0000898437 False 0000898437 2024-05-02 2024-05-02 iso4217:USD xbrli:shares iso4217:USD xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 2, 2024

_______________________________

Anika Therapeutics, Inc.

(Exact name of registrant as specified in its charter)

_______________________________

| Delaware | 001-14027 | 04-3145961 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

32 Wiggins Avenue

Bedford, Massachusetts 01730

(Address of Principal Executive Offices) (Zip Code)

(781) 457-9000

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

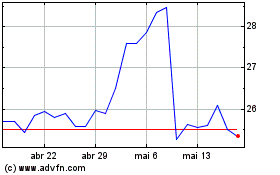

| Common Stock, par value $0.01 per share | ANIK | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On May 8, 2024, Anika Therapeutics, Inc. (the “Company”) announced that Stephen Griffin would be joining the Company as its Executive Vice President, Chief Financial Officer and Treasurer, effective June 3, 2024 (the “Effective Date”), replacing Michael Levitz, who tendered his resignation on May 2, 2024 and who will provide transitional services and continue in an advisory role as an employee of the Company with an anticipated end date of December 31, 2024. Effective as of the Effective Date, Mr. Griffin will serve as the Company’s principal financial officer.

In connection with Mr. Griffin’s appointment as Executive Vice President, Chief Financial Officer and Treasurer, the Company and Mr. Griffin entered into an offer letter, dated May 2, 2024 (the “Offer Letter”), which provides that Mr. Griffin will receive an initial annual base salary of $500,000, and a target annual performance bonus of up to 60% of Mr. Griffin’s annual base salary. Mr. Griffin will also be granted equity awards with an aggregate value of $2,000,000 as of the date of grant, split evenly between restricted stock units and premium priced time-vesting non-qualified stock options, under the Company’s 2021 Inducement Plan, on Mr. Griffin’s date of commencement of employment with the Company (“Grant Date”). These awards shall vest in three equal annual installments beginning one year from the Grant Date, subject to Mr. Griffin’s continued employment with the Company through the applicable vesting date. Mr. Griffin will also be eligible to participate in all customary employee benefit plans or programs generally available to the Company’s full-time employees and executive officers. The Company and Mr. Griffin also entered into an Executive Retention Agreement, effective on the Effective Date (the “Executive Retention Agreement”), which provides for certain severance protections in the event of Mr. Griffin’s involuntary or constructive termination, including in connection with a change in control of the Company.

There are no arrangements or understandings with any other person pursuant to which Mr. Griffin was appointed as the Company’s Executive Vice President, Chief Financial Officer and Treasurer and there are no family relationships between Mr. Griffin and any director or executive officer of the Company. Additionally, there are no transactions between Mr. Griffin and the Company that would be required to be reported under Item 404(a) of Regulation S-K.

In connection with the departure of Mr. Levitz from his positions as Executive Vice President, Chief Financial Officer and Treasurer, the Company and Mr. Levitz entered into a Transitional Services and Separation Agreement, dated May 2, 2024 (the “Separation Agreement”). Pursuant to the terms of the Separation Agreement, Mr. Levitz will continue to be employed by the Company and receive his current salary through December 31, 2024 or the earlier termination of Mr. Levitz’s employment as provided in the Separation Agreement. The Separation Agreement also provides that Mr. Levitz will receive a one-time payment of $100,000. Mr. Levitz continues to be bound by the terms and conditions of the confidentiality and proprietary rights agreement executed in connection with his employment with the Company. Additionally, in consideration of the separation pay and benefits provided by the Separation Agreement, Mr. Levitz has provided the Company, its affiliates and related parties with a general release of claims.

The foregoing descriptions of the Offer Letter, Executive Retention Agreement and Separation Agreement are qualified in their entirety by reference to the Offer Letter, Executive Retention Agreement and Separation Agreement, which are filed with this Current Report on Form 8-K as Exhibits 10.1, 10.2 and 10.3, respectively, and are incorporated herein by reference.

Information about Mr. Griffin’s business experience can be found in the press release detailing Mr. Griffin’s appointment as Executive Vice President, Chief Financial Officer and Treasurer issued by the Company on May 8, 2024, attached as Exhibit 99.1 hereto, which biographical information contained in paragraph six thereof is incorporated into this Item 5.02 by reference.

Item 9.01. Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | Anika Therapeutics, Inc. |

| | | |

| | | |

| Date: May 8, 2024 | By: | /s/ Cheryl R. Blanchard |

| | | Cheryl R. Blanchard |

| | | President and Chief Executive Officer |

| | | |

Exhibit 10.1

May 2, 2024

Stephen Griffin

7030 Elizabeth Drive

McLean, VA 22101

Dear Stephen:

I am pleased to confirm our offer to you to join

Anika Therapeutics, Inc. (“Anika” or the “Company”).

We are excited about the prospect of having you join our team and look forward to the addition of your professionalism and experience

to help the Company achieve its goals. This letter summarizes the initial terms of our offer for your employment with the Company.

Starting Position: Executive Vice President, Chief Financial Officer and Treasurer

Description of Duties: You will serve as a key member of the corporate leadership

team. Your initial duties will include those intrinsic to your position, as described in the draft job description being provided to

you with this offer letter and such other duties, reasonably consistent with your position, as may be assigned to you from time to time.

Also, you shall be responsible for performing any duties assigned to you by or under the authority of the Company that are appropriate

for an individual of your experience. You will be expected to devote your full business time and your best professional efforts

to the performance of your duties and responsibilities for the Company.

Reporting To: Cheryl Blanchard, Ph.D., President and Chief Executive

Officer

Employment Date: Anticipated to be June 3, 2024 unless otherwise

agreed upon

Initial Rate of Pay: $19,230.77 per bi-weekly

payroll (which equates to an annualized rate of $500,000). You will be paid in accordance with the Company’s normal payroll

practices as established or modified from time to time, and your compensation shall be subject to all applicable federal, state and local

taxes and withholdings. Currently, paychecks are issued on alternating Fridays.

Bonus Eligibility: You will be eligible to receive a discretionary annual cash

bonus. Your initial annual target bonus is 60% of your annualized base salary, subject to all applicable taxes and withholdings.

Your eligibility for this bonus shall be subject to determination by the Board of Directors and based on the Company's performance

and your personal performance against key objectives. Your actual bonus payout may be adjusted depending on your and the

Company’s performance, at the sole discretion of the Company’s Board of Directors. Notwithstanding the above, for the

2024 bonus cycle only, you will be guaranteed at least 100% of your annual target bonus, and will be eligible to receive amounts

above 100% in the discretion of the Company’s Board of Directors.

Equity Award: Subject to the approval of the Compensation Committee of the Board of

Directors of the Company, you will be granted equity awards with an aggregate value of $2,000,000 as of the date of grant, split

evenly between restricted stock units (“RSUs”) and premium-priced stock options (“PPISOs”), on the

first business day of the subsequent month following your start date (“Grant Date”). The

actual number of RSUs will be determined based on Anika’s average closing share price over the 20 trading days prior to the

Grant Date (“Average Closing Price”) and the number of shares underlying the PPISOs will be determined using the Average

Closing Price and applying the Company’s standard fair market valuation. The exercise price for the PPISOs will be set 10%

above Anika’s closing price on the Grant Date, and these should be viewed as performance incentives. The RSUs and PPISOs will

vest in three equal annual installments beginning one year from the grant date, subject to the terms of the grant, as long as you

continue to be employed by Anika or one of Anika’s subsidiaries. Each of these awards will be granted under, and governed by,

an Anika Therapeutics, Inc. equity plan and/or any applicable grant instruments. The awards referenced herein are offered as an

inducement material to your entering into employment with the Company (within the meaning of Rule 4635(c)(4) of the Nasdaq Stock

Market LLC Rules).

Benefits: You will be eligible to participate

in the Anika employee benefit programs upon commencement of employment to the same extent as, and subject to the same terms, conditions

and limitations applicable to, other employees of the Company of similar rank and tenure. This program currently

includes comprehensive medical, vision and dental benefits, life and disability insurance, supplemental disability insurance, and a Section

125 Plan. You will be eligible to participate in our 401(k) Savings and Investment Plan at the first enrollment date (first day of each

month) that is thirty (30) days following your date of hire. Unless you change the automatic contribution rate during your first thirty

(30) days, you will be automatically enrolled at 5% contribution to take advantage of the full match. Under the current terms, the 401(k)

plan entitles you to contribute up to the maximum limit established by the IRS. Furthermore, under the current 401(k) plan, the Company

will match 140% of your contribution up to 5% of your eligible compensation or to the limit specified by the Internal Revenue Code. There

is a four-year vesting schedule. The amount of the Company match is subject to the discretion of the Company.

Your participation in the benefit plans will be governed by and subject to the plan terms as described in

the official documents and Summary Plan Descriptions. Please note that the Company may alter, add to, modify or delete its benefits

programs at any time.

Vacation: You are eligible for vacation days,

which will accrue in accordance with Anika’s vacation policy, as may be modified from time to time, in the sole discretion of the

Company. Subject to the current terms of accrual and use set forth in Anika’s policies, you will accrue

four weeks of vacation during your first year of employment.

Termination of Employment:

| 1) | Resignation or Termination for Cause: Notwithstanding the at-will relationship

between you and the Company, if you voluntarily resign employment or are terminated for “Cause” at any time, all compensation

and benefits payable to you under this Agreement shall terminate on the date of termination of your employment. |

| | | |

| | | For purposes of this offer letter, “Cause” shall mean any one or

more of the following: (i) substantial and continuing neglect or inattention to your duties; (ii) willful misconduct or gross

negligence in connection with the performance of such duties; (iii) the commission of an act of embezzlement, fraud or deliberate

disregard of the rules or policies of the Company which results in economic loss, damage or injury to the Company; (iv) the

unauthorized disclosure of any trade secret or confidential information of the Company or any third party who has a business

relationship with the Company or the violation of any non-competition covenant obligation with the Company; (v) the commission of an

act which induces any customer or prospective customer of the Company to break a contract with the Company or to decline to do

business with the Company; (vi) the commission of an act which induces any investor or prospective investor in any investment entity

affiliated with or managed by the Company to break a contract with such investment entity or to decline to invest in such investment

entity, (vii) the conviction of a felony involving any financial impropriety or which would materially interfere with the

performance of services or otherwise be injurious to the Company; or (viii) the failure to perform in a material respect your

services or duties without proper cause. |

| 2) | Termination Without Cause: Termination of your employment without Cause, for “Good Reason,”

or in conjunction with a Change in Control shall be regulated by the Executive Retention Agreement being provided with this Offer

Letter, which shall be effective once executed upon your start date. |

Confidentiality and Proprietary Rights Agreement:

You understand that as a condition of your employment, you will be required to execute Anika's Confidentiality and Proprietary Rights

Agreement, a copy of which is enclosed. You further understand

that the Anika Confidentiality and Proprietary Rights Agreement contains conditions that will survive the termination of your employment,

regardless of the reason for that termination.

Arbitration: Except for any request by the Company or

by you for temporary, preliminary or permanent injunctive relief from a court of competent jurisdiction to enforce or enjoin any

portion of the Confidentiality and Proprietary Rights Agreement (which right shall remain in full force and effect following

the termination of your employment with the Company), in the event of any dispute, controversy or claim arising out of or relating

to this offer letter, your employment with the Company, or the termination of your employment including but not limited to, any

claims arising out of M.G.L. ch.151B, Title VII of the Civil Rights Act of 1964, the Americans with Disabilities Act, the Age

Discrimination in Employment Act, the Older Workers’ Benefit Protection Act, the Family and Medical Leave Act, the Small

Necessities Leave Act, the Massachusetts Civil Rights Act (M.G.L. ch. 12), the Massachusetts Paid Sick Leave Act, the Massachusetts

Paid Family Leave Act, the Massachusetts Domestic Violence Leave Act, the Massachusetts Equal Pay Act, or any other federal, state

or local statute, regulation or ordinance that provides protection against employment discrimination, harassment or retaliation; any

claims under the Fair Labor Standards Act or M.G.L. ch. 149, including without limitation the Massachusetts Wage Act, or any other

federal, state or local statute, regulation or ordinance that provides protection against wage and hour and/or wage payment

violations; any claims under the federal or state equal pay act; any tort and/or privacy claims, including those under the

Massachusetts Privacy Statute (M.G.L. ch. 214), that dispute, controversy or claim shall, to the fullest extent permitted by law, be

settled by binding arbitration before an arbitrator experienced in employment law. This arbitration provision does not waive or

limit a right to file an administrative charge or to cooperate with an administrative agency (e.g., the National Labor Relations

Board, the Equal Employment Opportunity Commission, or similar agencies). You also understand that you are not waiving rights under

Section 7 of the National Labor Relations Act and will not be disciplined or threatened with discipline for exercising such rights.

Said arbitration will be conducted in accordance with the Employment Dispute Resolution Rules and Mediation Procedures of the

American Arbitration Association (“AAA”) in Boston, Massachusetts, including, but not limited to, the

rules and procedures applicable to the selection of arbitrators (or alternatively, in any other forum or in any other form agreed

upon by the parties). Each party will pay the fees for his, her, or its own attorneys, subject to any remedies to which that

party may later be entitled under applicable law. Unless otherwise prohibited by law, if you initiate arbitration, you are

responsible for paying an initial filing fee of $200, or an amount equal to the applicable filing fee had the claim been brought in

a court of law, whichever is less. However, in all cases where required by law, the Company will pay the Arbitrator’s and any

fee for administering the arbitration. If under applicable law the Company is not required to pay all of the Arbitrator’s

and/or arbitration fees, such fee(s) will be apportioned between the parties in accordance with applicable law, and any disputes

regarding costs/fees associated with arbitration will be resolved by the Arbitrator. In the event that

any person or entity other than you or Anika may be a party with regard to any such controversy or claim, such controversy or claim

shall be submitted to arbitration subject to such other person or entity's agreement. Judgment upon the award rendered by the

arbitrator may be entered in any court having jurisdiction thereof. This provision shall be specifically enforceable. Arbitration as

provided in this section shall be the exclusive, final and binding remedy for any such dispute and will be used instead of any court

action, which is hereby expressly waived. The Federal Arbitration Act shall govern the interpretation and enforcement of such

arbitration proceeding. The arbitrator shall apply the substantive law (and the law of remedies, if applicable) of the Commonwealth

of Massachusetts, or federal law, if Massachusetts law is preempted. You acknowledge and understand that by agreeing to arbitrate,

you are waiving any right to bring an action against the company in a court of law, either state or federal, and the right to a

trial by jury, except as otherwise expressively set forth in this agreement.

Background Check and Drug Testing: You understand

and agree that all employees are subject to a background check, including verification of education, and drug testing. You

will be sent a link to the on-line information and release. This

offer is conditioned on the background check and drug testing results being satisfactory to the Company.

Reference Checks: You also understand and agree this offer is contingent upon

the completion of satisfactory reference checks in the sole discretion of the Company.

At-Will Employment: You, like everyone else at Anika, will be an at-will

employee. This means that, if you accept this offer, both you and the Company will retain the right to terminate your employment at any

time, with or without notice or cause. In accepting this offer, you give us assurance that you have not relied on any agreement or representation,

express or implied, with respect to your employment that is not set forth expressly in this letter. The terms of your employment will

be interpreted in accordance with and governed by the laws of the Commonwealth of Massachusetts.

Representation Regarding Other Agreements: Finally, this offer is conditioned

on your representation that you are not subject to any confidentiality or non-competition agreement, court order, or any similar type

of restriction that would affect your ability to devote full time and attention to your work at Anika. You further agree that you will

not disclose to, or use on behalf of, the Company any proprietary information of a third party without that party's consent.

Eligibility to Work. Your employment with the Company is conditioned on your

eligibility to work in the United States and on your providing to the Company proof of identification and authorization to work in the

United States, in accordance with the Immigration and Control Act of 1986. Should you choose to accept this offer, as required by law,

we must verify your employment eligibility on Form I-9 the day you begin your employment, so you will be asked to provide documentation

that establishes your identity and authorizes you to work in the United States. Furthermore, if applicable, you must always maintain your

visa status throughout your tenure with the Company, as it is Company policy to comply with all immigration laws and regulations. Please

let the Company know if you have any questions concerning your visa status.

Company Policies and Procedures. As a further condition of employment, you will

be required to abide by all Company policies and procedures, as in effect from time to time.

We feel you will be an outstanding addition to our organization and look forward

to you joining the Anika team. If the terms of this offer are acceptable, please indicate your acceptance by signing both copies of this

letter, the Anika Confidentiality and Proprietary Rights Agreement, and the Executive Retention Agreement, and return one

copy of each back to me. This offer is valid until May 10, 2024.

Sincerely,

Cheryl Blanchard

President & CEO

Agreed and accepted:

|

|

03-May-2024 |

|

| Stephen Griffin |

|

Date |

|

Enclosures:

Executive Retention Agreement

Confidentiality and Proprietary Rights Agreement Job Description

Exhibit 10.2

ANIKA THERAPEUTICS, INC.

EXECUTIVE

RETENTION AGREEMENT

Anika Therapeutics, Inc., a Delaware

corporation (the “Company”), and Stephen Griffin (the “Executive”) enter into this Executive Retention

Agreement (the “Agreement”) dated as of June 3, 2024 (the “Effective Date”).

WHEREAS,

the Company desires to provide and the Executive desires to accept the severance protections provided herein in the event of the Executive’s

involuntary or constructive termination, including in connection with a change in control of the Company.

NOW,

THEREFORE, in consideration of the mutual covenants and agreements herein contained and other good

and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties agree as follows:

1.

Key Definitions. As used herein, the following terms shall have the following respective meanings:

(a)

“Cause” shall be defined as that term is defined in the Executive’s offer letter, employment agreement,

or other similar agreement; or if there is no such definition, “Cause” means, as determined by the Company in its sole discretion,

any of the following:

(i)

substantial and continuing neglect or inattention to the Executive’s duties;

(ii)

willful misconduct or gross negligence in connection with the performance of such duties;

(iii)

the commission of an act of embezzlement, fraud, or deliberate disregard of the rules or policies of the Company, which results

in economic loss, damage, or injury to the Company;

(iv)

the unauthorized disclosure of any trade secret or confidential information of the Company or any third party who has a business

relationship with the Company or the violation of any non-competition obligation to the Company;

(v)

the commission of an act that induces any customer or prospective customer of the Company to break a contract with the Company

or to decline to do business with the Company;

(vi)

the commission of an act that induces any investor or prospective investor in any investment entity affiliated with or managed

by the Company to break a contract with such investment entity or to decline to invest in such investment entity;

(vii)

the conviction of a felony involving any financial impropriety or which would materially interfere with the performance of services

or otherwise be injurious to the Company; or

(viii)

the failure to perform in a material respect the Executive’s services or duties without proper cause.

(b)

“Change in Control” shall mean any of the following:

(i)

any “person,” as such term is used in Sections 13(d) and 14(d) of the Securities Exchange Act of 1934, as amended (the

“Act”) (other than the Company, any of its subsidiaries, or any trustee, fiduciary or other person or entity holding

securities under any employee benefit plan or trust of the Company or any of its subsidiaries), together with all “affiliates”

and “associates” (as such terms are defined in Rule 12b-2 under the Act) of such person, shall become the “beneficial

owner” (as such term is defined in Rule 13d-3 under the Act), directly or indirectly, of securities of the Company representing

more than 50 percent of the combined voting power of the Company’s then outstanding securities having the right to vote in an election

of the Board (“Voting Securities”) (in such case other than as a result of an acquisition of securities directly from

the Company); or

(ii)

the date a majority of the members of the Board is replaced during the longer of (a) any 12-month period or (b) the period covering

two consecutive annual meetings of the Company’s stockholders, in either case by directors whose appointment or election is not

endorsed by a majority of the members of the Board before the date of the appointment or election (other than an endorsement that occurs

as a result of an actual or threatened election contest with respect to the election or removal of directors or other actual or threatened

solicitation of proxies or consent by or on behalf of a person other than the Board); or

(iii) the

consummation of (A) any consolidation or merger of the Company where the stockholders of the Company, immediately prior to the

consolidation or merger, would not, immediately after the consolidation or merger, beneficially own (as such term is defined in Rule

13d-3 under the Act), directly or indirectly, shares representing in the aggregate more than 50 percent of the voting shares of the

Company issuing cash or securities in the consolidation or merger (or of its ultimate parent corporation, if any), or (B) any sale

or other transfer (in one transaction or a series of transactions contemplated or arranged by any party as a single plan) of all or

substantially all of the assets of the Company.

Notwithstanding the foregoing, a “Change

in Control” shall not be deemed to have occurred for purposes of the foregoing clause (i) solely as the result of an acquisition

of securities by the Company which, by reducing the number of shares of Voting Securities outstanding, increases the proportionate number

of Voting Securities beneficially owned by any person to more than 50 percent of the combined voting power of all of the then outstanding

Voting Securities; provided, however, that if any person referred to in this sentence shall thereafter become the beneficial owner of

any additional shares of Voting Securities (other than pursuant to a stock split, stock dividend, or similar transaction or as a result

of an acquisition of securities directly from the Company) and immediately thereafter beneficially owns more than 50 percent of the combined

voting power of all of the then outstanding Voting Securities, then a “Change in Control” shall be deemed to have occurred

for purposes of the foregoing clause (i).

(c)

“Disability” means inability to perform the essential functions of the Executive’s then existing position

or positions under this Agreement with or without reasonable accommodation for a period of 180 days (which need not be consecutive) in

any 12-month period.

(d)

“Good Reason” shall mean that the Executive has complied with the Good Reason Process (hereinafter defined)

following the occurrence of any of the following events: (i) a material diminution in the Executive’s responsibilities, authority

or duties; (ii) a material diminution in the

Executive’s annual base salary except

for across-the-board salary reductions based on the Company’s financial performance similarly affecting all or substantially all

senior management employees of the Company; (iii) a material change in the geographic location at which the Executive provides services

to the Company, which is a relocation of more than 75 miles from the Company’s Bedford, Massachusetts headquarters, not otherwise

agreed between the Executive and the Company; or (iv) the material breach of this Agreement by the Company.

(e)

“Good Reason Process” shall mean that (i) the Executive reasonably determines in good faith that a “Good

Reason” condition has occurred; (ii) the Executive notifies the Company in writing of the occurrence of the Good Reason condition

within 60 days of the occurrence of such condition; (iii) the Executive cooperates in good faith with the Company’s efforts, for

a period not less than 30 days following such notice (the “Cure Period”), to remedy the condition; (iv) notwithstanding

such efforts, the Good Reason condition continues to exist; and (v) the Executive terminates his employment within 60 days after the end

of the Cure Period. If the Company cures the Good Reason condition during the Cure Period, Good Reason shall be deemed not to have occurred.

(f)

“Qualifying Termination” shall mean (i) a termination of the Executive’s employment by the Company without

Cause within 3 months prior to or 12 months after a Change in Control, or (ii) a termination of the Executive’s employment by the

Executive for Good Reason within 12 months after a Change in Control.

2.

Term of Agreement. This Agreement shall take effect upon the Effective Date and shall expire upon the first to occur of

(a) the expiration of the Term (as defined below) if a Change in Control has not occurred during the Term, (b) the date 12 months after

the Change in Control Date, if the Executive is still employed by the Company as of such later date, or (c) the fulfillment by the Company

of all of its obligations under Sections 4 and 5 if the Executive’s employment with the Company terminates during the Term or within

12 months following the Change in Control Date. “Term” shall mean the period commencing as of the Effective Date and

continuing in effect through December 31 of the year of the Effective Date; provided, however, that commencing on January 1 of

the year following the year of the Effective Date, and each January 1 thereafter, the Term shall be automatically extended for one additional

year unless, not later than 90 days prior to the scheduled expiration of the Term (or any extension thereof), the Company shall have given

the Executive written notice that the Term will not be extended.

3.

Date of Termination.

(a)

Termination by Company for Cause. The Company may terminate the Executive’s employment for Cause at any time, subject

to any applicable notice or cure requirement related to the specific event triggering Cause.

(b)

Termination Without Cause. Any termination by the Company of the Executive’s employment that does not constitute a

termination for Cause or a termination due to the death or Disability of the Executive shall be deemed a termination without Cause.

(c)

Termination by Executive for Good Reason. In order to terminate employment for Good Reason, the Executive must comply with

the Good Reason Process.

(d)

Notice of Termination. Except for termination due to the Executive’s death, any termination of the Executive’s

employment by the Company or any such termination by the Executive shall be communicated by written Notice of Termination to the other

party hereto. For

purposes of this Agreement, a “Notice

of Termination” shall mean a notice that indicated the specific termination provision in this Agreement relied upon.

(e)

Date of Termination. “Date of Termination” shall mean: (i) if the Executive’s employment is terminated

by the Company without Cause, the date specified in the Notice of Termination (not earlier than the date the Notice of Termination is

given); (ii) if the Executive’s employment is terminated by the Executive without Good Reason, the date specified in the Notice

of Termination (not earlier than the date the Notice of Termination is given); and (iii) if the Executive’s employment is terminated

by the Executive for Good Reason, the date on which a Notice of Termination is given after the end of the Cure Period. Notwithstanding

the foregoing, in the event that the Executive gives a Notice of Termination to the Company, the Company may unilaterally accelerate the

Date of Termination and such acceleration shall not result in a termination by the Company for purposes of this Agreement.

4.

Compensation Upon Termination.

(a)

Termination Generally. If the Executive’s employment with the Company is terminated for any reason during the Term,

the Company shall pay or provide to the Executive (or to his authorized representative or estate) any earned but unpaid base salary, incentive

compensation earned but not yet paid, unpaid expense reimbursements, accrued but unused vacation and any vested benefits the Executive

may have under any employee benefit plan of the Company (the “Accrued Benefit”) within 30 days of the Executive’s

Date of Termination.

(b)

Termination by Company Without Cause. If the Executive’s employment is terminated by the Company without Cause, then

the Company shall, through the Date of Termination, pay the Executive his Accrued Benefit. If the Executive signs a general release of

claims in a form and manner satisfactory to the Company (the “Release”) within 45 days of the receipt of the Release

(which shall be provided no later than within two business days after the Date of Termination) and does not revoke such Release during

the seven-day revocation period,

(i)

the Company shall pay the Executive an amount (the “Severance Amount”) equal to 12 months of the Executive’s

annual base salary for the fiscal year in which the Date of Termination occurs. The Severance Amount shall be paid out in substantially

equal installments in accordance with the Company’s payroll practice over six months, beginning within 60 days after the Date of

Termination; provided, however, that if the 60-day period begins in one calendar year and ends in a second calendar year, the Severance

Amount commence to be paid in the second calendar year. Solely for purposes of Section 409A of the Internal Revenue Code of 1986, as amended

(the “Code”), each installment payment is considered a separate payment. Notwithstanding the foregoing, if the Executive

breaches any of the obligations contained in Section 7 of this Agreement, all payments of the Severance Amount shall immediately cease;

and

(ii)

subject to the Executive’s copayment of premium amounts at the active employees’ rate, the Executive may continue to

participate in the Company’s group health, dental and vision program for 12 months; provided, however, that the continuation of

health benefits under this Section shall reduce and count against the Executive’s rights under the Consolidated Omnibus Budget Reconciliation

Act of 1985, as amended (“COBRA”); provided, however, that if the Company determines necessary to avoid any adverse

tax or other consequences for the Executive or the Company, the Company may instead pay to the Executive on a monthly basis during the

period covered by this Section

4(b)(ii) an amount equal to the difference

between the applicable COBRA premium and the applicable active employees’ rate for the coverage.

5.

Change in Control. The provisions of this Section set forth certain terms of an agreement reached between the Executive

and the Company regarding the Executive’s rights and obligations upon the occurrence of a Change in Control of the Company. These

provisions are intended to assure and encourage in advance the Executive’s continued attention and dedication to his assigned duties

and his objectivity during the pendency and after the occurrence of any such event. These provisions shall apply in lieu of, and expressly

supersede, the provisions of Section 4(b) regarding severance pay and benefits upon a termination of employment, if such termination of

employment occurs within 3 months prior to or 12 months after the occurrence of the first event constituting a Change in Control, provided

that such first event occurs during the Term. These provisions shall terminate and be of no further force or effect beginning 12 months

after the occurrence of a Change in Control, in which case the provisions of Section 4(b) shall once again become applicable.

(a)

Change in Control Benefits.

(i)

If the Executive incurs a Qualifying Termination, then:

(A)

Subject to the signing of the Release by the Executive within 45 days of the receipt of the Release (which shall be provided

no later than two business days after the Date of Termination) and not revoking the Release during the seven-day revocation period, the

Company shall pay the Executive a lump sum in cash in an amount (the “Change in Control Severance Amount”) equal to

1.5 times the sum of (I) the Executive’s current annual base salary (or the Executive’s annual base salary in effect immediately

prior to the Change in Control, if higher) plus (II) the Executive’s target annual bonus for the current fiscal year (or if higher,

the target annual bonus for the fiscal year immediately prior to the Change in Control). The Change in Control Severance Amount shall

be paid to the Executive by the 60th day after the later of the date of the Change in Control and the Date of Termination; provided, however,

that (x) if the Date of Termination occurs during the three-month period before the Change in Control, the payment under this Section

5(a)(i)(A) shall be reduced by any payments made under Section 4(b)(i) before the date of the Change in Control; and (y) to the extent

that the Company determines necessary to comply with Section 409A of the Code, all or a portion of the payments under this Section 5(a)(i)(A)

shall be made on the schedule set forth in Section 4(b)(i) rather than in a lump sum.

(B)

The Company shall pay to the Executive in a cash lump sum by the 60th day after the later of the date of the Change in Control

and the Date of Termination, an amount equal to 18 times the excess of (I) the monthly premium payable by former employees for continued

coverage under COBRA for the same level of coverage, including dependents, provided to the Executive under the Company’s group health

benefit plans in which the Executive participates immediately prior to the Date of Termination over (II) the monthly premium paid by active

employees for the same coverage immediately prior to the Notice of Termination.

(ii)

Notwithstanding anything to the contrary in any applicable option agreement or stock-based award agreement:

(A)

[Reserved]; and

(B)

All stock options and other stock-based awards held by the Executive (I) if assumed or continued by the successor in the

Change in Control (as set forth in Section 15.2.1(b) of the Company’s 2017 Omnibus Incentive Plan, or any similar provision in any

predecessor or successor plan), and the Executive incurs a Qualifying Termination, shall only immediately accelerate and become fully

exercisable or nonforfeitable upon the later of the Date of Termination or the effective date of the Change in Control, and (II) if not

assumed or continued by the successor in the Change in Control, shall immediately accelerate and become fully vested, exercisable and

nonforfeitable upon the effective date of the Change in Control. In that regard, for any such award that includes a performance-based

vesting condition, vesting shall be based on the greater of assumed target performance or actual performance measured through the date

of accelerated vesting.

For the avoidance of any doubt, the provisions

of this Section 5(a)(ii) shall supersede the provisions contained in the applicable award agreements, provided that the provisions of

the award agreements will control to the extent such provisions are more favorable to the Executive.

(b)

Section 280G. If any of the payments or benefits received or to be received by the Executive (including, without limitation,

any payment or benefits received in connection with a Change in Control or the Executive’s termination of employment, whether pursuant

to the terms of this Agreement or any other plan, arrangement or agreement, or otherwise) (all such payments collectively referred to

herein as the “280G Payments”) constitute “parachute payments” within the meaning of Section 280G of the

Code and would, but for this Section 6(b), be subject to the excise tax imposed under Section 4999 of the Code (the “Excise Tax”),

then prior to making the 280G Payments, a calculation shall be made comparing (i) the Net Benefit (as defined below) to the Executive

of the 280G Payments after payment of the Excise Tax to (ii) the Net Benefit to the Executive if the 280G Payments are limited to the

extent necessary to avoid being subject to the Excise Tax. Only if the amount calculated under (i) above is less than the amount under

(ii) above will the 280G Payments be reduced to the minimum extent necessary to ensure that no portion of the 280G Payments is subject

to the Excise Tax. “Net Benefit” shall mean the present value of the 280G Payments net of all federal, state, local,

and foreign income, employment, and excise taxes. Any reduction made pursuant to this Section 5(b) shall be made in a manner determined

by the Company that is consistent with the requirements of Section 409A of the Code.

6.

Section 409A.

(a)

Anything in this Agreement to the contrary notwithstanding, if at the time of the Executive’s separation from service within

the meaning of Section 409A of the Code, the Company determines that the Executive is a “specified employee” within the meaning

of Section 409A(a)(2)(B)(i) of the Code, then to the extent any payment or benefit that the Executive becomes entitled to under this Agreement

would be considered deferred compensation subject to the 20 percent additional tax imposed pursuant

to Section 409A(a) of the Code as a result of the application of Section 409A(a)(2)(B)(i) of the Code, such payment shall not be

payable and such benefit shall not be provided until the date that is the earlier of (i) six months and one day after the Executive’s

separation from service, or (ii) the Executive’s death. If any such delayed cash payment is otherwise payable on an installment

basis, the first payment shall include a catch-up payment covering amounts that would otherwise have been paid during the six-month period

but for the application

of this provision, and the balance of the

installments shall be payable in accordance with their original schedule. Any such delayed cash payment shall earn interest at an annual

rate equal to the applicable federal short-term rate published by the Internal Revenue Service for the month in which the date of separation

from service occurs, from such date of separation from service until the payment.

(b)

The parties intend that this Agreement will be administered in accordance with Section 409A of the Code. To the extent that any

provision of this Agreement is ambiguous as to its compliance with Section 409A of the Code, the provision shall be read in such a manner

so that all payments hereunder comply with Section 409A of the Code. The parties agree that this Agreement may be amended, as reasonably

requested by either party, and as may be necessary to fully comply with Section 409A of the Code and all related rules and regulations

in order to preserve the payments and benefits provided hereunder without additional cost to either party.

(c)

The determination of whether and when a separation from service has occurred shall be made in accordance with the presumptions

set forth in Treasury Regulation Section 1.409A-1(h). To the extent required by Section 409A of the Code, each reimbursement or in-kind

benefit provided under the Agreement shall be provided in accordance with the following: (i) the amount of expenses eligible for reimbursement,

or in-kind benefits provided, during each calendar year cannot affect the expenses eligible for reimbursement, or in-kind benefits to

be provided, in any other calendar year, (ii) any reimbursement of an eligible expense shall be paid to the Executive on or before the

last day of the calendar year following the calendar year in which the expense was incurred, and (iii) any right to reimbursements or

in-kind benefits under the Agreement shall not be subject to liquidation or exchange for another benefit.

(d)

The Company makes no representation or warranty and shall have no liability to the Executive or any other person if any provisions

of this Agreement are determined to constitute deferred compensation subject to Section 409A of the Code but do not satisfy an exemption

from, or the conditions of, such Section.

7.

Confidentiality and Proprietary Rights Agreement. Nothing in this Agreement supersedes the

terms of the Confidentiality and Proprietary Rights Agreement between the Executive and the Company. Any and all obligations of

the Company under this Agreement are contingent upon the Executive’s compliance with the Executive’s obligations under the

Confidentiality and Proprietary Rights Agreement.

8.

Arbitration of Disputes. Except for any request by the Company or by the Executive for temporary, preliminary, or permanent

injunctive relief from a court of competent jurisdiction to enforce or enjoin any portion of the Confidentiality and Proprietary Rights

Agreement (which right shall remain in full force and effect following the termination of the Executive’s employment with the Company),

in the event of any dispute, controversy, or claim arising out of or relating to this Agreement, the Executive’s employment with

the Company, or the termination of the Executive’s employment, including but not limited to, any claims arising out of M.G.L. ch.151B,

Title VII of the Civil Rights Act of 1964, the Americans with Disabilities Act, the Age Discrimination in Employment Act, the Family and

Medical Leave Act, the Small Necessities Leave Act, the Massachusetts Civil Rights Act (M.G.L. ch. 12), or any other federal, state, or

local statute, regulation, or ordinance that provides protection against employment discrimination, harassment, or retaliation; any claims

under the Fair Labor Standards Act or M.G.L. ch. 149 or any other federal, state, or local statute, regulation, or ordinance that provides

protection against wage and hour and/or wage payment violations; any claims under the federal or state equal pay act; any tort and/or

privacy claims, including those under the Massachusetts Privacy Statute (M.G.L. ch. 214), that dispute, controversy, or claim shall, to

the fullest extent permitted by law, be settled by binding arbitration before an arbitrator experienced in employment law. Said arbitration

will be conducted in accordance with

the Employment Dispute Resolution Rules

and Mediation Procedures of the American Arbitration Association (“AAA”) in Boston, Massachusetts, including, but not

limited to, the rules and procedures applicable to the selection of arbitrators (or alternatively, in any other forum or in any other

form agreed upon by the parties). In the event that any person or entity other than the Executive or Anika may be a party with regard

to any such controversy or claim, such controversy or claim shall be submitted to arbitration subject to such other person or entity’s

agreement. Judgment upon the award rendered by the arbitrator may be entered in any court having jurisdiction thereof. This provision

shall be specifically enforceable. Arbitration as provided in this section shall be the exclusive, final, and binding remedy for any such

dispute and will be used instead of any court action, which is hereby expressly waived. The Federal Arbitration Act shall govern the interpretation

and enforcement of such arbitration proceeding. The Executive acknowledges and understands that by agreeing to arbitrate, the Executive

is waiving any right to bring an action against the Company in a court of law, either state or federal, and the right to a trial by jury,

except as otherwise expressively set forth in this Agreement.

9.

Consent to Jurisdiction. To the extent that any court action is permitted consistent with or to enforce Section 8 of this

Agreement, the parties hereby consent to the jurisdiction of the Superior Court of the Commonwealth of Massachusetts and the United States

District Court for the District of Massachusetts. Accordingly, with respect to any such court action, the Executive (a) submits to the

personal jurisdiction of such courts; (b) consents to service of process; and (c) waives any other requirement (whether imposed by statute,

rule of court, or otherwise) with respect to personal jurisdiction or service of process.

10.

Integration; Non-Duplication. This Agreement constitutes the entire agreement between the parties with respect to the subject

matter hereof and supersedes all prior agreements, including any severance provisions under an offer letter, employment agreement, or

other similar agreement. In no event shall the Executive be eligible for severance benefits under both this Agreement and any other agreement

with the Company or under and statutory requirements under applicable law.

11.

Withholding. All payments made by the Company to the Executive under this Agreement shall be net of any tax or other amounts

required to be withheld by the Company under applicable law.

12.

Successor to Executive. This Agreement shall inure to the benefit of and be enforceable by the Executive’s personal

representatives, executors, administrators, heirs, distributees, devisees, and legatees. In the event of the Executive’s death after

his termination of employment but prior to the completion by the Company of all payments due him under this Agreement, the Company shall

continue such payments to the Executive’s beneficiary designated in writing to the Company prior to his death (or to his estate,

if the Executive fails to make such designation).

13.

Enforceability. If any portion or provision of this Agreement (including, without limitation, any portion or provision of

any section of this Agreement) shall to any extent be declared illegal or unenforceable by a court of competent jurisdiction, then the

remainder of this Agreement, or the application of such portion or provision in circumstances other than those as to which it is so declared

illegal or unenforceable, shall not be affected thereby, and each portion and provision of this Agreement shall be valid and enforceable

to the fullest extent permitted by law.

14.

Waiver. No waiver of any provision hereof shall be effective unless made in writing and signed by the waiving party. The

failure of any party to require the performance of any term or obligation of this Agreement, or the waiver by any party of any breach

of this Agreement, shall not prevent any subsequent enforcement of such term or obligation or be deemed a waiver of any subsequent breach.

15.

Notices. Any notices, requests, demands, and other communications provided for by this Agreement shall be sufficient if

in writing and delivered in person or sent by a nationally recognized

overnight courier service or by registered

or certified mail, postage prepaid, return receipt requested, to the Executive at the last address the Executive has filed in writing

with the Company or, in the case of the Company, at its main offices, attention of the Board.

16.

Amendment. This Agreement may be amended or modified only by a written instrument signed by the Executive and by a duly

authorized representative of the Company.

17.

Governing Law. This is a Massachusetts contract and shall be construed under and be governed in all respects by the laws

of the Commonwealth of Massachusetts, without giving effect to the conflict of laws principles of such Commonwealth. With respect to any

disputes concerning federal law, such disputes shall be determined in accordance with the law as it would be interpreted and applied by

the United States Court of Appeals for the First Circuit.

18.

Counterparts. This Agreement may be executed in any number of counterparts, each of which when so executed and delivered

shall be taken to be an original; but such counterparts shall together constitute one and the same document.

19.

Successor to Company. The Company shall require any successor (whether direct or indirect, by purchase, merger, consolidation

or otherwise) to all or substantially all of the business or assets of the Company expressly to assume and agree to perform this Agreement

to the same extent that the Company would be required to perform it if no succession had taken place. Failure of the Company to obtain

an assumption of this Agreement at or prior to the effectiveness of any succession shall be a material breach of this Agreement.

20.

Gender Neutral. Wherever used herein, a pronoun in the masculine gender shall be considered as including the feminine gender

unless the context clearly indicates otherwise.

21.

At-Will Employment. The Executive acknowledges that the Executive’s employment remains at-will. Nothing in this Agreement

shall be construed otherwise.

IN WITNESS

WHEREOF, the parties hereby execute this Agreement as of the date first written above.

| |

Anika Therapeutics, Inc. |

| |

|

|

| |

By: |

|

| |

|

Name: Cheryl Blanchard |

| |

|

Title: President

& Chief Executive Officer |

| |

|

|

| |

STEPHEN GRIFFIN |

| |

|

|

| |

|

|

9

Exhibit 10.3

May 2, 2024

Michael Levitz

Re: Transitional Services and Separation

Agreement

Dear Michael,

This letter agreement follows our conversations regarding your employment

with Anika Therapeutics, Inc. (the “Company”). This confirms that you will be transitioning and resigning from your

employment. We appreciate your contributions and would like to work with you to make this transition as smooth as possible. Consistent

with that, this letter is to express the parties’ mutual understanding and promises concerning the orderly transition of your responsibilities

and the ultimate termination of your employment at the Company.

Regardless of whether you sign this Agreement, you are subject to continuing

obligations under the Confidentiality and Proprietary Rights Agreement between you and the Company, dated July 29, 2020 (the “Employee

Agreement” and with any other confidentiality, restrictive covenant and other ongoing obligations you have to any of the Releasees

(as defined below), the “Ongoing Obligations”).

Your Company equity rights remain subject in all respects to the Anika

Therapeutics, Inc. 2017 Omnibus Incentive Plan and the applicable grant agreements (collectively, the “Equity Documents”).

The remainder of this letter proposes an agreement (the “Agreement”)

between you and the Company. You and the Company agree as follows:

| 1. | | Separation Date; Transition Period |

If you enter into and comply with this Agreement you will continue to

be employed until December 31, 2024 unless you resign, whether to begin alternative employment or otherwise, or you are terminated with

or without Cause (as defined in your Offer Letter with the Company, dated July 29, 2020 (the “Offer Letter”)) prior

to that date. Your last day of employment, whether it is December 31, 2024 or an earlier date, shall be referred to as the “Separation

Date.” The time period between the date of this letter and the Separation Date shall be referred to as the “Transition

Period.”

During the Transition Period you will (i) continue to provide your existing

services to the Company until you resign your position as the Company’s Chief Financial Officer (“CFO”) effective

June 3, 2024; (ii) work directly with the Company’s new CFO to transition your duties and responsibilities to the new CFO through

June 21, 2024; and (iii) provide such other transition services as the President and Chief Executive Officer (the “CEO”)

reasonably requests (collectively, the “Transitional Services”). You shall continue to receive your current salary

and benefits and continue to vest pursuant and subject to the Equity Documents as a regular employee during the Transition Period except

you will not accrue vacation from the date of your resignation as the Company’s CFO through the remainder of the Transition Period

and you will not be eligible for any 2024 bonus. Your benefits will cease on the Separation Date, provided that if you elect and remain

eligible for COBRA you may continue your health benefits during the applicable COBRA period at your own expense. Your equity rights will

remain subject to the Equity Documents in all respects, including with respect to the time period to exercise vested stock options (i.e.

within 90 days after the Separation Date, subject to the terms of the Equity Documents).

Provided you (i) comply with this Agreement during the Transition Period,

(ii) are not terminated by the Company for Cause and do not resign and (iii) reaffirm the terms of this Agreement including the release

so that it covers the period between the date of this Agreement and the Separation Date by signing and returning the Certificate attached

as Exhibit A hereto after the Separation Date but no later than seven days after the Separation Date ((i), (ii) and (iii) collectively,

the “Severance Conditions”):

(a)

Severance Bonus. The Company shall make a one-time payment to you of one hundred thousand dollars ($100,000) (the “Severance

Bonus”) on June 21, 2024. On the Separation Date, the Company will also pay you any owed salary, wages, bonuses, and accrued

vacation/paid time off outstanding, premiums and/or reimbursable expenses. You acknowledge and agree that you are not eligible for any

other bonus from the Company, under the Offer Letter or otherwise.

(b)

Termination without Cause/Not for Breach. If, prior to December 31, 2024, the Company terminates your employment without Cause,

and if the termination is not because you breached this Agreement:

| a. | The

Company shall pay you your salary through December 31, 2024 (the “Balance of Salary”).

If payable, the Company shall pay you the Balance of Salary and the Company portion of the

premiums of your current benefits for continuing coverage through December 31, 2024 in a

single lump sum payment on the first payroll date applicable to your position with the Company

after the Certificate Effective Date (as defined in Exhibit A below); provided that

the Company shall not be obligated to pay the above amounts before the Certificate Effective

Date. |

| b. | If

the Company has not already paid the Severance Bonus, the Company shall pay the Severance

Bonus on the first payroll date applicable to your position with the Company after the Certificate

Effective Date. |

In consideration for, among other terms, your eligibility for continued

employment and for the payments and benefits set forth in this Agreement, to which you acknowledge you would otherwise not be entitled,

you, on behalf of yourself and your heirs, administrators, representatives, successors and assigns (together with you, the “Releasors”)

voluntarily release and forever discharge the Company, its affiliated and related entities, its and their respective predecessors, successors

and assigns, its and their respective employee benefit plans and fiduciaries of such plans, and the current and former officers, directors,

shareholders, employees, interest holders, managers, members, partners, investors, attorneys, accountants and agents of each of the foregoing

in their official and personal capacities (collectively referred to as the “Releasees”) generally from all claims,

demands, debts, damages and liabilities of every name and nature, known or unknown (“Claims”) that, as of the date

when you sign this Agreement, you or any other Releasor have, ever had, now claim to have or ever claimed to have had against any or

all of the Releasees. This release includes, without limitation, all Claims:

| - | relating to your employment by and termination of employment with the

Company; |

| - | of wrongful discharge or violation of public policy; |

| - | of breach of contract including, without limitation, the Offer Letter; |

| - | of defamation or other torts; |

| - | under the Retention Agreement |

| - | of retaliation or discrimination under

federal, state or local law (including, without limitation, Claims of discrimination or retaliation

under the Massachusetts Civil Rights Act, M.G.L. c. 151B, the Age Discrimination in Employment

Act, the Americans with Disabilities Act, and Title VII of the Civil Rights Act of 1964); |

| - | under any other federal or state statute); |

| - | for wages, bonuses, incentive compensation,

commissions, stock, stock options, vacation pay or any other compensation or benefits, either

under the Massachusetts Wage Act, M.G.L. c. 149, §§148-150C, or otherwise; and |

| - | for damages or other remedies of any sort,

including, without limitation, compensatory damages, punitive damages, injunctive relief

and attorney’s fees; |

provided, however, that this release shall not affect your vested

rights under the Equity Documents or the Company’s Section 401(k) plan or your rights under this Agreement.

You acknowledge and represent that, except as expressly provided in this

Agreement, the Company has paid or provided all salary, wages, bonuses, accrued vacation/paid time off, premiums, leaves, housing allowances,

relocation costs, interest, severance, outplacement costs, fees, commissions, stock, stock options, vesting, and any and all other benefits

and compensation due to you. You specifically represent that you are not due to receive any commissions or other incentive compensation

from the Company.

You agree not to accept damages of any nature, other equitable or legal

remedies for your own benefit or attorney’s fees or costs from any of the Releasees with respect to any Claim released by this

Agreement. As a material inducement to the Company to enter into this Agreement, you represent that you have not assigned any Claim to

any third party.

| 4. | | Resignations from Other Positions; Transition of Information and Access |

In connection with the Transition Period, at the Company’s request,

you agree to (i) resign from any and all positions, including, without implication of limitation, as CFO, Section 16 Officer and principal

financial officer of the Company and as a director, trustee or other officer, or other positions you occupy, or may be deemed to occupy,

at the Company, or any of its subsidiaries or affiliates; (ii) execute such documentation as the Company or its applicable subsidiary

or affiliate reasonably requires to effectuate such resignations; and (iii) take such steps as the Company (or its applicable subsidiary

or affiliate) reasonably requests to ensure the transition of any account access, systems access, password access, customer access, confidential

information, Company property, customer information or customer relationships to the Company or its applicable subsidiary or affiliate.

You acknowledge and agree that your resignations described in the above subsection (i) shall be effective as of June 3, 2024.

You shall not dispose of Company property (including information or documents,

including computerized data Company and any copies made of any computerized data Company or software (“Documents”)),

without authorization on or before the Separation Date. You agree to return to the Company all Company property, including, without limitation,

computer equipment, software, keys and access cards, credit cards, files and any Documents containing information concerning the Company,

its business or its business relationships (in the latter two cases, actual or prospective) and any information about the Company’s

commercial and technical strategies and mechanics associated with implementing those strategies. After returning all Documents and Company

property, you commit to deleting and finally purging any duplicates of files or documents that may contain Company information from any

non-Company computer or other device that remains your property. In the event that you discover that you continue to retain any such

property, you shall return it to the Company immediately.

Subject to the Protected Activities section below, you agree not to make

any oral or written disparaging statements (including through social media) concerning the Company or any of its affiliates or current

or former officers, directors, shareholders, employees or agents. You further agree not to take any actions or conduct yourself in any

way that would reasonably be expected to affect adversely the reputation or goodwill of the Company or any of its affiliates or any of

its current or former officers, members, directors, shareholders, employees or agents. The Company agrees to instruct the Company’s

Board of Directors and C-suite executives not to make any oral or written disparaging statements (including through social media) concerning

you. These non-disparagement obligations shall not in any way affect any of the above-

referenced individuals’ obligation to testify truthfully in any

legal proceeding.

For a period of one (1) year after the Separation

Date, you shall not, directly or indirectly, whether as owner, partner, shareholder, consultant, agent, employee, co-venturer or otherwise,

engage, participate, assist or invest in any Competing Business (as defined below). You understand that the foregoing restriction is

intended to protect the Company’s interest in its confidential information and goodwill, and you agree that this restriction is

reasonable and appropriate for this purpose. For purposes of this Agreement, the term “Competing Business” shall mean

a business conducted anywhere in the United States that is competitive with any business which the Company or any of its affiliates conducted

or proposed to conduct at any time during your employment. Notwithstanding the foregoing, you may own up to one percent (1%) of the outstanding

stock of a publicly held corporation which constitutes or is affiliated with a Competing Business.

| 8. | | Confidentiality of Agreement-Related Information; Other Obligations |

Subject to the “Protected Activities” section below, you

agree, to the fullest extent permitted by law, to keep all Agreement-Related Information completely confidential. “Agreement-Related

Information” means the negotiations leading to this Agreement and the terms of this Agreement. Notwithstanding the foregoing,

you may disclose Agreement-Related Information to your spouse, your family, your attorney and your financial advisors, and to them only

provided that they first agree for the benefit of the Company to keep Agreement-Related Information confidential. You represent that

during the period since the date of this Agreement, you have not made any disclosures that would have been contrary to the foregoing

obligation if it had then been in effect. You agree to promptly return all Company property to the Company by the Separation Date or

earlier upon the Company’s request; not to disclose or use any Company confidential information at any time; not to represent yourself

as currently employed by the Company after the Separation Date; and to notify future employers of your Ongoing Obligations.

| 9. | | Not Good Reason; Retention Agreement |

You agree that neither this Agreement nor the changes to your employment

contained herein constitute “Good Reason” as defined in the Executive Retention Agreement between you and the Company, dated

August 10, 2020 (the “Retention Agreement”) and you hereby waive any right to claim Good Reason or a without Cause

termination as a result of this Agreement. You further agree and acknowledge that (i) the Company does not owe you any severance or other

post- termination benefits or payments pursuant to the Retention Agreement or otherwise in connection with your resignation and (ii)

the Retention Agreement is void and of no further force or effect.

Nothing contained in this Agreement, any other agreement with the Company,

or any Company policy limits Employee’s ability, with or without notice to the Company, to: (i) file a charge or complaint with

any federal, state or local governmental agency or commission (a “Government Agency”), including without limitation,

the Equal Employment Opportunity Commission, the National Labor Relations Board or the Securities and Exchange Commission (the “SEC”);

(ii) communicate with any Government Agency or otherwise participate in any investigation or proceeding that may be conducted by any

Government Agency, including by providing non- privileged documents or information; (iii) exercise any rights under Section 7 of the

National Labor Relations Act, which are available to non-supervisory employees, including assisting co- workers with or discussing any

employment issue as part of engaging in concerted activities for the purpose of mutual aid or protection; (iv) discuss or disclose information

about unlawful acts in the workplace, such as harassment or discrimination or any other conduct that Employee has reason to believe is

unlawful; or (v) testify truthfully in a legal proceeding. Any such communications and disclosures must not violate applicable law and

the information disclosed must not have been obtained through a communication that was subject to the attorney-client privilege (unless

disclosure of that information would otherwise be permitted consistent with such privilege or applicable law). If a Government Agency

or any other third party pursues any claim on Employee’s behalf, Employee waives any right to monetary or other individualized

relief (either individually or as part of any collective or class action), but the Company will not limit any right Employee may have

to receive an award pursuant to the whistleblower provisions of any applicable law or regulation for providing information to the SEC

or any other Government Agency.

| 11. | | Defend Trade Secrets Act Notice |

You understand that pursuant to the Defend Trade Secrets Act of 2016,

you shall not be held criminally or civilly liable under any federal or state trade secret law for the disclosure of a trade secret that

(A) is made (i) in confidence to a federal, state, or local government official, either directly or indirectly, or to an attorney; and

(ii) solely for the purpose of reporting or investigating a suspected violation of law; or (B) is made in a complaint or other document

filed in a lawsuit or other proceeding, if such filing is made under seal.

(a)

Termination and Return of Payments. If you breach any of your obligations under this Agreement or the Ongoing Obligations,

in addition to any other legal or equitable remedies it may have for such breach, the Company shall have the right to terminate your

employment without any further payments hereunder. The termination in the event of your breach will not affect your continuing obligations

under this Agreement.

(b)

Enforceability. If any portion or provision of this Agreement (including, without limitation, any portion or provision of

any section of this Agreement) shall to any extent be declared illegal or unenforceable by a court of competent jurisdiction, then the

remainder of this Agreement, or the application of such portion or provision in circumstances other than those as to which it is so declared

illegal or unenforceable, shall not be affected thereby, and each portion and provision of this Agreement shall be valid and enforceable

to the fullest extent permitted by law.

(c)

Waiver; Absence of Reliance. No waiver of any provision of this Agreement shall be effective unless made in writing and signed

by the waiving party. The failure of a party to require the performance of any term or obligation of this Agreement, or the waiver by

a party of any breach of this Agreement, shall not prevent any subsequent enforcement of such term or obligation or be deemed a waiver

of any subsequent breach. In signing this Agreement, you are not relying upon any promises or representations made by anyone at or on

behalf of the Company.

(d)

Jurisdiction; Governing Law; Interpretation. You and the Company hereby agree that the state and federal courts of Massachusetts

located in Boston shall have the exclusive jurisdiction to consider any matters related to this Agreement, including without limitation

any claim of a violation of this Agreement. With respect to any such court action, you submit to the jurisdiction of such courts and

you acknowledge that venue in such courts is proper. This Agreement shall be interpreted and enforced under the laws of Massachusetts,

without regard to conflict of law principles.

(e)

Entire Agreement. This Agreement, the Ongoing Obligations (which are incorporated herein by reference) and the Equity Documents

constitute the entire agreement between you and the Company and supersede any previous agreements, understandings or communications between

you and the Company, including without limitation, the Offer Letter and the Retention Agreement.

(f)

Time for Consideration; Effective Date. You acknowledge that you have been given the opportunity to consider this Agreement

for twenty-one (21) days before signing it (the “Consideration Period”) and that you have knowingly and voluntarily

entered into this Agreement. You acknowledge that the above release of claims expressly includes without limitation claims under the

Age Discrimination in Employment Act. You are advised to consult with an attorney before signing this Agreement. To accept this Agreement,