false

Q1

--12-31

0001269026

0001269026

2024-01-01

2024-03-31

0001269026

2024-05-08

0001269026

2024-03-31

0001269026

2023-12-31

0001269026

SINT:SeriesBConvertiblePreferredStockMember

2024-03-31

0001269026

SINT:SeriesBConvertiblePreferredStockMember

2023-12-31

0001269026

SINT:SeriesCConvertiblePreferredStockMember

2024-03-31

0001269026

SINT:SeriesCConvertiblePreferredStockMember

2023-12-31

0001269026

SINT:SeriesDConvertiblePreferredStockMember

2024-03-31

0001269026

SINT:SeriesDConvertiblePreferredStockMember

2023-12-31

0001269026

us-gaap:ProductMember

2024-01-01

2024-03-31

0001269026

us-gaap:ProductMember

2023-01-01

2023-03-31

0001269026

SINT:GrantAndContractMember

2024-01-01

2024-03-31

0001269026

SINT:GrantAndContractMember

2023-01-01

2023-03-31

0001269026

2023-01-01

2023-03-31

0001269026

us-gaap:PreferredStockMember

2022-12-31

0001269026

us-gaap:CommonStockMember

2022-12-31

0001269026

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001269026

us-gaap:RetainedEarningsMember

2022-12-31

0001269026

2022-12-31

0001269026

us-gaap:PreferredStockMember

2023-12-31

0001269026

us-gaap:CommonStockMember

2023-12-31

0001269026

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001269026

us-gaap:RetainedEarningsMember

2023-12-31

0001269026

us-gaap:PreferredStockMember

2023-01-01

2023-03-31

0001269026

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0001269026

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-03-31

0001269026

us-gaap:RetainedEarningsMember

2023-01-01

2023-03-31

0001269026

us-gaap:PreferredStockMember

2024-01-01

2024-03-31

0001269026

us-gaap:CommonStockMember

2024-01-01

2024-03-31

0001269026

us-gaap:AdditionalPaidInCapitalMember

2024-01-01

2024-03-31

0001269026

us-gaap:RetainedEarningsMember

2024-01-01

2024-03-31

0001269026

us-gaap:PreferredStockMember

2023-03-31

0001269026

us-gaap:CommonStockMember

2023-03-31

0001269026

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001269026

us-gaap:RetainedEarningsMember

2023-03-31

0001269026

2023-03-31

0001269026

us-gaap:PreferredStockMember

2024-03-31

0001269026

us-gaap:CommonStockMember

2024-03-31

0001269026

us-gaap:AdditionalPaidInCapitalMember

2024-03-31

0001269026

us-gaap:RetainedEarningsMember

2024-03-31

0001269026

SINT:TwoThousandAndTwentyOneEquityDistributionAgreementMember

SINT:MaximGroupLLCMember

2021-02-24

2021-02-25

0001269026

SINT:TwoThousandAndTwentyOneEquityDistributionAgreementMember

SINT:MaximGroupLLCMember

2023-10-12

2023-10-12

0001269026

SINT:TwoThousandAndTwentyOneEquityDistributionAgreementMember

SINT:MaximGroupLLCMember

2021-02-25

2021-02-25

0001269026

SINT:TwoThousandAndTwentyOneEquityDistributionAgreementMember

SINT:MaximGroupLLCMember

2024-03-31

2024-03-31

0001269026

SINT:DistributionAgreementMember

2023-03-31

0001269026

2023-02-10

2023-02-10

0001269026

SINT:CommonStockWarrantsMember

2023-02-10

2023-02-10

0001269026

SINT:CommonStockAndPrefundedWarrantsMember

2023-02-10

2023-02-10

0001269026

SINT:DerivativeLiabilitiesForCommonStockWarrantsMember

2023-02-10

2023-02-10

0001269026

SINT:AgentWarrantOfferingMember

2023-02-10

2023-02-10

0001269026

2024-02-02

2024-02-02

0001269026

2024-02-02

0001269026

SINT:CommonStockAndPrefundedWarrantsMember

2024-02-02

2024-02-02

0001269026

SINT:ClassEAndClassFWarrantsMember

2024-02-02

0001269026

SINT:CommonStockWarrantsMember

2024-02-02

2024-02-02

0001269026

SINT:DerivativeLiabilitiesForCommonStockWarrantsMember

2024-02-02

2024-02-02

0001269026

SINT:AgentWarrantOfferingMember

2024-02-02

2024-02-02

0001269026

2024-03-26

2024-03-26

0001269026

2024-03-26

0001269026

2023-12-14

2023-12-14

0001269026

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

SINT:CommonStockWarrantsMember

2024-03-31

0001269026

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

SINT:CommonStockWarrantsMember

2024-03-31

0001269026

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

SINT:CommonStockWarrantsMember

2024-03-31

0001269026

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

SINT:CommonStockWarrantsMember

2023-12-31

0001269026

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

SINT:CommonStockWarrantsMember

2023-12-31

0001269026

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

SINT:CommonStockWarrantsMember

2023-12-31

0001269026

SINT:CommonStockWarrantsMember

us-gaap:FairValueInputsLevel3Member

2022-12-31

0001269026

us-gaap:FairValueInputsLevel3Member

SINT:CommonStockWarrantsMember

2023-01-01

2023-03-31

0001269026

SINT:CommonStockWarrantsMember

us-gaap:FairValueInputsLevel3Member

2023-03-31

0001269026

SINT:CommonStockWarrantsMember

us-gaap:FairValueInputsLevel3Member

2023-12-31

0001269026

us-gaap:FairValueInputsLevel3Member

SINT:CommonStockWarrantsMember

2024-01-01

2024-03-31

0001269026

SINT:CommonStockWarrantsMember

us-gaap:FairValueInputsLevel3Member

2024-03-31

0001269026

SINT:CommonStockWarrantsMember

SINT:BlackScholesMertonValuationModelMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

srt:MinimumMember

2024-03-31

0001269026

SINT:CommonStockWarrantsMember

SINT:BlackScholesMertonValuationModelMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

srt:MaximumMember

2024-03-31

0001269026

SINT:CommonStockWarrantsMember

SINT:BlackScholesMertonValuationModelMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

srt:MinimumMember

2023-12-31

0001269026

SINT:CommonStockWarrantsMember

SINT:BlackScholesMertonValuationModelMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

srt:MaximumMember

2023-12-31

0001269026

SINT:CommonStockWarrantsMember

SINT:BlackScholesMertonValuationModelMember

us-gaap:MeasurementInputExpectedTermMember

srt:MinimumMember

2024-03-31

0001269026

SINT:CommonStockWarrantsMember

SINT:BlackScholesMertonValuationModelMember

us-gaap:MeasurementInputExpectedTermMember

srt:MaximumMember

2024-03-31

0001269026

SINT:CommonStockWarrantsMember

SINT:BlackScholesMertonValuationModelMember

us-gaap:MeasurementInputExpectedTermMember

srt:MinimumMember

2023-12-31

0001269026

SINT:CommonStockWarrantsMember

SINT:BlackScholesMertonValuationModelMember

us-gaap:MeasurementInputExpectedTermMember

srt:MaximumMember

2023-12-31

0001269026

SINT:CommonStockWarrantsMember

SINT:BlackScholesMertonValuationModelMember

us-gaap:MeasurementInputExpectedDividendRateMember

2024-03-31

0001269026

SINT:CommonStockWarrantsMember

SINT:BlackScholesMertonValuationModelMember

us-gaap:MeasurementInputExpectedDividendRateMember

2023-12-31

0001269026

SINT:CommonStockWarrantsMember

SINT:BlackScholesMertonValuationModelMember

us-gaap:MeasurementInputOptionVolatilityMember

srt:MinimumMember

2024-03-31

0001269026

SINT:CommonStockWarrantsMember

SINT:BlackScholesMertonValuationModelMember

us-gaap:MeasurementInputOptionVolatilityMember

srt:MaximumMember

2024-03-31

0001269026

SINT:CommonStockWarrantsMember

SINT:BlackScholesMertonValuationModelMember

us-gaap:MeasurementInputOptionVolatilityMember

srt:MinimumMember

2023-12-31

0001269026

SINT:CommonStockWarrantsMember

SINT:BlackScholesMertonValuationModelMember

us-gaap:MeasurementInputOptionVolatilityMember

srt:MaximumMember

2023-12-31

0001269026

SINT:BusinessLoanMember

2021-07-20

0001269026

SINT:BusinessLoanMember

2021-07-19

2021-07-20

0001269026

SINT:PersonalLoansMember

2022-06-30

0001269026

SINT:PersonalLoansMember

2024-01-01

2024-03-31

0001269026

SINT:PersonalLoansMember

us-gaap:RelatedPartyMember

2024-03-31

0001269026

us-gaap:WarrantMember

2024-02-02

0001269026

us-gaap:WarrantMember

2024-02-02

2024-02-02

0001269026

SINT:ClassEWarrantsMember

2024-02-02

2024-02-02

0001269026

SINT:ClassFWarrantsMember

2024-02-02

2024-02-02

0001269026

SINT:CommonUnitMember

2024-02-02

0001269026

SINT:PreFundedWarrantUnitMember

2024-02-02

0001269026

us-gaap:OtherInvesteesMember

SINT:ClassEWarrantsMember

2024-02-02

0001269026

us-gaap:OtherInvesteesMember

SINT:ClassFWarrantsMember

2024-02-02

0001269026

SINT:ClassEWarrantMember

2024-02-02

0001269026

SINT:PreFundedWarrantMember

2024-02-02

0001269026

2024-07-31

0001269026

SINT:ClassCAndClassDWarrantsMember

2023-02-10

0001269026

2023-02-10

0001269026

SINT:ClassCWarrantMember

2023-02-10

2023-02-10

0001269026

SINT:ClassDWarrantMember

2023-02-10

2023-02-10

0001269026

SINT:ClassCWarrantMember

2023-02-10

0001269026

SINT:ClassDWarrantMember

2023-02-10

0001269026

SINT:DistributionAgreementMember

2024-03-31

0001269026

SINT:DistributionAgreementMember

2024-01-01

2024-03-31

0001269026

2023-01-01

2023-12-31

0001269026

2022-01-01

2022-12-31

0001269026

SINT:NonExecutiveMember

2024-01-01

2024-03-31

0001269026

us-gaap:EmployeeStockOptionMember

2024-03-31

0001269026

us-gaap:EmployeeStockOptionMember

2024-01-01

2024-03-31

0001269026

SINT:EmployeeStockGrantsMember

2024-03-31

0001269026

SINT:EmployeeStockGrantsMember

2024-01-01

2024-03-31

0001269026

SINT:IndustrialLeaseAgreementMember

2021-08-19

0001269026

SINT:IndustrialLeaseAgreementMember

2021-08-19

2021-08-19

0001269026

SINT:IndustrialLeaseAgreementMember

SINT:TechnologyAssessmentAndTransferIncTATMember

2021-08-19

0001269026

SINT:IndustrialLeaseAgreementMember

SINT:TechnologyAssessmentAndTransferIncTATMember

2024-03-31

0001269026

SINT:IndustrialLeaseAgreementMember

SINT:TechnologyAssessmentAndTransferIncTATMember

2024-01-01

2024-03-31

0001269026

2023-10-20

0001269026

2024-04-08

0001269026

2024-04-05

2024-04-05

0001269026

2024-04-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

utr:sqft

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

(Mark

One)

| ☒ |

QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the quarterly period ended March 31, 2024

OR

| ☐ |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission

File Number 001-33624

SINTX

Technologies, Inc.

(Exact

name of registrant as specified in its charter)

| delaware |

|

84-1375299 |

| (State

or other jurisdiction |

|

(IRS

Employer |

| of

incorporation or organization) |

|

Identification

No.) |

| 1885

West 2100 South, Salt Lake City, UT |

|

84119 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(801)

839-3500

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbols |

|

Name

of each exchange on which registered |

| Common

Stock |

|

SINT |

|

The

NASDAQ Capital Market |

Indicate

by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2)

has been subject to such filing requirements for the past 90 days: Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit and post such files); Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| |

|

|

|

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

|

|

| |

|

Emerging

growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): Yes ☐ No ☒

Indicate

the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date:

122,698,454

shares of common stock, $0.01 par value, were outstanding

at May 8, 2024.

SINTX

Technologies, Inc.

Table

of Contents

SINTX

Technologies, Inc.

Condensed

Consolidated Balance Sheets - Unaudited

(in

thousands, except share and per share data)

| | |

March 31, 2024 | | |

December 31, 2023 | |

| | |

| | |

| |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 5,762 | | |

$ | 3,340 | |

| Account and other receivables, net of allowance totaling 109 and 72 respectively | |

| 483 | | |

| 685 | |

| Prepaid expenses and other current assets | |

| 366 | | |

| 539 | |

| Inventories | |

| 707 | | |

| 888 | |

| Other current assets | |

| 196 | | |

| 80 | |

| Total current assets | |

| 7,514 | | |

| 5,532 | |

| | |

| | | |

| | |

| Inventories, net | |

| 469 | | |

| 333 | |

| Property and equipment, net | |

| 5,064 | | |

| 4,826 | |

| Intangible assets, net | |

| 20 | | |

| 21 | |

| Operating lease right of use asset | |

| 3,936 | | |

| 4,094 | |

| Other long-term assets | |

| 558 | | |

| 559 | |

| Total assets | |

$ | 17,561 | | |

$ | 15,365 | |

| | |

| | | |

| | |

| Liabilities and Stockholders’ Equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 448 | | |

$ | 636 | |

| Accrued liabilities | |

| 2,041 | | |

| 1,404 | |

| Current portion of long-term debt | |

| 233 | | |

| 46 | |

| Derivative liabilities | |

| 845 | | |

| 304 | |

| Current portion of operating lease liability | |

| 518 | | |

| 512 | |

| Other current liabilities | |

| 3 | | |

| 4 | |

| Total current liabilities | |

| 4,088 | | |

| 2,906 | |

| | |

| | | |

| | |

| Operating lease liability, net of current portion | |

| 3,547 | | |

| 3,687 | |

| Total liabilities | |

| 7,635 | | |

| 6,593 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| - | | |

| - | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Convertible preferred stock Series B, $0.01 par value, 130,000,000 total shares authorized inclusive of all series of preferred; 26 shares issued and outstanding as of March 31, 2024 and December 31, 2023. | |

| - | | |

| - | |

| Convertible preferred stock Series C, $0.01 par value, 130,000,000 total shares authorized inclusive of all series of preferred; 50 shares issued and outstanding as of March 31, 2024 and December 31, 2023. | |

| - | | |

| - | |

| Convertible preferred stock Series D, $0.01 par value, 130,000,000 total shares authorized inclusive of all series of preferred; 180 shares issued and outstanding as of March 31, 2024 and December 31, 2023. | |

| - | | |

| - | |

| Preferred stock value | |

| - | | |

| - | |

| Common stock, $0.01 par value, 250,000,000 shares authorized; 51,080,138 and 5,320,671 shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively. | |

| 511 | | |

| 53 | |

| Additional paid-in capital | |

| 281,015 | | |

| 279,433 | |

| Accumulated deficit | |

| (271,600 | ) | |

| (270,714 | ) |

| Total stockholders’ equity | |

| 9,926 | | |

| 8,772 | |

| Total liabilities and stockholders’ equity | |

$ | 17,561 | | |

$ | 15,365 | |

The

condensed consolidated balance sheet as of December 31, 2023, has been prepared using information from the audited consolidated balance

sheet as of that date.

The

accompanying notes are an integral part of these condensed consolidated financial statements.

SINTX

Technologies, Inc.

Condensed

Consolidated Statements of Operations - Unaudited

(in

thousands, except share data)

| | |

2024 | | |

2023 | |

| | |

Three

Months Ended March 31, | |

| | |

2024 | | |

2023 | |

| Product revenue | |

$ | 309 | | |

$ | 240 | |

| Grant and contract revenue | |

| 378 | | |

| 299 | |

| Total revenue | |

| 687 | | |

| 539 | |

| Costs of revenue | |

| 223 | | |

| 118 | |

| Gross profit | |

| 464 | | |

| 421 | |

| Operating expenses: | |

| | | |

| | |

| Research and development | |

| 2,019 | | |

| 2,200 | |

| General and administrative | |

| 1,123 | | |

| 1,169 | |

| Sales and marketing | |

| 246 | | |

| 310 | |

| Grant expenses | |

| 273 | | |

| 299 | |

| Total operating expenses | |

| 3,661 | | |

| 3,978 | |

| Loss from operations | |

| (3,197 | ) | |

| (3,557 | ) |

| Other income (expenses): | |

| | | |

| | |

| Interest expense | |

| (2 | ) | |

| (2 | ) |

| Interest income | |

| 19 | | |

| 38 | |

| Change in fair value of derivative liabilities | |

| 2,838 | | |

| 4,006 | |

| Offering costs of derivative liabilities | |

| (550 | ) | |

| (786 | ) |

| Other income (net) | |

| 6 | | |

| 8 | |

| Total other income, net | |

| 2,311 | | |

| 3,264 | |

| Provision for income taxes | |

| - | | |

| - | |

| Net loss | |

$ | (886 | ) | |

$ | (293 | ) |

| | |

| | | |

| | |

| Net loss per share – basic and diluted | |

| | | |

| | |

| Basic – net loss | |

$ | (0.05 | ) | |

$ | (0.13 | ) |

| Diluted – net loss | |

$ | (0.11 | ) | |

$ | (1.74 | ) |

| Weighted average common shares outstanding: | |

| | | |

| | |

| Basic | |

| 17,262,895 | | |

| 2,272,992 | |

| Diluted | |

| 34,460,877 | | |

| 2,558,059 | |

The

accompanying notes are an integral part of these condensed consolidated financial statements.

SINTX

Technologies, Inc.

Condensed

Consolidated Statements of Stockholders’ Equity - Unaudited

(in

thousands, except share and per share data)

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Equity | |

| | |

Preferred Stock | | |

Common Stock | | |

Paid-In | | |

Accumulated | | |

Total | |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Equity | |

| Balance as of December 31, 2022 | |

| 283 | | |

$ | - | | |

| 542,145 | | |

$ | 5 | | |

$ | 268,154 | | |

$ | (262,455 | ) | |

$ | 5,704 | |

| Stock based compensation | |

| - | | |

| - | | |

| 15 | | |

| - | | |

| 86 | | |

| - | | |

| 86 | |

| Common stock issued for cash, net of cash fees | |

| - | | |

| - | | |

| 1,980,000 | | |

| 20 | | |

| 4,437 | | |

| - | | |

| 4,457 | |

| Prefunded warrants issued for cash, net of cash fees | |

| - | | |

| - | | |

| - | | |

| - | | |

| 383 | | |

| - | | |

| 383 | |

| Extinguishment of derivative liability upon exercise of warrant | |

| - | | |

| - | | |

| - | | |

| - | | |

| 5,502 | | |

| - | | |

| 5,502 | |

| Issuance of common stock from the exercise of prefunded warrants for cash | |

| - | | |

| - | | |

| 170,000 | | |

| 2 | | |

| (2 | ) | |

| - | | |

| - | |

| Issuance of common stock from the cashless exercise of warrants | |

| - | | |

| - | | |

| 1,337,600 | | |

| 13 | | |

| (13 | ) | |

| - | | |

| - | |

| Redemption of preferred stock | |

| (1 | ) | |

| - | | |

| - | | |

| - | | |

| (2 | ) | |

| - | | |

| (2 | ) |

| Issuance of agent warrants | |

| - | | |

| - | | |

| - | | |

| - | | |

| 108 | | |

| - | | |

| 108 | |

| Round up shares issued in reverse split | |

| - | | |

| - | | |

| 20,475 | | |

| - | | |

| - | | |

| - | | |

| - | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (293 | ) | |

| (293 | ) |

| Balance as of March 31, 2023 | |

| 282 | | |

$ | - | | |

| 4,050,235 | | |

$ | 40 | | |

$ | 278,653 | | |

$ | (262,748 | ) | |

$ | 15,945 | |

| | |

Preferred Stock | | |

Common Stock | | |

Paid-In | | |

Accumulated | | |

Total | |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Equity | |

| Balance as of December 31, 2023 | |

| 256 | | |

$ | - | | |

| 5,320,671 | | |

$ | 53 | | |

$ | 279,433 | | |

$ | (270,714 | ) | |

$ | 8,772 | |

| Balance | |

| 256 | | |

$ | - | | |

| 5,320,671 | | |

$ | 53 | | |

$ | 279,433 | | |

$ | (270,714 | ) | |

$ | 8,772 | |

| Stock based compensation | |

| - | | |

| - | | |

| 17 | | |

| - | | |

| 50 | | |

| - | | |

| 50 | |

| Common stock issued for cash, net of fees | |

| - | | |

| - | | |

| 33,159,450 | | |

| 332 | | |

| 1,252 | | |

| - | | |

| 1,584 | |

| Prefunded warrants issued for cash, net of fees | |

| - | | |

| - | | |

| - | | |

| - | | |

| 406 | | |

| - | | |

| 406 | |

| Issuance of common stock from the exercise of warrants for cash | |

| - | | |

| - | | |

| 12,600,000 | | |

| 126 | | |

| (126 | ) | |

| - | | |

| - | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (886 | ) | |

| (886 | ) |

| Balance as of March 31, 2024 | |

| 256 | | |

$ | - | | |

| 51,080,138 | | |

$ | 511 | | |

$ | 281,015 | | |

$ | (271,600 | ) | |

$ | 9,926 | |

| Balance | |

| 256 | | |

$ | - | | |

| 51,080,138 | | |

$ | 511 | | |

$ | 281,015 | | |

$ | (271,600 | ) | |

$ | 9,926 | |

The

accompanying notes are an integral part of these condensed consolidated financial statements.

SINTX

Technologies, Inc.

Condensed

Consolidated Statements of Cash Flows - Unaudited

(in

thousands)

| | |

2024 | | |

2023 | |

| | |

Three

Months Ended March 31, | |

| | |

2024 | | |

2023 | |

| Cash Flows From Operating Activities | |

| | | |

| | |

| Net loss | |

$ | (886 | ) | |

$ | (293 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation expense | |

| 256 | | |

| 154 | |

| Amortization of right of use asset | |

| 163 | | |

| 183 | |

| Amortization of intangible assets | |

| 1 | | |

| 1 | |

| Stock based compensation | |

| 50 | | |

| 86 | |

| Change in fair value of derivative liabilities | |

| (2,838 | ) | |

| (3,898 | ) |

| Bad debt expense | |

| 37 | | |

| (3 | ) |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Trade accounts receivable | |

| 165 | | |

| (137 | ) |

| Prepaid expenses and other current assets | |

| 286 | | |

| (457 | ) |

| Inventories | |

| 45 | | |

| 110 | |

| Accounts payable and accrued liabilities | |

| 128 | | |

| (103 | ) |

| Other liabilities | |

| - | | |

| (337 | ) |

| Payments on operating lease liability | |

| (140 | ) | |

| (177 | ) |

| Net cash used in operating activities | |

| (2,733 | ) | |

| (4,871 | ) |

| Cash Flows From Investing Activities | |

| | | |

| | |

| Purchase of property and equipment | |

| (174 | ) | |

| (236 | ) |

| Proceeds from sale of property and equipment | |

| 1 | | |

| - | |

| Net cash used in investing activities | |

| (173 | ) | |

| (236 | ) |

| Cash Flows From Financing Activities | |

| | | |

| | |

| Proceeds from issuance of warrant derivative liabilities | |

| 3,366 | | |

| 6,650 | |

| Proceeds from issuance of common stock and prefunded warrants, net of cash fees | |

| 2,003 | | |

| 4,840 | |

| Proceeds from issuance of common stock in connection with exercise of warrants | |

| 1 | | |

| - | |

| Payment on debt | |

| (42 | ) | |

| - | |

| Redemption of Preferred Stock Series E | |

| - | | |

| (2 | ) |

| Net cash provided by financing activities | |

| 5,328 | | |

| 11,488 | |

| Net increase in cash and cash equivalents | |

| 2,422 | | |

| 6,381 | |

| Cash and cash equivalents at beginning of period | |

| 3,340 | | |

| 6,245 | |

| Cash and cash equivalents at end of period | |

$ | 5,762 | | |

$ | 12,626 | |

| | |

| | | |

| | |

| Noncash Investing and Financing Activities | |

| | | |

| | |

| Increase in Property, Plant, and Equipment from an Accrual | |

$ | 319 | | |

$ | - | |

| Debt Issued for Prepaid Insurance | |

| 229 | | |

| - | |

| Agent Warrant Offering Cost Allocated to Equity | |

| 13 | | |

| - | |

| Right of use asset for amended lease liability – increase | |

| 4 | | |

| - | |

| Right of use asset for lease liability | |

| - | | |

| 114 | |

| Reduction of derivative liability upon exercise of warrants | |

| - | | |

| 5,502 | |

| Par value of common stock upon cashless exercise of warrants | |

| - | | |

| 13 | |

| Par value of common stock upon exercise of prefunded warrants | |

| - | | |

| 2 | |

| | |

| | | |

| | |

| Supplemental Cash Flow Information | |

| | | |

| | |

| Cash paid for interest | |

$ | 2 | | |

$ | 2 | |

The

accompanying notes are an integral part of these condensed consolidated financial statements.

SINTX

TECHNOLOGIES, INC.

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1.

Organization and Summary of Significant Accounting Policies

The

condensed consolidated financial statements include the accounts of SINTX Technologies, Inc. (“SINTX”) and its

wholly-owned subsidiaries, SINTX Armor, Inc. (“SINTX Armor”) and Technology Assessment and Transfer, Inc. (TA&T),

which are collectively referred to as “we” or “the Company”. SINTX is an advanced ceramics company formed in

December 1996, focused on providing solutions in a variety of diverse fields, including biomedical, technical, and

antipathogenic applications. SINTX is a company that has grown over time from focusing on the research and development of silicon

nitride for use in human interbody implants to becoming an advanced ceramics company engaged in many different fields. The core strength of the Company is the manufacturing, research, and development

of advanced ceramics for external partners. The Company presently manufactures ceramic powders and components in its Salt Lake City

and Maryland facilities. The SINTX Salt Lake City facility is FDA and ANVISA registered, ISO 13485:2016 certified, and ASD9100D

certified. The Company’s products are primarily sold in the United States.

The

Company is focused on building revenue generating opportunities in three business industries - antipathogenic, technical (including

armor), and biomedical – thereby connecting with current and new customers, partners and manufacturers to help realize the goal

of leveraging expertise in high-tech ceramics to create new, innovative opportunities across these sectors. We expect our continued investment

in research and development to provide additional revenue opportunities.

The

Company’s initial focus was the development and commercialization of products made from silicon nitride for use in spinal fusion

and hip and knee replacement applications. SINTX believes it is the first and only manufacturer to use silicon nitride in medical applications

primarily focused on spine fusion therapies. Since then, we have developed other applications for our silicon nitride technology as well

as utilized our expertise in the use of ceramic materials in other applications. In July 2021, the Company acquired the equipment and

obtained certain proprietary know-how rights with which it intends to develop, manufacture, and commercialize protective armor from boron

carbide and a composite material of silicon carbide and boron carbide for military, law enforcement and civilian uses. The protective

armor operations are housed in SINTX Armor. In June 2022, the Company acquired TA&T, a nearly 40-year-old business with a mission

to transition advanced materials and process technologies from a laboratory environment to commercial products and services

On

October 1, 2018, the Company completed the sale of its retail spine business to CTL Medical, a Dallas, Texas-based privately held medical

device manufacturer. As a result of the sale, CTL Medical became the exclusive owner of the Company’s portfolio of metal and silicon

nitride spine products, as well as access to future silicon nitride spine technologies developed by the Company. The Company’s

name, Amedica, was also transferred to CTL Medical, which is now CTL Amedica. The Company serves as CTL’s exclusive OEM provider

of silicon nitride products. Manufacturing, R&D, and all intellectual property related to the core, non-spine, biomaterial technology

including silicon nitride remains with the Company.

On

October 30, 2018, the Company amended its Certificate of Incorporation with the State of Delaware to change its corporate name to SINTX

Technologies, Inc. The Company also changed its trading symbol on the NASDAQ Capital Market to “SINT”.

The

Company’s new corporate brand reflects both the Company’s core competence in the science and production of silicon nitride

ceramics and other ceramics, as well as encouraging prospects for the future, as an OEM supplier of spine implants to CTL Amedica, and

multiple opportunities outside of spine.

Basis

of Presentation

These

unaudited condensed consolidated financial statements have been prepared in accordance with the rules and regulations of the United States

Securities and Exchange Commission (“SEC”) and include all assets and liabilities of the Company.

SEC

rules and regulations allow the omission of certain information and footnote disclosures normally included in financial statements prepared

in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”) so long as the statements are not misleading.

In the opinion of management, these financial statements and accompanying notes contain all adjustments (consisting of normal recurring

adjustments) necessary to present fairly the financial position and results of operations for the periods presented herein. These condensed

consolidated financial statements should be read in conjunction with the consolidated audited financial statements and notes thereto

contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on March 29, 2023.

The results of operations for the three months ended March 31, 2024, are not necessarily indicative of the results to be expected for

the year ending December 31, 2024. The Company’s significant accounting policies are set forth in Note 1 to the consolidated financial

statements in its Annual Report on Form 10-K for the year ended December 31, 2023.

Use

of Estimates

The

preparation of condensed consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions

that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the condensed

consolidated financial statements and the reported amounts of revenue and expenses during the period. Actual results could differ from

those estimates. As of March 31, 2024, the most significant estimate relates to derivative liabilities relating to common stock warrants.

Liquidity

and Capital Resources

The

condensed consolidated financial statements have been prepared assuming the Company will continue to operate as a going concern, which

contemplates the realization of assets and settlement of liabilities in the normal course of business, and does not include any adjustments

to reflect the possible future effects on the recoverability and classification of assets or the amounts and classifications of liabilities

that may result from uncertainty related to its ability to continue as a going concern within one year from the date of issuance of these

condensed consolidated financial statements.

For

the three months ended March 31, 2024, and 2023, the Company incurred a net loss of $0.9 million and $0.3 million, respectively, and

used cash in operating activities of $2.7 million and $4.9 million, respectively. The Company had an accumulated deficit of $271.6 million

and $270.7 million as of March 31, 2024, and December 31, 2023, respectively. To date, the Company’s operations have been principally

financed from proceeds from the issuance of preferred and common stock and, to a lesser extent, cash generated from product sales. It

is anticipated that the Company will continue to generate operating losses and use cash in operations. The Company’s continuation

as a going concern is dependent upon its ability to increase sales, and/or raise additional funds through the capital markets. Whether

and when the Company can attain profitability and positive cash flows from operations or obtain additional financing is uncertain.

The

Company is actively generating additional scientific and clinical data to have it published in leading industry publications. The unique

features of our advanced ceramic materials are not well known, and we believe the publication of such data would help sales efforts as

the Company approaches new prospects. The Company is also making additional changes to the sales strategy, including a focus on revenue

growth by expanding the use of silicon nitride in other areas outside of spinal fusion applications. The Company has also acquired equipment

and certain proprietary know-how for the purpose of developing, manufacturing and commercializing armored plates made from boron carbide

and a composite of boron carbide and silicon carbide for military, law enforcement and other civilian uses.

The

Company has common stock that is publicly traded and has been able to successfully raise capital when needed since the date of the Company’s

initial public offering in February 2014.

On

February 25, 2021, the Company entered into an Equity Distribution Agreement (as amended, the “2021 Distribution Agreement”)

with Maxim Group LLC (“Maxim”), pursuant to which the Company may sell from time to time, shares of the Company’s common

stock having an aggregate offering price of up to $15

million through Maxim, as agent. On October 12,

2023, the Company entered into an amendment to the Distribution Agreement, pursuant to which the expiration date of the Distribution

Agreement was extended to the earlier of: (i) the sale of shares having an aggregate offering price of $15.0 million, (ii) the termination

by either Maxim or the Company upon the provision of fifteen (15) days written notice, or (iii) February 25, 2025. No other changes were

made to the terms of the Distribution Agreement. The Company currently has registered up to $1.1 million for sale under the Distribution

Agreement, pursuant to the Registration Statement on Form S-3 (File No. 333-274951). As of March 31, 2024, the Company had $0.07 million

available for sale under the Distribution Agreement. As of March 31, 2024, there have been 2,471,949

shares of common stock sold under the 2021 Distribution

Agreement for gross proceeds of $1.0 million. The Company is subject to General Instruction I.B.6 of Form S-3 which limits the amounts

that we may sell under the registration statement over a 12-month period to an amount equal to or less than one-third of our public float.

The shares of the Company’s common stock to be sold under the Distribution Agreement will be sold and issued pursuant to

the Form S-3, as amended, which was previously declared effective by the Securities and Exchange Commission, and the related prospectus

and one or more prospectus supplements.

On

February 10, 2023, the Company closed on a public offering of 2,150,000 units, with each unit consisting of one share of common stock,

or one pre-funded warrant to purchase one share of its common stock, one Class C Warrant to purchase one share of common stock, and one

half of one Class D Warrant with each whole Class D Warrant entitling the holder to purchase one share of common stock. Gross proceeds,

before deducting offering expenses, totaled approximately $12.0 million. Of the $12.0 million of gross proceeds, approximately $5.4 million

were allocated to common stock and prefunded warrants ($4.8 million net of offering costs) and approximately $6.7 million were allocated

to derivative liabilities (with approximately $0.7 million of cash offering costs and $0.1 million of agent warrant offering costs recorded

as derivative expense).

On February 2, 2024, the Company closed on a public

offering of 16,000,000 units, with each unit consisting of one share of its common stock, or one pre-funded warrant to purchase one share

of its common stock, one Class E Warrant with each warrant to purchase one share of common stock, and one Class F Warrant with each warrant

to purchase one share of common stock. Each unit was sold at a public offering price of $0.25 resulting in gross proceeds to the Company

of $4 million before deducting offering fees and expenses. The Class E and Class F Warrants in the units will be immediately exercisable

at a price of $0.25 per share. The Class E Warrants will expire five years from the date of issuance and the Class F Warrants will expire

eighteen months from the date of issuance. Of the $4.0 million of gross proceeds, approximately $0.6 million were allocated to common

stock and prefunded warrants ($0.5 million net of offering costs) and approximately $3.4 million were allocated to derivative liabilities

(with approximately $0.5 million of cash offering costs and $0.1 million of agent warrant offering costs recorded as derivative expense).

On March 26, 2024, the Company closed on

a public offering 28,400,000 shares of the Company’s

common stock, (the “Offering”).

Each Share was sold at a public offering price of $0.047. The aggregate proceeds to the Company from the Offering were approximately $1.3

million before deducting placement agent fees and other estimated offering expenses payable by the Company.

If the Company seeks to obtain additional equity and/or debt financing, such funding is not assured and may not be

available to the Company on favorable or acceptable terms and may involve significant restrictive covenants. Any additional equity financing

is also not assured and, if available to the Company, will most likely be dilutive to its current stockholders. If the Company is not

able to obtain additional debt or equity financing on a timely basis, the impact on the Company will be material and adverse. These

uncertainties raise substantial doubt about our ability to continue as a going concern. The consolidated financial statements do not

include any adjustments that might result from the outcome of these uncertainties.

Grant

and Contract Revenue

Revenues

from grants, contracts, and awards provided by governmental agencies are recorded based upon the terms of the specific agreements, which

generally provide that revenue is earned when the allowable costs specified in the applicable agreement have been incurred or a milestone

has been met. Cash received from federal grants, contracts, and awards can be subject to audit by the grantor and, if the examination

results in a disallowance of any expenditure, repayment could be required.

New

Accounting Pronouncements Not Yet Adopted

On December 14, 2023, the Financial Accounting Standards

Board issued Accounting Standards Update, No. 2023-09 “Improvements to Income Tax Disclosures.” (“ASU 2023-09”).

ASU 2023-09 enhances the detail that a business is required to disclose within its income tax footnote, including, but not limited to,

a breakout of the rate reconciliation into more specific categories, such as state and local income tax, and foreign taxes. Additionally,

a business must break out specific jurisdictions that encompass greater than or equal to 5% of their state and local, and foreign jurisdictions.

The Company will adopt ASU 2023-09 on January 1, 2025. The adoption of this Standard is not expected to have a significant impact on the

Company’s financial statements.

The

Company has reviewed all other recently issued, but not yet adopted, accounting standards, in order to determine their effects, if

any, on its results of operations, financial position or cash flows. Based on that review, the Company believes that no other

pronouncements will have a significant effect on its financial statements.

2.

Basic and Diluted Net Income (Loss) per Common Share

Basic

net income (loss) per share is calculated by dividing the net income (loss) by the weighted-average number of common shares

outstanding for the period, without consideration for common stock equivalents. Diluted net loss per share is calculated by dividing

the net loss by the weighted-average number of common share equivalents outstanding for the period that are determined to be

dilutive. Common stock equivalents are primarily comprised of preferred stock and warrants for the purchase of common stock. The

Company had potentially dilutive securities that were not included in the fully diluted loss per share calculation because they

would have been antidilutive totaling approximately 18.1 million

and 1.2

million as of March 31, 2024, and 2023, respectively.

Below

are basic and diluted loss per share data for the three months ended March 31, 2024, which are in thousands except for share and per

share data:

Schedule

of Basic and Diluted Loss Per Share

| | |

Basic

Calculation | | |

Effect of Dilutive

Warrant

Securities | | |

Diluted

Calculation | |

| Numerator: | |

| | | |

| | | |

| | |

| Net loss | |

$ | (886 | ) | |

$ | (2,846 | ) | |

$ | (3,732 | ) |

| | |

| | | |

| | | |

| | |

| Denominator: | |

| | | |

| | | |

| | |

| Number of shares used in per common share calculations: | |

| 17,262,895 | | |

| 17,197,982 | | |

| 34,460,877 | |

| | |

| | | |

| | | |

| | |

| Net loss per common share: | |

| | | |

| | | |

| | |

| Net loss | |

$ | (0.05 | ) | |

$ | (0.17 | ) | |

$ | (0.11 | ) |

Below

are basic and diluted loss per share data for the three months ended March 31, 2023, which are in thousands except for share and per

share data:

| | |

Basic

Calculation | | |

Effect of Dilutive

Warrant

Securities | | |

Diluted

Calculation | |

| Numerator: | |

| | | |

| | | |

| | |

| Net loss | |

$ | (293 | ) | |

$ | (4,149 | ) | |

$ | (4,442 | ) |

| | |

| | | |

| | | |

| | |

| Denominator: | |

| | | |

| | | |

| | |

| Number of shares used in per common share calculations: | |

| 2,272,992 | | |

| 258,067 | | |

| 2,558,059 | |

| | |

| | | |

| | | |

| | |

| Net loss per common share: | |

| | | |

| | | |

| | |

| Net loss | |

$ | (0.13 | ) | |

$ | (1.61 | ) | |

$ | (1.74 | ) |

3.

Inventories

Inventories

consisted of the following (in thousands):

Schedule of Components of Inventory

| | |

March 31, 2024 | | |

December 31, 2023 | |

| Raw materials | |

$ | 732 | | |

$ | 691 | |

| WIP | |

| 335 | | |

| 426 | |

| Finished goods | |

| 109 | | |

| 104 | |

| Inventory net | |

$ | 1,176 | | |

$ | 1,221 | |

As

of March 31, 2024, inventories totaling approximately $0.7 million and $0.5 million were classified as current and long-term, respectively.

Inventories classified as current represent the carrying value of inventories as of March 31, 2024, that management estimates will be

sold or used by March 31, 2025.

4.

Fair Value Measurements

Financial

Instruments Measured and Recorded at Fair Value on a Recurring Basis

The

Company has issued certain warrants to purchase shares of common stock, which are considered derivative liabilities because they have

registration rights which could require a cash settlement and are re-measured to fair value at each reporting period in accordance with

accounting guidance. Fair value is based on the price that would be received from selling an asset or paid to transfer a liability in

an orderly transaction between market participants at the measurement date, under a three-tier fair value hierarchy which prioritizes

the inputs used in measuring fair value as follows:

| |

Level

1 - |

quoted

market prices for identical assets or liabilities in active markets. |

| |

|

|

| |

Level

2 - |

observable

prices that are based on inputs not quoted on active markets but corroborated by market data. |

| |

|

|

| |

Level

3 - |

unobservable

inputs reflecting management’s assumptions, consistent with reasonably available assumptions made by other market participants.

These valuations require significant judgment. |

The

Company classifies assets and liabilities measured at fair value in their entirety based on the lowest level of input that is significant

to their fair value measurement. No financial assets were measured on a recurring basis as of March 31, 2024, and December 31, 2023.

The following tables set forth the financial liabilities measured at fair value on a recurring basis by level within the fair value hierarchy

as of March 31, 2024, and December 31, 2023 (in thousands):

Schedule of Financial Liabilities Measured at Fair Value on Recurring Basis by Level Within Fair Value Hierarchy

| | |

Fair Value Measurements as of March 31, 2024 | |

| Description | |

Level 1 | | |

Level 2 | | |

Level 3 | | |

Total | |

| Derivative liability | |

| | | |

| | | |

| | | |

| | |

| Common stock warrants | |

$ | - | | |

$ | - | | |

$ | 845 | | |

$ | 845 | |

| | |

Fair Value Measurements as of December 31, 2023 | |

| Description | |

Level 1 | | |

Level 2 | | |

Level 3 | | |

Total | |

| Derivative liability | |

| | | |

| | | |

| | | |

| | |

| Common stock warrants | |

$ | - | | |

$ | - | | |

$ | 304 | | |

$ | 304 | |

The

Company did not have any transfers of assets and liabilities between Level 1 and Level 2 of the fair value measurement hierarchy during

the three months ended March 31, 2024, and 2023. The following table presents a reconciliation of the derivative liabilities measured

at fair value on a recurring basis using significant unobservable inputs (Level 3) during the three months ended March 31, 2024, and

2023 (in thousands):

Schedule of Fair Value Measurement Hierarchy of Derivative Liability

| | |

Common Stock

Warrants | |

| Balance as of December 31, 2022 | |

$ | (5,126 | ) |

| Issuance of derivatives | |

| (6,650 | ) |

| Exercise of warrants | |

| 5,502 | |

| Change in fair value | |

| 4,006 | |

| Other | |

| 1 | |

| Balance as of March 31, 2023 | |

$ | (2,267 | ) |

| | |

| | |

| Balance as of December 31, 2023 | |

$ | (304 | ) |

| Issuance of derivatives | |

| (3,366 | ) |

| Change in fair value | |

| 2,838 | |

| Other | |

| (13 | ) |

| Balance as of March 31, 2024 | |

$ | (845 | ) |

Common

Stock Warrants

The

Company has issued certain warrants to purchase shares of common stock, which are considered derivative liabilities because they have

registration rights which could require a cash settlement and are re-measured to fair value at each reporting period in accordance with

accounting guidance. As of March 31, 2024, and December 31, 2023, the derivative liability was calculated using the Monte Carlo Simulation

valuation.

The

assumptions used in estimating the common stock warrant liability using the Monte Carlo simulation valuation model as of March 31, 2024,

and December 31, 2023 were as follows:

Schedule of Assumptions Used in Estimating Fair Value

| | |

| March 31, 2024 | | |

| December 31, 2023 | |

| Weighted-average risk-free interest rate | |

| 4.18%-5.07 | % | |

| 3.93-4.79

| % |

| Weighted-average expected life (in years) | |

| 0.85-4.84 | | |

| 1.10-4.12 | |

| Expected dividend yield | |

| - | % | |

| - | % |

| Weighted-average expected volatility | |

| 115.0%-145.0 | % | |

| 113.1%-125.7 | % |

Other

Financial Instruments

The

Company’s recorded values of cash and cash equivalents, account and other receivables, accounts payable and accrued liabilities

approximate their fair values based on their short-term nature. The recorded value of notes payable approximates the fair value as the

interest rate approximates market interest rates.

5.

Accrued Liabilities

Accrued

liabilities consisted of the following (in thousands):

Schedule of Accrued Liabilities

| | |

March 31, 2024 | | |

December 31, 2023 | |

| Payroll and related expense | |

$ | 851 | | |

$ | 610 | |

| Accrued payables | |

| 568 | | |

| 163 | |

| Other | |

| 622 | | |

| 631 | |

| Accrued liabilities | |

$ | 2,041 | | |

$ | 1,404 | |

6.

Debt

Business

Loan

On

July 20, 2021, TA&T entered into a Loan Authorization and Agreement in the amount of approximately $350,000 (the “Business

Loan”). The Company made a one-time $35,000 buy down payment when acquiring the loan. The Business Loan bears interest at a rate

of 3.75% per annum. The Business Loan is secured by a general security interest in all of the assets of TA&T. The business loan was

paid in full during the first quarter of 2023 and there was no outstanding balance at March 31, 2024.

Related

Party Debt

TA&T

is obligated to repay certain personal loans made by the founders of TA&T to TA&T prior to SINTX’s acquisition of TA&T (the Personal Loans”). The total amount of the Personal Loans at June 30, 2022 was approximately $350,000. The Company

agreed to repay the outstanding balance of the Personal Loans in (i) 24 equal monthly installments beginning September 1, 2022 and each

month thereafter until paid in full as one prior owner’s portion of the Personal Loans totaling $157,000, and (ii) for the other

owner’s portion of the Personal Loans totaling $193,000. As of March 31, 2024, the related party debt had an outstanding balance

of $26,000. The outstanding balance is being paid in monthly installments ending August 1, 2024. The related party debt is not collateralized

and has no interest rate.

7.

Equity

2024

February Registered Offering

On February 2, 2024, the “Company closed on

the public offering of 16,000,000 units consisting of (a)(i) 3,400,000 units (the “Common Units”) to purchase shares (the

“Unit Shares”) of the Company’s Common Stock, par value $0.01 per share (the “Common Stock”) and (ii) 12,600,000

units (the “Pre-Funded Warrant Units” and together with the Common Units, the “Units”) to purchase pre-funded

warrants (the “Pre-Funded Warrants and each share of Common Stock underlying a Pre-Funded Warrant, a “Pre-Funded Warrant Share”)

to purchase up to 12,600,000 shares of Common Stock, (b) accompanying Class E warrants to purchase 16,000,000 shares of the Company’s

Common Stock (the “Class E Warrants”), and (c) accompanying Class F warrants to purchase 16,000,000 shares of the Company’s

Common Stock (the “Class F Warrants”). The aggregate proceeds to the Company from the Offering were approximately $4 million

before deducting placement agent fees and other offering expenses payable by the Company. The offering was made pursuant to a securities

purchase agreement (the “Purchase Agreement”) with certain investors (the “Purchasers”), and a placement agency

agreement dated as of January 31, 2024 (the “PAA”) with Maxim Group LLC (the “Placement Agent”). Each Common Unit

was sold at a public offering price of $0.25 and each Pre-Funded Warrant Unit was sold at a public offering price of $0.2499. The Class

E Warrants and the Class F Warrants are immediately exercisable (subject to the beneficial ownership cap at 4.99% or 9.99%) for one share

of the Company’s Common Stock at an exercise price of $0.25 per share. The Class E Warrants will expire five years from the date

of issuance and the Class F Warrants will expire 18 months from the date of issuance. Each Pre-Funded Warrant is exercisable for one share

of the Company’s Common Stock at an exercise price of $0.0001 per share. The Pre-Funded Warrants are immediately exercisable (subject

to the beneficial ownership cap at 4.99% or 9.99%) and may be exercised at any time until all of the Pre-Funded Warrants are exercised

in full. The Company engaged Maxim Group LLC as the Company’s sole placement agent for the Offering pursuant to the PAA. Pursuant

to the PAA, the Company agreed to pay the Placement Agent a cash placement fee equal to 7.0% of the gross proceeds of the Offering, plus

reimbursement of certain expenses and legal fees up to $100,000. The Company also agreed to issue up to 640,000 Common Stock purchase

warrants to the Placement Agent (the “Placement Agent Warrants”). The Placement Agent Warrants are exercisable at an exercise

price of $0.275. The Placement Agent Warrants will be exercisable beginning July 31, 2024 and will expire five years after the commencement

of sales in the offering.

2024 March Registered Offering

On March 26, 2024, the Company closed on a public

offering 28,400,000 shares of the Company’s common stock, (the “Offering”). Each Share was sold at a public offering

price of $0.047. The aggregate proceeds to the Company from the Offering were approximately $1.3 million before deducting placement agent

fees and other estimated offering expenses payable by the Company.

2023

Registered Offering

On

February 10, 2023, the Company closed on a public offering of 2,150,000 units, with each unit consisting of one share of common stock,

or one pre-funded warrant to purchase one share of its common stock, one Class C Warrant to purchase one share of common stock, and one

half of one Class D Warrant with each whole Class D Warrant entitling the holder to purchase one share of common stock. Each unit was

sold at a public offering price of $5.60. The Class C and Class D Warrants are immediately exercisable at a price of $5.60 per share.

The Class C and Class D warrants each have a cashless exercise provision entitling the holders to surrender one Class C Warrant and receive

0.4 shares of common stock and on the surrender of one Class D Warrant the holder is entitled to receive 0.8 shares of common stock.

The Class C Warrants expire five years from the date of issuance and the Class D Warrants expire three years from the date of issuance.

The shares of common stock (or pre-funded warrants in lieu thereof) and accompanying warrants were only purchasable together in this

offering but were issued separately and were immediately separable upon issuance. In addition, the company issued a total of 86,000 common

stock warrants to the placement agent, Maxim Group, and the Company’s financial advisor, Ascendiant Capital. Gross proceeds, before

deducting offering expenses, totaled approximately $12.0 million. Of the $12.0 million of gross proceeds, approximately $5.4 million

were allocated to common stock and prefunded warrants ($4.8 million net of offering costs) and approximately $6.7 million were allocated

to derivative liabilities (with approximately $0.7 million of cash offering costs and $0.1 million of agent warrant offering costs recorded

as derivative expense).

2021

Equity Distribution Agreement

On

February 25, 2021, the Company entered into an Equity Distribution Agreement (as amended, the “Distribution Agreement”)

with Maxim Group LLC (“Maxim”), pursuant to which the Company may sell from time to time, shares of the Company’s

common stock having an aggregate offering price of up to $15 million through Maxim, as agent. Subject to the terms and conditions of

the Distribution Agreement, as amended, Maxim will use its commercially reasonable efforts to sell the shares from time to time,

based on our instructions. Under the Distribution Agreement, Maxim may sell the Shares by any method permitted by law deemed to be

an “at-the-market” offering (the “ATM”) as defined in Rule 415 promulgated under the Securities Act of 1933,

as amended (the “Securities Act”), including, without limitation, sales made directly on the Nasdaq Capital Market. We

have no obligation to sell any shares under the ATM and may at any time suspend offers under the 2021 Distribution Agreement. On

October 12, 2023, the Company entered into an amendment to the Distribution Agreement, pursuant to which the expiration date of the

Distribution Agreement was extended to the earlier of: (i) the sale of shares having an aggregate offering price of $15.0 million,

(ii) the termination by either Maxim or the Company upon the provision of fifteen (15) days written notice, or (iii) February 25,

2025. No other changes were made to the terms of the Distribution Agreement. Under the terms of the Distribution Agreement, Maxim

will be entitled to a transaction fee at a fixed rate of 2.0% of the gross sales price of Shares sold under the 2021 Distribution

Agreement. The Company will also reimburse Maxim for certain expenses incurred in connection with the Distribution Agreement

and agreed to provide indemnification and contribution to Maxim with respect to certain liabilities under the Securities Act and the

Securities Exchange Act of 1934, as amended. As of March 31, 2024, there have been 2,471,949 shares

of common stock sold under the 2021 Distribution Agreement for gross proceeds of $1,030,519.

As a result, there is only approximately $70,000 more

that could be raised under the 2021 Distribution Agreement. Because the company’s public float is less than $75 million,

we may not sell securities over a 12-month period in an amount greater than one-third of our public float. In connection with the

February 2024 offering, the Company agreed to not make any sales of securities under the ATM for a period of six months from the

date of closing the offering, February 2, 2024, until August 2, 2024. The shares of the Company’s common stock to be

sold under the Distribution Agreement will be sold and issued pursuant to the Form S-3, as amended, which was previously declared

effective by the Securities and Exchange Commission, and the related prospectus and one or more prospectus supplements.

8.

Stock-Based Compensation

A

summary of the Company’s outstanding stock option activity for the three months ended March 31, 2024, and 2023 is as follows:

Schedule of Stock Option Activity

| | |

| | |

March 31, 2024 | | |

| |

| | |

| | |

Weighted- Average | | |

Weighted- Average Remaining Contractual

| | |

Intrinsic | |

| | |

Options | | |

Exercise Price | | |

Life

(Years) | | |

Value | |

| As of December 31, 2023 | |

| 11,909 | | |

$ | 109.77 | | |

| 6.9 | | |

$ | - | |

| Granted | |

| - | | |

| - | | |

| - | | |

| - | |

| Exercised | |

| - | | |

| - | | |

| - | | |

| - | |

| Forfeited | |

| - | | |

| - | | |

| - | | |

| - | |

| Expired | |

| - | | |

| - | | |

| - | | |

| - | |

| As of March 31, 2024 | |

| 11,909 | | |

$ | 82.75 | | |

| 6.7 | | |

$ | - | |

| Exercisable at March 31, 2024 | |

| 10,838 | | |

$ | 140.68 | | |

| 6.8 | | |

$ | - | |

| Vested and expected to vest at March 31, 2024 | |

| 9,571 | | |

$ | 82.43 | | |

| 6.6 | | |

$ | - | |

| | |

| | |

March 31, 2023 | | |

| |

| | |

| | |

Weighted- Average | | |

Weighted- Average Remaining Contractual

| | |

Intrinsic | |

| | |

Options | | |

Exercise Price | | |

Life

(Years) | | |

Value | |

| As of December 31, 2022 | |

| 11,909 | | |

$ | 234.02 | | |

| 6.9 | | |

$ | - | |

| Granted | |

| - | | |

| - | | |

| - | | |

| - | |

| Exercised | |

| - | | |

| - | | |

| - | | |

| - | |

| Forfeited | |

| - | | |

| - | | |

| - | | |

| - | |

| Expired | |

| - | | |

| - | | |

| - | | |

| - | |

| As of March 31, 2023 | |

| 11,909 | | |

$ | 120.33 | | |

| 7.7 | | |

$ | - | |

| Exercisable at March 31, 2023 | |

| 8,303 | | |

$ | 330.56 | | |

| 7.6 | | |

$ | - | |

| Vested and expected to vest at March 31, 2023 | |

| 9,840 | | |

$ | 119.65 | | |

| 7.7 | | |

$ | - | |

The

Company estimates the fair value of each stock option on the grant date using the Black-Scholes-Merton valuation model, which requires

several estimates including an estimate of the fair value of the underlying common stock on grant date. The expected volatility was based

on an average of the historical volatility of the Company. The expected term was contractual life of option. The risk-free interest rate

was based on the U.S. Treasury yield curve in effect at the time of grant for the expected term of the option. The Company did not grant

any stock options during the first quarter of 2023.

Of

the 11,909 options outstanding as of March 31, 2024, 3,550 were awarded to non-executive members of the board of directors.

Unrecognized

stock-based compensation as of March 31, 2024, is as follows (in thousands):

Schedule of Unrecognized Stock-based Compensation

| | |

| | |

Weighted Average | |

| | |

Unrecognized Stock-Based | | |

Remaining of Recognition | |

| | |

Compensation | | |

(in years) | |

| Stock options | |

$ | 38 | | |

| 0.5 | |

| Stock grants | |

$ | 28 | | |

| 1.8 | |

9.

Commitments and Contingencies

The

Company has executed agreements with certain executive officers of the Company which, upon the occurrence of certain events related to

a change in control, call for payments to the executives up to three times their annual salary and accelerated vesting of previously

granted stock options.

From

time to time, the Company is subject to various claims and legal proceedings covering matters that arise in the ordinary course of its

business activities. Management believes any liability that may ultimately result from the resolution of these matters will not have

a material adverse effect on the Company’s consolidated financial position, operating results or cash flows.

10.

Leases

The

Company has entered into multiple operating leases from which it conducts its business.

SINTX

With

respect to SINTX operations, the Company leases 30,764 square feet of office, warehouse and manufacturing space under a single operating

lease. This lease expires in October 2031. The lease has one five-year extension option.

SINTX

Armor

On

August 19, 2021, the Company, on behalf of SINTX Armor, entered into an Industrial Lease Agreement (the “SINTX Armor Lease”)

pursuant to which the Company has agreed to lease approximately 10,936 square feet of office and manufacturing space from which SINTX

Armor will conduct its operations. The term of the SINTX Armor Lease is 122 months through October 2031.

TA&T

In

connection with operation of its business, TA&T has entered into various leases for approximately 15,840 square feet of office and

manufacturing space from which it conducts its research, development and manufacturing activities. The leases have various expiration

dates ranging from April 30, 2024 through April 2030. Subsequent to December 31, 2023 we entered into an amended lease agreement reducing

this area to 13,560 square feet. The leases have various expiration dates ranging from July 2024 through April 2025.

Leases

with an initial term of 12 months or less are not recorded on the balance sheet. Lease expense is recognized on a straight-line basis

over the term of the lease. The Company accounts for lease components separately from the non-lease components. The depreciable life

of the assets and leasehold improvements are limited by the expected lease term.

As

of March 31, 2024, the operating lease right-of-use assets totaled approximately $3.9 million, and the operating lease liability totaled

approximately $4.1 million. Non-cash operating lease expense during the three months ended March 31, 2024 and 2023, totaled approximately

$0.2 and $0.2 million, respectively. As of March 31, 2024, the weighted-average discount rate for the Company’s operating lease

was 8.7%.

Operating

lease future minimum payments together with the present values as of March 31, 2024, are summarized as follows:

Schedule of Operating Lease Future Minimum Payments

| Years Ending December 31, | |

March 31, 2024 | |

| 2024 | |

$ | 643 | |

| 2025 | |

| 738 | |

| 2026 | |

| 668 | |

| 2027 | |

| 688 | |

| 2028 | |

| 709 | |

| Thereafter | |

| 2,124 | |

| Total future minimum lease payments | |

| 5,570 | |

| Less amounts representing interests | |

| (1,505 | ) |

| Present value of lease liability | |

| 4065 | |

| | |

| | |

| Current-portion of operating lease liability | |

| 518 | |

| Long-term portion operating lease liability | |

$ | 3,547 | |

11.

Subsequent Events

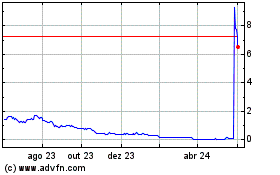

NASDAQ Notice of Delisting

As previously disclosed on

October 20, 2023, the Company received a notification letter from the Listing Qualifications Department (the “Staff”) of The

Nasdaq Stock Market LLC (“Nasdaq”) notifying the Company that, because the closing bid price for the Company’s common

stock was below $1.00 per share for 30 consecutive trading days, the Company is not currently in compliance with the minimum bid price

requirement for continued listing on The Nasdaq Capital Market, as set forth in Nasdaq Listing Rule 5550(a)(2) (the “Minimum Bid

Price Requirement”). In accordance with Listing Rule 5810(c)(3)(A), the Company was provided 180 calendar days, until April 17,

2024, to regain compliance with the Minimum Bid Price Requirement.

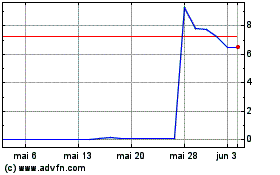

On April 8, 2024, the Company

received a new notification letter from the Staff notifying the Company that, as of April 5, 2024, the Company’s common stock had

a closing bid price of $0.10 or less for ten consecutive trading days and that, consistent with Nasdaq Listing Rule 5810(c)(3)(A)(iii),

the Staff has determined to delist the Company’s common stock from The Nasdaq Capital Market. The notice further provides that the

Company has until April 15, 2024, to request a hearing before an independent Hearings Panel (the “Panel”). The Company has

since been notified by the Nasdaq Hearing Panel that based on its review of the written record, the Nasdaq Hearings Panel (“Panel”)

determined to grant the Company a temporary exception to regain compliance with The Nasdaq Stock Market LLC’s (“Nasdaq”

or the “Exchange”) Listing Rule 5550(a)(2) (the “Bid Price Rule”) until June 10, 2024. In the event the Company

fails to regain compliance with the Bid Price Rule by that date, its securities will be delisted. There can be no assurance that the Company

will ultimately regain compliance with all applicable requirements for continued listing on The Nasdaq Capital Market.

2024 April Registered Offering

On April 5, 2024, the Company closed on a public offering

71,600,000 shares of the Company’s common stock, (the “Offering”). Each Share was sold at a public offering price of

$0.021. The aggregate proceeds to the Company from the Offering were approximately $1.5 million before deducting placement agent fees

and other estimated offering expenses payable by the Company.

Retirement of CEO and President

On April 25,

2024, B. Sonny Bal, MD, informed the board of directors of his intention to retire from his position as President and Chief Executive

Officer of SINTX Technologies, Inc. (the “Company”), effective on the Company naming a replacement President and Chief Executive

Officer. Dr. Bal will continue to serve on the Company’s board of directors in the position of Chairman. In connection with Dr.

Bal’s retirement, Dr. Bal and the Company entered into a Separation and Release of Claims Agreement (the “Agreement”).

The Agreement provides that in exchange for Dr. Bal’s covenants and releases under the terms of the Agreement, Dr. Bal will receive

upon his retirement a lump sum payment equal to three months of salary and the Company will pay Dr. Bal’s COBRA premium for a period

of three months should he elect COBRA benefits.

ITEM

2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

You

should read the following discussion and analysis of our financial condition and results of operations in conjunction with our consolidated

financial statements for the year ended December 31, 2023 and the notes thereto, along with Management’s Discussion and Analysis

of Financial Condition and Results of Operations, included in our Annual Report on Form 10-K for the year ended December 31, 2023, filed

separately with the U.S. Securities and Exchange Commission. This discussion and analysis contains forward-looking statements based upon

current beliefs, plans, expectations, intentions and projections that involve risks, uncertainties and assumptions, such as statements

regarding our plans, objectives, expectations, intentions and projections. Our actual results and the timing of selected events could

differ materially from those anticipated in these forward-looking statements as a result of several factors, including those set forth

under the “Risk Factors” section of our Annual Report on Form 10-K for the year ended December 31, 2023, and any updates

to those risk factors filed from time to time in our Quarterly Reports on Form 10-Q and in other filings with the Securities and Exchange

Commission we may make from time-to-time.

Overview

SINTX