UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form SD

SPECIALIZED DISCLOSURE REPORT

Wabash National Corporation

(Exact name of the registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-10883 | |

| (State or other jurisdiction

of incorporation) | | (Commission file number) | |

| | | | | | | | | | | | | | |

| 3900 McCarty Lane, Lafayette, Indiana | | 47905 | |

| (Address of principal executive offices) | | (Zip code) | |

| | | | | | | | | | | | | | |

| Michael N. Pettit | |

| Senior Vice President and Chief Financial Officer | |

| 765-771-5310 | |

| (Name and telephone number, including area code, of the person to contact in connection with this report.) | |

Check the appropriate box to indicate the rule pursuant to which this form is being filed:

☒ Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2023.

☐ Rule 13q-1 under the Securities Exchange Act (17 CFR 240.13q-1) for the fiscal year ended _____________.

Section 1 – Conflict Minerals Disclosure

Item 1.01 Conflict Minerals Disclosure and Report

Conflict Minerals Disclosure

A copy of Wabash National Corporation’s Conflict Minerals Report for the reporting period January 1, 2023 to December 31, 2023 is provided as Exhibit 1.01 hereto and is publicly available on the Company’s website at ir.onewabash.com/financials/sec-filings. A copy of Wabash National Corporation’s Conflict Minerals Policy is publicly available on our website at www.onewabash.com.

The references to Wabash National Corporation’s website included in this Form SD and its exhibits are provided for convenience only, and its contents are not incorporated by reference into this Form SD and Conflict Minerals Report nor deemed filed with the U.S. Securities and Exchange Commission.

Item 1.02 Exhibit

As specified in this Form SD, Wabash National Corporation is hereby filing its Conflict Minerals Report as Exhibit 1.01.

Section 2 – Resource Extraction Issuer Disclosure

Item 2.01 Resources Extraction Issuer Disclosure and Report

Not applicable.

Section 3 – Exhibits

Item 3.01 Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the duly authorized undersigned.

| | | | | | | | | | | | | | |

| | WABASH NATIONAL CORPORATION | |

| | | | |

| Date: | May 24, 2024 | By: | /s/ Michael N. Pettit | |

| | | Michael N. Pettit | |

| | | Senior Vice President and Chief Financial Officer | |

Exhibit 1.01

Wabash National Corporation

Conflict Minerals Report

For The Year Ended December 31, 2023

This Conflict Minerals Report (“CMR”) for the year ended December 31, 2023 is presented to comply with Rule 13p-1 under the Securities Exchange Act of 1934, as amended (the “Rule”). The Rule was adopted by the Securities and Exchange Commission (the “SEC”) to implement reporting and disclosure requirements related to conflict minerals as directed by the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”). The Rule imposes certain reporting obligations on SEC registrants for which conflict minerals are necessary to the functionality or production of products manufactured by the registrant or contracted by the registrant to be manufactured. For the purposes of the Rule, “conflict minerals” are defined as cassiterite, columbite-tantalite, gold, wolframite, and their derivatives, which are limited to tin, tantalum and tungsten (“3TG”). These requirements apply to registrants whatever the geographic origin of the 3TG and whether or not they fund armed conflict.

As described in detail below, following a reasonable country of origin inquiry conducted with our supply base into the source and chain of custody of 3TG in our products, we have reason to believe that a portion of the 3TG that is necessary to the functionality or production of products we have manufactured or contracted to be manufactured may have originated in the Democratic Republic of the Congo or an adjoining country (the “Covered Countries”) and may not be from recycled or scrap sources. This CMR is available on our website at ir.onewabash.com/financials/sec-filings. This CMR is not subject to an independent private sector audit in accordance with guidance issued by the SEC on April 29, 2014 and updated guidance issued by the SEC on April 7, 2017.

1. Company Overview

This CMR has been prepared by management of Wabash National Corporation (herein referred to as “Wabash,” the “Company,” “we,” “us,” or “our”). The information includes the activities of all majority-owned subsidiaries that are required to be consolidated. Founded in 1985 and headquartered in Lafayette, Indiana, Wabash National Corporation (NYSE: WNC) is an innovation leader of engineered solutions for the transportation, logistics, and distribution industries. Our mission is to enable customers to succeed with breakthrough ideas and solutions that help them move everything from first to final mile. To that end, we design and manufacture a diverse range of products, including dry freight and refrigerated trailers, platform trailers, bulk tank trailers, dry and refrigerated truck bodies, structural composite panels and products, trailer aerodynamic solutions, and specialty food grade and pharmaceutical equipment. Our innovative products, which could possibly contain 3TGs, are sold under the following brand names: Wabash®, DuraPlate®, DuraPlateHD®, ArcticLite®, Transcraft®, Benson®, DuraPlate® Cell Core, Walker Transport, Brenner® Tank, Bulk International, Walker® Engineered Products, Extract Technology®, DuraPlate® AeroSkirt®, AeroSkirt CX™, Ventix DRS™, AeroFin XL®, Kold King®, Inter-City®, and Spartan. To learn more, visit www.onewabash.com.

Supply Chain

Because of our size, the complexity of our products, and the depth, breadth, and constant evolution of our supply chain, it is difficult to identify entities upstream from our suppliers who provide us with products and/or raw materials necessary to the functionality or production of our products (“Direct Suppliers”). As such, we rely heavily on our Direct Suppliers to provide information on the origin of the 3TG contained in components and materials supplied to us – including sources of 3TG that are supplied to them from lower-tier suppliers. Current contracts with most of our key Direct Suppliers, which account for the majority of our sourced materials, are in effect for multiple year terms, and as a result, we cannot unilaterally impose new contract terms and flow-down requirements at this time. As we execute new contracts and/or renew contracts, we are requiring affected Direct Suppliers to provide us with geographic origin information concerning 3TG and smelters and refiners. Additionally, all new Direct Suppliers receive 3TG reporting requirements as a part of our new supplier information packet. It will take several years to ensure that all of our Direct Suppliers are contractually obligated to report this information to us as part of their normal business interactions with us. In the meantime, as described below, we have established a process to contact affected Direct Suppliers to collect necessary 3TG sourcing information. We have used and will continue to use the data collected through the process described below, and through our contractually obligated disclosures from our Direct Suppliers, to evaluate our supply chain to ensure compliance with the SEC’s current and future conflict minerals rules.

Reasonable Country of Origin Inquiry

Presently, our supply chain consists of over 12,000 suppliers, including many suppliers providing us with services and/or products that do not contain 3TG necessary to the functionality or production of our products and/or products that do not contain 3TG. As such, it was not practicable to conduct a survey of our entire supply base. Instead, we targeted our top 53 Direct Suppliers and certain additional Direct Suppliers that we have deemed "high risk", either because we have previously determined that they source materials and components containing 3TG from one or more of the Covered Countries or because they supply us with complex electronic components. This assessment was made based upon an evaluation of the composition of the products and/or raw materials supplied to us. The Company contacted these Direct Suppliers, requesting each to provide 3TG geographic origin data using the Conflict Minerals Reporting Template (“CMRT”) maintained by the Responsible Minerals Initiative (“RMI”). Surveys conducted with other

manufacturing companies confirmed that our risk-based approach to developing our list of our surveyed Direct Suppliers, as described above, is consistent with how many peer companies are approaching the Rule.

At this time, having conducted this reasonable country of origin inquiry, we have reason to believe that it is possible that some 3TG necessary to the functionality or production of the products we manufactured or contracted to have manufactured may have originated in the Covered Countries and may not be from recycled or scrap sources. Accordingly, we conducted further due diligence on the source and chain of custody of the 3TG contained in our products.

2. Due Diligence Process

2.1 Design of Due Diligence

Our due diligence measures have been designed to conform, in all material respects, with the framework in the OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas, Third Edition (2016), and the related supplements for Tin, Tantalum, Tungsten and Gold (the “OECD Guidance”).

2.2 Establish Strong Company Management Systems

Conflict Minerals Policy

Wabash is committed to working with our global supply chain to ensure compliance with the SEC’s Rule. We have established a conflict minerals compliance program, as outlined above, that is designed to follow the OECD Guidance. Our enterprise is fully engaged in implementing that program.

For additional information about our commitment to responsible sourcing and other human rights, see our Conflict Minerals Policy Statement and Code of Business Conduct and Ethics, which are both publicly available on our website at www.onewabash.com.

Internal Team

Our Senior Vice President, Chief Administrative Officer, Corporate Secretary – General Counsel and our Vice President of Global Procurement, established a cross-functional team of subject matter experts from relevant functions of finance, legal, and supply chain to create our 3TG compliance program and due diligence efforts necessary to comply with the Rule. As part of this team, our Vice President of Global Procurement, Global Category Manager and Strategic Sourcing Specialist lead our ongoing due diligence efforts with our Direct Suppliers. Senior management and members of the Audit Committee of our Board of Directors (the “Audit Committee”) are briefed about the results of our due diligence efforts at least annually.

Control Systems

As we do not typically have a direct relationship with 3TG smelters and refiners, we are engaged and actively cooperate with other major manufacturers in the transportation industry and other relevant sectors, as well as our own Direct Suppliers, to encourage the disclosure of the 3TG status of all upstream entities held in common by our various supply chains. Our due diligence process includes utilization of industry-wide initiatives to conduct due diligence on upstream entities in our supply chains, such as the CMRT and the RMI’s list of Responsible Minerals Assurance Process (“RMAP”) Conformant Smelters and Refiners.

Our controls include, but are not limited to, our Code of Business Conduct and Ethics, which outlines expected behaviors for all Wabash employees and suppliers. Going forward, as discussed above, our controls will also include contractual disclosure requirements in our new Direct Supplier contracts.

Supplier Engagement

We have invested in tools and developed internal processes and procedures to query and track supplier activity. In addition, we have included 3TG reporting requirements in our new supplier packets and we will continue to request 3TG reporting data as required from all of our Direct Suppliers. We will also utilize key opportunities such as annual executive management reviews with our suppliers to reinforce and review compliance.

Grievance Mechanism

We have multiple mechanisms and processes for employees and suppliers to use to report violations of Wabash’s policies. These are described in our Code of Business Conduct and Ethics, which is publicly available on our website at www.onewabash.com.

Maintain Records

We have adopted a policy to retain relevant documentation requested from and disclosed by our suppliers.

2.3 Identify and Assess Risk in the Supply Chain

As outlined previously, since we do not typically have a direct relationship with 3TG smelters and refiners, our due diligence efforts undertaken to comply with the Rule rely heavily on our Direct Suppliers providing us with information about the source of 3TG contained in the products and raw materials supplied to us. Our Direct Suppliers are similarly reliant upon information provided by their suppliers. Many of our largest suppliers are also SEC registrants and subject to the Rule. However, our ability to perform a reasonable country of origin inquiry and comply with the Rule is dependent upon receipt of complete and accurate information from our Direct Suppliers.

2.4 Design and Implement a Strategy to Respond to Risks

In response to this risk assessment, Wabash has an approved risk management plan, through which our 3TG compliance program is implemented, managed and monitored. As part of the risk management efforts undertaken as part of our 3TG compliance program, our Vice President, Global Strategic Sourcing Purchasing/Strategic Sourcing, regularly reviews 3TG data provided by our Direct Suppliers. Direct Suppliers who provide incomplete or inconsistent 3TG data are contacted to update and confirm the data provided until Wabash can conclude with a reasonable degree of certainty that the provided data is likely accurate. Updates regarding our due diligence process and this risk assessment are provided regularly to senior management and the Audit Committee.

As described above, we also utilize and participate in several industry-wide initiatives to diligence the 3TG status of upstream entities in our supply chain. We will continue to pursue training and participate in seminars to increase our awareness and further enhance our compliance efforts. As part of our risk management plan, and to ensure our suppliers understand our ongoing expectations to provide accurate and complete 3TG data, we will continue to engage suppliers in various ways such as training sessions, executive management reviews and our annual supplier conference.

2.5 Carry out Independent Third Party Audit of Supply Chain Due Diligence at Identified Points in the Supply Chain

Since we do not have a direct relationship with 3TG smelters and refiners, we do not perform or direct audits of these upstream entities within our supply chain. We will support audits by our supply base, as necessary, and have augmented our own Direct Supplier audit process with questions and procedures to address compliance by our Direct Suppliers with the Rule.

2.6 Report on Supply Chain Due Diligence

Wabash has filed a Form SD which includes this CMR, and we have made our Form SD and CMR available on our website, demonstrating our progress in implementing our Conflict Minerals Policy Statement.

3. Due Diligence Results

Request Information

As described above, we conducted a survey of certain Direct Suppliers using the CMRT, which was developed to facilitate disclosure and communication of information regarding smelters and refiners that are the source of the 3TG in a company’s supply chain. It includes questions regarding a supplier’s conflict-free policies, engagement with its own direct suppliers, and a listing of the smelters and refiners that the respondent (and its own suppliers) utilizes in its own supply chain. In addition, the CMRT contains questions about the origin of 3TG included in the respondent’s products, as well as the respondent’s own due diligence efforts. Written instructions and recorded training illustrating the use of the tool is available on RMI’s website. The CMRT is being used by many of our peer companies in their due diligence processes related to 3TG.

Survey Responses

We received responses from 44 Direct Suppliers of the 53 surveyed, which represents approximately 60% of Wabash’s direct material spend surveyed in 2023. We reviewed the responses provided against criteria developed to determine whether further engagement with our Direct Suppliers was necessary. These criteria included: (1) untimely or incomplete responses, (2) inconsistencies within the data reported in the CMRT or in other provided documentation, or (3) uncertainty in the accuracy of the data reported in light of the product supplied by the Direct Supplier. We conducted further engagement with Direct Suppliers who met one or more of these criteria until we received data sufficient to allow Wabash to conclude with a reasonable degree of certainty that the provided data is likely accurate.

Approximately 59% of our responding Direct Suppliers reported using no 3TG in products sold to Wabash; 0% provided insufficient detail, rendering their responses undeterminable; and 41% reported using 3TG from within the Covered Countries, in some cases from smelters or refiners not included on the RMI’s list of RMAP Conformant Smelters and Refiners. In all cases where 3TG was reported being used, our suppliers could not determine if 3TG was in the products they sold to Wabash. Of the thousands of lines of smelter and refiner data reported to us, we were able to identify 242 smelters and refiners that are potentially in our supply chain, based on the information available through the RMAP. Of these 242 smelters and refiners, 235 were included on the RMAP Conformant Smelters and Refiners list, 7 of which were active on the RMAP Active Smelters and Refiners list, indicating they have committed to undergo an RMAP assessment. As we do not typically have a direct relationship with 3TG smelters and refiners, and thus are unable to directly audit or request documentation from these facilities, Wabash supports the refinement and expansion of the RMAP lists of Active Smelters and Refiners and Conformant Smelters and Refiners.

Efforts to Determine Mine or Location of Origin

Through our utilization of RMI resources, the OECD Guidance, and requesting that our Direct Suppliers complete the CMRT, we have determined that seeking information about 3TG smelters and refiners through our supply chain represents the most reasonable effort we can make to determine the mines or locations of origin of the 3TG in our supply chain. Our Direct Suppliers did not provide information on mines of origin for 3TG used in our products manufactured during 2023. Accordingly, we do not have sufficient information to conclusively determine the mines or the locations of origin of the 3TG in our products or whether the 3TG in our products is from recycled or scrap sources.

Smelters or Refiners

Based on the Direct Supplier responses we received:

▪59% of responding Direct Suppliers reported using no 3TG in their products and, therefore, utilize no smelters or refiners of concern.

▪0% of responding Direct Suppliers provided responses with insufficient detail, rendering their responses indeterminable.

▪The remaining 41% of responding Direct Suppliers reported using 3TG from within the Covered Countries, along with lists of smelters and refiners utilized in their respective supply chains, although in many cases the responding Direct Suppliers indicated that they had not identified all of the smelters and refiners used to supply the products within the scope of their responses.

▪When smelter and refiner lists included verified smelter or refiner identification numbers in a response, we were able to confirm the following about those smelters or refiners:

•235 (97%) are on the RMAP Conformant Smelters and Refiners list.

•7 (3%) are on the Active Conformant Smelters and Refiners list.

▪The majority of our responding Direct Suppliers who do utilize 3TG in some or all of the products they sell to their entire customer base: (1) could not represent to us that any smelter or refiner entities they listed as supplying them with 3TG had actually been included in the supply chain for the products, parts and/or raw materials they supplied to Wabash; and/or (2) reported that it was “not known” or “undetermined” if 3TG had been supplied to them by smelters or refiners included in the supply chain for the products, parts and/or raw materials those Direct Suppliers supplied to Wabash.

The statements above are based on the reasonable country of origin inquiry process and due diligence performed in good faith by Wabash. As noted previously, these statements are based solely on the information received from our Direct Suppliers through this process, which may be inconclusive. As such, we do not have sufficient information to conclusively determine the list of smelters and refiners that processed 3TG in our products.

4. Steps to Be Taken to Mitigate Risk

We intend to take the following steps to improve the due diligence we conduct, in an effort to further mitigate risk that the 3TG necessary to the functionality or production of the products we manufacture or contract to manufacture could benefit armed groups in the Covered Countries:

▪Inclusion of 3TG flow-down requirements in Wabash’s new or renewed Direct Supplier contracts.

▪Revisit annually the scope of Direct Suppliers requested to supply information as part of our due diligence process.

▪Engage with Direct Suppliers, as deemed necessary, directing them to training resources in an attempt to increase the due diligence response rate and improve the content of the Direct Supplier survey responses.

▪Work with the Organisation for Economic Co-operation and Development and relevant trade associations to define and improve best practices and build leverage over the supply chain in accordance with the OECD Guidance.

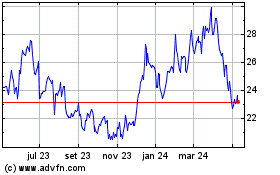

Wabash National (NYSE:WNC)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

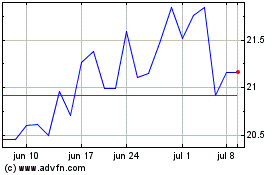

Wabash National (NYSE:WNC)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024