As filed with the Securities and Exchange

Commission on September 4, 2024

Registration

No. 333-280726

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

POST-EFFECTIVE AMENDMENT NO. 1 ON FORM S-8

TO FORM S-4 REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Noble Corporation

plc

(Exact name of registrant as specified in its charter)

England and Wales

(State or Other Jurisdiction of Incorporation or Organization) |

98-1644664

(I.R.S. Employer Identification No.) |

13135 Dairy Ashford, Suite 800

Sugar Land, Texas 77478

(281) 276-6100

(Address of Principal Executive Offices, Zip Code)

Diamond Offshore

Drilling, Inc. 2021 Long-Term Stock Incentive Plan

(Full title of the plans)

Jennie P. Howard

Senior Vice President, General Counsel, and Corporate Secretary

Noble Corporation plc

13135 Dairy Ashford

Suite 800

Sugar Land, Texas 77478

(281) 276-6100

(Name, address, including zip code, and telephone number, including area code, of agent for service)

_______________________________

Copies of all

communications, including communications sent to agent for service, should be sent to:

Scott A. Barshay

Kyle T. Seifried

Paul, Weiss, Rifkind, Wharton &

Garrison LLP

1285 Avenue of the Americas

New York, NY 10019-6064

(212) 373-3000

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer ☒ |

|

Accelerated filer ☐ |

|

| |

Non-accelerated filer ☐ |

|

Smaller reporting company ☐ |

|

| |

|

|

Emerging growth company ☐ |

|

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 7(a)(2)(B) of the Securities Act.

EXPLANATORY NOTE

Noble Corporation plc, a public limited company

organized under the laws of England and Wales (the “Registrant” or “Noble”) hereby

amends its original registration statement on Form S-4 (File No. 333-280726) filed with the Securities and Exchange Commission (the “Commission”)

on July 8, 2024, as amended by the pre-effective Amendment No. 1 thereto filed with the Commission on July 19, 2024 (the “Form

S-4”), which the Commission declared effective at 4:00 p.m. Eastern Time on July 25, 2024, by filing this post-effective

Amendment No. 1 on Form S-8 (this “Post-Effective Amendment” and together with the Form S-4, this “Registration

Statement”).

Noble filed the Form S-4 in connection with

the merger contemplated by the Agreement and Plan of Merger (the “Merger Agreement”), dated as of June 9, 2024,

by and among Noble, Diamond Offshore Drilling, Inc., a Delaware corporation (“Diamond Offshore”), Dolphin Merger

Sub 1, Inc., a Delaware corporation and indirect wholly owned subsidiary of Noble (“Merger Sub 1”), and Dolphin

Merger Sub 2, Inc., a Delaware corporation and indirect wholly owned subsidiary of Noble (“Merger Sub 2”). Effective

as of September 4, 2024, Merger Sub 1 merged with and into Diamond Offshore (the “First Merger”), with Diamond

Offshore surviving and becoming an indirect wholly owned subsidiary of Noble, and immediately thereafter, Diamond Offshore, as the surviving

entity in the First Merger, merged with and into Merger Sub 2, with Merger Sub 2 surviving and continuing as an indirect wholly owned

subsidiary of Noble.

Pursuant to the terms of the Merger Agreement, at the effective time of

the First Merger (the “Effective Time”), each then outstanding performance-vesting restricted stock unit (a

“PSU”) or time-vesting restricted stock unit (an “RSU”) covering shares of Diamond

Offshore common stock (each, a “Diamond PSU” and a “Diamond RSU”, respectively) ceased

to represent a right to acquire shares of Diamond Offshore common stock (or value equivalent to shares of Diamond Offshore common stock)

and was converted, at the Effective Time, into the right to acquire a number of Ordinary Shares (as defined below) equal to the product

of (i) the number of Diamond Offshore common stock subject to such Diamond PSU or Diamond RSU, as applicable, immediately prior to the

Effective Time and (ii) the sum of (a) the Exchange Ratio (as defined in the Merger Agreement) plus (b) the quotient of (1) the Per Share

Cash Consideration (as defined in the Merger Agreement), divided by (2) the closing price on the New York Stock Exchange for Ordinary

Shares on the last trading day immediately preceding the Effective Time. Under this formula, Diamond PSUs were converted

into RSUs covering Ordinary Shares (“Noble RSUs”) based on the greater of (x) actual Diamond Offshore performance

level achieved and (y) target Diamond Offshore performance level, in each case as determined under the performance criteria as otherwise

provided in the applicable award agreements of such Diamond PSUs, which Noble RSUs will otherwise vest on the same terms and conditions as were applicable under

the Diamond PSUs.

The Registrant hereby amends the Form S-4 by

filing this Post-Effective Amendment relating to 1,921,321 A ordinary shares of the Registrant, par value $0.00001 per share

(“Ordinary Shares”), issuable pursuant to the Diamond Offshore Drilling, Inc. 2021 Long-Term Stock

Incentive Plan (the “2021 LTIP”). All such Ordinary Shares were previously registered on the Form

S-4 but will be subject to issuance pursuant to this Post-Effective Amendment.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The information to be specified in Item 1 and Item

2 of Part I of this Post Effective Amendment is omitted from this filing in accordance with the provisions of Rule 428 under the Securities

Act of 1933, as amended (the “Securities Act”), and the introductory note to Part I of Form S-8. The documents

containing the information to be specified in Part I will be delivered to the holders as required by Rule 428(b)(1).

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents filed by the Registrant

with the Commission pursuant to the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), are incorporated by reference into, and shall be deemed to be a part of, this Post-Effective Amendment:

| · | Annual Report on Form 10-K for the year ended December 31, 2023, filed with the Commission on February 23, 2024 (the “Annual

Report”); |

| · | The information contained in Noble’s Definitive Proxy Statement on Schedule 14A, filed with the Commission on April 10, 2024

and incorporated into Part III of the Annual Report; |

| · | Quarterly Reports on Form 10-Q for the quarters ended March 31, 2024 and June 30, 2024, filed with the Commission on May 7, 2024 and

August 1, 2024, respectively; |

| · | Current Reports on Form 8-K filed on May 21, 2024, June 10, 2024, June 27, 2024, July 26, 2024, August 8, 2024, August 9, 2024 and

August 22, 2024 (other than the portions of those documents not deemed to be filed pursuant to the rules promulgated under the Exchange

Act); and |

| · | The description of the Ordinary Shares contained in Exhibit 4.2 to the Annual Report (which updates and supersedes the description

in Noble’s registration statements filed under Section 12 of the Exchange Act), including any amendment or report filed with the

Commission for the purpose of updating this description. |

All documents filed by the Registrant pursuant

to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act subsequent to the date of this Post-Effective Amendment (other than any such

documents or portions thereof that are furnished under Item 2.02 or Item 7.01 of Form 8-K, unless otherwise indicated therein, including

any exhibits included with such Items), prior to the filing of a post-effective amendment to this Post-Effective Amendment, which indicates

that all securities offered hereby have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated

by reference in this Post-Effective Amendment and to be a part hereof from the date of filing of such documents.

Any statement contained in this Post-Effective

Amendment or in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded

for purposes of this Post-Effective Amendment to the extent that a statement contained or incorporated by reference herein or in any subsequently

filed document that is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified

or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Post-Effective Amendment.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

Not applicable.

Item 6. Indemnification of Directors and

Officers.

Noble is a public limited company incorporated

under the laws of England and Wales. Chapter 7 of Part 10 of the Companies Act contains provisions in respect of the protection of directors

from liability. All statutory references in this Item 20 are to the Companies Act.

Section 232(1) makes void any provision that

purports to exempt a director of a company from any liability that would otherwise attach to him in connection with any negligence, default,

breach of duty or breach of trust in relation to the company.

Section 232(2) makes void any provision by

which a company directly or indirectly provides an indemnity for a director of the company (or of an associated company) against any liability

attaching to him in connection with any negligence, default, breach of duty or breach of trust in relation to the company, except as permitted

by:

(a) liability insurance pursuant to Section

233;

(b) qualifying third-party indemnity provisions

falling within Section 234; and

(c) qualifying pension scheme indemnity provisions

falling within Section 235.

Section 233 permits liability insurance, commonly

known as directors’ and officers’ liability insurance, purchased and maintained by a company against liability for negligence,

default, breach of duty or breach of trust in relation to the company.

Section 234 allows for Noble to provide an

indemnity against liability incurred by a director to someone other than Noble or an associated company. Such an indemnity does not permit

indemnification against liability to pay (i) criminal fines, (ii) penalties to a regulatory authority, (iii) the costs of an unsuccessful

defense of criminal proceedings, (iv) the costs of an unsuccessful defense of civil proceedings brought by Noble or an associated company

or (v) the costs in connection with an application for relief under Sections 661(3) or (4) (power of court to grant relief in case of

acquisition of shares by innocent nominee) or 1157 (general power of court to grant relief in case of honest and reasonable conduct).

Any indemnity provided under Section 234 must

be disclosed in Noble’s annual report in accordance with Section 236 and copies of such indemnification provisions made available

for inspection in accordance with Section 237 (and every member has a right to inspect and request such copies under Section 238).

Conduct of a director amounting to negligence, default, breach of

duty or breach of trust in relation to the company can be ratified, in accordance with Section 239, by a resolution of the members of

the company, disregarding the votes of the director (if a member) and any connected member.

To the extent permitted by the Companies Act

(as amended from time to time) and without prejudice to any indemnity to which any person may otherwise be entitled, Noble’s articles

authorize indemnification to the fullest extent permitted under law.

Where a person is indemnified against any liability

in accordance with this Item 20, such indemnity shall extend, to the extent permitted by the Companies Act, to all costs, charges, losses,

expenses and liabilities incurred by him in relation thereto.

In accordance with the authorization set out

in Noble’s articles, to the fullest extent permitted by law and without prejudice to any other indemnity to which the director may

otherwise be entitled, Noble has entered into deeds of indemnity with its directors and officers. Under the deeds of indemnity, Noble

will indemnify its directors and officers to the fullest extent permitted or authorized by the Companies Act, as it may from time to time

be amended, or by any other statutory provisions authorizing or permitting such indemnification.

The directors of Noble will, to the fullest

extent permitted by law, also be entitled to coverage pursuant to Noble’s current directors’ and officers’ liability

insurance. The directors and officers of Noble are covered by policies of insurance under which they are insured, within limits and subject

to limitations, against certain expenses not indemnifiable by Noble in connection with the defense of actions, suits or proceedings, and

certain liabilities not indemnifiable by Noble that might be imposed as a result of such actions, suits or proceedings, in which they

are parties by reason of being or having been directors or officers.

Item 7. Exemption from Registration Claimed.

Not applicable.

Item 8. Exhibits.

* Filed herewith.

Item 9. Undertakings.

| (a) | The undersigned Registrant hereby undertakes: |

| (1) | To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement: |

| (i) | To include any prospectus required by Section 10(a)(3) of the Securities Act;

|

| (ii) | To reflect in the prospectus any facts or events arising after the effective date of this Registration Statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth

in this Registration Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total

dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated

maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if in the aggregate,

the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation

of Registration Fee” table in this effective Registration Statement; and

|

| (iii) | To include any material information with respect to the plan of distribution not previously disclosed in this Registration Statement

or any material change to such information in this Registration Statement; |

provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii)

of this section do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained

in reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that

are incorporated by reference in this Registration Statement.

| (2) | That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to

be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be

deemed to be the initial bona fide offering thereof.

|

| (3) | To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering. |

| (b) | The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing

of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing

of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in

this Registration Statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering

of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

| (c) | Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling

persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the

Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event

that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a

director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by

such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion

of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether

such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication

of such issue. |

SIGNATURES

Pursuant to the requirements of the Securities

Act, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and

has duly caused this Post-Effective Amendment on Form S-8 to the Registration Statement on Form S-4 to be signed on its behalf by the

undersigned, thereunto duly authorized, in Sugar Land, Texas, on this 4th day of September, 2024.

| |

NOBLE CORPORATION plc |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Robert W. Eifler |

|

| |

|

Robert W. Eifler |

|

| |

|

President and Chief Executive Officer |

|

Pursuant to the requirements of the Securities Act of 1933, this

Post-Effective Amendment on Form S-8 to the Registration Statement on Form S-4 has been signed by the following persons in the capacities

indicated on the date indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/ Robert W. Eifler |

|

Director, President and Chief Executive Officer

(Principal Executive Officer) |

|

September 4, 2024 |

| Robert W. Eifler |

|

|

|

| |

|

|

|

|

| /s/ Richard B. Barker |

|

Executive Vice President and Chief Financial Officer

(Principal Financial Officer) |

|

September 4, 2024 |

| Richard B. Barker |

|

|

|

| |

|

|

|

|

| /s/ Jennifer Yeung |

|

Vice President, Chief Accounting Officer and Controller

(Principal Accounting Officer) |

|

September 4, 2024 |

| Jennifer Yeung |

|

|

|

| |

|

|

|

|

| * |

|

Director and Chairman |

|

September 4, 2024 |

| Charles M. Sledge |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

September 4, 2024 |

| Claus V. Hemmingsen |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

September 4, 2024 |

| Alan J. Hirshberg |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

September 4, 2024 |

| Kristin H. Holth |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

September 4, 2024 |

| H. Keith Jennings |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

September 4, 2024 |

| Alastair J. Maxwell |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

September 4, 2024 |

| Ann D. Pickard |

|

|

|

|

| |

|

|

|

|

|

|

Director |

|

September 4, 2024 |

| Patrice Douglas |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

| |

* By: |

/s/ Jennie Howard |

|

| |

|

Jennie Howard |

|

| |

|

Attorney-In-Fact |

|

| |

|

|

|

EXHIBIT 5.1

Travers Smith LLP 10 Snow Hill, London, EC1A 2AL

T: +44 (0)20 7295 3000 | www.traverssmith.com

|

Noble Corporation plc

3rd Floor

1 Ashley Road

Altrincham

WA14 2DT

|

Your ref: |

|

| Our ref: |

JMR/AZS |

| Doc ID: |

4129-6377-4527 |

| Direct line: |

+44 (0)20 7295 3413 |

| Email: |

jon.reddington

@traverssmith.com |

4 September 2024

Dear Sir/Madam

Legal opinion regarding shares of Noble Corporation plc in

connection with the Registration Statement on Form S-8 (Registration No. 333-181204) (the "Registration Statement") to be filed

with the United States Securities and Exchange Commission ("SEC")

Introduction

| 1. | We are acting as advisers as to English law to Noble Corporation plc, a public limited company incorporated under the laws of England

and Wales with registered number 12958050 (the "Company"). |

| 2. | We understand that the Company intends to file, on or around the date hereof, the Registration Statement with the SEC. As described

in the Registration Statement, we understand that the Company may propose to issue A ordinary shares of $0.00001 each in the Company pursuant

to the Diamond Offshore Drilling, Inc. 2021 Long-Term Incentive Plan (as amended pursuant to the terms of the agreement and plan of merger

entered into between the Company, Dolphin Merger Sub 1, Inc, Dolphin Merger Sub 2, Inc and Diamond Offshore Drilling, Inc dated 9 June

2024 (the "Merger Agreement")) (the "Plan"). We have been asked to provide an opinion on certain matters,

as set out below, in connection with the filing of the Registration Statement. |

Documents reviewed

| 3. | We have examined the documents listed in Schedule 3 to this opinion. Terms defined in the Schedules have the same meaning where used

in this opinion. |

Travers

Smith LLP is a limited liability partnership registered in England and Wales under number OC 336962 and is authorised and regulated by

the Solicitors Regulation Authority (SRA number 489478). A list of the members of Travers Smith LLP is open to inspection at our registered

office and principal place of business: 10 Snow Hill London EC1A 2AL

Nature of opinion and observations

| 4. | This opinion is confined to matters of English law (including case law) in force as at the date of this opinion. We express no opinion

with regard to any system of law other than the laws of England as currently applied by the English courts. In particular: |

| 4.1 | by giving this opinion, we do not assume any obligation to notify you of future changes in law which may affect the opinions expressed

in this opinion, or otherwise to update this opinion in any respect; |

| 4.2 | to the extent that the laws of any other jurisdiction may be relevant, our opinion is subject to the effect of such laws. We express

no views in this opinion on the validity of the matters set out in any opinion given in relation to such laws; |

| 4.3 | we have not been responsible for verifying whether statements of fact (including foreign law), opinion or intention in any documents

referred to in this opinion or in any related documents are accurate, complete or reasonable; and |

| 4.4 | the term 'non-assessable' has no recognised meaning in English law but for the purposes herein the term means that, under the Companies

Act 2006 (as amended), the articles of association of the Company (the "Articles") and any resolution passed in accordance

with the Articles approving the issuance of the Shares (as defined below), no holder of such Shares is liable, solely because of such

holder’s status as a holder of such Shares, for additional payments or calls on the relevant Shares to or by the Company or its

creditors. |

Opinion

| 5. | On the basis stated in paragraph 4, and subject to the assumptions in Schedule 1 and the qualifications in Schedule 2, we are of the

opinion that the securities being registered, being 1,921,321 A ordinary shares in the capital of the Company with a nominal value of

US$0.00001 each to be issued pursuant to the Plan (the "Shares"), will (when allotted) be validly issued, fully paid

and non-assessable once all of: (i) the Registration Statement, as finally amended, shall have become effective under the Securities Act

of 1933, as amended (the "Securities Act") and (ii) valid entries in the books and registers of the Company have been

made in respect of such issue. |

Benefit of Opinion

| 6. | This opinion is addressed to the Company solely for its own benefit. This opinion letter may not be delivered to or relied upon by

any person other than the Company without our express written consent. |

Consent to filing

| 7. | We hereby consent to the filing of this letter as an exhibit to the Registration Statement and to all references to our firm included

in or made a part of the Registration Statement. In giving such consent, we do not thereby admit that we are in the category |

of persons whose consent is required under Section 7 of

the Securities Act, or the rules or regulations promulgated thereunder.

Governing Law

| 8. | This opinion letter and any non-contractual obligations arising out of or in relation to it are governed by English law. The courts

of England and Wales shall have exclusive jurisdiction to settle any dispute or claim that arises out of or in connection with this opinion

letter (including non-contractual disputes or claims). |

Yours faithfully

/s/ Travers Smith LLP

Travers Smith LLP

Schedule

1

ASSUMPTIONS

In considering the documents listed in Schedule 3 and in rendering

this opinion, we have (with your consent and without any further enquiry) assumed:

| 1. | Authenticity: the genuineness of all signatures, stamps and seals on, and the authenticity, accuracy and completeness of, all

documents submitted to us whether as originals or copies; |

| 2. | Powers and Duties: the Directors of the Company when authorising the allotment of the Shares will exercise their powers in

accordance with their duties under English law and the articles of association of the Company at the relevant time; |

| 3. | Compliance with FSMA: (i) no Shares, or rights to subscribe for Shares, have been or shall be offered to the public in the

United Kingdom in breach of the Financial Services and Markets Act 2000 ("FSMA") or of any other law or regulation concerning

offers to the public, invitations to subscribe for, or to acquire rights to, or otherwise acquire, shares in the United Kingdom; and (ii)

in issuing and allotting the Shares, the Company is not carrying on a regulated activity for the purposes of section 19 of FSMA; |

| 4. | Copies: the conformity to originals of all documents supplied to us as photocopies, portable document format (PDF) copies,

facsimile copies or e-mail versions; |

| 5. | Officer's Certificate: that each of the statements contained

in a certificate of an Officer of the Company dated 3 September 2024 (the "Certificate")

is true and correct as at the date of this opinion; |

| 6. | Company Search: that the information revealed by our search against the Company's records available for public viewing at Companies

House through its website (https://find-and-update.company-information.service.gov.uk/)

made at approximately 10 a.m. on 4 September 2024 (the "Company Search")

(i) was accurate in all respects and has not since the time of such searches been altered, and (ii) was complete and included all relevant

information which had been properly submitted to the Registrar of Companies; |

| 7. | Winding-up Enquiry: that the information revealed by our enquiry of the Central Registry of Winding up Petitions made at approximately

10 a.m. on 4 September 2024 (the "Winding-up Enquiry") was accurate in all

respects and has not since the time of such enquiry been altered; |

| 8. | Filings under Other Laws: that all consents, licences, approvals, notices, filings, recordations, publications and registrations

which are necessary under any applicable laws (other than, in the case of the Company, English Law) in order to permit the performance

of the Plan, have been made or obtained, or will be made or obtained within the period permitted or required by such laws or regulations; |

| 9. | Compliance with Merger Agreement: that the conditions to the Merger (as defined in the Merger Agreement) set out in Section

7 of the Merger Agreement have been satisfied (and not waived by the Company) and the Merger has completed, such that the amendments to

the Plan pursuant to the Merger Agreement have taken effect; |

| 10. | Compliance with Plan Documentation: that the holders of awards granted under the terms of the Plan shall comply with the procedures

set out in the Plan Documentation (as defined in Schedule 3), as amended by the Merger Agreement, in order to acquire the Shares, in particular

the due execution of any notices or consents; that the Shares are duly allotted in accordance with the Allotment Resolutions; and the

Company complies with the Plan Documentation at all times in effecting the issue of the Shares and has adopted the prescribed procedures

therein to ensure that the Shares are paid up at least as to nominal value and (in the case of stock options) as to the amount of any

additional exercise price; |

| 11. | Superseding Agreement: that there is no other agreement, instrument or other arrangement, relationship or course of dealing

between any of the parties which modifies or supersedes the Plan and that the Plan Documentation has not been amended, terminated or replaced

prior to the issue of the Shares; and |

| 12. | Validity under Other Laws: that the Plan Documentation and Merger Agreement constitute legal, valid, binding and enforceable

obligations of each of the parties thereto under all applicable laws (other than, in the case of the Company, English Law) and that they

were approved, to the extent required, by the relevant board of directors and stockholders, and that insofar as the laws or regulations

of any jurisdiction other than England and Wales may be relevant to (i) the obligations or rights of any of the parties in relation to

the Plan Documentation (as amended by the Merger Agreement) or (ii) any of the transactions contemplated in connection with the Plan Documentation

(as amended by the Merger Agreement), such laws and regulations do not prohibit, and are not inconsistent with, the entering into and

performance of any of such obligations, rights or transactions. |

Schedule

2

QUALIFICATIONS

Our opinion is subject to the following qualifications:

| 1. | Company Search: the Company Search is not capable of revealing conclusively whether or not: |

| 1.1 | a winding-up order has been made or a resolution passed for the winding up of a company; or |

| 1.2 | an administration order has been made; or |

| 1.3 | a receiver, administrative receiver, administrator or liquidator has been appointed; or |

| 1.4 | a court order has been made under the Cross Border Insolvency Regulations 2006, |

since notice of these matters may not be filed with the

Registrar of Companies immediately and, when filed, may not be entered on the public microfiche of the relevant company immediately.

In addition, the Company Search is not capable of revealing,

prior to the making of the relevant order or the appointment of an administrator otherwise taking effect, whether or not a winding-up

petition or an application for an administration order has been presented or notice of intention to appoint an administrator under paragraphs

14 or 22 of Schedule B1 to the Insolvency Act 1986 has been filed with the Court;

| 2. | Winding-up Enquiry: the Winding-up Enquiry relates only to the presentation of (i) a petition for the making of a winding-up

order or the making of a winding-up order by the Court, (ii) an application to the High Court of Justice in London for the making of an

administration order and the making by such court of an administration order, and (iii) a notice of intention to appoint an administrator

or a notice of appointment of an administrator filed at the High Court of Justice in London. It is not capable of revealing conclusively

whether or not such a winding-up petition, application for an administration order, notice of intention or notice of appointment has been

presented or winding-up or administration order granted, because: |

| 2.1 | details of a winding-up petition or application for an administration order may not have been entered on the records of the Central

Registry of Winding-up Petitions immediately; |

| 2.2 | in the case of an application for the making of an administration order and the presentation of a notice of intention to appoint or

notice of appointment, if such application is made to, order made by or notice filed with, a Court other than the High Court of Justice

in London, no record of such application, order or notice will be kept by the Central Registry of Winding-up Petitions; |

| 2.3 | a winding-up order or administration order may be made before the relevant petition or application has been entered on the records

of the Central Registry immediately; |

| 2.4 | details of a notice of intention to appoint an administrator or a notice of appointment of an administrator under paragraphs 14 and

22 of Schedule B1 of the Insolvency Act 1986 may not be entered on the records immediately (or, in the case of a notice of intention to

appoint, at all); and |

| 2.5 | with regard to winding-up petitions, the Central Registry of Winding-up Petitions may not have records of winding-up petitions issued

prior to 1994. |

Schedule

3

| 1. | a copy of the draft Registration Statement; |

| 3. | a copy of the Merger Agreement; |

| 4. | the rules of the Diamond Offshore Drilling, Inc 2021 Long-Term Incentive Plan (the "Plan Documentation"); |

| 5. | a PDF copy of the ordinary resolution of the Company's sole shareholder, Noble Corporation 2022 Limited, passed on 5 May 2022 granting

general and unconditional authority to the Company's directors for the purposes of section 551 of the Companies Act 2006 to exercise all

powers of the Company to allot shares and to grant any such subscription rights, as are contemplated in sub-sections 551(1)(a) and 551(1)(b)

respectively of the Companies Act 2006 up to a maximum nominal amount of US$271.00 to such persons and at such times and on such terms

as they think proper during the period expiring at the end of five years from the date of the passing of the resolution (the "Allotment

Resolutions"); and |

| 6. | a PDF copy of the articles of association of the Company adopted by way of special resolution on 5 May 2022. |

EXHIBIT 23.1

CONSENT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We

hereby consent to the incorporation by reference in this Post-effective Amendment No. 1 on Form S-8 to Form S-4 Registration Statement

of Noble Corporation plc of our report dated February 23, 2024 relating to the financial statements and the effectiveness of internal

control over financial reporting of Noble Corporation plc (Successor), which appears in Noble Corporation plc's Annual Report on Form

10-K for the year ended December 31, 2023.

/s/

PricewaterhouseCoopers LLP

Houston, Texas

September 4, 2024

EXHIBIT 23.2

CONSENT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We

hereby consent to the incorporation by reference in this Post-effective Amendment No. 1 on Form S-8 to Form S-4 Registration Statement

of Noble Corporation plc of our report dated February 17, 2022 relating to the financial statements of Noble Corporation plc (Predecessor),

which appears in Noble Corporation plc's Annual Report on Form 10-K for the year ended December 31, 2023.

/s/

PricewaterhouseCoopers LLP

Houston, Texas

September 4, 2024

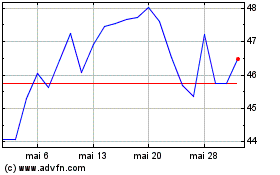

Noble (NYSE:NE)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Noble (NYSE:NE)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024