SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of June, 2024

Commission File Number: 001-13382

KINROSS GOLD CORPORATION

(Translation of registrant's name into English)

17th Floor, 25 York Street

Toronto, Ontario M5J 2V5

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Form 20-F

¨ Form 40-F x

EXPLANATORY NOTE

This Current Report on Form 6-K, dated July 31, 2024, is

being furnished for the sole purpose of providing a copy of the Consolidated Financial Statements and Management’s Discussion and

Analysis for the period ended June 30, 2024.

This current report is specifically incorporated by reference into

Kinross Gold Corporation’s Registration Statements on Form S-8 (Registration Nos. 333-180822, 333-180823, 333-180824 filed

on April 19, 2012, Registration No. 333-217099 filed on April 3, 2017 and Registration No. 333-262966 filed on February 24,

2022) and Form F-10 (Registration No. 333-277844 filed on March 12, 2024).

EXHIBITS

SIGNATURES

Pursuant to the requirements of Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

KINROSS GOLD CORPORATION |

| |

|

|

| |

By: |

/s/ Kar Ng |

| |

Name: |

Kar Ng |

| |

Title: |

Vice-President, Finance |

| |

|

|

| |

Date: |

July 31, 2024 |

| |

|

|

Exhibit 99.1

Kinross

Gold Corporation

management’s

discussion and analysis

For the three and six months ended June 30,

2024

This management's

discussion and analysis ("MD&A"), prepared as of July 31, 2024, relates to the financial condition and results of

operations of Kinross Gold Corporation together with its wholly owned subsidiaries, as at June 30, 2024 and for the three and six

months then ended, and is intended to supplement and complement Kinross Gold Corporation’s unaudited interim condensed consolidated

financial statements for the three and six months ended June 30, 2024 and the notes thereto (the “interim financial statements”).

Readers are cautioned that the MD&A contains forward-looking statements about expected future events and financial and operating

performance of the Company, and that actual events may vary from management's expectations. Readers are encouraged to read the Cautionary

Statement on Forward Looking Information included with this MD&A and to consult Kinross Gold Corporation's annual audited consolidated

financial statements for 2023 and corresponding notes to the financial statements which are available on the Company's web site at www.kinross.com

and on www.sedarplus.ca. The interim financial statements

and MD&A are presented in U.S. dollars. The interim financial statements have been prepared in accordance with International

Accounting Standard (“IAS”) 34 “Interim Financial Reporting” as issued by the International Accounting Standards

Board (“IASB”). This discussion addresses matters we consider important for an understanding of our financial condition and

results of operations as at and for the three and six months ended June 30, 2024, as well as our outlook.

This MD&A

contains forward-looking statements and should be read in conjunction with the risk factors described in "Risk Analysis" and

in the “Cautionary Statement on Forward-Looking Information” on

pages 31 – 32 of this MD&A. In certain instances, references are made to relevant notes in the

interim financial statements for additional information.

Where we say

"we", "us", "our", the "Company" or "Kinross", we mean Kinross Gold Corporation or

Kinross Gold Corporation and/or one or more or all of its subsidiaries, as it may apply. Where we refer to the "industry",

we mean the gold mining industry.

| 1. | DESCRIPTION

OF THE BUSINESS |

Kinross is engaged

in gold mining and related activities, including exploration and acquisition of gold-bearing properties, the extraction and processing

of gold-containing ore, and reclamation of gold mining properties. Kinross’ gold production and exploration activities are carried

out principally in Canada, the United States, Brazil, Chile, Mauritania and Finland. Gold is produced in the form of doré, which

is shipped to refineries for final processing. Kinross also produces and sells a quantity of silver.

The profitability

and operating cash flow of Kinross are affected by various factors, including the amount of gold and silver produced, the market prices

of gold and silver, operating costs, interest rates, regulatory and environmental compliance, the level of exploration activity and capital

expenditures, general and administrative costs, and other discretionary costs and activities. Kinross is also exposed to fluctuations

in currency exchange rates, political risks, and varying levels of taxation that can impact profitability and cash flow. Kinross seeks

to manage the risks associated with its business operations; however, many of the factors affecting these risks are beyond the Company’s

control.

Commodity prices

continue to be volatile as economies around the world continue to experience economic challenges along with political changes and uncertainties.

Volatility in the price of gold and silver impacts the Company's revenue, while volatility in the price of input costs, such as oil,

and foreign exchange rates, particularly the Brazilian real, Chilean peso, Mauritanian ouguiya and Canadian dollar, may have an impact

on the Company's operating costs and capital expenditures.

Kinross

Gold Corporation

management’s

discussion and analysis

For the three and six months ended June 30,

2024

Consolidated Financial and Operating

Highlights

| | |

Three

months ended June 30, | | |

Six

months ended June 30, | |

| (in millions,

except ounces, per share amounts and per ounce amounts) | |

2024 | | |

2023 | | |

Change | | |

%

Change | | |

2024 | | |

2023 | | |

Change | | |

%

Change | |

| Operating Highlights | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total

gold equivalent ounces(a) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Produced | |

| 535,338 | | |

| 555,036 | | |

| (19,698 | ) | |

| (4 | )% | |

| 1,062,737 | | |

| 1,021,058 | | |

| 41,679 | | |

| 4 | % |

| Sold | |

| 520,760 | | |

| 552,969 | | |

| (32,209 | ) | |

| (6 | )% | |

| 1,043,160 | | |

| 1,043,299 | | |

| (139 | ) | |

| (0 | )% |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Financial Highlights | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Metal sales | |

$ | 1,219.5 | | |

$ | 1,092.3 | | |

$ | 127.2 | | |

| 12 | % | |

$ | 2,301.0 | | |

$ | 2,021.6 | | |

$ | 279.4 | | |

| 14 | % |

| Production cost of sales | |

$ | 536.1 | | |

$ | 497.9 | | |

$ | 38.2 | | |

| 8 | % | |

$ | 1,049.0 | | |

$ | 981.8 | | |

$ | 67.2 | | |

| 7 | % |

| Depreciation, depletion and amortization | |

$ | 295.8 | | |

$ | 239.3 | | |

$ | 56.5 | | |

| 24 | % | |

$ | 566.5 | | |

$ | 451.2 | | |

$ | 115.3 | | |

| 26 | % |

| Operating earnings | |

$ | 298.3 | | |

$ | 237.8 | | |

$ | 60.5 | | |

| 25 | % | |

$ | 491.5 | | |

$ | 381.7 | | |

$ | 109.8 | | |

| 29 | % |

| Net earnings attributable to common

shareholders | |

$ | 210.9 | | |

$ | 151.0 | | |

$ | 59.9 | | |

| 40 | % | |

$ | 317.9 | | |

$ | 241.2 | | |

$ | 76.7 | | |

| 32 | % |

| Basic earnings per share attributable

to common shareholders | |

$ | 0.17 | | |

$ | 0.12 | | |

$ | 0.05 | | |

| 42 | % | |

$ | 0.26 | | |

$ | 0.20 | | |

$ | 0.06 | | |

| 30 | % |

| Diluted earnings per share attributable

to common shareholders | |

$ | 0.17 | | |

$ | 0.12 | | |

$ | 0.05 | | |

| 42 | % | |

$ | 0.26 | | |

$ | 0.20 | | |

$ | 0.06 | | |

| 30 | % |

| Adjusted

net earnings attributable to common shareholders(b) | |

$ | 174.7 | | |

$ | 167.6 | | |

$ | 7.1 | | |

| 4 | % | |

$ | 299.6 | | |

$ | 255.2 | | |

$ | 44.4 | | |

| 17 | % |

| Adjusted

net earnings per share(b) | |

$ | 0.14 | | |

$ | 0.14 | | |

$ | - | | |

| 0 | % | |

$ | 0.24 | | |

$ | 0.21 | | |

$ | 0.03 | | |

| 14 | % |

| Net cash flow provided from operating

activities | |

$ | 604.0 | | |

$ | 528.6 | | |

$ | 75.4 | | |

| 14 | % | |

$ | 978.4 | | |

$ | 787.6 | | |

$ | 190.8 | | |

| 24 | % |

| Adjusted

operating cash flow(b) | |

$ | 478.1 | | |

$ | 459.1 | | |

$ | 19.0 | | |

| 4 | % | |

$ | 903.0 | | |

$ | 791.9 | | |

$ | 111.1 | | |

| 14 | % |

| Capital

expenditures(c) | |

$ | 274.2 | | |

$ | 281.9 | | |

$ | (7.7 | ) | |

| (3 | )% | |

$ | 516.1 | | |

$ | 503.1 | | |

$ | 13.0 | | |

| 3 | % |

| Attributable(d) capital

expenditures(b) | |

$ | 264.5 | | |

$ | 272.3 | | |

$ | (7.8 | ) | |

| (3 | )% | |

$ | 496.6 | | |

$ | 484.9 | | |

$ | 11.7 | | |

| 2 | % |

| Attributable(d) free

cash flow(b) | |

$ | 345.9 | | |

$ | 258.3 | | |

$ | 87.6 | | |

| 34 | % | |

$ | 491.2 | | |

$ | 305.3 | | |

$ | 185.9 | | |

| 61 | % |

| Average

realized gold price per ounce(e) | |

$ | 2,342 | | |

$ | 1,976 | | |

$ | 366 | | |

| 19 | % | |

$ | 2,206 | | |

$ | 1,937 | | |

$ | 269 | | |

| 14 | % |

| Production

cost of sales per equivalent ounce(a) sold(f)(g) | |

$ | 1,029 | | |

$ | 900 | | |

$ | 129 | | |

| 14 | % | |

$ | 1,006 | | |

$ | 941 | | |

$ | 65 | | |

| 7 | % |

| Production

cost of sales per ounce sold on a by-product basis(b)(g) | |

$ | 989 | | |

$ | 845 | | |

$ | 144 | | |

| 17 | % | |

$ | 965 | | |

$ | 885 | | |

$ | 80 | | |

| 9 | % |

| All-in

sustaining cost per ounce sold on a by-product basis(b)(g) | |

$ | 1,357 | | |

$ | 1,262 | | |

$ | 95 | | |

| 8 | % | |

$ | 1,319 | | |

$ | 1,272 | | |

$ | 47 | | |

| 4 | % |

| All-in

sustaining cost per equivalent ounce(a) sold(b)(g) | |

$ | 1,387 | | |

$ | 1,296 | | |

$ | 91 | | |

| 7 | % | |

$ | 1,348 | | |

$ | 1,308 | | |

$ | 40 | | |

| 3 | % |

| Attributable(d) all-in

cost per ounce sold on a by-product basis(b) | |

$ | 1,756 | | |

$ | 1,596 | | |

$ | 160 | | |

| 10 | % | |

$ | 1,685 | | |

$ | 1,606 | | |

$ | 79 | | |

| 5 | % |

| Attributable(d) all-in

cost per equivalent ounce(a) sold(b) | |

$ | 1,774 | | |

$ | 1,614 | | |

$ | 160 | | |

| 10 | % | |

$ | 1,702 | | |

$ | 1,624 | | |

$ | 78 | | |

| 5 | % |

| (a) | “Gold

equivalent ounces” include silver ounces produced and sold converted to a gold

equivalent based on a ratio of the average spot market prices for the commodities for each

period. The ratio for the second quarter and first six months of 2024 was 81.06:1 and 84.51:1,

respectively (second quarter and first six months of 2023 – 81.88:1 and 82.85:1, respectively). |

| (b) | The

definition and reconciliation of these non-GAAP financial measures and ratios is included

in Section 11. Non-GAAP financial measures and ratios have no standardized meaning under

International Financial Reporting Standards (“IFRS”) and therefore, may not be

comparable to similar measures presented by other issuers. |

| (c) | “Capital

expenditures” is as reported

as “Additions to property, plant and equipment” on the interim condensed consolidated

statements of cash flows. |

| (d) | “Attributable”

includes Kinross’ 70% share of Manh Choh costs, capital expenditures and cash flow,

as appropriate. |

| (e) | “Average

realized gold price per ounce” is defined as gold metal sales divided by total gold

ounces sold. |

| (f) | “Production

cost of sales per equivalent ounce sold” is defined as production cost of sales divided

by total gold equivalent ounces sold. |

| (g) | As

production from Manh Choh commenced in July 2024, production cost of sales and attributable

all-in sustaining cost figures and ratios for Manh Choh are nil for all periods presented.

As a result, production cost of sales and all-in sustaining cost figures and ratios are equal

to attributable production cost of sales and attributable all-in sustaining cost figures

and ratios, as applicable. |

Consolidated

Financial Performance

This Consolidated

Financial Performance section references production cost of sales per ounce sold on a by-product basis, adjusted net earnings attributable

to common shareholders and adjusted net earnings per share, adjusted operating cash flow, attributable free cash flow, all-in sustaining

cost per equivalent ounce sold and per ounce sold on a by-product basis, and attributable all-in cost per equivalent ounce sold and per

ounce sold on a by-product basis, all of which are non-GAAP financial measures or ratios. The definitions and reconciliations of these

non-GAAP financial measures and ratios are included in Section 11

of this MD&A.

Second quarter

2024 vs. Second quarter 2023

Kinross’

production decreased by 4% compared to the second quarter of 2023, primarily

due to lower production at Paracatu, where mining is in a lower grade area of the pit, in accordance with planned mine sequencing.

Metal sales

increased by 12% compared to the second quarter of 2023, due to an

increase in average metal prices realized, partially offset by a decrease in gold equivalent ounces sold. Gold equivalent ounces

sold decreased to 520,760 ounces in the second quarter of 2024

compared to 552,969 ounces in the second quarter of 2023, due to the decrease in production, as described above, and timing of

sales. The average realized gold price increased to $2,342 per ounce

in the second quarter of 2024 from $1,976 per ounce in the same

period in 2023.

Production cost

of sales increased by 8% in the second quarter of 2024 compared to 2023,

primarily as a result of a lower proportion of mining activities related to capital development and higher mill maintenance costs at

La Coipa, higher contractor and labour costs at Fort Knox, as well as an increase in royalties.

Kinross

Gold Corporation

management’s

discussion and analysis

For the three and six months ended June 30,

2024

Production cost

of sales per equivalent ounce sold and per ounce sold on a by-product basis increased by 14% and 17%, respectively, compared to the second

quarter of 2023, primarily due to the increase in production cost of sales at La Coipa and Fort Knox, and the increase in royalties,

as described above, as well as higher gold equivalent ounces sold at Round Mountain.

In the second quarter

of 2024, depreciation, depletion and amortization increased by 24% compared

to the same period in 2023, primarily due to a higher depreciable asset base at Tasiast, as well as a decrease in mineral reserves

for Phase W at the end of 2023 and an increase in gold equivalent ounces sold at Round Mountain.

Operating earnings

increased by 25% to $298.3

million in the second quarter of 2024 from $237.8 million in the same period in 2023. The increase was primarily due to an increase

in margins (metal sales less production cost of sales), partially offset by the increase in depreciation, depletion and amortization,

as described above.

In the second quarter

of 2024, the Company recorded an income tax expense of $77.8 million,

compared to $62.0 million in the second quarter of 2023. The $77.8 million

income tax expense included $20.3 million of deferred tax expense, compared

to a $18.5 million deferred tax recovery in the second quarter of 2023, resulting from the net foreign currency translation of tax deductions

related to the Company’s operations in Brazil and Mauritania. The income tax expense in the second quarter of 2024 is net of a

$36.5 million deferred tax recovery as a result of a change in income tax-related uncertain tax positions. The remaining change in income

tax expense is due to differences in the level of income in the Company’s operating jurisdictions. Kinross' combined federal and

provincial statutory tax rate for the second quarters of both 2024 and 2023 was 26.5%.

Net earnings attributable

to common shareholders in the second quarter of 2024 were $210.9 million,

or $0.17 per share, compared to $151.0 million, or $0.12 per share, in

the same period in 2023. The change was primarily a result of the increase in operating earnings, as described above.

Adjusted net earnings

attributable to common shareholders increased to $174.7 million in the second quarter of 2024 from $167.6 million in the second quarter

of 2023, primarily due to the increase in operating earnings, as described above. In the second quarter of 2024, adjusted net earnings

attributable to common shareholders per share was comparable to the same period in 2023.

Net cash flow provided

from operating activities increased to $604.0 million in the second quarter

of 2024 from $528.6 million in the second quarter of 2023, primarily due to the increase in margins and a higher net working capital

inflow compared to the prior period.

In the second quarter

of 2024, adjusted operating cash flow increased to $478.1 million compared

to $459.1 million in the same period of 2023, primarily due to the increase in margins.

Capital expenditures

decreased to $274.2 million from $281.9 million in the second quarter

of 2023, primarily due to a decrease in capital development at Bald Mountain and La Coipa, partially offset by Phase S capital development

at Round Mountain which began in the first quarter of 2024.

Attributable free

cash flow increased to $345.9 million from $258.3

million in the second quarter of 2023, primarily due to the increase in net cash flow provided from operating activities, as discussed

above.

In the second quarter

of 2024, compared to the same period in 2023, all-in sustaining cost per equivalent ounce sold and per ounce sold on a by-product basis

increased by 7% and 8%, respectively, primarily as a result of the increase in production cost of sales, as discussed above, and the

decrease in ounces sold, partially offset by a decrease in sustaining capital expenditures.

In the second quarter

of 2024, compared to the same period in 2023, attributable all-in cost per equivalent ounce sold and per ounce sold on a by-product basis

increased by 10%, primarily as a result of the increase in production cost of sales and decrease in ounces sold.

First six months

of 2024 vs. First six months of 2023

Kinross’

production increased by 4% compared to the first six months of 2023,

primarily due to higher throughput at Tasiast, the timing of ounces recovered from the heap leach pads at Bald Mountain, as well as higher

production at La Coipa as a result of higher gold grades, the timing of ounces processed through the mill and increased mill throughput.

These production increases were partially offset by lower grades at Paracatu, in accordance with planned mine sequencing.

Metal sales increased

by 14% compared to the first six months of 2023, due to an increase

in average metal prices realized. Gold equivalent ounces sold in the first six months of 2024 were comparable to the same period in 2023.

The average realized gold price increased to $2,206 per ounce in the

first six months of 2024 from $1,937 per ounce in the same period in

2023.

Kinross

Gold Corporation

management’s

discussion and analysis

For the three and six months ended June 30,

2024

Production cost

of sales increased by 7% in the first six months of 2024 compared to

2023, primarily as a result of a lower proportion of mining activities related to capital development, higher mill maintenance costs

and an increase in gold equivalent ounces sold at La Coipa, higher input costs at Fort Knox and Paracatu, as well as an increase in royalties.

Production cost

of sales per equivalent ounce sold and per ounce sold on a by-product basis increased by 7% and 9%, respectively, compared to the first

six months of 2023, primarily due to the increase in production cost of sales at La Coipa, Fort Knox and Paracatu, as well as the increase

in royalties, as described above.

In the first

six months of 2024, depreciation, depletion and amortization increased by 26%

compared to the same period in 2023, primarily due to an increase in gold equivalent ounces sold and a higher depreciable asset base

at Tasiast, as well as a decrease in mineral reserves for Phase W at the end of 2023 and an increase in gold equivalent ounces sold

at Round Mountain.

Operating earnings

increased by 29% to $491.5 million in the first six months of 2024 from $381.7 million in the same period in 2023. The increase was primarily

due to an increase in margins (metal sales less production cost of sales), partially offset by the increase in depreciation, depletion

and amortization, as described above.

In the first six

months of 2024, the Company recorded an income tax expense of $146.9

million, compared to $101.8 million in the first six months of 2023. The $146.9

million income tax expense included $24.3 million of deferred

tax expense, compared to a $31.7 million deferred tax recovery in the first six months of 2023, resulting from the net foreign currency

translation of tax deductions related to the Company’s operations in Brazil and Mauritania. The income tax expense in the first

six months of 2024 is net of a $42.1 million deferred tax recovery as a result of changes in income tax-related uncertain tax positions.

The remaining change in income tax expense is due to differences in the level of income in the Company’s operating jurisdictions.

Kinross' combined federal and provincial statutory tax rate for the first six months of both 2024 and 2023 was 26.5%.

Net earnings attributable

to common shareholders in the first six months of 2024 were $317.9 million,

or $0.26 per share, compared to $241.2 million, or $0.20 per share, in

the same period in 2023. The change was primarily a result of the increase in operating earnings, as described above.

Adjusted net earnings

attributable to common shareholders in the first six months of 2024 were $299.6

million, or $0.24 per share, compared to $255.2 million, or $0.21

per share, for the same period in 2023. The increase was primarily due to the increase in operating earnings, as described above.

Net cash flow provided

from operating activities increased to $978.4 million in the first six

months of 2024 from $787.6 million in the first six months of 2023, primarily due to the increase in margins and favourable working capital

movements.

In the first six

months of 2024, adjusted operating cash flow increased to $903.0 million

compared to $791.9 million in the same period of 2023, primarily due to the increase in margins.

Capital expenditures

increased to $516.1 million from $503.1 million in the first six months of 2023, primarily as a result of increased spending at Great

Bear, at Fort Knox for mill modifications related to the processing of Manh Choh ore, which began in July 2024, and on capital development.

Capital development increased at Tasiast for West Branch 5 and at Round Mountain for the start of Phase S. These increases were

partially offset by a decrease in capital development at La Coipa and Bald Mountain as well as the completion of the solar and 24k projects

at Tasiast in the second half of 2023.

Attributable free

cash flow increased to $491.2 million from $305.3 million in the first

six months of 2023, primarily due to the increase in net cash flow provided from operating activities, as described above.

In the first six

months of 2024, compared to the same period in 2023, all-in sustaining cost per equivalent ounce sold and per ounce sold on a by-product

basis increased by 3% and 4%, respectively, primarily as a result of the increase in production cost of sales, as discussed above, partially

offset by a decrease in sustaining capital expenditures.

In the first six

months of 2024, compared to the same period in 2023, attributable all-in cost per equivalent ounce sold and per ounce sold on a by-product

basis increased by 5%, primarily as a result of the increase in production cost of sales, as discussed above, and the increase in capital

expenditures.

Kinross

Gold Corporation

management’s

discussion and analysis

For the three and six months ended June 30,

2024

| 2. | IMPACT OF KEY ECONOMIC

TRENDS |

Kinross’

2023 annual MD&A contains a discussion of key economic trends that affect the Company and its financial statements. Please refer

to the MD&A for the year ended December 31, 2023, which is available on the Company's website www.kinross.com and on

www.sedarplus.ca or is available upon request from the Company. Included in this MD&A is an update reflecting significant

changes since the preparation of the 2023 annual MD&A.

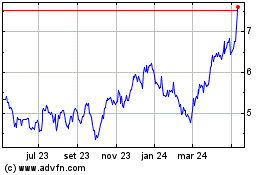

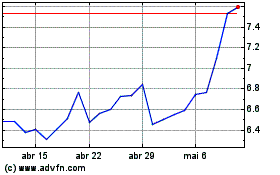

Price of Gold

The price of gold

is the single largest factor in determining profitability and cash flow from operations, therefore, the financial performance of the

Company has been, and is expected to continue to be, closely linked to the price of gold. During the second quarter of 2024, the average

price of gold was $2,338 per ounce, with gold trading between $2,265 and $2,427 per ounce based on the LBMA Gold Price PM benchmark.

This compares to an average of $1,976 per ounce during the second quarter of 2023, with gold trading between $1,900 per ounce and $2,048

per ounce. During the second quarter of 2024, Kinross realized an average price of $2,342 per ounce, compared to $1,976 per ounce for

the same period in 2023. Major influences on the gold price during the second quarter of 2024 included market expectations of potential

interest rate cuts, continued geopolitical tensions and central bank demand.

For the first six

months of 2024, the price of gold averaged $2,203 per ounce compared to $1,932 per ounce in the same period of 2023 based on the LBMA

Gold Price PM benchmark. In the first six months of 2024, Kinross realized an average price of $2,206 per ounce compared to $1,937 per

ounce in the first six months of 2023.

Cost Sensitivity

The Company’s

profitability is subject to industry-wide cost pressures on development and operating costs with respect to labour, energy, capital expenditures

and consumables in general. Since mining is generally an energy intensive activity, especially in open pit mining, energy prices have

a significant impact on operations.

The cost of fuel

as a percentage of operating costs varies amongst the Company’s mines, and overall, fuel prices in the second quarter of 2024 were

comparable to the second quarter of 2023. Kinross manages its exposure to fuel costs by entering into various hedge positions from time

to time – refer to Section 6 – Liquidity and Capital Resources for details.

Currency Fluctuations

At the Company’s

non-U.S. mining operations and exploration activities, which are primarily located in Brazil, Chile, Mauritania, and Canada, a portion

of operating costs and capital expenditures are denominated in their respective local currencies. Generally, as the U.S. dollar strengthens,

these currencies weaken, and as the U.S. dollar weakens, these foreign currencies strengthen. During the three and six months ended June 30,

2024, the U.S. dollar, on average, was stronger relative to the Canadian dollar, Brazilian real, Chilean peso and Mauritanian ouguiya,

compared to the same periods in 2023. As at June 30, 2024, the U.S. dollar was stronger compared to the December 31, 2023 spot

exchange rates of the Canadian dollar, Brazilian real, Chilean peso and Mauritanian ouguiya. In order to manage this risk, the Company

uses currency hedges for certain foreign currency exposures – refer to Section 6 – Liquidity and Capital Resources

for details.

Kinross

Gold Corporation

management’s

discussion and analysis

For the three and six months ended June 30,

2024

The following

section of this MD&A represents forward-looking information and users are cautioned that actual results may vary. We refer to the

risks and assumptions contained in the Cautionary Statement on Forward-Looking Information on pages 31 – 32 of

this MD&A.

This Outlook

section references attributable production cost of sales per equivalent ounce, attributable all-in sustaining cost per equivalent ounce

sold and attributable capital expenditures, which are non-GAAP ratios and financial measures, as applicable, with no standardized meaning

under IFRS and therefore, may not be comparable to similar measures presented by other issuers. The definitions of these non-GAAP ratios

and financial measures and comparable reconciliation is included in Section 11 of this MD&A.

The Company is on track to meet its 2024 guidance of 2.1 million (+/-

5%) attributable1 gold equivalent ounces produced at an attributable1 production cost of sales per equivalent

ounce sold2 of $1,020 (+/- 5%) and an attributable1 all-in sustaining cost per equivalent ounce sold3

of $1,360 (+/- 5%). The Company is also on track to meet its 2024 attributable1 capital expenditures3 guidance of

$1,050 million (+/- 5%).

| 4. | PROJECT UPDATES AND

NEW DEVELOPMENTS |

Great Bear

At the Great Bear project, the Company’s

robust exploration program continues to make excellent progress, execution planning for the Advanced Exploration (“AEX”) program

is well underway, permitting continues to advance, and the Preliminary Economic Assessment (“PEA”) is expected to be released

in September 2024.

The drilling results continue to support

the view of a high-grade, long-life mining complex at Great Bear, with recent results showing extension of mineralization at depth across

multiple zones.

The 2024 drill program will continue

to target mineralization below the existing mineral resource, explore for additional deposits along strike, and expand the Red Lake style

mineralization at Hinge and Limb.

For the AEX program, permitting, detailed

engineering, execution planning, and procurement continue to advance. Kinross is targeting the start of surface construction in the second

half of 2024. Construction of the underground decline is planned to commence in mid-2025.

For the Main Project, Kinross continues

to advance technical studies, including engineering and field test work campaigns. In the last quarter, metallurgical, geochemistry and

backfill test work was advanced to continue building technical knowledge and provide input into engineering studies.

Kinross is on track to release its

PEA in September 2024. The PEA will provide visibility into the potential production scale, construction capital, all-in sustaining

cost and margins for both the open pit and the underground. The PEA will only include a subset of the ounces in the measured,

indicated, and inferred resources drilled to date.

The Draft Tailored Impact Statement Guidelines for the Main Project

were received from the Impact Assessment Agency of Canada in the second quarter of 2024, as planned, and the Federal Impact Assessment

is underway. Studies are ongoing and the Company expects to file its Impact Statement in the first half of 2025.

Fort Knox – Manh Choh

At the Kinross-operated, 70%-owned Manh Choh project, processing of

ore at the Fort Knox mill began in early July and the first gold bar was poured on July 8, 2024, during a ceremony with the Native Village

of Tetlin and Lieutenant Governor of Alaska, Nancy Dahlstrom. Ore transportation has ramped up to planned volumes, full commissioning

of the mill modifications is expected to be completed in the third quarter of 2024, and the project remains on track to deliver planned

production this year.

1 Attributable guidance includes Kinross’ 70% share

of Manh Choh production, costs and capital expenditures. Attributable guidance figures are non-GAAP financial ratios and measures. Refer

to footnote 3.

2 “Production cost of sales per equivalent ounce

sold” is defined as production cost of sales divided by total gold equivalent ounces sold.

3 These guidance figures are non-GAAP financial ratios

and measures, as applicable, and are defined, and actual results for the three and six months ended June 30, 2024 are reconciled, in Section

11 of this MD&A. Non-GAAP financial ratios and measures have no standardized meaning under IFRS and therefore, may not be comparable

to similar measures presented by other issuers.

Round Mountain

The extension work at Round Mountain

is advancing well. At Phase S, mining remains on plan. For the heap leach pad expansion, earthworks and procurement are both complete

while deployment of the geomembrane and overliner is advancing.

At Phase X, development of the exploration decline is progressing well,

with over 2,200 metres developed to date. Infill drilling on the primary Phase X target began during the second quarter of 2024, as planned,

alongside continued opportunity drilling outside of the primary Phase X exploration target to extend zones of mineralization. The Company

expects to begin receiving the results from within the target mineralization in the third quarter of 2024.

The drilling in the second quarter of 2024 has shown exciting results,

demonstrating strong grades and widths. These results continue to indicate upside potential for expansion of the target area for mineralization

and for the potential of future mining at Phase X.

Curlew Basin exploration

At Curlew, Kinross’ exploration

program continued to show positive results at both the Stealth and Roadrunner zones.

Results at Stealth continued to show zones of wider mineralization

with strong grades. Drilling is still underway

and will continue through the second half of the year.

Delineation drilling at the Roadrunner

zone continues with drilling from both surface and underground platforms to document the geometry and continuity.

Chile

Kinross’ activities in Chile

are currently focused on La Coipa and potential opportunities to extend its mine life. The Lobo-Marte project continues to provide optionality

as a potential large, low-cost mine upon the conclusion of mining at La Coipa. While the Company focuses its technical resources on La

Coipa, it will continue to engage and build relationships with communities related to Lobo-Marte and government stakeholders.

Kinross

Gold Corporation

management’s

discussion and analysis

For the three and six months ended June 30,

2024

| 5. | CONSOLIDATED RESULTS

OF OPERATIONS |

Operating Highlights

| | |

Three

months ended June 30, | | |

Six

months ended June 30, | |

| (in

millions, except ounces and per ounce amounts) | |

2024 | | |

2023 | | |

Change | | |

%

Change | | |

2024 | | |

2023 | | |

Change | | |

%

Change | |

| Operating

Statistics | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total

gold equivalent ounces(a) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Produced | |

| 535,338 | | |

| 555,036 | | |

| (19,698 | ) | |

| (4 | )% | |

| 1,062,737 | | |

| 1,021,058 | | |

| 41,679 | | |

| 4 | % |

| Sold | |

| 520,760 | | |

| 552,969 | | |

| (32,209 | ) | |

| (6 | )% | |

| 1,043,160 | | |

| 1,043,299 | | |

| (139 | ) | |

| (0 | )% |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gold

ounces - sold | |

| 505,122 | | |

| 525,921 | | |

| (20,799 | ) | |

| (4 | )% | |

| 1,008,726 | | |

| 987,617 | | |

| 21,109 | | |

| 2 | % |

| Silver

ounces - sold (000's) | |

| 1,268 | | |

| 2,215 | | |

| (947 | ) | |

| (43 | )% | |

| 2,935 | | |

| 4,615 | | |

| (1,680 | ) | |

| (36 | )% |

| Average

realized gold price per ounce (b) | |

$ | 2,342 | | |

$ | 1,976 | | |

$ | 366 | | |

| 19 | % | |

$ | 2,206 | | |

$ | 1,937 | | |

$ | 269 | | |

| 14 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Financial

data | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Metal

sales | |

$ | 1,219.5 | | |

$ | 1,092.3 | | |

$ | 127.2 | | |

| 12 | % | |

$ | 2,301.0 | | |

$ | 2,021.6 | | |

$ | 279.4 | | |

| 14 | % |

| Production

cost of sales | |

$ | 536.1 | | |

$ | 497.9 | | |

$ | 38.2 | | |

| 8 | % | |

$ | 1,049.0 | | |

$ | 981.8 | | |

$ | 67.2 | | |

| 7 | % |

| Depreciation,

depletion and amortization | |

$ | 295.8 | | |

$ | 239.3 | | |

$ | 56.5 | | |

| 24 | % | |

$ | 566.5 | | |

$ | 451.2 | | |

$ | 115.3 | | |

| 26 | % |

| Operating

earnings | |

$ | 298.3 | | |

$ | 237.8 | | |

$ | 60.5 | | |

| 25 | % | |

$ | 491.5 | | |

$ | 381.7 | | |

$ | 109.8 | | |

| 29 | % |

| Net

earnings attributable to common shareholders | |

$ | 210.9 | | |

$ | 151.0 | | |

$ | 59.9 | | |

| 40 | % | |

$ | 317.9 | | |

$ | 241.2 | | |

$ | 76.7 | | |

| 32 | % |

| (a) | “Gold

equivalent ounces” include silver ounces produced and sold converted to a gold

equivalent based on a ratio of the average spot market prices for the commodities for each

period. The ratio for the second quarter and first six months of 2024 was 81.06:1 and 84.51:1,

respectively (second quarter and first six months of 2023 – 81.88:1 and 82.85:1, respectively). |

| (b) | “Average

realized gold price per ounce” is defined as gold metal sales divided by total gold

ounces sold. |

Operating Earnings

(Loss) by Segment

| | |

Three

months ended June 30, | | |

Six

months ended June 30, | |

| (in

millions) | |

2024 | | |

2023 | | |

Change | | |

%

Change(c) | | |

2024 | | |

2023 | | |

Change | | |

%

Change(c) | |

| Operating

segments | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Tasiast | |

$ | 172.7 | | |

$ | 126.4 | | |

$ | 46.3 | | |

| 37 | % | |

$ | 292.7 | | |

$ | 221.6 | | |

$ | 71.1 | | |

| 32 | % |

| Paracatu | |

| 114.8 | | |

| 127.9 | | |

| (13.1 | ) | |

| (10 | )% | |

| 195.9 | | |

| 210.3 | | |

| (14.4 | ) | |

| (7 | )% |

| La

Coipa | |

| 41.9 | | |

| 36.5 | | |

| 5.4 | | |

| 15 | % | |

| 85.7 | | |

| 70.8 | | |

| 14.9 | | |

| 21 | % |

| Fort

Knox(a) | |

| 38.5 | | |

| 31.0 | | |

| 7.5 | | |

| 24 | % | |

| 51.1 | | |

| 57.1 | | |

| (6.0 | ) | |

| (11 | )% |

| Round

Mountain | |

| (32.3 | ) | |

| (15.7 | ) | |

| (16.6 | ) | |

| nm | | |

| (41.3 | ) | |

| (44.4 | ) | |

| 3.1 | | |

| nm | |

| Bald

Mountain | |

| 11.9 | | |

| 2.9 | | |

| 9.0 | | |

| nm | | |

| 29.4 | | |

| (0.5 | ) | |

| 29.9 | | |

| nm | |

| Non-operating

segments | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Great

Bear | |

| (13.5 | ) | |

| (14.2 | ) | |

| 0.7 | | |

| nm | | |

| (25.9 | ) | |

| (25.4 | ) | |

| (0.5 | ) | |

| nm | |

| Corporate

and other(b) | |

| (35.7 | ) | |

| (57.0 | ) | |

| 21.3 | | |

| nm | | |

| (96.1 | ) | |

| (107.8 | ) | |

| 11.7 | | |

| nm | |

| Total | |

$ | 298.3 | | |

$ | 237.8 | | |

$ | 60.5 | | |

| 25 | % | |

$ | 491.5 | | |

$ | 381.7 | | |

$ | 109.8 | | |

| 29 | % |

| (a) | The

Fort Knox segment includes Manh Choh, which was aggregated with Fort Knox during the six

months ended June 30, 2024. Results for all periods include 100% for Manh Choh. Comparative

results are presented in accordance with the current year’s presentation. |

| (b) | “Corporate

and other” includes operating costs which are not directly related to individual mining

properties such as overhead expenses, insurance recoveries, gains and losses on disposal

of assets and investments, and other costs relating to corporate, shutdown, and other non-operating

assets (including Kettle River-Buckhorn, Lobo-Marte, and Maricunga). |

| (c) | “nm”

means not meaningful. |

Kinross

Gold Corporation

management’s

discussion and analysis

For the three and six months ended June 30,

2024

Mining Operations

Tasiast (100%

ownership and operator) – Mauritania

| | |

Three

months ended June 30, | | |

Six

months ended June 30, | |

| | |

2024 | | |

2023 | | |

Change | | |

%

Change | | |

2024 | | |

2023 | | |

Change | | |

%

Change | |

| Operating

Statistics | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Tonnes

ore mined (000's) | |

| 1,985 | | |

| 1,688 | | |

| 297 | | |

| 18 | % | |

| 4,029 | | |

| 3,378 | | |

| 651 | | |

| 19 | % |

| Tonnes

processed (000's) | |

| 2,161 | | |

| 1,663 | | |

| 498 | | |

| 30 | % | |

| 4,234 | | |

| 2,871 | | |

| 1,363 | | |

| 47 | % |

| Grade

(grams/tonne) | |

| 2.70 | | |

| 3.25 | | |

| (0.55 | ) | |

| (17 | )% | |

| 2.58 | | |

| 3.35 | | |

| (0.77 | ) | |

| (23 | )% |

| Recovery | |

| 91.8 | % | |

| 92.5 | % | |

| (0.7 | )% | |

| (1 | )% | |

| 91.6 | % | |

| 92.0 | % | |

| (0.4 | )% | |

| (0 | )% |

| Gold

equivalent ounces: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Produced | |

| 161,629 | | |

| 157,844 | | |

| 3,785 | | |

| 2 | % | |

| 320,828 | | |

| 288,889 | | |

| 31,939 | | |

| 11 | % |

| Sold | |

| 156,038 | | |

| 152,564 | | |

| 3,474 | | |

| 2 | % | |

| 307,052 | | |

| 281,043 | | |

| 26,009 | | |

| 9 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Financial

Data (in millions) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Metal

sales | |

$ | 365.6 | | |

$ | 301.6 | | |

$ | 64.0 | | |

| 21 | % | |

$ | 679.0 | | |

$ | 547.4 | | |

$ | 131.6 | | |

| 24 | % |

| Production

cost of sales | |

| 102.3 | | |

| 99.5 | | |

| 2.8 | | |

| 3 | % | |

| 202.0 | | |

| 187.9 | | |

| 14.1 | | |

| 8 | % |

| Depreciation,

depletion and amortization | |

| 84.0 | | |

| 58.6 | | |

| 25.4 | | |

| 43 | % | |

| 161.9 | | |

| 104.8 | | |

| 57.1 | | |

| 54 | % |

| | |

| 179.3 | | |

| 143.5 | | |

| 35.8 | | |

| 25 | % | |

| 315.1 | | |

| 254.7 | | |

| 60.4 | | |

| 24 | % |

| Other

operating expense | |

| 4.7 | | |

| 16.1 | | |

| (11.4 | ) | |

| (71 | )% | |

| 19.0 | | |

| 31.4 | | |

| (12.4 | ) | |

| (39 | )% |

| Exploration

and business development | |

| 1.9 | | |

| 1.0 | | |

| 0.9 | | |

| 90 | % | |

| 3.4 | | |

| 1.7 | | |

| 1.7 | | |

| 100 | % |

| Segment

operating earnings | |

$ | 172.7 | | |

$ | 126.4 | | |

$ | 46.3 | | |

| 37 | % | |

$ | 292.7 | | |

$ | 221.6 | | |

$ | 71.1 | | |

| 32 | % |

Second quarter

2024 vs. Second quarter 2023

In the second quarter

of 2024, mining at Tasiast increased at West Branch 4, resulting in an increase in tonnes of ore mined of 18%

compared to the second quarter of 2023. Mining at Tasiast during the second quarter of 2024 also involved an increase in capital development

at West Branch 5. Mill grades decreased by 17% in the second quarter

of 2024 compared to the same period in 2023 as a result of mine sequencing. Mill throughput increased by 30%

in the second quarter of 2024 compared to the same period in 2023 as Tasiast continued to achieve higher throughput levels as a result

of the completion of the 24k project in the second half of 2023. Gold equivalent ounces produced and sold increased by 2% in the second

quarter of 2024 compared to the same period in 2023 as higher mill throughput was largely offset by lower grades.

In the second quarter

of 2024, metal sales increased by 21% compared to the second quarter

of 2023, primarily due to the increase in average metal prices realized. Production cost of sales increased by 3%

in the second quarter of 2024, compared to the same period in 2023, primarily due to the increase in gold equivalent ounces sold. Depreciation,

depletion and amortization increased by 43% in the second quarter of

2024, primarily due to an increase in the depreciable asset base.

First six months

of 2024 vs. First six months of 2023

In the first six

months of 2024, mining at Tasiast increased at West Branch 4, resulting in an increase in tonnes of ore mined of 19%

compared to the second quarter of 2023. Mining at Tasiast during the first six months of 2024 also involved an increase in capital development

at West Branch 5. Mill grades decreased by 23% in the first six months

of 2024 compared to the same period in 2023 as a result of mine sequencing. Mill throughput increased by 47%

in the first six months of 2024 compared to the same period in 2023 as Tasiast continued to achieve higher throughput levels as a result

of the completion of the 24k project in the second half of 2023. In addition, the prior period was impacted by a planned 15-day plant

shutdown in February 2023. Elevated mill throughput levels, partially offset by lower grades, drove overall increases in gold equivalent

ounces produced and sold of 11% and 9%,

respectively, in the first six months of 2024 compared to the same period in 2023.

In the first six months of 2024, metal sales increased by 24% compared

to the first six months of 2023, due to the increases in average metal prices realized and gold equivalent ounces sold. Production cost

of sales increased by 8% in the first six months of 2024, compared to the same period in 2023, primarily due to the increase in gold equivalent

ounces sold. Depreciation, depletion and amortization increased by 54% in the first six months of 2024, primarily due to the increase

in gold equivalent ounces sold and an increase in the depreciable asset base.

Kinross

Gold Corporation

management’s

discussion and analysis

For the three and six months ended June 30,

2024

Paracatu (100%

ownership and operator) – Brazil

| | |

Three

months ended June 30, | | |

Six

months ended June 30, | |

| | |

2024 | | |

2023 | | |

Change | | |

%

Change | | |

2024 | | |

2023 | | |

Change | | |

%

Change | |

| Operating

Statistics | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Tonnes

ore mined (000's) | |

| 14,094 | | |

| 14,199 | | |

| (105 | ) | |

| (1 | )% | |

| 28,172 | | |

| 22,255 | | |

| 5,917 | | |

| 27 | % |

| Tonnes

processed (000's) | |

| 15,053 | | |

| 15,104 | | |

| (51 | ) | |

| (0 | )% | |

| 30,662 | | |

| 30,234 | | |

| 428 | | |

| 1 | % |

| Grade

(grams/tonne) | |

| 0.35 | | |

| 0.42 | | |

| (0.07 | ) | |

| (17 | )% | |

| 0.33 | | |

| 0.40 | | |

| (0.07 | ) | |

| (18 | )% |

| Recovery | |

| 80.2 | % | |

| 80.1 | % | |

| 0.1 | % | |

| 0 | % | |

| 79.6 | % | |

| 79.3 | % | |

| 0.3 | % | |

| 0 | % |

| Gold

equivalent ounces: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Produced | |

| 130,228 | | |

| 164,243 | | |

| (34,015 | ) | |

| (21 | )% | |

| 258,501 | | |

| 287,577 | | |

| (29,076 | ) | |

| (10 | )% |

| Sold | |

| 130,174 | | |

| 163,889 | | |

| (33,715 | ) | |

| (21 | )% | |

| 258,284 | | |

| 292,233 | | |

| (33,949 | ) | |

| (12 | )% |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Financial

Data (in millions) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Metal

sales | |

$ | 304.6 | | |

$ | 322.9 | | |

$ | (18.3 | ) | |

| (6 | )% | |

$ | 569.0 | | |

$ | 565.5 | | |

$ | 3.5 | | |

| 1 | % |

| Production

cost of sales | |

| 135.2 | | |

| 135.2 | | |

| - | | |

| 0 | % | |

| 270.9 | | |

| 253.2 | | |

| 17.7 | | |

| 7 | % |

| Depreciation,

depletion and amortization | |

| 45.7 | | |

| 49.8 | | |

| (4.1 | ) | |

| (8 | )% | |

| 92.4 | | |

| 90.2 | | |

| 2.2 | | |

| 2 | % |

| | |

| 123.7 | | |

| 137.9 | | |

| (14.2 | ) | |

| (10 | )% | |

| 205.7 | | |

| 222.1 | | |

| (16.4 | ) | |

| (7 | )% |

| Other

operating (income) expense | |

| 6.8 | | |

| 8.9 | | |

| (2.1 | ) | |

| (24 | )% | |

| 6.2 | | |

| 9.8 | | |

| (3.6 | ) | |

| (37 | )% |

| Exploration

and business development | |

| 2.1 | | |

| 1.1 | | |

| 1.0 | | |

| 91 | % | |

| 3.6 | | |

| 2.0 | | |

| 1.6 | | |

| 80 | % |

| Segment

operating earnings | |

$ | 114.8 | | |

$ | 127.9 | | |

$ | (13.1 | ) | |

| (10 | )% | |

$ | 195.9 | | |

$ | 210.3 | | |

$ | (14.4 | ) | |

| (7 | )% |

Second quarter

2024 vs. Second quarter 2023

Planned mine sequencing

at Paracatu resulted in a 17% decrease in grade in the second quarter

of 2024 compared to the second quarter of 2023. Lower grades drove overall decreases in gold equivalent ounces produced and sold of 21%

in the second quarter of 2024 compared to the same period in 2023.

Metal sales decreased

by 6% compared to the second quarter of 2023, due to the decrease in

gold equivalent ounces sold, partially offset by the increase in average metal prices realized. Production cost of sales was consistent

with the same period in 2023, due to the decrease in gold equivalent ounces sold, offset by higher labour, drilling and blasting costs.

Depreciation, depletion and amortization decreased by 8% compared to

the same period in 2023, primarily due to the decrease in gold equivalent ounces sold, partially offset by an increase in the depreciable

asset base and a decrease in mineral reserves at the end of 2023.

First six months

of 2024 vs. First six months of 2023

Planned mine sequencing

at Paracatu, which included mining in shorter haul distance areas of the pit, resulted in a 27%

increase in tonnes of ore mined as well as a 18% decrease in grade in

the first six months of 2024 compared to the first six months of 2023. Lower grades drove decreases in gold equivalent ounces produced

and sold of 10% and 12%, respectively, in the first six months of 2024 compared to the same period in 2023.

Metal sales in

the first six months of 2024 were comparable to the first six months of 2023 with the increase in average metal prices realized offset

by the decrease in gold equivalent ounces sold. Production cost of sales increased by 7%

compared to the same period in 2023, due to higher labour, drilling and blasting costs related to the increase in tonnes mined, partially

offset by lower gold equivalent ounces sold. Depreciation, depletion and amortization increased by 2%

compared to the same period in 2023, primarily due to an increase in the depreciable asset base and a decrease in mineral reserves at

the end of 2023, partially offset by the decrease in gold equivalent ounces sold.

Kinross

Gold Corporation

management’s

discussion and analysis

For the three and six months ended June 30,

2024

La Coipa (100% ownership and operator)

– Chile

| | |

Three

months ended June 30, | | |

Six

months ended June 30, | |

| | |

2024 | | |

2023 | | |

Change | | |

%

Change(b) | | |

2024 | | |

2023 | | |

Change | | |

%

Change(b) | |

| Operating

Statistics | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Tonnes

ore mined (000's) | |

| 690 | | |

| 869 | | |

| (179 | ) | |

| (21 | )% | |

| 1,725 | | |

| 1,617 | | |

| 108 | | |

| 7 | % |

| Tonnes

processed (000's) | |

| 882 | | |

| 971 | | |

| (89 | ) | |

| (9 | )% | |

| 1,709 | | |

| 1,662 | | |

| 47 | | |

| 3 | % |

| Grade

(grams/tonne): | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gold | |

| 1.97 | | |

| 1.62 | | |

| 0.35 | | |

| 22 | % | |

| 2.03 | | |

| 1.64 | | |

| 0.39 | | |

| 24 | % |

| Silver | |

| 65.02 | | |

| 109.84 | | |

| (44.82 | ) | |

| (41 | )% | |

| 75.76 | | |

| 116.46 | | |

| (40.70 | ) | |

| (35 | )% |

| Recovery: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gold | |

| 84.4 | % | |

| 81.3 | % | |

| 3.1 | % | |

| 4 | % | |

| 85.9 | % | |

| 84.1 | % | |

| 1.8 | % | |

| 2 | % |

| Silver | |

| 50.6 | % | |

| 56.0 | % | |

| (5.4 | )% | |

| (10 | )% | |

| 54.1 | % | |

| 61.8 | % | |

| (7.7 | )% | |

| (12 | )% |

| Gold

equivalent ounces(a): | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Produced | |

| 65,851 | | |

| 66,744 | | |

| (893 | ) | |

| (1 | )% | |

| 137,096 | | |

| 120,340 | | |

| 16,756 | | |

| 14 | % |

| Sold | |

| 63,506 | | |

| 67,378 | | |

| (3,872 | ) | |

| (6 | )% | |

| 134,631 | | |

| 129,158 | | |

| 5,473 | | |

| 4 | % |

| Silver

ounces: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Produced

(000's) | |

| 1,146 | | |

| 1,998 | | |

| (852 | ) | |

| (43 | )% | |

| 2,658 | | |

| 3,881 | | |

| (1,223 | ) | |

| (32 | )% |

| Sold

(000's) | |

| 1,112 | | |

| 2,025 | | |

| (913 | ) | |

| (45 | )% | |

| 2,621 | | |

| 4,237 | | |

| (1,616 | ) | |

| (38 | )% |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Financial

Data (in millions) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Metal

sales | |

$ | 149.6 | | |

$ | 132.0 | | |

$ | 17.6 | | |

| 13 | % | |

$ | 297.5 | | |

$ | 249.8 | | |

$ | 47.7 | | |

| 19 | % |

| Production

cost of sales | |

| 58.8 | | |

| 43.6 | | |

| 15.2 | | |

| 35 | % | |

| 110.9 | | |

| 88.5 | | |

| 22.4 | | |

| 25 | % |

| Depreciation,

depletion and amortization | |

| 45.8 | | |

| 48.3 | | |

| (2.5 | ) | |

| (5 | )% | |

| 95.8 | | |

| 84.7 | | |

| 11.1 | | |

| 13 | % |

| | |

| 45.0 | | |

| 40.1 | | |

| 4.9 | | |

| 12 | % | |

| 90.8 | | |

| 76.6 | | |

| 14.2 | | |

| 19 | % |

| Other

operating expense | |

| 2.4 | | |

| 0.2 | | |

| 2.2 | | |

| nm | | |

| 4.2 | | |

| 0.4 | | |

| 3.8 | | |

| nm | |

| Exploration

and business development | |

| 0.7 | | |

| 3.4 | | |

| (2.7 | ) | |

| (79 | )% | |

| 0.9 | | |

| 5.4 | | |

| (4.5 | ) | |

| (83 | )% |

| Segment

operating earnings | |

$ | 41.9 | | |

$ | 36.5 | | |

$ | 5.4 | | |

| 15 | % | |

$ | 85.7 | | |

$ | 70.8 | | |

$ | 14.9 | | |

| 21 | % |

| (a) | “Gold

equivalent ounces” include silver ounces produced and sold converted to a gold equivalent

based on a ratio of the average spot market prices for the commodities for each period. The

ratio for the second quarter and first six months of 2024 was 81.06:1 and 84.51:1, respectively

(second quarter and first six months of 2023 – 81.88:1 and 82.85:1, respectively). |

| (b) | “nm”

means not meaningful. |

Second quarter 2024 vs. Second quarter

2023

Planned

mine sequencing at La Coipa, with an increased focus on Phase 7, resulted in a 21% decrease in tonnes of ore mined and a 22% increase

in gold grades in the second quarter of 2024 compared to the same period in 2023. Tonnes of ore processed in the second quarter of 2024

were 9% lower compared to the same period in 2023 due to increased maintenance activity in the second quarter of 2024. Gold

equivalent ounces sold decreased by 6% compared to the same period in

2023, due to the timing of sales.

Metal sales increased

by 13% compared to the second quarter of 2023, due to the increase in average metal prices realized, partially offset by the decrease

in gold equivalent ounces sold. Production cost of sales increased by 35%

compared to the same period in 2023, primarily due to a lower proportion of mining activities related to capital development and higher

mill maintenance costs, partially offset by the decrease in gold equivalent ounces sold. Depreciation, depletion and amortization decreased

by 5% compared to the same period in 2023, primarily due to the decrease

in gold equivalent ounces sold.

First six months

of 2024 vs. First six months of 2023

Mining

at La Coipa in 2024 continues to focus on the Phase 7 and Puren deposits. As capital development at the Puren deposit was largely completed

in the second half of 2023, ore mined increased by 7% in the first six months of 2024 compared to the same period in 2023. Gold grades

increased by 24% compared to the first six months of 2023 due to mine sequencing, specifically higher grade ore from Phase 7. Tonnes

of ore processed in the first six months of 2024 were 3% higher compared to the same period in 2023, primarily due to a planned mill

shutdown in February 2023 for maintenance. Gold equivalent ounces produced and sold increased

by 14% and 4%, respectively, compared to the same period in 2023, primarily

due to the increase in gold grades, the timing of ounces processed through the mill and the increase in mill throughput.

Metal sales increased

by 19% compared to the first

six months of 2023, due to the increases in average metal prices realized and gold equivalent ounces sold. Production cost of

sales increased by 25% compared to the same period in 2023, primarily

due to a lower proportion of mining activities related to capital development, higher mill maintenance costs and the increase in gold

equivalent ounces sold. Depreciation, depletion and amortization increased by 13%

compared to the same period in 2023, due to the increase in gold equivalent ounces sold as well as an increase in the depreciable asset

base.

Kinross

Gold Corporation

management’s

discussion and analysis

For the three and six months ended June 30,

2024

Fort Knox (Fort

Knox: 100% ownership and operator; Manh Choh: 70% ownership and operator) – USA(a)

| | |

Three

months ended June 30, | | |

Six

months ended June 30, | |

| | |

2024 | | |

2023 | | |

Change | | |

%

Change | | |

2024 | | |

2023 | | |

Change | | |

%

Change | |

| Operating

Statistics | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Tonnes

ore mined (000's) | |

| 8,331 | | |

| 7,624 | | |

| 707 | | |

| 9 | % | |

| 18,368 | | |

| 15,036 | | |

| 3,332 | | |

| 22 | % |

| Tonnes

processed (000's)(b) | |

| 8,388 | | |

| 8,912 | | |

| (524 | ) | |

| (6 | )% | |

| 19,016 | | |

| 16,850 | | |

| 2,166 | | |

| 13 | % |

| Grade

(grams/tonne)(c) | |

| 0.85 | | |

| 0.82 | | |

| 0.03 | | |

| 4 | % | |

| 0.76 | | |

| 0.80 | | |

| (0.04 | ) | |

| (5 | )% |

| Recovery(c) | |

| 80.7 | % | |

| 81.5 | % | |

| (0.8 | )% | |

| (1 | )% | |

| 78.9 | % | |

| 81.7 | % | |

| (2.8 | )% | |

| (3 | )% |

| Gold

equivalent ounces: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Produced | |

| 69,914 | | |

| 69,438 | | |

| 476 | | |

| 1 | % | |

| 123,264 | | |

| 134,825 | | |

| (11,561 | ) | |

| (9 | )% |

| Sold | |

| 70,477 | | |

| 69,206 | | |

| 1,271 | | |

| 2 | % | |

| 126,769 | | |

| 134,610 | | |

| (7,841 | ) | |

| (6 | )% |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Financial

Data (in millions) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Metal

sales | |

$ | 163.9 | | |

$ | 136.9 | | |

$ | 27.0 | | |

| 20 | % | |

$ | 280.2 | | |

$ | 260.0 | | |

$ | 20.2 | | |

| 8 | % |

| Production

cost of sales | |

| 94.8 | | |

| 79.3 | | |

| 15.5 | | |

| 20 | % | |

| 177.3 | | |

| 156.9 | | |

| 20.4 | | |

| 13 | % |

| Depreciation,

depletion and amortization | |

| 25.9 | | |

| 22.1 | | |

| 3.8 | | |

| 17 | % | |

| 46.4 | | |

| 40.7 | | |

| 5.7 | | |

| 14 | % |

| | |

| 43.2 | | |

| 35.5 | | |

| 7.7 | | |

| 22 | % | |

| 56.5 | | |

| 62.4 | | |

| (5.9 | ) | |

| (9 | )% |

| Other

operating expense | |

| 0.1 | | |

| 0.2 | | |

| (0.1 | ) | |

| (50 | )% | |

| 0.1 | | |

| 0.6 | | |

| (0.5 | ) | |

| (83 | )% |

| Exploration

and business development | |

| 4.6 | | |

| 4.3 | | |

| 0.3 | | |

| 7 | % | |

| 5.3 | | |

| 4.7 | | |

| 0.6 | | |

| 13 | % |

| Segment

operating earnings | |

$ | 38.5 | | |

$ | 31.0 | | |

$ | 7.5 | | |

| 24 | % | |

$ | 51.1 | | |

$ | 57.1 | | |

$ | (6.0 | ) | |

| (11 | )% |

| (a) | The

Fort Knox segment includes Manh Choh, which was aggregated with Fort Knox during the six

months ended June 30, 2024. Results for all periods include 100% for Manh Choh. Comparative

results are presented in accordance with the current year’s presentation. |

| (b) | Includes 6,385,000 and

15,163,000 tonnes placed on the heap leach pad during the second quarter and first six months

of 2024, respectively (second quarter and first six months of 2023 – 6,837,000 and

12,809,000 tonnes, respectively). |

| (c) | Amount represents mill grade and recovery only. Ore placed on the heap leach pads had an average grade

of 0.22 and 0.23 grams per tonne during the second quarter and first six months of 2024, respectively (second quarter and first six months

of 2023 – 0.24 and 0.23 grams per tonne, respectively). Due to the nature of heap leach operations, point-in-time recovery rates are not

meaningful. |

Second quarter

2024 vs. Second quarter 2023

Planned mine sequencing

at Fort Knox, which included Phase 9 leachable ore and the advancement of Phase 10, resulted in a 9%

increase in tonnes of ore mined and a 4% increase in mill grades. Tonnes of ore processed decreased by 6% compared to the second quarter

of 2023, due to a decrease in ore placed on the Barnes Creek heap leach facility. Gold equivalent ounces sold increased by 2%

compared to the second quarter of 2023 and were higher than production, due to the timing of sales.

During the second

quarter of 2024, metal sales increased by 20% compared to the same period

in 2023 due to the increases in average metal prices realized and gold equivalent ounces sold. Production cost of sales increased by

20% compared to the second quarter of 2023, primarily due to higher contractor

and labour costs. Depreciation, depletion, and amortization increased by 17%

in the second quarter of 2024 compared to the same period in 2023 primarily due to an

increase in the depreciable asset base and a decrease in mineral reserves at the end of 2023.

First six months

of 2024 vs. First six months of 2023

Planned mine sequencing

at Fort Knox, which included Phase 9 leachable ore and the advancement of Phase 10, resulted in a 22%

increase in tonnes of ore mined and a 5% decrease in mill grades. Tonnes of ore processed increased by 13% compared to the first six

months of 2023, due to an overall increase in ore placed on the Barnes Creek heap leach facility. Mill recovery decreased by 3%

in the first six months of 2024 compared to the same period in 2023, due to lower mill grades as well as reduced gravity circuit availability

and leaching circuit performance in the first quarter of 2024. Gold equivalent ounces produced and sold decreased by 9%

and 6%, respectively, compared to the first six months of 2023, primarily

due to the lower mill grade, throughput and recovery, as well as the timing of ounces processed through the mill. Gold equivalent ounces

sold were higher than produced due to the timing of sales.

During the first

six months of 2024, metal sales increased by 8% compared to the same period in 2023, due to the increase in average metal prices realized,

partially offset by the decrease in gold equivalent ounces sold. Production cost of sales increased by 13% compared to the first six

months of 2023, primarily due to higher contractor and labour costs, partially offset by the decrease in gold equivalent ounces sold.

Depreciation, depletion, and amortization increased by 14% in the first six months of 2024 compared to the same period in 2023 due to

an increase in the depreciable asset base and a decrease in mineral reserves at the end of 2023, partially offset by the decrease in

gold equivalent ounces sold.

Kinross Gold

Corporation

management’s discussion

and analysis

For the three and six months ended June 30, 2024

Round Mountain (100% ownership and

operator) – USA

| | |

Three

months ended June 30, | | |

Six

months ended June 30, | |

| | |

2024 | | |

2023 | | |

Change | | |

%

Change(c) | | |

2024 | | |

2023 | | |

Change | | |

%

Change(c) | |

| Operating

Statistics | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Tonnes

ore mined (000's) | |

| 2,956 | | |

| 10,496 | | |

| (7,540 | ) | |

| (72 | )% | |

| 7,202 | | |

| 15,515 | | |

| (8,313 | ) | |

| (54 | )% |

| Tonnes

processed (000's)(a) | |

| 2,347 | | |

| 11,049 | | |

| (8,702 | ) | |

| (79 | )% | |

| 6,564 | | |

| 16,294 | | |

| (9,730 | ) | |

| (60 | )% |

| Grade

(grams/tonne)(b) | |

| 1.11 | | |

| 0.67 | | |

| 0.44 | | |

| 66 | % | |

| 1.22 | | |

| 0.74 | | |

| 0.48 | | |

| 65 | % |

| Recovery(b) | |

| 73.2 | % | |

| 76.3 | % | |

| (3.1 | )% | |

| (4 | )% | |

| 73.3 | % | |

| 77.4 | % | |

| (4.1 | )% | |

| (5 | )% |

| Gold

equivalent ounces: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Produced | |

| 61,787 | | |

| 57,446 | | |

| 4,341 | | |

| 8 | % | |

| 130,139 | | |

| 116,278 | | |

| 13,861 | | |

| 12 | % |

| Sold | |

| 60,049 | | |

| 57,412 | | |

| 2,637 | | |

| 5 | % | |

| 128,218 | | |

| 115,638 | | |

| 12,580 | | |

| 11 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Financial

Data (in millions) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Metal

sales | |

$ | 140.9 | | |

$ | 114.4 | | |

$ | 26.5 | | |

| 23 | % | |

$ | 281.8 | | |

$ | 223.5 | | |

$ | 58.3 | | |

| 26 | % |

| Production

cost of sales | |

| 93.9 | | |

| 85.5 | | |

| 8.4 | | |

| 10 | % | |

| 184.5 | | |

| 182.0 | | |

| 2.5 | | |

| 1 | % |

| Depreciation,

depletion and amortization | |

| 65.9 | | |

| 33.5 | | |

| 32.4 | | |

| 97 | % | |

| 113.2 | | |

| 68.1 | | |

| 45.1 | | |

| 66 | % |

| | |

| (18.9 | ) | |

| (4.6 | ) | |

| (14.3 | ) | |

| nm | | |

| (15.9 | ) | |

| (26.6 | ) | |

| 10.7 | | |

| nm | |

| Other

operating expense | |

| 0.5 | | |

| - | | |

| 0.5 | | |

| nm | | |

| 0.5 | | |

| 1.7 | | |

| (1.2 | ) | |

| (71 | )% |

| Exploration

and business development | |

| 12.9 | | |

| 11.1 | | |

| 1.8 | | |

| 16 | % | |

| 24.9 | | |

| 16.1 | | |

| 8.8 | | |

| 55 | % |

| Segment

operating loss | |

$ | (32.3 | ) | |

$ | (15.7 | ) | |

$ | (16.6 | ) | |

| nm | | |

$ | (41.3 | ) | |

$ | (44.4 | ) | |

$ | 3.1 | | |

| nm | |

| (a) | Includes 1,541,000 and 4,798,000 tonnes placed on the heap leach pads during the second quarter and

first six months of 2024, respectively (second quarter and first six months of 2023 – 10,028,000 and 14,395,000, respectively). |

| (b) | Amount represents mill grade and recovery only. Ore placed on the heap leach pads had an average grade

of 0.35 and 0.36 grams per tonne in the second quarter and first six months of 2024, respectively (second quarter and first six months

of 2023 – 0.35 and 0.38 grams per tonne, respectively). Due to the nature of heap leach operations, point-in-time recovery rates

are not meaningful. |

| (c) | "nm" means not meaningful. |

Second quarter 2024 vs. Second quarter

2023

Tonnes of ore mined decreased by 72%

in the second quarter of 2024 compared to the same period in 2023, due to planned mine sequencing, which included Phase S capital development

and deeper, higher-grade ore benches of Phase W2. Tonnes of ore processed decreased by 79%,

compared to the second quarter of 2023, due to the decrease in tonnes of ore mined and a decrease in ore placed on the heap leach pads.

During the second quarter of 2024, mill grades increased by 66% as a result

of the focus on the deeper, higher-grade benches of Phase W2. Gold equivalent ounces produced and sold increased by 8% and 5%,

respectively, compared to the second quarter of 2023, due to the higher mill grade, partially offset by fewer ounces recovered from the

heap leach pads.

Metal sales increased by 23% in the

second quarter of 2024 compared to the same period in 2023, due to the increases in average metal prices realized and gold

equivalent ounces sold. Production cost of sales increased by 10% compared to the second quarter of 2023, primarily due to the

increase in gold equivalent ounces sold, which included higher cost ounces produced from the heap leach pads, partially offset by