Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

23 Janeiro 2024 - 6:11PM

Edgar (US Regulatory)

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of January, 2024

Brazilian

Distribution Company

(Translation of Registrant’s Name Into English)

Av. Brigadeiro Luiz Antonio,

3142 São Paulo, SP 01402-901

Brazil

(Address of Principal Executive Offices)

(Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F)

Form 20-F X Form

40-F

(Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule

101 (b) (1)):

Yes ___ No X

(Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule

101 (b) (7)):

Yes ___ No X

(Indicate

by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes ___ No X

COMPANHIA BRASILEIRA DE DISTRIBUIÇÃO

Publicly-Held Company

CNPJ/MF 47.508.411/0001-56

NIRE 35.300.089.901

Final Voting Statement – Detailed Version

COMPANHIA BRASILEIRA DE DISTRIBUIÇÃO

(“Company”) discloses to its shareholders and the market in general, according to article 48, §6th,

comma II, of CVM Resolution No. 81/22 the final voting statement – detailed version (Single Annex) of the Extraordinary General

Shareholders’ Meeting held on January 22, 2024.

São Paulo, January 23, 2024.

Rafael Sirotsky Russowsky

Vice President of Finance and Investor Relations

Officer of GPA

Single Annex

Final Voting Statement – Detailed

Version

Extraordinary General Shareholders’ Meeting (“ESM”)"

– 01/22/2024 at 11:00 am

| CNPJ/CPF |

Ações |

11 |

22 |

33 |

44 |

| 57104 |

99.619.228 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 49485 |

980.695 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 12972 |

581.601 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 10205 |

433 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 59874 |

88.700 |

REJECT |

APPROVE |

APPROVE |

APPROVE |

| 45919 |

178.243 |

REJECT |

APPROVE |

APPROVE |

APPROVE |

| 23041 |

15.134 |

REJECT |

APPROVE |

APPROVE |

APPROVE |

| 23442 |

38.795 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 26611 |

3.107 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 19194 |

21.490 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 28723 |

500 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 23847 |

229.350 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 22847 |

433.924 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 38756 |

108.800 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 58389 |

43.800 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 74963 |

1.194.354 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 29571 |

27.200 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 58399 |

4.500 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 72087 |

47.112 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 18550 |

11.200 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 19176 |

262.150 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 39511 |

150.000 |

REJECT |

REJECT |

REJECT |

REJECT |

| 76337 |

2.010.000 |

REJECT |

ABSTAIN |

ABSTAIN |

ABSTAIN |

| 15486 |

291.100 |

ABSTAIN |

APPROVE |

APPROVE |

APPROVE |

| 11561 |

1 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 67844 |

57.647 |

REJECT |

APROVAR |

APROVAR |

REJECT |

| 34642 |

100 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 71954 |

585.000 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 74963 |

94.315 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 11729 |

21.267 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 75069 |

100.917 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 92990 |

14.578.000 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 17911 |

200 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 87318 |

8.517 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 87318 |

15.747 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 54797 |

3.932 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 30254 |

1.565.200 |

REJECT |

APPROVE |

APPROVE |

APPROVE |

| 18323 |

121.000 |

REJECT |

APPROVE |

APPROVE |

APPROVE |

| 30254 |

271.300 |

REJECT |

APPROVE |

APPROVE |

APPROVE |

| 24367 |

1.189.240 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 24830 |

2.771.720 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 26206 |

124.900 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 58400 |

17.556 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 93490 |

126.925 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 71914 |

138.900 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 12068 |

7.514.600 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 11410 |

308.700 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 47705 |

600 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 41199 |

200 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 37113 |

13.500 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 26311 |

2.100 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 95596 |

63.121 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 21407 |

110.025 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 11184 |

963 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 12984 |

2.822 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 34803 |

86.693 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 70965 |

2.915 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 60699 |

4.292 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 76866 |

734 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 18138 |

12.187 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 19388 |

32.872 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 33700 |

38.515 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 10263 |

22.063 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 47518 |

13.100 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 30419 |

41.149 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 10266 |

1.000 |

APPROVE |

APPROVE |

APPROVE |

APPROVE |

| 55011 |

11.892.058 |

APPROVE |

|

|

|

| 55011 |

205.378 |

REJECT |

|

|

|

| 55011 |

54.679 |

ABSTAIN |

|

|

|

| 55011 |

12.012.683 |

|

APPROVE |

|

|

| 55011 |

47.616 |

|

REJECT |

|

|

| 55011 |

91.816 |

|

ABSTAIN |

|

|

| 55011 |

11.951.714 |

|

|

APPROVE |

|

| 55011 |

142.626 |

|

|

REJECT |

|

| 55011 |

57.775 |

|

|

ABSTAIN |

|

| 55011 |

12.035.990 |

|

|

|

APPROVE |

| 55011 |

40.671 |

|

|

|

REJECT |

| 55011 |

75.454 |

|

|

|

ABSTAIN |

1 Increase of the limit

of the Company's authorized capital, with the consequent change in the wording of Article 5 of the Company's Bylaws.

2 Amendment of paragraph

1st of Article 2nd of the Company's Bylaws, in order to include activity carried out by the Company within the scope of its corporate

purpose.

3 Change in the number

of Co-Vice-Presidents and the competence to appoint the Chairman and Vice-Chairman of the Board of Directors, with the consequent exclusion

of item “iii” of Article 8th of the Bylaws and change in the wording (i) of the caput of Articles 8th, 13 and 15; (ii) of

paragraphs 2nd, 3rd and 4th of Article 13, and (iii) of paragraph 1st of Article 14 of the Company’s Bylaws.

4 Consolidation of the

Company's Bylaws to reflect the changes proposed above.

SIGNATURES

Pursuant

to the requirement of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| |

|

|

| |

|

COMPANHIA BRASILEIRA DE DISTRIBUIÇÃO

|

| Date: January 23, 2024 |

By: /s/ Marcelo Pimentel

|

| |

|

Name: |

Marcelo Pimentel |

| |

|

Title: |

Chief Executive Officer |

| |

|

|

|

| |

|

By: /s/

Rafael Sirotsky Russowsky |

| |

|

Name: |

Rafael Sirotsky Russowsky |

| |

|

Title: |

Investor Relations Officer |

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements.

These statements are statements that are not historical facts, and are based on management's current view and estimates offuture

economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes",

"estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended

to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal

operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends

affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect

the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected

events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic

and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual

results to differ materially from current expectations.

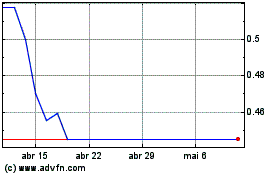

Companhia Brasileira de ... (NYSE:CBD)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Companhia Brasileira de ... (NYSE:CBD)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025