SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

REPORT OF FOREIGN

ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE

ACT OF 1934

For the month of

March 2024

(Commission File

No. 001-32221)

GOL LINHAS AÉREAS

INTELIGENTES S.A.

(Exact name of registrant

as specified in its charter)

GOL INTELLIGENT

AIRLINES INC.

(Translation of

registrant’s name into English)

Praça Comandante

Linneu Gomes, Portaria 3, Prédio 24

Jd. Aeroporto

04630-000 São Paulo, São Paulo

Federative Republic of Brazil

(Address of registrant’s

principal executive offices)

Indicate by check mark

whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check

mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ______ No ___X___

GOL LINHAS AÉREAS INTELIGENTES

S.A.

CNPJ/MF

[Taxpayer Identification Number] nº 06.164.253/0001-87 NIRE 35.300.314.441

Publicly-held Company

MANAGEMENT PROPOSAL

For the Annual

and Extraordinary General Meeting April 30, 2024

Document approved

at the Board of Directors´ Meeting held on March 27, 2024

TABLE OF CONTENTS

| 1. |

PRELIMINARY REMARKS |

3 |

| 2. |

ANNUAL GENERAL MEETING |

4 |

| 2.1. |

DOCUMENTS AND INFORMATION FOR COMPLIANCE WITH CVM RESOLUTIONS Nº 81/2022 AND Nº

80/2022 |

4 |

| 2.1.1. |

PROPOSAL FOR THE OVERALL REMUNERATION OF THE MANAGERS FOR YEAR 2024 |

4 |

| 2.1.2. . |

MANAGEMENT´S PROPOSAL FOR ALLOCATION OF THE INCOME FOR YEAR 2023 |

5 |

| 2.1.3. . |

MANAGEMENT´S COMMENT ON THE COMPANY´S FINANCIAL POSITION (ITEM 2 OF THE REFERENCE

FOR) |

6 |

| 2.1.4. |

INFORMATION REGARDING CANDIDATES NOMINATED OR SUPPORTED BY MANAGEMENT OR CONTROLLING SHAREHOLDERS

(ITEMS 7.3 TO 7.6 OF THE REFERENCE FORM) |

48 |

| 2.1.5. |

COMPENSATION OF ADMINISTRATORS (ITEM 8 OF THE REFERENCE FORM) |

84 |

| 4 |

STATEMENT BY THE MANAGERS THAT THEY HAVE REVIEWED, DISCUSSED AND AGREED WITH THE COMPANY’S

FINANCIAL STATEMENTS |

136 |

| 6. |

FISCAL COUNCIL´S OPINION |

138 |

| 7 |

STATEMENT BY THE CANDIDATES TO THE BOARD OF DIRECTORS |

139 |

| 8 |

STATEMENT BY THE BOARD OF DIRECTORS |

140 |

| 9 |

SPECIAL MEETING OF SHAREHOLDERS |

141 |

| According to Article 12, items I and II of CVM Resolution

No. 81, of March 29, 2022, as amended, the Company's management makes available below the information related to the statutory amendment

proposed for resolution at the Company's Annual and Special Meeting, to be held on April 30, 2024, at 10 am |

141 |

| 9.1. |

AMENDMENT TO THE HEAD PROVISION OF ARTICLE 5 OF THE COMPANY’S BYLAWS |

141 |

| 9.2. |

COPY OF THE BYLAWS |

142 |

GOL LINHAS AÉREAS

INTELIGENTES S.A. CNPJ/MF nº 06.164.253/0001-87

NIRE 35.300.314.441

The Management

of Gol Linhas Aéreas Inteligentes S.A. (“Company”) informs that the documents listed below, and attached to this document,

are already available to the Shareholders at the Company’s headquarters and disclosed on the websites of:Investor Relations (http://www.voegol.com.br/ri),

the Brazilian Securities and Exchange Commission (“CVM”) (www.cvm.gov.br) and B3 S.A. - Brasil, Bolsa e Balcão (“B3”)(www.b3.com.br).

We emphasize that this disclosure complies with the legal determinations in effect, as well as with CVM Resolution no. 80, of March 29,

2022 (“RCVM 80”), CVM Resolution no. 81, of March 29, 2022 (“RCVM 81 ”), as amended, and to the Annual Circular

Letter 2024 CVM/SEP issued by the CVM’s Corporate Relations Superintendence.

| · | Annual Management Report; |

| · | Copy of the Financial Statements; |

| · | Report of the Independent Auditors; |

| · | Statement by the Managers that they have reviewed, discussed and agreed with the |

Company’s financial statements;

| · | Statement by the Managers that they have reviewed, discussed, and agree with the |

opinions expressed in the Independent

Auditors’ Report;

| · | Annual Report and Opinion of the Company ’s Statutory Audit Committee; |

| · | Release of results for the 4th quarter 2023; |

| · | Standardized Financial Statement Form - DFP; |

| · | Opinion of the Fiscal Council; and |

| · | Comparative table that includes (a) the proposed amendments to the Bylaws,

and (b) the origin and justification of the amendments, in accordance with Article 1 2 of RCVM 81. |

2.1.

DOCUMENTS AND INFORMATION FOR COMPLIANCE WITH CVM RESOLUTIONS Nº 81/2022 AND Nº 80/2022

2.1.1.

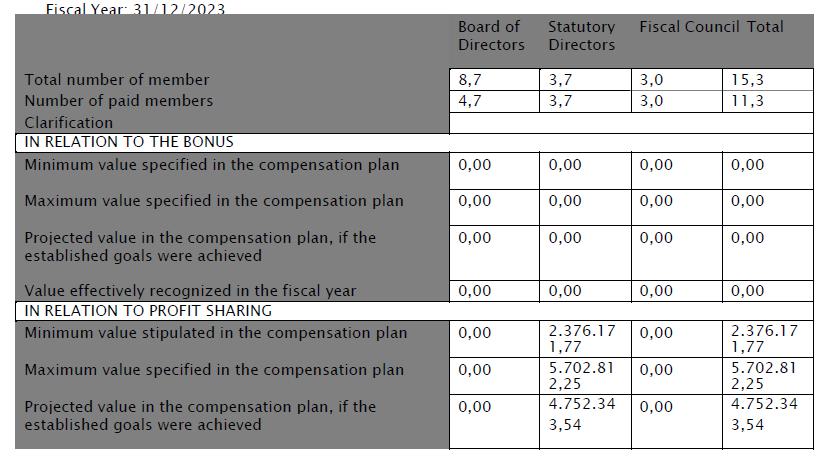

PROPOSAL FOR THE OVERALL REMUNERATION OF THE MANAGERS FOR YEAR 2024

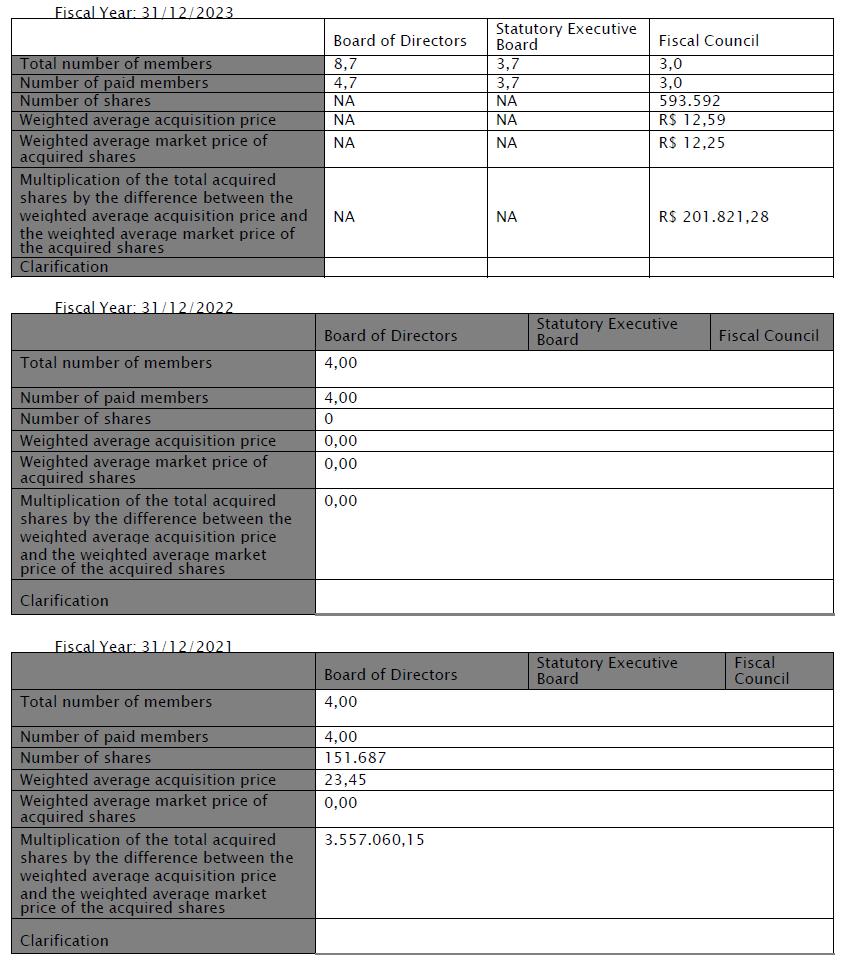

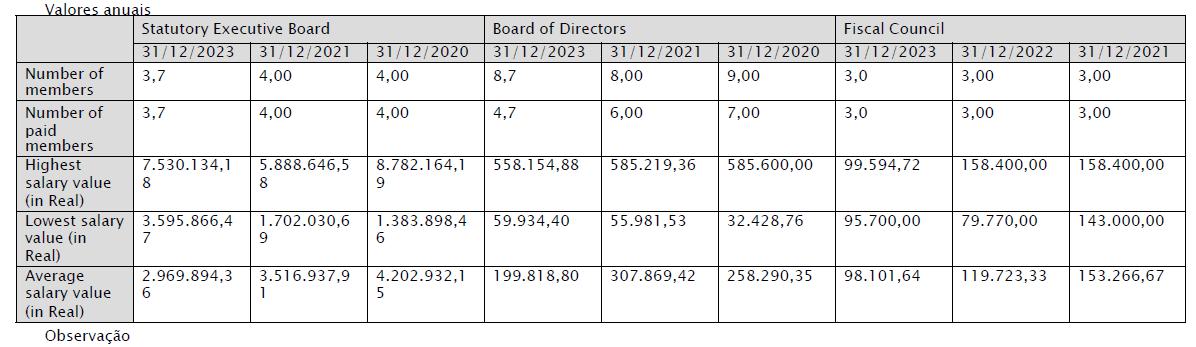

The Company’s

Management proposes an overall and annual gross amount of BRL R$51.271.416,01 (fifty-one million, two hundred and seventy-one thousand,

four hundred and sixteen reais and one cent) for the remuneration of the Company’s Managers (Board of Directors and Executive Board)

for the year 2024, complying with the provisions in the legislation in force and in the Company’s Bylaws. Said value includes labor

and tax charges on salary amounts. The net amount for Managers’ remuneration for the year 2024, corresponding to BRL R$ 38.565.432,27

(thirty-eight million five hundred and sixty-five thousand four hundred and thirty-two reais and twenty-seven centavos), represents an

increase of 140.83% - R$ 22.551.568,96 (twenty-two million five hundred and fifty-one thousand five hundred and sixty-eight reais and

ninety-six cents) compared to the overall net remuneration paid to the Managers in 2023. The variation arises from the payment of Retention

Bonuses to the Company's Statutory Directors, carried out in January/24 as a result of the Chapter 11 request.

.

For fiscal year

2023, a proposal for net remuneration of the managers in the amount of R$27,230,610.98 (twenty-seven million, two hundred and thirty thousand,

six hundred and ten reais and ninety-eight cents) was approved. The amount effectively realized during this period was BRL R$ 23.568.174,01

(twenty-three million five hundred and sixty-eight thousand one hundred and seventy-four reais and one cent), which represents a reduction

of 13.45% - BRL R$3.662.436,97 (three million six hundred and sixty-two thousand four hundred and thirty-six reais and ninety-seven cents)

in relation to the net amount approved.

Additional and detailed

information, pursuant to Article 13, item II of CVM Resolution 81/2022, as per item 8 of the Reference Form, are available in item 2.1.5

of the Management Proposal, at the Company’s headquarters and on theInvestor Relations websites (http://www.voegol.com.br/ri), of

the Securities and Exchange Commission of Brazil (www.cvm.gov.br) and B3 S.A. - Brasil, Bolsa, Balcão (www.b3.com.br).

São Paulo, March 27, 2024.

THE

MANAGEMENT

2.1.2.

MANAGEMENT´S PROPOSAL FOR ALLOCATION OF THE INCOME FOR YEAR 2023

The Company’s

Management, in compliance with item II of the Sole Paragraph of Article 10 and Annex A of CVM Resolution No. 81/2022, as amended, provides

the proposed allocation of income for the year ended December 31, 2022.

Having in consideration

that the Company recorded a loss for the fiscal year ended December 31, 2023, the presentation of the allocation of net income, in accordance

with RCVM 81 is not applicable.

São Paulo,

March 27, 2024.

THE MANAGEMENT

2.1.3.

MANAGEMENT´S COMMENT ON THE COMPANY´S FINANCIAL

POSITION (ITEM 2 OF THE REFERENCE FOR)

Pursuant to

art. 10, item III, of CVM Resolution No. 81, dated March 29, 2022, as amended, the Company provides the management’s comments on

the Company’s financial position corresponding to item 2 of the Reference Form (“FRE”).

ITEM

FRE 2.1 – FINANCIAL AND EQUITY CONDITIONS

The financial

data referred to below is extracted from our consolidated financial statements for the fiscal year ended December 31, 2023. These financial

statements were prepared under the responsibility of our management, in accordance with International Financial Reporting Standards

(“IFRS”) issued by the International Accounting Standards Board

- IASB and the accounting practices adopted in Brazil. The accounting practices adopted in Brazil comprise those included in the Brazilian

corporate law and the technical pronouncements, guidelines and interpretations issued by the Accounting Pronouncements Committee (“CPC”),

approved by the Federal Accounting Council (“CFC”) and CVM.

Finally, the information

included in this section concerning our industry, financial indicators, as well as estimates regarding market shares, was obtained through

internal surveys, public information, and publications on the industry. There was included information from reports prepared by official

public sources, such as the Central Bank of Brazil (BACEN), the Brazilian Institute of Geography and Statistics (IBGE),

the National Civil Aviation Authority (ANAC), the Brazilian Airport Infrastructure Company (INFRAERO), among others. The information

contained in these publications is extracted from sources believed to be reliable, but we cannot guarantee the accuracy and completeness

of such information. These internal surveys and estimates have not been independently verified.

The amounts presented

herein are expressed in thousands of Reais, unless indicated otherwise.

| a. | general financial and asset conditions |

The Company

continues to work on improving its operational efficiency and increasing profitability, in addition to face challenges related to its

capital structure, aiming at reducing leverage and strengthening its balance sheet, in addition to address the deferred maintenance of

the engines. The operational indicators of GOL related to the punctuality, regularity, occupancy rate and daily use of the operational

fleet show its focus on efficiency and productivity, even in a scenario of lower aircraft availability.

Despite a successful

operating model, the Company has been facing liquidity problems, challenges caused mainly by the COVID-19 pandemic, in line with the impacts

of the airline industry globally, which suffered unprecedented disruption to its business. Consequently, the volatility in the operating

cash flow caused by the substantial decline in demand for air travel resulting in disruptions and dramatic reduction in the revenue and

cash generation has created significant restrictions for liquidity and resources during the pandemic. In order to manage such problems,

the Company has reached agreements to defer certain leases, tax and other regulatory obligations, as well as financial obligations related

to the extension and renewal of financed debt maturities.

The result was the

continuity of the Company's business operations, despite these challenges related to the pandemic, but with a substantial increase in

the deferred and unpaid liabilities. Although the Company's operations have been recovered after the pandemic and, as from today, the

Company is capable of financing its future operating costs and certain necessary investments by means of operating cash flow, many of

these inherited liabilities and deferred maintenance obligations remain outstanding and require cash flow maintenance.

The Company has

executed certain transactions and undertaken a number of other efforts to address these financial headwinds, many of which have provided

temporary relief and the much-needed liquidity at key times. Several market-driven factors continue to exacerbate the Company's liquidity

challenges, including high fuel prices, the consistently low valuation of the Brazilian Real in relation to the dollar (affecting the

size of dollar costs in relation to the real revenues), and the increase in interest rates, among others. Persistent disruptions in the

supply chain and the restricted capacity in the industry maintenance, repair and operations have made it difficult to

timely obtain

necessary maintenance, leading to the accumulation of short-term required maintenance and related costs. Delays in the delivery of new

aircraft scheduled for 2023 have prevented the Company from placing new aircraft into service to compensate for those undergoing maintenance,

as described above.

As a result, the

Company reduced the number of operationally ready aircraft in the fleet, which made it impossible for the Company to increase or even

maintain its operational capacity. These operational limitations, in turn, have reduced revenue

and cash generation, exacerbating the restrictions on liquidity and operational challenges.

On

January 25, 2024, GOL and its subsidiaries filed for voluntary reorganization under the rules of the Chapter 11 of the Bankruptcy

Code with the United States Bankruptcy Court for the Southern District of New York ("Bankruptcy Court"). Chapter 11 is a court-supervised

reorganization process that companies use to raise capital, restructure their finances, and strengthen their business operations over

the long- term while continuing to operate normally.

The voluntary reorganization

aims at allowing the Company to reorganize and improve liquidity, to terminate unprofitable contracts and to modify its agreements in

order to enable sustainable profitability.

As part of Chapter

11, the Company will continue to operate its business in the ordinary course, and the board and the management will remain in their positions.

Following the initiation

of Chapter 11, the debtors have obtained relief from the Bankruptcy Court to operate their businesses in the ordinary course and to pay

or otherwise honor, at the Debtors' discretion, certain obligations prior to the petition. These obligations include, but are not limited

to, certain salary, benefits and employee-related obligations, taxes, insurance and the payment of certain suppliers.

On February 28,

2024, the Bankruptcy Court definitively granted the Debtors' request for access to up to $1 billion of debtor-in-possession ("DIP")

financing from certain secured bondholders and/or their designated, to be used for, among other purposes, designated

working capital expenditures, general corporate needs, and restructuring- related costs.

Immediately

after the beginning of Chapter 11, a global automatic stay of adverse actions for collection and enforcement by creditors came into force

under section 362 of Title 11 of the United States Code (the "Bankruptcy Code") to prevent, among other effects, that the Debtors'

creditors exercise measures in relation to the obligations prior to the Debtors' petition.

As a result of

the beginning of Chapter 11, the realization of assets and the satisfaction of obligations are subject to uncertainty. The Debtors, as

debtors-in- possession under the Bankruptcy Code, may, subject to Bankruptcy Court approval, sell or otherwise dispose of assets and settle

or resolve obligations in amounts other than those reflected in the consolidated financial statements.

For the Company

to successfully complete the Chapter 11 restructuring process, it is crucial to obtain Bankruptcy Court approval for a reorganization

plan. A confirmed reorganization plan or other agreement may change materially the amounts and classifications in the Company's consolidated

financial statements.

A plan of reorganization

determines the rights and satisfaction of claims of various creditors and interested parties

and is subject to the outcome of ongoing negotiations and decisions of the Bankruptcy Court up to the date the plan of reorganization

is confirmed.

The Company currently

expects that any proposed plan of reorganization shall include, among other things, mechanisms for the resolution of claims against the

Company's assets, treatment of the Company's current equity and debt holders, as well as corporate governance and administrative issues

relating to the Company reorganized.

Any proposed plan

of reorganization shall be subject to review before submission to the Bankruptcy Court, based on discussions with the Company's creditors

and other interested parties, and subsequently, in response to interested party objections and the requirements of the Bankruptcy Code

and of the Bankruptcy Court.

Our individual

and consolidated financial statements were prepared on a going concern accounting basis, which contemplates the realization of assets

and the satisfaction of liabilities and commitments in the ordinary course of business.

As a result of

Chapter 11, the Company's operations and ability to develop and execute its business plan, financial condition, liquidity and continuity

are subject to a high degree of risk and uncertainty associated with Chapter 11. The outcome of Chapter 11 depends on factors beyond the

Company's control, including actions of the Bankruptcy Court. These individual and consolidated financial statements do not include any

adjustments which may result from the outcome of this uncertainty.

The total liquidity

(cash, cash equivalents, short and long-term financial investments and accounts receivable) amounted to R$1,607.6 million on December

31, 2023 (R$1,480.2 million on December 31, 2022) and represented at the end of 2023, 8.6% of our net operating revenues for the last

twelve months (9.7% in 2022). Given the challenging scenario, the Management has been committed daily to honoring the Company's financial

commitments and preserving its cash and liquidity position.

As of December

31, 2023, our current liquidity ratio, calculated by dividing current assets by current liabilities, was 0.23 times, compared to 0.22

times in 2022.

The Company's gross

debt, made up of loans and financing and leases, on December 31, 2023 was R$20,024.9 million, compared to R$23,191.8 million on December

31, 2022.

Next, we present

a summary of the consolidated balance sheet accounts for the years ended December 31, 2023 and 2022:

| Consolidated Balance Sheet |

2023 |

2022 |

| Cash and cash equivalents |

323,928 |

169,035 |

| Short-term financial investments |

315,901 |

404,113 |

| Accounts receivable |

825,196 |

887,734 |

| Short-term deposits |

264,524 |

380,267 |

| Long-term financial investments |

142,636 |

19,305 |

| Long-term deposits |

2,291,413 |

2,279,503 |

| Fixed assets |

9,187,700 |

9,588,696 |

| Other short and long-term assets |

3,374,896 |

3,241,632 |

| Total of assets |

16,726,194 |

16,970,285 |

| Short-term loans |

1,261,554 |

1,126,629 |

| Short-term payable leases |

1,739,642 |

1,948,258 |

| Shipments to be performed |

3,130,772 |

3,502,556 |

| Short-term frequent flyer program |

1,765,664 |

1,576,849 |

| Long-term loans |

9,322,035 |

10,858,262 |

| Long-term payable leases |

7,701,733 |

9,258,701 |

| Long-term frequent flyer program |

239,209 |

292,455 |

| Other short and long-term liabilities |

14,732,699 |

9,765,390 |

| Total of liabilitiess |

39,893,308 |

38,329,100 |

| Shareholders’ equity |

(23,167,114) |

(21,358,815) |

As of December 31, 2023

and 2022, our total fleet was as shown in the table below:

| Total fleet at the end of the period |

2023 |

2022 |

| B737-700 NG |

16 |

20 |

| B737-800 NG |

81 |

88 |

| MAX 8 |

44 |

38 |

| Total (Boeing 737) |

141 |

146 |

The Company leases

its entire aircraft fleet. As of December 31, 2023, the total fleet consisted of 141 aircraft, of which 137 were leased without a purchase

option and 4 were leased upon an option to purchase.

Equity

As of December

31, 2023, our shareholders' equity amounted to a deficit of R$23,122.5 million, while on December 31, 2022, our shareholders' equity recorded

a deficit of R$21,358.8 million. This variation is mainly due to the recognition of fair value in a transaction related to ESSN 2028 and

losses for the year.

As of December 31,

2023, the capital stock was represented by 3,200,601,904 shares, of which 2,863,682,500 were common shares and 336,919,404 were preferred

shares. Abra Mobi LLP held 50.0% of our common shares and 18.7% of our preferred shares, while Abra Kingsland LLP held 50.0% of our common

shares and 18.7% of our preferred shares and Abra Group Limited held 3.7% of our preferred

shares, totaling

52.7% of our total capital stock. As of December 31, 2023, the Company had 50.6% of our outstanding preferred shares.

On February 15,

2023, the Board of Administration of the Company approved the voluntary conversion of 210 common shares into 6 preferred shares, all nominative

and with no par value and without changing the value of the Company's capital stock.

On July 26, 2023,

the Board of Administration of the Company approved an increase in the capital stock in the amount of R$264, by means of the issuance

of 85,827 preferred shares, all nominative and with no par value, resulting from the exercise of share purchase options granted to eligible

employees under the Share Purchase Option Plan.

The percentage

shareholdings of each shareholder indicated in the table below are based on the amount of 2,863,682,500 common shares and 336,919,404

preferred shares as of December 31, 2023.

| |

Common

Shares |

% |

Prefererred

Shares |

% |

Total

Shares % |

|

Abra MOBI LLP (1) (2)

(3) |

1,431,841,250 |

50.00% |

63,331,009 |

18.77% |

1,495,172,259 |

24.86% |

| Abra Kingsland LLP (3) |

1,31,840,865 |

50.00% |

63,331,008 |

18.77

% |

1,495,171,873 |

25.86% |

| American Airlines Inc. |

- |

- |

22,224,513 |

6.59% |

22,224,513 |

5.30% |

| Abra Group Limited |

- |

- |

12,664,965 |

3.75% |

12,664,965 |

3.02% |

| Others |

385 |

- |

4,940,582 |

1.46% |

4,940,967 |

1.8% |

| Market |

- |

- |

170,427,327 |

50.67% |

170,427,327 |

40.78% |

| Total |

2,863,682,500 |

100.00% |

336,919,404 |

100.00% |

3,200,601,904 |

100.00% |

| (1) | In connection with the 2024 Exchangeable Senior Notes issued in 2019, MOBI lent

up to 14,000,000 ADSs to Bank of America Corporation, which operates the ADS lending facility, in order to facilitate the privately negotiated

derivative transactions or other hedging activities related to the Exchangeable senior notes On September 30, 2023, there are 4,477,760

preferred shares, equivalent to 1.1% of the total, pledged as collateral for this operation, which shall be returned to MOBI upon maturity

of the Exchangeable Senior Notes or upon termination of the loan agreement. As part of the closing of the transactions involved in the

creation of Abra Group Limited, the ADSs were |

transferred

to Abra MOBI LLP and Abra Kingsland LLP and partially canceled. On August 11, 2023, 11,761,120 ADSs were canceled and the underlying GOL

preferred shares were delivered to Abra affiliates. There are currently 2,238,880 ADSs outstanding subject to the ADS loan agreement with

Bank of America Corporation, which shall be returned upon maturity of the Exchangeable Senior Notes or upon termination of the ADS loan

agreement entered into.

| (2) | It refers to legal entities controlled by the controlling shareholders (Constantino

family). |

| (3) | As regards the agreement between the controlling shareholder and the main shareholders

of Avianca, in the year ending December 31, 2023, MOBI FIA transferred 100% of the Company's common shares to Abra. During this same period,

Abra transferred 50% of the Company's common shares owned by it to Abra Kingsland LLP and 50% of the common shares to Abra MOBI LLP. Abra

holds 99.99% of the economic rights of Abra MOBI LLP and Abra Kingsland LLP. |

Third-party capital

Not applicable.

Capital Structure

The following table shows our capital structure

in terms of third-party capital’s share

of our total capital as of December 31, 2023

and 2022:

| |

12/31/2023 |

12/31/2022 |

| Total loans and financing |

(10.583.589) |

(11.984.891) |

| Total leases payable |

(9.441.375) |

(11.206.959) |

| (-) Cash and cash equivalents |

323.928 |

169.035 |

| (-) Financial investments |

458.537 |

423.418 |

| A – Net Debt |

(19.242.499) |

(22.599.397) |

| B - Total negative shareholders´ equity |

23.167.114 |

21.358.815 |

| C = (B + A) – Total capital |

(3.924.615) |

(1.240.582) |

Net debt = total debt (short and long

term) minus total cash (cash and cash equivalents + financial investments);

Total capital = net debt + equity;

Possibility of Redemption of Shares

We

inform that there is no possibility of redemption of our shares, other than the legal hypotheses.

| c. | ability to pay in relation to the financial commitments assumed |

Liquidity

To manage

our liquidity, we take into account our total cash as well as our receivables balances. Our accounts receivable are affected by the timing

of our credit card receivables. Our customers can purchase tickets by paying in installments on credit cards, usually generating a gap

of one to two months between the payment of our suppliers and expenses and the actual receipt of revenues from our services. When necessary,

we obtain loans to finance our working capital, which can be secured by our receivables, to finance the sale-receipt cycle.

The

table below presents consolidated financial information used in liquidity analyses:

| |

2023 |

2022 |

Var. (23/22) % |

| Cash and cash equivalents |

323.928 |

169.035 |

91,6% |

| Financial investments |

458.537 |

423.418 |

8,3% |

| Accounts receivable |

825.196 |

887.734 |

(7,0)% |

| Total Liquidity |

1.607.661 |

1.480.187 |

92,9% |

On December

31, 2023, the “total cash” (cash, cash equivalents, short and long-term financial investments) reached R$782.4 million, consisting

of R$323.9 million of cash and cash equivalents balance,

R$315.9 million in short-term financial investments and R$142.6 million in long-term financial investments.

On December 31,

2023, our dry liquidity ratio, calculated by dividing the sum of cash and cash equivalents, financial investments, and accounts receivable

recorded under current assets by current liabilities was 0.11, compared to 0.11 in 2022.

On December 31,

2023, we had negative net working capital of R$9,973.3 million, due to (i) the increase in the balances of transport to be carried out

and the mileage program, as a result of the resumption of operations; (ii) investments in working capital, fleet maintenance and the acquisition

of Boeing 737 MAX aircraft; and (ii) disbursements made for lease and deposit payments. Since the onset of the global

pandemic, and

in response to this scenario, we have successfully taken a number of measures to protect our liquidity and cash position, including adjusting

our airline network, renewing and deferring short-term obligations, including debt and certain lease obligations, and reducing fixed and

variable costs. We will continue to take action with our suppliers and counterparties, who have been very cooperative in our efforts to

keep our costs down and preserve our liquidity.

d.

sources of financing for working capital and for Investments in non- current assets used

When necessary,

we obtain loans to finance our working capital, which can be secured by our receivables, to finance the sale-receipt cycle. The Company

had a liquidity position (cash, cash equivalents, short and long-term financial investments, and accounts receivable) that represented

8.6% of our net operating revenues for the last twelve months. The Company is also committed to avoiding maturity pressure on significant

financial debt over a two-year horizon in order to ensure healthy liquidity levels.

e.

sources of financing for working capital and for investments in non- current assets that it intends to use to cover liquidity

shortfalls

The Company's strategy

is to rely primarily on cash flows from operations to obtain working capital for current and future operations. The Company's operating

cash flows are affected by the requirement of some aircraft operating lease agreements, which establish maintenance deposit reserve accounts

for these aircraft, with funds at specific levels. The funds will be taken from maintenance reserve accounts for the reimbursement of

certain structural maintenance expenses incurred. We believe that the amounts already deposited, and to be deposited, plus our own cash

resources, are sufficient to cover our future aircraft and maintenance costs for the duration of the respective operating leases.

The Company expects

to make payments for the acquisition of aircraft using funds from loans contracted through short-term credit lines and/or vendor financing

and from revenues from our operations. We expect to finance the balance of the purchase price of the Boeing 737-MAX aircraft through a

combination of sources, such as cash and cash equivalents arising from our operations, low-interest bank financing agreements, sale-leaseback

transactions from the purchaser, offers of debt or equity

securities

and/or vendor financing. As of December 31, 2023 we have R$473.2 million in balances of advances for the acquisition of aircraft.

f.

levels of indebtedness and characteristics of such debts

i.

relevant loans and financing contracts

Our loans and financing as of December 31,

2023 and 2022 were made up as follows:

| |

|

2022 |

|

|

|

Consolidated |

|

|

|

|

2023 |

|

| In R$: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Debentures |

1,072,019 |

640,046 |

431,973 |

886,000 |

- |

(1,090,976) |

164,954 |

(165,537) |

- |

585 |

867,045 |

347,614 |

519,431 |

|

Working

capital |

115,781 |

76,710 |

39,071 |

- |

- |

(76,417) |

13,345 |

(13,934) |

- |

- |

38,775 |

36,632 |

2,143 |

| In US$: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Import

financing |

77,193 |

77,193 |

- |

- |

- |

(45,361) |

8,415 |

(9,442) |

(4,787) |

- |

26,018 |

26,018 |

- |

| ESN 2024 |

1,857,429 |

38,114 |

1,819,315 |

- |

(14,894) |

(1,639,173) |

69,936 |

(56,007) |

(26,525) |

15 |

190,781 |

190,781 |

- |

| Spare Engine Facility |

124,228 |

30,265 |

93,963 |

- |

- |

(115,171) |

3,338 |

(4,686) |

(8,057) |

348 |

- |

- |

- |

| Credit Facility |

- |

- |

- |

104,377 |

- |

(13,842) |

2,199 |

- |

146 |

- |

92,880 |

92,880 |

- |

|

Senior

Notes

2025 |

3,471,272 |

98,919 |

3,372,353 |

- |

- |

(1,592,644) |

138,950 |

(182,740) |

(139,446) |

5,772 |

1,701,164 |

48,352 |

1,652,812 |

|

Senior Secured

Notes

2026 |

3,272,229 |

- |

3,272,229 |

- |

- |

(2,007,389) |

128,728 |

(125,675) |

(101,462) |

16,663 |

1,183,094 |

- |

1,183,094 |

|

Senior Secured Amortizing

Notes |

1,003,279 |

121,111 |

882,168 |

220,634 |

- |

(161,868) |

46,242 |

(44,884) |

(79,138) |

7,605 |

991,920 |

479,148 |

512,772 |

| Loan Facility |

171,864 |

27,682 |

144,182 |

- |

- |

(159,198) |

8,532 |

(10,191) |

(12,274) |

1,267 |

- |

- |

- |

|

Senior Secured

Notes 2028 |

- |

- |

- |

7,363,736 |

- |

(6,407,576) |

740,265 |

(331,727) |

(237,104) |

- |

1,127,594 |

5,019 |

1,122,575 |

| ESSN 2028 |

- |

- |

- |

6,923,269 |

(3,409,360) |

- |

284,107 |

- |

(118,632) |

- |

3,679,384 |

21,248 |

3,658,439 |

|

Perpetual

bonuses |

819,597 |

16,589 |

803,008 |

- |

- |

(79,615) |

61,857 |

(65,182) |

(51,723) |

- |

684,934 |

13,862 |

671,072 |

| Total |

11,984,891 |

1,126,629 |

10,858,262 |

15,498,016 |

(3,424,254) |

(13,389,230) |

1,670,868 |

(1,009,955) |

(779,002) |

32,255 |

10,583,589 |

1,261,554 |

9,322,035 |

Next, the summary table of the material

loan and financing agreements of the Company, in effect as December 31, 2023.

| Modality |

Maturity |

Interest Rates(*) |

Currency |

| Debentures |

06/2026 |

17.23% a.a. |

Real |

| Working capital |

10/2025 |

17.76% a.a. |

Real |

| Import financing |

05/2024 |

14.28% a.a. |

American dollar |

| ESN 2024 |

07/2024 |

3.75% a.a. |

American dollar |

| Credit Facility |

11/2024 |

0.00% a.a. |

American dollar |

| Senior bonus 2025 |

01/2025 |

7.00% a.a |

American dollar |

| Senior bonus 2026 |

06/2026 |

8.00% a.a. |

American dollar |

| Senior Secured Amortizing |

06/2026 |

4.76% a.a. |

American dollar |

| Senior Secured Notes 2028 |

03/2028 |

18.00% a.a. |

American dollar |

| ESSN 2028 |

03/2028 |

18.00% a.a |

American dollar |

| Perpetual bonuses |

- |

8.75% a.a. |

American dollar |

(*) It refers to the average interest rate of the

agreements as of December 31, 2023.

The

tables below show the maturity schedule of our long-term obligations, resulting from loans and financing in effect on December 31, 2023:

The following

describes our significant financial contracts in effect as of December 31, 2023:

Debentures

On October

29, 2018, GLA, a Company subsidiary, issued 88,750 simple, non- convertible debentures of the 7th series in the total amount of R$887.5

million and issuance costs of R$28,739, amortized over the period of the debt. The funds raised were used exclusively for the early settlement

at face value of the 6th series of debentures that, as a consequence, had their costs fully written off in income.

During the years

ended December 31, 2021 and 2020, GLA, the Company’s subsidiary, carried out renegotiations related to changes in the maturity of

the series, early maturity clauses and the remuneration of these debentures. On October 26, 2021 GLA repurchased 4,250 debentures, totaling

R$28,333.

On October 25, 2021

the 8th issue of debentures was carried out by GLA, a subsidiary of the Company, fully used to refinance the short-term debt of import

financing lines of credit and for working capital, in the amount of R$620,21 7 and remuneration of CDI + 4.50% p.a. This issue will mature

on October 27, 2024 and the payments of principal and interest will be monthly, after a vesting period of one (1) year for principal and

six

(6) months for interest.

| Date of operation |

Principal |

R$

thousand

Costs and discount |

Interest rate (p.a.) |

Date of Maturity |

| 10/25/2021 |

610.217 |

35.645 |

CDI + 4.50% |

10/27/2024 |

During the

year ended December 31, 2022, Debenture Holders’ General Meetings were held and resolved (i) to postpone the payment of the mandatory

extraordinary amortization installment from October 1 3, 2022 to November 27, 2022; (ii) to postpone the payment of the mandatory extraordinary

amortization installments and the current amortization, in addition to the mandatory guarantee composition, all of November 27, 2022 to

December 12, 2022; (iii) postponing the payment of the mandatory extraordinary amortization installment and the mandatory guarantee composition,

both from December 12, 2022 to February 27, 2023; and (iv) changing the current

amortization date from

December 27, 2022 to January 15, 2023.

On September

26, 2023, the General Meetings of Debenture Holders were held and decided to change the maturity of the First Series, Second Series, Third

Series of the 7th

issue and Single

Series of the 8th issue from October 2024 to June 2026, with new remuneration of CDI + 5.0% p.a., which can be redeemed in advance by

the Company.

The outstanding

balance of R$886,000 will be amortized in 30 monthly installments from January 2024 to June 2026. Settlement is subject to the creation,

by the Company, of a receivables anticipation structure by January 25, 2024, the resources obtained from which will be used mandatorily

and as a priority for the full payment of the value corresponding to the main amount of the emissions.

On December

31, 2023, the amount recorded under current and non-current liabilities was R$347.6 million and R$519.4 million, respectively.

Working Capital

In 2020, 2021

and 2022 GLA, the Company’s subsidiary, raised funds under this modality, with the objective of maintaining and managing the Company’s

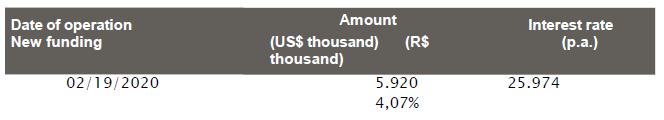

working capital. Information about such financing is presented below:

|

Operation

Date |

R$ thousand

Principal |

Interest

rate

(p.a.) |

Date of

Maturity |

| 04/20/2020 |

21,195 |

8.52% |

07/20/2020 |

| 04/20/2020 |

72,000 |

10.03% |

07/20/2020 |

| 04/20/2020 |

94,830 |

8.99% |

08/18/2020 |

| 05/08/2020 |

147,871 |

CDI + 6.90% |

08/07/2020 |

| 05/11/2020 |

10,013 |

8.60% |

08/10/2020 |

| 05/13/2020 |

24,000 |

CDI + 8.00% |

03/12/2021 |

| 05/15/2020 |

254,468 |

CDI + 2.50% |

11/09/2020 |

| 10/07/2020 |

59,795 |

8.58% |

12/07/2020 |

| 10/23/2020 |

10,000 |

6.90% |

10/23/2025 |

| 11/26/2020 |

10,000 |

10.69% |

05/19/2023 |

| 10/15/2021 |

40,000 |

CDI + 6.80% |

04/13/2022 |

| 08/31/2022 |

70,000 |

CDI + 4.70% |

02/29/2024 |

| 09/20/2022 |

40,000 |

18.53% |

09/20/2024 |

During the years ended December

31, 2022, 2021 and 2020, GLA, a subsidiary of the Company, renegotiated maturities of contracts of this type, with the maintenance of

the guarantees of the operations. Such renegotiations had as the main change the maturity date and interest rate.

On December 31,

2023, the amount registered in current and non-current liabilities was R$36.6 million and R$2.1 million, respectively.

Import financing (Finimp)

The import

financing is a with private banks, used to finance the import of spare parts and aeronautical equipment.

Information about such

financing is presented below:

During the years

ended December 31, 2023, 2022 and 2021, GLA, the Company’s subsidiary, renegotiated the postponement of the maturities of contracts

of this modality, with an impact on the interest rate, disclosed in the table above. The other conditions of these operations remained

unchanged. Such operations are part of a facility for financing imports, with the objective of maintaining engines, purchasing spare parts

and aeronautical equipment.

The total outstanding

balance of these operations recorded under current liabilities as of December 31, 2023 was R$26.0 million.

Exchangeable Senior Notes (“ESN”)

GOL Equity

Finance (“issuer”), a special purpose company incorporated under the laws of Luxembourg, issued Exchangeable

Senior Notes (“ESN”) in 2019, maturing in 2024, which will accrue nominal

interest of 3.75% p.a., to be paid semi-annually. This operation was guaranteed by the Company and the subsidiary GLA.

Holders of

ESN securities will have the right to swap them for American Depositary Shares

(“ADSs”) where each represents two Company's preferred shares. The initial swap rate for the securities is 49.3827 ADSs per

US$1 mil principal amount of the securities which equates to an initial exchange price of approximately US$20.25 per ADS and represents

an exchange premium of approximately 35% above the initial public offering price of the ADSs sold in the simultaneous ADS offering described

below, which was US$15.00 per ADS. The swap rate of the securities is subject to adjustment upon the occurrence of certain events.

Settlement of the securities

can be made in cash, ADSs, or a combination of both.

On December 31, 2023,

the amount recorded in current liabilities was R$190.7 million.

Senior Bonus

As of December

11, 201 7, Gol Finance (previously named GOL LuxCo S.A.), a subsidiary of the Company, issued a series of Senior Bonds due 2025, in the

amount of R$1,642,000 (US$500,000 on the funding date), with issuance costs of R$45,172 (US$17,283 on the funding date). On February 2,

2018, Gol Finance, a subsidiary of the Company, carried out the additional issuance of Senior Bonus VIII maturing in 2025, in the amount

of R$486,735 (US$150 million on the funding date), with issue costs of R$8,578 (US$2,873 on the funding date). The Senior Bonus is guaranteed

by the Company with semi-annual interest payments of 7.00% p.a. The funds raised are intended to be used to repurchase other Bonuses and

for general corporate purposes.

On December 31,

2023, the amount recorded in non-current liabilities was R$1,652.8 million, in addition to interest payable recorded in current liabilities

of R$48.3 million.

In December 2020,

Gol Finance raised Senior Secured Notes due June 2026 and secured

by fiduciary alienation of certain assets: (i) substantially all of the Company ’s

intellectual property, including patents, trademarks, trademark names and domains; and (ii)spare

parts for GLA aircraft. In May and September 2021, Gol Finance raised two new Senior

Secured Notes, as additional and Consolidated issues to the Senior

Secured Notes issued in December 2020. The funding within the scope of this operation is presented below:

| Date of |

Principal |

Costs |

Interest |

Date of |

| Operation |

(US$ thou) |

(R$ thou) |

(US$ thou) |

(R$ thou) |

rate (p.a.) |

maturity |

| 12/23/2020 |

200,000 |

1,039,340 |

16,750 |

86,831 |

8.00% |

06/30/2026 |

| 05/11/2021 |

300,000 |

1,569,660 |

11,997 |

62,784 |

8.00% |

06/30/2026 |

| 09/08/2021 |

150,000 |

815,910 |

10,210 |

55,140 |

8.00% |

06/30/2026 |

On December

31, 2023, the amount recorded in the non-current liabilities of the Senior Secured

Notes 2026 was R$1,183.1 million.

Senior

Secured Amortizing Notes

On December 30,

2022 Gol Finance, a subsidiary of the Company, issued 5.00% Senior Secured Amortizing

Notes due 2026 (Series A) and 3.00% Subordinated Secured Amortizing

Notes due 2025 (Series B), for a total volume of $196 million.

The Notes were

issued in exchange for full compliance, at 100% of face value, with certain lease payment obligations for aircraft that are under deferral

arrangements, among other obligations that participating aircraft lessors have elected to exchange for Notes.

The Notes

have an average vesting period of 12 months. After the vesting period, the Series A Notes

will be amortized in ten equal quarterly installments and the Series B Notes

will be amortized in nine equal quarterly installments and will be contractually subordinated to the Series A Notes.

The Notes may be redeemed by Gol Finance, a subsidiary of the Company,

at any time at face value and are guaranteed by an unencumbered fiduciary assignment of receivables by GOL Linhas Aéreas S.A. (“GLA”).

|

Transaction

Date |

Principal

(US$ thou)

(R$ thou) |

Costs

(US$ thou) (R$ thou) |

Interest

Rate (p.a.) |

Maturity

Date |

| 12/30/2022 |

70,078 365,645 |

370 1,928 |

3.0% |

06/30/2025 |

| 12/30/2022 |

125,700 655,865 |

3.125 16,303 |

5.0% |

06/30/2026 |

| 01/27/2023 |

6,993 35,499 |

365 1,826 |

5.0% |

06/30/2026 |

| 04/20/2023 |

19,976 100,873 |

578 2,700 |

3.0% |

06/30/2025 |

| 06/07/2023 |

9,000 44,207 |

214 1,160 |

3.0% |

06/30/2025 |

| 07/19/2023 |

8,970 43,055 |

34 161 |

5.0% |

06/30/2026 |

As of December

31, 2023, the amount recorded in current and non-current liabilities was R$479,1 million and R$512,7 million, respectively.

Credit Facility

On October,

2023, the Company announced the expansion of its strategic partnership with Air France – KLM.

In November 2023, GOL received the amounts related to the credit facility totaling US$25,000, of which R$77,000 (US$16,000) came from

Air France and R$43,571 (US$9,000) from KLM, the fair value of which at the initial recognition was R$72,892 (US R$14,818) for Air France

and R$41,438 (US$8,365) for KLM maturing in November 2024, without interest.

As of December 31, 2023, the

amount recorded in current liabilities was R$92.8 million.

Senior Secured Notes and Exchangeable Senior

Secured Notes 2028

In February

2023, the Company and Abra signed the Support Agreement with Abra's investment commitment in the Company by means of the issuance of Senior

Secured Notes maturing in 2028.

To this end, Abra

agreed to issue Senior Secured Notes (“SSNs”) due 2028, convertible into Exchangeable Senior Secured Notes (“ESSNs”)

due 2028 and the Ad-Hoc Group agreed to exchange certain existing Senior Notes of the Company (ESN 2024, Senior Notes 2025, Senior Secured

Notes 2026 and perpetual Bonuses) for SSNs.

In March 2023,

Abra issued the SSNs and entered into the Senior Secured Note Purchase Agreement with GOL as guarantor and paying agent, being GOL Finance

as issuer and upon the suretyship of Smiles Fidelidade S.A. On the same date, GOL issued Senior Secured Notes 2028 (“SSNs 2028”)

to Abra, which provide for the payment of interest of 18.0% p.a., paid semi-annually, with 4.5% being coupons paid in cash and 13.5% p.a.

in PIK (payment in kind). The 2028 SSNs are guaranteed by the intellectual property, infrastructure systems, data and manuals of the Smiles

loyalty program, in addition to the guaranty of parts shared with the 2026 Senior Secured Notes.

Part of the issuance

carried out was used to repurchase 90.1% of ESN 2024, 47.3% of Senior Notes 2025, 61.4% of Senior Secured Notes 2026 and 9.9% of Perpetual

Bonuses, valued in accounting manner at the total amount of R$5,192,880. Taking in consideration the change of creditor, such amortizations

were considered as partial extinction, from the perspective of CPC 48 – “Financial instruments”, equivalent to IFRS

9. In this context,

the costs related to the issuance, as well as the difference between the book value attributed to the derecognized part due to the partial

extinction of the repurchased securities and the nominal value of the new liability assumed, were recognized directly in profit or loss.

In addition to the amounts mentioned above, part of the issue did not pass through the Company's cash flow, being directly transferred

by Abra to pay the Company's obligations to the supplier.

Until September

29, 2023, the Company issued to Abra R$6,494,496, equivalent to US$1,258,031 thousand, in the form of Senior Secured Notes 2028, the fair

value of which at initial recognition amounted to R$6,934,269 (US$1,343,181 thousand). Given that the transaction was carried out with

Abra, the difference between the nominal value of the debt and the fair value was recognized directly in the shareholders' equity.

On the same

date, the Company converted R$5,911,181 (US$1,180,442 thousand) from SSNs 2028 into Exchangeable Senior Secured Notes 2028 (“ESSNs

2028”), which may be converted into GOL preferred shares by Abra and shall be subject to certain precedent conditions, which may

or may not be met.

The 2028 SSNs converted

into 2028 ESSNs had a book value of R$6,407,575 (US$1,279,570 thousand).

The 2028 ESSNs issued

on September 29, 2023 have the same term, maturity date and interest payment as the 2028 SSNs previously in effect. In connection with

this transaction, the Company issued a total of 1,008,166,796 warrants for preferred shares issued

by the Company, of which 991,951,681 were subscribed for the purpose of future conversion of the 2028 ESSNs.

The Company carried

out the initial measurement of the fair value of the financial liability, considering the income approach, resulting in the amount of

R$6,789,995 (US$1,355,938 thousand). Given that the transaction was carried out with Abra, the difference between the transaction price

of the extinguished portion of the 2028 SSNs and the fair value was recognized directly in the shareholders' equity. In September 2023,

the portion corresponding to the option to convert the bonds into shares at market value corresponded to R$3,409,360 (US$680,837). Between

the period of October 1, 2023 and December 31, 2023, the Company issued additional Senior

Secured Notes 2028 to Abra in the total amount of R$407,990 (US$82,364), the fair value of which

at initial recognition amounted to R$22,349 (US$4,550). Given that the transaction was carried out with Abra, the difference between

the nominal value of the debt and the fair value was recognized directly in the shareholders' equity.

On December 31,

2023, the amount recorded related to the Senior Secured Notes 2028 in current and non-current liabilities was R$5.0 million and R$1,300.2

million, respectively.

On December 31,

2023, the amount recorded related to the Exchangeable Senior Secured Notes 2028 in current and non-current liabilities was R$21,2 million

and R$3.480,4 million, respectively.

Perpetual Bonus

On April 05,

2006, Gol Finance, a subsidiary of the Company (previously named GOL LuxCo S.A.), raised funds by issuing perpetual bonuses denominated

in US dollars in the nominal amount of US$200 million with a fiduciary guarantee by the Company and its subsidiary GLA. The perpetual

bonuses have no fixed maturity, and can be redeemed at face value after five years from the issue date, bearing interest at 8.75% p.a.

The funds raised are for financing the acquisition of aircraft and bank financing with a guarantee from the U.S. Ex-Im Bank.

On December 31,

2023, the amount recorded in current liabilities, referring to interest, and non-current liabilities was R$13.8 million and R$671.0 million,

respectively.

| ii. | other long-term relations with financial institutions |

On December

31,2023, we did not have any other long-term operations with financial institutions besides those mentioned in the previous item.

| iii. | degree of subordination between debts |

In an eventual universal

composition with creditors, the subordination among the obligations recorded in the liabilities payable will take place in accordance

with law

11.101 of 2005:

| · | Social and labor obligations; |

| · | Dividends and interest on own capital. |

Under our finance lease

agreements, the lessor has priority over other creditors in the repossession of the aircraft under the terms of the applicable agreement.

There is no degree of

subordination among the Company’s debts.

iv.

restrictions imposed on the Company, particularly with regard to indebtedness

limits and contracting new debt, dividend distribution, asset disposal, issuing new securities and disposing of corporate control, as

well as whether the Company has been complying with these restrictions

The

operations contracted by GLA and by Gol Finance, subsidiaries of the Company, have covenants in the Debentures, and the Senior

Secured Amortizing Notes.

On December 31,

2023, the Company was in compliance with the indicators set out in the deeds of the 7th and 8th issues. The next measurement requirement

will be in June 2024.

In the operation

of the Senior Secured Amortizing Notes, the Company is required to

comply with guarantee conditions related to receivables on a quarterly basis. On December 31, 2023, the Company held GLA receivables as

collateral for this contract that met the contractual conditions. The next measurement requirement will be in June 2024.

| g. | limits of contracted financing and percentages already used |

The Company

has the possibility of contracting credit lines with financial institutions and banks to finance working capital and investments in our

business.

At December 31,

2023, the Company recorded no financing agreement the disbursement of which has not been fully made.

| h. | significant changes in income statement and cash flow items |

Brazilian

Economic Scenario

As we are a

Brazilian airline with primary operations in the Brazilian domestic market, we are affected by Brazilian macroeconomic conditions. Brazil’s

economic growth is an important indicator in determining our growth and results of operations.

The Company’s operations

are also very sensitive to the macroeconomic scenario and to

the volatility of the

Real, given that approximately 94.3% of its indebtedness (loans and

financing and

leases) is negotiated in U.S. dollars (“US$”) and 48.6% of its costs are also linked to the U.S. currency, and its ability

to adjust the price of the tariffs charged to its customers to recapture the variation of the U.S. dollar depends on the rational capacity

(supply) and behavior of its competitors. In 2023 and 2022, respectively, 51.4% and 52.2% of our operating costs and expenses were denominated

in reais, respectively, and many of our suppliers and service providers generally increase their prices to reflect Brazilian inflation

rates.

| Economic Indicators |

2023 |

2022 |

| GDP growth |

2.9% |

2.9% |

| Inflation (IGP-M)(1) |

(3.2%) |

5.5% |

| Inflation (IPCA)(2) |

4.7% |

5.8% |

| CDI rate (3) |

13.0% |

13.7% |

| LIBOR rate(4) |

5.6% |

4.7% |

| Exchange rate at the end of the period |

R$4.841 |

R$5.218 |

| Real depreciation vs. US dollar |

7.2% |

6.5% |

| Average exchange rate (5) |

4.996 |

5.163 |

|

WTI

(West Texas intermediate) price at the end of the period (p

barrel) |

US$71.65 |

US$80.26 |

| Increase (decrease) of the WTI final price per barrel |

(10.7%) |

6.7% |

| Average WTI price for the period (per barrel) |

US$72.12 |

US$94.33 |

| Increase (decrease) in the average price of WTI per barrel |

(23.5%) |

40.1% |

Sources: Banco Central do Brasil, FGV,

IBGE and Bloomberg.

| (1) | Inflation expressed by the IGP-M is the general market price index measured

by Fundação Getúlio Vargas;; |

| (2) | Inflation expressed by IPCA is the broad national consumer price index

measured by the Brazilian Institute of Geography and Statistics (IBGE); |

| (3) | The CDI is the interbank deposit certificate (annualized and accumulated

for the periods ended); |

| (4) | Three-month LIBOR expressed in US dollars

at the end-of-period exchange rate; |

| (5) | It represents the average of end-of-period exchange rates for each month. |

The following table presents our main

financial and operational indicators in 2023 and 2022:

| Operating Information |

2023 |

2022 |

| Passenger-kilometers transported (RPK) (in million) |

35,271 |

32,628 |

| Seat-kilometers offered (ASK) (in million) |

42,992 |

40,789 |

| Occupancy rate (%) |

82.0% |

80.0% |

| Aircraft use (block hours per day) |

12.61 |

11.0 |

| Net yield per passenger/km (in cents) |

48.9 |

43.4 |

| Operating revenue per available seat kilometer, net (in cents) |

43.7 |

37.3 |

| Operating cost per available seat-kilometer (in cents) |

35.8 |

35. |

| Net operating revenue (in million) |

18,774.0 |

15,198.7 |

| Operating cost and expense (in million) |

(15,390.5) |

(14,641.6) |

| Operating margin (%) |

18.0% |

3.7% |

| Net loss (in million) |

(1,177.7) |

(1,561.5) |

The table below shows the composition

of our data and operating expenses based on seat kilometers offered in 2023 and 2022:

| Cost per ASK (R$/cents) |

2023 |

2022 |

| With staff |

(5.87) |

(5.58) |

| Fuels and lubricants |

(13.84) |

(15.42) |

| Landing and take-off fees |

(2.10) |

(1.91) |

| Rendering of services |

(2.81) |

(2.26) |

| Passenger expenses |

(1.89) |

(2.16) |

| Commercials and advertising |

(2.14) |

(2.00) |

| Maintenance and repair |

(3.17) |

(1.13) |

| Depreciation and amortization |

(3.88) |

(4.22) |

| Others |

(0.21) |

(1.21) |

| Cost per ASK (CASK) |

(35.9) |

(35.9) |

| Cost per ASK excluding fuel (CASK ex-comb.) |

(22.06) |

(20.48) |

Comparison of

operating and financial results and cash flows for the year ended December 31, 2023:

Our operating profit

in 2023 was R$3,338.9 million, from R$557.1 million in 2022, compared to an operating loss of R$3,834.6 million in 2021. Our operating

margin in 2023 was positive 17.8% and 4.0% in 2022. In 2023 and 2023 we recorded net losses of R$1,222.2 million and R$1,561.5 million,

respectively.

Net Operating Revenues

Net operating revenues

for 2023 increased 23.5% to R$18,774.0 million.

In 2023, our operating

revenue per seat-kilometer offered (“RASK”) showed an increase of 17.0%, from R$43.67 in 2023 to R$37.26 in 2022, due to the

increase in yield with the revision of the tariffs due to the fuel

price level.

Our revenue

per passenger per seat-kilometer offered (“PRASK”) totaled R$40.1 cents, a 15.6% increase from R$34.7 cents in 2022.

Operating Costs and Expenses

In 2023, operating

costs and expenses totaled R$15,435.0 million, an increase of 5.4% over the previous year, mainly due to increase maintenance material

and repair expenses.

The expenses

with salaries and benefits with personnel in the year 2023 totaled R$2,522.7 million, an increase of 10.7% compared to the previous year

mainly due to an increase in employees’ salaries considering inflation adjustments. Wages per ASK increased

by 5.0%, due to the increase in seat-kilometer offered. On December 31, 2023, we had 14,394 total employees, representing a 3%

decrease from December 31, 2022.

Fuel and lubricant

costs in 2023 totaled R$ 5,950.3 million, a reduction of 5.4% compared to the previous year. Fuel expenditures per ASK decreased by 10.2%

due to the reduction in the average price of QAV, with a stable level of fuel consumption per seat-kilometer offered.

The expenses with

landing and take-off fees in 2023 were R$901. million, an increase of 15.9% compared to 2022, mainly due to the increase in supply and

take-offs. Landing fees per available seat kilometer increased 10.0%, due to the average adjustment in certain landing, navigation and

stay fees in the domestic market and the greater representativeness of the international fees that are higher than the domestic ones.

Expenses with

services recorded R$1,209.2 million in 2023, increase of 31.91% compared to 2022. Service provision expenses per available seat kilometer

decreased 13.8% due to the increase in supply, measured by ASK.

Passenger spending

recorded a reduction of 8.1% compared to 2022, in a total of R$811.7 million in 2023. Expenses for passenger service per available seat

kilometer decreased by 12.8% as compared to 2022.

Commercial and advertising

expenses for 2023 increased by 12.4% year-on-year to R$918.6 million, due to increased marketing campaigns, sales commissions and credit

card chargebacks. Sales and marketing expenses per available seat

kilometer increased by 6.6% for the same reasons.

Maintenance, materials

and repair expenses totaled R$1,364.6 million in 2023, an increase of 195.6% compared to 2022.

Expenses with maintenance, materials and repairs per available seat kilometer increased by 180.7% as compared to 2022.

The depreciation

and amortization expenses recorded R$667.3 million in 2023, a reduction of 3.1% year-on-year. Depreciation and amortization expenses per

available seat kilometer decreased by 8.0% compared to 2022, due to the increase in ASK.

Other operating

income (expenses), net decreased 81.4% and went from an expense of R$492.7 million in 2022 to an expense of R$235.7 million in 2023, mainly

due to (i) higher gains on sale- leaseback transactions

in 2023 related to 6 aircraft and 12 engines; and (ii) increase in 2023 of other tax lawsuit expenses. Other operating revenues

(expenses), net per seat-kilometer provided, went from an expense of R$1.21 cents in 2022 to

an expense of R$0.55 cents in 2023, a reduction of 54.6%, for the same reasons.

Financial income

In 2023, the

net financial income recorded negative R$4,295.8 million, compared to negative R$2,074.8 million in 2022. In 2023, GOL recorded gains

with exchange rate variations of R$177.3 million, while in 2022 it recorded losses with exchange rate variations of R$328.2 million.

Income taxation

Income tax

and social contribution in 2023 was an expense of R$265.5 million, compared to revenues of R$43.8 million recorded in 2022.

Cash flow

Operating activities:

we had a net cash flow from operating activities of R$1,821.7 million in 2023, compared to R$2,168.8 million in 2022.

Investment activities:

we had net cash flows from investing activities of R$871.9 million in 2023, compared to R$787.5 million in 2022.

Financing activities:

we had net cash flows used in financing activities of R$626.4 million in 2023, compared to R$1,673.5 million in 2022.

The Income Statement

for the Year and the Company's cash flow are included in its financial statements, which are available at the Company's headquarters and

website, as well as published on the CVM portal.

ITEM FRE 2.2 –

OPERATING AND FINANCIAL INCOME

Financing activities: we had net

cash flows used in financing activities of R$636.4 million in 2023, compared to R$1,673.5 million in 2022.

The Income Statement

for the Year and the Company's cash flow are contained in its financial statements, which are available at the Company's headquarters

and website, as well as being disclosed on the CVM website.

| a. | results of the Company´s operations |

| i. | description of any material components of the revenue |

Our total net

revenue is derived from passenger transportation revenue, our On Board Sales, fees for rebooking, reimbursement and cancellation of tickets,

also by revenues from “GOL+ Conforto” in the domestic market and the sale of “GOL+ Conforto” seats in international

flights and ancillary revenue comprising cargo revenue, from our frequent flyer program Smiles (ex-GOL), among others.

| ii. | factors that materially affected the operating income |

Our operating income in 2023

was affected by the following key factors:

Increase in operating

revenue: GOL recorded a total net revenue for the year of R$18,774.0 million, 23.5% higher than 2022. This is due to the increased demand

in the domestic and international leisure air travel market and the increased yield.

Structural increase

in our operating cost which totaled R$15,435.0 million, an increase of 5.4% over the previous year, mainly: due to increase in the maintenance

material and repair expenses.

b.

significant changes in revenues attributable to the introduction of new products and services, changes in volumes and changes

in prices, exchange rates and inflation

Net Revenue Variation

in 2023: The net revenue presented an increase of 23.5% in relation to 2022. This is due to increased demand in the domestic and international

leisure air travel market and increased income.

c.

significant impacts of inflation, price variation of the main inputs and products, exchange and interest rates on the operating

result and financial income

of the Company

Fuel price:

The price of aviation kerosene varies, both in the short and long term, in line with variations in the price of crude oil and its derivatives,

in addition to the exchange rate variation, given that these disbursements are priced in US currency.

On December 31, 2023,

the expenses with fuel in the year accounted for 38.6% of the costs, with an average price per liter of aviation kerosene (QAV) reaching

R$4.85, a reduction of 14.2% in comparison with the previous year. In this period, fuel costs

totaled R$5,950.3 million.

Tariffs: We are allowed

to set our own domestic rates without prior government approval and to offer discounts on their prices or pursue other promotional activities.

In 2023, The yield,

the main fare indicator used by the sector, which represents the average amount paid to fly

one kilometer, showed an increase of 12.8% over the previous year.

Exchange rate: Exchange

rate risk arises from the possibility of unfavorable variation in the foreign currencies to which our liabilities or our cash flow are

exposed.

The exposure of

our equity items to foreign currency risk arises mainly from leases and financing in foreign currency.

Interest rate:

Our income is exposed to fluctuations in domestic and International interest rates, substantially to the CDI and Libor, respectively.

ITEM FRE 2.3 - CHANGES IN ACCOUNTING PRACTICES - MODIFIED

OPINIONS AND

EMPHASES IN THE AUDITOR’S REPORT

a.

changes in accounting practices that have resulted in significant effects on the information provided in fields 2.1 and 2.2

There have been no changes in any accounting

practices with respect to the previous period that have a significant effect on the financial and equity position of the Company.

| b. | modified opinions and emphases present in the auditor's report |

There are no modifications on the

independent auditor's report related to the individual and consolidated financial statements for 2023.

The independent

auditors included an emphasis paragraph related to the Company's operational continuity, transcribed below, due to the negative net working

capital. Management's plans for business continuity are disclosed in explanatory note 1.3 of the aforementioned statements.

Significant uncertainty related

to the Company`s ability to continue as a going concern

We draw attention to the explanatory

note 1.2 to the parent company and consolidated financial statements, which states the Company incurred in loss, parent company and consolidated

of R$1,222 million, for the year ended December 31, 2023 and, as of that date, current liabilities of the Company exceeded current assets,

parent company and consolidated, by R$799 million and R$9,973 million, respectively. Additionally, on January 25, 2024, the Company commenced

voluntary petitions for reorganization under the United States Bankruptcy Court for the Southern

District of New York, based on the rules of the United States Bankruptcy Code (“Chapter

11”). As disclosed in the explanatory note 1.2, these events or conditions, together with other matters described in the explanatory

note 1.2, indicate the existence of significant uncertainty that can raise substantial doubts about the Company`s ability to continue

as a going concern. Our opinion is not modified in respect of this matter.

ITEM FRE 2.4 - RELEVANT EFFECTS ON

FINANCIAL STATEMENTS AND RESULTS

| a. | introduction or disposal of operating segment |

None.

| b. | formation, acquisition or disposal of equity interest |

None.

| c. | unusual events or operations |

None.

ITEM FRE 2.5 - NON-ACCOUNTING MEASUREMENTS

| a. | value of the non-accounting measurements |

Item not applicable, as we do not

disclose non-accounting measurements in the financial statements.

b.

reconciliations between the disclosed values and the values in the audited financial statements

Item not applicable, as we do not disclose

non-accounting measurements in the financial statements.

c.

reason why such measurement is more appropriate for the correct understanding of its financial condition and the results

of its operations

Item not applicable, as we do not disclose

non-accounting measurements in the financial statements.

ITEM FRE 2.6 - EVENTS SUBSEQUENT TO THE LATEST

FINANCIAL STATEMENTS WHICH MAY CHANGE THEM SUBSTANTIALLY

On January 25,

2024, the Company and its subsidiaries voluntarily filed for Chapter 11 in the United States Bankruptcy Court for the Southern District

of New York (U.S. Court), as mentioned in the Capital Structure and Financial Restructuring section above.

On January 26,

2024, the New York Stock Exchange ("NYSE") suspended the trading of the Company's American Depositary Shares ("ADSs")

and shall request the Securities and Exchange Commission to cancel the listing of the ADSs, the usual procedure after completing the filing

under Chapter 11 in accordance with Section 802.01D of the NYSE Listed Company Manual.

GOL initiated the

legal process in the United States upon a financing commitment of US$950 million, in the debtor in possession (“DIP”) modality,

by members of the Ad Hoc Group of Abra Bondholders and other Abra Bondholders, which were approved by the

U.S. Court

on January 29, 2024. On January 29 and 30, 2024, the Company received the first installment of the DIP in the total amount of US$350 million

and on February 28, 2024, the court approved the second installment of US$150 million, as well as the additional US$ $50 million financed

by 2026 bondholders, thus bringing total DIP to $1 billion. DIP financing is subject to certain objectives and contractual agreements.

The financing,

together with the cash generated from ongoing operations, shall provide substantial liquidity to support business as usual during the

financial restructuring process. Upon the support of the Court-supervised process and the additional liquidity of the DIP financing, GOL's

passenger flights, GOLLOG's cargo flights, the Smiles loyalty program and other Company operations continue to operate normally.

ITEM FRE 2.7 - DESTINATION OF SOCIAL

RESULTS

| a. | rules on profit withholding |

In accordance

with Article 193 of Law 6404/76 and item "a" of § 2, of Article 34 of the Company's Bylaws, the Company must maintain a

legal reserve to which it must allocate 5% of the net profit of each fiscal year up to the limit in which the amount of the reserve is

equal to 20% of the paid-in capital. The Company is not obliged to allocate amounts to the legal reserve in the year in which the balance

of this reserve, plus the amount of capital reserves relating to the subscription of shares and proceeds from the sale of beneficial parties

and subscription bonuses, exceeds 30% of the capital stock. Furthermore, whenever the amount of the minimum mandatory dividend exceeds

the realized portion of the net profit for the year, the management may propose, and the General Meeting approves, allocating the excess

to the creation of a profit reserve to be realized, in accordance with Article 197, of Law 6404/76. By taking into consideration that

the Company recorded a loss in the fiscal year ended December 31, 2023, there will be no distribution of dividends to shareholders for

this year.

| b. | rules on dividend distribution |

As per §

2 of Article 34 of the company's articles of incorporation, any accumulated losses and the provision for income tax shall be deducted

from the results of the year, before any interest. After this deduction, the following shall be allocated: a) 5% to the legal reserve,

up to 20% of the paid-in capital; b) from the balance of net profit for the year, obtained after the deduction referred to in the previous

paragraph and adjusted in accordance with art. 202 of Law nº 6404/76, 25% shall be allocated to the payment of mandatory dividends

to all shareholders; c) whenever the amount of the minimum mandatory dividend exceeds the realized portion of the net profit for the year,

the management may propose, and the General Meeting approves, allocating the excess to

the creation

of a profit reserve to be realized, in accordance with Article 197, of Law 6404/76; and d) assuming the approval by the General Meeting

and if it does not decide otherwise, the remaining balance shall be allocated as assigned by the Board of Directors.

| c. | periodicity of dividend distributions |

Annually.

However, the Board of Directors of the Company may determine the preparation of balance sheets at any time, respecting the legal precepts,

and approve the distribution of interim dividends based on the profits recorded (§ 2 of Art. 33 of the Company's Bylaws). At any

time, the Board of Directors may also decide on the distribution of interim dividends to the retained earnings account or the existing

profit reserve (Art. 33, § 3, of the Company's Bylaws).

d.

possible restrictions on the distribution of dividends imposed by legislation or special regulations applicable to the Company,

as well as contracts, judicial, administrative or arbitration decisions.

The §4 of Article

202 of Law 6404/75 allows a publicly-held company to suspend the mandatory distribution of dividends in any fiscal year in which the Board

of Directors reports to the general shareholders meeting that the distribution would be inadvisable in view of the financial situation

of the company, as well as in case the Company has retained losses relating to previous fiscal years. In this event, the audit committee,