UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2024

Commission File Number 001-39766

Orla Mining Ltd.

(Translation of registrant’s name into English)

Suite 1010, 1075 West Georgia Street

Vancouver, British Columbia,

V6E 3C9, Canada

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [ ] Form 40-F [ X ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

Incorporation by Reference

Exhibit 99.2 (Management Information Circular) to this Report on Form 6-K is incorporated by reference into this report and is hereby incorporated by reference into and as an exhibit to the registrant’s Registration Statement on Form F-10 (File No. 333-271236) and Registration Statement on Form S-8 (File No. 333-272171), in both cases as amended or supplemented, to the extent not superseded by documents or reports subsequently filed or furnished by us under the Securities Act of 1933 or the Securities Exchange Act of 1934, in each case as amended.

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

| |

Orla Mining Ltd. |

| |

|

|

| Date: May 21, 2024 |

By: |

/s/ Etienne Morin |

| |

Name: |

Etienne Morin |

| |

Title: |

Chief Financial Officer |

Exhibit 99.1

ORLA MINING LTD

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS

NOTICE is hereby given that the annual general and special meeting (the “Meeting”) of the holders of common shares (“Shareholders”) of Orla Mining Ltd. (the “Company”) will be held via conference call on the 20th day of June, 2024, at 8:00 a.m. (Vancouver time) for the following purposes:

|

|

| (a) |

to receive the audited consolidated financial statements of the Company as at and for the financial year ended December 31, 2023, together with the report of the auditor thereon; |

| |

|

| (b) |

to elect directors of the Company for the ensuing year; |

| |

|

| (c) |

to appoint Ernst & Young LLP as auditor of the Company for the ensuing year and authorize the board of directors to fix the remuneration of the auditor; |

| |

|

| (d) |

to consider a non-binding advisory resolution on the Company’s approach to executive compensation, as more fully described in the accompanying management information circular (the “Circular”); |

| |

|

| (e) |

to consider, and if deemed advisable, to pass, with or without variation, an ordinary resolution to approve all unallocated stock options under the Company’s stock option plan, as more particularly described in the accompanying Circular; and |

| |

|

| (f) |

to transact such other business as may properly come before the Meeting or any adjournment or postponement thereof. |

The Meeting will be held in a virtual only format, which will be conducted via conference call and available for guests via live webcast, as follows:

Conference Call (Participant or Guest): 877-407-6184 (toll free)

Webcast (Guest Only): https://event.choruscall.com/mediaframe/webcast.html?webcastid=zeJt8Lgd

Only registered Shareholders and duly appointed proxyholders will be able to vote in real time and ask questions at the Meeting via conference call, provided they are connected to the call and comply with all of the requirements set out in the Circular. Once dialed in, instructions will be provided as to how Shareholders entitled to vote at the Meeting may participate, vote and ask questions at the Meeting. Any person, including registered shareholders and duly appointed proxyholders, who participates at the Meeting via webcast only will not be able to vote on matters put before the Meeting, ask questions, or otherwise participate at the Meeting and must vote in advance of the Meeting by using the voting instruction form or form of proxy mailed to them with the Circular. Non-registered Shareholders (being Shareholders who beneficially own shares that are registered in the name of an intermediary such as a bank, trust company, securities broker or other nominee, or in the name of a depository of which the intermediary is a participant) who have not duly appointed themselves as proxyholder will be able to attend the Meeting via conference call or webcast as guests, but guests will not be able to vote, ask questions or otherwise participate at the Meeting.

The specific details of the foregoing matters to be put before the Meeting, as well as further information with respect to voting by proxy and detailed instructions about how to participate at the virtual Meeting are set forth in the Circular which accompanies, and is deemed to form a part of, this Notice of Meeting.

Dated May 14, 2024.

By Order of the Board of Directors

“Jason Simpson”

Jason Simpson

President, Chief Executive Officer and Director

Exhibit 99.2

MANAGEMENT INFORMATION

CIRCULAR

NOTICE OF ANNUAL GENERAL

AND SPECIAL

MEETING OF SHAREHOLDERS

JUNE 20, 2024

DATED AS OF MAY 14, 2024

| |

|

|

TSX: OLA

NYSE AMERICAN: ORLA

|

| |

|

|

TSX: OLA

NYSE AMERICAN: ORLA

|

LETTER

TO SHAREHOLDERS

May 14, 2024

Dear Fellow Shareholders,

On behalf of the Board of Directors

(the “Board”) of Orla Mining Ltd. (“Orla”

or the “Company”), we invite you to attend our 2024

annual general and special meeting (the “Meeting”)

of the holders of common shares of Orla, which will be held on June 20, 2024 at 8:00 am (PST) in virtual format via conference call.

2023

IN REVIEW

I

am proud to report that 2023 represented continued success for Orla in a number of areas:

| ● | Strong

Operating Performance: Our Camino Rojo Oxide Mine, in Zacatecas, Mexico, achieved continued

operating success, as we exceeded the high end of our increased 2023 annual production guidance

at industry leading costs. |

| ● | Employee

Health & Safety and Environmental Management: Perhaps more importantly, the operational

success of the Company was achieved while maintaining the health and safety of our employees

and protecting the local communities in the jurisdictions in which we operate, as well as

upholding a strong environmental record. |

| ● | Financial

Strength: In addition to the cash flow generated from our operational performance, we

improved our liquidity through the extension and expansion in our revolving credit facility. |

| ● | Exploration

& Project Advancement: We continued to advance exploration and study work on our

large prospective land packages in Mexico and Nevada, as we seek to grow and diversify our

operating platform. |

| ● | Sustainability:

We continued to advance our overall sustainability efforts, which included the release

of our inaugural Sustainability Report, as we seek to transparently report on our

efforts. |

THE

MEETING

The

enclosed management information circular (the “Circular”) provides important information on the matters to be considered

at the Meeting, including information about the nominated directors, our director and executive compensation programs and our

governance practices. You will also be given the opportunity to vote on our approach to executive compensation. Your vote is advisory

and will provide our Human Resources and Compensation Committee and the Board with important feedback. Finally, you will also be asked

to approve the unallocated stock options under Orla’s stock option plan.

Your participation at the

Meeting is important to us, regardless of the number of Shares that you own. We encourage you to read the Circular and to exercise

your right to vote on the items for consideration at the Meeting. If you are unable to attend the Meeting, we encourage you to

complete and return your form of proxy

or voting instruction form in accordance with the instructions

in the Circular to ensure that your votes are counted.

LOOKING FORWARD

We have carried our

momentum into 2024 with continued operational performance on the wave of all- time high gold prices. We are also unlocking value within

our project and exploration portfolio. This operational strength coupled with tangible growth will help us generate value for our stakeholders

over the long term.

THANK YOU

On behalf of the

Board, thank you for your continued support and engagement and we look forward to your participation at the Meeting.

Sincerely,

“Charles

Jeannes”

Chairman of the Board of Directors

ORLA MINING LTD.

NOTICE OF ANNUAL GENERAL

AND SPECIAL MEETING OF SHAREHOLDERS

NOTICE

is hereby given that the annual general and special meeting (the “Meeting”)

of the holders of common shares (“Shareholders”) of

Orla Mining Ltd. (the “Company”) will be held via

conference call on the 20th day of June, 2024, at 8:00 a.m. (Vancouver time) for the following

purposes:

| (a) | to receive the audited consolidated financial statements of

the Company as at and for the financial year ended December 31, 2023, together with the report of the auditor thereon; |

| (b) | to elect directors of the Company for the ensuing year; |

| (c) | to appoint Ernst & Young LLP as auditor of the Company

for the ensuing year and authorize the board of directors to fix the remuneration of the auditor; |

| (d) | to consider a non-binding advisory resolution on the Company’s

approach to executive compensation, as more fully described in the accompanying management information circular (the “Circular”); |

| (e) | to consider, and if deemed advisable, to pass, with or without

variation, an ordinary resolution to approve all unallocated stock options under the Company’s stock option plan, as more particularly

described in the accompanying Circular; and |

| (f) | to transact such other business as may properly come before

the Meeting or any adjournment or postponement thereof. |

The Meeting will be held in a virtual

only format, which will be conducted via conference call and available for guests via live webcast, as follows:

Conference

Call (Participant or Guest): 877-407-6184 (toll free)

Webcast

(Guest Only): https://event.choruscall.com/mediaframe/webcast.html?webcastid=zeJt8Lgd

Only registered Shareholders and

duly appointed proxyholders will be able to vote in real time and ask questions at the Meeting via conference call, provided they are

connected to the call and comply with all of the requirements set out in the Circular. Once dialed in, instructions will be provided

as to how Shareholders entitled to vote at the Meeting may participate, vote and ask questions at the Meeting. Any

person, including registered shareholders and duly appointed proxyholders, who participates at the Meeting via webcast will not be able

to vote on matters put before the Meeting, ask questions, or otherwise participate at the Meeting and must vote in advance of the Meeting

by using the voting instruction form or form of proxy mailed to them with the Circular. Non-registered Shareholders (being Shareholders

who beneficially own shares that are registered in the name of an intermediary such as a bank, trust company, securities broker or other

nominee, or in the name of a depository of which the intermediary is a participant) who have not duly appointed themselves as proxyholder

will be able to attend the Meeting via conference call or webcast as guests, but guests will not be able to vote, ask questions or otherwise

participate at the Meeting.

The specific details of the foregoing

matters to be put before the Meeting, as well as further information with respect to voting by proxy and detailed instructions about how

to participate at the virtual Meeting are set forth in the Circular which accompanies, and is deemed to form a part of, this Notice of

Meeting.

Dated

May 14, 2024.

By Order of the Board of Directors

“Jason Simpson”

Jason Simpson

President, Chief Executive Officer and Director

MANAGEMENT

INFORMATION CIRCULAR

This management information circular (the “Circular”)

is furnished in connection with the solicitation by management (“Management”)

of Orla Mining Ltd. (the “Company” or “Orla”)

of proxies to be used at the Company’s annual general and special meeting of the holders (“Shareholders”)

of common shares of the Company (the “Common Shares”)

to be held on June 20, 2024 (the “Meeting”) or at

any adjournment or postponement thereof at the time and place and for the purposes set forth in the accompanying notice of annual and

special meeting (“Notice of Meeting”).

The Meeting will be held in a virtual only format,

which will be conducted via conference call and available for guests via live webcast. Shareholders and duly appointed proxyholders can

attend the Meeting as follows:

Conference

Call (Participant or Guest): 877-407-6184 (toll free)

Webcast

(Guest Only): https://event.choruscall.com/mediaframe/webcast.html?webcastid=zeJt8Lgd

Only registered Shareholders and duly appointed

proxyholders will be able to vote and ask questions in real time at the Meeting via conference call, provided they are connected to the

call and comply with all of the requirements set out in this Circular. Once dialed in, instructions will be provided as to how Shareholders

entitled to vote at the Meeting may participate, vote and ask questions at the Meeting. Any

person, including registered shareholders and duly appointed proxyholders, who participates at the Meeting via webcast only will not

be able to vote on matters put before the Meeting, ask questions or otherwise participate at the Meeting and must vote in advance of

the Meeting by using the voting instruction form or form of proxy mailed to them with the Circular. Shareholders will not be able to

physically attend the Meeting. For a summary of how Shareholders may attend the Meeting via conference call, see “Voting

at the Virtual Meeting” below.

Except as otherwise indicated, the information

contained in this Circular is stated as at May 14, 2024. All dollar amounts referenced herein, unless otherwise indicated, are expressed

in Canadian dollars.

SOLICITATION OF PROXIES AND VOTING

INSTRUCTIONS

SOLICITATION OF PROXIES

It is anticipated that the solicitations

will be made primarily by mail in relation to the delivery of the Circular. Proxies may also be solicited personally or by telephone by

directors, officers or employees of the Company at nominal cost. The cost of the solicitation will be borne by the Company. The Company

has arranged for Intermediaries (as defined below) to forward the meeting materials to Non-Registered Shareholders (as defined below)

and the Company will reimburse the Intermediaries for their reasonable fees and disbursements in that regard.

This solicitation of proxies and voting instruction

forms involves securities of a Company located in Canada and is being effected in accordance with the applicable corporate and securities

laws of Canada. The proxy solicitation rules under the United States Securities

Exchange Act of 1934, as amended (the “Exchange Act”),

are not applicable to the Company or this solicitation. Shareholders should be aware that disclosure and proxy solicitation requirements

under the applicable securities laws of Canada and the Toronto Stock Exchange (“TSX”)

differ from the disclosure and proxy solicitation requirements under United States securities laws.

APPOINTMENT AND REVOCATION

OF PROXIES

The person(s) designated by Management in the enclosed

form of proxy are directors and/or officers of the Company (the “Management

Proxyholders”). Each Shareholder has the right to appoint

as proxyholder a person (who need not be a Shareholder) other than Management Proxyholders to represent the

Shareholder at the Meeting

or at any adjournment or postponement thereof. Such right may be exercised by striking out the names of the person(s) printed in the

accompanying form of proxy and inserting the name of the person in the blank space provided in the enclosed form of proxy or by completing

another suitable form of proxy and, in either case, delivering the completed and executed form of proxy as provided below.

If you are a Non-Registered Shareholder

and wish to vote at the Meeting, you have to insert your own name in the blank space provided on the voting instruction form or form of

proxy sent to you by your Intermediary and follow the applicable instructions provided by your Intermediary.

VOTING OF PROXIES

On any ballot that may be called for,

the Common Shares represented by a properly executed proxy given in favour of the Management Proxyholders will be voted or withheld from

voting in accordance with the instructions given on the ballot. If the Shareholder specifies a choice with respect to any matter to be

acted upon, the Common Shares will be voted accordingly.

In the absence of any direction in the

instrument of proxy, such Common Shares will be voted in favour of the matters set forth in the accompanying Notice of Meeting. The enclosed

form of proxy confers discretionary authority upon the persons named therein with respect to amendments or variations to matters identified

in the accompanying Notice of Meeting, and with respect to other matters which may properly come before the Meeting or any adjournment

or postponement thereof. At the date of this Circular, Management is not aware of any such amendment, variation or other matter to come

before the Meeting. However, if any amendments or variations to matters identified in the accompanying Notice of Meeting or any other

matters which are not now known to Management should properly come before the Meeting or any adjournment or postponement thereof, the

Common Shares represented by properly executed proxies given in favour of the Management Proxyholders will be voted on such matters pursuant

to such discretionary authority.

REGISTERED SHAREHOLDERS

In the case of registered Shareholders

(“Registered Shareholders”), the completed, signed

and dated form of proxy should be sent in the addressed envelope enclosed to Computershare Investor Services Inc., Attn: Proxy Department,

100 University Avenue, 8th Floor, Toronto, Ontario M5J 2Yl, or via fax to 1-866-249-7775 (toll free North America) or 1-416-263-9524

(International). Alternatively, Registered Shareholders may vote by telephone by calling 1-866-732-8683 (toll free) or online via www.investorvote.com.

To be effective, a proxy must be received not later than 8:00 a.m. (Vancouver time) on June 18, 2024, or at least 48 hours (excluding

Saturdays and holidays), before the time for holding the Meeting or any adjournment thereof.

A Registered Shareholder who has given

a proxy may revoke it by depositing an instrument in writing, including another proxy bearing a later date, signed by the Registered Shareholder

or by the Registered Shareholder’s attorney, who is authorized in writing, or by transmitting, by telephonic or electronic means,

a revocation signed by electronic signature by the Registered Shareholder or by the Registered Shareholder’s attorney, who is authorized

in writing, to the head office of the Company at any time up to and including the last business day preceding the day of the Meeting,

or in the case of any adjournment or postponement of the Meeting, the last business day preceding the day of the adjournment or postponement,

or by dialing into the Meeting via conference call and accepting the terms and conditions (see “Voting

at the Virtual Meeting” below). A Registered Shareholder may also revoke a proxy in any other manner permitted by law.

Only Registered Shareholders have the right to revoke a proxy. A Non-Registered Shareholder who wishes to change its vote must arrange

for its Intermediary to revoke its proxy on its behalf.

NON-REGISTERED

HOLDERS

Only

Registered Shareholders (or duly appointed proxyholders) are permitted to vote at the Meeting. However, in many cases, Shareholders are

“non-registered” Shareholders because the Common Shares they own are not registered in their names, but are instead registered

in the name of the brokerage firm, bank or trust company through which they purchased the Common Shares. More particularly, a person

is not a Registered Shareholder in respect of Common Shares which are held on behalf of that person (a “Non-Registered Shareholder”),

but which are registered either: (a) in the name of an intermediary (an “Intermediary”) that the Non-Registered Shareholder

deals with in respect of the Common Shares (Intermediaries include, among others, banks, trust companies, securities dealers or brokers

and trustees or administrators of self-administered RRSPs, RRIFs, RESPs and similar plans); or (b) in the name of a clearing agency (such

as The Canadian Depository for Securities Limited) of which the Intermediary is a participant. Non-Registered Shareholders do not appear

on the list of Shareholders maintained by the transfer agent.

Non-Registered

Shareholders who have not objected to their Intermediary disclosing certain ownership information about themselves to the Company are

referred to as Non-Objecting Beneficial Owners (“NOBOs”). Those Non-Registered Shareholders who have objected to their

Intermediary disclosing ownership information about themselves to the Company are referred to as Objecting Beneficial Owners (“OBOs”).

Issuers

can request and obtain a list of their NOBOs from Intermediaries via their transfer agents, pursuant to National Instrument 54-101—

Communication with Beneficial Owners of Securities of a Reporting Issuer (“NI 54- 101”) and issuers can use

this NOBO list for distribution of proxy-related materials directly to NOBOs. The Company has decided to take advantage of those provisions

of NI 54-101 that allow it to directly deliver proxy-related materials to its NOBOs. As a result, NOBOs can expect to receive a voting

instruction form from the Company’s transfer agent, Computershare Investor Services Inc. (“Computershare”).

These voting instruction forms are to be completed and returned to Computershare in the envelope provided or by facsimile. Computershare

will tabulate the results of the voting instruction forms received from NOBOs and will provide appropriate instructions at the Meeting

with respect to the Common Shares represented by voting instruction forms they receive. Alternatively, NOBOs may vote following the instructions

on the voting instruction form, via the internet or by phone.

These

securityholder materials are being sent to both registered and non-registered owners of the securities. If you are a non-registered owner,

and the issuer or its agent has sent these materials directly to you, your name and address and information about your holdings of securities,

have been obtained in accordance with applicable securities regulatory requirements from the intermediary holding on your behalf.

By

choosing to send these materials to you directly, the issuer (and not the intermediary holding on your behalf) has assumed responsibility

for (i) delivering these materials to you, and (ii) executing your proper voting instructions. Please return your voting instructions

as specified in the request for voting instructions.

With

respect to OBOs, in accordance with applicable securities law requirements, the Company will have distributed copies of the Notice of

Meeting, this Circular, the form of proxy or voting instruction form and the supplemental mailing list request card (collectively, the

“Meeting Materials”) to the clearing agencies and Intermediaries for distribution to Non-Registered Shareholders.

The Company intends to pay for Intermediaries to deliver the Meeting Materials to OBOs.

Intermediaries

are required to forward the Meeting Materials to Non-Registered Shareholders unless a Non- Registered Shareholder has waived the right

to receive them. Very often, Intermediaries will use service companies to forward the Meeting Materials to Non-Registered Shareholders.

Generally, Non-Registered Shareholders who have not waived the right to receive the Meeting Materials will either:

| (a) | be

given a form of proxy which has already been signed by the Intermediary (typically by a facsimile, stamped

signature), which is restricted as to the number of Common Shares beneficially owned by the Non-Registered

Shareholder but which is otherwise not completed. Because the Intermediary has |

already

signed the form of proxy, this form of proxy is not required to be signed by the Non-Registered Shareholder when submitting the proxy.

If the Non-Registered Shareholder does not wish to attend and vote at the virtual Meeting in person (or have another person attend and

vote on the holder’s behalf), the Non-Registered Shareholder must complete the form of proxy and deposit it with the Company’s

registrar and transfer agent, Computershare, as provided above; or

| (b) | be

given a voting instruction form which is not signed by the Intermediary, and which, when properly completed

and signed by the Non-Registered Shareholder and returned to the Intermediary or its service company,

will constitute voting instructions (often called a “proxy authorization form”), which the

Intermediary must follow. Typically, the proxy authorization form will consist of a one-page pre-printed

form. Sometimes, instead of the one-page pre-printed form, the proxy authorization form will consist

of a regular printed proxy form accompanied by a page of instructions, which contains a removable label

containing a barcode and other information. In order for the form of proxy to validly constitute a proxy

authorization form, the Non-Registered Shareholder must remove the label from the instructions and affix

it to the form of proxy, properly complete and sign the form of proxy and return it to the Intermediary

or its service company in accordance with the instructions of the Intermediary or its service company.

If the Non-Registered Shareholder does not wish to attend and vote at the virtual Meeting in person

(or have another person attend and vote on the holder’s behalf), the voting instruction form must

be completed, signed and returned in accordance with the directions on the form. |

In

either case, the purpose of this procedure is to permit a Non-Registered Shareholder to direct the voting of the Common Shares which

they beneficially own. In addition, an Intermediary subject to the New York Stock Exchange rules and who has not received specific voting

instructions from the Non-Registered Shareholder will not be able to vote the Common Shares on all or, as applicable, any matters at

the Meeting. Non-Registered Shareholders should carefully follow the instructions of their Intermediary, including those regarding

when and where the proxy or proxy authorization form is to be delivered. Only Registered Shareholders have the right to revoke a

proxy. A Non-Registered Shareholder who wishes to change its vote must arrange for its Intermediary to revoke its proxy on its behalf.

VOTING

AT THE VIRTUAL MEETING

The

Company will hold its Meeting in a virtual only format, which will be conducted via conference call and available for guests via live

webcast. The Company believes that hosting a virtual meeting will increase participation by its Shareholders, as it will enable Shareholders

to more easily attend the Meeting regardless of their geographic location. Shareholders will not be able to physically attend the

Meeting.

In

order to streamline the Meeting process, the Company encourages Shareholders to vote in advance of the Meeting using the voting instruction

form or the form of proxy mailed to them with the Meeting Materials. Shareholders wishing to attend the Meeting may continue to do

so as follows:

Conference

Call (Participant or Guest): 877-407-6184 (toll free)

Webcast

(Guest Only): https://event.choruscall.com/mediaframe/webcast.html?webcastid=zeJt8Lgd

Only

Registered Shareholders and duly appointed proxyholders will be able to vote in real time at the Meeting via conference call, provided

they are connected to the call and comply with all of the requirements set out in this Circular. Once dialed in, instructions will be

provided as to how Shareholders entitled to vote at the Meeting may participate, vote and ask questions at the Meeting. Any person,

including Registered Shareholders and duly appointed proxyholders, who participates at the Meeting via webcast will not be able to vote

on matters put before the Meeting, ask questions or otherwise participate at the Meeting and must vote in advance of the Meeting by using

the voting instruction form or form of proxy mailed to them with the Circular. If you attend the Meeting via conference call, it

is important that you call in early and remain connected for the duration of the Meeting in order to vote when balloting commences. It

is your responsibility to ensure that you remain connected. The Meeting will begin promptly at 8:00 a.m. (Vancouver time) on June

20, 2024,

unless

otherwise adjourned or postponed. You should allow ample time for the check-in procedures prior to the start of the Meeting.

Registered

Shareholders and duly appointed proxyholders who participate in the Meeting via conference call may ask questions in accordance with

the instructions provided at the Meeting. Questions will generally only be addressed during a question period at the end of the Meeting,

however, questions regarding procedural matters or directly related to a specific motion may be addressed during the Meeting.

Non-Registered

Shareholders who have not duly appointed themselves as proxyholders may attend the Meeting as guests. Guests will be able to listen to

the Meeting, but will not be able to vote, ask questions or otherwise participate at the Meeting. This is because the transfer agent,

Computershare, does not have a record of the Non- Registered Shareholders and, as a result, will have no knowledge of shareholdings or

entitlement to vote, unless the Non-Registered Shareholder appoints itself as proxyholder.

If

you are a Non-Registered Shareholder and wish to vote at the Meeting, you must appoint yourself as proxyholder by inserting your own

name in the space provided for appointing a proxyholder on the voting instruction form sent to you and follow all of the applicable instructions,

including the deadline, provided by the Intermediary.

A

summary of the information Shareholders will need to attend and vote at the virtual meeting is provided below.

| · | Registered

Shareholders and duly appointed proxyholders must dial in prior to the start of the Meeting

and, once dialed in, follow the instructions provided. |

| · | Guests,

including Non-Registered Shareholders who have not duly appointed themselves as proxyholder

can listen to the Meeting, but will not be able to vote, ask questions or otherwise participate

at the Meeting. Log in online through the webcast or dial-in via conference call, and then

complete the registration. |

If

you are dialing into the Meeting via conference call and you accept the terms and conditions, you will be revoking any and all previously

submitted proxies. However, in such a case you will be provided the opportunity to vote by ballot on the matters put forth at the Meeting.

If you DO NOT wish to revoke all previously submitted proxies: (i) do not accept the terms and conditions, in which case

you can only enter the Meeting via conference call as a guest; or (ii) join the Meeting via webcast, in which case you will be able to

listen to the Meeting, but, in both cases, you will not be able to vote, ask questions or otherwise participate at the Meeting.

RECORD

DATE

The

board of directors of the Company (the “Board”) has fixed May 14, 2024 (the “Record Date”) as the

record date for the purpose of determining holders of Common Shares entitled to receive notice of and to vote at the Meeting. In accordance

with the provisions of the Canada Business Corporation Act (the “CBCA”), the Company or its transfer agent

will prepare a list of holders of Common Shares on the Record Date. Each Shareholder named in the list or such Shareholder’s proxy

will be entitled to vote the Common Shares shown opposite such Shareholder’s name on the list at the Meeting.

VOTING

SHARES

The

authorized voting securities of the Company consist of an unlimited number of Common Shares. As at Record Date, the Company had 318,259,449

Common Shares outstanding, each carrying the right to one vote. Except as otherwise noted in this Circular, a simple majority of the

votes cast at the Meeting, whether in person, by proxy or otherwise, will constitute approval of any matter submitted to a vote.

QUORUM

A

quorum will be present at the Meeting if there are at least two persons present in person, each being a Shareholder entitled to vote

thereat or a duly appointed proxy or proxyholder for an absent Shareholder so entitled, holding or representing in the aggregate not

less than 25% of the issued and outstanding Common Shares.

PRINCIPAL

SHAREHOLDERS

To

the knowledge of the directors and executive officers of the Company, as at the Record Date, no person beneficially owned, controlled

or directed, directly or indirectly, more than 10% of the voting rights attached to the outstanding Common Shares except the following:

Shareholder |

Number

of Common Shares |

%

of Outstanding

Common Shares |

| Fairfax

Financial Holdings Limited |

55,655,229 |

17.5% |

| Newmont

Corporation (“Newmont”) |

43,245,294 |

13.6% |

| Pierre

Lassonde |

31,840,763(1) |

10.0% |

| Agnico

Eagle Mines Limited (“Agnico Eagle”) |

27,602,589(2) |

8.7% |

| Notes: |

|

|

| 1. | Mr.

Lassonde also holds warrants to purchase 6,700,000 Common Shares, which upon exercise and

together with his Common Shares represents approximately 11.9% of the Common Shares on a

partially-diluted basis. |

| 2. | Agnico

Eagle also holds warrants to purchase 10,400,000 Common Shares, which upon exercise and together

with its Common Shares represents approximately 11.6% of the Common Shares on a partially-diluted

basis. |

INTEREST

OF CERTAIN PERSONS OR COMPANIES

IN MATTERS TO BE ACTED UPON

No:

(i) director or executive officer of the Company at any time since the beginning of the last completed financial year; (ii) proposed

nominee for election as a director; or (iii) any associate of a person in (i) or (ii) has any material interest, direct or indirect,

by way of beneficial ownership of securities or otherwise, in any matter to be acted upon at the Meeting.

PARTICULARS

OF MATTERS TO BE ACTED UPON AT THE MEETING

FINANCIAL

STATEMENTS

The

audited consolidated financial statements for the financial year ended December 31, 2023 and the report of the auditor thereon will be

placed before the Shareholders at the Meeting, but no vote thereon is required. These documents are available upon request or they can

be found under the Company’s profile on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov or on its website at www.orlamining.com.

ELECTION

OF DIRECTORS

The

Company’s Articles of Arrangement (the “Articles”) provide that the Board consist of a minimum of three and

a maximum of ten directors. The Board currently consists of ten directors and the term of office of each of the present directors expires

at the close of the Meeting. The Board has fixed the size of the Board for election at the

Meeting at ten directors. At the Meeting, the ten persons set out below

will be proposed for election as directors of the Company (the “Nominees”). Each of the Nominees is currently a director.

Each director elected will hold office until the close of the next annual meeting of shareholders or until such person’s successor

is elected or appointed. Management does not contemplate that any of the Nominees will be unable to serve as a director, but if that should

occur for any reason prior to the Meeting, it is intended that discretionary authority will be exercised by the persons named in the accompanying

proxy to vote the proxy for the election of any other person or persons in place of any Nominee or Nominees unable to serve. All

Nominees have established their eligibility and willingness to serve as directors.

The Board recommends that Shareholders vote FOR the election

of each of the Nominees. Unless authority is withheld, the Management Proxyholders intend to vote FOR the election of each of the

Nominees.

In accordance with the requirements of the CBCA, directors stand for

election each year at the annual meeting of Shareholders, and a separate vote of Shareholders is taken with respect to each candidate

nominated for director. If there is only one candidate nominated for each position available on the Board (an uncontested election), each

candidate is elected only if the number of votes cast in their favor represents a majority of the votes cast for and against them by the

Shareholders who are present in person or represented by proxy. If an incumbent director is not re-elected in an uncontested election,

the director may continue in office until the earlier of the 90th day after the day of the election and the day on which their successor

is appointed or elected. Majority voting will not apply in the case of a contested election of directors, in which case the directors

will be elected by a plurality of votes of the shares represented in person or by proxy at the meeting and voted on the election of directors.

The requirements of the CBCA satisfy the TSX’s majority voting requirements and the Company is no longer required to have a majority

voting policy in place. On that basis, the Board has revoked the Company’s Majority Voting Policy.

The following tables set forth information with respect to each Nominee

and is based upon information furnished by the respective proposed Nominee. Except as indicated below, each of the proposed Nominees has

held the principal occupation shown beside the Nominee’s name in the table below or another executive office with the same or a

related company, for the last five years.

[Remainder of Page Intentionally Left Bank]

| CHARLES JEANNES |

Principal Occupation |

|

|

| |

|

|

Corporate Director |

|

| |

|

|

|

| |

|

Board and Board Committees |

2023 Meeting

Attendance |

|

| |

|

Board of Directors (Chair) |

100% |

|

| |

|

Human Resources and Compensation Committee |

100% |

|

| |

|

Audit Committee |

100% |

|

| |

|

Corporate Governance and Nominating Committee |

100% |

|

| |

Nevada, USA |

|

|

|

| |

Age, 65 |

|

Securities Holdings as at May 14, 2024 |

|

| |

Director since June 2017 |

|

Common

Shares |

Options |

Warrants |

DSUs |

Ownership

Requirement |

|

| Independent |

| |

Diversity Factors: N/A |

|

3,480,583 (1) |

154,831 |

520,000 |

244,894 |

Satisfied |

|

| |

|

|

|

|

|

|

|

|

| |

Historical Voting Results |

|

Other Board Memberships |

|

| |

Year |

For |

Against |

|

Pan American Silver Corp. (Director) |

|

| |

2023 |

99.15% |

0.85% |

|

Wheaton Precious Metals Corp. (Director) |

|

| |

2022 |

82.78% |

17.22% |

|

|

|

| |

2021 |

90.75% |

9.25% |

|

|

|

| |

|

|

|

|

|

|

| |

Biography |

|

| |

Mr. Jeannes served as President and Chief Executive Officer of Goldcorp

Inc. (“Goldcorp”) from 2009 until April 2016, and Executive Vice President, Corporate Development from 2006 until 2008. From

1999 until the acquisition of Glamis Gold Ltd. (“Glamis”) by Goldcorp, he was Executive Vice President, Administration, General

Counsel and Secretary of Glamis. Prior to joining Glamis, Mr. Jeannes worked for Placer Dome Inc., most recently as Vice President of

Placer Dome North America. He is also currently a Director of Pan American Silver Corp. and Wheaton Precious Metals Corp. (formerly Silver

Wheaton Corp.) and serves as a Trustee of the Wolf Pack Athletic Association of the University of Nevada (a non-profit Board). He holds

a Bachelor of Arts degree from University of Nevada - Reno and graduated from the University of Arizona School of Law with honours in

1983. He practiced law from 1983 until 1994 and has broad experience in capital markets, mergers and acquisitions, public and private

financing, and international operations. |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Note:

| 1. | In addition, Mr. Jeannes is entitled to 500,000 Bonus Shares (as defined

herein). The Bonus Shares will become issuable on the date Mr. Jeannes ceases to act as a director. See “Report on Director Compensation”. |

| JASON SIMPSON |

Principal Occupation |

|

|

| |

|

|

President, Chief Executive Officer and Director of the Company |

|

| |

|

|

|

| |

|

Board and Board Committees |

2023

Meeting

Attendance |

|

| |

|

Board of Directors |

100% |

|

| |

|

Environmental, Sustainability, Health and Safety Committee |

100% |

|

| |

|

|

|

|

| |

Ontario, Canada |

|

|

|

| |

Age, 51 |

|

Securities Holdings as at May 14, 2024 |

|

| |

Director since November 2018 |

|

Common

Shares |

Options |

RSUs |

PSUs |

Warrants |

Ownership

Requirement |

|

| Not Independent |

| |

Diversity Factors: N/A |

|

1,923,248 |

912,453 |

222,248 |

205,565 |

NIL |

Satisfied |

|

| |

|

|

|

|

|

|

|

|

|

| |

Historical Voting Results |

|

Other Board Memberships |

|

| |

Year |

For |

Withhold |

|

None |

|

| |

2023 |

99.97% |

0.03% |

|

|

|

| |

2022 |

91.28% |

8.72% |

|

|

|

| |

2021 |

97.64% |

2.36% |

|

|

|

| |

|

|

|

|

|

|

| |

Biography |

|

| |

Mr. Simpson was appointed the Company’s President and Chief Executive

Officer effective November 12, 2018. In addition to the role of President and CEO, Mr. Simpson also serves as a director of the Company.

Mr. Simpson is a mining executive with over 27 years of experience in operations leadership, mining engineering and project construction.

Previously, he was Chief Operating Officer of Torex Gold Resources (“Torex”) where, over his nearly six-year tenure, he oversaw

the successful construction and operation of the ELG Mine in Mexico. Prior to Torex, Mr. Simpson spent 11 years at Vale in various roles

of increasing responsibility ending his tenure as General Manager of the Labrador Operations (Voisey’s Bay) in 2013. Mr. Simpson also worked at McIntosh Redpath

Engineering on mining studies for companies including Barrick, Freeport McMoran, CVRD, Rio Tinto and Falconbridge, among others, where

he gained global multi- commodity experience and perspective. Mr. Simpson is currently a director on the Laurentian University –

School of Engineering Industry Advisory Board. Mr. Simpson holds dual degrees in Mining Engineering from the Technical University of Nova

Scotia and in Physics from Dalhousie University. |

|

| |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| JEAN ROBITAILLE |

Principal Occupation |

|

|

| |

|

|

Executive Vice-President, Chief Strategy & Technology Officer at Agnico Eagle |

|

| |

|

|

| |

|

Board and Board Committees |

2023 Meeting

Attendance |

|

| |

|

Board of Directors |

100% |

|

| |

|

Human Resources and Compensation Committee (Chair) |

100% |

|

| |

|

Technical Committee |

100% |

|

| |

Ontario, Canada |

|

|

|

| |

Age, 62 |

|

Securities Holdings as at May 14, 2024 |

|

| |

Director since December 2016 |

|

Common Shares |

Options |

Warrants |

DSUs |

Ownership

Requirement |

|

| Independent |

| |

Diversity Factors: N/A |

|

1,879,950 |

80,409 |

NIL |

136,271 |

Satisfied |

|

| |

|

|

|

|

|

|

|

|

| |

Historical Voting Results |

|

Other Board Memberships |

|

| |

Year |

For |

Withhold |

|

None |

|

| |

2023 |

94.27% |

5.73% |

|

|

|

| |

2022 |

83.00% |

17.00% |

|

|

|

| |

2021 |

93.57% |

6.43% |

|

|

|

| |

|

|

|

|

|

|

| |

Biography |

|

| |

Mr. Robitaille joined the Board in December 2016, upon closing of the

Company’s acquisition of Pershimco Resources Inc. Mr. Robitaille is Executive Vice-President, Chief Strategy & Technology Officer

at Agnico Eagle. Prior to this nomination and since 1988, he served Agnico Eagle in various senior executive roles for Corporate Development,

Business Strategy, Technical Services, Project Development and Operations. Before joining Agnico Eagle, Mr. Robitaille worked as a metallurgist

with Teck Mining Group and served as a Director of Pershimco Resources Inc. (2011 to 2016). Mr. Robitaille is a mining graduate of the

College de l’Abitibi Témiscamingue with a specialty in mineral processing. |

|

| |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| TIM HALDANE |

Principal Occupation |

|

|

| |

|

|

Mining professional/Corporate Director |

|

| |

|

|

|

| |

|

Board and Board Committees |

2023 Meeting

Attendance |

|

| |

|

Board of Directors |

100% |

|

| |

|

Environmental, Sustainability, Health and Safety Committee |

100% |

|

| |

|

Technical Committee (Chair) |

100% |

|

| |

Arizona, USA |

|

|

|

| |

Age, 67 |

|

Securities Holdings as at May 14, 2024 |

|

| |

Director since June 2017 |

|

Common Shares |

Options |

Warrants |

DSUs |

Ownership

Requirement |

|

| Independent |

| |

Diversity Factors: N/A |

|

191,900 |

80,409 |

NIL |

143,347 |

Satisfied |

|

| |

|

|

|

|

|

|

|

|

| |

Historical Voting Results |

|

Other Board Memberships |

|

| |

Year |

For |

Withhold |

|

None |

|

| |

2023 |

99.16% |

0.84% |

|

|

|

| |

2022 |

99.85% |

0.15% |

|

|

|

| |

2021 |

99.80% |

0.20% |

|

|

|

| |

|

|

|

|

|

|

| |

Biography |

|

| |

Mr. Haldane joined the Board in June 2017. Mr. Haldane is a mining

professional with 40 years of operating and project development experience including 15 years in Mexico. Mr. Haldane most recently held

the position of Senior Vice President of Operations - USA & Latin America at Agnico Eagle from 2014 until February 2017. Mr. Haldane

holds a B.S. in Metallurgical Engineering from Montana Technological University and is a Registered Professional Engineer. |

|

| |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| DAVID STEPHENS |

Principal Occupation |

|

|

| |

|

|

Partner at Agentis Capital Mining Partners |

|

| |

|

|

|

| |

|

Board and Board Committees |

2023 Meeting

Attendance |

|

| |

|

Board of Directors |

100% |

|

| |

|

Audit Committee |

100% |

|

| |

|

Corporate Governance and Nominating Committee (Chair) |

100% |

|

| |

Ontario, Canada |

|

|

|

| |

Age, 42 |

|

Securities Holdings as at May 14, 2024 |

|

| |

Director since March 2018 |

|

Common Shares |

Options |

Warrants |

DSUs |

Ownership

Requirement |

|

| Independent |

| |

Diversity Factors: N/A |

|

12,500 |

37,503 |

65,000 |

123,394 |

Satisfied |

|

| |

|

|

|

|

|

|

|

|

| |

Historical Voting Results |

|

Other Board Memberships |

|

| |

Year |

For |

Withhold |

|

None |

|

| |

2023 |

99.16% |

0.84% |

|

|

|

| |

2022 |

82.77% |

17.23% |

|

|

|

| |

2021 |

93.37% |

6.63% |

|

|

|

| |

|

|

|

|

|

|

| |

Biography |

|

| |

Mr. Stephens is a partner at Agentis Capital Mining Partners, which

provides capital markets advisory services. Mr. Stephens is also VP, Marketing and a director of San Cristobal Mining Inc. He also provides

consulting services in the mining and technology industries through his private consulting company. He was the Vice President, Corporate

Development and Marketing at Goldcorp until its acquisition by Newmont, having previously served as Vice President and Treasurer. Prior

to joining Goldcorp, Mr. Stephens spent ten years working in investment banking and equity research at various organizations including

Macquarie Capital Markets Canada Ltd. and Orion Securities. Mr. Stephens holds a Bachelor’s degree in Electrical Engineering and

Computer Science from Harvard University. |

|

| |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| ELIZABETH McGREGOR |

Principal Occupation |

|

|

| |

|

|

Finance professional/Corporate Director |

|

| |

|

|

|

| |

|

Board and Board Committees |

2023 Meeting

Attendance |

|

| |

|

Board of Directors |

100% |

|

| |

|

Audit Committee (Chair) |

100% |

|

| |

|

Human Resources and Compensation Committee |

100% |

|

| |

British Columbia, Canada |

|

|

|

| |

Age, 47 |

|

Securities Holdings

as at May 14, 2024 |

|

| |

Director since June 2019 |

|

Common

Shares |

Options |

Warrants |

DSUs |

Ownership

Requirement |

|

| Independent |

| |

Diversity Factors: Female, Indigenous |

|

24,400 |

100,409 |

65,000 |

106,608 |

Satisfied |

|

| |

|

|

|

|

|

| |

Historical Voting Results |

|

Other Board Memberships |

|

| |

Year |

For |

Withhold |

|

Kinross Gold Corporation (Director) |

|

| |

2023 |

99.87% |

0.13% |

|

|

|

| |

2022 |

82.97% |

17.03% |

|

|

|

| |

2021 |

95.44% |

4.56% |

|

|

|

| |

|

|

|

|

|

|

| |

Biography |

|

| |

Ms. McGregor served as the Executive Vice President and Chief Financial

Officer of Tahoe Resources Inc. from August 9, 2016 until the acquisition by Pan American Silver Corp. on February 22, 2019. Ms. McGregor

is a Canadian Chartered Professional Accountant (CPA, CA) and, prior to her role as Chief Financial Officer, served as Tahoe Resources

Inc.’s VP Treasurer. She directed financial planning, corporate liquidity, financial reporting and risk management. Prior to joining

Tahoe Resources Inc., she worked at Goldcorp from 2007 to 2013 where she held various financial roles including Director of Project Finance

and Cost Control; Administration Manager at the Peñasquito mine; and Director of Risk. Ms. McGregor has also served as a director

of Kinross Gold Corporation since November 6, 2019. Ms. McGregor began her career at KPMG as Audit Manager. She holds a B.A. (Hons) from

Queen’s University in Kingston. |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| TAMARA BROWN |

Principal Occupation |

|

|

| |

|

|

Corporate Director |

|

| |

|

|

|

| |

|

Board and Board Committees |

2023 Meeting

Attendance |

|

| |

|

Board of Directors |

100% |

|

| |

|

Human Resources and Compensation Committee |

100% |

|

| |

|

Environmental,

Sustainability, Health and Safety Committee (Chair)

|

100% |

|

| |

Ontario, Canada |

|

|

|

| |

Age, 51 |

|

Securities Holdings as at May 14, 2024 |

|

| |

Director since June 2022 |

|

Common Shares |

Options |

Warrants |

DSUs |

Ownership

Requirement |

|

| Independent |

| |

Diversity Factors: Female |

|

4,400 |

26,580 |

NIL |

50,186 |

N/A |

|

| |

|

|

|

|

|

|

|

|

| |

Historical Voting Results |

|

Other Board Memberships |

|

| |

Year |

For |

Withhold |

|

Lithium Royalty Corp. (Director) |

|

| |

2023 |

99.29% |

0.71% |

|

29Metals Limited (Director) |

|

| |

2021 |

99.84% |

0.16% |

|

|

|

| |

2020 |

- |

- |

|

|

|

| |

|

|

|

|

|

|

| |

Biography |

|

| |

Ms. Brown is a mining industry professional with over 25 years of experience

in the mining and capital markets sectors. She is currently a partner of Oberon Capital Corp., an investment services provider, and was

the Interim Chief Executive Officer of Superior Gold Inc., a gold producer, from 2020 to 2021. Ms. Brown is currently an Independent Director

of Lithium Royalty Corp. (TSX) and 29Metals Limited (ASX) and was previously a Non-Executive Director for Lundin Gold Inc., Eastmain Resources

Inc. and Superior Gold Inc. Her previous executive roles include Vice President, Investor Relations and Corporate Development (Americas)

for Newcrest Mining, Vice President, Corporate Development and Investor Relations for Primero Mining Corp., and Director of Investor Relations

for IAMGOLD Corp. Ms. Brown was also a professional engineer in the mining industry. She has a Bachelor of Engineering degree from Curtin

University in Australia and has completed the Chartered Business Valuator course at York University. |

|

| |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

ANA

SOFÍA RÍOS |

Principal

Occupation |

|

|

| |

|

|

Partner, Chevez Ruiz Zamarripa |

|

| |

|

|

|

| |

|

Board and Board Committees |

2023 Meeting

Attendance |

|

| |

|

Board of Directors |

100% |

|

| |

|

Environmental, Sustainability, Health and Safety

Committee |

100% |

|

| |

|

Corporate Governance and Nominating

Committee |

100% |

|

| |

Mexico City, Mexico |

|

|

|

| |

Age, 38 |

|

Securities Holdings

as at May 14, 2024 |

|

| |

Director since June 2023 |

|

Common

Shares |

Options |

Warrants |

DSUs |

Ownership

Requirement |

|

| Independent |

| |

Diversity Factors: Female,

Visible Minority |

|

NIL |

NIL |

NIL |

41,875 |

N/A |

|

| |

|

|

|

|

|

|

|

|

| |

Historical Voting Results |

|

Other Board Memberships |

|

| |

Year |

For |

Withhold |

|

None |

|

| |

2023 |

99.87% |

0.13% |

|

|

|

| |

2022 |

- |

- |

|

|

|

| |

2021 |

- |

- |

|

|

|

| |

|

|

|

|

|

|

| |

Biography |

|

| |

Ms. Ríos is a

partner with the Mexican law firm of Chevez Ruiz Zamarripa. Her practice focuses on corporate law, banking and finance, including

mergers and acquisitions, private equity, as well as advising clients and family offices on wealth management matters. In addition,

Ms. Ríos advises public and private companies on corporate governance and regulatory compliance matters. She is currently an

alternate independent board member of Grupo Corporativo Cever, S.A. de C.V. (a private Mexican corporate group that manages vehicle

dealerships and restaurant brands). Ms. Ríos is also the Vice-president Legal Committee, Banking Commission of the

International Chamber of Commerce - Mexico (ICC Mexico) and a Member of the Mexican Bar Association, College of Attorneys-at-Law.

She has a law degree from the Universidad Iberoamericana (UIA) and a Master’s Degree in Corporate Law from New York University

School of Law.

|

|

| |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

ROB

KRCMAROV |

Principal Occupation |

|

| |

|

|

Independent Director |

|

| |

|

|

|

| |

|

Board and Board Committees |

2023 Meeting

Attendance |

|

| |

|

Board of Directors |

100% |

|

| |

|

Technical Committee |

N/A(1) |

|

| |

|

|

|

|

| |

Ontario, Canada |

|

|

|

| |

Age, 59 |

|

Securities Holdings

as at May 14, 2024 |

|

| |

Director since November 2023 |

|

Common Shares |

Options |

Warrants |

DSUs |

Ownership

Requirement |

|

| Independent |

| |

Diversity Factors: N/A |

|

NIL |

NIL |

NIL |

48,328 |

N/A |

|

| |

|

|

|

|

|

|

|

|

| |

Historical Voting Results |

|

Other Board Memberships |

|

| |

Year |

For |

Withhold |

|

None |

|

| |

2023 |

- |

- |

|

|

|

| |

2022 |

- |

- |

|

|

|

| |

2021 |

- |

- |

|

|

|

| |

|

|

|

|

|

|

| |

Biography |

|

| |

Mr. Krcmarov is a geologist and an experienced international mining

executive who has held mine site, regional and corporate leadership roles in his 35-year career in the natural resources sector. Mr. Krcmarov

most recently served as a technical advisor to Barrick Gold Corporation, having previously served as an executive with that company for

13 years, and as Executive Vice President Exploration and Growth since 2016. In these various roles, he led exploration teams which have

discovered, drilled and delineated multiple value adding orebodies, including several world class greenfield discoveries. Mr. Krcmarov’s

international experience spans many countries in five continents, and he has a strong track record running efficient and safe operations,

conducting effective community relations, and engaging in constructive dialogue with institutional investors, financial markets, board

members, government officials and other stakeholders. Mr. Krcmarov holds a Master of Economic Geology from the University of Tasmania

and a Bachelor of Science in Geology from the University of Adelaide. |

|

| |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Notes:

| (1) | No

Technical Committee meetings were held following Mr. Krcmarov’s appointment to the

Board in November 2023. |

| SCOTT LANGLEY (1) |

Principal Occupation |

|

|

| |

|

|

Vice President, Corporate Development, Newmont Corporation |

|

| |

|

|

|

| |

|

Board and Board Committees |

2023 Meeting

Attendance |

|

| |

|

Board of Directors |

86% |

|

| |

|

|

|

|

| |

|

|

|

|

| |

Ontario, Canada |

|

|

|

| |

Age, 49 |

|

Securities Holdings

as at May 14, 2024 |

|

| |

Director since June 2022 |

|

Common Shares |

Options |

Warrants |

DSUs |

Ownership

Requirement |

|

| Not Independent |

| |

Diversity Factors: N/A |

|

NIL |

NIL |

NIL |

NIL |

N/A |

|

| |

|

|

|

|

|

|

|

|

| |

Historical Voting Results |

|

Other Board Memberships |

|

| |

Year |

For |

Withhold |

|

None |

|

| |

2023 |

93.55% |

6.45% |

|

|

|

| |

2022 |

87.71% |

12.29% |

|

|

|

| |

2021 |

- |

- |

|

|

|

| |

|

|

|

|

|

|

| |

Biography |

|

| |

Mr. Langley is Vice President, Corporate Development at Newmont. Prior

to joining Newmont in 2022, he spent over 15 years working in investment banking, at both National Bank Financial and Bank of America,

and was most recently Managing Director, Head of North American Metals & Mining for Bank of America. Mr. Langley has worked on numerous

equity and debt capital markets transactions as well as M&A transactions, including acting as financial advisor to Agnico Eagle on

its 2021 merger transaction with Kirkland Lake Gold. Mr. Langley holds a Master of Business Administration from the Richard Ivey School

of Business, and a Bachelor of Commerce from Queens University. |

|

| |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Notes:

| 1. | Mr.

Langley is the director nominee of Newmont. See “Investor Rights Agreement”

below. Accordingly, Mr. Langley will waive his annual base retainer and will not be subject

to share ownership requirements. |

CEASE TRADE ORDERS, BANKRUPTCIES, PENALTIES

OR SANCTION

No director or proposed

director of the Company is, as at the date of this Circular, or has been, within the 10 years preceding the date of this Circular, a

director, chief executive officer and chief financial officer of any company (including the Company) that:

| (a) | while that person was

acting in that capacity, was the subject of a cease trade, an order similar to a cease trade

order or an order that denied the relevant company access to any exemption under securities

legislation, in each case that was in effect for a period of more than 30 consecutive days

(each, an “Order”); |

| (b) | was subject to an Order

that was issued after the proposed director ceased to be a director, chief executive officer

or chief financial officer and which resulted from an event that occurred while that person

was acting in the capacity as a director, chief executive officer or chief financial officer;

or |

| (c) | while that person was

acting in that capacity, or within a year of that person ceasing to act in that capacity,

became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency

or was subject to or instituted any proceedings, arrangement or compromise with creditors

or had a receiver, receiver manager or trustee appointed to hold its assets. |

No director or proposed

director of the Company has, within the 10 years before the date of this Circular, become bankrupt, made a proposal under any legislation

relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or

had a receiver, receiver manager or trustee appointed to hold the assets of such director or proposed director.

To the knowledge of

the Company, as of the date hereof, no proposed director has been subject to: (a) any penalties or sanctions imposed by a court relating

to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory

authority; or (b) any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to

a reasonable security holder in deciding whether to vote for a proposed director.

ADVANCE NOTICE PROVISIONS

The Company’s amended and restated by-law

No 1. (the “By-Laws”) contains an advance-notice provision

for director nominations. Shareholders who wish to nominate candidates for election as directors must provide written notice of their

intention to the Corporate Secretary (via personal delivery to 1010-1075 West Georgia Street, Vancouver, BC, V6E 3C9, or via email at

info@orlamining.com) and include certain information as set out in Part Four of the By-Laws. The notice must be made not less than 30

days prior to the date of our next annual meeting, in compliance with Part Four. If you wish to submit a director nomination to be presented

at the Meeting, the required information must be sent to our Corporate Secretary by May 20, 2024. A copy of the By-Laws is available

on the Company’s website and was filed on May 20, 2022 under the Company’s profile on SEDAR+ and EDGAR at www.sedarplus.ca

and www.sec.gov, respectively.

INVESTOR RIGHTS AGREEMENTS

In accordance with the terms of the investor rights

agreement dated November 7, 2017 between Goldcorp (now Newmont) and Orla (the “Newmont Agreement”), Newmont has, among

other rights, the right to nominate an individual for election to the Board. In the event the number of directors on the Board is increased

to more than ten directors, Newmont shall be entitled to designate an additional nominee, provided that at the time of such increase

in the size of the Board it holds at least 10% of the Common Shares. Newmont’s current nominee to the Board is Mr. Scott Langley.

Under

the terms of the Newmont Agreement, Newmont has agreed to vote its Common Shares in accordance with the recommendations of the Board

or Management on all matters to be submitted to Shareholders, including for the Management nominee’s for directors, except in the

case of voting in respect of: (i) any issuer bid, insider bid, related party transaction or business combination; (ii) any amendment

to the constating documents of the Company, other than immaterial or administrative changes; (iii) any matter in relation to which a

recognized proxy advisor is recommending against Management or the Board on any resolution for Shareholders; (iv) any disposition of

assets for consideration equal or greater than 50% of the market capitalization immediately prior to the entering into of such transaction;

(v) any proposed distribution of securities where the number of Common Shares issued or issuable thereunder is greater than 25% of the

Common Shares which are outstanding prior to closing; and (vi) in any circumstances where the Company or its directors or officers are

not in compliance with the Newmont Agreement or applicable laws, in which case Newmont is entitled to vote its Common Shares in its discretion.

Any nominee of Newmont on the Board will not be required to vote in accordance with the recommendations of the Board and Management but

will exercise his or her fiduciary responsibilities as a director by voting as he or she sees fit.

Pursuant

to the Newmont Agreement, Newmont has been granted certain participation rights to maintain its pro rata interest in future offerings

for as long as it maintains ownership of at least 10% of the Common Shares.

Similarly,

in accordance with an amended and restated investor rights agreement dated December 17, 2019 (the “Agnico Agreement”)

between Agnico Eagle and the Company, Agnico Eagle has, among other rights, the right to nominate an individual for election to the Board,

provided it holds at least 5% of the Common Shares. As of the date hereof, Agnico Eagle has not exercised its right to nominate an individual

for election to the Board.

Pursuant

to the Agnico Agreement, Agnico Eagle has been granted certain participation rights to maintain its pro rata interest in future

offerings for as long as it maintains ownership of at least 5% of the Common Shares.

Copies

of the Newmont Agreement and the Agnico Agreement are available on the Company’s profile on SEDAR+ and EDGAR at www.sedarplus.ca

and www.sec.gov, respectively.

APPOINTMENT

OF AUDITOR

On

March 25, 2020, Ernst & Young LLP (“Ernst & Young”) was appointed as the auditor of Orla, which appointment

was last approved by Shareholders at the annual general meeting held on June 21, 2023. At the Meeting, Management is recommending the

re-appointment of Ernst & Young as auditor for the Company, to hold office until the next annual general meeting of the Shareholders

at a remuneration to be fixed by the Board.

The

Board recommends that Shareholders vote FOR the re-appointment of Ernst & Young. Unless authority is withheld, the Management

Proxyholders intend to vote FOR the re-appointment of Ernst & Young as the auditor of the Company to hold office until the

next annual general meeting of Shareholders or until a successor is appointed and the Board is authorized to fix their remuneration.

SAY

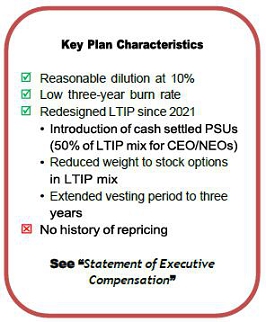

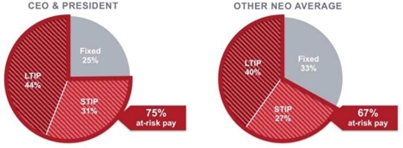

ON PAY ADVISORY VOTE

The

Board has adopted a non-binding Shareholder advisory vote on the Company’s approach

to executive compensation, also known as “Say-on-Pay”. This advisory vote

allows Shareholders a formal opportunity to provide their views on the Company’s executive

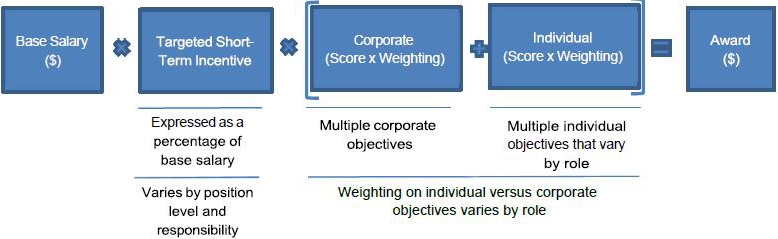

compensation program as set forth in this Circular under the heading “Statement

of Executive Compensation” beginning on page 44. This is the second year that the

Company has adopted a non-binding advisory resolution on executive compensation. In 2023,

97.5% of Shareholders voted FOR the resolution.

|

|

|

The

Company will disclose the results of this year’s vote as part of its report on the voting results for the Meeting. The advisory

vote is non-binding on the Company and it remains the duty of the Board to develop and implement appropriate executive compensation policies.

However, the Board will take the results into account when

considering

the executive compensation plans and policies of the Company for future periods. In the event that a significant number of Shareholders

oppose the resolution, the Board will endeavour to consult with its Shareholders as appropriate (particularly those who are known to

have voted against it) to understand their concerns and will review the Company’s approach to compensation in the context of those

concerns. The Board will consider disclosing to Shareholders as soon as is practicable, and no later than in the management information

circular for its next annual meeting, a summary of any comments received from Shareholders in the engagement process and any changes

to the compensation plans made or to be made by the Board (or why no changes will be made).

At

the Meeting, Shareholders will be asked to consider a non-binding advisory resolution on executive compensation, known as “Say

on Pay”, as follows (the “Say on Pay Advisory Resolution”):

“BE

IT RESOLVED THAT, on an advisory basis and not to diminish the role and responsibilities of the Board of Directors, the Shareholders

of the Company accept the approach to executive compensation disclosed in the Company’s Management Information Circular dated May

14, 2024, with respect to the Annual General and Special Meeting of Shareholders.”

The

Board recommends that Shareholders vote FOR the Say on Pay Advisory Resolution to approve the Company’s approach to executive

compensation. Unless otherwise instructed, the Management Proxyholders intend to vote FOR the Say on Pay Advisory Resolution.

APPROVAL

OF UNALLOCATED OPTIONS UNDER STOCK OPTION PLAN

BACKGROUND

The

Corporation has adopted a 10% rolling stock option plan (the “Stock Option Plan”).

The purpose of the Stock Option Plan is to secure for the Company and the Company’s shareholders