U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE

ACT OF 1934

For the Month of August 2024

Nexa Resources S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of Registrant’s Name)

37A, Avenue J.F. Kennedy

L-1855, Luxembourg

Grand Duchy of Luxembourg

(Address of principal executive offices)

Indicate by check mark

whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Indicate by check mark

if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Indicate by check mark

if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

Indicate by check mark

whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

If “Yes” is marked,

indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: August 1, 2024

| Nexa Resources S.A. |

| By:/s/ José Carlos del Valle |

| Name: José Carlos del Valle |

|

Title: Senior Vice President

of Finance and Group Chief Financial Officer |

EXHIBIT INDEX

Nexa Reports Second

Quarter 2024 Results including

Net Loss of US$69 million and Adjusted EBITDA of US$200 million

Luxembourg, August

1, 2024 – Nexa Resources S.A. (“Nexa Resources”, “Nexa”, or the “Company”)

announces today its results for the three and six-month periods ended on June 30, 2024.

CEO Message – Ignacio

Rosado

We are pleased to report a favorable second

quarter of 2024, highlighting our continued operational efficiency, increased production, improved margins at our Aripuanã mine,

and disciplined capital allocation supported by higher zinc prices. Our ability to adapt to market dynamics has led to enhanced execution

across our operations.

The quarter began with positive momentum

from the end of 1Q24, which was sustained throughout 2Q24, resulting in solid operational performance and financial results. We achieved

a reduction in our net leverage ratio compared to both 2Q23 and 1Q24, higher Adjusted EBITDA across segments and at consolidated levels,

stable production and sales volumes, and strategic portfolio optimization, all of which have reinforced our healthy and steady business

fundamentals.

Aripuanã performed as expected, demonstrating

increased utilization rates, stable concentrate quality, and metallurgical recoveries. This resulted in higher metal production and improved

margins compared to 1Q24, contributing to solid Adjusted EBITDA for the second consecutive quarter. In June, Aripuanã achieved

a milestone by generating positive operational cash flow. As we approach the final stage of its ramp up phase in light of its recent solid

operational and financial performances, we confirm the transitions of Aripuanã to an ongoing operation. Moving forward, our efforts

will focus on further increasing production and reducing costs, continually improving the asset's margin and cash generation capacity.

On the zinc price side, the overall outlook

has brightened since mid-April, bolstered by solid fundamentals, mainly driven by a persistently tight concentrate market. Despite

potential volatility, prices across the base metals complex could receive a tailwind in the coming quarters in a scenario of potential

lower interest rates, and ongoing supply constraints.

At Nexa, the safety of our people and operations

remains our topmost priority. We are committed to ensuring safe operations in our facilities and continue to invest in strengthening the

organization-wide safety framework. In early May, we implemented a structured 30-day, 90-day and 180-day safety plan, focusing on key

actions to reduce risk exposure, boost safety practices, and reinforce leadership oversight. Our goal is to continuously improve our solid

safety system.

Looking ahead, we will continue to focus

on enhancing productivity, efficiency, and performance across operations and corporate areas, while also prioritizing the safety of our

people. We will maintain our disciplined focus on our priorities, including the improvement of Aripuanã’s performance, the

development of the Cerro Pasco Integration Project, delivering on guidance, extending the life of our mines, and consistently improving

in our cash generation.

We remain confident in the long-term fundamentals

of our industry, and we are prepared to capitalize on new opportunities in our operations, always striving to create shared value for

all our stakeholders and the communities in which we operate.

Summary of Financial

Performance

| US$ million (except per share amounts) |

2Q24 |

1Q24 |

2Q23 |

1H24 |

1H23 |

| Net revenues |

736 |

580 |

627 |

1,316 |

1,294 |

| Gross profit |

179 |

87 |

62 |

266 |

161 |

| Net loss |

(69) |

(11) |

(103) |

(81) |

(118) |

| EBITDA (1) |

89 |

121 |

(44) |

210 |

71 |

| Basic and diluted loss per share |

(0.58) |

(0.18) |

(0.77) |

(0.76) |

(0.92) |

| Adjusted net income (loss) (1) |

42 |

(10) |

12 |

33 |

15 |

| Adjusted EBITDA (1) |

200 |

123 |

72 |

323 |

205 |

| Adjusted basic and diluted earnings (loss) per share (1) |

0.15 |

(0.15) |

0.04 |

(0.01) |

0.03 |

| Cash provided by operating activities before working capital (1) (2) |

133 |

81 |

56 |

214 |

172 |

| Capex |

64 |

74 |

60 |

138 |

116 |

| Free cash flow (1) |

149 |

(144) |

34 |

5 |

(97) |

| Total cash (3) |

474 |

324 |

421 |

474 |

421 |

| Net debt (1) |

1,387 |

1,427 |

1,262 |

1,387 |

1,262 |

| Net Debt/LTM Adj. EBITDA |

2.72x |

3.75x |

2.83x |

2.72x |

2.83x |

(1) Refer

to “Use of Non-IFRS Financial Measures” for further information. Adjusted EBITDA, adjusted net income (loss) and adjusted

EPS, exclude the items presented in the “Net income (loss) reconciliation to Adjusted EBITDA” section of this earnings release.

For details on segment definition and accounting policy, please refer to explanatory note 2 – “Information by business segment”

in the “Condensed consolidated interim financial statements at and for the three and six-month periods ended on June 30, 2024.”

(2) Working

capital variations in 2Q24 had a negative impact of US$17 million, totaling US$141 million in 1H24. Working capital variations in 2Q23

had a positive impact of US$79 million, totaling negative impact of US$36 million in 1H23.

(3) Cash,

cash equivalents and financial investments.

Executive Summary

Operational Performance

| § | Zinc

production of 83kt in the quarter rose by 2% from 2Q23, mainly due to higher average zinc

grades, particularly at Cerro Lindo. Compared to 1Q24, zinc production decreased by 5%, mainly

due to lower volumes from the Peruvian mines and the absence of contributions from Morro

Agudo in May and June 2024, following the cessation of mining operations on April 30, 2024

due to the divestment of this mine announced on April 5, 2024. |

| § | Run-of-mine mining cost in 2Q24 was US$49/t, 10%

higher compared to 2Q23, due to lower treated ore volumes by the cease of mining operations in Morro Agudo on April 30, 2024, partially

offset by lower operating costs related to maintenance expenses, energy costs and materials (e.g.

explosives and related items). Compared to 1Q24, run-of-mine mining cost increased by 7%, primarily due

to higher third-party services and increased personnel costs associated with workers participation. Despite this increase, run-of-mine

mining cost in 2Q24 performed within the guidance range for the year. |

| § | Mining cash cost net of by-products1

in 2Q24 decreased to US$0.03/lb compared to US$0.37/lb in 2Q23. This decrease was

primarily due to higher by-products contribution, driven by higher copper and lead prices, and lower TCs, which were partially offset

by higher operating costs due to increased variable costs. Compared to 1Q24, cash cost decreased by US$0.24/lb, also impacted by lower

TCs and higher by-products contribution, which were partially offset by higher operating costs, particularly in Cerro Lindo and El Porvenir.

Mining cash cost net of by-products in 2Q24 and 1H24 performed below the lower range of the guidance for the year. |

| § | The smelting segment achieved a total production (zinc metal and

oxide) of 152kt in 2Q24, up 3% year-over-year and 10% quarter-over-quarter, mainly driven by higher volumes at the Cajamarquilla and Juiz de

Fora smelters, attributed to improved performance in the roasters, which enhanced production stability in the period. |

1

Our cash cost net of by-products credits is measured with respect to zinc sold.

| | |

| 2 |

| § | In 2Q24, zinc metal and oxide sales were 148kt, down 1% from 2Q23. Compared

to 1Q24, metal sales increased by 7%, following higher production volumes in Cajamarquilla and Juiz de Fora. |

| § | Smelting conversion cost was US$0.30/lb in 2Q24 compared with US$0.32/lb

in 2Q23, mainly due to improved operational efficiency. Compared to 1Q24, conversion cost was relatively flat. Smelting conversion cost

performed within the guidance range for the year. |

| § | Smelting cash cost1 was US$1.19/lb in

2Q24 compared to US$1.12/lb in 2Q23. This increase was mainly driven by higher costs of raw materials

attributed to higher zinc prices and lower TCs. Compared to 1Q24, cash cost increased by 21%, primarily

due to higher zinc prices and lower TCs. Smelting cash cost performed within the guidance range for the year. |

Financial Performance

| § | Net revenues in 2Q24 were US$736 million compared with US$627 million

in 2Q23. This increase was primarily driven by higher LME metal prices and increased mining sales volumes, which was partially offset

by lower net premium and slightly lower smelting sales volume. Compared to 1Q24, net revenues increased by 27%, mainly due to higher LME

metal prices and higher smelting sales volume, which were partially offset by lower net premium. In 1H24, net revenues amounted to US$1,316

million, up by 2% compared to the same period a year ago. |

| § | In 2Q24, net loss amounted to US$69 million,

totaling US$81 million in 1H24, resulting in basic and diluted loss per share attributable to Nexa's

shareholders of US$0.58 and US$0.76, respectively. |

| § | Adjusted

net income in 2Q24 was US$42 million, with adjusted net income attributable to Nexa’s shareholders

of US$20 million, resulting in adjusted basic and diluted earnings per share of US$0.15. In 1H24, Adjusted

net income was US$33 million, with adjusted net loss attributable to Nexa’s shareholders of US$1 million, resulting in adjusted

basic and diluted loss per share of US$0.01. Refer to our “Net income (loss)” section for further details. |

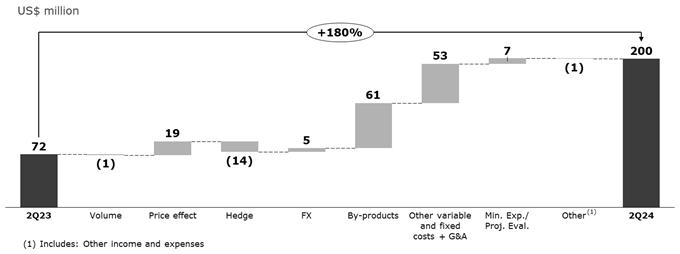

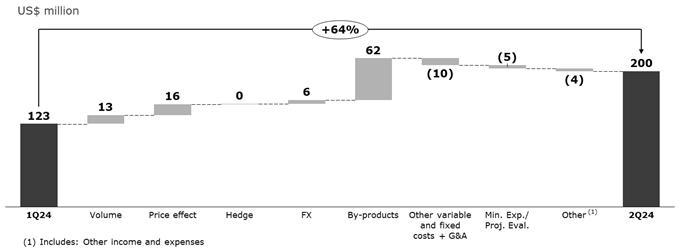

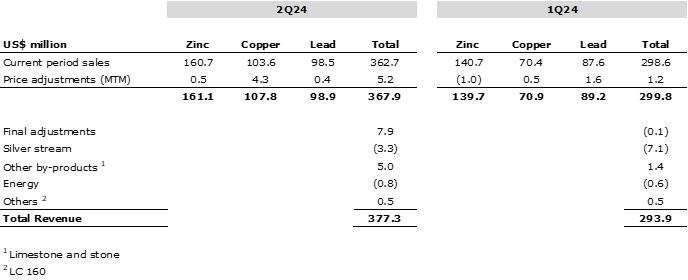

| § | Adjusted EBITDA2

in 2Q24 was US$200 million compared to US$72 million in 2Q23 and US$123 million in

1Q24. The year-over-year increase was primarily driven by higher mining sales volume, higher by-products contribution, lower variable

costs and higher zinc prices. The quarter-over-quarter increase was attributed to higher by-products contribution, higher zinc prices

and increased smelting sales volume. In 1H24, Adjusted EBITDA

amounted to US$323 million, up by 58% compared to the same period a year ago. |

| § | Adjusted EBITDA margin increased to 27.2% in 2Q24, 6.1bps and 15.8bps

higher than 1Q24 and 2Q23, respectively. |

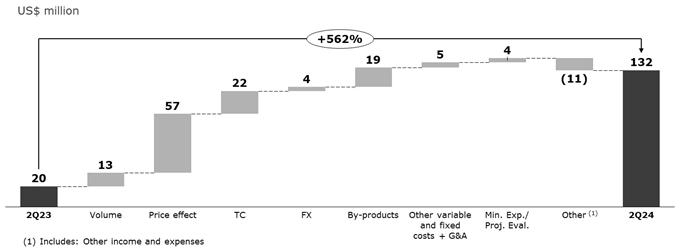

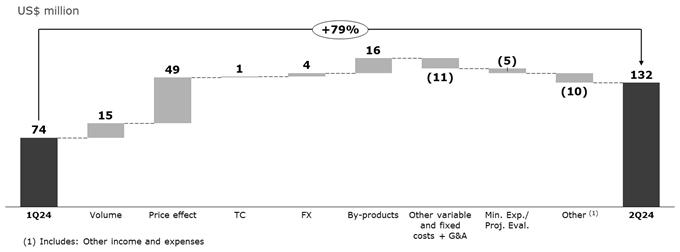

| § | Adjusted EBITDA for the mining segment in 2Q24 was US$132 million compared

to US$74 million in 1Q24. This increase was mainly driven by higher LME metal prices, higher by-products contribution and increased mining

sales volumes, which were partially offset by higher fixed and variable costs, and higher mineral exploration and project evaluation expenses.

Compared to 2Q23, Adjusted EBITDA increased by US$112 million. |

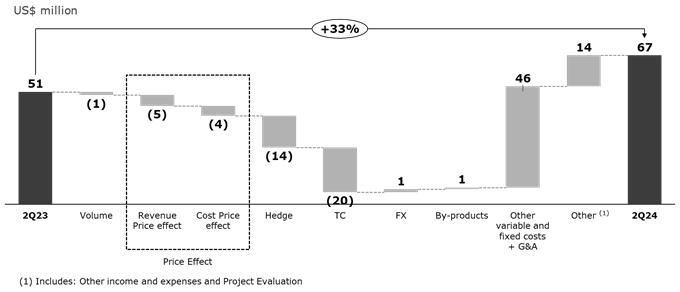

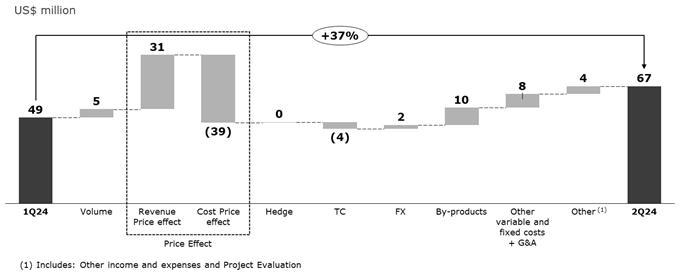

| § | Adjusted EBITDA for the smelting segment in 2Q24 was US$67 million compared

with US$49 million in 1Q24. This increase was mainly driven by higher by-products contribution, lower variable costs and higher sales

volume, which were partially offset by higher zinc prices and lower TCs, negatively impacting the purchase of zinc concentrate. Compared

to 2Q23, Adjusted EBITDA increased by 33%. |

2

Adjusted EBITDA excludes the items presented in the “Net income (loss) reconciliation to Adjusted EBITDA” section of this

earnings release – US$112 million in 2Q24, totaling US$113 million in 1H24.

| | |

| 3 |

Financial Position,

Investments and Financing

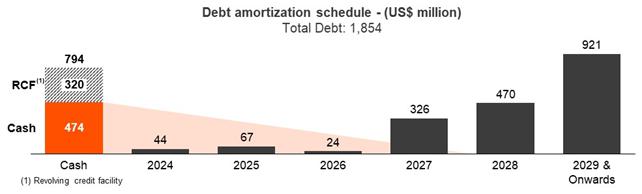

| § | Total cash3

at June 30, 2024, was US$474 million compared to US$324 million at March 31, 2024.

Our available liquidity in 2Q24 was US$794 million, including our undrawn sustainability-linked revolving credit facility of US$320 million. |

| § | In 2Q24, our free cash flow was positive US$149 million,

primarily impacted by a debenture issuance and partially offset by negative working capital variations amounting to US$17 million. This

was mainly due to an increase in inventories, tax credits and trade accounts receivables,

which were partially offset by an increase in other liabilities, primarily related to compensation costs for Morro Agudo’s employees.

Despite its negative position in 2Q24, working capital intensity reduced significantly compared to 1Q24. We remain focused on implementing

initiatives to reverse this position in the following quarters. Our investments in sustaining CAPEX (including HS&E investments) totaled

US$64 million, with US$10 million allocated to Aripuanã. Refer to our “Net cash flows from operating activities excluding

working capital variations and free cash flow - Reconciliation” section for further details. |

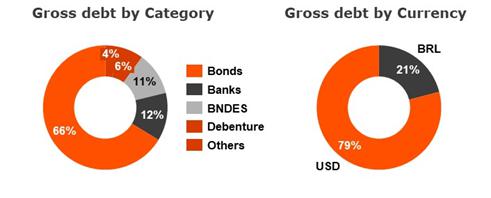

| § | Net debt to Adjusted EBITDA ratio for the last twelve months (“LTM”)

decreased to 2.72x at the end of 2Q24 compared with 3.75x at the end of 1Q24 and 2.83x at the end of 2Q23. This improvement was primarily

due to higher LTM Adjusted EBITDA and lower net debt, reflecting our strategy and efforts to reduce leverage. Total debt increased mainly

due to a debenture issuance in 2Q24. |

Environmental,

Social and Governance (“ESG”) and Corporate Highlights

| § | In May 2024, as part of Nexa’s circular economy

initiatives, we completed our first commercial sale transaction involving 26.4 tonnes of waste material (manganese

dioxide - MnO2) from our Três Marias smelter. This project aims to sell significant amounts of waste

from our smelters by developing partnerships and evaluating viable technologies and trade routes for these materials. |

| § | In May 2024, Nexa, in collaboration with the Brazilian Mining Association

(“IBRAM”), Brazilian Mining Hub, and other mining companies operating in Brazil, began discussions on structuring a decarbonization

roadmap for the mining sector in Brazil. |

| § | In May 2024, Nexa signed a three-year collaboration agreement with the

National University Daniel Alcides Carrión (“UNDAC”) in Pasco, Peru. The partnership aims to foster the exchange of

scientific and technological knowledge in the mining sector. The partnership also aims to enhance professional training, develop innovative

technological solutions, and establish a startup incubator for social impact. This initiative highlights Nexa's commitment to supporting

the Pasco region's communities through education and entrepreneurship. |

| § | In 2Q24, Nexa provided school supplies to nearly 13,000 students from

communities near its operations and greenfield projects in Peru. This initiative, part of our annual School Supplies Campaign, aligns

with the UN's Sustainable Development Goals (“SDGs”) by aiming to alleviate the economic burden on families by supporting

children's education. |

| § | In May 2024, Nexa renewed its partnership with Amazon Web Services for

the second edition of the "Talento na Nuvem" (Talent in the Cloud) program in Brazil, offering 40,000 scholarships. The program

focuses on generative AI and cloud solution architecture, aiming to equip professionals from various fields with valuable technological

skills. This initiative is part of the partnership announced in 2Q23, intended to train 100,000 individuals in cloud computing fundamentals

in Brazil and Peru by 2025. The program has already trained more than 20,000 people in 2023, underscoring Nexa's commitment to fostering

professional development and inclusion. |

| § | In 2Q24, Nexa, in collaboration with the Brazilian Agricultural Research

Corporation (“Embrapa”) and the Brazilian Micro and Small Business Support Service (“Sebrae”) partnered to expand

the Rural Practices Project in Vazante, Brazil. This initiative aims to enhance the income of 40 selected farmers by introducing new agricultural

techniques and market strategies. This project demonstrates Nexa's dedication

to improving local agricultural practices and supporting community development. |

3

Cash and cash equivalents and financial investments.

| | |

| 4 |

| § | In May 2024, Nexa Peru was recognized for the third consecutive year

as one of the 16 leading companies in sustainable practices by the S&P/BVL Peru General ESG Index for 2024-2025 period. This recognition

reflects Nexa's ongoing commitment to integrating ESG strategies into its operations and advancing responsible mining practices. |

| § | In June 2024, Nexa in collaboration with Brazil’s National Industrial

Training Service (“SENAI”), helped 13 young individuals graduate from a mining technical course in Aripuanã, Brazil,

with 11 of them joining Nexa's workforce. Nexa continues to invest in local talent development, having trained over 600 residents in various

technical fields across all of our operations since 2019. |

| § | In June 2024, Nexa launched the 9th edition of its solid

and recognized Mining Lab Challenge program, inviting innovative solutions from the global ecosystem to address five defined challenges

across three main themes: Decarbonization, Circular Economy, and Productivity and Security. |

| § | On April 5, 2024, we announced the signing of a definitive agreement

to divest the Morro Agudo Complex, which encompasses the Morro Agudo and Ambrósia mines. Furthermore, on July 1, 2024, we announced

the closing of this transaction, and pursuant to the terms of the definitive agreement, Nexa has sold, transferred and assigned all rights,

titles, and interests in the Morro Agudo Complex to Casa Verde. The transaction was completed following the fulfillment of all closing

conditions. |

| § | On April 3, 2024, Nexa Brazil, a subsidiary of Nexa Resources, announced

its first ESG-linked debenture issuance, totaling R$650 million (approximately US$130 million) with a 6-year term. Settled on April 2,

2024, the unsecured debentures feature a bullet repayment and bears interest at 100% of CDI rate plus 1.50 per annum. This issuance, part

of Nexa’s liquidity improvement and liability management strategy, aligns with the ESG framework of our US$320 million sustainability-linked

revolving credit facility. |

| § | On April 3, 2024, Nexa announced the pricing of its offering of US$600

million 6.750% senior unsecured notes due in 2034, which closed on April 9, 2024. The net proceeds of this offering were used to fund

cash tender offers for Nexa’s existing notes due 2027 and 2028. |

| § | On April 5, 2024, Nexa announced the results of the tender offer for

its 2027 Notes, pursuant to which Nexa purchased approximately 69.2% of the outstanding principal amount, reducing it to US$215.5 million

following the settlement on April 10, 2024. Subsequently, on April 12, 2024, Nexa announced the results of the tender offer for its 2028

Notes, purchasing approximately 19.9% of the outstanding principal amount at a proration factor of 32.3%, reducing it to US$400,501,000.00

following the settlement on April 15, 2024. |

| § | In June 2024, at the Annual General Meeting, Mr. Paulo Macedo was elected

as a director of the Company for a term starting on June 13, 2024, and ending at the 2026 Annual General Meeting of the shareholders.

Mr. Macedo brings extensive experience in private equity, M&A, investment banking, and capital markets. He is the co-founder and partner

of 4x4 Capital, a New York-based private equity firm, and serves as board observer of 1440 Foods and as board member of Hejoassu, the

ownership board of Votorantim. |

| § | In June 2024, at the Annual General Meeting, Mr. Diego Hernandez and

Mr. Eduardo Borges de Andrade Filho, members of our Board of Directors who served as chairs of the Sustainability and Capital Projects

Committee and Compensation, Nominating and Governance Committee, respectively, ended their respective mandates, effective June 13, 2024. |

Growth Strategy

and Asset Portfolio

| § | We remain focused on free cash flow generation and continue to evaluate

our capital allocation framework, which prioritizes sustaining capital, brownfield mineral exploration and ESG and Health, Safety and

Environment (“HS&E”) initiatives. |

| § | The strategic review of our assets continues with additional

initiatives to optimize the portfolio. In 2Q24, Nexa initiated a structured process to sell its non-operational Peruvian subsidiary,

Minera Pampa de Cobre S.A.C (owner

of the Chapi mine asset), and the greenfield project Pukaqaqa. These potential sales are aligned with Nexa’s portfolio optimization

initiatives, aiming to ensure efficient capital allocation to the highest return assets. |

| | |

| 5 |

| § | In 2Q24, we had important advancements in the main work fronts of the

Cerro Pasco integration project, such as engineering for the underground mine connection and the El Porvenir shaft upgrade. Additionally,

we progressed in the engineering studies for the tailings pumping system and the engineering assessment of the El Porvenir plant, which

presents opportunities to enhance processing capacity. Support activities, including technical reviews and environmental studies and permits,

are also advancing as expected. We are moving forward with the project, closely monitoring market conditions, and expect to submit it

for approval in the upcoming months. |

| § | Nexa submitted a request to modify the Environmental Impact Assessment

(“MEIA”) for the Magistral Copper Project in Peru to the National Environmental Certification Agency (“SENACE”).

During the review process, the Peruvian Water Authority (“ANA”) and Protected Natural Areas Service (“SERNANP”)

raised unfavorable observations regarding Nexa’s MEIA request. Consequently, on May 24, 2024, SENACE formally rejected the MEIA.

Nexa is currently addressing this situation with the competent authorities and expects to receive a response in the coming months. The

denial of the request modification to the environmental permit is relevant and could impact the assessment of the project’s economic

feasibility and technical development, as well as the recoverability of its assets. The project remains in Nexa's portfolio of Exploration

and Evaluation (“E&E”) assets, and the Company has decided to reassess the engineering studies and continue evaluating

options for the project. This reassessment may affect the project’s current maturity stage and was considered an impairment indicator.

For more information on impairment, refer to the “Others” section.

|

| | |

| 6 |

Outlook

Production and

Sales Guidance

Guidance is based on several assumptions

and estimates and is subject to the continuous evaluation of several factors, including, but not limited to, metal prices, operational

performance, maintenance, input costs and exchange rates.

Nexa will continue to monitor risks associated

with global supply chain disruptions, which could be exacerbated, among other factors, by the ongoing Russia-Ukraine war, the Middle-East

conflict, unusual weather conditions, the global recession, and its potential impact on the demand for our products, inflationary cost

pressure, metal price volatility, local community or union’s protests, and changes to the political situations or regulatory frameworks

in the countries in which we operate that could affect our production levels and our costs. Refer to “Risks and Uncertainties”

and “Cautionary Statement on Forward-Looking Statements” for further information.

| § | As of date of this Earnings Release, Nexa reiterates its 2024 consolidated

production guidance for all metals, including zinc and lead. The guidance for zinc metal sales, consolidated cash cost for mining and

smelting, capital expenditures, exploration, project evaluation, and other expenses is outlined below. |

| o | Cerro Lindo: as

per the mining plan for the year, zinc production in 3Q24 is expected to be lower compared to 2Q24, primarily

explained by lower average head grades. Copper production is also expected to decrease due to lower average grades, resulting in reduced

recoveries. |

| o | El Porvenir: based on mine sequencing, zinc production in 3Q24

is expected to increase compared to 2Q24, driven by higher mined ore volumes and higher average grades. Additionally, lead and silver

production is expected to increase, following the same trend, as we expect higher average head grades for those metals. |

| o | Atacocha: we anticipate a slight decrease in zinc production

in 3Q24 compared to 2Q24. However, lead and silver production are expected to increase, driven by mining activities in areas with higher

grades. |

| o | Vazante: ore throughput in 3Q24 is expected to remain at same

level as 2Q24, while zinc head grade is anticipated to increase, resulting in slightly higher zinc production for the period. |

| o | Morro Agudo: as previously disclosed, on July 1, 2024, we announced

the closing of the sale transaction, and pursuant to the terms of the definitive agreement (signed on April 5, 2024), Nexa has sold, transferred

and assigned all rights, titles, and interests in the Morro Agudo Complex to Casa Verde. Under these conditions, mining activities attributed

to Nexa were ceased on April 30, 2024. |

| o | Aripuanã: operational performance boosted in 2Q24 compared

to 1Q24, driven by higher utilization capacity, improved plant feed and throughput rates, stable concentrate quality within commercial

specifications, as well as higher metallurgical recoveries. Solid Adjusted EBITDA for the second consecutive quarter and positive operating

cash flow in June. Moving forward, we anticipate further increases in plant feed and throughput rates, improvements in concentrate grades,

and higher metal recoveries. Additionally, we expect utilization capacity to continue improving, reaching around 90% in the upcoming months.

As of now, we expect Aripuanã’s zinc production to be closer to the lower end of the guidance for the year. |

| | |

| 7 |

Mining segment – production

| Mining production |

|

1H24 |

|

Guidance 2024 |

| (Metal in concentrate) |

|

| |

|

|

|

|

|

|

|

| Zinc |

kt |

|

170 |

|

323 |

- |

381 |

| Cerro Lindo |

|

|

48 |

|

73 |

- |

86 |

| El Porvenir |

|

|

25 |

|

51 |

- |

57 |

| Atacocha |

|

|

4.8 |

|

8 |

- |

9 |

| Vazante |

|

|

69 |

|

130 |

- |

148 |

| Morro Agudo |

|

|

7 |

|

18 |

- |

23 |

| Aripuanã |

|

|

15 |

|

42 |

- |

57 |

| |

|

|

|

|

|

|

|

| Copper |

kt |

|

17 |

|

30 |

- |

35 |

| Cerro Lindo |

|

|

14 |

|

24 |

- |

28 |

| El Porvenir |

|

|

0.2 |

|

0.2 |

- |

0.3 |

| Aripuanã |

|

|

2.8 |

|

5.7 |

- |

7.3 |

| |

|

|

|

|

|

|

|

| Lead |

kt |

|

35 |

|

66 |

- |

82 |

| Cerro Lindo |

|

|

8 |

|

11 |

- |

13 |

| El Porvenir |

|

|

13 |

|

23 |

- |

28 |

| Atacocha |

|

|

5 |

|

11 |

- |

12 |

| Vazante |

|

|

0.4 |

|

1.0 |

- |

1.4 |

| Morro Agudo |

|

|

2.3 |

|

4.3 |

- |

6.6 |

| Aripuanã |

|

|

5.8 |

|

16 |

- |

20 |

| |

|

|

|

|

|

|

|

| Silver |

MMoz |

|

6 |

|

11 |

- |

13 |

| Cerro Lindo |

|

|

2.3 |

|

4.0 |

- |

4.2 |

| El Porvenir |

|

|

2.2 |

|

4.6 |

- |

5.4 |

| Atacocha |

|

|

0.6 |

|

1.1 |

- |

1.2 |

| Vazante |

|

|

0.2 |

|

0.3 |

- |

0.5 |

| Aripuanã |

|

|

0.5 |

|

1.0 |

- |

1.5 |

Smelting segment – sales

| § | Metal sales guidance also remains unchanged at 580-605kt. |

| o | Peru: we expect production at Cajamarquilla in 3Q24 to be higher

compared to 2Q24, mainly driven by better performance and production stability. |

| o | Brazil: in Três Marias, we expect production in 3Q24 to

slightly decrease compared to 2Q24, while production in Juiz de Fora is expected to increase due to the reprocessing of third-party High

Grade (“HG”) zinc to produce Special High Grade (“SHG”) zinc. |

| Smelting sales |

|

1H24 |

|

Guidance 2024 |

| |

|

|

|

|

|

|

|

| Zinc metal |

kt |

|

270 |

|

545 |

- |

565 |

| Cajamarquilla |

|

|

156 |

|

315 |

- |

325 |

| Três Marias |

|

|

73 |

|

155 |

- |

160 |

| Juiz de Fora |

|

|

41 |

|

75 |

- |

80 |

| |

|

|

|

|

|

|

|

| Zinc oxide |

kt |

|

16 |

|

35 |

- |

40 |

| Três Marias |

|

|

16 |

|

35 |

- |

40 |

| |

|

|

|

|

|

|

|

| Metal Sales |

kt |

|

287 |

|

580 |

- |

605 |

| | |

| 8 |

Cash Costs

| § | Nexa also estimates that 2024 consolidated cash cost guidance for its

mining and smelting segments will be achieved. |

| o | Mining and smelting volumes are expected to remain at the same levels

or slightly increase in 3Q24 compared to 2Q24, remaining within the guidance ranges noted above. |

| o | We anticipate that continuous improvements in operational efficiency

and cost management will positively impact our overall performance. Several initiatives are already being implemented across our mines

and smelters. |

| o | We observed a significant increase in copper, lead, and silver prices

in 2Q24 compared to 1Q24. Although there may be volatility, we expect these prices to remain at similar levels in 3Q24. Nexa’s C1

cash cost is sensitive to by-product prices and volumes, which may impact our final cost results. |

| o | Foreign exchange rates assumptions are maintained (BRL/USD: 4.90 and

Soles/USD: 3.67). |

| o | Zinc TCs assumptions for the year of US$174/t remain unchanged. |

| Mining Operating costs |

|

Cost ROM

(US$/t) |

|

Cash Cost

(US$/lb) |

|

Cost ROM

(US$/t) |

|

Cash Cost

(US$/lb) |

| |

|

|

|

| |

1H24 |

|

1H24 |

|

Guidance 2024 |

|

Guidance 2024 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Mining (1) |

|

46.8 |

|

0.15 |

|

44.0 |

- |

51.4 |

|

0.23 |

- |

0.42 |

| Cerro Lindo |

|

43.7 |

|

(0.41) |

|

41.0 |

- |

45.0 |

|

(0.22) |

- |

0.03 |

| El Porvenir |

|

63.8 |

|

0.10 |

|

58.4 |

- |

71.6 |

|

(0.02) |

- |

0.25 |

| Atacocha |

|

33.1 |

|

(0.53) |

|

34.3 |

- |

43.2 |

|

(0.27) |

- |

(0.02) |

| Vazante |

|

49.9 |

|

0.53 |

|

55.8 |

- |

63.6 |

|

0.52 |

- |

0.60 |

| Morro Agudo |

|

40.8 |

|

0.96 |

|

27.9 |

- |

40.0 |

|

0.80 |

- |

1.24 |

(1) C1 Weighted Cash cost net of

by-products credits is measured with respect to zinc sold per mine.

Note: Consolidated cash costs do not include

Aripuanã.

| Smelting Operating costs |

|

Conversion cost

(US$/lb) |

|

Cash Cost

(US$/lb) |

|

Conversion cost

(US$/lb) |

|

Cash Cost

(US$/lb) |

| |

|

|

|

| |

1H24 |

|

1H24 |

|

Guidance 2024 |

|

Guidance 2024 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Smelting (2) |

|

0.30 |

|

1.09 |

|

0.29 |

- |

0.32 |

|

1.07 |

- |

1.18 |

| Cajamarquilla |

|

0.27 |

|

1.06 |

|

0.29 |

- |

0.32 |

|

1.02 |

- |

1.13 |

| Três Marias |

|

0.30 |

|

1.12 |

|

0.25 |

- |

0.27 |

|

1.12 |

- |

1.23 |

| Juiz de Fora |

|

0.43 |

|

1.17 |

|

0.38 |

- |

0.42 |

|

1.17 |

- |

1.28 |

(2) C1 Weighted Cash cost net

of by-products credits is measured with respect to zinc sold per smelter.

| § | In 1H24, Mining C1 cash cost of US$0.15/lb was below our 2024 guidance,

primarily driven by higher by-products contribution, particularly from Cerro Lindo, and lower TCs across all units. The run-of-mine mining

costs of US$46.8/t was in line with our 2024 guidance. For further information, please see the section “Business performance –

Mining segment.” |

| § | In 1H24, Smelting C1 cash cost of US$1.09/lb and conversion cost of

US$0.30/lb were in line with our 2024 guidance. For further information, please see the section “Business performance – Smelting

segment.” |

Capital Expenditures

(“CAPEX”) Guidance

| § | Nexa invested US$64 million in 2Q24, nearly

all of which was sustaining, which includes CAPEX to sustain operations as well as mine development. In

1H24, total CAPEX amounted to US$138 million. |

| § | The depreciation of the Brazilian real against the U.S. dollar resulted

in a positive impact of US$1.2 million in the quarter, totaling US$1.9 million in 1H24. |

| | |

| 9 |

| § | We expect investment disbursement to accelerate in the upcoming quarters,

and 2024 CAPEX guidance remains unchanged at US$311 million. |

| CAPEX |

|

1H24 |

|

Guidance 2024 |

| (US$ million) |

|

|

| Non-Expansion |

|

142 |

|

307 |

| Sustaining (1) |

|

135 |

|

261 |

| HS&E |

|

3 |

|

24 |

| Others (2) |

|

4 |

|

21 |

| |

|

|

|

|

| Expansion projects (3) |

|

2 |

|

4 |

| Reconciliation to Financial Statements (4) |

|

(6) |

|

- |

| TOTAL |

|

138 |

|

311 |

(1) Investments

in tailing dams are included in sustaining expenses.

(2) Modernization,

IT and others.

(3) Includes

Vazante deepening, among several other projects to improve operational performance.

(4) The

amounts are mainly related to capitalization of interest net of advanced payments for imported materials and tax credits.

Exploration &

Project Evaluation and Other Expenses Guidance

| § | In 2Q24, we invested US$16 million in exploration and project evaluation,

totaling US$29 million in 1H24. |

| § | In 2Q24, we also allocated a total of US$5 million to technology and

community initiatives, totaling US$7 million in 1H24. These investments aim to enhance our current operations and to further contribute

to the social and economic development of our host communities. |

| § | Our total 2024 guidance for exploration and project evaluation, and

other operating expenses remains unchanged at US$72 million and US$21 million, respectively. We expect investment disbursements to accelerate

in the upcoming quarters. |

| § | As part of our long-term strategy, we remain focused on replacing and

increasing mineral reserves and resources. We expect to continue advancing our exploration activities, primarily by identifying new ore

bodies and upgrading resources classification through infill drilling campaigns. |

| Other Operating Expenses |

|

1H24 |

|

Guidance 2024 |

| (US$ million) |

|

|

| Exploration |

|

23 |

|

58 |

| Mineral Exploration |

|

17 |

|

42 |

| Mineral rights |

|

3 |

|

6 |

| Sustaining (mine development) |

|

3 |

|

10 |

| |

|

|

|

|

| Project Evaluation |

|

6 |

|

14 |

| |

|

|

|

|

| Exploration & Project Evaluation |

|

29 |

|

72 |

| |

|

|

|

|

| Other |

|

7 |

|

21 |

| Technology |

|

1 |

|

4 |

| Communities |

|

6 |

|

17 |

Note: Exploration and project evaluation expenses

consider several stages of development, from mineral potential definition, R&D, and subsequent scoping and pre-feasibility studies

(FEL1 and FEL2).

| | |

| 10 |

Earnings Release

2Q24

This Earnings Release should be read

in conjunction with the “Condensed consolidated interim financial statements at and for the three and six-month periods ended on

June 30, 2024.” This document contains forward-looking statements.

Table of contents

UPCOMING EVENT

Earnings Conference

Call

Date: Friday, August 2, 2024 –

9:00am (EST)

Dial In

US: +1-833-816-1265

Canada: +1-647-484-8814

Brazil: +55 11 3181-8565

International: +1-412-317-5635

Conference ID: Nexa Resources

Live audio webcast with slide presentation

will be available on:

https://ir.nexaresources.com

| | |

| 11 |

Consolidated performance

Selected financial

information

US$ million

(except where otherwise indicated) |

2Q24 |

1Q24 |

2Q23 |

1H24 |

1H23 |

| |

|

|

|

|

|

| Net Revenues |

736 |

580 |

627 |

1,316 |

1,294 |

| Mining |

377 |

294 |

268 |

671 |

536 |

| Smelting |

508 |

418 |

465 |

926 |

1,008 |

| Intersegment results | Adjustments |

(149) |

(133) |

(107) |

(281) |

(250) |

| |

|

|

|

|

|

| Cost of Sales |

(557) |

(493) |

(565) |

(1,050) |

(1,133) |

| Mining |

(257) |

(252) |

(256) |

(510) |

(499) |

| Current Operations |

(215) |

(210) |

(195) |

(424) |

(398) |

| Aripuanã |

(42) |

(43) |

(60) |

(85) |

(101) |

| Smelting |

(450) |

(373) |

(415) |

(823) |

(884) |

| Intersegment results | Adjustments |

150 |

132 |

106 |

282 |

250 |

| |

|

|

|

|

|

| Selling, general and administrative |

(30) |

(34) |

(33) |

(64) |

(61) |

| Mining |

(16) |

(17) |

(14) |

(33) |

(29) |

| Smelting |

(14) |

(15) |

(16) |

(30) |

(31) |

| Intersegment results | Adjustments |

0 |

(1) |

(3) |

(1) |

(1) |

| |

|

|

|

|

|

| Depreciation and amortization |

70 |

73 |

72 |

142 |

143 |

| Mining |

51 |

53 |

53 |

104 |

105 |

| Smelting |

18 |

19 |

19 |

37 |

38 |

| Intersegment results | Adjustments |

1 |

0 |

0 |

1 |

0 |

| |

|

|

|

|

|

| Adjusted EBITDA (1) |

200 |

123 |

72 |

323 |

205 |

| Mining |

132 |

74 |

20 |

206 |

61 |

| Smelting |

67 |

49 |

51 |

116 |

140 |

| Intersegment results | Adjustments |

1 |

(0) |

1 |

1 |

3 |

| Adj. EBITDA margin (%) |

27.2% |

21.1% |

11.4% |

24.5% |

15.8% |

| |

|

|

|

|

|

| Net loss |

(69) |

(11) |

(103) |

(81) |

(118) |

| Attributable to Nexa's shareholders |

(76) |

(24) |

(102) |

(100) |

(122) |

| Attributable to non-controlling interests |

7 |

12 |

(0) |

19 |

4 |

| |

|

|

|

|

|

| Basic and diluted loss per share |

(0.58) |

(0.18) |

(0.77) |

(0.76) |

(0.92) |

| |

|

|

|

|

|

| Adjusted net income (loss) (1) |

42 |

(10) |

12 |

33 |

15 |

| Attributable to Nexa's shareholders |

20 |

(20) |

6 |

(1) |

4 |

| Attributable to non-controlling interests |

23 |

11 |

7 |

33 |

10 |

| |

|

|

|

|

|

| Adjusted basic and diluted earnings (loss) per share (1) |

0.15 |

(0.15) |

0.04 |

(0.01) |

0.03 |

(1) Refer to “Use of Non-IFRS Financial

Measures” for further information. Adjusted EBITDA, adjusted net income (loss) and adjusted EPS, exclude the items presented in

the “Net income (loss) reconciliation to Adjusted EBITDA” section of this earnings release. For details on segment definition

and accounting policy, please refer to explanatory note 2 – “Information by business segment” in the “Condensed

consolidated interim financial statements at and for the three and six-month periods ended on June 30, 2024.”

| | |

| 12 |

Net revenues

In 2Q24, net revenues were US$736 million,

17% higher year-over-year, primarily driven by higher LME metal prices and higher mining sales volumes, which were partially offset by

lower net premium and slightly lower smelting sales volume. The LME average prices for zinc, copper, and lead increased by 12%, 15% and

2%, respectively, compared to the same period in 2023 – for more information on metal prices, refer to the “Market Scenario”

section.

Compared to 1Q24, net revenues rose by

27%, mainly due to higher LME metal prices, higher smelting sales volume, and higher by-products contribution, partially offset by lower

net premium.

In 1H24, net revenues amounted to US$1,316

million, up 2% compared to the same period a year ago, as a result of the aforementioned reasons.

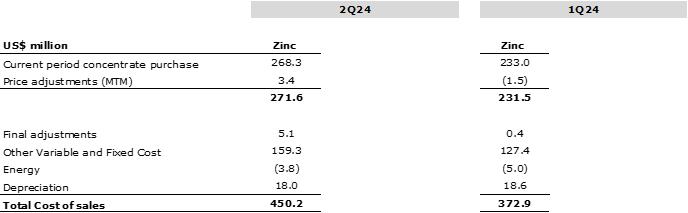

Cost of Sales

In 2Q24, cost of sales amounted to US$557

million, down 1% year-over-year, primarily due to the positive impact of lower consumption of third-party concentrate in the smelting

segment and slightly lower smelting sales volume, which was offset by higher mining sales volumes and the negative hedge impact. Compared

to 1Q24, cost of sales increased by 13% driven by higher smelting sales volume, the impact of higher zinc prices on the purchase of zinc

concentrates for our smelting segment, and the negative hedge impact.

In 1H24, cost of sales amounted to US$1,050

million, down 7% compared to the same period a year ago, mainly due to the aforementioned reasons.

Mineral exploration

and project evaluation

In 2Q24, mineral exploration and project

evaluation investments were US$16 million, compared to US$21 million in 2Q23. In 1H24, mineral exploration and project evaluation investment

amounted to US$29 million.

For additional information about our exploration

results in the second quarter 2024, please refer to our 2Q24 Exploration Report published on July 25, 2024.

SG&A

In 2Q24, SG&A expenses of US$30 million

were down by 7% compared to 2Q23, mainly driven by lower third-party services in support areas, which was partially offset by higher employee

benefit expenses. SG&A expenses also decreased by 10% compared to 1Q24.

In 1H24, SG&A expenses amounted to

US$64 million, up by 5% compared to the same period a year ago, primarily due to higher employee benefit expenses.

Adjusted EBITDA

In 2Q24, Adjusted EBITDA was US$200 million

compared with US$72 million in 2Q23. The main factors that contributed to this increase were (i) higher by-products contribution of US$61

million, mainly due to higher prices and volumes; (ii) the positive net impact of US$53 million due to lower costs, driven by Aripuanã’s

margin improvement, the positive raw material inventory consumption costs, and lower third-party concentrate consumption in our smelting

segment; (iii) the positive net price effect of US$19 million, primarily attributed to higher zinc prices; and (iv) lower mineral exploration

and project evaluation expenses, which were partially offset by (v) the negative hedge effect of US$14 million.

| | |

| 13 |

Compared to 1Q24, Adjusted EBITDA increased

by 64%. This increase was primarily driven by (i) higher by-products contribution of US$62 million, attributed to increased copper and

lead sales volumes and prices, higher payable values for silver and gold in our Peruvian operations and Aripuanã, increased sulphuric

acid sales volume, and higher copper cement and silver prices in Cajamarquilla; (ii) a positive net price effect of US$16 million due

to higher zinc prices; (iii) higher smelting sales volume of US$13 million, mainly in Cajamarquilla, partially offset by lower sales volume

in Três Marias. The positive factors were partially offset by (iv) the negative net impact of US$14 million in costs, mainly due

to higher operational costs in our mining segment.

During 1H24, Adjusted EBITDA was US$323

million compared to US$205 million in the same period a year ago, primarily driven by higher by-products contribution, higher LME metal

prices and lower mineral exploration and project evaluation expenses, partially offset by lower metal net premium.

| | |

| 14 |

Net income (loss) reconciliation

to Adjusted EBITDA

| US$ million |

2Q24 |

1Q24 |

2Q23 |

1H24 |

1H23 |

| Net loss |

(69.3) |

(11.5) |

(102.8) |

(80.8) |

(118.2) |

| Depreciation and amortization |

69.9 |

72.6 |

71.7 |

142.4 |

143.4 |

| Share in the results of associates |

(5.3) |

(5.7) |

(5.7) |

(11.1) |

(11.1) |

| Net financial results |

116.6 |

66.0 |

26.5 |

182.6 |

65.7 |

| Income tax expense |

(23.0) |

(0.4) |

(33.5) |

(23.4) |

(8.4) |

| EBITDA |

88.8 |

120.9 |

(43.7) |

209.8 |

71.5 |

| Changes in fair value of the offtake agreement (2) |

17.2 |

1.8 |

(13.4) |

19.0 |

(0.0) |

| Impairment loss (reversal) of long-lived assets (3) |

60.2 |

(17.2) |

57.2 |

43.0 |

57.2 |

| Ramp-up expenses of greenfield projects (Aripuanã) (4) |

11.3 |

13.8 |

(3.8) |

25.2 |

1.8 |

| Impairment of other assets (5) |

0.0 |

0.3 |

0.0 |

0.3 |

0.0 |

| Loss on sale of property, plant and equipment (6) |

0.0 |

0.2 |

1.0 |

0.2 |

1.3 |

| Remeasurement in estimates of asset retirement obligations (7) |

14.8 |

2.6 |

1.4 |

17.4 |

(0.1) |

| Remeasurement adjustment of streaming agreement (8) |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

| Energy forward contracts – Changes in Fair Value (9) |

(3.8) |

(4.4) |

9.7 |

(8.2) |

9.7 |

| Tax voluntary disclosure – Value added tax ("VAT") discussions (10) |

0.0 |

0.0 |

63.2 |

0.0 |

63.2 |

| Other restoration obligations (11) |

(0.2) |

1.4 |

0.0 |

1.1 |

0.0 |

| Divestment and restructuring (12) |

2.4 |

3.2 |

0.0 |

5.6 |

0.0 |

| Dividends received from associate (13) |

9.7 |

0.0 |

0.0 |

9.7 |

0.0 |

| Adjusted EBITDA (1) |

200.5 |

122.6 |

71.5 |

323.1 |

204.5 |

(1) Adjusted EBITDA excludes the items presented

above in the “Net income (loss) reconciliation to Adjusted EBITDA.” For details on segment definition and accounting policy,

please refer to explanatory note 2 – “Information by business segment” in the “Condensed consolidated interim

financial statements at and for the three and six-month periods ended on June 30, 2024.”

(2) Non-cash adjustment: Derivative financial

instrument related to the “Offtake agreement” described in the section “Others—Offtake agreement” of this

earnings release.

(3) Non-cash adjustment: Cash generating unit

and individual PP&E assets impairment loss (reversal). Please refer to “Others – Impairment” section in this Earnings

Release for further details.

(4) Expenses related to pre-operating and ramp-up

expenses incurred during the commissioning and ramp-up phases of greenfield projects which have not achieved their expected production

capacity. Once the Aripuanã operation is stabilized and operational at its expected production capacity, such effects will no longer

be excluded. Commencing on July 1, 2024, we expect these effects to be no longer included since, at the end of June 2024, it was approaching

the final stage of its ramp-up phase, transitioning to an ongoing operation.

(5) Non-cash adjustment: Value-added-taxes impairment

loss.

(6) Non-cash adjustment: Results from sale and

disposal of certain non-current assets.

(7) Non-cash adjustment: Asset retirement obligation

remeasurement of discount rate and updated studies that are not subject to capitalization.

(8) Non-cash adjustment: Remeasurement of contractual

obligation related to the forward sale contract of Cerro Lindo's Silver contained in the ore.

(9) Non-cash adjustment: The fair value adjustment

of the energy surplus resulting from electric energy purchase contracts of the Company’s subsidiary, Pollarix.

(10) Expenses related to the impact of accruals

related to VAT discussions.

(11) Non-cash adjustment: Expenses related to

the remeasurement of provision related to estimated costs of anticipated additional obligations in relation to certain inactive industrial

waste containment structures in Brazil that have been closed for more than 20 years and that do not contain mining tailings, water or

liquid waste.

(12) Expenses related to the effects of obligations

of restructuring and divestment related to assets held for sale.

(13) Amount received in cash related to dividends

from associate, since the results from these dividends were not consolidated on prior periods. Please refer to “Others – Dividends

received form associate” section in this Earnings Release for further details.

Net financial

results

The net financial result in 2Q24 was US$117

million in expenses compared to US$66 million in 1Q24, mainly driven by FX losses and higher financial expenses due to interest paid on

loans and financing, partially offset by higher financial income related to interest on financial investments and cash equivalents.

The foreign

exchange variation resulted in a negative impact of US$64 million in 2Q24 compared to a US$22 million negative impact in 1Q24, mainly

due to the 11% depreciation of the Brazilian real against the U.S. dollar4

in 2Q24.

Excluding the effect of the foreign exchange

variation, the net financial results in 2Q24 were an expense of US$53 million compared to an expense of US$44 million in the previous

quarter.

4

In 2Q24, the Brazilian real / U.S. dollar (end of period) exchange rate was R$5.559/US$1.00 compared to R$4.996/US$1.00 in 1Q24.

| | |

| 15 |

| US$ thousand |

2Q24 |

1Q24 |

2Q23 |

| |

|

|

|

| Financial income |

6,775 |

5,013 |

6,700 |

| |

|

|

|

| Financial expenses |

(60,619) |

(48,958) |

(59,363) |

| |

|

|

|

| Other financial items, net |

(62,734) |

(22,042) |

26,149 |

| Foreign exchange gain (loss) |

(63,766) |

(21,902) |

26,812 |

| |

|

|

|

| Net financial result |

(116,578) |

(65,987) |

(26,514) |

| Net financial result excluding FX |

(52,812) |

(44,085) |

(53,326) |

Net income (loss)

In 2Q24,

Net loss was US$69 million compared to Net loss of US$103 million and US$11 million in 2Q23 and 1Q24, respectively. Compared to 1Q24,

the decrease was primarily driven by the recognition of an impairment loss5,

higher Other income and expenses6

related to changes in the fair value of the offtake agreements, adjustments to asset retirement, restoration,

and environmental obligations, as well as increased mineral exploration and project evaluation expenses.

Excluding miscellaneous adjustments detailed

below and above in the Net income (loss) reconciliation to Adjusted EBITDA section, Adjusted Net Income was US$42 million in the quarter,

totaling US$33 million in 1H24.

Adjusted Net Income attributable to Nexa’s

shareholders was US$20 million in 2Q24, resulting in adjusted earnings per share of US$0.15. In 1H24, Adjusted Net Loss attributable to

Nexa’s shareholders was US$1 million, resulting in adjusted loss per share of US$0.01.

US$ million

(except where otherwise indicated) |

2Q24 |

1Q24 |

2Q23 |

1H24 |

1H23 |

| Net Loss |

(69.3) |

(11.5) |

(102.8) |

(80.8) |

(118.2) |

| Attributable to Nexa's shareholders |

(76.3) |

(23.8) |

(102.5) |

(100.1) |

(122.2) |

| Attributable to non-controlling interests |

7.0 |

12.4 |

(0.3) |

19.4 |

4.0 |

| Basic and diluted loss per share |

(0.58) |

(0.18) |

(0.77) |

(0.76) |

(0.92) |

| |

|

|

|

|

|

| Miscellaneous adjustments (1) |

111.6 |

1.7 |

115.2 |

113.3 |

133.0 |

| Attributable to Nexa's shareholders |

95.9 |

3.5 |

108.2 |

99.4 |

126.6 |

| Attributable to non-controlling interests |

15.7 |

(1.8) |

7.0 |

13.9 |

6.4 |

| Basic and diluted miscellaneous adjustments per share |

0.72 |

0.03 |

0.82 |

0.75 |

0.96 |

| |

|

|

|

|

|

| Adjusted net income (loss) |

42.4 |

(9.8) |

12.5 |

32.6 |

14.8 |

| Attributable to Nexa's shareholders |

19.6 |

(20.3) |

5.7 |

(0.7) |

4.4 |

| Attributable to non-controlling interests |

22.8 |

10.5 |

6.7 |

33.3 |

10.5 |

| Weighted average number of outstanding shares - in thousand |

132,439 |

132,439 |

132,439 |

132,439 |

132,439 |

| Adjusted basic and diluted earnings (loss) per share |

0.15 |

(0.15) |

0.04 |

(0.01) |

0.03 |

(1) Miscellaneous adjustments include: (i) Changes in fair value of

the offtake agreement; (ii) Impairment loss (reversal) of long-lived assets; (iii) Ramp-up expenses of greenfield projects (Aripuanã);

(iv) Impairment of other assets; (v) Loss on sale of property, plant and equipment; (vi) Remeasurement in estimates of asset retirement

obligations; (vii) Remeasurement adjustment of streaming agreement; (viii) Changes in fair value of energy forward contracts; (ix) Tax

voluntary disclosure – VAT discussions; (x) Other restoration obligations; (xi) Divestment and restructuring; and (x) Dividends

received from associate.

5

For more information, please refer to explanatory note 18 – “Impairment of long-lived assets”

in the “Condensed consolidated interim financial statements at and for the three and six-month periods ended on June 30, 2024.”

6

For more information, please refer to explanatory notes 10 (e) – “Financial instruments in the

offtake agreement: fair value” and 16 (ii) – “Changes in asset retirement, restoration and environmental obligations”

in the “Condensed consolidated interim financial statements at and for the three and six-month periods ended on June 30, 2024.”

| | |

| 16 |

Business Performance

Mining segment

| Consolidated |

|

2Q24 |

1Q24 |

2Q23 |

2Q24 vs. 2Q23 |

1H24 |

1H23 |

1H24 vs. 1H23 |

| Ore Mined |

kt |

3,216 |

3,263 |

3,214 |

0.0% |

6,479 |

6,153 |

5.3% |

| Treated Ore |

kt |

3,281 |

3,393 |

3,546 |

(7.5%) |

6,674 |

6,677 |

(0.0%) |

| |

|

|

|

|

|

|

|

|

| Grade |

|

|

|

|

|

|

|

|

| Zinc |

% |

2.99 |

3.02 |

2.72 |

27 bps |

3.00 |

2.81 |

19 bps |

| Copper |

% |

0.38 |

0.31 |

0.35 |

4 bps |

0.35 |

0.31 |

3 bps |

| Lead |

% |

0.65 |

0.69 |

0.64 |

1 bps |

0.67 |

0.67 |

0 bps |

| Silver |

oz/t |

1.12 |

1.14 |

1.02 |

10.5% |

1.13 |

1.02 |

10.7% |

| Gold |

oz/t |

0.006 |

0.006 |

0.005 |

12.8% |

0.006 |

0.005 |

14.5% |

| |

|

|

|

|

|

|

|

|

| Production | metal contained |

|

|

|

|

|

|

|

| Zinc |

kt |

82.5 |

87.2 |

80.7 |

2.3% |

169.8 |

155.5 |

9.2% |

| Copper |

kt |

9.7 |

7.5 |

8.7 |

12.6% |

17.2 |

14.7 |

16.9% |

| Lead |

kt |

16.7 |

18.2 |

16.0 |

4.6% |

35.0 |

31.2 |

12.1% |

| Silver |

MMoz |

2.8 |

3.0 |

2.6 |

7.9% |

5.8 |

5.0 |

16.5% |

| Gold |

koz |

8.6 |

8.7 |

6.8 |

25.5% |

17.2 |

13.3 |

29.4% |

| Zinc Equivalent (1) |

kt |

159.1 |

158.8 |

151.9 |

4.7% |

318.1 |

284.9 |

11.7% |

(1) Consolidated mining production in

kt of zinc equivalent is calculated by converting copper, lead, silver, and gold contents to a zinc equivalent grade, assuming 2023 LME

average prices: Zn: US$1.20/lb; Cu: US$3.85/lb; Pb: US$0.97/lb; Ag: US$23.4/oz; Au: US$1,943/oz.

In 2Q24, treated ore volume reached 3,281kt,

down 7% year-over-year, mainly attributed to lower plant performance across all mines, primarily due to delays in mine development and

limited availability of third-party employees, except for Atacocha. Additionally, the absence of contributions from Morro Agudo in May

and June 2024 further impacted overall performance.

Compared to 1Q24, treated ore volume decreased

by 3%, mainly due to the absence of contributions from Morro Agudo in May and June 2024, despite positive performance from all other mines.

The ore throughput, year-over-year, increased

at Vazante (+10%) and Atacocha (+2%), while Cerro Lindo decreased by (-4%), both El Porvenir and Aripuanã decreased by (-2%), in

addition to the absence of contributions from Morro Agudo in May and June.

Zinc equivalent production totaled 159kt

in 2Q24, up 5% compared to 2Q23. The average zinc, copper, lead and silver head grades increased by 27bps to 2.99%, 4bps to 0.38%, 1bps

to 0.65% and 11% to 1.12oz/t. Compared to 1Q24, zinc equivalent production was relatively flat.

Zinc production of 83kt in the quarter

rose by 2% from 2Q23, mainly due to higher average grades, particularly at Cerro Lindo. Compared to 1Q24, zinc production decreased by

5%, mainly due to the absence of contributions from Morro Agudo in May and June 2024, in addition to slightly lower volumes from Cerro

Lindo, El Porvenir and Vazante.

Copper production of 10kt increased by

13% from 2Q23 and 30% from 1Q24, driven by positive contribution from the Cerro Lindo.

Lead production increased by 5% year-over-year,

mainly explained by higher contributions from El Porvenir, Atacocha and Aripuanã, and decreased by 8% quarter-over-quarter, mainly

driven by the absence of contributions from Morro Agudo

in May and June 2024, in addition to lower production at Cerro Lindo and El Porvenir.

| | |

| 17 |

In 1H24, treated ore volume was relatively

flat year-over-year, totaling 6,674kt. Zinc average grade was up 19bps to 3.00%. Therefore, zinc production totaled 170kt, 9% higher than

in 1H23. Copper production of 17kt was 17% higher and lead production increased by 12% to 35kt.

Cerro Lindo

Cerro Lindo

(100% basis) |

|

2Q24 |

1Q24 |

1H24 |

4Q23 |

3Q23 |

2Q23 |

1Q23 |

1H23 |

| |

|

|

|

|

|

|

|

|

|

| Ore Mined |

kt |

1,484 |

1,457 |

2,941 |

1,617 |

1,515 |

1,595 |

1,254 |

2,850 |

| Treated Ore |

kt |

1,472 |

1,471 |

2,943 |

1,644 |

1,540 |

1,530 |

1,277 |

2,807 |

| |

|

|

|

|

|

|

|

|

|

| Grade |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Zinc |

% |

1.86 |

1.87 |

1.87 |

1.70 |

1.63 |

1.31 |

1.38 |

1.34 |

| Copper |

% |

0.66 |

0.51 |

0.59 |

0.58 |

0.63 |

0.57 |

0.48 |

0.53 |

| Lead |

% |

0.31 |

0.44 |

0.38 |

0.32 |

0.32 |

0.33 |

0.25 |

0.29 |

| Silver |

oz/t |

0.92 |

1.14 |

1.03 |

0.83 |

0.81 |

0.83 |

0.72 |

0.78 |

| Gold |

oz/t |

0.002 |

0.003 |

0.003 |

0.003 |

0.002 |

0.002 |

0.002 |

0.002 |

| |

|

|

|

|

|

|

|

|

|

| Production | metal contained |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Zinc |

kt |

24.1 |

24.3 |

48.4 |

24.6 |

21.7 |

16.9 |

15.0 |

31.9 |

| Copper |

kt |

8.4 |

5.9 |

14.3 |

7.9 |

8.1 |

7.4 |

5.2 |

12.5 |

| Lead |

kt |

3.3 |

4.9 |

8.2 |

3.8 |

3.6 |

3.6 |

2.1 |

5.7 |

| Silver |

MMoz |

1.0 |

1.3 |

2.3 |

1.0 |

0.9 |

0.9 |

0.6 |

1.6 |

| Gold |

koz |

1.0 |

1.2 |

2.2 |

1.2 |

0.7 |

0.8 |

0.7 |

1.5 |

| |

|

|

|

|

|

|

|

|

|

| Zinc sales |

kt |

24.4 |

22.8 |

47.3 |

25.3 |

20.8 |

17.5 |

14.8 |

32.3 |

| |

|

|

|

|

|

|

|

|

|

| Costs |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Cost of sales |

US$ mm |

92.9 |

84.9 |

177.8 |

98.1 |

88.6 |

86.5 |

81.6 |

168.1 |

| Cost ROM (2) |

US$/t |

45.8 |

41.6 |

43.7 |

41.5 |

41.3 |

39.8 |

39.6 |

39.7 |

| Cash cost (1) |

US$/lb |

(0.58) |

(0.23) |

(0.41) |

0.06 |

(0.18) |

(0.13) |

(0.02) |

(0.08) |

| Sustaining cash cost (1) |

US$/lb |

(0.36) |

(0.06) |

(0.22) |

0.29 |

0.07 |

0.15 |

0.23 |

0.19 |

| |

|

|

|

|

|

|

|

|

|

| CAPEX |

US$ mm |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Sustaining |

|

11.5 |

8.5 |

20.0 |

11.2 |

9.1 |

9.4 |

8.0 |

17.3 |

| Other |

|

0.1 |

0.0 |

0.1 |

1.7 |

2.0 |

1.5 |

0.4 |

1.9 |

(1) Our cash cost and sustaining cash cost

are net of by-products credits, measured with respect to zinc sold per mine. For a cash cost reconciliation to COGS, please refer to Appendix

– All in Sustaining Cash Cost | Mining.

(2) Our cost per ROM is measured with respect

to treated ore volume. Refer to “Use of Non-IFRS Financial Measures” for further information.

In 2Q24, treated ore volume was 1,472kt,

down by 4% year-over-year and remained relatively flat quarter-over-quarter.

Zinc production of 24kt increased by 43%

compared to 2Q23, primarily due to accessing areas with higher zinc grades. Compared to 1Q24, zinc production slightly decreased, primarily

due to corrective maintenance on the underground conveyor

belt area in April, which lasted for 10 days. As a result, mine development and rehabilitation activities in areas with higher zinc grades

were reduced in the period.

| | |

| 18 |

Zinc head grade averaged 1.86% in the

quarter, up 55bps and down 1bps compared to 2Q23 and 1Q24, respectively.

Copper production of 8.4kt increased by

13% year-over-year and 41% quarter-over-quarter, attributed to operations in areas with higher copper grades. The average copper grade

was 0.66% in 2Q24 compared to 0.57% in 2Q23 and 0.51% in 1Q24.

Lead production was 3.3kt, down from 3.6kt

in 2Q23 and 4.9kt in 1Q24, mainly driven by lower average grade in the period, decreasing by 2bps year-over-year and 13bps quarter-over-quarter.

In the first six months of 2024, zinc

production totaled 48kt, up 52% compared to 1H23, mainly driven by a significant reduction in daily production in 1Q23 and higher treated

ore volumes throughout the period. Copper also rose by 14% to 14kt, while lead production increased by 43% to 8kt, both attributed to

higher average grades.

Cost

Cost of sales was US$93 million in 2Q24

compared to US$87 million in the same period last year. This increase was primarily due to higher variable costs associated with increased

metal production and inflation. Compared to 1Q24, cost of sales rose by 9%, mainly driven by higher metal sales, increased personnel costs,

higher variable costs associated with mine development, increased third-party services, and higher maintenance expenses during the period.

Run-of-mine mining cost was US$46/t in

the quarter, up 15% year-over-year, mainly explained by higher variable costs, higher inflation and lower mined ore. Compared to 1Q24,

run-of-mine mining cost increased by 10%, explained by the aforementioned reasons.

Cash cost net of by-products in 2Q24 decreased

to US$(0.58)/lb compared with US$(0.13)/lb in 2Q23 and US$(0.23)/lb in 1Q24. The year-over-year improvement was primarily driven by higher

by-products contribution, supported by higher LME metal prices and lower TCs, which were partially offset by higher operational costs.

The quarter-over-quarter decrease was mainly attributed to a higher contribution from by-products, mainly driven by increased copper volumes

and prices.

CAPEX

In 2Q24, sustaining capital expenditures

amounted to US$11 million, primarily allocated to mine development, maintenance, and equipment acquisition, totaling US$20 million in

1H24.

| | |

| 19 |

El Porvenir

El Porvenir

(100% basis) |

|

2Q24 |

1Q24 |

1H24 |

4Q23 |

3Q23 |

2Q23 |

1Q23 |

1H23 |

| |

|

|

|

|

|

|

|

|

|

| Ore Mined |

kt |

538 |

530 |

1,068 |

562 |

568 |

546 |

544 |

1,090 |

| Treated Ore |

kt |

538 |

530 |

1,068 |

562 |

568 |

546 |

544 |

1,090 |

| |

|

|

|

|

|

|

|

|

|

| Grade |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Zinc |

% |

2.56 |

2.76 |

2.66 |

2.83 |

2.89 |

2.89 |

2.82 |

2.85 |

| Copper |

% |

0.14 |

0.16 |

0.15 |

0.16 |

0.16 |

0.17 |

0.15 |

0.16 |

| Lead |

% |

1.41 |

1.48 |

1.44 |

1.39 |

1.36 |

1.35 |

1.38 |

1.36 |

| Silver |

oz/t |

2.42 |

2.47 |

2.45 |

2.20 |

2.22 |

2.42 |

2.55 |

2.48 |

| Gold |

oz/t |

0.009 |

0.011 |

0.010 |

0.010 |

0.010 |

0.011 |

0.011 |

0.011 |

| |

|

|

|

|

|

|

|

|

|

| Production | metal contained |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Zinc |

kt |

12.1 |

12.9 |

24.9 |

13.9 |

14.4 |

13.8 |

13.6 |

27.5 |

| Copper |

kt |

0.1 |

0.1 |

0.2 |

0.1 |

0.1 |

0.1 |

0.1 |

0.2 |

| Lead |

kt |

6.4 |

6.6 |

13.0 |

6.5 |

6.3 |

6.0 |

6.2 |

12.2 |

| Silver |

MMoz |

1.1 |

1.1 |

2.2 |

1.0 |

1.0 |

1.1 |

1.2 |

2.2 |

| Gold |

koz |

1.7 |

2.2 |

3.9 |

2.1 |

2.0 |

2.2 |

2.3 |

4.5 |

| |

|

|

|

|

|

|

|

|

|

| Zinc sales |

kt |

12.0 |

12.7 |

24.8 |

14.2 |

14.5 |

14.5 |

14.4 |

28.9 |

| |

|

|

|

|

|

|

|

|

|

| Costs |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Cost of sales |

US$ mm |

50.2 |

49.0 |

99.2 |

57.4 |

47.8 |

48.1 |

51.8 |

99.9 |

| Cost ROM (2) |

US$/t |

65.7 |

62.0 |

63.8 |

70.6 |

57.5 |

63.1 |

60.1 |

61.6 |

| Cash cost (1) |

US$/lb |

(0.05) |

0.24 |

0.10 |

0.37 |

0.20 |

0.35 |

0.22 |

0.28 |

| Sustaining cash cost (1) |

US$/lb |

0.40 |

1.14 |

0.78 |

1.30 |

0.73 |

0.65 |

0.64 |

0.65 |

| |

|

|

|

|

|

|

|

|

|

| CAPEX |

US$ mm |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Sustaining |

|

12.0 |

25.2 |

37.2 |

28.8 |

16.7 |

9.7 |

13.4 |

23.1 |

| Other |

|

0.0 |

0.0 |

0.0 |

0.0 |

- |

(0.0) |

(0.0) |

(0.0) |

(1) Our cash cost and sustaining cash cost

are net of by-products credits, measured with respect to zinc sold per mine. For a cash cost reconciliation to COGS, please refer to Appendix

– All in Sustaining Cash Cost | Mining.

(2) Our cost per ROM is measured with respect

to treated ore volume. Refer to “Use of Non-IFRS Financial Measures” for further information.

In 2Q24, treated ore volume was 538kt,

down 2% year-over-year and up 1% quarter-over-quarter.

In 2Q24, zinc production totaled 12kt,

down 13% from 2Q23 and 6% from 1Q24. This performance was primarily due to reduced treated ore volumes and lower zinc grades during the