UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 6-K

Report of

Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16

UNDER the

Securities Exchange Act of 1934

For the month of July, 2024

Commission File Number: 001-39766

ORLA MINING LTD.

(Translation of registrant's name into English)

1010-1075

West Georgia Street

Vancouver,

BC

V6E

3C9

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒

SIGNATURE

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

ORLA MINING LTD.. |

| |

|

| Date: July 10, 2024 |

|

/s/ Etienne Morin |

| |

Name: Etienne Morin

Title: Chief Financial Officer

|

| |

|

EXHIBIT INDEX

Exhibit 99.1

| News Release |  |

Orla Mining Provides Q2 2024 Operational Results

Camino Rojo Delivers Another

Strong Quarter of Gold Production

VANCOUVER, BC, July 10, 2024 /CNW/ - Orla Mining

Ltd. (TSX: OLA) (NYSE: ORLA) ("Orla" or the "Company") is pleased to provide an interim operational update for

the second quarter ended June 30, 2024.

(All amounts expressed in millions of US dollars,

as at June 30, 2024 and are unaudited unless otherwise stated)

Second Quarter 2024 Camino Rojo Oxide Mine

Operational Update

The Camino Rojo Oxide Mine produced 33,206 ounces

and sold 34,875 ounces of gold during the second quarter 2024.

| Camino Rojo Mining and Processing Totals |

|

Q2 2024 |

YTD Q2 2024 |

| Ore Mined |

tonnes |

1,904,649 |

3,848,513 |

| Waste Mined |

tonnes |

2,051,940 |

2,924,511 |

| Total Mined |

tonnes |

3,956,589 |

6,773,024 |

| Strip Ratio |

w:o |

1.08 |

0.76 |

| Ore Stacked |

tonnes |

1,934,678 |

3,717,983 |

| Daily Stacked Throughput Rate – Average |

tpd |

19,717 |

19,657 |

| Stacked Ore Gold Grade |

g/t |

0.87 |

0.84 |

| Gold Produced |

oz |

33,206 |

66,429 |

| Gold Sold |

oz |

34,875 |

66,921 |

At June 30, 2024, Orla had cash of $154.3 million

and total debt of $78.4 million, resulting in a net cash position of $75.9 million1. The Company has an undrawn amount of $71.6

million available on its revolving credit facility, which supports total liquidity of $225.9 million at quarter end1. The liquidity

position at June 30, 2024, is shown below. Financial and operating results for the second quarter 2024 will be provided on August 12,

2024.

Liquidity Position

| Cash position |

$154.3 |

| Long-term debt2 |

$78.4 |

| Net cash1,[2] |

$75.9 |

| Undrawn debt available2 |

$71.6 |

| Total available liquidity1 |

$225.9 |

__________________________________

1 Net cash and liquidity are non-GAAP measures. See the "Non-GAAP Measures" section of this news release for additional information.

2 Long-term debt, net cash and undrawn debt may not tie due to rounding |

Second Quarter 2024 Conference Call

Orla will host a conference call on Tuesday August

13, 2024, at 10:00 AM, Eastern Time, to provide a corporate update following the release of its financial and operating results for the

second quarter 2024:

| Dial-In Numbers / Webcast: |

|

| |

|

| Conference ID: |

5844017 |

| |

|

| Toll Free: |

1 (888) 550-5302 |

| |

|

| Toll: |

1 (646) 960-0685 |

| |

|

| Webcast: |

https://orlamining.com/investors/presentations-and-events/ |

Qualified Persons Statement

The scientific and technical information in this news

release was reviewed and approved by Mr. J. Andrew Cormier, P. Eng., Chief Operating Officer of the Company, who is the Qualified Person

as defined under NI 43-101 standards.

About Orla Mining Ltd.

Orla's corporate strategy is to acquire, develop,

and operate mineral properties where the Company's expertise can substantially increase stakeholder value. The Company has two material

gold projects: (1) Camino Rojo, located in Zacatecas State, Mexico and (2) South Railroad, located in Nevada, United States. Orla is operating

the Camino Rojo Oxide Gold Mine, a gold and silver open-pit and heap leach mine. The property is 100% owned by Orla and covers over 139,000

hectares which contains a large oxide and sulphide mineral resource. Orla is also developing the South Railroad Project, a feasibility-stage,

open pit, heap leach gold project located on the Carlin trend in Nevada. The technical reports for the Company's material projects are

available on Orla's website at www.orlamining.com, and on SEDAR+ and EDGAR under the Company's profile at www.sedarplus.ca and www.sec.gov,

respectively.

Non-GAAP Measures

The Company has included certain performance measures

in this news release which are not specified, defined, or determined under generally accepted accounting principles (in the Company's

case, International Financial Reporting Standards ("IFRS")). These are common performance measures in the gold mining industry,

but because they do not have any mandated standardized definitions, they may not be comparable to similar measures presented by other

issuers. Accordingly, the Company uses such measures to provide additional information and you should not consider them in isolation or

as a substitute for measures of performance prepared in accordance with generally accepted accounting principles ("GAAP"). In

this section, all currency figures in tables are in millions, except per-share and per-ounce amounts.

Net Cash

Net cash is calculated as cash and cash equivalents

and short-term investments less total debt at the end of the reporting period. This measure is used by management to measure the Company's

debt leverage. The Company believes that net cash is useful in evaluating the Company's leverage and is also a key metric in determining

the cost of debt.

| NET CASH |

Jun 30, 2024 |

Dec 31, 2023 |

| Cash and cash equivalents |

$ 154.3 |

$ 96.6 |

| Long term debt |

(78.4) |

(88.4) |

| NET CASH |

$ 75.9 |

$ 8.2 |

Liquidity

Liquidity is calculated as the sum of cash and

cash equivalents, short-term Investments, and undrawn amounts available under the Company's revolving credit facility. Liquidity does

not have any standardized meaning prescribed by GAAP and therefore may not be comparable to similar measures presented by other companies.

The Company believes that liquidity is useful to evaluate the Company's ability to meet its short -term obligations as they come due.

| LIQUIDITY |

Jun 30, 2024 |

Dec 31, 2023 |

| Cash and cash equivalents |

$ 154.3 |

$ 96.6 |

| Total credit facility available |

150.0 |

150.0 |

| Credit facility principal drawn down |

(78.4) |

(88.4) |

| LIQUIDITY |

$ 225.9 |

$ 158.2 |

Preliminary Financial Results

The financial results contained in this news release

for the three- and six-month periods ended June 30, 2024 are preliminary. Such results represent the most current information available

to the Company's management, as the Company completes its financial procedures. The Company's interim consolidated financial statements

for such period may result in material changes to the financial information contained in this news release (including by any one financial

metric, or all of the financial metrics, being below or above the figures indicated) as a result of the completion of normal period end

accounting procedures and adjustments.

Forward-looking Statements

This news release contains certain "forward-looking

information" and "forward-looking statements" within the meaning of Canadian securities legislation and within the meaning

of Section 27A of the United States Securities Act of 1933, as amended, Section 21E of the United States Exchange Act of 1934, as amended,

the United States Private Securities Litigation Reform Act of 1995, or in releases made by the United States Securities and Exchange Commission,

all as may be amended from time to time.. Forward-looking statements are statements that are not historical facts which address events,

results, outcomes or developments that the Company expects to occur. Forward-looking statements are based on the beliefs, estimates and

opinions of the Company's management on the date the statements are made and they involve a number of risks and uncertainties. Certain

material assumptions regarding such forward-looking statements were made. Consequently, there can be no assurances that such statements

will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Forward-looking

statements involve significant known and unknown risks and uncertainties, which could cause actual results to differ materially from those

anticipated. These risks include, but are not limited to, the risk factors discussed in the Company's most recently filed management's

discussion and analysis, as well as its annual information form dated March 19, 2024, which are available on www.sedarplus.ca and www.sec.gov.

Except as required by the securities disclosure laws and regulations applicable to the Company, the Company undertakes no obligation to

update these forward-looking statements if management's beliefs, estimates or opinions, or other factors, should change.

SOURCE Orla Mining Ltd.

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/July2024/10/c2388.html

%CIK: 0001680056

For further information: For further information, please contact:

Jason Simpson, President & Chief Executive Officer; Andrew Bradbury, Vice President, Investor Relations & Corporate Development,

www.orlamining.com, investor@orlamining.com

CO: Orla Mining Ltd.

CNW 06:00e 10-JUL-24

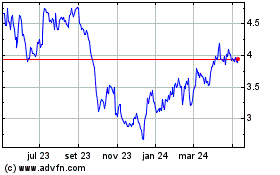

Orla Mining (AMEX:ORLA)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

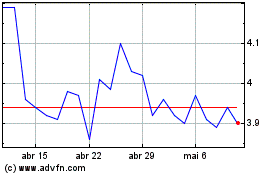

Orla Mining (AMEX:ORLA)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025