5

Date of changes 30 November 2023

16). Repurchase of shares (or other securities) but not

cancelled

Date of changes 01 December 2023

381,615

%

%

17). Repurchase of shares (or other securities) but not

cancelled

Date of changes 04 December 2023

386,571

%

%

18). Repurchase of shares (or other securities) but not

cancelled

Date of changes 05 December 2023

1,974,447

%

%

19). Repurchase of shares (or other securities) but not

cancelled

Date of changes 08 December 2023

989,820

%

%

20). Repurchase of shares (or other securities) but not

cancelled

Date of changes 11 December 2023

396,480

%

%

21). Repurchase of shares (or other securities) but not

cancelled

Date of changes 15 December 2023

380,520

%

%

22). Repurchase of shares (or other securities) but not

cancelled

Date of changes 21 December 2023

391,590

%

%

23). Repurchase of shares (or other securities) but not

cancelled

Date of changes 22 December 2023

1,922,814

%

%

24). Repurchase of shares (or other securities) but not

cancelled

Date of changes 02 January 2024

381,876

%

%

25). Repurchase of shares (or other securities) but not

cancelled

Date of changes 03 January 2024

379,254

%

% |

| FF304

Page 4 of 7 v 1.2.5

26). Repurchase of shares (or other securities) but not

cancelled

Date of changes 04 January 2024

382,305 % %

27). Repurchase of shares (or other securities) but not

cancelled

Date of changes 05 January 2024

393,189 % %

28). Repurchase of shares (or other securities) but not

cancelled

Date of changes 08 January 2024

920,058 % %

29). Repurchase of shares (or other securities) but not

cancelled

Date of changes 09 January 2024

1,010,046 % %

30). Repurchase of shares (or other securities) but not

cancelled

Date of changes 10 January 2024

1,011,828 % %

31). Repurchase of shares (or other securities) but not

cancelled

Date of changes 11 January 2024

1,013,676 % %

32). Repurchase of shares (or other securities) but not

cancelled

Date of changes 12 January 2024

1,015,320 % %

33). Repurchase of shares (or other securities) but not

cancelled

Date of changes 16 January 2024

1,056,240 % %

34). Repurchase of shares (or other securities) but not

cancelled

Date of changes 17 January 2024

1,633,971 0.044 % %

Closing balance as at (Note 8) 17 January 2024 3,571,960,220 |

| FF304

Page 5 of 7 v 1.2.5

N/A

Notes to Section I:

1. Where shares have been issued at more than one issue price per share, a weighted average issue price per share should be given.

2. Please insert the closing balance date of the last Next Day Disclosure Return published pursuant to Main Board Rule 13.25A / GEM Rule 17.27A or Monthly Return pursuant to Main

Board Rule 13.25B / GEM Rule 17.27B, whichever is the later.

3. Please set out all changes in issued share capital requiring disclosure pursuant to Main Board Rule 13.25A / GEM Rule 17.27A together with the relevant dates of issue. Each category

will need to be disclosed individually with sufficient information to enable the user to identify the relevant category in the listed issuer's Monthly Return. For example, multiple issues of

shares as a result of multiple exercises of share options under the same share option scheme or of multiple conversions under the same convertible note must be aggregated and

disclosed as one category. However, if the issues resulted from exercises of share options under 2 share option schemes or conversions of 2 convertible notes, these must be disclosed

as 2 separate categories.

4. The percentage change in the number of issued shares of listed issuer is to be calculated by reference to the listed issuer's total number of shares in issue (excluding for such purpose

any shares repurchased or redeemed but not yet cancelled) as it was immediately before the earliest relevant event which has not been disclosed in a Monthly Return or Next Day

Disclosure Return.

5. Where trading in the shares of the listed issuer has been suspended, “closing market price per share of the immediately preceding business day” should be construed as “closing market

price per share of the business day on which the shares were last traded”.

6. In the context of a repurchase of shares:

■ “issues of shares” should be construed as “repurchases of shares”; and

■ “issued shares as a % of existing number of shares before relevant share issue” should be construed as “repurchased shares as a % of existing number of shares before

relevant share repurchase”.

7. In the context of a redemption of shares:

■ “issues of shares” should be construed as “redemptions of shares”;

■ “issued shares as a % of existing number of shares before relevant share issue” should be construed as “redeemed shares as a % of existing number of shares before relevant

share redemption”; and

■ “issue price per share” should be construed as “redemption price per share”.

8. The closing balance date is the date of the last relevant event being disclosed.

9. Items (i) to (viii) are suggested forms of confirmation which may be amended to meet individual cases.

10. “Identical” means in this context:

■ the securities are of the same nominal value with the same amount called up or paid up;

■ they are entitled to dividend/interest at the same rate and for the same period, so that at the next ensuing distribution, the dividend/interest payable per unit will amount to

exactly the same sum (gross and net); and

■ they carry the same rights as to unrestricted transfer, attendance and voting at meetings and rank pari passu in all other respects. |

| FF304

Page 6 of 7 v 1.2.5

11. SEHK refers to Stock Exchange of Hong Kong. |

| FF304

Page 7 of 7 v 1.2.5

Section II must also be completed by a listed issuer where it has made a repurchase of shares which is discloseable under Main Board Rule 10.06(4)(a) / GEM Rule 13.13(1).

The issuer has Purchase report or additional information for issuer whose primary listing is on the Exchange

Section II

1. Class of shares WVR ordinary shares Type of shares A Listed on SEHK (Note) Yes

Stock code (if listed) 02423 Description

A. Purchase report

Trading date Number of securities

purchased

Method of purchase

(Note)

Price per share or highest price

paid $ Lowest price paid $ Total paid $

1). 17 January 2024 1,633,971 On another stock exchange

New York Stock Exchange

USD 4.65 USD 4.55 USD 7,499,981

Total number of securities

purchased 1,633,971 Total paid $ USD 7,499,981

B. Additional information for issuer whose primary listing is on the Exchange

1). Number of such securities purchased on the Exchange in the year to date (since ordinary resolution) (a)

2). % of number of shares in issue at time ordinary resolution passed acquired on the Exchange since date of resolution

( (a) x 100 )/ Number of shares in issue

%

We hereby confirm that the repurchases set out in A above which were made on another stock exchange were made in accordance with the applicable Main Board Listing Rules and there have

been no material changes to the particulars contained in the Explanatory Statement dated 27 April 2023 which has been filed with the Exchange. We also confirm that any purchases set out in A

above which were made on another stock exchange were made in accordance with the applicable rules applying to purchases made on that other exchange.

Remarks: B1) Number of such securities purchased on the above said exchange since the ordinary resolution passed at the annual general meeting held on June 15, 2023 is

97,251,348.

B2) % of number of shares in issue at time the ordinary resolution passed acquired on the above said exchange since date of resolution is 2.568%.

Note to Section II: Please state whether on the Exchange, on another stock exchange (stating the name of the exchange), by private arrangement or by general offer.

Submitted by: Siting Li

(Name)

Title: Joint Company Secretary

(Director, Secretary or other Duly Authorised Officer) |

Exhibit 99.3

| FF304

Page 1 of 6 v 1.2.5

Next Day Disclosure Return

(Equity issuer - changes in issued share capital and/or share buybacks)

Instrument: Equity issuer Status: New Submission

Name of Issuer: KE Holding Inc.

Date Submitted: 19 January 2024

Section I must be completed by a listed issuer where there has been a change in its issued share capital which is discloseable pursuant to rule 13.25A of the Main Board Rules (the “Main Board

Listing Rules”) / rule 17.27A of the GEM Rules (the “GEM Listing Rules”) Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (the “Exchange”)

Section I

1. Class of shares WVR ordinary shares Type of shares A Listed on SEHK (Note 11) Yes

Stock code (if listed) 02423 Description

Issues of shares

(Notes 6 and 7) No. of shares

Issued shares as a %

of existing number of

issued shares before

relevant share issue

(Notes 4, 6 and 7)

Issue price per share

(Notes 1 and 7)

Closing market price per

share of the immediately

preceding business day

(Note 5)

% discount(-)/

premium of issue

price to market price

(Note 7)

Opening balance as at (Note 2) 17 January 2024 3,571,960,220

1). Repurchase of shares (or other securities) but not

cancelled

Date of changes 02 January 2024

381,876 % %

2). Repurchase of shares (or other securities) but not

cancelled

Date of changes 03 January 2024

379,254 % %

3). Repurchase of shares (or other securities) but not

cancelled

Date of changes 04 January 2024

382,305 % %

4). Repurchase of shares (or other securities) but not

cancelled

Date of changes 05 January 2024

393,189 % % |

| FF304

Page 2 of 6 v 1.2.5

5). Repurchase of shares (or other securities) but not

cancelled

Date of changes 08 January 2024

920,058

%

%

6). Repurchase of shares (or other securities) but not

cancelled

Date of changes 09 January 2024

1,010,046

%

%

7). Repurchase of shares (or other securities) but not

cancelled

Date of changes 10 January 2024

1,011,828

%

%

8). Repurchase of shares (or other securities) but not

cancelled

Date of changes 11 January 2024

1,013,676

%

%

9). Repurchase of shares (or other securities) but not

cancelled

Date of changes 12 January 2024

1,015,320

%

%

10). Repurchase of shares (or other securities) but not

cancelled

Date of changes 16 January 2024

1,056,240

%

%

11). Repurchase of shares (or other securities) but not

cancelled

Date of changes 17 January 2024

1,633,971

%

%

12). Repurchase of shares (or other securities) but not

cancelled

Date of changes 18 January 2024

1,646,274 0.044

%

%

13). Repurchase of shares (or other securities) and

cancelled

Shares repurchased on November 1 to 3, 6 to 10,

13, 14, 16, 27 to 30, 2023 and December 1, 4, 5, 8,

11, 15, 21 and 22, 2023 and cancelled on January

19, 2024

Date of changes 19 January 2024

-24,066,132 0.646

%

%

14). Other (please specify)

Conversion of Class B ordinary shares to Class A

978,301

%

% |

| FF304

Page 3 of 6 v 1.2.5

ordinary shares

Date of changes 19 January 2024

Closing balance as at (Note 8) 19 January 2024 3,548,872,389

2. Class of shares Ordinary shares Type of shares B Listed on SEHK (Note 11) No

Stock code (if listed) 02423 Description

Issues of shares

(Notes 6 and 7) No. of shares

Issued shares as a %

of existing number of

issued shares before

relevant share issue

(Notes 4, 6 and 7)

Issue price per share

(Notes 1 and 7)

Closing market price per

share of the immediately

preceding business day

(Note 5)

% discount(-)/

premium of issue

price to market price

(Note 7)

Opening balance as at (Note 2) 31 December 2023 151,354,549

1). Other (please specify)

Conversion of Class B ordinary shares to Class A

ordinary shares

Date of changes 19 January 2024

-978,301 % %

Closing balance as at (Note 8) 19 January 2024 150,376,248 |

| FF304

Page 4 of 6 v 1.2.5

N/A

Notes to Section I:

1. Where shares have been issued at more than one issue price per share, a weighted average issue price per share should be given.

2. Please insert the closing balance date of the last Next Day Disclosure Return published pursuant to Main Board Rule 13.25A / GEM Rule 17.27A or Monthly Return pursuant to Main

Board Rule 13.25B / GEM Rule 17.27B, whichever is the later.

3. Please set out all changes in issued share capital requiring disclosure pursuant to Main Board Rule 13.25A / GEM Rule 17.27A together with the relevant dates of issue. Each category

will need to be disclosed individually with sufficient information to enable the user to identify the relevant category in the listed issuer's Monthly Return. For example, multiple issues of

shares as a result of multiple exercises of share options under the same share option scheme or of multiple conversions under the same convertible note must be aggregated and

disclosed as one category. However, if the issues resulted from exercises of share options under 2 share option schemes or conversions of 2 convertible notes, these must be disclosed

as 2 separate categories.

4. The percentage change in the number of issued shares of listed issuer is to be calculated by reference to the listed issuer's total number of shares in issue (excluding for such purpose

any shares repurchased or redeemed but not yet cancelled) as it was immediately before the earliest relevant event which has not been disclosed in a Monthly Return or Next Day

Disclosure Return.

5. Where trading in the shares of the listed issuer has been suspended, “closing market price per share of the immediately preceding business day” should be construed as “closing market

price per share of the business day on which the shares were last traded”.

6. In the context of a repurchase of shares:

■ “issues of shares” should be construed as “repurchases of shares”; and

■ “issued shares as a % of existing number of shares before relevant share issue” should be construed as “repurchased shares as a % of existing number of shares before

relevant share repurchase”.

7. In the context of a redemption of shares:

■ “issues of shares” should be construed as “redemptions of shares”;

■ “issued shares as a % of existing number of shares before relevant share issue” should be construed as “redeemed shares as a % of existing number of shares before relevant

share redemption”; and

■ “issue price per share” should be construed as “redemption price per share”.

8. The closing balance date is the date of the last relevant event being disclosed.

9. Items (i) to (viii) are suggested forms of confirmation which may be amended to meet individual cases.

10. “Identical” means in this context:

■ the securities are of the same nominal value with the same amount called up or paid up;

■ they are entitled to dividend/interest at the same rate and for the same period, so that at the next ensuing distribution, the dividend/interest payable per unit will amount to

exactly the same sum (gross and net); and

■ they carry the same rights as to unrestricted transfer, attendance and voting at meetings and rank pari passu in all other respects. |

| FF304

Page 5 of 6 v 1.2.5

11. SEHK refers to Stock Exchange of Hong Kong. |

| FF304

Page 6 of 6 v 1.2.5

Section II must also be completed by a listed issuer where it has made a repurchase of shares which is discloseable under Main Board Rule 10.06(4)(a) / GEM Rule 13.13(1).

The issuer has Purchase report or additional information for issuer whose primary listing is on the Exchange

Section II

1. Class of shares WVR ordinary shares Type of shares A Listed on SEHK (Note) Yes

Stock code (if listed) 02423 Description

A. Purchase report

Trading date Number of securities

purchased

Method of purchase

(Note)

Price per share or highest price

paid $ Lowest price paid $ Total paid $

1). 18 January 2024 1,646,274 On another stock exchange

New York Stock Exchange

USD 4.67 USD 4.52 USD 7,499,985

Total number of securities

purchased 1,646,274 Total paid $ USD 7,499,985

B. Additional information for issuer whose primary listing is on the Exchange

1). Number of such securities purchased on the Exchange in the year to date (since ordinary resolution) (a)

2). % of number of shares in issue at time ordinary resolution passed acquired on the Exchange since date of resolution

( (a) x 100 )/ Number of shares in issue

%

We hereby confirm that the repurchases set out in A above which were made on another stock exchange were made in accordance with the applicable Main Board Listing Rules and there have

been no material changes to the particulars contained in the Explanatory Statement dated 27 April 2023 which has been filed with the Exchange. We also confirm that any purchases set out in A

above which were made on another stock exchange were made in accordance with the applicable rules applying to purchases made on that other exchange.

Remarks: B1) Number of such securities purchased on the above said exchange since the ordinary resolution passed at the annual general meeting held on June 15, 2023 is

98,897,622.

B2) % of number of shares in issue at time the ordinary resolution passed acquired on the above said exchange since date of resolution is 2.612%.

Note to Section II: Please state whether on the Exchange, on another stock exchange (stating the name of the exchange), by private arrangement or by general offer.

Submitted by: Siting Li

(Name)

Title: Joint Company Secretary

(Director, Secretary or other Duly Authorised Officer) |

Exhibit 99.4

| FF304

Page 1 of 5 v 1.2.5

Next Day Disclosure Return

(Equity issuer - changes in issued share capital and/or share buybacks)

Instrument: Equity issuer Status: New Submission

Name of Issuer: KE Holding Inc.

Date Submitted: 22 January 2024

Section I must be completed by a listed issuer where there has been a change in its issued share capital which is discloseable pursuant to rule 13.25A of the Main Board Rules (the “Main Board

Listing Rules”) / rule 17.27A of the GEM Rules (the “GEM Listing Rules”) Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (the “Exchange”)

Section I

1. Class of shares WVR ordinary shares Type of shares A Listed on SEHK (Note 11) Yes

Stock code (if listed) 02423 Description

Issues of shares

(Notes 6 and 7) No. of shares

Issued shares as a %

of existing number of

issued shares before

relevant share issue

(Notes 4, 6 and 7)

Issue price per share

(Notes 1 and 7)

Closing market price per

share of the immediately

preceding business day

(Note 5)

% discount(-)/

premium of issue

price to market price

(Note 7)

Opening balance as at (Note 2) 19 January 2024 3,548,872,389

1). Repurchase of shares (or other securities) but not

cancelled

Date of changes 02 January 2024

381,876 % %

2). Repurchase of shares (or other securities) but not

cancelled

Date of changes 03 January 2024

379,254 % %

3). Repurchase of shares (or other securities) but not

cancelled

Date of changes 04 January 2024

382,305 % %

4). Repurchase of shares (or other securities) but not

cancelled

Date of changes 05 January 2024

393,189 % % |

| FF304

Page 2 of 5 v 1.2.5

5). Repurchase of shares (or other securities) but not

cancelled

Date of changes 08 January 2024

920,058 % %

6). Repurchase of shares (or other securities) but not

cancelled

Date of changes 09 January 2024

1,010,046 % %

7). Repurchase of shares (or other securities) but not

cancelled

Date of changes 10 January 2024

1,011,828 % %

8). Repurchase of shares (or other securities) but not

cancelled

Date of changes 11 January 2024

1,013,676 % %

9). Repurchase of shares (or other securities) but not

cancelled

Date of changes 12 January 2024

1,015,320 % %

10). Repurchase of shares (or other securities) but not

cancelled

Date of changes 16 January 2024

1,056,240 % %

11). Repurchase of shares (or other securities) but not

cancelled

Date of changes 17 January 2024

1,633,971 % %

12). Repurchase of shares (or other securities) but not

cancelled

Date of changes 18 January 2024

1,646,274 % %

13). Repurchase of shares (or other securities) but not

cancelled

Date of changes 19 January 2024

1,664,721 0.045 % %

Closing balance as at (Note 8) 19 January 2024 3,548,872,389 |

| FF304

Page 3 of 5 v 1.2.5

N/A

Notes to Section I:

1. Where shares have been issued at more than one issue price per share, a weighted average issue price per share should be given.

2. Please insert the closing balance date of the last Next Day Disclosure Return published pursuant to Main Board Rule 13.25A / GEM Rule 17.27A or Monthly Return pursuant to Main

Board Rule 13.25B / GEM Rule 17.27B, whichever is the later.

3. Please set out all changes in issued share capital requiring disclosure pursuant to Main Board Rule 13.25A / GEM Rule 17.27A together with the relevant dates of issue. Each category

will need to be disclosed individually with sufficient information to enable the user to identify the relevant category in the listed issuer's Monthly Return. For example, multiple issues of

shares as a result of multiple exercises of share options under the same share option scheme or of multiple conversions under the same convertible note must be aggregated and

disclosed as one category. However, if the issues resulted from exercises of share options under 2 share option schemes or conversions of 2 convertible notes, these must be disclosed

as 2 separate categories.

4. The percentage change in the number of issued shares of listed issuer is to be calculated by reference to the listed issuer's total number of shares in issue (excluding for such purpose

any shares repurchased or redeemed but not yet cancelled) as it was immediately before the earliest relevant event which has not been disclosed in a Monthly Return or Next Day

Disclosure Return.

5. Where trading in the shares of the listed issuer has been suspended, “closing market price per share of the immediately preceding business day” should be construed as “closing market

price per share of the business day on which the shares were last traded”.

6. In the context of a repurchase of shares:

■ “issues of shares” should be construed as “repurchases of shares”; and

■ “issued shares as a % of existing number of shares before relevant share issue” should be construed as “repurchased shares as a % of existing number of shares before

relevant share repurchase”.

7. In the context of a redemption of shares:

■ “issues of shares” should be construed as “redemptions of shares”;

■ “issued shares as a % of existing number of shares before relevant share issue” should be construed as “redeemed shares as a % of existing number of shares before relevant

share redemption”; and

■ “issue price per share” should be construed as “redemption price per share”.

8. The closing balance date is the date of the last relevant event being disclosed.

9. Items (i) to (viii) are suggested forms of confirmation which may be amended to meet individual cases.

10. “Identical” means in this context:

■ the securities are of the same nominal value with the same amount called up or paid up;

■ they are entitled to dividend/interest at the same rate and for the same period, so that at the next ensuing distribution, the dividend/interest payable per unit will amount to

exactly the same sum (gross and net); and

■ they carry the same rights as to unrestricted transfer, attendance and voting at meetings and rank pari passu in all other respects. |

| FF304

Page 4 of 5 v 1.2.5

11. SEHK refers to Stock Exchange of Hong Kong. |

| FF304

Page 5 of 5 v 1.2.5

Section II must also be completed by a listed issuer where it has made a repurchase of shares which is discloseable under Main Board Rule 10.06(4)(a) / GEM Rule 13.13(1).

The issuer has Purchase report or additional information for issuer whose primary listing is on the Exchange

Section II

1. Class of shares WVR ordinary shares Type of shares A Listed on SEHK (Note) Yes

Stock code (if listed) 02423 Description

A. Purchase report

Trading date Number of securities

purchased

Method of purchase

(Note)

Price per share or highest price

paid $ Lowest price paid $ Total paid $

1). 19 January 2024 1,664,721 On another stock exchange

New York Stock Exchange

USD 4.61 USD 4.38 USD 7,500,012

Total number of securities

purchased 1,664,721 Total paid $ USD 7,500,012

B. Additional information for issuer whose primary listing is on the Exchange

1). Number of such securities purchased on the Exchange in the year to date (since ordinary resolution) (a)

2). % of number of shares in issue at time ordinary resolution passed acquired on the Exchange since date of resolution

( (a) x 100 )/ Number of shares in issue

%

We hereby confirm that the repurchases set out in A above which were made on another stock exchange were made in accordance with the applicable Main Board Listing Rules and there have

been no material changes to the particulars contained in the Explanatory Statement dated 27 April 2023 which has been filed with the Exchange. We also confirm that any purchases set out in A

above which were made on another stock exchange were made in accordance with the applicable rules applying to purchases made on that other exchange.

Remarks: B1) Number of such securities purchased on the above said exchange since the ordinary resolution passed at the annual general meeting held on June 15, 2023 is

100,562,343.

B2) % of number of shares in issue at time the ordinary resolution passed acquired on the above said exchange since date of resolution is 2.656%.

Note to Section II: Please state whether on the Exchange, on another stock exchange (stating the name of the exchange), by private arrangement or by general offer.

Submitted by: Siting Li

(Name)

Title: Joint Company Secretary

(Director, Secretary or other Duly Authorised Officer) |

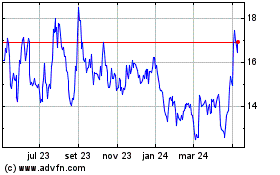

KE (NYSE:BEKE)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

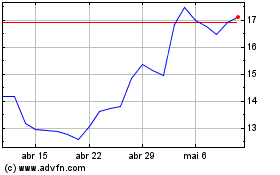

KE (NYSE:BEKE)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024