Form 424B7 - Prospectus [Rule 424(b)(7)]

05 Junho 2024 - 6:25PM

Edgar (US Regulatory)

Filed Pursuant to Rule 424(b)(7)

Registration No. 333-277029

PROSPECTUS SUPPLEMENT NO. 1

(To prospectus dated April 11, 2024)

iQSTEL Inc.

48,888,890 Shares of Common

Stock

This

prospectus supplement updates and amends the selling shareholders (each, a “selling shareholder” and collectively, the “selling

shareholders”) information contained in the prospectus dated April 11, 2024 (the “Prospectus”), which forms a part of

the Registration Statement on Form S-1 (File No. 333-277029) of iQSTEL Inc. (the “Company”, “we”, “our”

or “us”), and relates to the resale of an aggregate of 48,888,890 shares of our common stock, including 3,535,354 shares of

common stock, 35,353,536 shares of common stock issuable upon conversion of a secured convertible promissory note (the “Note”)

and 10,000,000 shares of common stock issuable upon exercise of a common stock purchase option (the “Option”).

This

prospectus supplement is being filed solely for the purpose of updating the information of the selling shareholders described below.

This

prospectus supplement is not complete without, and may not be utilized except in connection with, the Prospectus, including any amendments

or supplements thereto.

Investing

in our securities involves a high degree of risk. Before investing in our securities, you should carefully consider the risks and uncertainties

described under the caption “Risk Factors” of the Prospectus and under similar headings in the documents incorporated by reference

herein and therein.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon

the adequacy or accuracy of this prospectus supplement. Any representation to the contrary is a criminal offense.

The date of this prospectus

supplement is June 5, 2024.

SELLING SHAREHOLDERS

The

shares of common stock being offered by the selling shareholders are those currently held by the selling shareholders and those issuable

to the selling shareholders pursuant to the terms of the Note and Option.

For

purposes of this prospectus, “selling shareholders” mean the shareholders listed below and their permitted transferees, pledgees,

assignees, distributees, donees or successors or others who later hold any of the selling shareholders’ interests in the securities.

To the extent required, we will file a supplement to this prospectus (or a post-effective amendment hereto, if necessary) to name successors

to the named selling shareholder who are able to use this prospectus to resell the common shares registered hereby.

Except

for the ownership of the Note and Option, the selling shareholders have not had any material relationship with us within the past three

years.

The

table below lists the selling shareholders and other information regarding the beneficial ownership of the shares of common stock by each

of the selling shareholders. The second column lists the number of shares of common stock beneficially owned by the selling shareholders,

based on their ownership of the shares of common stock, the Note and Option, as of the date of this prospectus, assuming full conversion

of the Note and full exercise of the Option held by the selling shareholders on that date, without regard to any limitation on conversion.

In

accordance with the terms of the Registration Rights Agreement with the holder of the Note and the agreement to register the shares underlying

the Option, this prospectus generally covers the resale of that number of shares of common stock equal to the number of shares of common

stock currently held by the selling shareholders and the number of shares of common stock issuable upon conversion and exercise of the

Note and Option, respectively, until all of the shares may be sold without any restrictions pursuant to Rule 144 of the Securities Act.

.

The

amounts listed in the third and fourth columns reflect the number of shares being offered by the selling shareholders and the number of

shares remaining following the sale of such shares, respectively.

Under

the terms of the Note and Option, the selling shareholders may not convert or be issued shares of common stock to the extent such conversion

or issuance would cause such selling shareholder, together with its affiliates and attribution parties and any group of which it is a

member, to beneficially own a number of shares of common stock which would exceed 4.99% of our then outstanding common stock following

such conversion or issuance. The number of shares in the second and fourth columns do not reflect this limitation. The selling shareholders

may sell all, some or none of their shares in this offering. See “Plan of Distribution.”

| Name and Address of Selling Shareholder |

|

Number of Shares of Common Stock

Owned Prior to Offering (1) |

|

|

Maximum

Number of Shares of Common Stock to be Sold Pursuant to this Prospectus |

|

|

Shares of

Common Stock to be Owned After Offering (1) |

|

| M2B Funding Corp. (2) |

|

|

3,535,354 |

|

|

|

38,888,890 |

|

|

|

0% |

|

| ADI Funding LLC (3) |

|

|

0 |

|

|

|

10,000,000 |

|

|

|

0% |

|

| |

(1) |

“Beneficial ownership” is a term broadly

defined in Rule 13d-3 under the Exchange Act and includes more than the typical form of stock ownership, that is, stock held in a person’s

name. The term also includes what is referred to as “indirect ownership,” meaning ownership of shares as to which a person

has or shares investment power. For purposes of this column, a person or group of persons is deemed to have “beneficial ownership”

of any shares that are currently exercisable or exercisable within 60 days of the date of this prospectus.

The amounts listed do not give effect to any limitation

on conversion or the issuance of shares pursuant to the terms of the Note or Option (including the limitations on beneficial ownership

discussed above). |

|

| |

|

|

|

| |

(2) |

Daniel Kordash holds voting and dispositive power over the shares of common stock beneficially owned by M2B Funding Corp. Includes (i) 3,535,354 shares of common stock and (ii) 35,353,536 shares issuable upon conversion of the Note held by the selling stockholder (but without giving effect to the limitation on beneficial ownership contained therein). |

|

| |

|

|

|

| |

(3) |

Ariella Basdeo holds voting and dispositive power over the shares of common stock beneficially owned by ADI Funding LLC. Includes 10,000,000 shares issuable upon exercise of the Option held by the selling stockholder (but without giving effect to the limitation on beneficial ownership contained therein). |

|

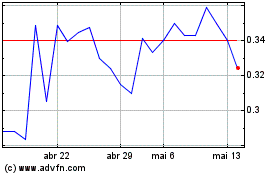

iQSTEL (QX) (USOTC:IQST)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

iQSTEL (QX) (USOTC:IQST)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024