Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

Registration Statement

Under the Securities Act of 1933

Travelzoo

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | |

Delaware | | 36-4415727 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

590 Madison Avenue, 35th Floor

New York, New York | | 10022 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Nonqualified Stock Option Agreements

(Full Title of the Plan)

Lijun Qi

Principal Accounting Officer

Travelzoo

590 Madison Avenue, 35th Floor

New York, New York 10022

(Name and address of agent for service)

+1 (212) 516-1300

(Telephone number, including area code, of agent for service)

Copies of all correspondence to:

Christina Sindoni Ciocca

General Counsel and Head of Global Functions

Travelzoo

590 Madison Avenue, 35th Floor

New York, New York 10022

Telephone: +1 (212) 516-1300

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | x |

| | Emerging growth company | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. | ☐ |

PART I

INFORMATION REQUIRED IN THE

SECTION 10(a) PROSPECTUS

Item 1. Plan Information.

Information required by Part 1 of Form S-8 to be contained in the Section 10(a) prospectus is omitted from this Registration Statement in accordance with Rule 428 under the Securities Act, and the Note to the instructions to Part I of Form S-8.

Item 2. Registrant Information and Employee Plan Annual Information.

Information required by Part 1 of Form S-8 to be contained in the Section 10(a) prospectus is omitted from this Registration Statement in accordance with Rule 428 under the Securities Act, and the Note to the instructions to Part I of Form S-8.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents filed by the Registrant (File No. 000-50171) pursuant to the Securities Exchange Act of 1934 (the "Exchange Act") are incorporated by reference into this Registration Statement:

1. The Registrant's Annual Report on Form 10-K for the year ended December 31, 2023, filed March 22, 2024;

2. The Registrant’s Quarterly Reports on Form 10-Q for the quarter ended March 31, 2024, filed May 15, 2024; and

3. The description of the Registrant's Common Stock, which is contained in Exhibit 4.1 on Form 10-K, dated and filed on March 22, 2024.

All documents subsequently filed by the Registrant pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, prior to the filing of a post-effective amendment which indicates that all securities offered have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference in this Registration Statement and to be a part hereof from the date of filing such documents. Any statement contained in a document incorporated or deemed to be incorporated herein by reference shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

Not applicable.

Item 6. Indemnification of Directors and Officers.

The Delaware General Corporation Law (the "DGCL") permits the indemnification by a Delaware corporation of its directors, officers, employees and other agents against expenses (including attorneys' fees), judgments, fines and amounts paid in settlement in connection with specified actions, suits or proceedings, whether civil, criminal, administrative or investigative (other than derivative actions which are by or in the right of the corporation) if they acted in good faith and in a manner they reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe their conduct was unlawful. A similar standard of care is applicable in the case of derivative actions, except that indemnification only extends to expenses (including attorneys' fees) incurred in connection with defense or settlement of such an action and requires court approval before there can be any indemnification where the person seeking indemnification has been found liable to the corporation.

As permitted by Delaware law, the Registrant's Certificate of Incorporation provides that no director of the Registrant will be personally liable to the Registrant or its stockholders for monetary damages for breach of fiduciary duty as a director, except for liability (a) for any breach of duty of loyalty to the Registrant or to its stockholders, (b) for acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of law, (c) under Section 174 of the DGCL, or (d) for any transaction from which the director derived an improper personal benefit.

The Registrant's Certificate of Incorporation further provides that the Registrant must indemnify its directors and executive officers and may indemnify its other officers, employees and agents to the fullest extent permitted by Delaware law. The Registrant believes that indemnification under its Certificate of Incorporation covers negligence and gross negligence on the part of indemnified parties.

The Registrant’s By-laws provides that the Registrant shall have the power to indemnify, to the full extent authorized by law, any person made or threatened to be made a party to any action, suit or proceeding, whether criminal, civil, administrative or investigative, by reason of the fact that he, his testator or intestate is or was a director, officer or employee of the Registrant or any predecessor of the Registrant or serves or served any other enterprise as a director, officer or employee at the request of the Registrant or any predecessor of the Registrant.

The Registrant has entered into indemnification agreements with each of its directors and officers. These agreements, among other things, require the Registrant to indemnify such directors and officers for certain expenses (including attorneys' fees), judgments, fines and settlement amounts incurred by any such person in any action, suit or proceeding, and any appeal therefrom, arising out of such person's services as a director, officer, employee or agent of the Registrant or services provided at the request of the Registrant to another corporation, partnership, joint venture, trust, employee benefit plan or other enterprise, or by reason of any action alleged to have been taken or omitted in such capacity. In the case of a derivative action where the director or officer is found liable to the Registrant, no indemnification shall be made unless a court finds that the director or officer is fairly and reasonably entitled to indemnity for such expenses which the court shall deem proper.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling the Registrant pursuant to such provisions, the Registrant has been informed that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in such Act and is therefore unenforceable.

Item 7. Exemption from Registration Claimed.

Not applicable.

Item 8. Exhibits.

See Exhibit Index.

Item 9. Undertakings.

(a) The undersigned registrant hereby undertakes:

1. To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

i. To include any prospectus required by Section 10(a)(3) of the Securities Act;

ii. To reflect in the prospectus any facts or events arising after the effective date of this Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in this Registration Statement; and

iii. To include any material information with respect to the plan of distribution not previously disclosed in this Registration Statement or any material change to such information in this Registration Statement;

provided however, that paragraphs (a)(1)(i) and (a)(1)(ii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in this Registration Statement.

2. That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

3. To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(b) The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant's annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act that is incorporated by reference in this Registration Statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in

the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized in Mountain View, California on the 24th day of May, 2024.

| | | | | |

| TRAVELZOO |

| |

| /s/ LIJUN QI |

| Lijun Qi |

| Principal Accounting Officer |

POWER OF ATTORNEY

Each person whose signature appears below hereby constitutes and appoints Lijun Qi as his or her true and lawful attorney in fact and agent for him or her and on his or her behalf and in his or her name, place and stead, in any and all capacities to sign any and all amendments (including post-effective amendments) to this Registration Statement, and to file the same, with exhibits and any and all other documents filed with respect thereto, with the Securities and Exchange Commission (or any other governmental or regulatory authority), granting unto said attorney full power and authority to do and to perform each and every act and thing requisite and necessary to be done in and about the premises in order to effectuate the same as fully to all intents and purposes as he or she might or could do if personally present, hereby ratifying and confirming all that said attorney in fact and agent may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

| | | | | | | | | | | | | | |

| Signature | | Title | | Date |

| | | | |

| /s/ Christina Sindoni Ciocca | | Chair of the Board of Directors | | May 24, 2024 |

| Christina Sindoni Ciocca | | | | |

| | | | |

| /s/ Holger Bartel | | Global Chief Executive Officer | | May 24, 2024 |

| Holger Bartel | | | | |

| | | | |

| /s/ Lijun Qi | | Principal Accounting Officer | | May 24, 2024 |

| Lijun Qi | | | | |

| | | | |

| /s/ Carrie Liqun Liu | | Director | | May 24, 2024 |

| Carrie Liqun Liu | | | | |

| | | | |

/s/ Volodymyr Cherevko | | Director | | May 24, 2024 |

| Volodymyr Cherevko | | | | |

| | | | |

/s/ Michael Karg | | Director | | May 24, 2024 |

| Michael Karg | | | | |

EXHIBIT INDEX

| | | | | | | | | | | |

Exhibit

Number | | Description |

| | | Certificate of Incorporation of Travelzoo (Incorporated by reference to our Pre-Effective Amendment No. 6 to our Registration Statement on Form S-4 (File No. 333-55026), filed February 14, 2002) |

| | | Certificate of Incorporation of Travelzoo and Certificates of Amendment to the Certificate of Incorporation to Effect a Reverse Stock Split Followed by a Forward Stock Split of Travelzoo’s Common Stock (Incorporated by reference to Exhibit 3.2 on Form 10-K (File No. 000-50171), filed February 12, 2014) |

| | | Certificate of Amendment of Certificate Incorporation of Travelzoo (Incorporated by reference to Exhibit 3.4 to our Form 8-K (File No. 000-50171), filed May 10, 2017) |

| | | Certificate of Amendment of Certificate of Incorporation of Travelzoo (Incorporated by reference to Exhibit C to our Schedule 14A (File No. 000-50171), filed April 1, 2019) |

| | | Amended and Restated By-laws of Travelzoo (Incorporated by reference to Exhibit 3.5 on Form 8-K (File No. 000-50171), filed April 5, 2022) |

| | | Nonqualified Stock Option Agreement between Travelzoo and William Brown dated January 1, 2021 (Incorporated by reference to Appendix A on Form DEF 14A (File No. 000-50171), filed April 29, 2021) |

| | | Nonqualified Stock Option Agreement between Travelzoo and Holger Bartel dated March 3, 2022 (Incorporated by reference to Appendix A on Form DEF 14A (File No. 000-50171), filed April 1, 2022) |

| | | Nonqualified Stock Option Agreement between Travelzoo and Justin Soffer dated June 1, 2022 |

| | | Nonqualified Stock Option Agreement between Travelzoo and Christina Sindoni Ciocca dated March 8, 2023 (Incorporated by reference to Appendix A on Form DEF 14A (File No. 000-50171), filed April 28, 2023) |

| | | Nonqualified Stock Option Agreement between Travelzoo and Holger Bartel dated March 28, 2024 (Incorporated by reference to Appendix A on Form DEF 14A (File No. 000-50171), filed March 29, 2024) |

| | | Opinion of General Counsel regarding the validity of the Common Stock |

| | | Consent of KPMG LLP, independent registered public accounting firm |

| | | Consent of RSM US LLP, independent registered public accounting firm |

| 23.3 | | Consent of General Counsel (included in Exhibit 5.1) |

| 24 | | Power of Attorney (included on signature page) |

| | | Filing Fee Table |

| | | |

| | | |

| | | |

* Filed herewith.

Exhibit 107

Calculation of Filing Fee Tables

Form S-8

(Form Type)

Travelzoo

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

| | | | | | | | | | | | | | | | | | | | | | | |

| Security Type | Security Class Title | Fee Calculation Rule | Amount Registered (1) | Proposed Maximum Offering Price Per Unit (2) | Maximum Aggregate Offering Price | Fee Rate | Amount of Registration Fee |

| Equity | Common Stock, par value $0.01 per share | Rule 457(c) and 457(h) | 1,550,000 | $8.44 | $13,082,000 | $147.60 per $1,000,000 | $1,930.90 |

| Total Offering Amounts | | $13,082,000 | | $1,930.90 |

| Total Fee Offsets | | | | $— |

| Net Fee Due | | | | $1,930.90 |

(1)This Registration Statement covers, in addition to the number of shares of Travelzoo, a Delaware corporation (the

"Company" or the "Registrant"), common stock, par value $0.01 per share (the "Common Stock"), stated above, (a) options granted to employees of the Company to purchase up to an aggregate of 1,550,000 shares of Common Stock pursuant to the Nonqualified Stock Option Agreements which appear as exhibits to this Registration Statement and (b) pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the "Securities Act"), an indeterminate number of additional shares as may be issuable as a result of a stock split, stock dividend or similar adjustment of the outstanding shares of Common Stock of the Registrant.

(2)Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) and Rule 457(h) under

the Securities Act. The offering price per share and the aggregate offering price are based on a price of $8.44 per share, which price is an average of the high and low prices of the Common Stock as reported on the Nasdaq Global Select Market on May 20, 2024, which date is within five business days prior to filing this Registration Statement.

Exhibit 4.3

NON-QUALIFIED STOCK OPTION AGREEMENT

THIS NON-QUALIFIED STOCK OPTION AGREEMENT (this “Agreement”) is made this day of June 1, 2022, by and between Travelzoo, a Delaware corporation (the "Company") and Justin Soffer ("Optionee").

WHEREAS, the Company and Optionee have agreed that Optionee will provide services to the Company starting June 1, 2022, pursuant to an employment agreement dated June 1, 2022 (the “Employment Agreement”); and

WHEREAS, in exchange for such services pursuant to the Employment Agreement and as inducement to Optionee to become an employee of the Company in accordance with NASDAQ Listing Rule 5635(c)(4), the Company desires to grant to Optionee the option to purchase certain shares of its stock, in accordance with the terms of this Agreement, with such option intended to be a nonstatutory stock option that is not an incentive stock option within the meaning of Section 422 of the Internal Revenue Code of 1986, as amended.

NOW, THEREFORE, in consideration of the premises and of the mutual agreements hereinafter set forth, it is covenanted and agreed as follows:

1. Grant and Terms of Option. Pursuant to action of the Compensation Committee (the “Committee”) of the Board of Directors of the Company (the “Board”), the Company grants, effective June 1, 2022 (“Date of Grant”) to Optionee the option to purchase all or any part of 100,000 shares of common stock of the Company, par value of $0.01 each ("Common Stock"), to vest quarterly beginning July 1, 2022 over a period of three (3) years (the “Term”) upon the achievement of certain performance metrics, as set forth below, at the purchase price of $6.78 per share, which is the fair market value of the Common Stock determined as the official NASDAQ closing share price on the Date of Grant; provided, however, that the right to exercise such option shall be, and is hereby, restricted as follows:

(a) No shares may be purchased until they have vested in accordance with the terms of this Agreement. Subject to the terms of this Agreement, the 100,000 stock options shall vest quarterly in installments provided that the following conditions are triggered:

(i) The stock options shall vest on the first date on which the Time Condition is met if, as of the date such Time Condition is met, the Performance Condition is also met.

(ii) The “Time Condition” will be satisfied as to 8.33% of the stock options at the end of each quarter following July 1, 2022.

(iii) The “Performance Condition” will be met if, as of the date of the satisfaction of the Time Condition:

(A) the total new members of Travelzoo in North America, Travelzoo in Europe, Jack’s Flight Club (PREMIUM service) or any combination thereof, as of the last day of the quarter, is at least 10% higher than the total new members for the same quarter in 2019 (with 2019 numbers as set forth on Exhibit A), respectively;

(B) the total cost savings in a quarter of Travelzoo in North America, Travelzoo in Europe, Jack’s Flight Club (PREMIUM service) or any combination thereof, as calculated for each category of members by the total new members per subsection (A) multiplied by the decrease of the average cost-per-acquisition (CPA) compared to the 2019 average (with 2019 numbers as set forth on Exhibit A), is at least $70,000, respectively; and

(C) the average quality of the acquired members per subsection (A), as measured by the Company’s official member quality score for North America and Europe added together and divided by 2, is at least 10% higher compared to the 2019 average calculated in the same manner (with 2019 numbers as

set forth on Exhibit A). This criterion does not apply to Jack’s Flight Club PREMIUM members.

(iv) If the Performance Condition is not met as of the first date on which the Time Condition is met, the Time Condition may be extended by one quarter up to three times; provided, that if the Time Condition is extended, the measurement of the Performance Condition shall be aggregated for the original quarter plus the additional quarter(s) and compared against the same period in 2019, as applicable.

(v) For the avoidance of doubt, the achievement of the above Performance Condition, including paid acquisition of new members, must respect and align with the Company’s strategic allocation of marketing budget, which will be decided and may be updated by the Company at any time in its sole discretion, including without limitation, where, when and how much of the Company’s marketing budget is allocated towards acquisition of members in each market.

(b) In no event may this option or any part thereof be exercised after the expiration of five (5) years from the Date of Grant, which shall be the term of the option.

(c) The purchase price of the shares subject to the option may be paid for (i) in cash, (ii) in the discretion of the Board, by tender of shares of Common Stock already owned by Optionee, or (iii) in the discretion of the Board, by such other method as the Board may determine.

(d) The option may not be exercised for a fraction of a share.

(e) The option may not be exercised if Optionee is no longer employed by the Company subject to the provisions of Section 4 of this Agreement.

(f) The option may not be exercised prior to the registration of the shares being offered under the Agreement, which registration shall be filed by the Company with the United States Securities and Exchange Commission following the execution of this Agreement.

(g) The Board or the Committee shall also determine the methods by which shares of stock shall be delivered or deemed to be delivered to Optionee.

2. Anti-Dilution Provisions. In the event that, during the term of this Agreement, there is any change in the number of shares of outstanding Common Stock of the Company by reason of stock dividends, recapitalizations, mergers, consolidations, split-ups, combinations or exchanges of shares and the like, not including any issuances of shares for consideration or capital increases by the Company, the number of shares covered by this option agreement and the price thereof shall be adjusted, to the same proportionate number of shares and price as in this original agreement.

3. Non-Transferability. Neither the option hereby granted nor any rights thereunder or under this Agreement may be assigned, transferred or in any manner encumbered except by will or the laws of descent and distribution, and any attempted assignment, transfer, mortgage, pledge or encumbrance except as herein authorized, shall be void and of no effect.

The option may be exercised during Optionee's lifetime only by Optionee or his guardian or legal representative as set forth herein.

4. Termination of Employment. In the event of the termination of the Employment Agreement prior to its expiration, or to the extent the Company terminates employment of Optionee, including upon death or disability, Optionee’s (or, in the event of death, the legatee or legatees of Optionee under his last will, or his personal representatives or distributees) right to exercise the option, only to the extent it was vested and he was entitled to exercise it on the date of termination of services or employment, shall continue for 90 days after such termination but not after five (5) years from the Date of Grant. If Optionee (or, in the event of death, the legatee or legatees of Optionee under his last will, or his personal representatives or distributees) does not exercise the option within 90 days following such termination of Employment, any unexercised vested option shall be null and void.

5. Method of Exercise/Shares Issued on Exercise of Option. The option may be exercised (in whole or in part) at any time during the period specified in this Agreement, (a) by delivering to the Corporate Secretary of the Company not less than thirty (30) days prior to the date of exercise (or such shorter period as the Company shall approve) a written notice (email being acceptable) of Optionee’s intent to exercise and estimated date of exercise, and (b) by delivering to the Corporate Secretary of the Company not less than five (5) business days prior to the date of exercise (or such shorter period as the Company shall approve) (i) a written notice of exercise designating the number of shares to be purchased, signed by Optionee, and (ii) payment of the full amount of the purchase price of the shares and payment of the full amount of applicable taxes triggered by the exercise of the shares, in each case, with respect to which the option is exercised. If the written notice of exercise is delivered by mail, or by any other means of delivery, the date of delivery shall be the date the written notice is actually received by the Corporate Secretary. It is the intention of the Company that on any exercise of this option it will transfer to Optionee shares of its authorized but unissued stock or transfer Treasury shares or utilize any combination of Treasury shares and authorized but unissued shares, to satisfy its obligations to deliver shares on any exercise hereof. No rights of a shareholder shall exist with respect to the Common Stock under this option as a result of the mere grant of this option.

6. Board Administration. The Board, the Committee, or any successor or other committee authorized by the Board, subject to the express terms of this option, shall have plenary authority to interpret any provision of this option and to make any determinations necessary or advisable for the administration of this option and the exercise of the rights herein granted, and may waive or amend any provisions hereof in any manner not adversely affecting the rights granted to Optionee by the express terms hereof.

7. Option not an Incentive Stock Option. It is intended that this option shall not be treated as an incentive stock option under Section 422 of the Internal Revenue Code of 1986, as amended, or otherwise qualify for any special tax benefits to Optionee.

8. No Contract of Employment. Nothing contained in this Agreement shall be considered or construed as creating a contract of employment for any specified period of time.

9. Restrictions on Exercise. This option may not be exercised if the issuance of Common Stock upon Optionee’s exercise or the method of payment of consideration for such Common Stock would constitute a violation of any applicable Federal or state securities law or other applicable law or regulation. As a condition to the exercise of this option, the Company may require Optionee to make any representations and warranty to the Company as may be required by any applicable law or regulation.

10. Termination of Option. Notwithstanding anything to the contrary herein, this option shall not be exercisable after the expiration of the term of five (5) years from the Date of Grant, as set forth in section 1(b) hereof.

11. Withholding upon Exercise. Prior to the issuance of shares upon the exercise of the option, the Optionee must make arrangements satisfactory to the Company to pay or provide for any applicable federal, state and local withholding obligations of the Company. The Optionee may satisfy any federal, state or local tax withholding obligation relating to the exercise of the option by any of the following means: (a) tendering a cash payment; or (b) requesting that the Company (which may or may not approve in its sole discretion) withhold shares of Common Stock from the shares of Common Stock otherwise issuable to the Optionee as a result of the exercise of the option; provided, however, that no shares of Common Stock are withheld with a value exceeding the maximum amount of tax required to be withheld by law. The Company reserves the right to withhold, in accordance with any applicable laws, from any consideration payable to Optionee any taxes required to be withheld by federal, state or local law as a result of the grant or exercise of this option. If the amount of any consideration payable to Optionee is insufficient to pay such taxes or if no consideration is payable to Optionee, upon request of the Company, Optionee shall pay to the Company in cash an amount sufficient for the Company to satisfy any Federal, state or local tax withholding requirements it may incur as a result of the grant or exercise of this option. Notwithstanding any action the Company takes with respect to any or all income tax, social insurance, payroll tax, or other tax-related withholding (”Tax-Related Items”), the ultimate liability for all Tax-Related Items is and remains the Optionee’s responsibility and the Company (a) makes no representation or undertakings regarding the treatment of any Tax-Related Items in connection with the grant, vesting, or exercise of the option or the subsequent sale of any shares acquired on exercise; and (b) does not commit to structure the option to reduce or eliminate the Optionee’s liability for Tax-Related Items.

12. Severability. Any word, phrase, clause, sentence or other provision herein which violates or is prohibited by any applicable law, court decree or public policy shall be modified

as necessary to avoid the violation or prohibition and so as to make this Agreement enforceable as fully as possible under applicable law, and if such cannot be so modified, the same shall be ineffective to the extent of such violation or prohibition without invalidating or affecting the remaining provisions herein.

13. Non-Waiver of Rights. The Company’s failure to enforce at any time any of the provisions of this agreement or to require at any time performance by Optionee of any of the provisions hereof shall in no way be construed to be a waiver of such provisions or to affect either the validity of this agreement, or any part hereof, or the right of the Company thereafter to enforce each and every provision in accordance with the terms of this agreement.

14. Entire Agreement; Amendments. No modification, amendment or waiver of any of the provisions of this agreement shall be effective unless in writing specifically referring hereto and signed by the parties hereto. This agreement supersedes all prior agreements and understandings between Optionee and the Company to the extent that any such agreements or understandings conflict with the terms of this agreement.

15. Assignment. This agreement shall be freely assignable by the Company to and shall inure to the benefit of, and be binding upon, the Company, its successors and assigns and/or any other entity which shall succeed to the business presently being conducted by the Company.

16. Governing Law. To the extent that Federal laws do not otherwise control, all determinations made, or actions taken pursuant hereto shall be governed by the laws of the state of New York, without regard to the conflict of laws rules thereof.

[Signature Page Follows]

IN WITNESS WHEREOF, the Company has caused this Agreement to be executed on its behalf by the undersigned officer pursuant to due authorization, and Optionee has signed this Agreement to evidence his acceptance of the option herein granted and of the terms hereof, all as of the date hereof.

COMPANY:

TRAVELZOO

By: /s/ Christina Sindoni Ciocca

Name: Christina Sindoni Ciocca

Title: Authorized Signatory

Date: June 1, 2022

OPTIONEE:

By: /s/ Justin Soffer

Name: Justin Soffer

Date: May 31, 2022

Exhibit 5.1

May 24,2024

Board of Directors

Travelzoo

590 Madison Avenue, 35th Floor

New York, NY 10022

RE: Travelzoo - Form S-8 Registration

Ladies and Gentlemen:

I have acted as counsel for Travelzoo, a Delaware corporation (the “Company”), in connection with the Company's Registration Statement on Form S-8 (the “Registration Statement”) filed by the Company with the Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933, as amended (the “Act”), relating to the registration of an aggregate of 1,550,000 shares (the “Shares”) of common stock of the Company, par value $.01 per share (the “Common Stock”), which may be issued and sold to certain executives of the Company upon exercise of stock options to purchase shares of Common Stock. Such options were granted pursuant to Nonqualified Stock Option Agreements between the Company and such executives (the “Stock Option Agreements”).

In connection herewith, I have examined the Registration Statement, the Stock Option Agreements, the Certificate of Incorporation of the Company, the By-Laws of the Company and such other corporate records, agreements and instruments of the Company, certificates of officers of the Company, and such other documents, records, and instruments, and I have made such legal and factual inquiries, as I have deemed necessary or appropriate as a basis for me to render the opinion hereinafter expressed. In my examination of the foregoing, I have assumed the genuineness of all signatures, the legal competence and capacity of natural persons, the authenticity of documents submitted to me as originals and the conformity with authentic original documents of all documents submitted to me as copies or by facsimile or other means of electronic transmission, or which I obtained from the Securities and Exchange Commission's Electronic Data Gathering, Analysis and Retrieval system (“Edgar”) or other sites maintained by a court or governmental authority or regulatory body, and the authenticity of the originals of such latter documents. When relevant facts were not independently established, I have relied without independent investigation as to matters of fact upon statements of governmental officials and upon representations made in or pursuant to certificates and statements of appropriate representatives of the Company.

In connection herewith, I have assumed that, other than with respect to the Company, all of the documents referred to in this opinion letter have been duly authorized by, have been duly executed and delivered by, and constitute the valid, binding and enforceable obligations of, all of the parties to such documents, all of the signatories to such documents have been duly authorized and all such parties are duly organized and validly existing and have the power and authority (corporate or other) to execute, deliver and perform such documents.

Based upon the foregoing and in reliance thereon, and subject to the assumptions, comments, qualifications, limitations and exceptions set forth herein, I am of the opinion that the Shares, when issued, delivered and paid for in accordance with the terms of the Stock Option Agreements, will be validly issued, fully paid and non-assessable shares of Common Stock.

In addition to the assumptions, comments, qualifications, limitations and exceptions set forth above, I render this opinion only with respect to the General Corporation Law of the State of Delaware. I express no opinion as to the laws, rules or regulations of any other jurisdiction, including, without limitation, the federal laws of the United States of America or any state securities or blue sky laws. The opinion set forth herein is made as of the date hereof and is subject to, and may be limited by, future changes in the factual matters set forth herein, and I undertake no duty to advise you of the same. The opinion expressed herein is based upon the law in effect (and published or otherwise generally available) on the date hereof, and I assume no obligation to revise or supplement this opinion should such law be changed by legislative action, judicial decision or otherwise. In rendering this opinion, I have not

considered, and hereby disclaim any opinion as to, the application or impact of any laws, cases, decisions, rules or regulations of any other jurisdiction, court or administrative agency.

I do not give any opinions except as set forth above. I hereby consent to the filing of this opinion letter as Exhibit 5.1 to the Registration Statement and to the reference to this firm in the Registration Statement. I also consent to your filing copies of this opinion letter as an exhibit to the Registration Statement with agencies of such states as you deem necessary in the course of complying with the laws of such states regarding the offering and sale of the Shares. In giving such consent, I do not thereby concede that I am within the category of persons whose consent is required under Section 7 of the Act or the Rules and Regulations of the Commission thereunder.

Very truly yours,

/s/ Christina Sindoni Ciocca

Christina Sindoni Ciocca

General Counsel and Head of Global Functions

Exhibit 23.1

Consent of Independent Registered Public Accounting Firm

We consent to the use of our report dated March 22, 2024, with respect to the consolidated financial statements of Travelzoo and subsidiaries, incorporated herein by reference.

/s/ KPMG LLP

New York, New York

May 24, 2024

Exhibit 23.2

Consent of Independent Registered Public Accounting Firm

We consent to the incorporation by reference in this Registration Statement on Form S-8 of Travelzoo of our report dated March 31, 2023, except for the restatement described in Note 17 as to which the date is August 14, 2023, relating to the consolidated financial statements of Travelzoo, appearing in the Annual Report on Form 10-K of Travelzoo for the year ended December 31, 2023.

As discussed in Note 12 to the consolidated financial statements, the 2022 financial statements have been restated due to a change in reportable segments. We have not audited the adjustments to the 2022 financial statements to retrospectively present the change in reportable segments, as described in Note 12.

/s/ RSM US LLP

San Jose, California

May 24, 2024

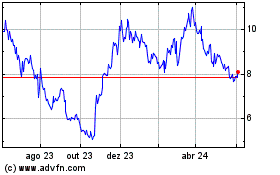

Travelzoo (NASDAQ:TZOO)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

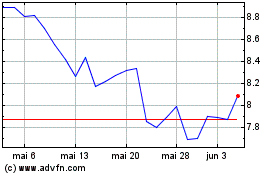

Travelzoo (NASDAQ:TZOO)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024