0001444192false00014441922024-08-122024-08-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 12, 2024 |

ACASTI PHARMA INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Quebec |

001-35776 |

98-1359336 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

103 Carnegie Center Suite 300 |

|

Princeton, New Jersey |

|

08540 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 818 839-4378 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Shares, no par value per share |

|

ACST |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On August 12, 2024, Acasti Pharma Inc. (the “Company”) entered into an employment agreement with Prashant Kohli, the Company’s Chief Executive Officer (the “Letter Agreement”). Pursuant to the Letter Agreement, Mr. Kohli is entitled to receive an annual base salary of $500,000 and an annual discretionary bonus of up to 50% of his annual base salary as determined by the Board of Directors (the “Board”). In order to earn the discretionary bonus, Mr. Kohli must remain employed with the Company throughout the year for which the bonus is paid, and must be actively employed in good standing on the date in which the bonus is paid.

In addition, the Letter Agreement provides that, subject to approval by the Board, Mr. Kohli may be granted from time to time an option (an “Option”) to purchase common shares of the Company (“Common Shares”) pursuant to the Company’s stock option plan (the “Plan”), with a price per share equal to the fair market value of a Common Share, as determined by the Board at the time of the grant, which will be conditioned upon (a) Mr. Kohli’s continued employment with the Company at the time of the grant, (b) entering into an option agreement with the Company (an “Option Agreement”) and (c) any other terms and conditions set forth in the Plan, the applicable Option Agreement and as may be determined by the Board in its sole discretion at the time of grant.

The term of the Letter Agreement commenced on August 12, 2024 and continues until terminated in accordance therewith. Either the Company or Mr. Kohli may terminate the Letter Agreement at any time, upon advanced written notice. The Letter Agreement also imposes certain confidentiality, non-competition and non-solicitation obligations on Mr. Kohli during the term of the Letter Agreement and for a specified time thereafter. The Letter Agreement provides for standard Company benefits, such as paid vacation and participation in the Company’s employee benefit plans and programs.

In the event that Mr. Kohli’s employment is terminated by the Company without Cause (as defined in the Letter Agreement), including after a change of control, and subject to his delivery to the Company of a general release of claims in a form acceptable to the Company, the Company will pay Mr. Kohli a continuation of his base salary then in effect for twelve (12) months after termination.

In connection with executing the Letter Agreement, Mr. Kohli also entered into the Company’s standard form of Confidentiality of Information and Ownership of Proprietary Property Agreement, which, among other things, (a) acknowledges the Company’s ownership rights in any proprietary property, (b) assigns any such ownership rights to the Company and (c) prohibits Mr. Kohli from disclosing certain confidential or proprietary information of the Company.

The foregoing description of the Letter Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Letter Agreement, which is attached to this Current Report on Form 8-K as Exhibit 10.1 and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

ACASTI PHARMA INC. |

|

|

|

|

Date: |

August 16, 2024 |

By: |

/s/ Robert J. DelAversano |

|

|

|

Robert J. DelAversano

Vice President, Finance |

August 12, 2024

PRIVATE AND CONFIDENTIAL

Prashant Kohli

31 Northrup Court,

Newtown, PA 18940

p.kohli@acasti.com

Dear Prashant:

This Letter Agreement (“Letter Agreement”) sets forth the terms and conditions of your employment with Acasti Pharma Inc. (the "Company”), and supersedes in its entirety the Welcome Letter between you and Acasti, dated August 25, 2021.

Title: Chief Executive Officer

Reporting to: The Board of Directors

Base Salary: Annualized base salary of $500,000 less applicable deductions and withholdings.

Annual Discretionary

Bonus: You will be eligible to earn an annual discretionary bonus of up to 50% of your base salary as determined by the Company in its sole discretion. The discretionary bonus, if any, for a given year will be paid no later than May 15th in the year following the completion of the relevant fiscal year. In order to earn the discretionary bonus, you must remain employed with the Company throughout the year for which the bonus is paid, and must be actively employed in good standing on the date in which the bonus is paid.

Stock Option: Subject to approval by the board of directors of the Company, you may be granted from time to time an option to purchase common shares in the capital of the Company (the “Option”) pursuant to the Company’s equity incentive plan (the “Plan”), with a price per share equal to the fair market value of a common share, as determined by the board of directors at the time of the grant. Any grant of the Option to you shall be conditional upon: (a) your continued employment with the Company at the time of the grant; (b) you entering into an option agreement with the Company (the “Option Agreement”); and (c) any other terms and conditions set forth in the

Plan, your Option Agreement and as may be determined by the board of directors in its sole discretion at the time of grant.

Benefits: Subject to the terms and conditions of the applicable benefit plans and policies, you will be eligible to participate in such group benefit plans as the Company may make available for executives from time to time in its sole discretion.

Vacation: Vacation entitlement, including treatment of unused vacation time, will be in accordance with the Company’s vacation policy for executives as in effect from time to time.

Severance: If you are terminated by the Company without Cause (as defined below) including after change of control, provided that you execute and deliver to Company within sixty (60) days of your termination a general release of claims in a form acceptable to the Company, and do not revoke the same, the Company shall pay you a continuation of your base salary then in effect for twelve (12) months if your employment is terminated without Cause.

For the purposes of this Letter Agreement, “Cause” shall mean your (a) material failure to comply with any material Company policy to the satisfaction of the Board which is not cured within twenty (20) calendar days of receipt by you of notice of such failure (if such action is curable); (b) willful failure to carry out or comply with any material, lawful, and reasonable written directive from the Board, which is not cured within twenty (20) calendar days of receipt by you of notice of such failure (if such action is curable); (c) commission of any act or omission that results in, or that may reasonably be expected to result in, a conviction, plea of no contest or imposition of unadjudicated probation for any felony or any crime involving moral turpitude; (d) commission of any act or omission that results in your incarceration in a federal, state, or local jail or prison; (e) unlawful use (including being under the influence) or possession of illegal drugs on the Company’s premises or while performing your duties and responsibilities to the Company; (f) commission of any act of dishonestly, illegal conduct, fraud, embezzlement, misappropriation, material misconduct, or breach of fiduciary duty either (i) against the Company or any of its parent, subsidiary, or affiliate entities (collectively, “Affiliates”) (or any predecessor thereto or successor thereof) or (y) which is or which is reasonably expected to be materially injurious to the Company or its

Affiliates; or (g) material or willful breach of the Confidentiality Agreement (defined below) which is not cured within ten (10) calendar days after receipt by you of written notice of such breach (if such breach is curable).

Non-Competition You undertake to not work, for the duration of this Letter Agreement and for a period of twelve (12) months following the end of this contract for any reason whatsoever, directly or indirectly, personally or through an intermediary, alone or through a company or corporation, jointly with any other person, company, or corporation, as a principal, agent, shareholder, or in any other capacity, within the territories of any country in which the Company does business or in any jurisdiction in which the Company holds patents, for a company of a similar nature as that operated by the Company, which presently is a late-stage biopharmaceutical company pursuing the 505(b)2 regulatory pathway with drug candidates addressing rare and orphan diseases, specifically aneurysmal subarachnoid hemorrhage, ataxia-telangiectasia, postherpetic neuralgia and other undisclosed indications associated with GTX-201, and to not use the Company's know-how for any purpose whatsoever (a “Competitive Business”). You understand that the Company’s business is subject to change over time and the definition of Competitive Business shall be subject to corresponding changes as mutually agreed between parties. However, nothing precludes you from being or becoming a shareholder in a public company with a Competitive Business, i.e., a company whose shares are publicly traded, competing with the Company, provided you hold no more than 5% of the shares issued and outstanding comprising said public company’s capital stock.

Non-Solicitation For the duration of this Letter Agreement and for a period of twelve (12) months following the end of this Letter Agreement for any reason whatsoever, you undertake to not directly or indirectly solicit or convince any other person, including an employee of the Company, to terminate his/her business or employment relations with the Company, or to commit any act likely to harm or rival the Company.

Simultaneous to signing this Letter Agreement, you agree to execute the Company’s standard form Confidentiality of Information and Ownership of Proprietary Property Agreement (“Confidentiality Agreement”). You further agree that your continued employment constitutes good and sufficient consideration for the enforcement of the provisions set forth herein and in the Confidentiality Agreement. You agree that the restrictive covenants herein and in the

Confidentiality Agreement are reasonable for the position you hold and the benefits and amenities provided for in your Letter Agreement. If a court of competent jurisdiction determines that any provision of this Letter Agreement (or portion thereof) is invalid or unenforceable, then the invalidity or unenforceability of that provision (or portion thereof) shall not affect the validity or enforceability of any other provision of this Letter Agreement, and all other provisions shall remain in full force and effect. It is the intention of the parties that any such invalid or unenforceable provision be reformed and enforced to the fullest extent permitted by law. Further, you acknowledge that it may be impossible to assess the damages caused by your violation of the restrictive covenants herein and in the Confidentiality Agreement and further agree that any threatened or actual violation or breach of those provision will constitute immediate and irreparable injury to the Company. You therefore agree that any such breach of this Agreement is a material breach of this Agreement and/or the Confidentiality Agreement, and, in addition to any and all other damages and remedies available to the Company upon your breach of this Agreement and/or the Confidentiality Agreement, the Company shall be entitled to an injunction to prevent you from violating or breaching this Agreement and/or the Confidentiality Agreement.

Your employment with the Company is at-will, which means that you have the right to terminate your employment with the Company at any time, for any reason. Similarly, the Company has the right to terminate the employment relationship at any time, for any reason.

If your employment is terminated without Cause, the Company shall provide you with up to 60 days’ advance written notice. The Company may, at any time during such notice period, relieve you from all or any of your duties for all or part of the remainder of the notice period and/or terminate you at any time without impact to salary for the remainder of the notice period.

If you resign your employment, you agree to provide the Company with 60 days’ advance written notice. The Company may, at any time during such notice period, relieve you from all or any of your duties for all or part of the remainder of the notice period and/or consider your resignation effective as of any date within the notice period. In the event that the Company accepts your resignation as of any date within the notice period, as of such date, you shall not be paid your base salary or other benefits in accordance with this Letter Agreement, and you shall not be entitled to any severance benefits.

Any contrary representations, which may have been made to you, are superseded by this Letter Agreement. Any modifications to this “at-will” term of your employment must be in writing and signed by you and the Board.

This Letter Agreement shall be governed by the laws of the Commonwealth of Pennsylvania, without regard to conflicts of law.

We look forward to your continued commitment to the Company and the goal of advancing science in support of better patient outcomes.

Sincerely,

Vimal Kavuru

I have read, understand and accept these terms and conditions of employment. I further understand that while my salary, benefits, job title and job duties may change from time to time without a written modification of this agreement, the at-will term of my employment is a term of employment which cannot be altered or modified except in writing, signed by me and the Company’s Board of Directors. By accepting this offer, I confirm that I am able to accept this job and carry out the work involved without breaching any legal restrictions on my activities, such as restrictions imposed by a current or former employer.

Signature /s/ Prashant Kohli Date August 12, 2024

ACASTI PHARMA Inc.

By: /s/ Robert J. DelAversano

Name: Robert J. DelAversano

Title: Vice President, Finance

Date: August 12, 2024

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

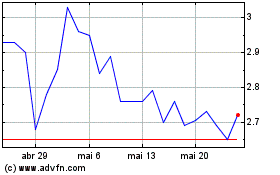

Acasti Pharma (NASDAQ:ACST)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Acasti Pharma (NASDAQ:ACST)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025