Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

10 Setembro 2024 - 2:33PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________

FORM 6-K

_______________________________

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2024

Commission File No. 001-37596

_______________________________

FERRARI N.V.

(Translation of Registrant’s Name Into English)

_______________________________

Via Abetone Inferiore n.4

I-41053 Maranello (MO)

Italy

Tel. No.: +39 0536 949111

(Address of Principal Executive Offices)

_______________________________

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F x Form 40-F o

The following exhibit is furnished herewith:

Exhibit 99.1 Press release issued by Ferrari N.V. dated September 10, 2024.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | |

| Date: September 10, 2024 | FERRARI N.V. |

| | | |

| | | |

| By: | /s/ Antonio Picca Piccon |

| | Name: | Antonio Picca Piccon |

| | Title: | Chief Financial Officer |

Index of Exhibits

Exhibit

Number Description of Exhibit

99.1 Press release issued by Ferrari N.V. dated September 10, 2024.

Exhibit 99.1

FERRARI N.V.: PERIODIC REPORT ON THE BUYBACK PROGRAM

Maranello (Italy), September 10, 2024 – Ferrari N.V. (NYSE/EXM: RACE) (“Ferrari” or the “Company”) informs that the Company has purchased, under the Euro 250 million share buyback program announced on June 28, 2024, as the fifth tranche of the multi-year share buyback program of approximately Euro 2 billion expected to be executed by 2026 in line with the disclosure made during the 2022 Capital Markets Day (the “Fifth Tranche”), the additional common shares - reported in aggregate form, on a daily basis - on the Euronext Milan (EXM) and on the New York Stock Exchange (NYSE) as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EXM | NYSE | Total |

Trading

Date

(d/m/y) | Number of

common

shares

purchased

|

Average price per share

excluding fees

(€)

|

Consideration excluding fees

(€)

| Number of

common

shares

purchased

|

Average price per share

excluding fees

($)

|

Consideration excluding fees

($)

|

Consideration excluding fees

($)

| Number of

common

shares

purchased

|

Average price per share

excluding fees

(€)*

|

Consideration excluding fees

(€)*

|

| 02/09/2024 | 4,600 | 445.6153 | 2,049,830.38 | — | — | — | — | 4,600 | 445.6153 | 2,049,830.38 |

| 03/09/2024 | 4,500 | 447.8750 | 2,015,437.50 | 2,049 | 487.8168 | 999,536.62 | 905,787.61 | 6,549 | 446.0567 | 2,921,225.11 |

| 04/09/2024 | 4,700 | 438.4323 | 2,060,631.81 | 3,084 | 486.3047 | 1,499,763.69 | 1,357,252.21 | 7,784 | 439.0910 | 3,417,884.02 |

| 05/09/2024 | 5,000 | 431.8014 | 2,159,007.00 | 4,194 | 476.8310 | 1,999,829.21 | 1,802,135.00 | 9,194 | 430.8399 | 3,961,142.00 |

| 06/09/2024 | 5,000 | 430.2781 | 2,151,390.50 | 2,971 | 471.1957 | 1,399,922.42 | 1,260,850.60 | 7,971 | 428.0819 | 3,412,241.10 |

| 09/09/2024 | 5,100 | 428.4734 | 2,185,214.34 | — | — | — | — | 5,100 | 428.4734 | 2,185,214.34 |

| Total | 28,900 | 436.7305 | 12,621,511.53 | 12,298 | 479.6757 | 5,899,051.96 | 5,326,025.43 | 41,198 | 435.641 | 17,947,536.96 |

(*) translated at the European Central Bank EUR/USD exchange reference rate as of the date of each purchase

Since the announcement of such Fifth Tranche till September 9, 2024, the total invested consideration has been:

•Euro 86,272,640.26 for No. 215,050 common shares purchased on the EXM

•USD 8,998,310.03 (Euro 8,124,725.44 *) for No. 18,841 common shares purchased on the NYSE.

As of September 9, 2024, the Company held in treasury No. 14,399,557 common shares equal to 5.60% of the total issued share capital including the common shares and the special voting shares, net of shares assigned under the Company’s equity incentive plan.

| | | | | | | | | | | |

Ferrari N.V.

Amsterdam, The Netherlands |

Registered Office:

Via Abetone Inferiore N. 4,

I – 41053 Maranello (MO) Italy |

Dutch trade registration number:

64060977 | |

Since the start of the multi-year share buyback program of approximately Euro 2 billion announced during the 2022 Capital Markets Day, on July 1, 2022, until September 9, 2024, the Company has purchased a total of 3,575,453 own common shares on EXM and NYSE, including transactions for Sell to Cover, for a total consideration of Euro 1,017,141,438.41.

A comprehensive overview of the transactions carried out under the buyback program, as well as the details of the above transactions, are available on Ferrari’s corporate website under the Buyback Programs section (https://www.ferrari.com/en-EN/corporate/buyback-programs).

For further information:

Media Relations

tel.: +39 0536 949337

Email: media@ferrari.com

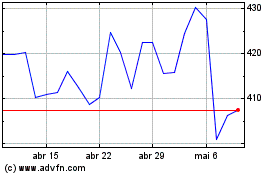

Ferrari NV (NYSE:RACE)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

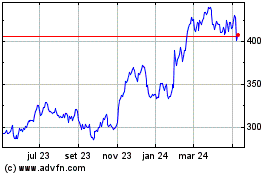

Ferrari NV (NYSE:RACE)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024