Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

17 Maio 2024 - 6:07PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2024

Commission file number: 001-35223

BioLineRx Ltd.

(Translation of registrant’s name into English)

2 HaMa’ayan Street

Modi’in 7177871, Israel

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

On May 17, 2024, the registrant issued the press release

which is filed as

Exhibit 1 to this Report on Form 6-K.

This Form 6-K, including the exhibit attached hereto, is hereby incorporated by reference into all effective registration statements

filed by the registrant under the Securities Act of 1933.

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

|

BioLineRx Ltd.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Philip A. Serlin

|

|

|

|

|

Philip A. Serlin

|

|

|

|

|

Chief Executive Officer

|

|

Exhibit 1

BioLineRx Announces Receipt of Nasdaq Minimum Bid Price Notification

TEL AVIV, Israel, May 17, 2024–

BioLineRx Ltd. (NASDAQ: BLRX) (TASE: BLRX) ("BioLineRx" or the "Company"), a commercial stage biopharmaceutical company pursuing life-changing therapies in oncology and rare diseases, today announced that it has received a notification letter from the

Nasdaq Stock Market LLC ("Nasdaq"). The letter notifies the Company that it is not in compliance with the minimum bid price requirement set forth in Nasdaq Listing Rules for continued listing on the Nasdaq Capital Market, since the closing bid price

for the Company's American Depositary Shares (“ADSs”) listed on the Nasdaq was below USD $1.00 for 30 consecutive trading days. Nasdaq Listing Rule 5550(a)(2) requires listed securities to maintain a minimum bid price of USD $1.00 per share, and Nasdaq

Listing Rule 5810(c)(3)(A) provides that a failure to meet the minimum bid price requirement exists if the deficiency continues for a period of 30 consecutive business days.

The Notice has no immediate effect on the Company’s Nasdaq listing or the trading of its ADSs, and during the grace period, as may be

extended, the Company’s ADSs will continue to trade on the Nasdaq under the symbol “BLRX”.

In accordance with Listing Rule 5810(c)(3)(A), the Company has a period of 180 calendar days from the date of notification, or until

November 11, 2024, to regain compliance with the minimum bid price. If at any time before November 11, 2024 the bid price of the Company's ADSs closes at or above USD $1.00 per share for a minimum of 10 consecutive business days, Nasdaq will provide

written notification that the Company has achieved compliance with the minimum bid price requirement.

In the event the Company does not regain compliance by November 11, 2024, the Company may be eligible for an additional 180 days to regain

compliance if it meets the continued listing requirement for market value of publicly held shares and all other initial listing standards for the Nasdaq Capital Market, with the exception of the minimum bid price requirement. In this case, the

Company will need to provide written notice of its intention to cure the deficiency during the second compliance period.

The Company will continue to monitor the closing bid price of its ADSs on the Nasdaq between now and November 11, 2024 and seek to cure the

deficiency within the prescribed compliance period. The Company's business operations are not affected by the notification letter.

If the Company cannot demonstrate compliance by the allotted compliance period(s), Nasdaq’s staff will notify the Company that its ADSs are

subject to delisting.

The Company’s ordinary shares are also listed on the Tel Aviv Stock Exchange and the notification letter does not affect the Company's

compliance status with such listing.

About BioLineRx

BioLineRx Ltd. (NASDAQ/TASE: BLRX) is a commercial stage biopharmaceutical company pursuing life-changing therapies in oncology and rare

diseases. The company’s first approved product is APHEXDA® (motixafortide) with an indication in the U.S. for stem cell mobilization for autologous transplantation in multiple myeloma. BioLineRx is advancing a pipeline of investigational medicines for

patients with sickle cell disease, pancreatic cancer, and other solid tumors. Headquartered in Israel, and with operations in the U.S., the company is driving innovative therapeutics with end-to-end expertise in development and commercialization,

ensuring life-changing discoveries move beyond the bench to the bedside.

Learn more about who we are, what we do, and how we do it at www.biolinerx.com,

or on Twitter and LinkedIn.

Forward Looking Statement

Various statements in this release

concerning BioLineRx's future expectations constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include words such as "anticipates," "believes," "could," "estimates,"

"expects," "intends," "may," "plans," "potential," "predicts," "projects," "should," "will," and "would," and describe opinions about future events. These forward-looking statements involve known and unknown risks, uncertainties and other factors

that may cause the actual results, performance or achievements of BioLineRx to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Factors that could cause BioLineRx's

actual results to differ materially from those expressed or implied in such forward-looking statements include, but are not limited to: the initiation, timing, progress and results of BioLineRx's preclinical studies, clinical trials, and other

therapeutic candidate development efforts; BioLineRx's ability to advance its therapeutic candidates into clinical trials or to successfully complete its preclinical studies or clinical trials; whether BioLineRx’s collaboration partners will be able

to execute on collaboration goals in a timely manner; whether the clinical trial results for APHEXDA will be predictive of real-world results; BioLineRx's receipt of regulatory approvals for its therapeutic candidates, and the timing of other

regulatory filings and approvals; the clinical development, commercialization and market acceptance of BioLineRx's therapeutic candidates, including the degree and pace of market uptake of APHEXDA for the mobilization of hematopoietic stem cells for autologous transplantation in multiple myeloma

patients; whether access to APHEXDA is achieved in a commercially viable manner and whether APHEXDA receives adequate reimbursement from third-party payors; BioLineRx's ability to establish, operationalize and maintain corporate collaborations;

BioLineRx's ability to integrate new therapeutic candidates and new personnel; the interpretation of the properties and characteristics of BioLineRx's therapeutic candidates and of the results obtained with its therapeutic candidates in preclinical

studies or clinical trials; the implementation of BioLineRx's business model and strategic plans for its business and therapeutic candidates; the scope of protection BioLineRx is able to establish and maintain for intellectual property rights

covering its therapeutic candidates and its ability to operate its business without infringing the intellectual property rights of others; estimates of BioLineRx's expenses, future revenues, capital requirements and its needs for and ability to

access sufficient additional financing, including any unexpected costs or delays in the commercial launch of APHEXDA; risks related to changes in healthcare laws, rules and regulations in the United States or elsewhere; competitive companies,

technologies and BioLineRx's industry; statements as to the impact of the political and security situation in Israel on BioLineRx's business; and the impact of the COVID-19 pandemic, the Russian invasion of Ukraine, the declared war by Israel against

Hamas and the military campaigns against Hamas and other terrorist organizations, which may exacerbate the magnitude of the factors discussed above. These and other factors are more fully discussed in the "Risk Factors" section of BioLineRx's most

recent annual report on Form 20-F/A filed with the Securities and Exchange Commission on March 26, 2024. In addition, any forward-looking statements represent BioLineRx's views only as of the date of this release and should not be relied upon as

representing its views as of any subsequent date. BioLineRx does not assume any obligation to update any forward-looking statements unless required by law.

Contacts:

United States

John Lacey

BioLineRx

IR@biolinerx.com

Israel

Moran Meir

LifeSci Advisors, LLC

moran@lifesciadvisors.com

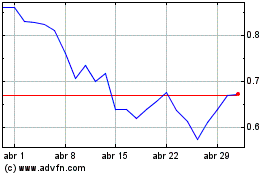

BioLineRx (NASDAQ:BLRX)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

BioLineRx (NASDAQ:BLRX)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024