Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

10 Outubro 2024 - 2:51PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration Statement No. 333-262384

Pricing Term Sheet

¥281,800,000,000

BERKSHIRE HATHAWAY INC.

Pricing Term Sheet

¥155,400,000,000 1.031% Senior Notes due 2027

¥58,000,000,000 1.265% Senior Notes due 2029

¥23,300,000,000 1.465% Senior Notes due 2031

¥16,000,000,000 1.737% Senior Notes due 2034

¥11,800,000,000 2.373% Senior Notes due 2044

¥5,000,000,000 2.577% Senior Notes due 2052

¥12,300,000,000 2.625% Senior Notes due 2054

|

|

|

| Issuer: |

|

Berkshire Hathaway Inc. |

|

|

| Offering Format: |

|

SEC Registered |

|

|

| Trade Date: |

|

October 10, 2024 |

|

|

| Settlement Date: |

|

October 23, 2024 (T+8 Tokyo business days) |

|

|

| Expected Ratings*: |

|

Aa2/AA (Stable/Stable) |

|

|

| Title of Securities: |

|

1.031% Senior Notes due 2027 ( the “2027 Notes”) |

|

|

1.265% Senior Notes due 2029 (the “2029 Notes”) |

|

|

1.465% Senior Notes due 2031 (the “2031 Notes”) |

|

|

1.737% Senior Notes due 2034 (the “2034 Notes”) |

|

|

2.373% Senior Notes due 2044 (the “2044 Notes”) |

|

|

2.577% Senior Notes due 2052 (the “2052 Notes”) |

|

|

2.625% Senior Notes due 2054 (the “2054 Notes”) |

|

|

| Principal Amount: |

|

¥155,400,000,000 (2027 Notes) |

|

|

¥58,000,000,000 (2029 Notes) |

|

|

¥23,300,000,000 (2031 Notes) |

|

|

¥16,000,000,000 (2034 Notes) |

|

|

¥11,800,000,000 (2044 Notes) |

|

|

¥5,000,000,000 (2052 Notes) |

|

|

¥12,300,000,000 (2054 Notes) |

|

|

|

| Maturity Date: |

|

December 8, 2027 (2027 Notes) |

|

|

December 7, 2029 (2029 Notes) |

|

|

October 23, 2031 (2031 Notes) |

|

|

October 23, 2034 (2034 Notes) |

|

|

October 21, 2044 (2044 Notes) |

|

|

October 23, 2052 (2052 Notes) |

|

|

October 23, 2054 (2054 Notes) |

|

|

| Issue Price (Price to Public): |

|

100% of face amount (2027 Notes) |

|

|

100% of face amount (2029 Notes) |

|

|

100% of face amount (2031 Notes) |

|

|

100% of face amount (2034 Notes) |

|

|

100% of face amount (2044 Notes) |

|

|

100% of face amount (2052 Notes) |

|

|

100% of face amount (2054 Notes) |

|

|

| Gross Spread: |

|

10 bps (2027 Notes) |

|

|

15 bps (2029 Notes) |

|

|

20 bps (2031 Notes) |

|

|

25 bps (2034 Notes) |

|

|

45 bps (2044 Notes) |

|

|

50 bps (2052 Notes) |

|

|

55 bps (2054 Notes) |

|

|

| Proceeds to Issuer: |

|

¥281,325,250,000 |

|

|

| Interest Rate: |

|

1.031% per annum (2027 Notes) |

|

|

1.265% per annum (2029 Notes) |

|

|

1.465% per annum (2031 Notes) |

|

|

1.737% per annum (2034 Notes) |

|

|

2.373% per annum (2044 Notes) |

|

|

2.577% per annum (2052 Notes) |

|

|

2.625% per annum (2054 Notes) |

|

|

| Reference Rate: |

|

0.541% (2027 Notes) |

|

|

0.635% (2029 Notes) |

|

|

0.735% (2031 Notes) |

|

|

0.917% (2034 Notes) |

|

|

1.463% (2044 Notes) |

|

|

1.637% (2052 Notes) |

|

|

1.665% (2054 Notes) |

|

|

|

| Spread to Reference Rate: |

|

49 bps (2027 Notes) |

|

|

63 bps (2029 Notes) |

|

|

73 bps (2031 Notes) |

|

|

82 bps (2034 Notes) |

|

|

91 bps (2044 Notes) |

|

|

94 bps (2052 Notes) |

|

|

96 bps (2054 Notes) |

|

|

| Yield: |

|

1.031% (2027 Notes) |

|

|

1.265% (2029 Notes) |

|

|

1.465% (2031 Notes) |

|

|

1.737% (2034 Notes) |

|

|

2.373% (2044 Notes) |

|

|

2.577% (2052 Notes) |

|

|

2.625% (2054 Notes) |

|

|

| Day Count Convention: |

|

30/360 |

|

|

| Interest Payment Dates: |

|

Semi-annually on April 23 and October 23 of each year commencing April 23, 2025 (short last coupon for 2027 Notes, 2029 Notes and 2044 Notes) |

|

|

| Par Call: |

|

No Par Call (2027 Notes) |

|

|

No Par Call (2029 Notes) |

|

|

On or after August 23, 2031 (2031 Notes) |

|

|

On or after July 23, 2034 (2034 Notes) |

|

|

On or after April 21, 2044 (2044 Notes) |

|

|

On or after April 23, 2052 (2052 Notes) |

|

|

On or after April 23, 2054 (2054 Notes) |

|

|

| Minimum Denomination: |

|

¥100,000,000 and integral multiples of ¥10,000,000 in excess thereof |

|

|

| CUSIP: |

|

084670 EJ3 (2027 Notes) |

|

|

084670 EK0 (2029 Notes) |

|

|

084670 EL8 (2031 Notes) |

|

|

084670 EM6 (2034 Notes) |

|

|

084670 EP9 (2044 Notes) |

|

|

084670 ER5 (2052 Notes) |

|

|

084670 EQ7 (2054 Notes) |

|

|

|

| Common Code: |

|

291918883 (2027 Notes) |

|

|

291918930 (2029 Notes) |

|

|

291918972 (2031 Notes) |

|

|

291919006 (2034 Notes) |

|

|

291919219 (2044 Notes) |

|

|

292039328 (2052 Notes) |

|

|

291919278 (2054 Notes) |

|

|

| ISIN: |

|

XS2919188834 (2027 Notes) |

|

|

XS2919189303 (2029 Notes) |

|

|

XS2919189725 (2031 Notes) |

|

|

XS2919190061 (2034 Notes) |

|

|

XS2919192190 (2044 Notes) |

|

|

XS2920393282 (2052 Notes) |

|

|

XS2919192786 (2054 Notes) |

|

|

| Paying Agent: |

|

The Bank of New York Mellon, London Branch |

|

|

| Listing: |

|

None |

|

|

| Joint Book-Running Managers: |

|

Merrill Lynch International |

|

|

Mizuho Securities USA LLC |

| * |

Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to

revision or withdrawal at any time. |

UK MiFIR professionals/ECPs-only/No EEA or UK PRIIPs KID: Manufacturer target market (UK MiFIR

product governance) is eligible counterparties and professional clients only (all distribution channels). No EEA or UK PRIIPs key information document (KID) has been prepared as the Securities are not available to retail investors in the EEA or in

the United Kingdom, respectively.

Settlement Period: The closing will occur on October 23, 2024, which will be more than one Tokyo business day

after the date of this pricing term sheet. Rule 15c6-1 under the Securities Exchange Act of 1934 generally requires that securities trades in the secondary market settle in one business day, unless the parties

to a trade expressly agree otherwise. Accordingly, purchasers who wish to trade the notes prior to the business day before the delivery of the notes will be required, by virtue of the fact that the Securities initially will settle in T+8, to specify

an alternative settlement cycle at the time of any such trade to prevent failed settlement. Purchasers of the notes who wish to trade the notes prior to the business day before the delivery of the notes should consult their own advisors.

The Issuer has filed a registration statement (including a prospectus) with the SEC for the offering to

which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the Issuer has filed with the SEC for more complete information about the Issuer and this offering. You may get

these documents for free by visiting EDGAR on the SEC web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling Merrill Lynch

International toll-free at +1-800-294-1322 or Mizuho Securities USA LLC toll-free at (866)

271-7403.

Berkshire Hathaway (NYSE:BRK.B)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

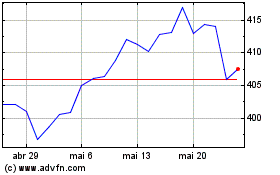

Berkshire Hathaway (NYSE:BRK.B)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024