0001837014false00018370142024-08-072024-08-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 7, 2024

SmartRent, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

Delaware |

|

001-39991 |

|

85-4218526 |

(State or other jurisdiction of incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification Number) |

|

|

|

|

|

|

8665 E. Hartford Drive, Suite 200 Scottsdale, Arizona |

|

85255 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

(844) 479-1555

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of Each Class |

|

Trading Symbol |

|

Name of Each Exchange on Which Registered |

Class A Common Stock, par value $0.0001 per share |

|

SMRT |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On August 7, 2024, SmartRent, Inc. (the “Company”) issued a press release announcing its financial results for the second quarter ended June 30, 2024. A copy of the Company’s press release is attached hereto and incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

On August 7, 2024, the Company posted supplemental investor materials on the investor relations section of its website (investors.smartrent.com). The Company announces material information to the public about its business, its products and services, and other matters through a variety of means, including filings with the Securities and Exchange Commission, press releases, public conference calls, webcasts, and the investor relations section of its website (investors.smartrent.com) in order to achieve broad, non-exclusionary distribution of information to the public and for complying with its disclosure obligations under Regulation FD.

The information in Item 2.02 and Item 7.01 of this Current Report on Form 8-K and Exhibit 99.1 attached hereto, is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: August 7, 2024

|

|

|

|

|

|

SMARTRENT, INC. |

|

|

By: |

|

/s/ Daryl Stemm |

Name: |

|

Daryl Stemm |

Title: |

|

Interim Principal Executive Officer and Chief Financial Officer |

SmartRent Reports Second Quarter 2024 Results

Delivers Record SaaS Annual Recurring Revenue (“ARR”) of $51.2 million in Q2 2024

Scottsdale, Ariz., August 7, 2024 – (BUSINESS WIRE) – SmartRent, Inc. (NYSE: SMRT) (“SmartRent” or the “Company”), a leading provider of smart communities and smart operations solutions for the rental housing industry, today reported financial results for the three months ended June 30, 2024. Management is hosting an investor call to discuss results today, August 7, 2024, at 11:30 a.m. Eastern Time.

Financial and Business Highlights for the Second Quarter 2024

•Total Revenue of $48.5 million, decreased by 9 percent year-over year.

•SaaS Revenue of $12.8 million, increased by 32 percent year-over year.

•Net Loss of $(4.6) million, improved by 56 percent from $(10.3) million in the second quarter of 2023, a $5.7 million improvement year-over-year.

•Adjusted EBITDA of $902K, improved by 114 percent, a $7.3 million improvement year-over-year.

•Balance Sheet: $187.4 million in cash, cash equivalents and restricted cash as of June 30, 2024, no debt and an undrawn credit facility of $75 million.

Management Commentary

"SmartRent is a leader of smart solutions for the rental housing industry, distinguished by our exceptional products and services that deliver significant value to our customers," stated John Dorman, Chairman of the Board. "As we navigate this transitional phase in SmartRent’s leadership, our strategy remains sharply focused on leveraging our core strengths and the great potential SmartRent has for substantial long-term growth. We are refining our operations to better execute disciplined, strategic measures that enhance stability and scalability across our business and unlock growth."

Dorman continued, "This period of change is underpinned by our great confidence in SmartRent's fundamentals and its capacity for innovation. The newly formed Management Committee comprises talented, experienced leaders who are deeply familiar with our business and equipped to drive our key strategic initiatives forward as we conduct our search for SmartRent’s next CEO. With over seven million rental units owned and/or managed by our loyal customer base, we see immense opportunities to deepen market penetration and expand our reach. As we prepare for SmartRent's next growth phase, we are conducting a comprehensive financial review to ensure we are taking the right steps to support our vision for the future so we can continue to deliver exceptional value and improve the resident experience while driving improved performance. The Board and I are excited about our path ahead, firmly believing in our strategy and its potential to create lasting value for our shareholders."

Second Quarter 2024 Results

The Company delivered a 32% year-over-year increase in SaaS revenue, driven by improvements in SaaS ARPU and total Units Deployed, which are key metrics the Company is focused on improving to deliver more predictable growth. Over the same period, SaaS ARR increased to $51.2 million, up from $38.8 million in Q2 2023. SaaS ARPU for the quarter increased by 9%, to $5.63 from $5.16 in Q2 2023, primarily due to improvements in pricing. Additionally, Units Booked SaaS ARPU saw a decrease of 8% to $8.07 from $8.74 in Q2 2023.

Total revenue for the quarter was $48.5 million, a 9% decrease from the same quarter prior year, driven by fewer Units Shipped and New Units Deployed. Hosted services revenue for the quarter was $18.0 million, including a record $12.8 million of SaaS revenue, a 16% increase from $15.6 million from the same quarter prior year. Hardware revenue was $25.0 million, a decrease of $3.1 million or 11% from the same quarter prior year. Professional services revenue was $5.8 million, a decrease of $4.2 million, or 42% from the same quarter in the prior year.

As of June 30, 2024, total Units Deployed reached 771,870, a 19% increase with 121,546 more units compared to the same quarter prior year. The Company had 22,469 New Units Deployed during the quarter, a 53% decrease with 47,768 New Units Deployed in the same quarter prior year. Units Booked for the quarter was 37,691, an 89% increase with an additional 17,724 units compared to the same quarter prior year. Total Bookings were $45.5 million, marking a $14.0 million or 44% increase from the same quarter prior year.

In the second quarter, total gross margin improved to 35.7% from 18.5%, for a total of 1,716 basis points, from the same quarter prior year, primarily driven from changes to product mix, cost management and improvements to our operating model. SaaS gross margin improved to 75.5% from 75.1%, a 43-basis point improvement from a year ago. Total gross profit significantly increased in the second quarter to $17.3 million from $9.9 million last year, for an increase of 75%. Hardware gross profit was $8.4 million, a 44% increase from $5.8 million, due to product mix. Professional services gross loss narrowed to $3.0 million from $5.8 million in the same quarter of the previous year, primarily due to overall reduced volume in New Units Deployed, followed by the benefits of cost management initiatives. Hosted services gross profit increased to $12 million from $9.8 million in the same quarter prior year and continues to be the company’s most profitable revenue stream.

In the second quarter of 2024, operating expenses were $24.2 million in the quarter, an increase. from $21.9 in the same quarter in the prior year due to a one-time $2.3 million impairment charge related to an investment.

Net losses in the second quarter were $(4.6) million, improved from $(10.3) million in the second quarter of 2023, for a total $5.7 million improvement year-over-year. Adjusted EBITDA was $902K, a 114% improvement from $(6.4) million in the same quarter from the prior year. This marks the third consecutive quarter of positive adjusted EBITDA results.

The Company’s $50 million share repurchase program remains active. In the quarter, the company purchased approximately 765K shares, and following the close of the quarter, the company has purchased an additional 842K shares, leaving approximately $41.6 million available for future purchases. The Company ended the quarter with a cash balance of $187 million.

"Our team is taking comprehensive steps to address the increasing market headwinds and enhance both our financial stability and overall execution discipline," stated Daryl Stemm, CFO and interim Principal Executive Officer. "In response to these dynamic conditions and in light of the ongoing CEO transition, we determined it was appropriate to temporarily suspend our annual guidance. Our financial foundation remains strong with ample liquidity, and we are well positioned to advance our growth strategies. We are particularly focused on strengthening our recurring revenue streams, which are supported by an exceptionally high net revenue retention rate exceeding 100%. We are confident that these measures will not only provide predictable and repeatable revenue but also guide SmartRent’s progress towards long-term success during this pivotal phase."

SmartRent has not provided the forward-looking GAAP equivalents or a GAAP reconciliation for forward-looking Adjusted EBITDA in this presentation due to the uncertainty regarding, and the potential variability of, reconciling items such as stock-based compensation expense. Accordingly, a reconciliation of Adjusted EBITDA guidance to net income or loss is not available without unreasonable effort. However, it is important to note that material changes to reconciling items could have a significant effect on future GAAP results.

Revenue Drivers

|

|

|

|

|

|

|

For the three months ended June 30, |

|

|

|

2024 |

|

2023 |

|

% Change |

Hardware |

|

|

|

|

|

Hardware Units Shipped |

48,780 |

|

55,516 |

|

(12%) |

Hardware ARPU |

$505.86 |

|

$500.54 |

|

1% |

|

|

|

|

|

|

Professional Services |

|

|

|

|

|

New Units Deployed |

22,469 |

|

47,768 |

|

(53%) |

Professional Services ARPU |

$333.45 |

|

$264.59 |

|

26% |

|

|

|

|

|

|

Hosted Services |

|

|

|

|

|

Units Deployed (1) |

771,870 |

|

650,324 |

|

19% |

Average aggregate units deployed |

760,636 |

|

626,440 |

|

21% |

SaaS ARPU |

$5.63 |

|

$5.16 |

|

9% |

|

|

|

|

|

|

Bookings |

|

|

|

|

|

Units Booked |

37,691 |

|

19,967 |

|

89% |

Bookings (in thousands) |

$45,511 |

|

$31,539 |

|

44% |

Units Booked SaaS ARPU |

$8.07 |

|

$8.74 |

|

(8%) |

|

|

|

|

|

|

(1) As of the last date of the quarter |

|

|

|

|

|

Conference Call Information

SmartRent is hosting a conference call today, August 7, 2024, at 11:30 a.m. ET to discuss its financial results. To join the call, please register on the Company’s investor relations website here. A copy of the second quarter 2024 earnings deck is available on the Investor Relations section of SmartRent’s website.

About SmartRent

Founded in 2017, SmartRent, Inc. (NYSE: SMRT) is a leading provider of smart communities solutions and smart operations solutions to the rental housing industry. SmartRent’s end-to-end ecosystem powers smarter living and working in rental housing by automating operations, protecting assets, reducing energy consumption and more. The Company’s differentiators - purpose-built software and hardware, and end-to-end implementation and support - create an exceptional experience, with 15 of the top 20 multifamily operators and millions of users leveraging SMRT solutions daily. For more information, please visit smartrent.com.

Forward-Looking Statements

This press release contains forward-looking statements which address the Company's expected future business and financial performance, areas of focus, leadership transition, expected growth, strategy, performance, financial review, stock repurchase program and expected benefits from stock repurchase program, and other future events. Forward-looking statements may contain words such as "goal," "target," "future," "estimate," "expect," "anticipate," "intend," "plan," "believe," "seek," "project," "may," "should," "will" or similar expressions. Examples of forward-looking statements include, among others, statements regarding the expected financial results, product portfolio enhancements, expansion plans and opportunities and earnings guidance related to financial and operational metrics. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those currently anticipated. Some of the factors that could cause actual results to differ materially from those expressed or implied by the forward-looking statements include, among other things, our ability to: (1) accelerate adoption of our products and services; (2) anticipate the uncertainties inherent in the development of new business lines and business strategies; (3) manage risks associated with our third-party suppliers and manufacturers and partners for our products; (4) manage risks associated with adverse macroeconomic conditions, including inflation, slower growth or recession, barriers to trade, changes to fiscal and monetary policy, tighter credit, higher interest rates, high unemployment, and currency fluctuations; (5) attract, train, and retain effective officers, key employees and directors and manage risks associated with the leadership transition; (6) develop, design, manufacture, and sell products and services that are differentiated from those of competitors; (7) realize the benefits expected from our acquisitions; (8) acquire or make investments in other businesses, patents, technologies, products or services to grow the business; (9) successfully pursue, defend, resolve or anticipate the outcome of pending or future litigation matters; (10) comply with laws and regulations applicable to our business, including privacy regulations; (11) realize the benefits expected from our stock repurchase program; and (12) maintain key strategic relationships with partners and distributors. The forward-looking statements herein represent the judgment of the Company, as of the date of this release, and SmartRent disclaims any intent or obligation to update forward-looking statements. This press release should be read in conjunction with the information included in the Company's other press releases, reports and other filings with the SEC. Understanding the information contained in these filings is important

in order to fully understand the Company's reported financial results and our business outlook for future periods.

Use of Non-GAAP Financial Measures

In addition to disclosing financial results that are determined in accordance with GAAP, SmartRent also discloses certain non-GAAP financial measures in this press release, including EBITDA and Adjusted EBITDA These financial measures are not recognized measures under GAAP and should not be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP.

We define Adjusted EBITDA as EBITDA before the following items: stock-based compensation expense, non-recurring warranty provisions, impairment of investment in non-affiliate, compensation expenses in connection with acquisitions, non-recurring expenses in connection with acquisitions, and other expenses caused by non-recurring, or unusual, events that are not indicative of our ongoing business. We define EBITDA as net income or loss computed in accordance with GAAP before interest income/expense, income tax expense and depreciation and amortization.

EBITDA and Adjusted EBITDA may be determined or calculated differently by other companies. Reconciliations of these non-GAAP measures to the most directly comparable GAAP financial measures have been provided in the financial statement tables included in this press release, and investors are encouraged to review the reconciliations.

EBITDA and Adjusted EBITDA are not used as measures of SmartRent’s liquidity and should not be considered alternatives to net income or loss or any other measure of financial performance presented in accordance with GAAP.

SmartRent’s management uses EBITDA and Adjusted EBITDA in a number of ways to assess the Company’s financial and operating performance and believes that these measures provide useful information to investors regarding financial and business trends related to SmartRent’s results of operations. EBITDA and Adjusted EBITDA are also used to identify certain expenses and make decisions designed to help SmartRent meet its current financial goals and optimize its financial performance, while neutralizing the impact of expenses included in its operating results which could otherwise mask underlying trends in its business. SmartRent’s management believes that investors are provided with a more meaningful understanding of SmartRent’s ongoing operating performance when non-GAAP financial information is viewed with GAAP financial information.

Operating Metrics Defined

SmartRent regularly monitors several operating metrics including the following which the Company believes are key measures of its growth, to evaluate its operating performance, identify trends affecting its business, formulate business plans, measure its progress, and make strategic decisions. These metrics may not provide accurate predictions of future GAAP financial results.

Units Deployed is defined as the aggregate number of Hub Devices that have been installed (including customer self-installations) and have an active subscription as of a stated measurement date.

New Units Deployed is defined as the aggregate number of Hub Devices that were installed (including customer self-installations) and resulted in a new active subscription during a stated measurement period.

Units Shipped is defined as the aggregate number of Hub Devices that have been shipped to customers during a stated measurement period.

Units Booked is defined as the aggregate number of Hub Device units subject to binding orders executed during a stated measurement period. The Company utilizes the concept of Units Booked to measure estimated near-term resource demand and the resulting approximate range of post-delivery revenue that it will earn and record. Units Booked represent binding orders only.

Bookings represent the contract value of hardware, professional services, and the first year of ARR for binding orders executed during a stated measurement period.

Annual Recurring Revenue (“ARR”) is defined as the annualized value of our SaaS revenue earned in the current quarter.

Average Revenue per Unit (“ARPU”) is used to assess the growth and health of the overall business and reflects our ability to acquire, retain, engage and monetize our customers, and thereby drive revenue. Each revenue stream ARPU is calculated as follows:

Hardware ARPU is total hardware revenue during a given period divided by the total Units Shipped during the same period.

Professional Services ARPU is total professional services revenue during a given period divided by the total New Units Deployed, excluding customer self-installations, during the same period.

SaaS ARPU is total SaaS revenue during a given period divided by the average aggregate Units Deployed in the same period.

Units Booked SaaS ARPU is the first year ARR for binding orders executed during the stated measurement period divided by the total Units Booked in the same period.

Net Revenue Retention is defined as SaaS revenue at the end of the current period related to properties which had SaaS revenue at the end of the same period in the prior year, divided by SaaS revenue at the end of the same period in the prior year for those same properties. This includes any reductions in revenue caused by cancellations or downgrades, offset by additions to revenue from price increases on existing products, and additions of new products at existing properties.

SMARTRENT, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(in thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended June 30, |

|

|

For the six months ended June 30, |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

Hardware |

|

$ |

24,676 |

|

|

$ |

27,788 |

|

|

$ |

53,753 |

|

|

$ |

65,113 |

|

|

Professional services |

|

|

5,816 |

|

|

|

10,050 |

|

|

|

9,274 |

|

|

|

22,819 |

|

|

Hosted services |

|

|

18,026 |

|

|

|

15,564 |

|

|

|

35,980 |

|

|

|

30,549 |

|

|

Total revenue |

|

|

48,518 |

|

|

|

53,402 |

|

|

|

99,007 |

|

|

|

118,481 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

Hardware |

|

|

16,318 |

|

|

|

21,990 |

|

|

|

35,002 |

|

|

|

54,562 |

|

|

Professional services |

|

|

8,869 |

|

|

|

15,809 |

|

|

|

15,317 |

|

|

|

33,443 |

|

|

Hosted services |

|

|

6,026 |

|

|

|

5,720 |

|

|

|

11,960 |

|

|

|

11,478 |

|

|

Total cost of revenue |

|

|

31,213 |

|

|

|

43,519 |

|

|

|

62,279 |

|

|

|

99,483 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

7,484 |

|

|

|

6,536 |

|

|

|

15,846 |

|

|

|

13,767 |

|

|

Sales and marketing |

|

|

4,716 |

|

|

|

4,829 |

|

|

|

9,270 |

|

|

|

9,990 |

|

|

General and administrative |

|

|

12,023 |

|

|

|

10,605 |

|

|

|

28,689 |

|

|

|

22,622 |

|

|

Total operating expense |

|

|

24,223 |

|

|

|

21,970 |

|

|

|

53,805 |

|

|

|

46,379 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations |

|

|

(6,918 |

) |

|

|

(12,087 |

) |

|

|

(17,077 |

) |

|

|

(27,381 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income, net |

|

|

2,290 |

|

|

|

1,815 |

|

|

|

4,699 |

|

|

|

3,831 |

|

|

Other income (expense), net |

|

|

91 |

|

|

|

(59 |

) |

|

|

194 |

|

|

|

(3 |

) |

|

Loss before income taxes |

|

|

(4,537 |

) |

|

|

(10,331 |

) |

|

|

(12,184 |

) |

|

|

(23,553 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax expense |

|

|

68 |

|

|

|

18 |

|

|

|

113 |

|

|

|

11 |

|

|

Net loss |

|

$ |

(4,605 |

) |

|

$ |

(10,349 |

) |

|

$ |

(12,297 |

) |

|

$ |

(23,564 |

) |

|

Other comprehensive loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment |

|

|

(11 |

) |

|

|

(9 |

) |

|

|

(5 |

) |

|

|

95 |

|

|

Comprehensive loss |

|

$ |

(4,616 |

) |

|

$ |

(10,358 |

) |

|

$ |

(12,302 |

) |

|

$ |

(23,469 |

) |

|

Net loss per common share |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

$ |

(0.02 |

) |

|

$ |

(0.05 |

) |

|

$ |

(0.06 |

) |

|

$ |

(0.12 |

) |

|

Weighted-average number of shares used in computing net loss per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

201,986 |

|

|

|

199,619 |

|

|

|

202,735 |

|

|

|

198,980 |

|

|

SMARTRENT, INC.

CONSOLIDATED BALANCE SHEETS

(in thousands, except per share amounts)

|

|

|

|

|

|

|

As of |

|

|

June 30, 2024 |

|

December 31, 2023 |

ASSETS |

|

|

|

|

Current assets |

|

|

|

|

Cash and cash equivalents |

|

$ 187,435 |

|

$ 215,214 |

Restricted cash, current portion |

|

247 |

|

495 |

Accounts receivable, net |

|

65,220 |

|

61,903 |

Inventory |

|

34,420 |

|

41,575 |

Deferred cost of revenue, current portion |

|

11,335 |

|

11,794 |

Prepaid expenses and other current assets |

|

15,179 |

|

9,359 |

Total current assets |

|

313,836 |

|

340,340 |

Property and equipment, net |

|

1,319 |

|

1,400 |

Deferred cost of revenue |

|

6,555 |

|

11,251 |

Goodwill |

|

117,268 |

|

117,268 |

Intangible assets, net |

|

25,312 |

|

27,249 |

Other long-term assets |

|

11,057 |

|

12,248 |

Total assets |

|

$ 475,347 |

|

$ 509,756 |

|

|

|

|

|

LIABILITIES, CONVERTIBLE PREFERRED STOCK AND STOCKHOLDERS' EQUITY |

|

|

|

|

Current liabilities |

|

|

|

|

Accounts payable |

|

$ 6,449 |

|

$ 15,076 |

Accrued expenses and other current liabilities |

|

26,696 |

|

24,976 |

Deferred revenue, current portion |

|

67,187 |

|

77,257 |

Total current liabilities |

|

100,332 |

|

117,309 |

Deferred revenue |

|

44,671 |

|

45,903 |

Other long-term liabilities |

|

961 |

|

4,096 |

Total liabilities |

|

145,964 |

|

167,308 |

|

|

|

|

|

Commitments and contingencies (Note 12) |

|

|

|

|

Convertible preferred stock, $0.0001 par value; 50,000 shares authorized as of June 30, 2024 and December 31, 2023; no shares of preferred stock issued and outstanding as of June 30, 2024 and December 31, 2023 |

|

- |

|

- |

|

|

|

|

|

Stockholders' equity |

|

|

|

|

Class A common stock, $0.0001 par value; 500,000 shares authorized as of June 30, 2024 and December 31, 2023, respectively; 202,169 and 203,327 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively |

|

20 |

|

20 |

Additional paid-in capital |

|

633,793 |

|

628,156 |

Accumulated deficit |

|

(304,209) |

|

(285,512) |

Accumulated other comprehensive loss |

|

(221) |

|

(216) |

Total stockholders' equity |

|

329,383 |

|

342,448 |

Total liabilities, convertible preferred stock and stockholders' equity |

$ 475,347 |

|

$ 509,756 |

SMARTRENT, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

|

|

|

|

|

|

|

For the six months ended June 30, |

|

|

2024 |

|

2023 |

Net loss |

|

$ (12,297) |

|

$ (23,564) |

Adjustments to reconcile net loss to net cash used by operating activities |

|

|

|

|

Depreciation and amortization |

|

3,086 |

|

2,596 |

Impairment of investment in non-affiliate |

|

2,250 |

|

- |

Provision for warranty expense |

|

(837) |

|

- |

Non-cash lease expense |

|

732 |

|

412 |

Stock-based compensation related to acquisition |

|

- |

|

109 |

Stock-based compensation |

|

6,565 |

|

6,847 |

Compensation expense related to acquisition |

|

- |

|

1,769 |

Change in fair value of earnout related to acquisition |

|

140 |

|

306 |

Non-cash interest expense |

|

72 |

|

65 |

Provision for excess and obsolete inventory |

|

120 |

|

47 |

Provision for expected credit losses |

|

1,360 |

|

(1) |

Non-cash legal expense (Note 12 “Commitments and Contingencies”) |

|

4,955 |

|

- |

Change in operating assets and liabilities |

|

- |

|

|

Accounts receivable |

|

(4,712) |

|

2,416 |

Inventory |

|

2,059 |

|

15,188 |

Deferred cost of revenue |

|

5,155 |

|

7,285 |

Prepaid expenses and other assets |

|

(1,839) |

|

(6,311) |

Accounts payable |

|

(8,663) |

|

(12,059) |

Accrued expenses and other liabilities |

|

(3,339) |

|

(13,201) |

Deferred revenue |

|

(11,208) |

|

2,878 |

Lease liabilities |

|

(813) |

|

(466) |

Net cash used in operating activities |

|

(17,214) |

|

(15,684) |

CASH FLOWS FROM INVESTING ACTIVITIES |

|

|

|

|

Purchase of property and equipment |

|

(275) |

|

(49) |

Capitalized software costs |

|

(1,722) |

|

(2,279) |

Net cash used in investing activities |

|

(1,997) |

|

(2,328) |

CASH FLOWS FROM FINANCING ACTIVITIES |

|

|

|

|

Payments for repurchases of Class A common stock |

|

(6,381) |

|

- |

Proceeds from options exercise |

|

2 |

|

71 |

Proceeds from ESPP purchases |

|

337 |

|

438 |

Taxes paid related to net share settlements of stock-based compensation awards |

|

(1,267) |

|

(1,085) |

Payment of earnout related to acquisition |

|

(1,530) |

|

(1,702) |

Net cash used in provided by financing activities |

|

(8,839) |

|

(2,278) |

Effect of exchange rate changes on cash and cash equivalents |

|

23 |

|

41 |

Net decrease (increase) in cash, cash equivalents, and restricted cash |

|

(28,027) |

|

(20,249) |

Cash, cash equivalents, and restricted cash - beginning of period |

|

215,709 |

|

217,713 |

Cash, cash equivalents, and restricted cash - end of period |

|

$ 187,682 |

|

$197,464 |

|

|

|

|

|

Reconciliation of cash, cash equivalents, and restricted cash to the consolidated balance sheets |

|

|

|

|

Cash and cash equivalents |

|

$ 187,435 |

|

$ 196,970 |

Restricted cash, current portion |

|

247 |

|

247 |

Restricted cash, included in other long-term assets |

|

- |

|

247 |

Total cash, cash equivalents, and restricted cash |

|

$ 187,682 |

|

$ 197,464 |

SMARTRENT, INC.

RECONCILIATION OF NON-GAAP MEASURES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended June 30, |

|

|

For the six months ended June 30, |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

(dollars in thousands) |

|

|

(dollars in thousands) |

|

Net loss |

$ |

(4,605 |

) |

|

$ |

(10,349 |

) |

|

$ |

(12,297 |

) |

|

$ |

(23,564 |

) |

Interest income, net |

|

(2,290 |

) |

|

|

(1,815 |

) |

|

|

(4,699 |

) |

|

|

(3,831 |

) |

Income tax expense |

|

68 |

|

|

|

18 |

|

|

|

113 |

|

|

|

11 |

|

Depreciation and amortization |

|

1,585 |

|

|

|

1,342 |

|

|

|

3,086 |

|

|

|

2,596 |

|

EBITDA |

|

(5,242 |

) |

|

|

(10,804 |

) |

|

|

(13,797 |

) |

|

|

(24,788 |

) |

Legal matter |

|

- |

|

|

|

- |

|

|

|

5,300 |

|

|

|

- |

|

Stock-based compensation |

|

3,284 |

|

|

|

3,276 |

|

|

|

6,565 |

|

|

|

6,956 |

|

Impairment of investment in non-affiliate |

|

2,250 |

|

|

|

- |

|

|

|

2,250 |

|

|

|

- |

|

Non-recurring warranty provision |

|

463 |

|

|

|

|

|

|

463 |

|

|

|

- |

|

Compensation expense in connection with acquisitions |

|

- |

|

|

|

370 |

|

|

|

- |

|

|

|

1,995 |

|

Other acquisition expenses |

|

117 |

|

|

|

226 |

|

|

|

257 |

|

|

|

431 |

|

Other non-operating expenses |

|

30 |

|

|

|

488 |

|

|

|

261 |

|

|

|

488 |

|

Adjusted EBITDA |

$ |

902 |

|

|

$ |

(6,444 |

) |

|

$ |

1,299 |

|

|

$ |

(14,918 |

) |

Investor Contact

Kelly Reisdorf

Head of Investor Relations

investors@smartrent.com

Media Contact

Amanda Chavez

Senior Director, Corporate Communications

media@smartrent.com

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

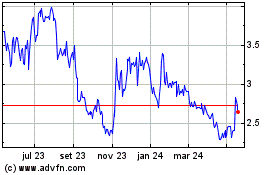

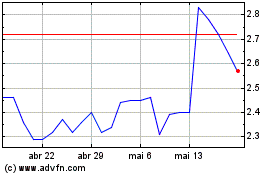

SmartRent (NYSE:SMRT)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

SmartRent (NYSE:SMRT)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024