0000822818false00008228182024-02-022024-02-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 2, 2024

CLEAN HARBORS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

Massachusetts | | 001-34223 | | 04-2997780 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | | | | | | | | | | | | | | | | |

| 42 Longwater Drive | Norwell | MA | | | | 02061-9149 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code (781) 792-5000

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

Common Stock, $0.01 par value | | CLH | | New York Stock Exchange |

Item 8.01 Other Events

On February 2, 2024, Clean Harbors, Inc. (the "Company") entered into a purchase agreement with Gryphon Investors which provides that, subject to the terms and conditions set forth therein, the Company will acquire HEPACO for $400 million in cash. Further information about that proposed transaction is set forth in the Company's press release issued on February 6, 2024, a copy of which is furnished with this report as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

SIGNATURES

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| | Clean Harbors, Inc. |

| | (Registrant) |

| | |

| | |

| February 6, 2024 | /s/ Eric J. Dugas |

| | Executive Vice President and Chief Financial Officer |

Exhibit 99.1

Press Release

Clean Harbors to Acquire HEPACO for $400 Million

•Leading Provider of Specialized Environmental and Emergency Response Services in Eastern U.S. Will Accelerate Growth Opportunities in Environmental Services Segment

•Significant Margin Improvement to be Achieved Through Projected $20 Million in Cost Synergies and Efficiency Gains

•HEPACO Adds Complementary Emergency Response Rail Assets

•Transaction Expected to Close in the First Half of 2024

NORWELL, Mass. – February 6, 2024 – Clean Harbors, Inc. (“Clean Harbors”) (NYSE: CLH) today announced it has entered into a definitive agreement with Gryphon Investors (“Gryphon”) to acquire HEPACO (“HEPACO”), a leading provider of specialized environmental and emergency response services in the Eastern United States, for $400 million in cash. The acquisition is expected to close in the first half of 2024, subject to regulatory approval and other customary closing conditions.

“HEPACO is a recognized leader in Field Services and its addition will accelerate the growth of our Environmental Services segment,” said Eric Gerstenberg, Co-Chief Executive Officer of Clean Harbors. “When providing emergency services, scale and rapid response capabilities are critical. HEPACO’s geographic footprint, trained personnel and equipment fleet will enhance our existing business, enabling us to gain efficiencies and offer an even broader range of solutions. Field Services and emergency response have been a hallmark of Clean Harbors since our founding in 1980. We are confident that we can deliver strong shareholder value through this transaction in the years ahead.”

Headquartered in Charlotte, North Carolina, HEPACO has more than 2,000 customers, which it services through more than 40 regional locations in 17 states. Its primary offerings include field services, environmental remediation and emergency response services.

On an adjusted basis, HEPACO is expected to generate full-year 2023 EBITDA of approximately $36 million on $270 million of revenues. Clean Harbors expects the acquisition to generate cost synergies of approximately $20 million after the first full year of operations, which equates to a post-synergy acquisition multiple of 7.1 times. Clean Harbors expects to fund the acquisition through available cash and the issuance of some additional debt financing.

Mike Battles, Co-Chief Executive Officer of Clean Harbors, said, “The acquisition of HEPACO aligns with our Vision 2027 long-term strategic plan for driving growth through a continued focus on value creation across all areas of our business. We see an excellent cultural fit with our two organizations that

Clean Harbors • 42 Longwater Drive • PO Box 9149 • Norwell, Massachusetts 02061-9149 • 800.282.0058

should help ensure the success of this acquisition. HEPACO has demonstrated a commitment to safety, environmental compliance and service excellence that matches our principles in these areas. We look forward to welcoming HEPACO’s talented team to the Clean Harbors family.”

Key strategic benefits of the transaction for Clean Harbors include:

•Complementary product offerings that increase the scale and capabilities of Clean Harbors’ Field Services business;

•Synergies in areas such as subcontracting, branch network, asset rentals, transportation and procurement;

•Expansion of its rail and marine service capabilities through the addition of HEPACO’s highly trained people and specialized equipment;

•The opportunity to drive additional volumes of waste to Clean Harbors’ network of disposal and recycling facilities;

•Meaningful cross-selling opportunities, particularly for industrial services and hazardous waste disposal; and

•The opportunity to introduce new customers to the Clean Harbors and Safety-Kleen brands, and to deepen relationships with existing customers.

HEPACO employs approximately 1,000 people, operates a fleet of more than 900 vehicles and serves a diverse set of industry verticals. In addition to the company’s regional operations spanning 17 states, HEPACO’s National Operations center provides 24-hour coverage across the continental U.S. through a network of contractors.

Robb Schreck, Chief Executive Officer of HEPACO, said, “Given its leading position in environmental and field services, as well as a 40-year history in emergency response, Clean Harbors is an ideal fit for HEPACO. Clean Harbors will provide HEPACO’s customers with far greater resources and access to North America’s largest network of permitted disposal and recycling assets. This transaction also will offer enhanced career opportunities for HEPACO employees.”

For this acquisition, Davis, Malm & D’Agostine is serving as legal counsel to Clean Harbors. For HEPACO, Piper Sandler Companies and Houlihan Lokey, Inc. are serving as financial advisors and Kirkland & Ellis LLP and Moore & Van Allen PLLC are serving as legal counsel.

Clean Harbors • 42 Longwater Drive • PO Box 9149 • Norwell, Massachusetts 02061-9149 • 800.282.0058

About Clean Harbors

Clean Harbors (NYSE: CLH) is North America’s leading provider of environmental and industrial services. The Company serves a diverse customer base, including a majority of Fortune 500 companies. Its customer base spans a number of industries, including chemical, manufacturing and refining, as well as numerous government agencies. These customers rely on Clean Harbors to deliver a broad range of services such as end-to-end hazardous waste management, emergency spill response, industrial cleaning and maintenance, and recycling services. Through its Safety-Kleen subsidiary, Clean Harbors also is North America’s largest re-refiner and recycler of used oil and a leading provider of parts washers and environmental services to commercial, industrial and automotive customers. Founded in 1980 and based in Massachusetts, Clean Harbors operates in the United States, Canada, Mexico, Puerto Rico and India. For more information, visit www.cleanharbors.com.

Safe Harbor Statement

Any statements contained herein that are not historical facts are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are generally identifiable by use of the words “believes,” “expects,” “intends,” “anticipates,” “plans to,” “seeks,” “should,” “estimates,” “projects,” “may,” “likely,” or similar expressions. Such statements may include, but are not limited to, statements about future financial and operating results, and other statements that are not historical facts. Such statements are based upon the beliefs and expectations of Clean Harbors’ management as of this date only and are subject to certain risks and uncertainties that could cause actual results to differ materially, including, without limitation, the risks and uncertainties surrounding the proposed Clean Harbors and HEPACO transaction, and those items identified as “Risk Factors” in Clean Harbors’ most recently filed Form 10-K and Form 10-Q. Forward-looking statements are neither historical facts nor assurances of future performance. Therefore, readers are cautioned not to place undue reliance on these forward-looking statements. Clean Harbors undertakes no obligation to revise or publicly release the results of any revision to these forward-looking statements other than through its filings with the Securities and Exchange Commission, which may be viewed in the “Investors” section of Clean Harbors’ website at www.cleanharbors.com.

Contacts:

| | | | | | | | |

Eric J. Dugas | | Jim Buckley |

EVP and Chief Financial Officer | | SVP Investor Relations |

Clean Harbors, Inc. | | Clean Harbors, Inc. |

781.792.5100 | | 781.792.5100 |

InvestorRelations@cleanharbors.com | | Buckley.James@cleanharbors.com |

Clean Harbors • 42 Longwater Drive • PO Box 9149 • Norwell, Massachusetts 02061-9149 • 800.282.0058

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

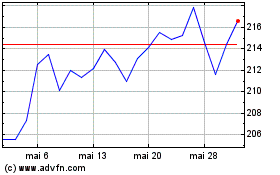

Clean Harbors (NYSE:CLH)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Clean Harbors (NYSE:CLH)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025