Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

03 Junho 2024 - 5:03PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN

PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF

THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No.___)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material under 240.14a-12 |

LIGAND PHARMACEUTICALS INCORPORATED

Name of Registrant as Specified In Its Charter

Name of Person(s) Filing Proxy Statement, if other than the Registrant

Payment of Filing Fee (Check the appropriate box):

| | | | | |

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Ligand Pharmaceuticals Incorporated is providing the following additional information in communications with stockholders regarding Proposal No. 4 in its Definitive Proxy Statement filed on April 25, 2024:

###

Dear Stockholder,

We would like to provide you some information in connection with Proposal No. 4 in our Proxy Statement filed in connection with our 2024 Annual Meeting. Specifically, the request that our stockholders vote to approve the amendment and restatement of the equity plan we use to compensate our personnel (the 2002 Stock Incentive Plan). We have proposed a 1.3 million share increase in the number of shares available for issuance under the Plan. This would increase our total equity overhang to 28.1%. In your consideration of Proposal No. 4 we would like to draw your attention to certain facts.

1.908,533 shares of our common stock are held by former employees, including those who were “spun out” with the OmniAb and Primrose transactions.

2.While we believe the 28.1% overhang to be both reasonable and consistent with market practices, we believe it worth noting that subtracting shares held by former employees from the total overhang calculation reduces the total overhang from 28.1% to 22.7%, including units currently available for grant. This latter number is well below the normal “cap” suggested by ISS.

3.The restructuring and spin out transactions reduced our total employee headcount to below 40 from nearly 175, thereby reducing significant cash and equity expense on a go forward basis. This has been financially beneficial to the company and therefore to the shareholders. In fact, we believe that this contributed greatly to the fact that our adjusted earnings have more than doubled since those transactions were consummated.

4.In our operating strategy, we rely heavily upon the talent of our most important resource, our people, and specifically on our ability to attract and retain these valued professionals. These are talented pharmaceutical executives and private equity investors who have significant professional opportunities elsewhere. They have come to, and remain at, Ligand because they are excited about the strategy, the potential for growth, and business we are building. It is important that we are able to retain and motivate them and we utilize equity to appropriately align their interests with those of our shareholders.

Below, for your information, we have provided the results of some internal analysis that we have done on this topic.

###

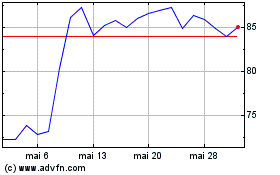

Ligand Pharmaceuticals (NASDAQ:LGND)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Ligand Pharmaceuticals (NASDAQ:LGND)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025