As

filed with the Securities and Exchange Commission on February 26, 2024

Registration

No. 333-________

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

S-8

REGISTRATION

STATEMENT UNDER

THE

SECURITIES ACT OF 1933

HEART

TEST LABORATORIES, INC.

(Exact

name of registrant as specified in its charter)

| Texas |

|

26-1344466 |

(State

or other jurisdiction of

incorporation or organization) |

|

(I.R.S.

Employer

Identification No.) |

550

Reserve Street, Suite 360

Southlake, TX 76092

(Address

of Principal Executive Offices)(Zip Code)

Heart

Test Laboratories, Inc.

2023

Equity Incentive Plan

(Full

title of the plan)

Danielle Watson

Chief Financial Officer

550 Reserve St, Suite 360

Southlake, Texas 76092

(682) 237-7781

(Name,

address and telephone number, including area code, of agent for service)

With a copy to:

Jonathan Shechter, Esq.

Sasha Ablovatskiy, Esq.

Foley Shechter Ablovatskiy LLP

1180 Avenue of the Americas, 8th Floor, New York, NY 10036

(212) 335-0465

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company”

in Rule 12b-2 of the Exchange Act. (Check one):

| Large

accelerated filer ☐ |

|

Accelerated

filer ☐ |

| Non-accelerated

filer ☒ |

|

Smaller

reporting company ☒ |

| |

|

Emerging

growth company ☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

EXPLANATORY

STATEMENT

This

Registration Statement on Form S-8 registers the offer and sale of an aggregate of 9,332,195 shares of common stock, $0.001 par value

per share (the “Shares”), of Heart Test Laboratories, Inc. (the “Company,” “we,” “us”

or “our”) for issuance under the Company’s 2023 Equity Incentive Plan, as amended (the “2023 Plan”), which includes

(i) 8,500,000 Shares for issuance under the 2023 Plan plus (ii) any Shares subject to options that expire or otherwise terminate without

having been exercised in full, are tendered to or withheld by the Company for payment of an exercise price or for tax withholding obligations,

or are forfeited to or repurchased by the Company due to failure to vest, with the maximum number of Shares to be added to the 2023 Plan

under this clause (ii) equal to 832,195 Shares.

PART

I

INFORMATION

REQUIRED IN THE 10(a) PROSPECTUS

Item

1. Plan Information.

We

will provide each recipient (a “Recipient”) of a grant under the 2023 Plan with documents that contain information related

to the 2023 Plan, and other information including, but not limited to, the disclosure required by Item 1 of Form S-8, which information

is not required to be and is not being filed as a part of this Registration Statement on Form S-8 (this “registration statement”)

or as prospectuses or prospectus supplements pursuant to Rule 424 under the Securities Act of 1933, as amended (the “Securities

Act”). The foregoing information and the documents incorporated by reference in response to Item 3 of Part II of this registration

statement, taken together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act. A Section 10(a)

prospectus will be given to each Recipient who receives common stock covered by this registration statement, in accordance with Rule

428(b)(1) under the Securities Act.

Item

2. Registrant Information and Employee Plan Annual Information.

We

will provide to each Recipient a written statement advising of the availability of documents incorporated by reference in Item 3 of Part

II of this registration statement (which documents are incorporated by reference in this Section 10(a) prospectus) and of documents required

to be delivered pursuant to Rule 428(b) under the Securities Act without charge and upon written or oral request by contacting:

Danielle Watson

Chief Financial Officer

550 Reserve St, Suite 360

Southlake, Texas 76092

(682)

237-7781

PART

II

INFORMATION

REQUIRED IN THE REGISTRATION STATEMENT

Item

3. Incorporation of Documents by Reference

The

following documents previously filed by the Company with the U.S. Securities and Exchange Commission (the “SEC”) pursuant

to the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are incorporated herein by reference:

| ● | the

Company’s Annual Report on Form 10-K for the fiscal year ended April 30, 2023, filed

with the SEC on July 19, 2023 (File No. 001-41422); |

| ● | the

Company’s Quarterly Reports on Form 10-Q for the quarter ended July 31, 2023 and October

31, 2023, filed with the SEC on September 14, 2023 (File No. 001-41422) and December 14, 2023 (File No. 001-41422), respectively; |

| ● | the

Company’s Current Reports on Form 8-K, filed with the SEC on July

19, 2023, August 4, 2023, August

17, 2023, August 30, 2023, September

7, 2023, September 14, 2023, September

21, 2023, September 22, 2023, November

13, 2023, November 17,

2023, November 21, 2023, November

27, 2023, November 28,

2023, December 6, 2023, December

14, 2023, January 18, 2024, January

25, 2024, and January 31, 2024; and |

| ● | the

description of the Company’s common stock contained in the Company’s Registration

Statement on Form S-3 (File No. 333-274554), filed with the SEC on September 18, 2023, including

any amendment or report filed for the purpose of updating such description. |

All

documents we file with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, except as to any portion of any report

or documents that is not deemed filed under such provisions, (1) on or after the date of filing of the registration statement containing

this prospectus and prior to the effectiveness of the registration statement, and (2) on or after the date of this prospectus until the

earlier of the date on which all of the securities registered hereunder have been sold or the registration statement of which this prospectus

is a part has been withdrawn, shall be deemed incorporated by reference in this prospectus and to be a part of this prospectus from the

date of filing of those documents.

Any

statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded

for purposes of this registration statement to the extent that a statement contained herein or in any other subsequently filed document,

which also is or is deemed to be incorporated by reference herein, modifies or supersedes such statement. Any such statement so modified

or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this registration statement. Under no

circumstances will any information filed under items 2.02 or 7.01 of a Current Report on Form 8-K be deemed to be incorporated by reference,

unless such Current Report on Form 8-K expressly provides to the contrary.

Item

4. Description of Securities

Not

applicable.

Item

5. Interests of Named Experts and Counsel

No

expert named in the registration statement as having prepared or certified any part thereof (or is named as having prepared or certified

a report or valuation for use in connection with such registration statement) or counsel named in the registration statement as having

given an opinion upon the validity of the securities being offered pursuant to this registration statement or upon other legal matters

in connection with the registration or offering such securities was employed for such purpose on a contingency basis. Also, other than

as set forth herein, at the time of such preparation, certification or opinion or at any time thereafter, through the date of effectiveness

of such registration statement or that part of such registration statement to which such preparation, certification or opinion relates,

no such person had, or is to receive, in connection with the offering, a substantial interest, direct or indirect, in our Company or

any of our parents or subsidiaries. Nor was any such person connected with our Company or any of our parents or subsidiaries as a promoter,

managing or principal underwriter, voting trustee, director, officer or employee.

Item

6. Indemnification of Directors and Officers

The

Texas Business Organizations Code (the “TBOC”) authorizes corporations to limit or eliminate the personal liability of directors

to corporations and their shareholders for monetary damages for breaches of directors’ fiduciary duties (other than breaches of

the directors’ duty of loyalty to corporations or their shareholders), subject to certain exceptions. Our Certificate of Formation,

as amended, includes a provision that limits the personal liability of directors for monetary damages for an act or omission in the director’s

capacity as a director to the fullest extent permitted by Texas law. However, exculpation will not apply to any director if the director

has acted in bad faith, engaged in intentional misconduct, knowingly violated the law, authorized illegal dividends or redemptions, derived

an improper benefit from his or her actions as a director or engaged in an act or omission for which the liability of the director is

expressly provided by an applicable statute.

Our

Certificate of Formation provides that we must indemnify our directors and officers to the fullest extent authorized by the TBOC. We

also are expressly authorized to carry directors’ and officers’ liability insurance providing indemnification for our directors,

officers and certain employees for some liabilities. We believe that these indemnification provisions and insurance will be useful to

attract and retain qualified directors and officers.

The

limitation of liability and indemnification provisions in our Certificate of Formation and Bylaws may discourage shareholders from bringing

a lawsuit against directors for breach of their fiduciary duty. These provisions also may have the effect of reducing the likelihood

of derivative litigation against directors and officers, even though such an action, if successful, might otherwise benefit us and our

shareholders. In addition, your investment may be adversely affected to the extent we pay the costs of settlement and damage awards against

directors and officers pursuant to these indemnification provisions. As of the date of this prospectus, there is no pending material

litigation or proceeding involving any of our directors, officers or employees for which indemnification is sought.

Insofar

as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers or persons controlling

the registrant pursuant to the foregoing provisions, the registrant has been informed that in the opinion of the SEC such indemnification

is against public policy as expressed in the Securities Act and is therefore unenforceable.

Item

7. Exemption From Registration Claimed

Not

applicable.

Item

8. Exhibits

The

following exhibits are filed with or incorporated by reference into this registration statement:

Exhibit

Number |

|

Description |

| 1.1 |

|

Underwriting Agreement dated June 15, 2022 by and between the Heart Test Laboratories, Inc. and The Benchmark Company, LLC (incorporated by reference to Exhibit 1.1 to our Current Report on Form 8-K filed on June 15, 2022) |

| 1.2 |

|

Equity Distribution Agreement, dated as of September 18, 2023 by and between the Company and Maxim Group LLC (incorporated by reference to Exhibit 1.2 to our Registration Statement on Form S-3, filed with the SEC on September 18, 2023) |

| 1.3 |

|

Amendment No. 1 to Equity Distribution Agreement dated November 9, 2023 between Heart Test Laboratories, Inc. and Maxim Group LLC (incorporated by referred to Exhibit 1.2 to our Current Report on Form 8-K filed with the SEC on November 13, 2023) |

| 1.4 |

|

Amendment No. 2 to Equity Distribution Agreement dated November 17, 2023 between Heart Test Laboratories, Inc. and Maxim Group LLC (filed as Exhibit 1.3 on our Current Report on Form 8-K filed with the SEC on November 17, 2023) |

| 3.1 |

|

Amended and Restated Certificate of Formation of Heart Test Laboratories, Inc. (incorporated by reference to Exhibit 3.1 to our Registration Statement on Form S-1 filed May 17, 2022) |

| 3.2 |

|

Certificate of Designations, Number, Voting Power, Preferences and Rights of Series C Convertible Preferred Stock of Heart Test Laboratories, Inc. (incorporated by reference to Exhibit 3.2 to our Registration Statement on Form S-1 filed May 17, 2022) |

| 3.3 |

|

Second Amended and Restated Bylaws of Heart Test Laboratories, Inc. (incorporated by reference to Exhibit 3.3 to our Registration Statement on Form S-1 filed May 17, 2022) |

| 3.4 |

|

Form of Certificate of Amendment to Amended and Restated Certificate of Formation of Heart Test Laboratories, Inc. (incorporated by reference to Exhibit 3.4 to Amendment No. 1 to our Registration Statement on Form S-1 filed June 6, 2022) |

| 3.5 |

|

Certificate of Amendment to Amended and Restated Certificate of Formation of Heart Test Laboratories, Inc., as amended (incorporated by reference to Exhibit 3.1 to our Current Report on Form 8-K filed June 23, 2022) |

| 4.1 |

|

Form of Registration Rights Agreement by and between Heart Test Laboratories, Inc. and Buyers listed as signatories thereto, dated December 22, 2021 (incorporated by reference to Exhibit 4.2 to our Registration Statement on Form S-1 filed May 17, 2022) |

| 4.2 |

|

Form of Registration Rights Agreement by and among Heart Test Laboratories, Inc. and the parties listed as signatories thereto related to the Series C Preferred Stock (incorporated by reference to Exhibit 4.3 to our Registration Statement on Form S-1 filed May 17, 2022) |

| 4.3 |

|

Form of Bridge Warrant (incorporated by reference to Exhibit 4.4 to our Registration Statement on Form S-1 filed May 17, 2022) |

| 4.4 |

|

Form of Pre-Funded Warrant (incorporated by reference to Exhibit 4.5 to our Registration Statement on Form S-1 filed May 17, 2022) |

| 4.5 |

|

Form of $1M Lender Warrant and $1.5M Lender Warrant (incorporated by reference to Exhibit 4.6 to our Registration Statement on Form S-1 filed May 17, 2022) |

| 4.6 |

|

Form of Investor Warrant (incorporated by reference to Exhibit 4.7 to our Registration Statement on Form S-1 filed May 17, 2022) |

| 4.7 |

|

Representative’s Warrant Agreement issued June 17, 2022 (incorporated by reference to Exhibit 4.1 to our Current Report on Form 8-K filed June 23, 2022) |

| 4.8 |

|

Warrant Agent Agreement dated June 17, 2022 between Heart Test Laboratories, Inc. and American Stock Transfer & Trust Company, LLC (incorporated by reference to Exhibit 4.2 to our Current Report on Form 8-K filed June 23, 2022) |

| 4.9 |

|

Form of Certificated Warrant (incorporated by reference to Exhibit 4.10 to Amendment No. 2 to our Registration Statement on Form S-1 filed June 10, 2022) |

| 4.10 |

|

Amendment No. 1 to Bridge Warrants dated September 8, 2022 (incorporated by reference to Exhibit 4.1 to our Current Report on Form 8-K, filed with the SEC on September 9, 2022) |

| 4.11 |

|

Form of Amendment No. 2 to Bridge Warrants dated February 3, 2023 (incorporated by reference to Exhibit 4.1 to our Current Report on Form 8-K, filed with the SEC on February 3, 2023) |

| 4.12 |

|

Form of Amended and Restated Warrant to Purchase Common Stock, as amended through February 3, 2023 (incorporated by reference to Exhibit 4.1 to our Current Report on Form 8-K, filed with the SEC on February 22, 2023) |

| 4.13 |

|

Form of Pre-Funded Warrant, issued pursuant to Amendment No. 2 to Warrants to Purchase Common Stock (incorporated by reference to Exhibit 4.2 to our Current Report on Form 8-K/A, filed with the SEC on March 14, 2023) |

| 4.14 |

|

Form of Warrant to Purchase Common Stock dated September 7, 2023 (incorporated by reference to Exhibit 4.1 our Current Report on Form 8-K, filed with the SEC on September 7, 2023) |

| 4.15 |

|

Form of Pre-Funded Purchase Warrant dated as of September 20, 2023 (incorporated by reference to Exhibit 4.1 our Current Report on Form 8-K, filed with the SEC on September 21, 2023) |

| 4.16 |

|

Form of Common Stock Warrant dated September 20, 2023 (incorporated by reference to Exhibit 4.2 our Current Report on Form 8-K, filed with the SEC on September 21, 2023) |

| 5.1* |

|

Opinion of Foley Shechter Ablovatskiy LLP |

| 10.1 |

|

MyoVista Technology Agreement, by and between Heart Test Laboratories, Inc. and Guangren “Gary” Chen, dated December 31, 2013 (incorporated by reference to Exhibit 10.1 to our Registration Statement on Form S-1 filed May 17, 2022) |

| 10.2 |

|

First Amendment of MyoVista Technology Agreement by and between Heart Test Laboratories, Inc. and Guangren “Gary” Chen, dated March 13, 2017 (incorporated by reference to Exhibit 10.2 to our Registration Statement on Form S-1 filed May 17, 2022) |

| 10.3 |

|

Master Assignment by and between Heart Test Laboratories, Inc. and Guangren “Gary” Chen, dated January 1, 2014 (incorporated by reference to Exhibit 10.3 to our Registration Statement on Form S-1 filed May 17, 2022) |

| 10.4 |

|

Security Agreement and Pledge by and between Heart Test Laboratories, Inc. and Guangren “Gary” Chen, dated March 14, 2014 (incorporated by reference to Exhibit 10.4 to our Registration Statement on Form S-1 filed May 17, 2022) |

| 10.5 |

|

Evaluation, Option and License Agreement by and between Heart Test Laboratories, Inc. and The University Court of The University of Glasgow, dated June 2, 2015 (incorporated by reference to Exhibit 10.5 to our Registration Statement on Form S-1 filed May 17, 2022) |

| 10.6 |

|

Exercise of Option Agreement by and between Heart Test Laboratories, Inc. and The University Court of The University of Glasgow, dated December 23, 2015 (incorporated by reference to Exhibit 10.6 to our Registration Statement on Form S-1 filed May 17, 2022) |

| 10.7 |

|

$130K Note by and between Heart Test Laboratories, Inc. and Front Range Ventures, LLC, dated August 12, 2019 (incorporated by reference to Exhibit 10.7 to our Registration Statement on Form S-1 filed May 17, 2022) |

| 10.8 |

|

$1M Loan and Security Agreement by and among Heart Test Laboratories, Inc., Front Range Ventures, LLC and John Q. Adams, Sr., dated April 24, 2020 (incorporated by reference to Exhibit 10.8 to our Registration Statement on Form S-1 filed May 17, 2022) |

| 10.9 |

|

Amendment No. 1 to the $1M Loan and Security Agreement, dated September 30, 2021 (incorporated by reference to Exhibit 10.9 to our Registration Statement on Form S-1 filed May 17, 2022) |

| 10.10 |

|

Amendment No. 2 to the $1M Loan and Security Agreement, dated November 3, 2021 (incorporated by reference to Exhibit 10.10 to our Registration Statement on Form S-1 filed May 17, 2022) |

| 10.11 |

|

Form of $1.5M Note (incorporated by reference to Exhibit 10.11 to our Registration Statement on Form S-1 filed May 17, 2022) |

| 10.12 |

|

Form of Amendment No. 1 to the Form of $1.5M Note by and among Heart Test Laboratories, Inc. and the Requisite Noteholders, dated November 2, 2021 (incorporated by reference to Exhibit 10.12 to our Registration Statement on Form S-1 filed May 17, 2022) |

| 10.13 |

|

Form of Securities Purchase Agreement by and between Heart Test Laboratories, Inc. and Purchasers listed as signatories thereto, dated December 22, 2021 (incorporated by reference to Exhibit 10.13 to our Registration Statement on Form S-1 filed May 17, 2022) |

| 10.14 |

|

Form of Bridge Note (incorporated by reference to Exhibit 10.14 to our Registration Statement on Form S-1 filed May 17, 2022) |

| 10.15 |

|

Consulting Agreement by and between Heart Test Laboratories, Inc. and Kyngstone Limited, Inc., dated June 25, 2013 (incorporated by reference to Exhibit 10.15 to our Registration Statement on Form S-1 filed May 17, 2022) |

| 10.16 |

|

FRV Side Letter by and between Heart Test Laboratories, Inc. and Front Range Ventures, LLC, dated April 10, 2019 (incorporated by reference to Exhibit 10.16 to Amendment No. 1 to our Registration Statement on Form S-1 filed June 6, 2022) |

| 10.17† |

|

Amended and Restated Employment Agreement by and between Heart Test Laboratories, Inc. and Mark Hilz, dated April 5, 2022 (incorporated by reference to Exhibit 10.17 to our Registration Statement on Form S-1 filed May 17, 2022) |

| 10.18† |

|

Employment Agreement by and between Heart Test Laboratories, Inc. and Andrew Simpson, dated April 5, 2022 (incorporated by reference to Exhibit 10.18 to our Registration Statement on Form S-1 filed May 17, 2022) |

| 10.19 |

|

Form of Amendment No. 3 to the $1M Loan and Security Agreement, dated May 2022 (incorporated by reference to Exhibit 10.19 to our Registration Statement on Form S-1 filed May 17, 2022) |

| 10.20 |

|

Form of Amendment No. 2 to the Form of $1.5M Note by and among Heart Test Laboratories, Inc. and the Requisite Noteholders, dated May 2022 (incorporated by reference to Exhibit 10.20 to our Registration Statement on Form S-1 filed May 17, 2022) |

| 10.21 |

|

Form of Time-Based Vesting Nonstatutory Stock Option Agreement of Heart Test Laboratories, Inc. (incorporated by reference to Exhibit 10.21 to our Registration Statement on Form S-1 filed May 17, 2022) |

| 10.22 |

|

Form of Performance-Based Vesting Nonstatutory Stock Option Agreement of Heart Test Laboratories, Inc (incorporated by reference to Exhibit 10.22 to our Registration Statement on Form S-1 filed May 17, 2022) |

| 10.23 |

|

Amendment No. 4 to the $1M Loan and Security Agreement, dated January 24, 2023 (incorporated by reference to Exhibit 10.1 to our Current Report on Form 8-K, filed with the SEC on January 24, 2023) |

| 10.24 |

|

Purchase Agreement, dated as of March 10, 2023, by and between Heart Test Laboratories, Inc. and Lincoln Park (incorporated by reference to Exhibit 10.1 to the Current Report on Form 8-K, filed with the SEC on March 10, 2023) |

| 10.25 |

|

Registration Rights Agreement, dated as of March 10, 2023, by and between Heart Test Laboratories, Inc. and Lincoln Park (incorporated by reference to Exhibit 10.2 to the Current Report on Form 8-K, filed with the SEC on March 13, 2023) |

| 10.26† |

|

Heart Test Laboratories, Inc. 2023 Equity Incentive Plan (incorporated by reference to Exhibit 10.1 to the Current Report on Form 8-K, filed with the SEC on March 16, 2023) |

| 10.27† |

|

Form of Heart Test Laboratories, Inc.’s Incentive Stock Option Agreement under Heart Test Laboratories Inc.’s 2023 Equity Incentive Plan (incorporated by reference to Exhibit 10.1 to the Current Report on Form 8-K, filed with the SEC on March 23, 2023) |

| 10.28† |

|

Form of Heart Test Laboratories Inc.’s Non-Qualified Stock Option Agreement under Heart Test Laboratories Inc.’s 2023 Equity Incentive Plan (incorporated by reference to Exhibit 10.2 to the Current Report on Form 8-K, filed with the SEC on March 23, 2023) |

| 10.29* |

|

Amendment No. 1 to the Heart Test Laboratories, Inc. 2023 Equity Incentive Plan |

| 10.30 |

|

Amendment No. 2 License Agreement by and between Heart Test Laboratories, Inc. and The University Court of The University of Glasgow, dated March 31, 2023 (incorporated by reference to Exhibit 10.29 to the Annual Report on Form 10-K, filed with the SEC on July 19, 2023) |

| 10.31 |

|

Senior Unsecured Promissory Drawdown Loan Note by and among Heart Test Laboratories, Inc., and Matthews Southwest Holdings, Inc., dated September 6, 2023 and executed on September 7, 2023 (incorporated by reference to Exhibit 10.1 our Current Report on Form 8-K, filed with the SEC on September 7, 2023) |

| 10.32 |

|

Securities Purchase Agreement, dated as of September 20, 2023, by and between the Company and Icahn School of Medicine at Mount Sinai (incorporated by reference to Exhibit 10.1 our Current Report on Form 8-K, filed with the SEC on September 21, 2023) |

| 10.33 |

|

License: Pulmonary Embolism Detection From the Electrocardiogram Using Deep Learning (incorporated by reference to Exhibit 10.2 our Current Report on Form 8-K, filed with the SEC on September 21, 2023) |

| 10.34 |

|

License: Deep Learning Algorithm to Predict PVC-Related Cardiomyopathy (incorporated by reference to Exhibit 10.3 our Current Report on Form 8-K, filed with the SEC on September 21, 2023) |

| 10.35 |

|

License: Deep Learning on ECGs to Derive Left and Right Ventricular Function (incorporated by reference to Exhibit 10.4 our Current Report on Form 8-K, filed with the SEC on September 21, 2023) |

| 10.36 |

|

License: Prediction of right ventricular size and systolic function from the 12-lead ECG (incorporated by reference to Exhibit 10.5 our Current Report on Form 8-K, filed with the SEC on September 21, 2023) |

| 10.37 |

|

License: Deep learning for electrocardiograms to identify left heart valvular dysfunction – aortic stenosis (incorporated by reference to Exhibit 10.6 our Current Report on Form 8-K, filed with the SEC on September 21, 2023) |

| 10.38 |

|

License: Deep learning for electrocardiograms to identify left heart valvular dysfunction – mitral regurgitation (incorporated by reference to Exhibit 10.7 our Current Report on Form 8-K, filed with the SEC on September 21, 2023) |

| 10.39 |

|

License: HeartBEiT: Vision Transformers improve diagnostic performance for electrocardiograms (incorporated by reference to Exhibit 10.8 our Current Report on Form 8-K, filed with the SEC on September 21, 2023) |

| 10.40 |

|

License: Derivation of low Left Ventricular Ejection fraction based on a foundational vision transformer (HeartBEiT) (incorporated by reference to Exhibit 10.9 our Current Report on Form 8-K, filed with the SEC on September 21, 2023) |

| 10.41 |

|

License: Diagnosis of Hypertrophic Cardiomyopathy using a model derived from a foundational vision transformer (HeartBEiT) (incorporated by reference to Exhibit 10.10 our Current Report on Form 8-K, filed with the SEC on September 21, 2023) |

| 10.42 |

|

License: Diagnosis of STEMI using a model derived from a foundational vision transformer (HeartBEiT) (incorporated by reference to Exhibit 10.11 our Current Report on Form 8-K, filed with the SEC on September 21, 2023) |

| 10.43 |

|

License: Electrocardiogram Deep Learning Interpretability Toolbox (incorporated by reference to Exhibit 10.12 our Current Report on Form 8-K, filed with the SEC on September 21, 2023) |

| 10.44 |

|

Amendment No. 5 to the $1M Loan and Security Agreement, dated September 29, 2023 (incorporated by reference to Exhibit 10.45 to our Registration Statement on Form S-1 filed October 16, 2023) |

| 10.45 |

|

Note Conversion Letter Agreement, dated November 16, 2023, by and between Heart Test Laboratories, Inc. and Matthews Southwest Holdings, Inc. (filed as Exhibit 10.1 on our Current Report on Form 8-K, filed with the SEC on November 17, 2023) |

| 10.46 |

|

Note Conversion Letter Agreement, dated November 16, 2023, by and between Heart Test Laboratories, Inc. and John Q. Adams (filed as Exhibit 10.2 on our Current Report on Form 8-K, filed with the SEC on November 17, 2023) |

| 10.47 |

|

Warrant Amendment, dated November 16, 2023, by and between Heart Test Laboratories, Inc. and Matthews Southwest Holdings, Inc. (filed as Exhibit 10.3 on our Current Report on Form 8-K, filed with the SEC on November 17, 2023) |

| 10.48 |

|

Warrant Amendment, dated November 16, 2023, by and between Heart Test Laboratories, Inc. and John Q. Adams (filed as Exhibit 10.4 on our Current Report on Form 8-K, filed with the SEC on November 17, 2023) |

| 10.49† |

|

Employment Agreement by and between Heart Test Laboratories, Inc. and Danielle Watson, dated October 15, 2021 (incorporated by reference to Exhibit 10.19 to our Registration Statement on Form S-1 filed October 16, 2023) |

| 23.1* |

|

Consent of Haskell & White LLP, independent registered public accounting firm |

| 23.2* |

|

Consent of Foley Shechter Ablovatskiy LLP (included as part of Exhibit 5.1) |

| 107* |

|

Fee Table |

| * |

Filed herewith |

| ** |

Furnished herewith |

| † |

Management contract or compensatory arrangement |

Item

9. Undertakings

(a)

The undersigned registrant hereby undertakes:

(1)

to file, during any period in which offers or sales are being made of the securities registered hereby, a post-effective amendment to

this registration statement:

(i)

to include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii)

to reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in this registration

statement;. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities

offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offered range

may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and

price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration

Fee” table in the effective registration statement; and

(iii)

to include any material information with respect to the plan of distribution not previously disclosed in this registration statement

or any material change to such information in this registration statement;

provided,

however, that Paragraphs (a)(1)(i) and (a)(1)(ii) of this section do not apply if the registration statement is on Form S-8 (§239.16b

of this chapter), and the information required to be included in a post-effective amendment by those paragraphs is contained in reports

filed with or furnished to the SEC by the registrant pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934 (15

U.S.C. 78m or 78o(d)) that are incorporated by reference in the registration statement.

(2)

that, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be

a new registration statement relating to the securities offered herein, and the offering of such securities at that time shall be deemed

to be the initial bona fide offering thereof.

(3

to remove from registration by means of a post-effective amendment any of the securities being registered hereby which remain unsold

at the termination of the offering.

(b)

The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing

of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where

applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of

1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to

the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering

thereof.

(c)

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling

persons of the registrant pursuant to the provisions described in the first paragraph of Item 15 above, or otherwise, the registrant

has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Act and is, therefore,

unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses

incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding)

is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will,

unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction

the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication

of such issue.

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all

of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned,

thereunto duly authorized, in the City of Southlake, State of Texas, on February 26, 2024.

| |

HEART TEST LABORATORIES, INC. |

| |

|

|

| |

By: |

/s/ Andrew Simpson |

| |

Name: |

Andrew Simpson |

| |

Title: |

Chief

Executive Officer

(Principal Executive Officer) |

POWER

OF ATTORNEY

The

registrant and each person whose signature appears below constitutes and appoints Andrew Simpson as his, her or its true and lawful attorneys-in-fact

and agent, with full power of substitution and resubstitution, for him, her or it and in his, her or its name, place and stead, in any

and all capacities, to sign and file any and all amendments (including post-effective amendments) to this registration statement on Form

S-8, with all exhibits thereto, and other documents in connection therewith, with the U.S. Securities and Exchange Commission, granting

unto said attorney-in-fact and agent, and each of them, full power and authority to do and perform each and every act and thing requisite

or necessary to be done in and about the premises, as fully to all intents and purposes as he, she, or it might or could do in person,

hereby ratifying and confirming all that said attorney-in-fact and agent or his substitute or substitutes, may lawfully do or cause to

be done by virtue hereof.

Pursuant

to the requirements of the Securities Act of 1933, this registration statement has been signed below by the following persons in the

capacities and on the date indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

| /s/

Andrew Simpson |

|

President,

Chief Executive Officer and |

|

February

26, 2024 |

| Andrew

Simpson |

|

Chairman

of the Board of Directors

(Principal Executive Officer) |

|

|

| |

|

|

| /s/

Danielle Watson |

|

Chief

Financial Officer and Treasurer |

|

February

26, 2024 |

| Danielle

Watson |

|

(Principal

Financial and Accounting Officer) |

|

| |

|

|

| /s/

Mark Hilz |

|

Chief

Operating Officer, Secretary and Director |

|

February

26, 2024 |

| Mark

Hilz |

|

|

| |

|

|

| /s/

Bruce Bent |

|

Director |

|

February

26, 2024 |

| Bruce

Bent |

|

|

| |

|

|

| /s/

David R. Wells |

|

Director |

|

February

26, 2024 |

| David

R. Wells |

|

|

| |

|

|

| /s/

Brian Szymczak |

|

Director |

|

February

26, 2024 |

| Brian

Szymczak |

|

|

|

|

Exhibit 5.1

1180 Avenue of the Americas | 8th Floor

New York, NY 10036

Dial: 212.335.0466

Fax: 917.688.4092

info@foleyshechter.com

www.foleyshechter.com

February 26, 2024

Heart Test Laboratories, Inc.

550 Reserve St, Suite 360

Southlake, Texas 76092

Ladies and Gentlemen:

We have acted as counsel

to Heart Test Laboratories, Inc., a Texas corporation (the “Company” or “you”), and have examined the Registration

Statement on Form S-8 (the “Registration Statement”) filed by the Company with the U.S. Securities and Exchange Commission

(the “Commission”) on February 26, 2024, in connection with the registration under the Securities Act of 1933, as amended

(the “Securities Act”), of 9,332,195 shares (the “Shares”) of the Company’s common stock, $0.001 par value

per share (the “Common Stock”), issuable under the Company’s 2023 Equity Incentive Plan (the “Plan”).

In connection herewith, we

have examined the Plan and the Registration Statement. We have also examined originals or copies, certified or otherwise identified to

our satisfaction, of the Company’s Amended and Restated Certificate of Formation and Bylaws, each as currently in effect, and such

other corporate records, agreements and instruments of the Company, and certificates of public officials and officers of the Company,

and we have made such legal and factual inquiries, as we have deemed necessary or appropriate as a basis for us to render the opinion

hereinafter expressed. In our examination of the foregoing, we have assumed the genuineness of all signatures, the legal competence and

capacity of natural persons, the authenticity of documents submitted to us as originals and the conformity with authentic original documents

of all documents submitted to us as copies or by facsimile or other means of electronic transmission, or which we obtained from the Commission’s

Electronic Data Gathering, Analysis and Retrieval system (“Edgar”) or other sites maintained by a court or governmental authority

or regulatory body and the authenticity of the originals of such latter documents. If any documents we examined in printed, word processed

or similar form has been filed with the Commission on Edgar or such court or governmental authority or regulatory body, we have assumed

that the document so filed is identical to the document we examined except for formatting changes.

When relevant facts were

not independently established, we have relied without independent investigation as to matters of fact upon statements of governmental

officials and upon representations made in or pursuant to the Registration Statement and certificates or statements of appropriate representatives

of the Company.

Based upon the foregoing

and subject to the assumptions, qualifications and limitations set forth herein, we are of the opinion that the Shares have been duly

authorized and, when issued, paid for, if such payment is required by the applicable award agreement, and delivered pursuant to the terms

and in the manner set forth in the Plan and any relevant agreements thereunder, and assuming that the Shares have been and remain duly

reserved for issuance within the limits of the Common Stock then remaining authorized but unissued, the Shares will be validly issued,

fully paid and nonassessable.

In addition to the assumptions,

comments, qualifications, limitations and exceptions set forth above, the opinion set forth herein is further limited by, subject to

and based upon the following assumptions, comments, qualifications, limitations and exceptions: our opinion herein reflects only the

application of the laws of the State of Texas and the State of New York. We express no opinion herein as to any other laws, statutes,

regulations or ordinances. The opinion set forth herein is made as of the date hereof and is subject to, and may be limited by,

future changes in factual matters, and we undertake no duty to advise you of the same. The opinion expressed herein is based upon the

law in effect (and published or otherwise generally available) on the date hereof, and we assume no obligation to revise or supplement

this opinion should such law be changed by legislative action, judicial decision or otherwise. In rendering our opinion, we have not

considered, and hereby disclaim any opinion as to, the application or impact of any laws, cases, decisions, rules or regulations of any

other jurisdiction, court or administrative agency.

This opinion letter is being

delivered by us in connection with the filing of the Registration Statement with the Commission. We do not render any opinions except

as set forth above. We hereby consent to the inclusion of this opinion letter as Exhibit 5.1 to the Registration Statement and to the

reference to this firm in the Registration Statement. In giving this consent, we do not thereby concede that we are in the category of

persons whose consent is required under Section 7 of the Securities Act or the Rules and Regulations of the Commission thereunder.

| |

Sincerely yours, |

| |

|

| |

/s/ Foley Shechter Ablovatskiy LLP |

Exhibit 10.29

AMENDMENT NO. 1 TO THE HEART TEST LABORATORIES,

INC.

2023 EQUITY INCENTIVE PLAN

WHEREAS, the Board of Directors

and shareholders of Heart Test Laboratories, Inc. (the “Company”) have previously adopted the Heart Test Laboratories, Inc.

2023 Equity Incentive Plan (the “Plan”);

WHEREAS, pursuant to Section

3(a) of the Plan, an initial total of two million five hundred thousand (2,500,000) shares of the Company’s common stock, $0.001

par value per share (the “Common Stock”), are currently reserved for issuance under the Plan;

WHEREAS, the Company desires

to increase the number of shares currently issuable under the Plan by six million (6,000,000) to eight million five hundred thousand (8,500,000)

shares, including shares previously issued thereunder;

WHEREAS, the Company desires

to make certain other changes to the Plan as more fully discussed below, and Section 19 of the Plan permits the Company to amend the Plan

from time to time, subject to certain limitations specified therein; and

WHEREAS, this Amendment No.

1 to the Plan is proposed to be approved by the Company’s 2024 Annual Meeting of Shareholders.

NOW, THEREFORE, the following

amendments and modifications are hereby made a part of the Plan:

1. Section 3(a) of the Plan

is hereby amended and restated in its entirety to read as follows:

“(a) Reservation of

Shares. Subject to the provisions of Section 13 of the Plan and the following sentence, the maximum aggregate number of Shares that may

be issued under the Plan is (i) 8,500,000 Shares plus (ii) any Shares subject to options that expire or otherwise terminate without having

been exercised in full, are tendered to or withheld by the Company for payment of an exercise price or for tax withholding obligations,

or are forfeited to or repurchased by the Company due to failure to vest, with the maximum number of Shares to be added to the Plan under

this clause (ii) equal to 832,195 Shares. The number of Shares available for issuance under the Plan will be subject to automatic increase

on the first day of each Fiscal Year beginning with Fiscal Year beginning May 1, 2024, so that the number of Shares available for issuance

under the Plan is equal to the least of:

(i) Twenty five percent (25%)

of the total number of shares of all classes of common stock and preferred stock as converted to common stock of the Company outstanding

on the last day of the immediately preceding Fiscal Year, and

(ii) a lesser number of

Shares determined by the Administrator.

Notwithstanding the above, the number of shares available for issuance under Awards that are

Incentive Stock Options will be no more than the lesser of (x) the actual maximum aggregate amount of Shares available for issuance

as has been adjusted annually pursuant to subsection (A)-(C) or (y) the maximum aggregate number of shares that would be available

for issuance if each annual adjustment described above would be pursuant to subsection (C).”

2. In all other respects,

the Plan, as amended, is hereby ratified and confirmed and shall remain in full force and effect.

IN WITNESS WHEREOF, the Company

has executed this Amendment No. 1 to the Company’s 2023 Equity Incentive Plan as of November 27, 2023.

| |

HEART TEST LABORATORIES, INC. |

| |

|

| |

By: |

/s/ Andrew Simpson |

| |

Name: |

Andrew Simpson |

| |

Title: |

CEO |

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

We consent to the incorporation by reference in

the Registration Statement on Form S-8 of Heart Test Laboratories, Inc. dba HeartSciences (the “Company”) of our audit report

dated July 18, 2023 relating to the financial statements of the Company as of and for each of the years ended April 30, 2023 and 2022

included in the Company’s Annual Report on Form 10-K for the year ended April 30, 2023.

Our report dated July 18, 2023 contains an explanatory

paragraph that states the Company has experienced recurring losses, negative cash flows from operations, and limited capital resources.

These conditions raise substantial doubt about the Company’s ability to continue as a going concern. The financial statements do

not include any adjustments that might result from the outcome of this uncertainty.

| |

/s/ Haskell & White LLP |

| |

HASKELLL & WHITE LLP |

Irvine, CA

February 26, 2024

Exhibit 107

Calculation of Filing Fee Table

Form S-8

(Form Type)

Heart Test Laboratories, Inc.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

| Security Type | |

Security Class Title | |

Fee Calculation Rule (1) | |

Amount Registered (2) | | |

Proposed

Maximum

Offering

Price

Per Unit (1) | | |

Maximum

Aggregate

Offering

Price (1) | | |

Fee Rate | | |

Amount of

Registration

Fee | |

| Equity | |

Common Stock, $0.001 par value per

share | |

Other | |

| 9,332,195 | | |

$ | 0.12 | | |

$ | 1,119,863 | | |

| 0.00014760 | | |

$ | 165.30 | |

| Total Offering Amounts | | |

| — | | |

$ | 1,119,863 | | |

| — | | |

$ | 165.30 | |

| Total Fee Offsets | |

| — | | |

| — | | |

| — | | |

| — | |

| Net Fees Due | | |

| — | | |

| — | | |

| — | | |

$ | 165.30 | |

| (1) | Calculated solely for purposes of this offering under Rules 457(c) and 457(h) of the Securities Act of 1933, as amended (the “Securities Act”), on the basis of the average of the high and low prices per share of Registrant’s Common Stock on February 21, 2024 as reported by The Nasdaq Stock Market. |

| (2) | Covers 9,332,195 shares of the Registrant’s common stock, $0.001 par value per share (“Common Stock”), issuable under the Registrant’s 2023 Equity Incentive Plan, as amended (the “Plan”). Pursuant to Rule 416 promulgated under the Securities Act, this registration statement shall also be deemed to cover any additional shares of Common Stock that may from time to time be offered or issued under the Plan to prevent dilution resulting from stock splits, stock dividends or similar transactions that increases the number of outstanding shares of Common Stock. |

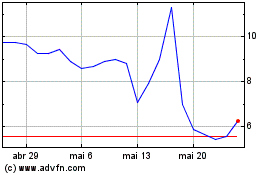

HeartSciences (NASDAQ:HSCS)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

HeartSciences (NASDAQ:HSCS)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024