false

0000903419

0000903419

2024-02-16

2024-02-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM 8-K

CURRENT

REPORT PURSUANT TO

SECTION

13 OR 15(d)

OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

February 16, 2024

Alerus

Financial Corporation

(Exact Name of Registrant

as Specified in Charter)

| Delaware |

001-39036 |

45-0375407 |

(State

or Other Jurisdiction of

Incorporation) |

(Commission File Number) |

(IRS Employer Identification

No.) |

401

Demers Avenue

Grand

Forks, North

Dakota 58201

(Address of Principal Executive

Offices) (Zip Code)

Registrant’s telephone

number, including area code: (701) 795-3200

N/A

(Former Name or Former Address,

if Changed Since Last Report.)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant

to Section 12(b) of the Act:

| Title

of each class |

|

Trading

symbol |

|

Name

of each exchange on which registered |

| Common

Stock, $1.00 par value per share |

|

ALRS |

|

The

Nasdaq Stock Market LLC |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter)

or Rule 12b–2 of the Securities Exchange Act of 1934 (§ 240.12b–2 of this chapter).

Emerging

growth company x

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers. |

Item 5.02(b). Departure of Certain Directors.

On February 16, 2024, Kevin

Lemke notified Alerus Financial Corporation (the “Company”) of his decision not to stand for reelection to the Company’s

board of directors at the Company’s 2024 annual meeting of stockholders. Mr. Lemke’s decision not to stand for reelection

did not result from a disagreement with the Company on any matter relating to the Company’s operations, policies or practices. Mr.

Lemke has been a valued presence on the Company’s board of directors, and the Company thanks him for his service.

Item 5.02(c). Appointment of Certain Officers.

On February 22,

2024, the Company announced that Forrest Wilson has been appointed to the position of Executive

Vice President and Chief Retirement Services Officer of the Company, effective February 26, 2024. Mr. Wilson, age 54, previously served

as the Senior Vice President of Retirement Plans Sales and Distribution at Ameritas Mutual Holding Company, a position he had held since

December 2018. Prior to that, he served in various management and sales leadership roles with firms, including Allianz Global Investors,

Aspire Financial Services, Empower, and Voya. Mr. Wilson will be responsible for the overall leadership and direction of the Company’s

Retirement and Benefits division, which serves thousands of third-party advisors, over 8,000 employer-sponsored retirement plans, and

approximately 474,000 plan participants nationwide.

There are no family relationships

between Mr. Wilson and any of the Company’s directors or executive officers. There is no arrangement or understanding between Mr.

Wilson and any other person pursuant to which he was selected as an officer, nor is the Company aware, after inquiry of Mr. Wilson, of

any related-party transaction or series of transactions required to be disclosed under Item 404(a) of Regulation S-K promulgated under

the Securities Exchange Act of 1934, as amended.

Mr. Wilson will receive a

compensation package, including annual base salary and bonus potential, that is consistent with the packages received by the Company’s

other executive officers. He will be eligible to participate in the Company’s established short and long-term incentive bonus programs,

including equity incentive plans, and to receive certain employee and fringe benefits that are available to the Company’s other

executive officers. Mr. Wilson will receive a cash signing bonus and a sign-on

grant of restricted stock. The sign-on grant vests over three years starting in December 2025 and continuing through December 2027.

In connection with the appointment

of Mr. Wilson as Executive Vice President and Chief Retirement Services Officer, the Company and Mr. Wilson entered into an Executive

Severance Agreement, the form of which is substantially similar to the severance agreements entered into with other executive officers

of the Company. The Executive Severance Agreement sets forth the duties and obligations of each party in the event of a termination of

employment and obligates Mr. Wilson to abide by the terms of certain restrictive covenants during the term of his employment and thereafter

for a specified period of time. The agreement provides for an initial term of two years, with automatic renewal for an additional day

on each day after the effective date, such that the agreement term is two years at all times. Either party may elect nonrenewal upon notice

of one hundred and twenty days prior to termination. In the event of a change in control, the agreement automatically terminates on the

second anniversary of the change in control. In the event the Company terminates Mr. Wilson for any reason other than for cause prior

to a change in control, the Company must make a severance payment to him, to be paid in accordance with the Company’s regular payroll

practices over 12 months, equal to the sum of (i) 100% of annual base salary; (ii) the average of the his three most recent annual bonuses;

and (iii) 12 months of the Company’s portion of premiums for health, disability, and life insurance policies in which he was entitled

to participate immediately prior to the termination. In the event of a termination within a 24-month period following a change in control

by the Company without cause or by Mr. Wilson for a Good Reason, as defined in the agreement, the Company must provide a severance payment

in a lump sum equal to twice the amount described above. All severance payments under the agreement are conditioned upon Mr. Wilson’s

execution of a release of claims in favor of the Company.

A copy of the press release announcing the appointment

of Mr. Wilson to the position of Executive Vice President and Chief Retirement Services Officer is attached hereto as Exhibit 99.1.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

SignatureS

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: February 22, 2024 | Alerus Financial Corporation |

| | |

| By: | /s/ Katie A. Lorenson |

| Name: | Katie A. Lorenson |

| Title: | President and Chief Executive Officer |

Exhibit 99.1

|

Kris

Bevill, Public Relations Manager

701.280.5076 (Office) :: 701.306.8561 (Cell)

kris.bevill@alerus.com

investors.alerus.com |

FOR IMMEDIATE RELEASE

Alerus

Financial Corporation Names Forrest Wilson Chief Retirement Services Officer

MINNEAPOLIS (February 22, 2024) – Alerus Financial

Corporation (Nasdaq: ALRS) announced today that Forrest Wilson will join Alerus as Executive Vice President and Chief Retirement Services

Officer, effective February 26, 2024.

A well-rounded retirement industry veteran, Mr. Wilson brings

over 25 years of experience on both the platform/recordkeeping and investment sides of the retirement business. He has extensive knowledge

in sales and distribution growth, product oversight and strategy, acquisitions, digital engagement, implementation, and service delivery,

and has a proven track record in leading teams of all sizes to reach and exceed significant goals. Before joining Alerus, he spent six

years at Ameritas Mutual Holding Company and served most recently as Senior Vice President of Retirement Plans Sales and Distribution,

where he was accountable for all aspects of the business strategy, including several successful acquisitions, while consistently delivering

strong results. Prior to that, he served in various management and sales leadership roles with firms including Allianz Global Investors,

Aspire Financial Services, Empower, and Voya.

As Chief Retirement Services Officer, Mr. Wilson will be responsible

for the overall leadership and direction of Alerus’ retirement and benefits division, which serves thousands of third-party advisors,

over 8,000 employer-sponsored retirement plans, and approximately 474,000 plan participants nationwide. He will work to ensure that all

client-related areas are aligned with Alerus’ client-centric, holistic, and collaborative approach to client service, focusing on

the needs of Alerus’ third-party advisors, plan sponsors, and participants.

“Forrest is widely experienced and well known in the retirement

services industry,” said President and Chief Executive Officer Katie Lorenson. “His career path has led him from the ground

up through many years of leadership positions, which has provided him with a deep understanding of every aspect of the business, a unique

ability to lead and develop high performing teams, and the depth of experience to repeatedly identify and implement successful growth

strategies. His proven execution in integrating strategic acquisitions, accelerating organic growth, improving margins, and optimizing

workflows and technology while improving the client experience aligns with our key strategic objectives.”

Mr. Wilson holds a bachelor’s degree in marketing from Central

Connecticut State University and an MBA in finance and marketing from New York University Stern School of Business.

About Alerus Financial Corporation

Alerus Financial

Corporation is a commercial/wealth bank and national retirement services provider with corporate

offices in Grand Forks, North Dakota, and the Minneapolis-St. Paul, Minnesota metropolitan area. Through

its subsidiary, Alerus Financial, N.A., Alerus provides diversified and comprehensive financial solutions to businesses and consumer clients,

including banking, mortgage, retirement and benefits services, wealth management. Alerus provides clients with a primary point of contact

to help fully understand the unique needs and delivery channel preferences of each client. Clients are provided with competitive products,

valuable insight, and sound advice supported by digital solutions designed to meet the clients’ needs.

Alerus has banking and wealth management offices in Grand Forks and

Fargo, North Dakota, the Minneapolis-St. Paul, Minnesota metropolitan area, and Phoenix and Scottsdale, Arizona. Alerus retirement and

benefits services include retirement plans, financial wellness, health savings accounts, flexible spending accounts, health reimbursement

arrangements, and COBRA. Alerus has provided retirement services since 1944 and serves advisors, brokers, employers, and plan participants

across the United States. The common stock of the company trades on the Nasdaq Capital Market under the symbol ALRS.

# # #

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

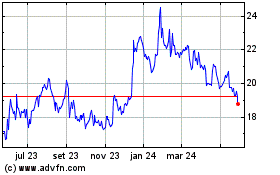

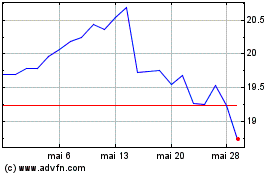

Alerus Financial (NASDAQ:ALRS)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Alerus Financial (NASDAQ:ALRS)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025