0001539029false00015390292024-05-092024-05-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): May 09, 2024 |

Clearside Biomedical, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-37783 |

45-2437375 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

900 North Point Parkway Suite 200 |

|

Alpharetta, Georgia |

|

30005 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 678 270-3631 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.001 per share |

|

CLSD |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On May 9, 2024, Clearside Biomedical, Inc. (the “Registrant”) issued a press release announcing its financial results for the quarter ended March 31, 2024, as well as information regarding a conference call to discuss these financial results and the Registrant’s recent corporate highlights. A copy of this press release is furnished herewith as Exhibit 99.1 to this Current Report and is incorporated herein by reference.

In accordance with General Instruction B.2. of Form 8-K, the information in this Item 2.02, and Exhibit 99.1 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, nor shall it be deemed incorporated by reference in any of the Registrant’s filings under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, regardless of any incorporation language in such a filing, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Clearside Biomedical, Inc. |

|

|

|

|

Date: |

May 9, 2024 |

By: |

/s/Charles A. Deignan |

|

|

|

Charles A. Deignan |

|

|

|

Chief Financial Officer |

Clearside Biomedical Announces First Quarter 2024

Financial Results and Provides Corporate Update

- Phase 2b ODYSSEY Trial in Wet AMD Remains on Track

with Topline Data Expected Q3 2024 -

- Strengthened Management Team and Board of Directors with Two Key Additions -

- Management to Host Webcast and Conference Call Today at 4:30 P.M. ET -

ALPHARETTA, Ga., May 9, 2024 -- Clearside Biomedical, Inc. (Nasdaq: CLSD), a biopharmaceutical company revolutionizing the delivery of therapies to the back of the eye through the suprachoroidal space (SCS®), today reported financial results for the first quarter ended March 31, 2024, and provided a corporate update.

“As we near the midpoint of 2024, I am excited to highlight key aspects of our program and the steps we have taken to position Clearside for an important year,” said George Lasezkay, Pharm.D., J.D., Clearside’s President and Chief Executive Officer. “Our lead clinical program, CLS-AX (axitinib injectable suspension), is focused on the multi-billion-dollar market for wet AMD. Our target profile for CLS-AX is to maintain visual acuity without the need for retreatment for potentially up to 6 months. The data readout from our Phase 2b ODYSSEY clinical trial remains on track for the end of the third quarter of this year. Importantly, ODYSSEY is a 36-week study designed to re-dose patients with CLS-AX at 6 months, or earlier if needed. This will provide valuable data in a chronic disease for patients treated with more than one dose of CLS-AX, as we begin planning our CLS-AX Phase 3 clinical development program.”

Dr. Lasezkay continued, “We have an outstanding team at Clearside that has been strategically expanded over the past several months. We added Dr. Victor Chong, a well-respected, board-certified retinal specialist, as our Chief Medical Officer. Victor’s extensive major pharmaceutical company experience, most recently at Johnson & Johnson, is extremely valuable as he spearheads our product development activities led by the upcoming ODYSSEY data analysis and the planning for our Phase 3 program. In addition, we appointed Tony Gibney, a seasoned biotechnology executive, to our Board of Directors. Tony has broad expertise in business strategy, collaborations, finance, and M&A, including recent and relevant ophthalmology experience at Iveric Bio. We look

forward to their contributions as we advance our pipeline and continue our efforts to increase the adoption of suprachoroidal delivery.”

Key Highlights

•Topline data expected in the third quarter of 2024 from Phase 2b ODYSSEY clinical trial of CLS-AX using suprachoroidal delivery in neovascular age-related macular degeneration (wet AMD).

•Victor Chong, M.D., MBA joined Clearside in March 2024 as Chief Medical Officer. Dr. Chong has more than 25 years of experience advancing drug candidates through all stages of development, including serving as Vice President, Global Head of Retina DAS at Johnson & Johnson, and Global Head of Medicine, Retinal Health at Boehringer Ingelheim.

•Appointed Tony Gibney to Clearside’s Board of Directors in April 2024. Mr. Gibney is an experienced biotechnology executive and former investment banker who brings over 25 years of experience dedicated to advising biotechnology companies on business strategy, collaborations, financings, and mergers and acquisitions.

•Completed a registered direct offering in February 2024, which generated $15.0 million in gross proceeds to Clearside.

•On January 1, 2024, a new permanent Category 1 Current Procedural Terminology (CPT) code for XIPERE® (triamcinolone acetonide injectable suspension) for suprachoroidal use became available for physician use.

•Multiple data presentations on the use of Clearside’s suprachoroidal delivery platform were featured at prominent medical meetings, including the Association for Research in Vision and Ophthalmology (ARVO), the Macula Society and Hawaiian Eye and Retina.

‒Presentations included positive data on the extended treatment duration of XIPERE utilizing suprachoroidal delivery. Real-world data showed excellent durability in which more than 75% of eyes did not require retreatment for 6 months after a single dose of XIPERE, supporting Clearside’s approach to extended drug release and reduced treatment burden for patients by delivering drug directly to the back of the eye via the SCS Microinjector.

First Quarter 2024 Financial Results

•License and other revenue for the first quarter of 2024 was $230,000, compared to $4,000 for the first quarter of 2023.

•Research and development expenses for the first quarter of 2024 were $5.6 million, compared to $4.5 million for the first quarter of 2023. The increase was primarily due to ODYSSEY clinical trial expenses.

•General and administrative expenses for the first quarter of 2024 were $2.8 million, compared to $3.2 million for the first quarter of 2023.

•Other expense for the first quarter of 2024 was $1.5 million, compared to $0 for the first quarter of 2023. Other expense was comprised of issuance costs for the warrants and shares of common stock issued in the February 2024 registered direct offering and the change in fair value related to warrant liabilities.

•Non-cash interest expense for the first quarter of 2024 was $2.4 million, compared to $2.2 million in the first quarter of 2023. Non-cash interest expense was comprised of imputed interest on the liability related to the sales of future royalties and the amortization of the associated issuance costs.

•Net loss for the first quarter of 2024 was $11.8 million, or $0.17 per share of common stock, compared to net loss of $9.3 million, or $0.15 per share of common stock, for the first quarter of 2023.

•As of March 31, 2024, Clearside’s cash and cash equivalents totaled $35.4 million. The Company believes it will have sufficient resources to fund its planned operations into the third quarter of 2025.

Conference Call & Webcast Details

Clearside’s management will host a webcast and conference call today at 4:30 p.m. Eastern Time to discuss the financial results and provide a corporate update. The live and archived webcast may be accessed on the Clearside website under the Investors section: Events and Presentations. The live call can be accessed by dialing 888-645-4404 (U.S.) or 862-298-0702 (international) and requesting the Clearside call. The Company suggests participants join 15 minutes in advance of the event.

About Clearside Biomedical, Inc.

Clearside Biomedical, Inc. is a biopharmaceutical company revolutionizing the delivery of therapies to the back of the eye through the suprachoroidal space (SCS®). Clearside’s SCS injection platform, utilizing the Company’s patented SCS Microinjector®, enables an in-office, repeatable, non-surgical procedure for the targeted and compartmentalized delivery of a wide variety of therapies to the macula, retina, or choroid to potentially preserve and improve vision in patients with sight-threatening eye diseases. Clearside is developing its own pipeline of small molecule product candidates for administration via its SCS Microinjector. The Company’s lead program, CLS-AX (axitinib injectable suspension), for the treatment of neovascular age-related macular degeneration (wet AMD), is in Phase 2b clinical testing. Clearside developed and gained approval for its first product, XIPERE® (triamcinolone acetonide injectable suspension) for suprachoroidal use, which is available in the U.S. through a commercial partner. Clearside also strategically partners its SCS injection platform with companies utilizing other ophthalmic

therapeutic innovations. For more information, please visit clearsidebio.com and follow us on LinkedIn and X.

Cautionary Note Regarding Forward-Looking Statements

Any statements contained in this press release that do not describe historical facts may constitute forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements may be identified by words such as “believe”, “expect”, “may”, “plan”, “potential”, “will”, and similar expressions, and are based on Clearside’s current beliefs and expectations. These forward-looking statements include statements regarding the clinical development of CLS-AX, the expected timing of topline results from the ODYSSEY clinical trial, the potential benefits of CLS-AX, Clearside’s suprachoroidal delivery technology and Clearside’s SCS Microinjector® and Clearside’s ability to fund its operations into the third quarter of 2025. These statements involve risks and uncertainties that could cause actual results to differ materially from those reflected in such statements. Risks and uncertainties that may cause actual results to differ materially include uncertainties inherent in the conduct of clinical trials, Clearside’s reliance on third parties over which it may not always have full control and other risks and uncertainties that are described in Clearside’s Annual Report on Form 10-K for the year ended December 31, 2023, filed with the U.S. Securities and Exchange Commission (SEC) on March 12, 2024 and Clearside’s other Periodic Reports filed with the SEC. Any forward-looking statements speak only as of the date of this press release and are based on information available to Clearside as of the date of this release, and Clearside assumes no obligation to, and does not intend to, update any forward-looking statements, whether as a result of new information, future events or otherwise.

Investor and Media Contacts:

Jenny Kobin

Remy Bernarda

ir@clearsidebio.com

(678) 430-8206

-Financial Tables Follow-

CLEARSIDE BIOMEDICAL, INC.

Selected Financial Data

(in thousands, except share and per share data)

(unaudited)

|

|

|

|

|

|

|

|

|

Statements of Operations Data |

|

Three Months Ended March 31, |

|

|

|

2024 |

|

|

2023 |

|

License and other revenue |

|

$ |

230 |

|

|

$ |

4 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

Research and development |

|

|

5,615 |

|

|

|

4,451 |

|

General and administrative |

|

|

2,824 |

|

|

|

3,158 |

|

Total operating expenses |

|

|

8,439 |

|

|

|

7,609 |

|

Loss from operations |

|

|

(8,209 |

) |

|

|

(7,605 |

) |

Interest income |

|

|

348 |

|

|

|

492 |

|

Other expense |

|

|

(1,499 |

) |

|

|

— |

|

Non-cash interest expense on liability related to the sales of future royalties |

|

|

(2,403 |

) |

|

|

(2,167 |

) |

Net loss |

|

$ |

(11,763 |

) |

|

$ |

(9,280 |

) |

Net loss per share of common stock — basic and diluted |

|

$ |

(0.17 |

) |

|

$ |

(0.15 |

) |

Weighted average shares outstanding — basic and diluted |

|

|

69,853,227 |

|

|

|

61,169,486 |

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet Data |

March 31, |

|

|

December 31, |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

35,355 |

|

|

$ |

28,920 |

|

Total assets |

|

40,142 |

|

|

|

34,018 |

|

Liabilities related to the sales of future royalties, net |

|

44,391 |

|

|

|

41,988 |

|

Warrant liabilities |

|

11,039 |

|

|

|

— |

|

Total liabilities |

|

61,952 |

|

|

|

49,930 |

|

Total stockholders’ deficit |

|

(21,810 |

) |

|

|

(15,912 |

) |

v3.24.1.u1

Document And Entity Information

|

May 09, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

May 09, 2024

|

| Entity Registrant Name |

Clearside Biomedical, Inc.

|

| Entity Central Index Key |

0001539029

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-37783

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

45-2437375

|

| Entity Address, Address Line One |

900 North Point Parkway

|

| Entity Address, Address Line Two |

Suite 200

|

| Entity Address, City or Town |

Alpharetta

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30005

|

| City Area Code |

678

|

| Local Phone Number |

270-3631

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

CLSD

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

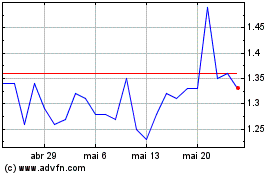

Clearside Biomedical (NASDAQ:CLSD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Clearside Biomedical (NASDAQ:CLSD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024